| 00:30 |

|

ACEA New Car Registrations |

Monthly

|

Data

|

Transportation

|

||

|

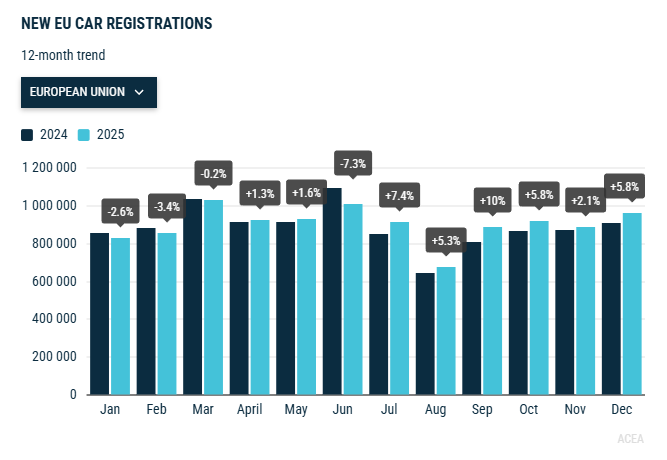

In 2025, new EU car registrations increased by 1.8% compared to the same period last year. However, overall volumes remain well below pre-pandemic levels. In December alone, registrations were up 5.8% YoY. |

|||||||

| 02:45 |

|

France Consumer Confidence |

Monthly

|

Data

|

Sentiment

|

||

|

|

|||||||

| 03:00 |

|

|

Spain Employment |

Quarterly

|

Data

|

Employment

|

|

| 08:15 |

|

ADP Weekly Preliminary Employment Report |

Weekly

|

Data

|

Employment

|

||

|

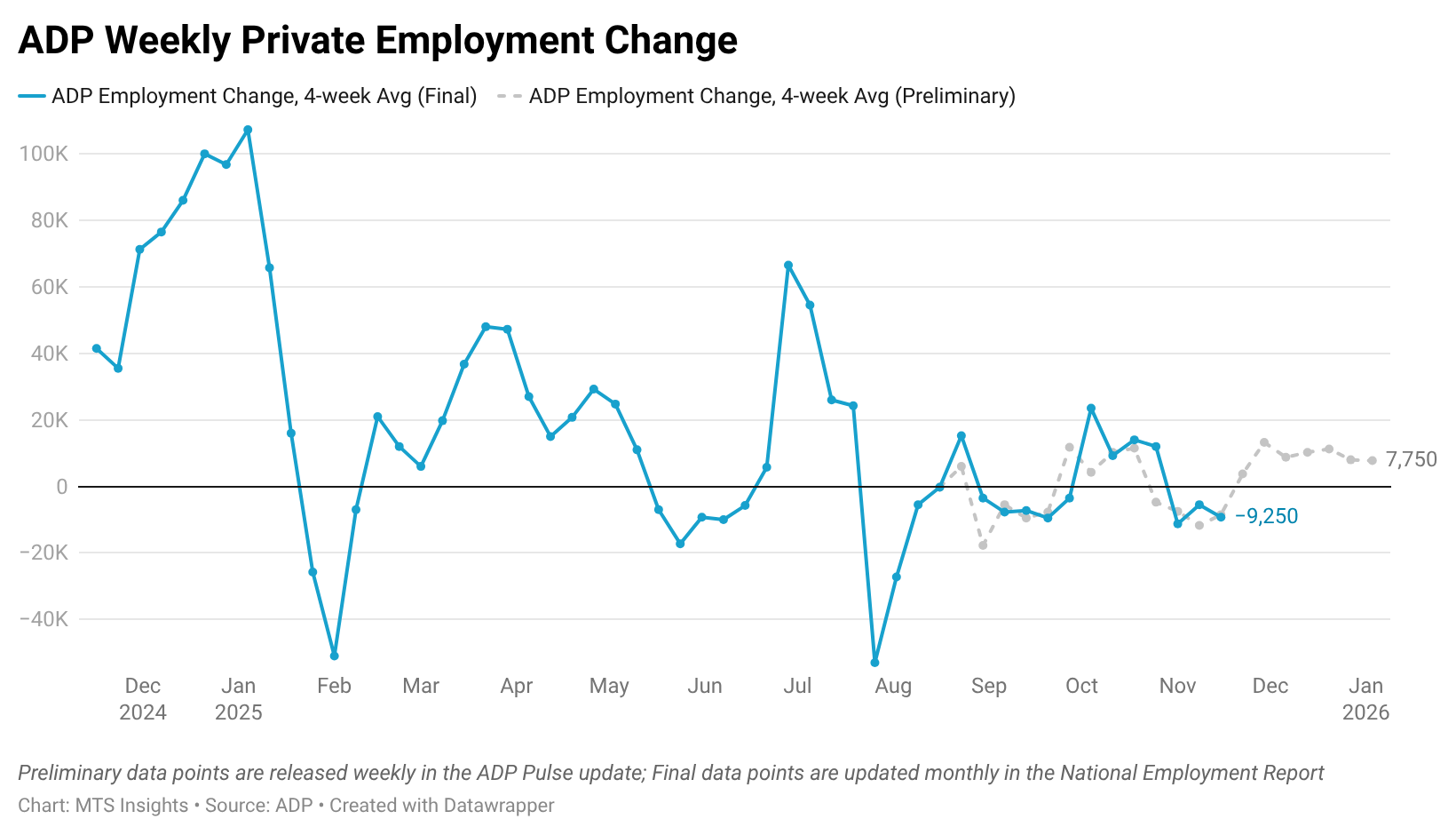

ADP estimates that private employers added an average of 7,750 jobs in the four weeks to Jan 3rd, mostly unchanged from 8,000 in the four weeks to Dec 27th.

|

|||||||

| 08:30 |

|

Canada Wholesale Trade |

Monthly

|

Data

|

Macro

|

|

|

| 08:55 |

|

Redbook Retail Sales Index |

Weekly

|

Data

|

Consumption

|

||

| 09:00 |

|

|

FHFA House Price Index |

Monthly

|

Data

|

Real Estate

|

|

|

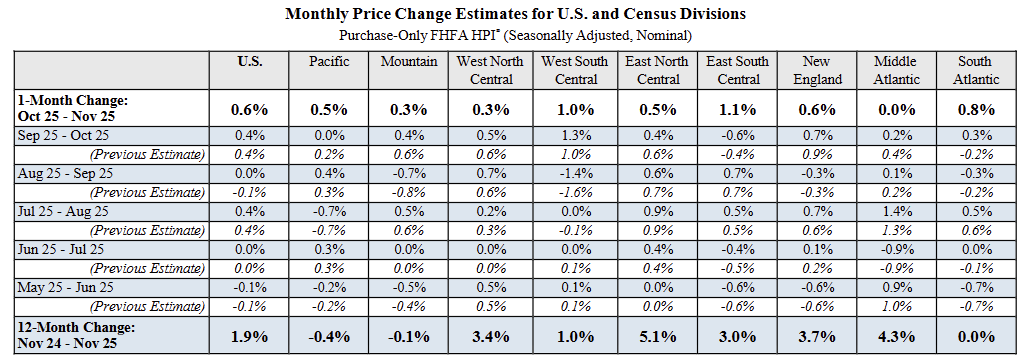

U.S. house prices rose +0.6% MoM (vs +0.3% MoM expected) and +1.9% YoY in November 2025, showing modest monthly gains with soft annual growth.

|

|||||||

| 09:00 |

|

S&P CoreLogic Case-Shiller Home Price Index |

Monthly

|

Data

|

Real Estate

|

||

|

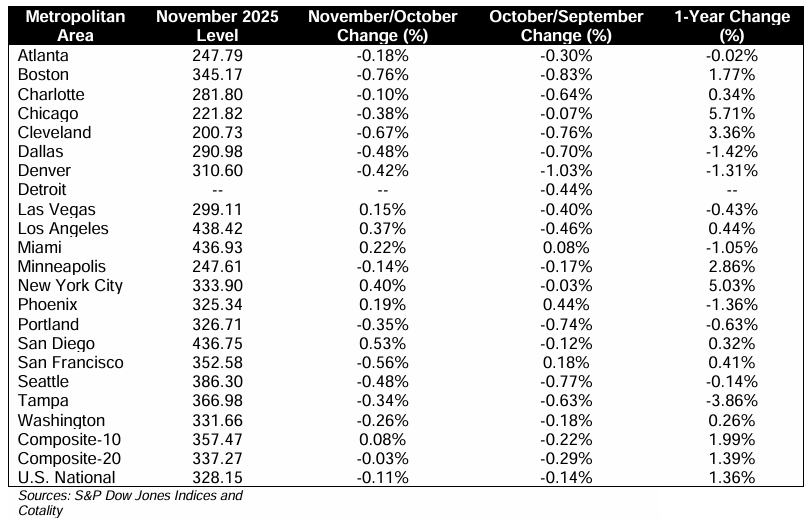

The S&P Case-Shiller U.S. National Home Price Index rose +1.4% YoY in November 2025, unchanged from October 2025, remaining near the weakest annual pace since mid-2023.

