US Retail Sales

US Retail Sales

- Source

- Census Bureau

- Source Link

- https://www.census.gov/

- Frequency

- Monthly

- Next Release(s)

- September 16th, 2025 8:30 AM

Latest Updates

-

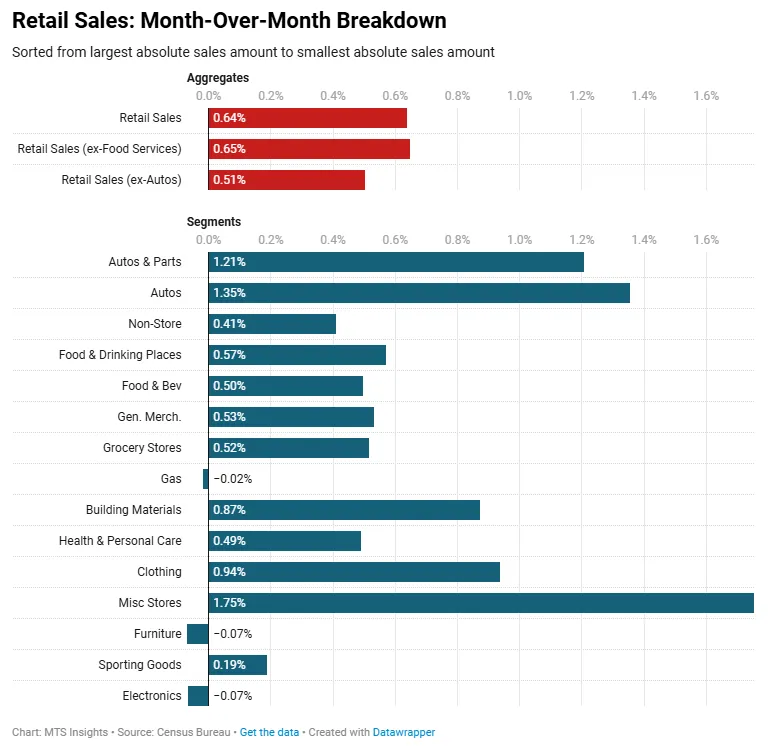

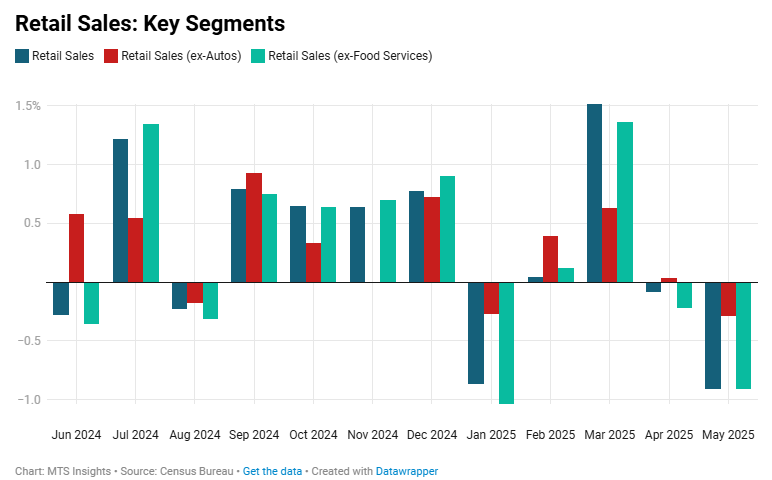

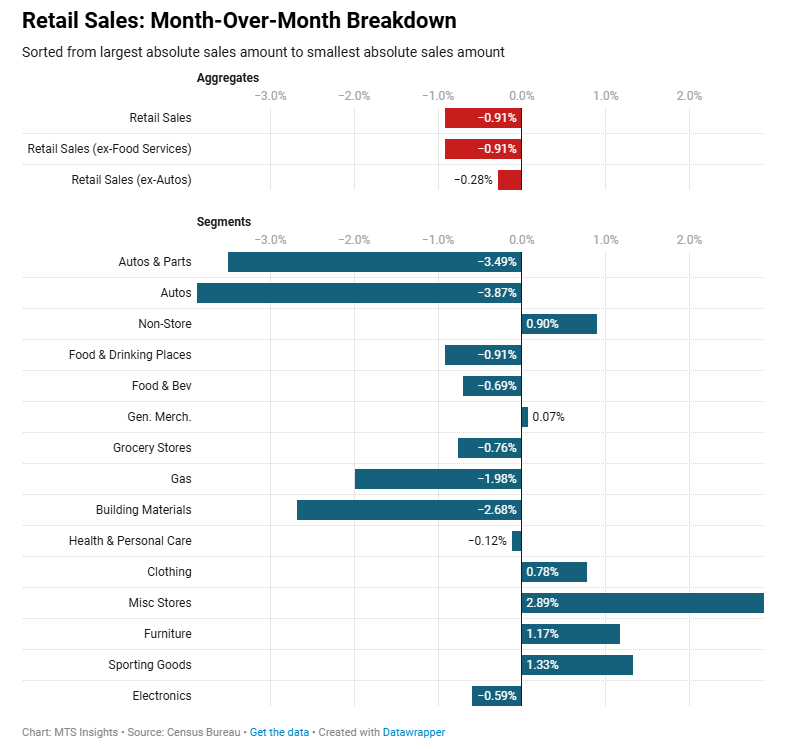

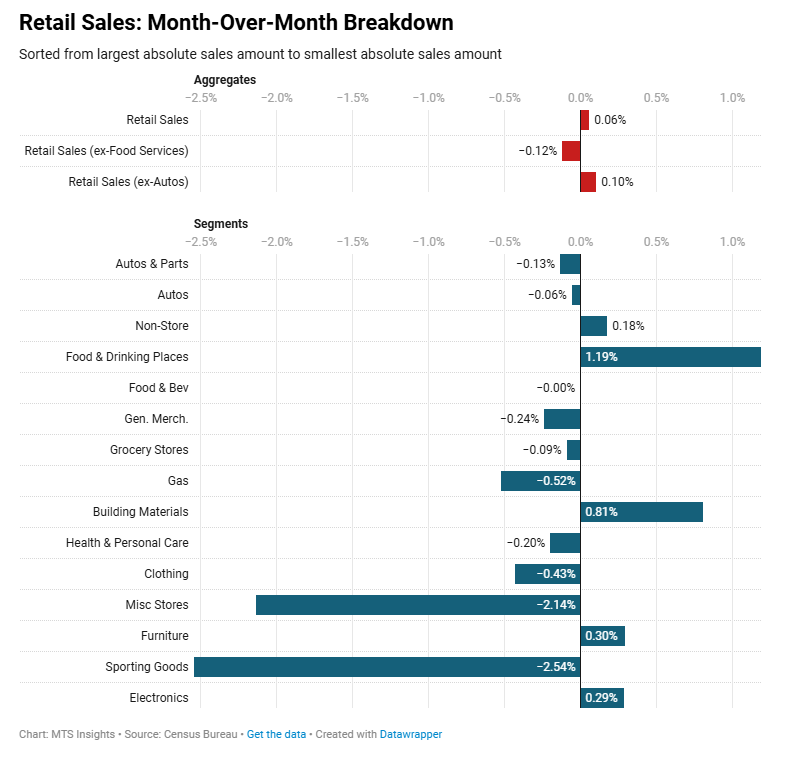

