S&P Global US Services PMI

S&P Global US Services PMI

- Source

- S&P Global

- Source Link

- https://www.pmi.spglobal.com/

- Frequency

- Monthly

- Next Release(s)

- February 4th, 2026 9:45 AM

-

March 4th, 2026 9:45 AM

-

April 3rd, 2026 9:45 AM

-

May 5th, 2026 9:45 AM

-

June 3rd, 2026 9:45 AM

-

July 6th, 2026 9:45 AM

-

August 5th, 2026 9:45 AM

-

September 3rd, 2026 9:45 AM

-

October 5th, 2026 9:45 AM

-

November 4th, 2026 9:45 AM

-

December 3rd, 2026 9:45 AM

Latest Updates

-

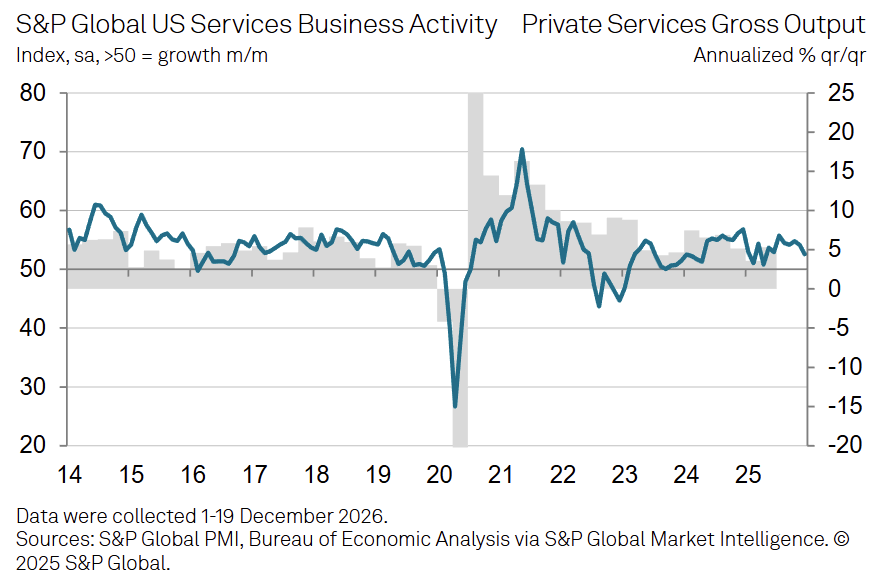

The S&P Global US Services PMI fell to 52.5 in December (from 54.1 in November), signaling slower services activity growth amid cooling demand late in the year.

-

Business activity remained in expansion for a 35th consecutive month, but December marked the slowest growth rate in eight months, reflecting softer momentum as 2025 closed.

-

New business rose only marginally, the weakest increase in 20 months, as firms cited squeezed client budgets, demand uncertainty, and tariff-related instability, particularly for foreign orders.

-

New export business declined for the second time in three months, with the pace of contraction the steepest since May, highlighting external demand softness.

-

Employment edged down slightly, ending a nine-month run of job growth, as cost pressures, budget constraints, and slower demand limited hiring despite modest increases in backlogs.

-

Input cost inflation accelerated to a seven-month high, driven by tariffs, higher supplier charges, and labor-related expenses, remaining well above the historical average.

-

Selling prices rose at a faster pace as firms attempted to pass through higher costs, marking the strongest increase since August and underscoring margin pressure.

-

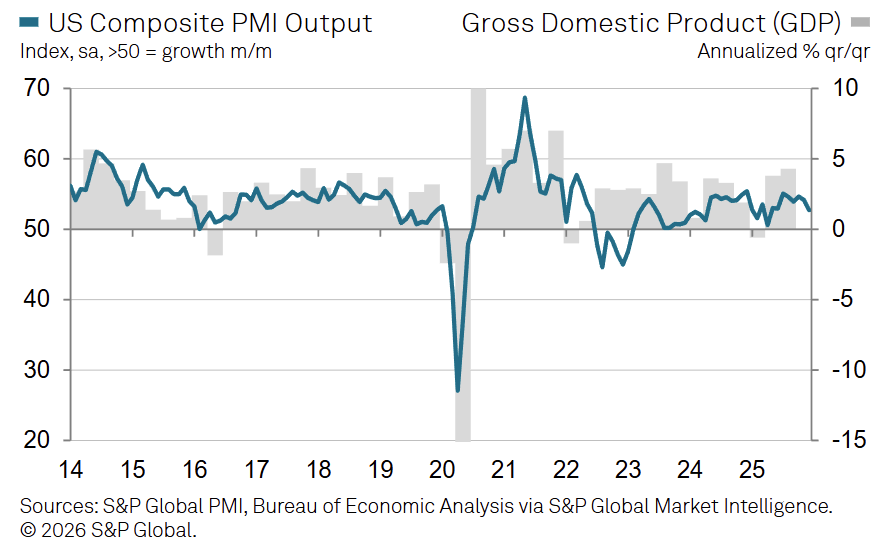

The US Composite PMI eased to 52.7 (Nov: 54.2), consistent with slower growth across both services and manufacturing while remaining above the 50 threshold.

-