|

|||||||

| 10:00 |

|

|

Richmond Fed Manufacturing Survey |

Monthly

|

Data

|

Industry

PMI

|

|

|

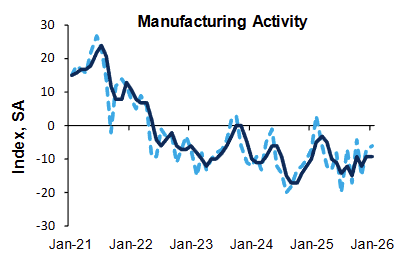

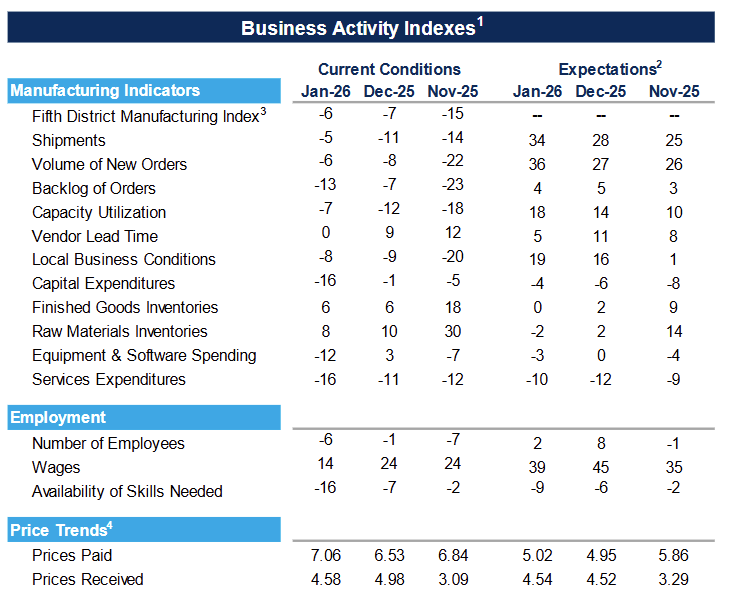

Fifth District manufacturing activity was little changed in January, with the composite index at -6 (Dec: -7), indicating continued mild contraction with slight monthly improvement.

|

|||||||

| 10:00 |

|

Conference Board Consumer Confidence |

Monthly

|

Data

|

Sentiment

|

||

|

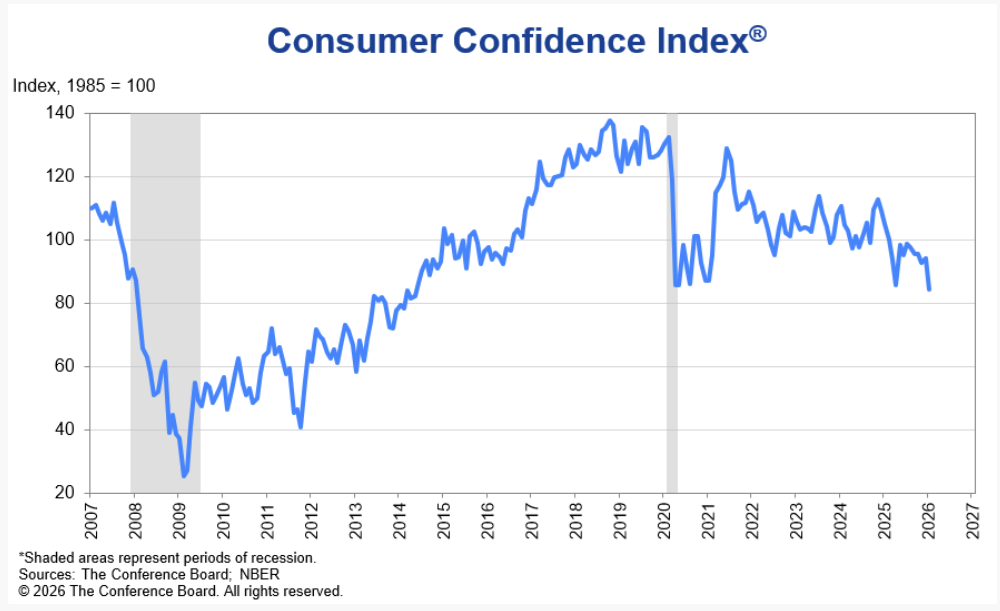

The Conference Board Consumer Confidence Index fell to 84.5 in January (-9.7 pts MoM), marking a sharp pullback in household sentiment.

|

|||||||

| 10:00 |

|

EIA Gasoline and Diesel Fuel Update |

Weekly

|

Data

|

Energy

|

||

| 10:00 |

|

|

Richmond Fed Services Survey |

Monthly

|

Data

|

PMI

Services

|

|

|

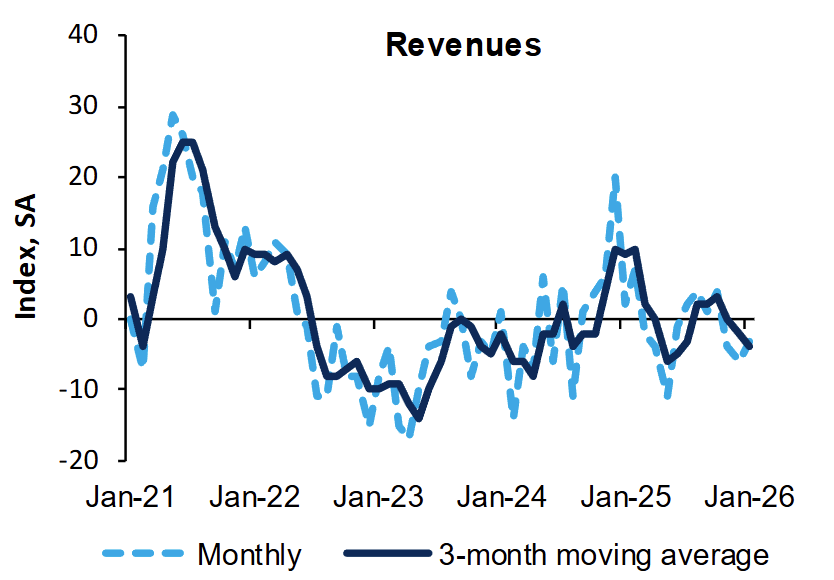

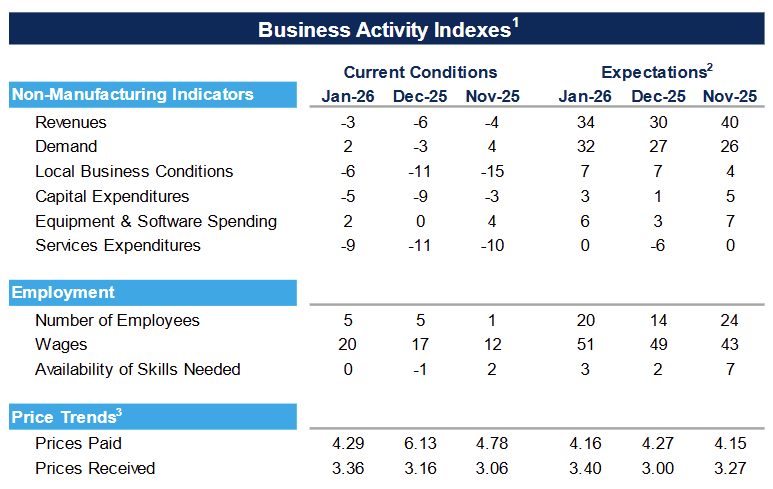

Fifth District non-manufacturing activity was essentially flat in January, with modest MoM improvements in revenues and demand alongside softer input cost growth.