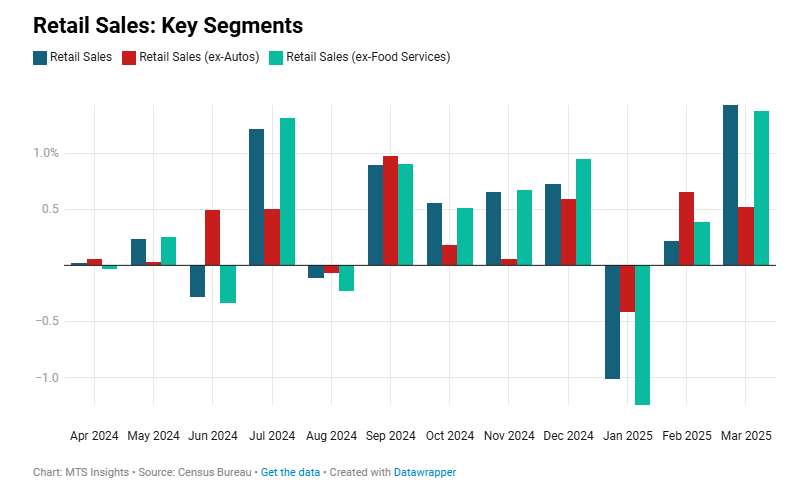

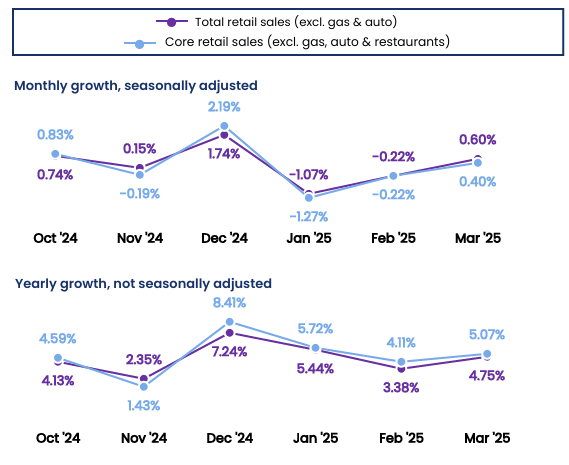

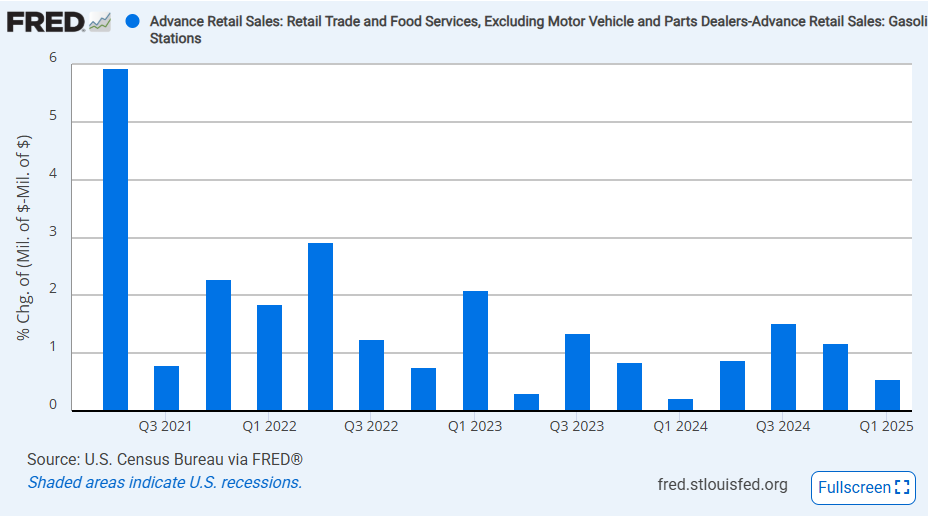

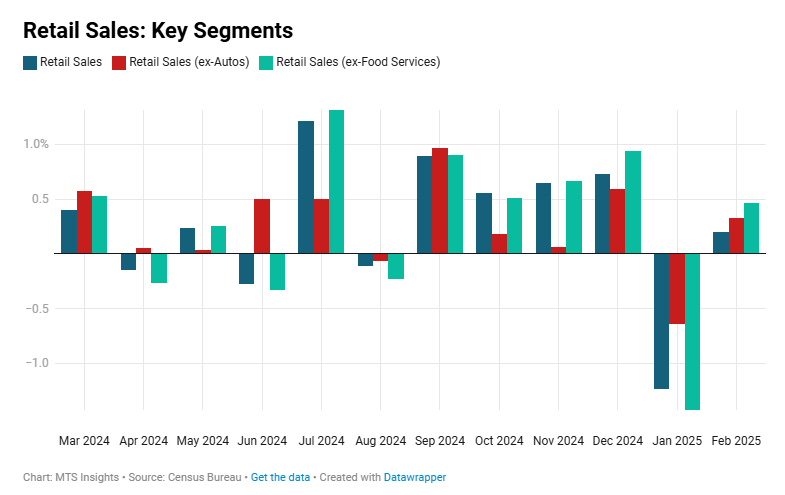

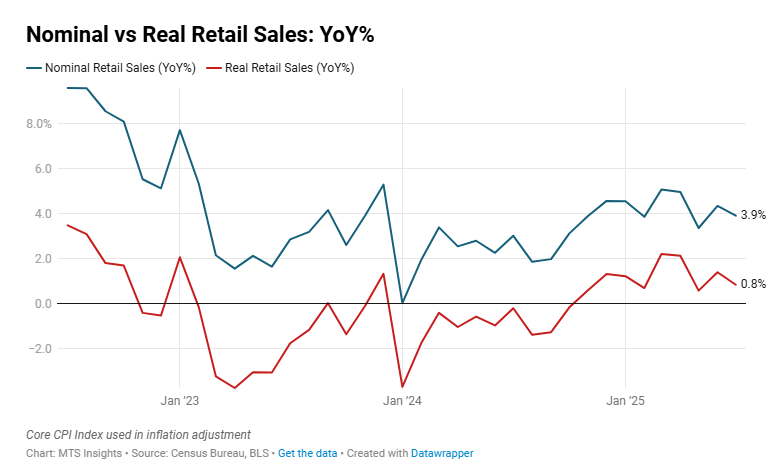

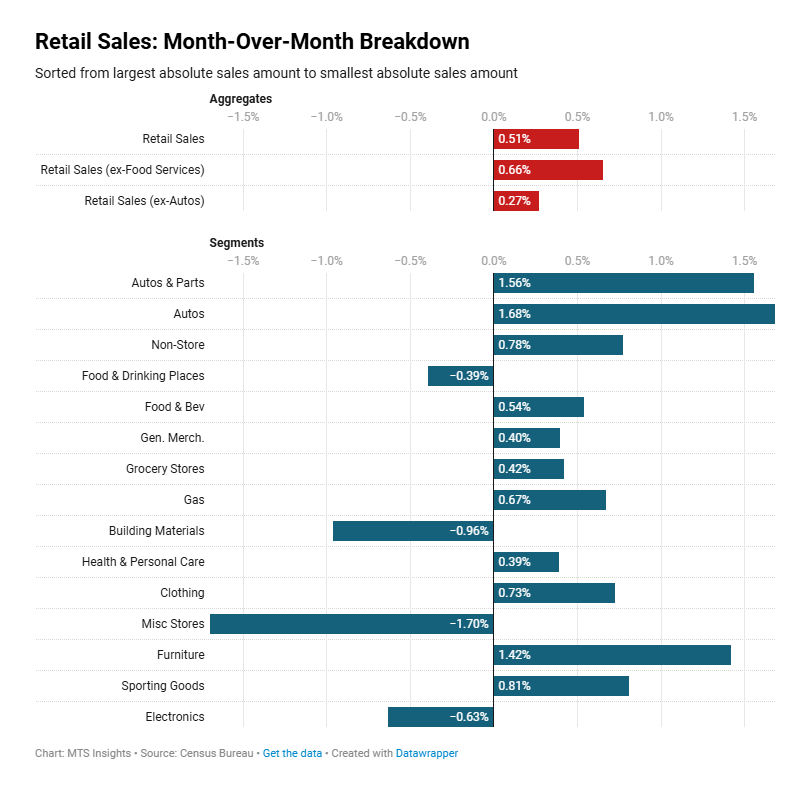

US retail sales data in July pointed to a continuation of strength in consumer spending. Total retail sales increased 0.5% MoM in July, which was in line with what analysts expected, but the more surprising news was an upward revision in the June data that showed that monthly retail sales growth was a robust 0.9% MoM, up from the 0.6% MoM in the initial estimate. The strength fades a bit when excluding autos and gas. Retail sales excluding those categories were up just 0.2% MoM in July, a more substantial slowdown from the 0.8% MoM increase in June. Still, the near-term trend is robust. Sales ex gas and autos in the May to July period were 1.0% higher than in the February through April period. The bottom line is that even though retail sales growth has been volatile recently, the momentum appears to be holding up well as the nominal annual gain is still hovering around 4% YoY.

