Westpac Leading Index

Westpac Leading Index

- Source

- Westpac

- Source Link

- https://www.westpaciq.com.au/

- Frequency

- Monthly

- Next Release(s)

- September 17th, 2025 7:00 PM

Latest Updates

-

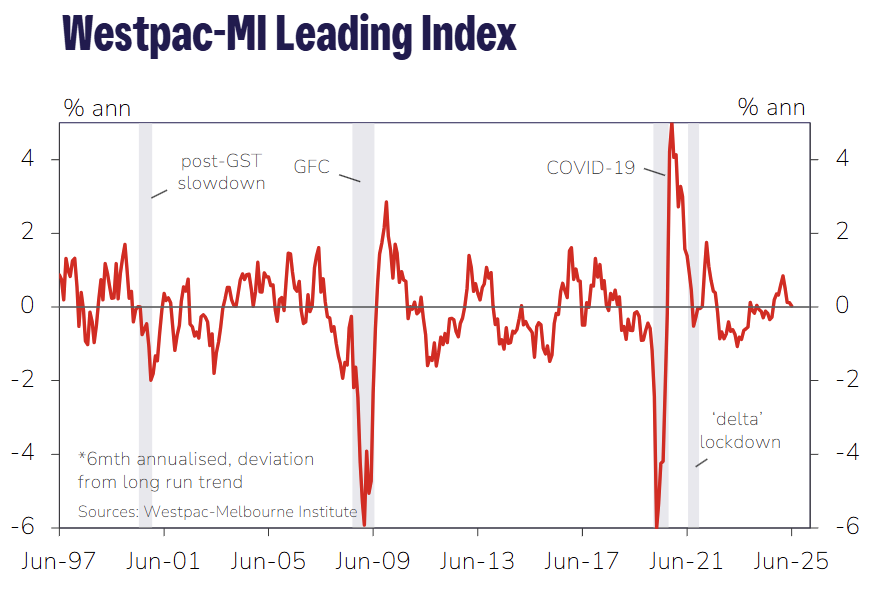

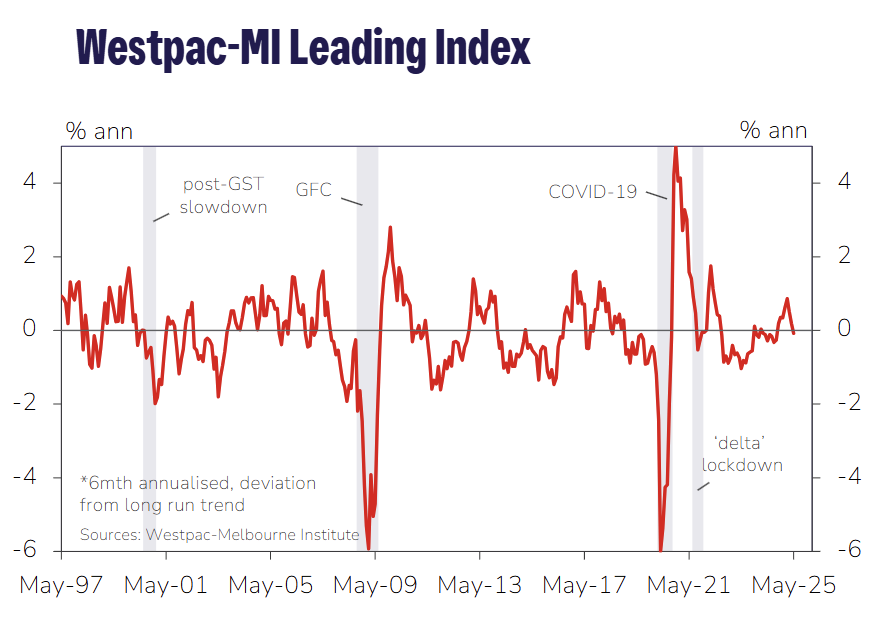

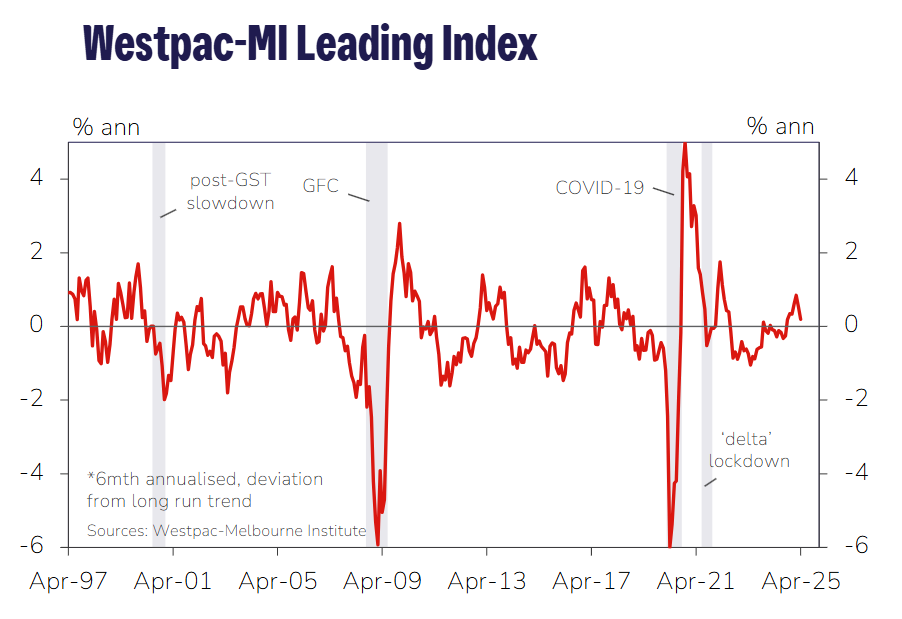

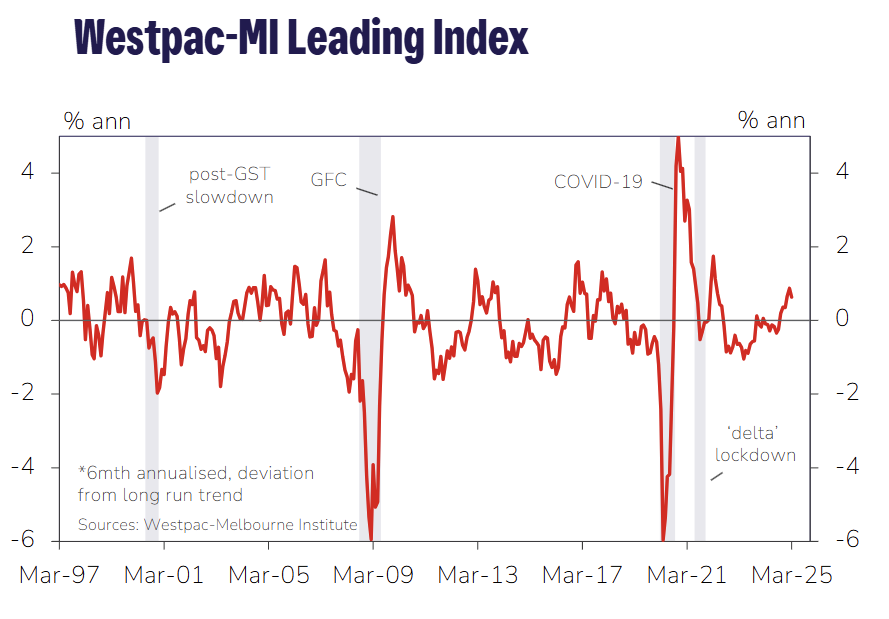

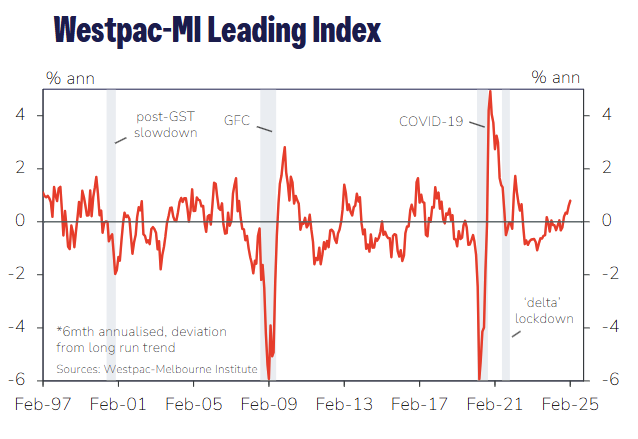

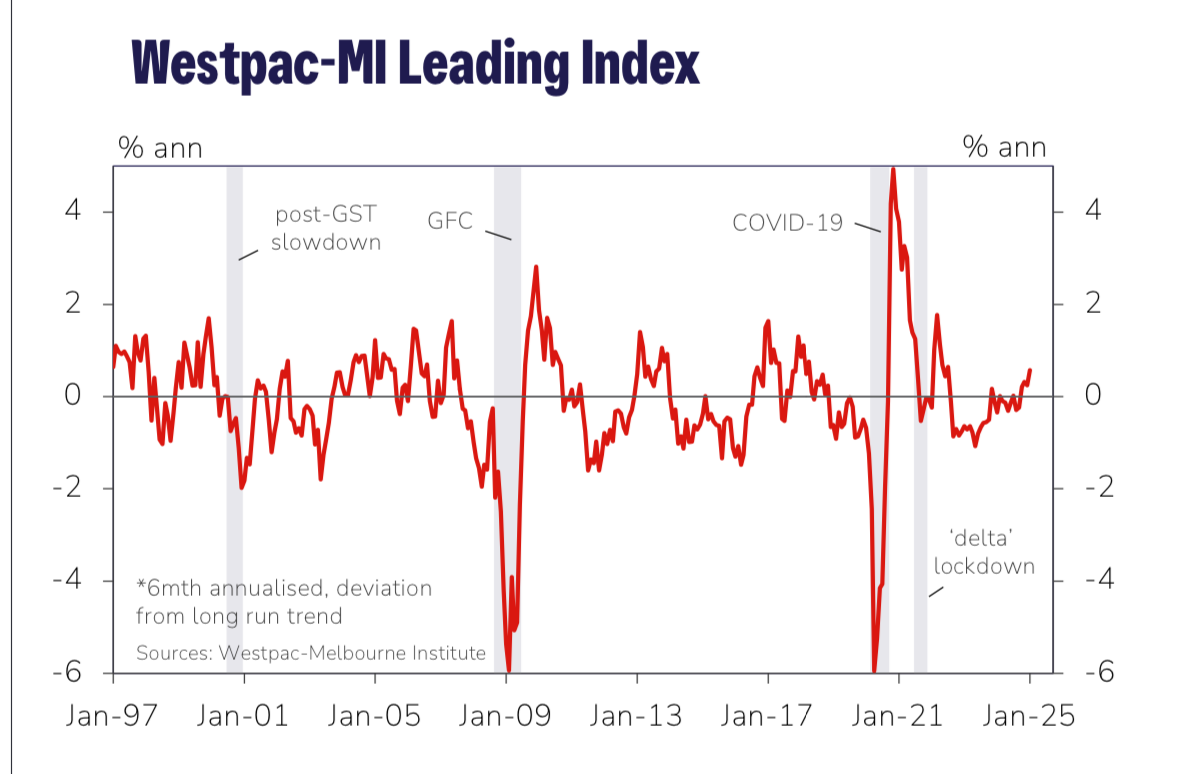

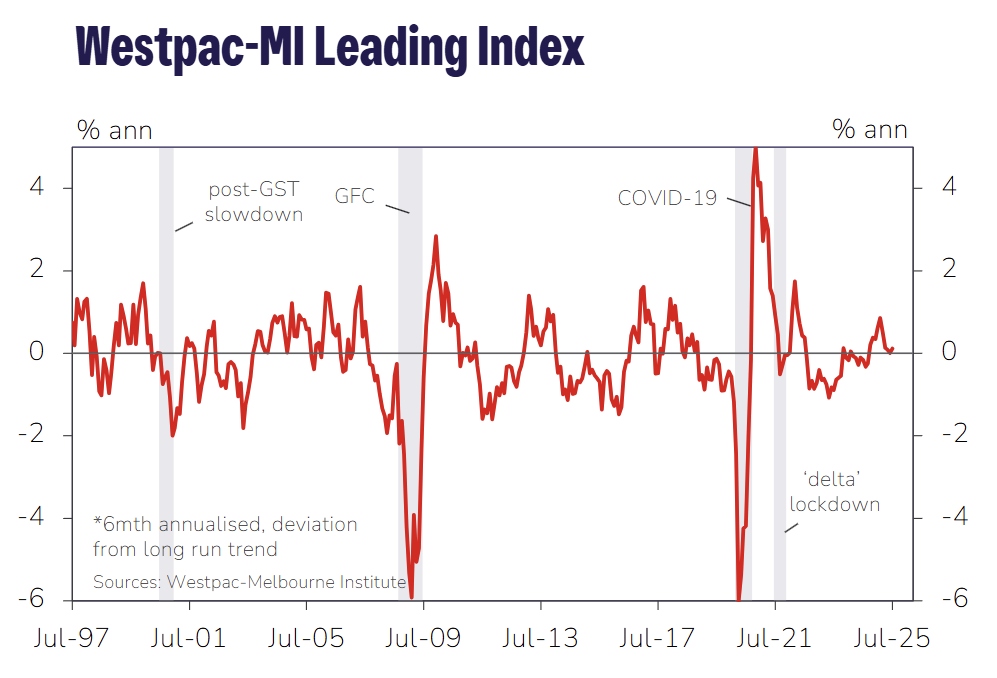

The Westpac–Melbourne Institute Leading Index six-month annualised growth rate edged up to 0.12% in July (prev 0.01%), but momentum remains subdued and well below the 0.61% start to the year.

-

Commodity prices were the largest drag, subtracting –0.25 ppts from the Index since January due to falling USD commodity prices and a stronger AUD.

-

Labor market indicators also weighed, with declining total hours worked and softer consumer expectations cutting –0.22 ppts from growth.

-

Dwelling approvals and unemployment expectations improved in July but remained weak for much of 2025.

-

Financial markets contributed modest support, with the ASX200 recovery and a slightly steeper yield curve adding +0.13 ppts since January.

-

Westpac projects GDP growth of 1.7% in 2025 (vs 1.3% in 2024), returning to a 2.2% trend pace only by end-2026.

-

The RBA is expected to hold rates at its September meeting, with a further 25 bp cut anticipated in November as easing continues gradually.

-