|

|||||||

| 10:30 |

|

|

Texas Service Sector Outlook Survey |

Monthly

|

Data

|

PMI

Services

|

|

|

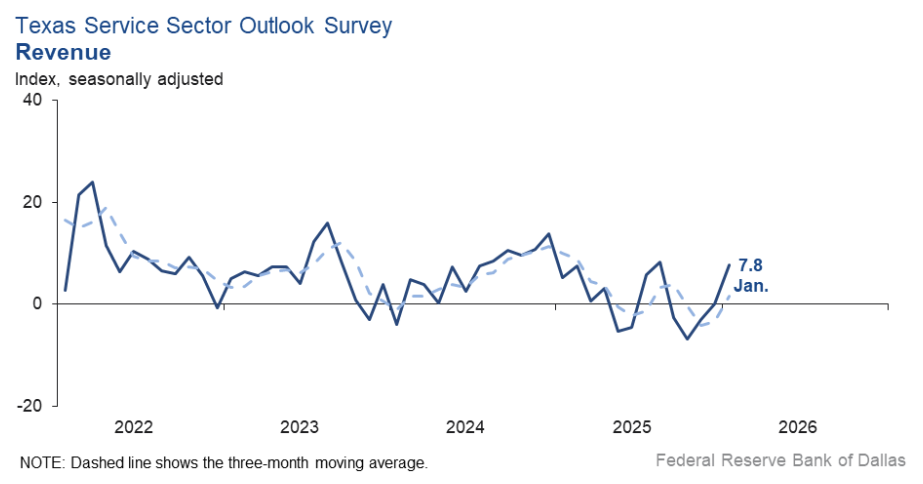

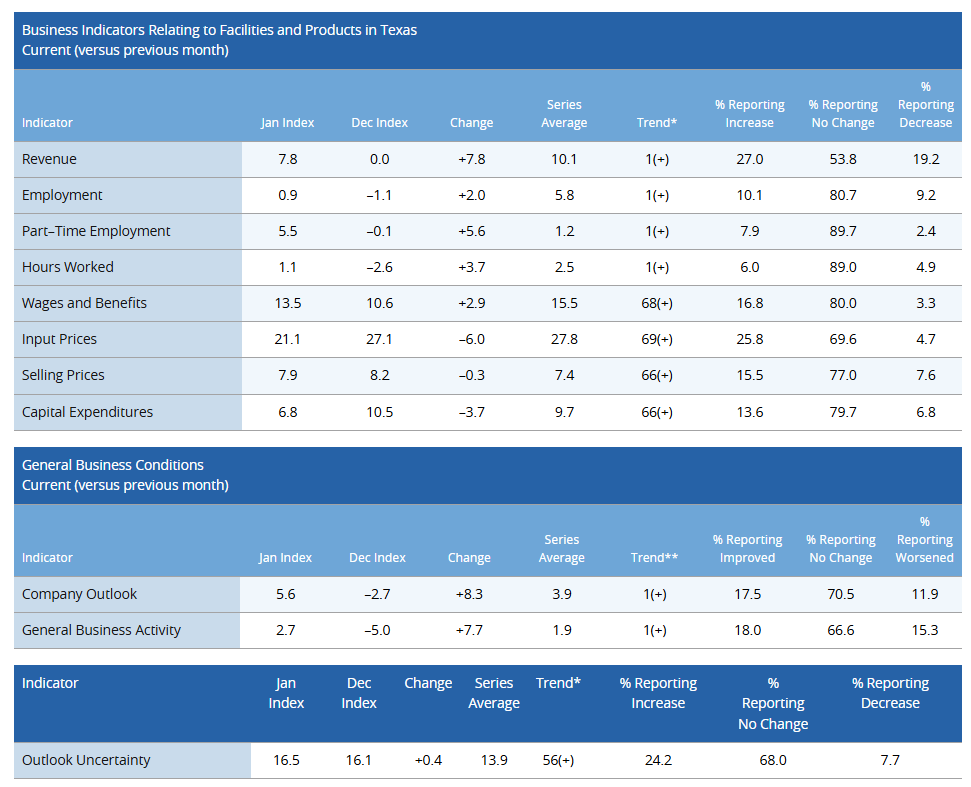

Texas service sector activity improved in January, with the revenue index rising to +7.8 from 0, indicating modest growth after flat conditions in December.

|

|||||||

| 12:00 |

|

Freightos Weekly Update |

Weekly

|

Commentary

|

Transportation

|

||

|

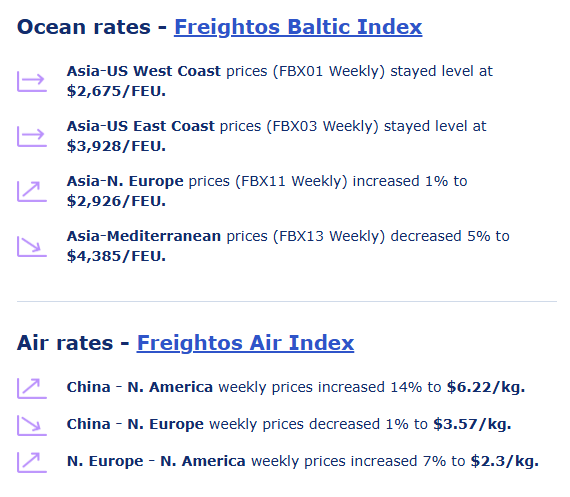

AnalysisAlmost as abruptly as President Trump’s tariff and possibly military threats related to Greenland came, they went. Trump called off the proposed tariffs on eight NATO allies following talks with NATO leadership in Davos last-Wednesday that the president said yielded an accepted framework for a future deal. This chain of events joins several other examples of Trump threatening and then scrapping tariffs due either to concessions gained, backlash, or both since taking office last year. President Trump issued more tariff threats on social media this week, promising 25% tariffs on all exports from South Korea if parliament does not pass the bill approving the terms of the US-Korea trade deal negotiated last year. And, prompted by Canada’s recent trade agreement with China centering on Chinese EVs and Canadian canola seeds, Trump also threatened Canada with 100% tariffs if it enters a comprehensive free trade deal with China. This development reflects growing tensions between the US and Canada ahead of a possible US review of the USMCA this summer. In addition to resolving tariff issues with China, Canada is also holding trade cooperation talks with India, as they and other countries are increasingly looking to diversify away from an over-reliance on the US as trade tensions stretch on. Asia - Europe ocean rates were level to N. Europe and dipped 5% to the Mediterranean as the pre-Lunar New Year rush starts to ease. A five-day rail worker strike in Belgium started on Sunday which could cause delays and additional congestion in Antwerp and knock-on impacts on ports like Rotterdam and Hamburg, which are already struggling with congestion. Transpacific container prices were stable last week as well, with reports that carriers are starting to offer discounts. Rates starting to slide a little earlier than usual suggests carriers are working to capture volumes that may be proving weaker than expected, as retailers exercise caution in ordering decisions given the trade war-driven uncertainty. The massive winter storm that brought snow, sub-zero temperatures and ice to much of the northeast, southeast and parts of the midwest US over the weekend significantly disrupted rail services, road transport and container port operations across the impacted regions. Ports in the southeast have started to recover slowly, but as snowfall in the northeast continued through Monday, the major hubs including New York/New Jersey remained closed. The storm also led to more than 11,000 flight US cancellations on Sunday – the most since the pandemic – with that number dropping to 6,000 on Monday as some southeast and midwest airports were able to restart. Still, more than 1,000 Tuesday flights were scrapped, now concentrated in the northeast. Extremely cold temperatures that may linger and keep conditions icy could slow the speed of recovery. Air cargo rates from China to the US climbed to more than $6.20/kg and back to early January levels, with prices increasing 9% to $4.57/kg out of South East Asia, possibly helped by storm-driven backlogs and the beginning of some pre-LNY frontloading. China - Europe rates were level at about $3.60/kg.

|

|||||||

| 12:00 |

|

US Mergers & Acquisition Monthly Review |

Monthly

|

Data

|

Financials

|

||

|

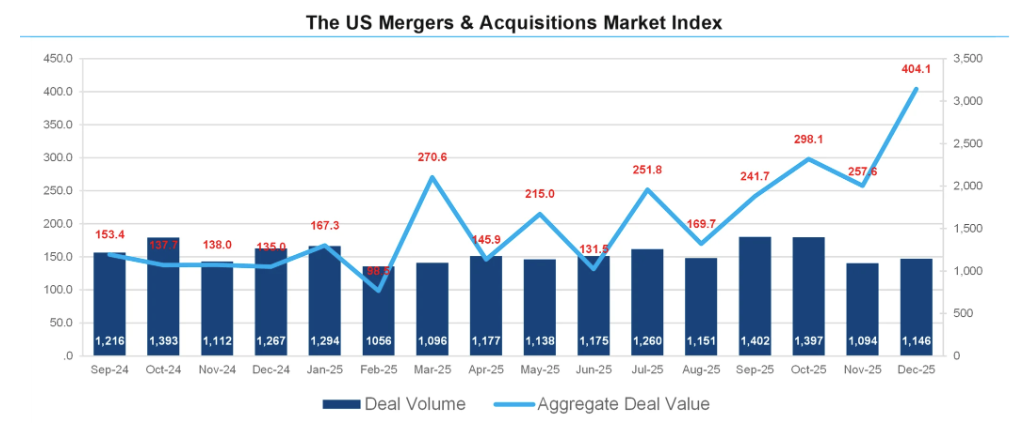

U.S. M&A deal activity increased in December, going up 4.8% with 1,146 announcements compared to 1,094 in November. Aggregate M&A spending increased as well. In December 56.9% more was spent on deals compared to November.