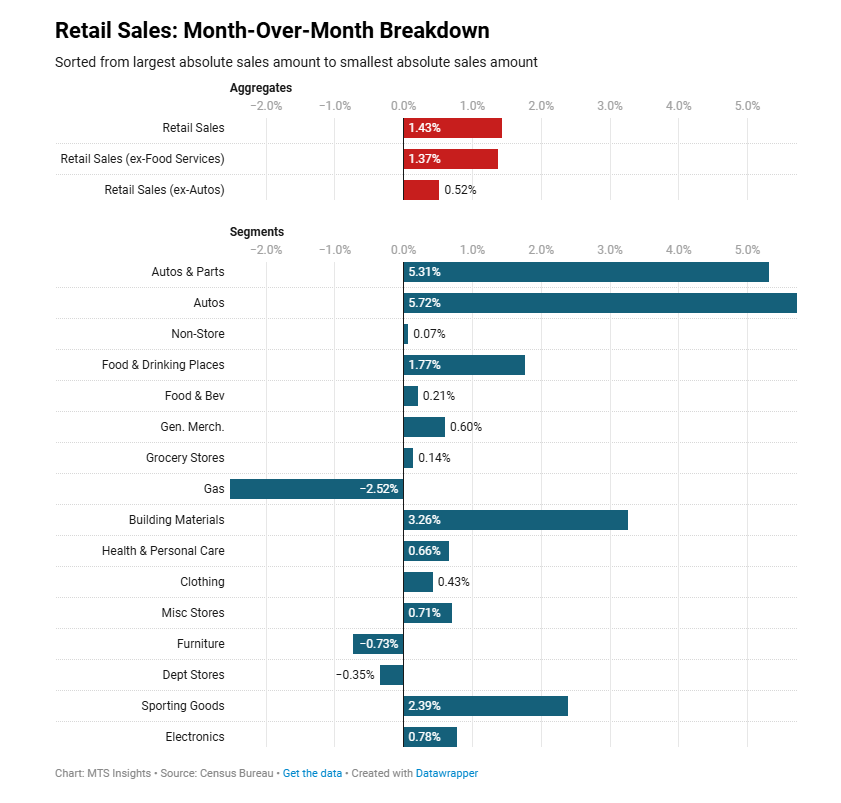

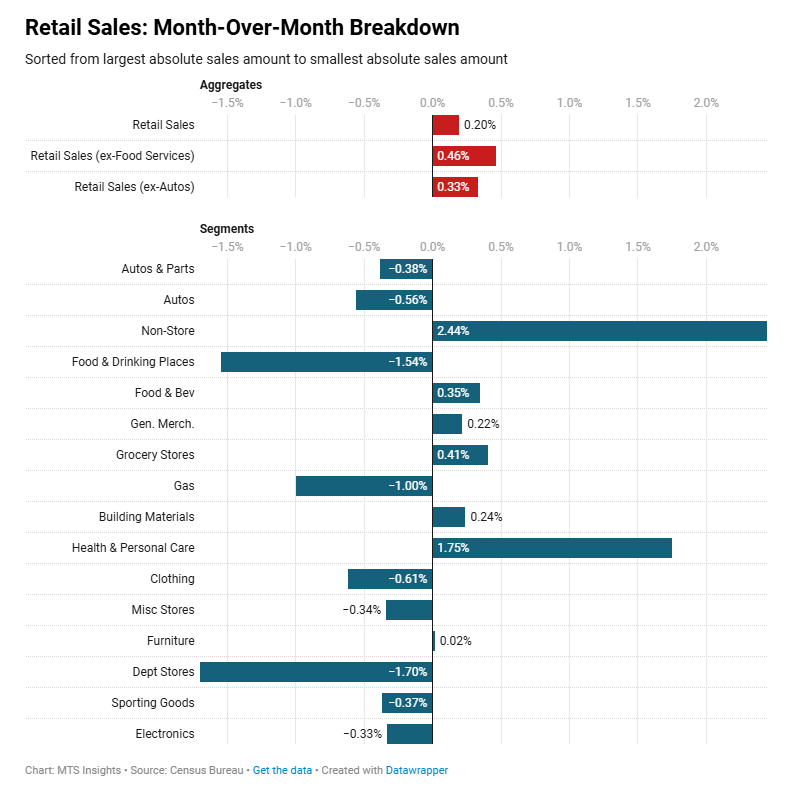

Here are some notes on key retail segments:

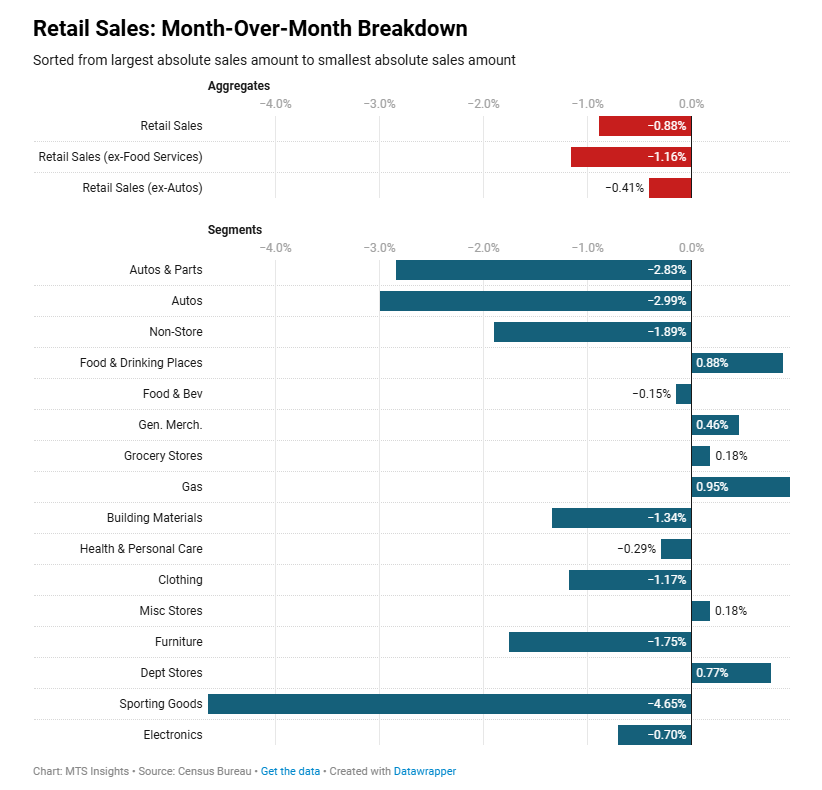

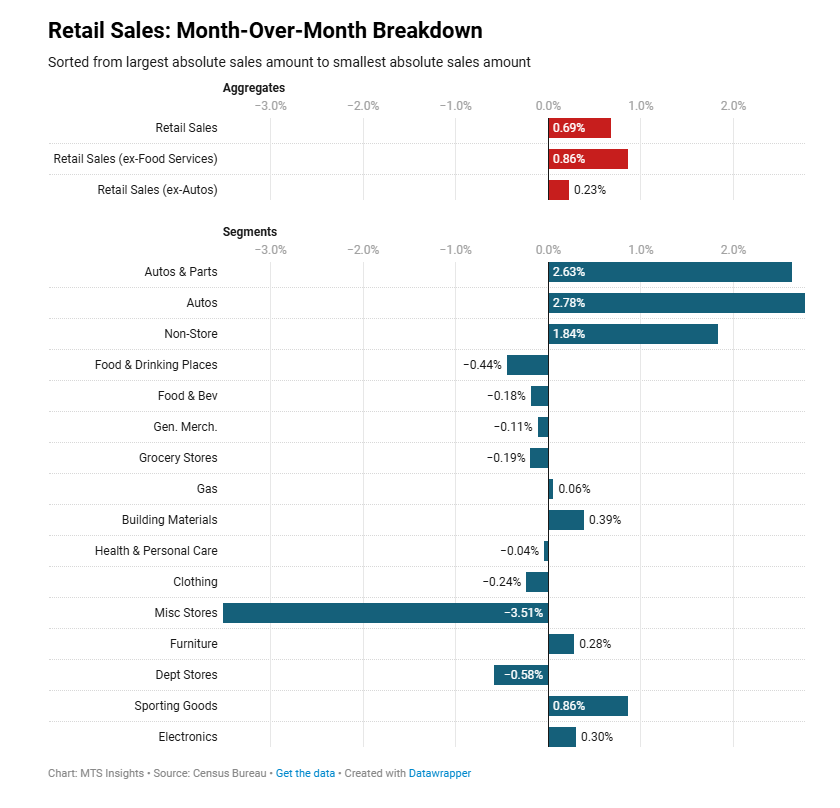

- Auto sales were the main force behind the headline gain as they increased 1.7% MoM in July, adding to the 1.6% MoM increase in June. However, these strong gains are a bit of a rally from the drop in sales that followed the tariff front-running in Q1. On an annual basis, auto sales are still growing at a healthy 4.7% YoY and not showing signs of capitulation.

