S&P Global US Manufacturing PMI

S&P Global US Manufacturing PMI

- Source

- S&P Global

- Source Link

- https://www.pmi.spglobal.com/

- Frequency

- Monthly

- Next Release(s)

- February 2nd, 2026 9:45 AM

Latest Updates

-

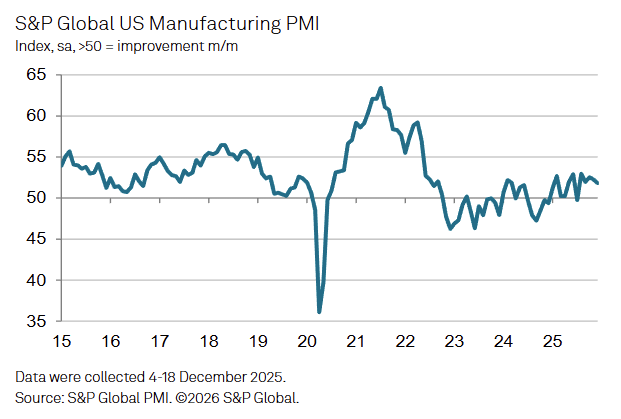

The US S&P Manufacturing PMI eased to 51.8 in December (from 52.2 in November), marking a slower pace of expansion as demand weakened despite continued output growth.

-

New orders declined for the first time in exactly one year, signaling a mild but notable softening in demand conditions after a prolonged expansion.

-

Output continued to grow but at the slowest pace in three months, as production remained solid even amid weaker sales momentum.

-

New export orders fell for a seventh consecutive month, with tariffs cited as a key factor weighing on international demand, particularly exports to Canada.

-

Finished goods inventories increased for a fifth straight month, though the pace of accumulation slowed sharply from November’s record, indicating production continued to outpace sales.

-

Employment growth strengthened to its most pronounced level since August, reflecting firms filling vacancies in anticipation of stronger conditions in 2026.

-

Backlogs of work declined for a fourth consecutive month, pointing to expanding labor capacity and limited workload pressures.

-

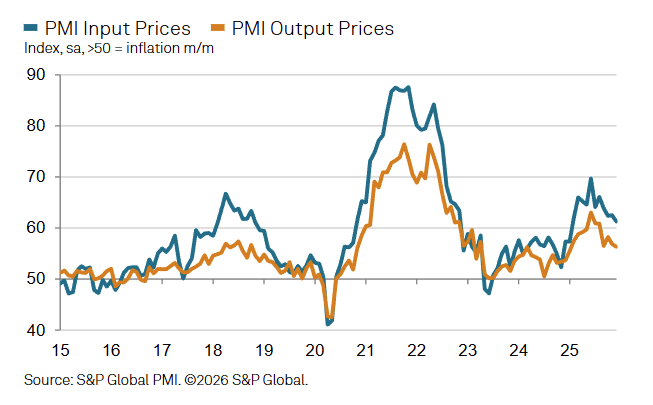

Input cost inflation moderated to an 11-month low but remained historically elevated, while output price inflation also slowed to its weakest rate since early 2025, still reflecting tariff-related cost pressures.

-

Business confidence remained positive but eased from November, as firms cited uncertainty around tariffs and insufficient new orders to replace existing demand.

-