|

|||||||

| 13:00 |

|

|

US Money Supply |

Monthly

|

Data

|

Monetary Policy

|

|

|

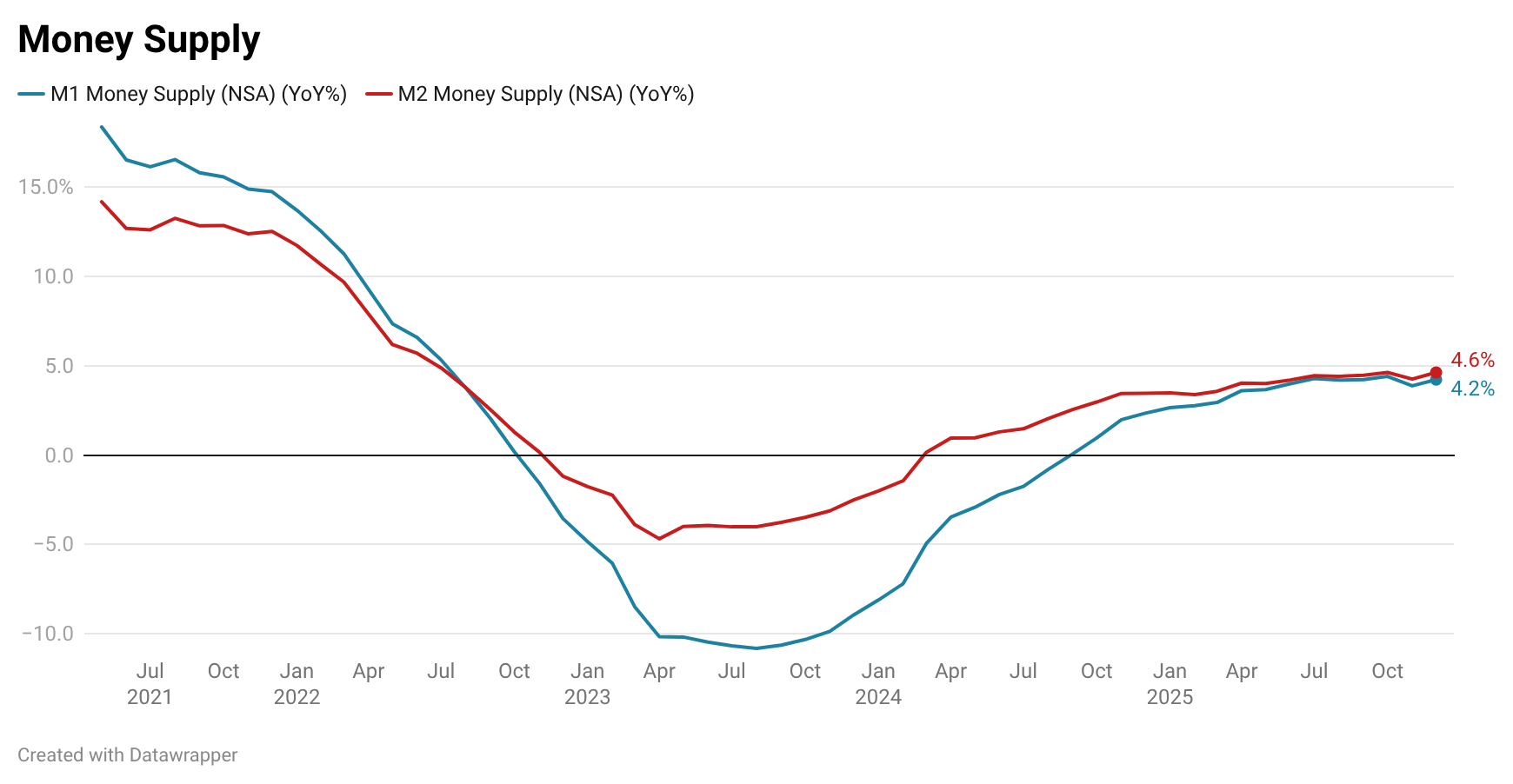

The US M2 money supply increased 0.5% MoM in December, a stronger monthly rise than the 0.1% MoM increase in November. The annual increase accelerated from 4.3% YoY to 4.6% YoY.