- Non-store sales, the second largest retail category behind auto sales, were up 0.8% MoM and 8.0% YoY. The growth here was another reason for the strong headline number as e-commerce sales continue to drive consumer spending higher.

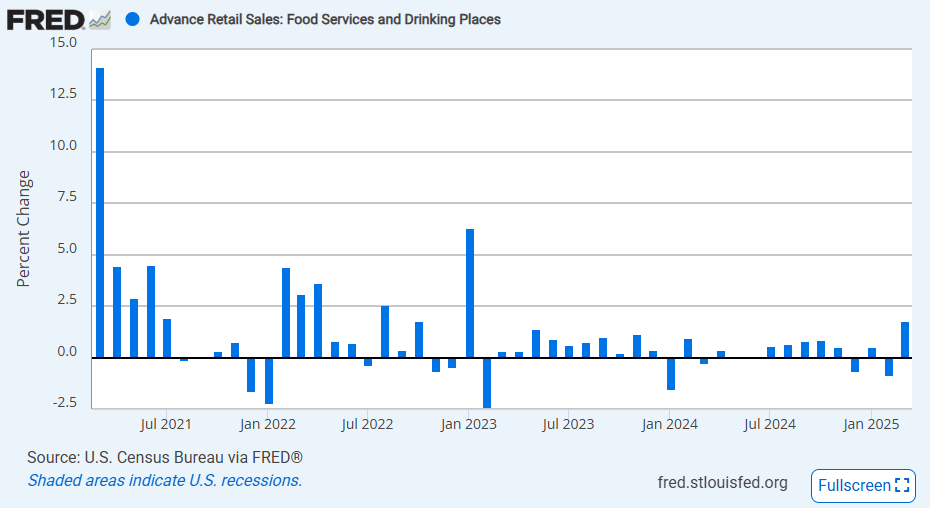

- Food & drinking services, down -0.4% MoM, were the primary dampener to spending growth. This affected the headline number, but is excluded from the retail trade total, which grew a robust 0.7% MoM. Even though there was a monthly decline, food & drinking services spending is still up 5.6% YoY.

- Broadly, most of the other categories saw sales higher in Jul,y with the largest gains in furniture (+1.4% MoM), sporting goods (+0.8% MoM), and clothing (+0.7% MoM). Interestingly, many of these segments would be sensitive to the rise in tariff rates on imported consumer goods, so it is safe to say that tariffs (and the modest increases in goods prices that have come so far) have not deterred consumers from buying goods.

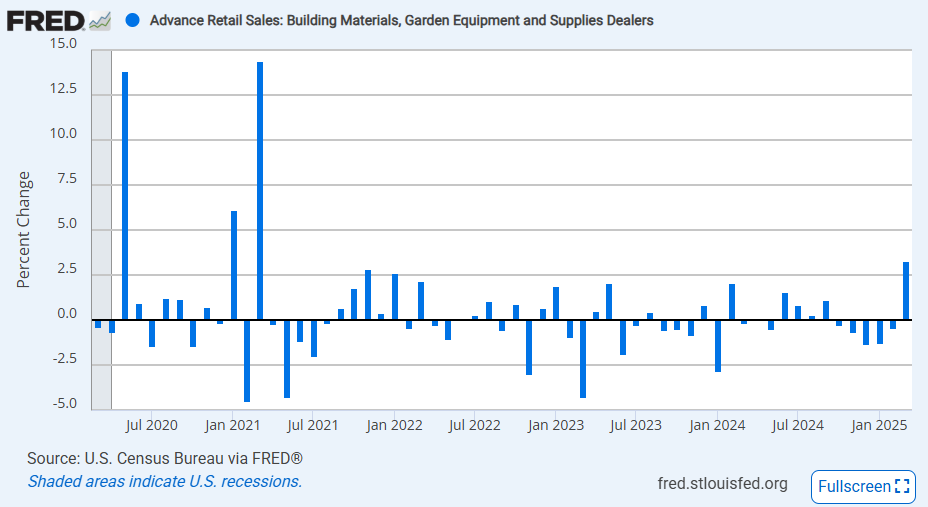

- Building materials, down -1.0% MoM, and electronics & appliances, -0.6% MoM, look a bit like outliers. These categories might be a reflection of weakness in the real estate market, which is finding it difficult to cope with high interest rates.