Analysis

Almost as abruptly as President Trump’s tariff and possibly military threats related to Greenland came, they went. Trump called off the proposed tariffs on eight NATO allies following talks with NATO leadership in Davos last-Wednesday that the president said yielded an accepted framework for a future deal.

This chain of events joins several other examples of Trump threatening and then scrapping tariffs due either to concessions gained, backlash, or both since taking office last year. President Trump issued more tariff threats on social media this week, promising 25% tariffs on all exports from South Korea if parliament does not pass the bill approving the terms of the US-Korea trade deal negotiated last year. And, prompted by Canada’s recent trade agreement with China centering on Chinese EVs and Canadian canola seeds, Trump also threatened Canada with 100% tariffs if it enters a comprehensive free trade deal with China.

This development reflects growing tensions between the US and Canada ahead of a possible US review of the USMCA this summer. In addition to resolving tariff issues with China, Canada is also holding trade cooperation talks with India, as they and other countries are increasingly looking to diversify away from an over-reliance on the US as trade tensions stretch on.

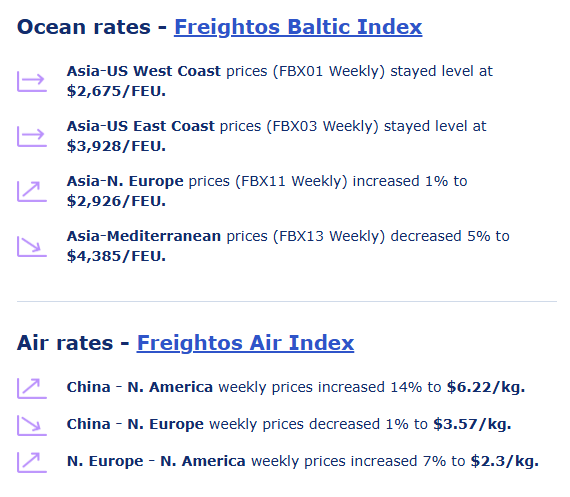

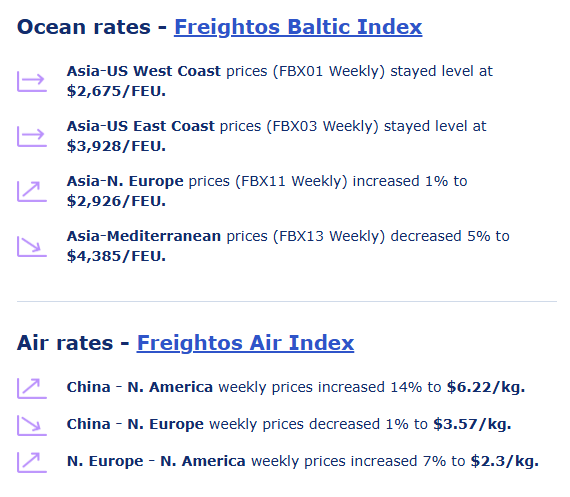

Asia - Europe ocean rates were level to N. Europe and dipped 5% to the Mediterranean as the pre-Lunar New Year rush starts to ease. A five-day rail worker strike in Belgium started on Sunday which could cause delays and additional congestion in Antwerp and knock-on impacts on ports like Rotterdam and Hamburg, which are already struggling with congestion.

Transpacific container prices were stable last week as well, with reports that carriers are starting to offer discounts. Rates starting to slide a little earlier than usual suggests carriers are working to capture volumes that may be proving weaker than expected, as retailers exercise caution in ordering decisions given the trade war-driven uncertainty.

The massive winter storm that brought snow, sub-zero temperatures and ice to much of the northeast, southeast and parts of the midwest US over the weekend significantly disrupted rail services, road transport and container port operations across the impacted regions. Ports in the southeast have started to recover slowly, but as snowfall in the northeast continued through Monday, the major hubs including New York/New Jersey remained closed.

The storm also led to more than 11,000 flight US cancellations on Sunday – the most since the pandemic – with that number dropping to 6,000 on Monday as some southeast and midwest airports were able to restart. Still, more than 1,000 Tuesday flights were scrapped, now concentrated in the northeast. Extremely cold temperatures that may linger and keep conditions icy could slow the speed of recovery.

Air cargo rates from China to the US climbed to more than $6.20/kg and back to early January levels, with prices increasing 9% to $4.57/kg out of South East Asia, possibly helped by storm-driven backlogs and the beginning of some pre-LNY frontloading. China - Europe rates were level at about $3.60/kg.

The possibility of a US strike on Iran is leading several European carriers to cancel flights to the Middle East, with rising tensions also relevant to ocean freight as the Houthis have threatened to renew attacks on passing vessels in the event of US military action.