|

|||||||

| 16:30 |

|

API Crude Oil Stock Change |

Weekly

|

Data

|

Energy

|

||

| 18:50 |

|

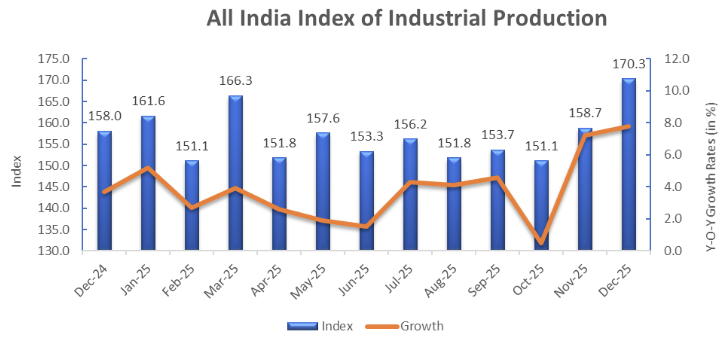

Bank of Japan Monetary Policy Meeting Minutes |

Commentary

|

Monetary Policy

|

|

||

| 19:30 |

|

|

Australia CPI |

Monthly

|

Data

|

Prices

|

|

|

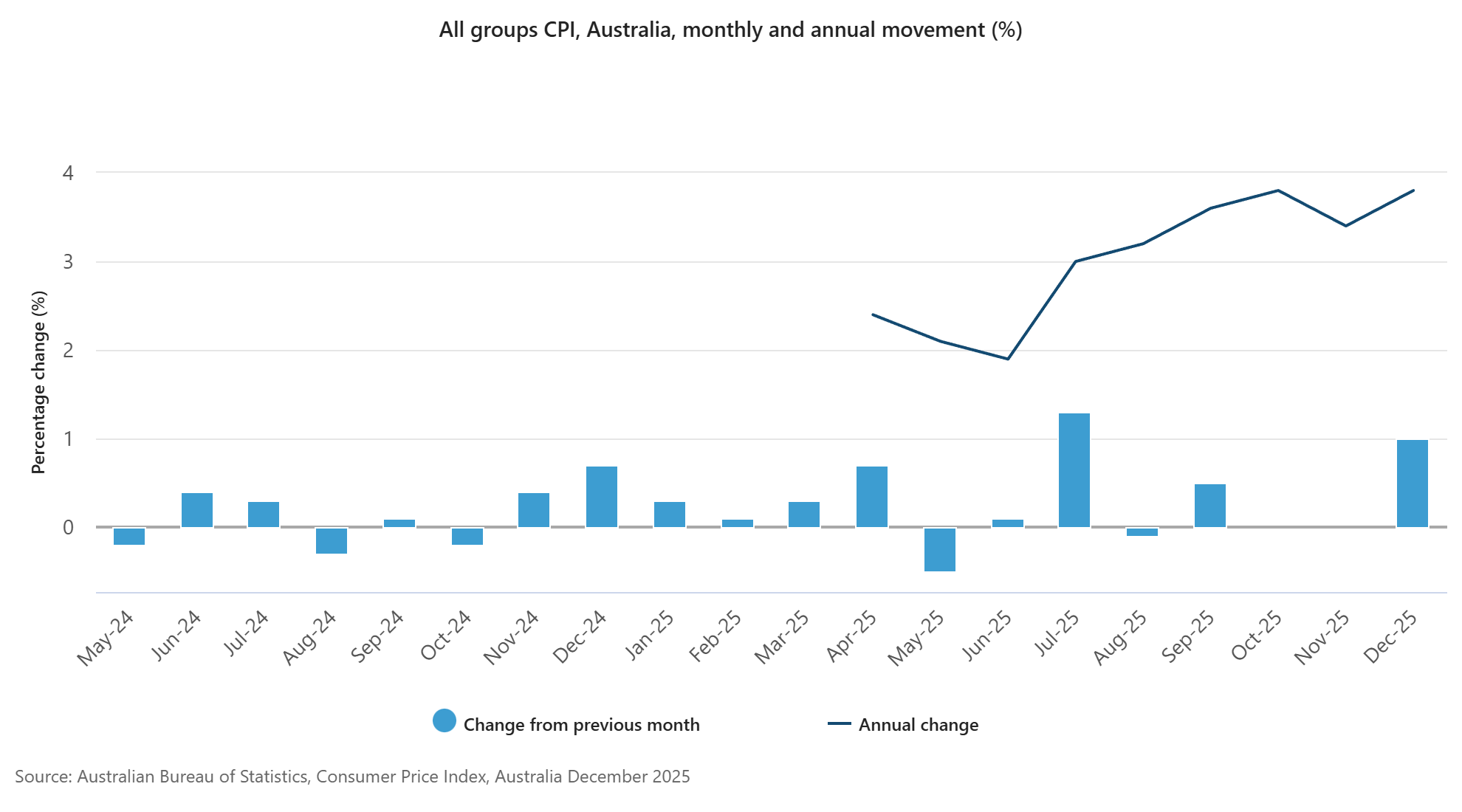

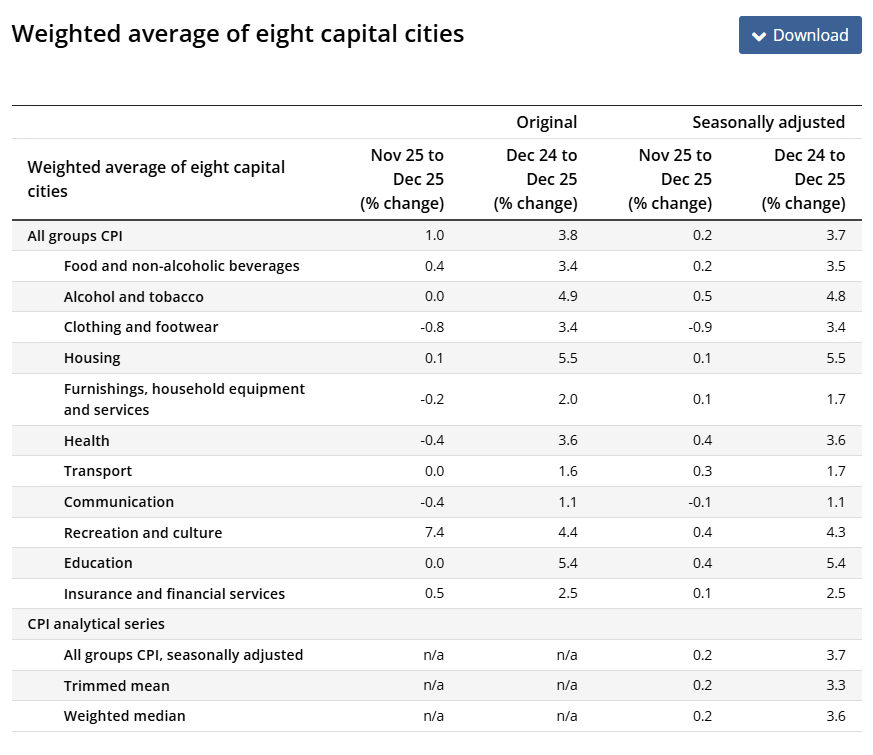

Australia’s CPI rose +0.2% MoM and +3.8% YoY in December 2025 (up from +3.4% YoY in November), showing a reacceleration in headline inflation.

|

|||||||

| 02:00 |

|

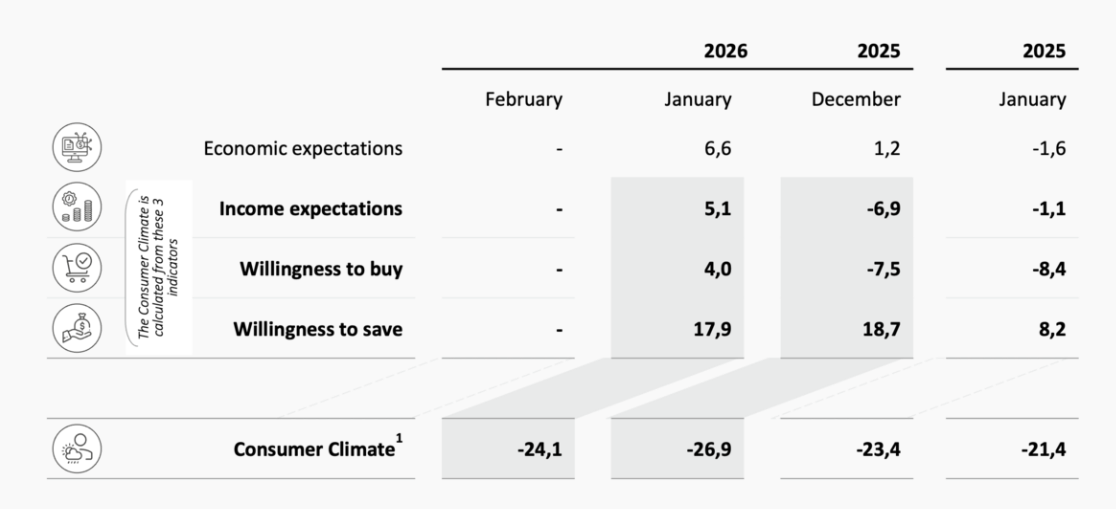

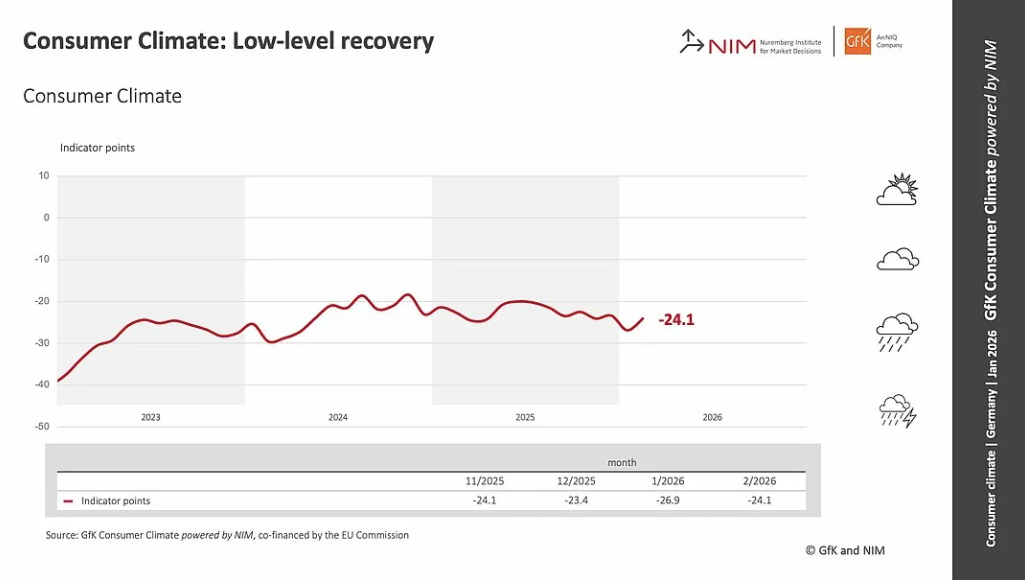

GfK Germany Consumer Climate |

Monthly

|

Data

|

Macro

|

||

|

|

|||||||

| 02:00 |

|

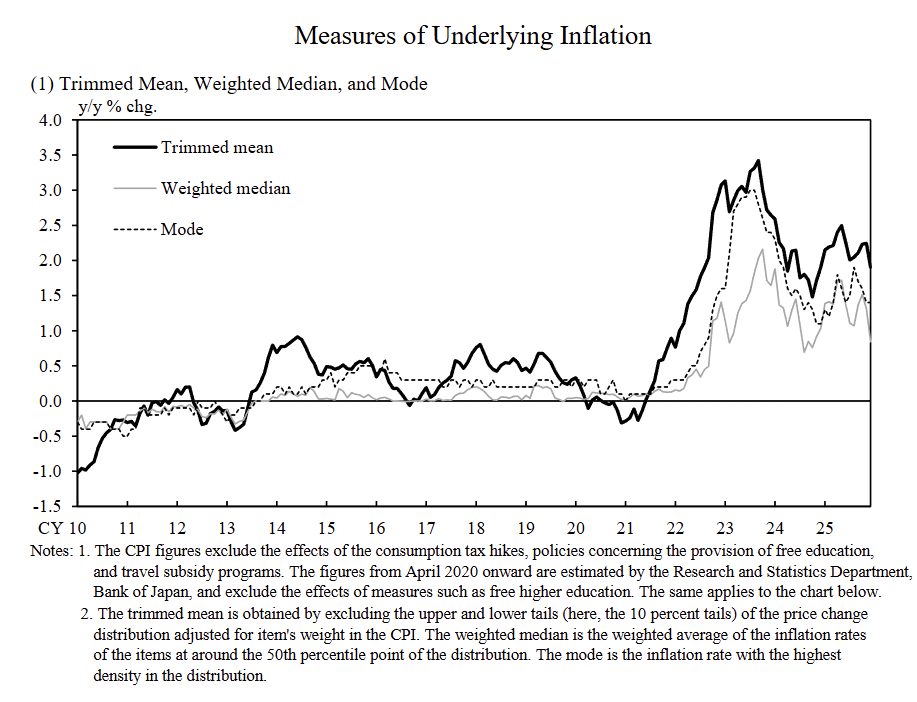

Japan Measures of Underlying Inflation |

Monthly

|

Data

|

Prices

|

||

|

Japan’s measures of underlying inflation in December:

|

|||||||

| 02:45 |

|

France Business Creations |

Monthly

|

Data

|

Macro

|

|

|

| 04:00 |

|

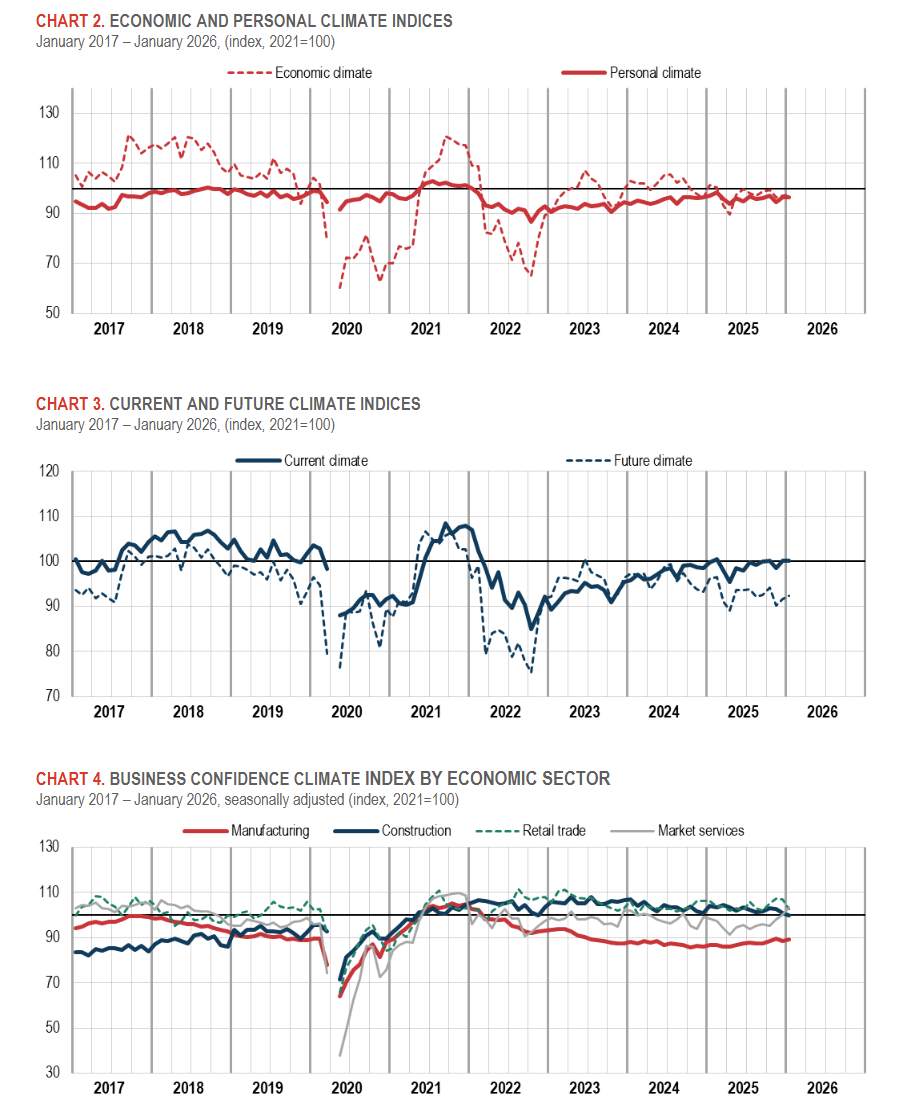

Italy Consumer and Business Confidence |

Monthly

|

Data

|

Sentiment

|

||

|

|

|||||||

| 05:30 |

|

|

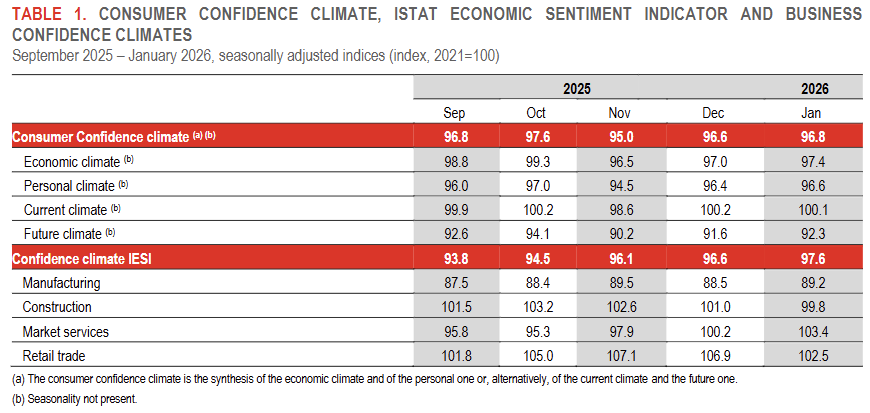

India Industrial Production |

Monthly

|

Data

|

Industry

|

|

|

India’s Index of Industrial Production rose +7.8% YoY in December 2025 (up from +6.7% YoY in November), marking the strongest reading in over two years.

|

|||||||

| 07:00 |

|

|

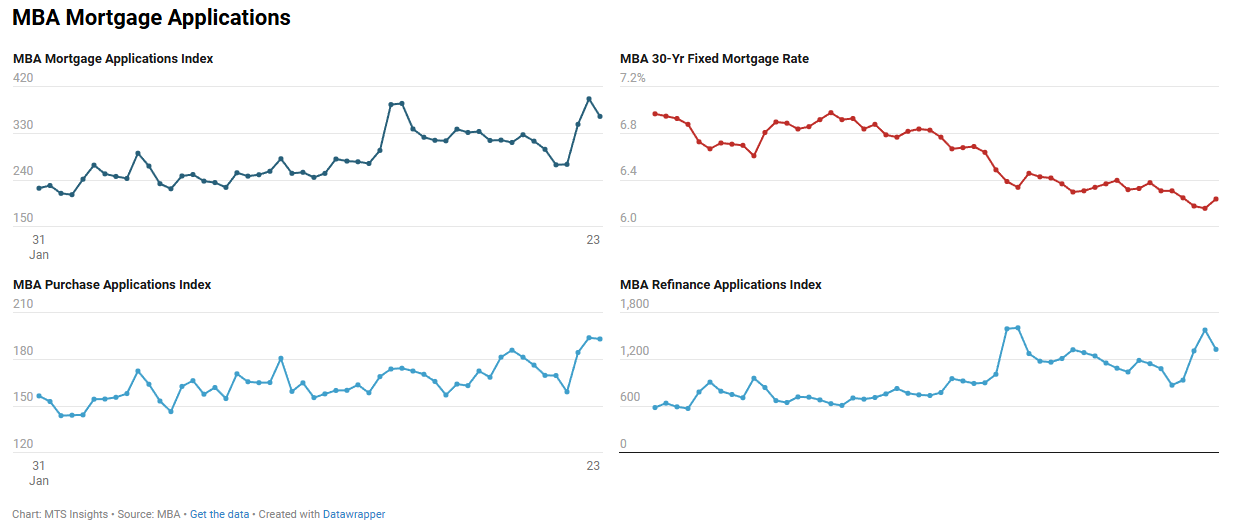

MBA Mortgage Applications |

Weekly

|

Data

|

Real Estate

|

|

|

The MBA Mortgage Applications Composite Index fell 8.5% WoW last week, a sharp decline driven by higher mortgage rates.

|

|||||||

| 08:30 |

|

Chicago Fed National Financial Conditions Index (NFCI) |

Weekly

|

Data

|

Markets

|

||

| 09:45 |

|

|

Bank of Canada Monetary Policy Decision |

Monetary Policy Decision

|

Monetary Policy

|

||

| 10:30 |

|

|

EIA Weekly Petroleum Status Report |

Weekly

|

Data

|

Energy

|

|

| 10:30 |

|

ASA Staffing Index |

Weekly

|

Data

|

Employment

|

||

| 11:00 |

|

Atlanta Fed Survey of Business Uncertainty |

Monthly

|

Data

|

Macro

|

||

| 12:00 |

|

AAR Weekly Rail Traffic |

Weekly

|

Data

|

Transportation

|

||

| 14:00 |

|

|

Federal Reserve Monetary Policy Decision |

Monetary Policy Decision

|

Monetary Policy

|

||

| 16:00 |

|

AAII Bull/Bear Investor Sentiment Survey |

Weekly

|

Data

|

Markets

|

||

| 16:00 |

|

Weekly Market Guide |

Weekly

|

Commentary

|

Markets

|

||

| 19:00 |

|

UK Vehicle Production |

Monthly

|

Data

|

Transportation

|

||

| 19:30 |

|

Australia International Trade Price Indexes |

Quarterly

|

Data

|

Prices

Trade

|

||

| 19:50 |

|

Japan International Transactions in Securities |

Weekly

|

Data

|

Markets

|

||

| 00:00 |

|

Japan Current Survey on Orders Received for Construction |

Monthly

|

Data

|

Construction

|

||

| 00:30 |

|

ACEA New Commercial Vehicle Registrations |

Quarterly

|

Data

|

Transportation

|

||

| 01:00 |

|

Japan Consumer Confidence |

Monthly

|

Data

|

Sentiment

|

||

| 02:45 |

|

|

France Manufacturing Sales |

Monthly

|

Data

|

Industry

|

|

| 03:00 |

|

|

Spain GDP |

Quarterly

|

Data

|

GDP

|

|

| 03:00 |

|

|

Spain Retail Sales |

Monthly

|

Data

|

Consumption

|

|

| 04:00 |

|

Italy Industry and Services Turnover |

Monthly

|

Data

|

Industry

Services

|

||

| 04:00 |

|

Euro Area Monetary Developments |

Monthly

|

Data

|

Macro

|

||

| 04:30 |

|

CBI Service Sector Survey |

Monthly

|

Data

|

Services

|

||

| 05:00 |

|

Euro Area Economic Sentiment |

Semi-Monthly

|

Data

|

Sentiment

|

||

| 06:00 |

|

Spain Business Confidence |

Monthly

|

Data

|

Sentiment

|

||

| 08:00 |

|

Bank of England Weekly Report |

Weekly

|

Data

|

Monetary Policy

|

||

| 08:30 |

|

Chicago Fed Labor Market Indicators |

Semimonthly

|

Data

|

Employment

|

||

| 08:30 |

|

|

US Unemployment Insurance |

Weekly

|

Data

|

Employment

|

|

| 08:30 |

|

|

Canada International Trade |

Monthly

|

Data

|

Trade

|

|

| 08:30 |

|

|

US Productivity and Costs |

Quarterly

|

Data

|

Employment

Macro

|

|

| 08:30 |

|

|

US International Trade |

Monthly

|

Data

|

Trade

|

|

| 08:30 |

|

US Advance Economic Indicators |

Monthly

|

Data

|

Macro

|

||

| 09:45 |

|

Drewry World Container Index |

Weekly

|

Data

|

Shipping

|

||

| 10:00 |

|

US Wholesale Inventories |

Monthly

|

Data

|

Macro

|

||

| 10:00 |

|

US Business Trends and Outlook Survey |

Biweekly

|

Data

|

Macro

|

||

| 10:00 |

|

|

US Manufacturers' Shipments, Inventories, and Orders |

Monthly

|

Data

|

Industry

|

|

| 10:00 |

|

Richmond Fed Regional Business Surveys |

Monthly

|

Data

|

PMI

|

||

| 10:00 |

|

St Louis Fed Financial Stress Index |

Weekly

|

Data

|

Markets

|

||

| 10:30 |

|

|

EIA Natural Gas Storage Report |

Weekly

|

Data

|

Energy

|

|

| 11:30 |

|

Weekly Economic Index |

Weekly

|

Data

|

Macro

|

||

| 12:00 |

|

AAA Gas Prices |

Weekly

|

Data

|

Energy

|

||

| 12:00 |

|

Freddie Mac Mortgage Rates |

Weekly

|

Data

|

Real Estate

|

||

| 16:00 |

|

RBC Global Insight Weekly |

Weekly

|

Outlook

|

Macro

|

||

| 16:30 |

|

Federal Reserve Balance Sheet |

Weekly

|

Data

|

Monetary Policy

|

||

| 18:50 |

|

Preliminary Report on the Current Survey of Commerce |

Monthly

|

Data

|

Consumption

|

||

| 19:30 |

|

|

Japan Employment |

Monthly

|

Data

|

Employment

|

|

| 19:50 |

|

|

Japan Industrial Production |

Monthly

|

Data

|

Industry

|

|

| 21:30 |

|

Australia PPI |

Quarterly

|

Data

|

Prices

|

| 00:00 |

|

Mizuho Forex Medium-Term Outlook |

Monthly

|

Outlook

|

FX

|

||

| 02:00 |

|

Germany Import & Export Prices |

Monthly

|

Data

|

Prices

Trade

|

||

| 02:00 |

|

Spain Import & Export Price Indexes |

Monthly

|

Data

|

Prices

Trade

|

||

| 02:00 |

|

UK Nationwide House Price Index |

Monthly

|

Data

|

Real Estate

|

||

| 02:00 |

|

|

Germany GDP |

Monthly

|

Data

|

GDP

|

|

| 02:45 |

|

|

France GDP |

Quarterly

|

Data

|

GDP

|

|

| 02:45 |

|

France Agricultural Producer Prices |

Monthly

|

Data

|

Agriculture

Prices

|

||

| 02:45 |

|

|

France PPI |

Monthly

|

Data

|

Prices

|

|

| 02:45 |

|

|

France Household Goods Consumption |

Monthly

|

Data

|

Consumption

|

|

| 02:45 |

|

France Trade Sales |

Monthly

|

Data

|

Macro

|

||

| 02:45 |

|

|

France Payroll Employment |

Quarterly

|

Data

|

Employment

|

|

| 03:00 |

|

|

Spain CPI |

Monthly

|

Data

|

Prices

|

|

| 03:45 |

|

France Trade Sales |

Monthly

|

Data

|

Macro

|

||

| 03:45 |

|

France Services Output |

Monthly

|

Data

|

Services

|

||

| 03:55 |

|

|

Destatis Germany Employment |

Monthly

|

Data

|

Employment

|

|

| 03:55 |

|

Bundesagentur fur Arbeit Germany Employment |

Monthly

|

Data

|

Employment

|

||

| 04:00 |

|

ECB Consumer Expectations Survey |

Monthly

|

Data

|

Macro

|

||

| 04:00 |

|

|

Italy GDP |

Quarterly

|

Data

|

GDP

|

|

| 04:00 |

|

|

Italy Employment |

Monthly

|

Data

|

Employment

|

|

| 04:00 |

|

Spain Current Account |

Monthly

|

Data

|

Trade

|

||

| 04:30 |

|

Money and Credit |

Monthly

|

Data

|

Monetary Policy

|

||

| 05:00 |

|

|

Italy PPI |

Monthly

|

Data

|

Prices

|

|

| 05:00 |

|

|

Euro Area Employment |

Monthly

|

Data

|

Employment

|

|

| 06:00 |

|

IATA Chart of the Week |

Weekly

|

Commentary

|

Transportation

|

||

| 08:30 |

|

|

US PPI |

Monthly

|

Data

|

Prices

|

|

| 08:30 |

|

|

Canada GDP |

Monthly

|

Data

|

GDP

|

|

| 09:00 |

|

NRA Restaurant Performance Index |

Monthly

|

Data

|

Services

|

||

| 09:00 |

|

Freddie Mac House Price Index |

Monthly

|

Data

|

Real Estate

|

||

| 09:00 |

|

NRA Restaurant Same-Store Sales and Customer Traffic |

Monthly

|

Data

|

Services

|

||

| 09:30 |

|

IATA Air Cargo Market Analysis |

Monthly

|

Data

|

Transportation

|

||

| 09:30 |

|

Freddie Mac Monthly Volume Summary |

Monthly

|

Data

|

Real Estate

|

||

| 09:30 |

|

Fannie Mae Monthly Summary |

Monthly

|

Data

|

Real Estate

|

||

| 09:30 |

|

IATA Air Passenger Market Analysis |

Monthly

|

Data

|

Transportation

|

||

| 09:45 |

|

ISM Chicago PMI |

Monthly

|

Data

|

PMI

|

||

| 10:00 |

|

Drewry Port Throughput Index |

Monthly

|

Data

|

Shipping

|

||

| 11:45 |

|

New York Fed Staff Nowcast |

Weekly

|

Outlook

|

GDP

|

||

| 12:00 |

|

CIBC The Week Ahead |

Weekly

|

Commentary

|

Macro

|

||

| 12:00 |

|

MTSI Services PMI Composite Indexes |

Weekly

|

Data

|

PMI

|

||

| 12:00 |

|

MTSI Manufacturing PMI Composite Indexes |

Weekly

|

Data

|

PMI

|

||

| 13:00 |

|

Baker Hughes Rig Count |

Weekly

|

Data

|

Energy

|

||

| 16:00 |

|

Wells Fargo Weekly Economic and Financial Commentary |

Weekly

|

Commentary

|

Macro

|

||

| 16:30 |

|

Wells Fargo Looking Ahead |

Weekly

|

Commentary

|

Markets

|

||

| 20:30 |

|

|

China NBS PMIs |

Monthly

|

Data

|

Industry

PMI

|

| 08:00 |

|

|

Germany CPI |

Monthly

|

Data

|

Prices

|

| 04:00 |

|

OPEC Meeting |

Monthly

|

Event

|

Energy

|

||

| 18:50 |

|

Bank of Japan Summary of Opinions |

Commentary

|

Monetary Policy

|

| 00:00 |

|

|

S&P Global Manufacturing PMIs |

Monthly

|

Data

|

Industry

PMI

|

|

| 00:30 |

|

RBA Index of Commodity Prices |

Monthly

|

Data

|

Commodities

|

||

| 02:00 |

|

|

Germany Retail Sales |

Monthly

|

Data

|

Consumption

|

|

| 06:00 |

|

ICE Mortgage Monitor |

Monthly

|

Data

|

Real Estate

|

||

| 07:00 |

|

JPMorgan Weekly Market Recap |

Weekly

|

Commentary

|

Markets

|

||

| 07:00 |

|

Capital Economics Chief Economist's Note |

Weekly

|

Commentary

|

Macro

|

||

| 07:00 |

|

BlackRock Global Weekly Commentary |

Weekly

|

Commentary

|

Markets

|

||

| 09:00 |

|

S&P Global This Week in Credit |

Weekly

|

Commentary

|

Credit

|

||

| 09:00 |

|

GasBuddy Weekly Gas Price Report |

Weekly

|

Commentary

|

Energy

|

||

| 09:15 |

|

NBER Digest |

Monthly

|

Research

|

Macro

|

||

| 09:30 |

|

LinkUp Monthly NFP Forecast |

Monthly

|

Data

|

Employment

|

||

| 09:45 |

|

|

S&P Global US Manufacturing PMI |

Monthly

|

Data

|

Manufacturing

PMI

|

|

| 10:00 |

|

|

US Construction Spending |

Monthly

|

Data

|

Construction

|

|

| 10:00 |

|

Creighton University Mid-American PMI |

Monthly

|

Data

|

PMI

|

||

| 10:00 |

|

|

ISM Manufacturing PMI |

Monthly

|

Data

|

Industry

PMI

|

|

| 10:00 |

|

Cox Automotive Auto Market Weekly |

Weekly

|

Commentary

|

Macro

|

||

| 11:00 |

|

Commodity Price & Supply Indicators |

Monthly

|

Data

|

Macro

|

||

| 12:00 |

|

IATA Jet Fuel Price Monitor |

Weekly

|

Data

|

Energy

|

||

| 12:00 |

|

MTSI Manufacturing PMI Composite Indexes |

Weekly

|

Data

|

PMI

|

||

| 14:00 |

|

Senior Loan Officer Opinion Survey (SLOOS) |

Quarterly

|

Data

|

Credit/Debt

|

||

| 15:00 |

|

Merrill Lynch Capital Market Outlook |

Weekly

|

Commentary

|

Markets

|

||

| 15:00 |

|

Apartment List National Rent Report |

Monthly

|

Data

|

Real Estate

|

||

| 15:00 |

|

US Treasury Refunding Financing Estimates |

Quarterly

|

Data

|

Government

|

| 00:30 |

|

|

RBA Monetary Policy Decision |

Monetary Policy Decision

|

Monetary Policy

|

||

| 01:00 |

|

Japan Machine Tool Orders |

Monthly

|

Data

|

Industry

|

||

| 02:45 |

|

|

France CPI |

Monthly

|

Data

|

Prices

|

|

| 03:00 |

|

Spain Tourist Arrivals |

Monthly

|

Data

|

Services

|

||

| 03:00 |

|

Spain Monthly Unemployment |

Monthly

|

Data

|

Employment

|

||

| 03:00 |

|

Spain Tourist Expenditures |

Monthly

|

Data

|

Services

|

||

| 04:00 |

|

Euro Area Bank Lending Survey |

Quarterly

|

Data

|

Credit/Debt

|

||

| 06:00 |

|

Logistics Managers’ Index |

Monthly

|

Data

|

PMI

|

||

| 08:00 |

|

|

BEA US Vehicle Sales |

Monthly

|

Data

|

Consumption

Transportation

|

|

| 08:30 |

|

Paychex Small Business Employment Watch |

Monthly

|

Data

|

Employment

|

||

| 08:55 |

|

Redbook Retail Sales Index |

Weekly

|

Data

|

Consumption

|

||

| 10:00 |

|

US Housing Vacancies and Homeownership |

Quarterly

|

Data

|

Real Estate

|

||

| 10:00 |

|

Richmond Fed Business Attitudes on Pricing and Inflation |

Quarterly

|

Data

|

Prices

|

||

| 10:00 |

|

|

JOLTS Survey |

Monthly

|

Data

|

Employment

|

|

| 10:00 |

|

EIA Gasoline and Diesel Fuel Update |

Weekly

|

Data

|

Energy

|

||

| 10:00 |

|

RCM-TIPP Consumer Sentiment Survey |

Monthly

|

Data

|

Sentiment

|

||

| 12:00 |

|

Freightos Weekly Update |

Weekly

|

Commentary

|

Transportation

|

||

| 16:30 |

|

API Crude Oil Stock Change |

Weekly

|

Data

|

Energy

|

||

| 19:00 |

|

Ai Group Australian Industry Index |

Monthly

|

Data

|

Macro

PMI

|

| 00:00 |

|

|

S&P Global Services PMIs |

Monthly

|

Data

|

PMI

Services

|

|

| 00:00 |

|

S&P Global Sector PMIs |

Monthly

|

Data

|

Macro

|

||

| 04:00 |

|

Euro Area Bank Interest Rate Statistics |

Monthly

|

Data

|

Monetary Policy

|

||

| 05:00 |

|

OECD Consumer Barometer |

Monthly

|

Data

|

Sentiment

|

||

| 05:00 |

|

|

Euro Area HICP Inflation |

Monthly

|

Data

|

Prices

|

|

| 05:00 |

|

|

Italy CPI |

Monthly

|

Data

|

Prices

|

|

| 05:00 |

|

|

Euro Area PPI |

Monthly

|

Data

|

Prices

|

|

| 07:00 |

|

|

MBA Mortgage Applications |

Weekly

|

Data

|

Real Estate

|

|

| 08:15 |

|

|

ADP National Employment Report |

Monthly

|

Data

|

Employment

|

|

| 08:30 |

|

US Treasury Refunding Financing Estimates |

Quarterly

|

Data

|

Government

|

||

| 08:30 |

|

Chicago Fed National Financial Conditions Index (NFCI) |

Weekly

|

Data

|

Markets

|

||

| 09:45 |

|

|

S&P Global US Services PMI |

Monthly

|

Data

|

Services

PMI

|

|

| 10:00 |

|

|

ISM Services PMI |

Monthly

|

Data

|

PMI

Services

|

|

| 10:30 |

|

|

EIA Weekly Petroleum Status Report |

Weekly

|

Data

|

Energy

|

|

| 12:00 |

|

AAR Weekly Rail Traffic |

Weekly

|

Data

|

Transportation

|

||

| 12:00 |

|

MTSI Services PMI Composite Indexes |

Weekly

|

Data

|

PMI

|

||

| 16:00 |

|

Weekly Market Guide |

Weekly

|

Commentary

|

Markets

|

||

| 16:00 |

|

AAII Bull/Bear Investor Sentiment Survey |

Weekly

|

Data

|

Markets

|

||

| 19:50 |

|

Japan International Transactions in Securities |

Weekly

|

Data

|

Markets

|

||

| 21:30 |

|

Australia International Trade |

Monthly

|

Data

|

Trade

|