US Personal Income and Outlays

US Personal Income and Outlays

- Source

- Bureau of Economic Analysis

- Source Link

- https://www.bea.gov/

- Frequency

- Monthly

- Next Release(s)

- December 5th, 2025 10:00 AM

-

December 19th, 2025 8:30 AM

Latest Updates

-

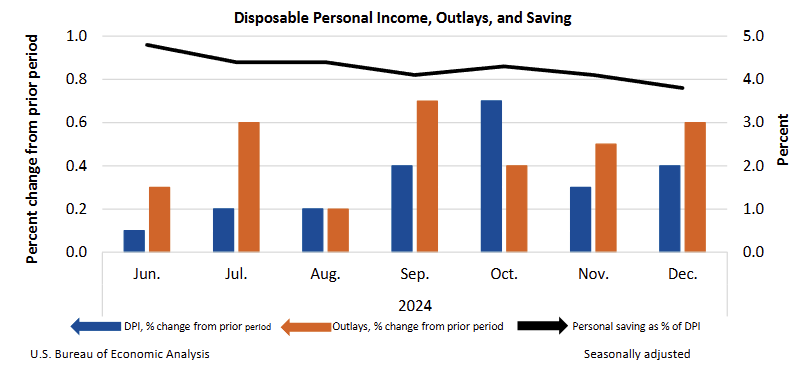

Personal Income

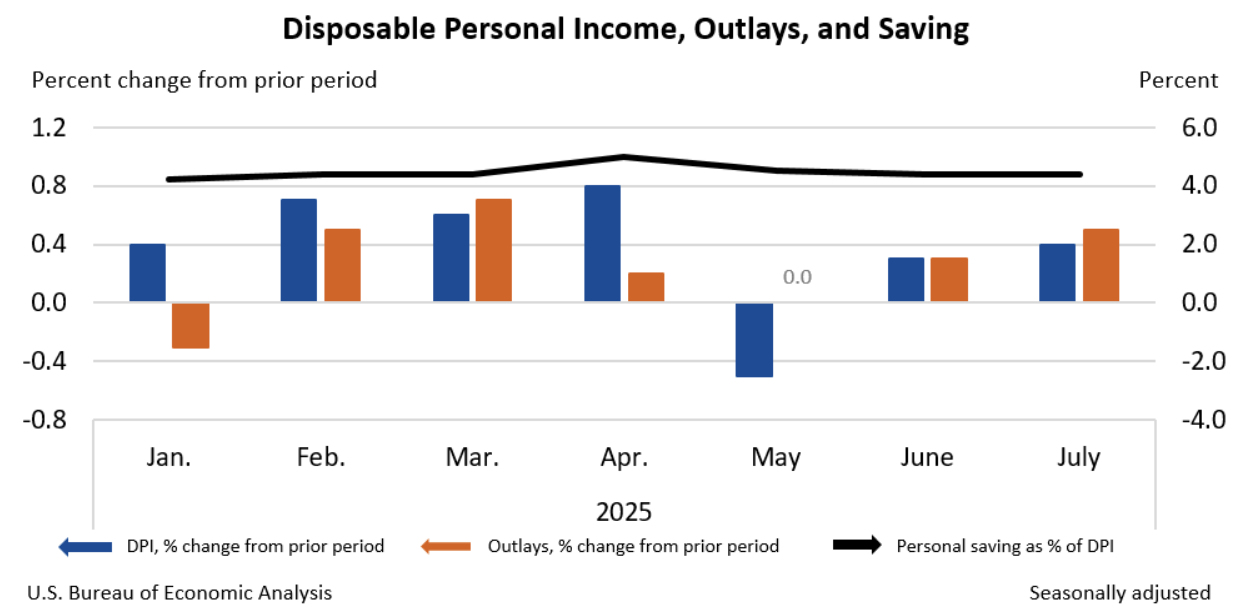

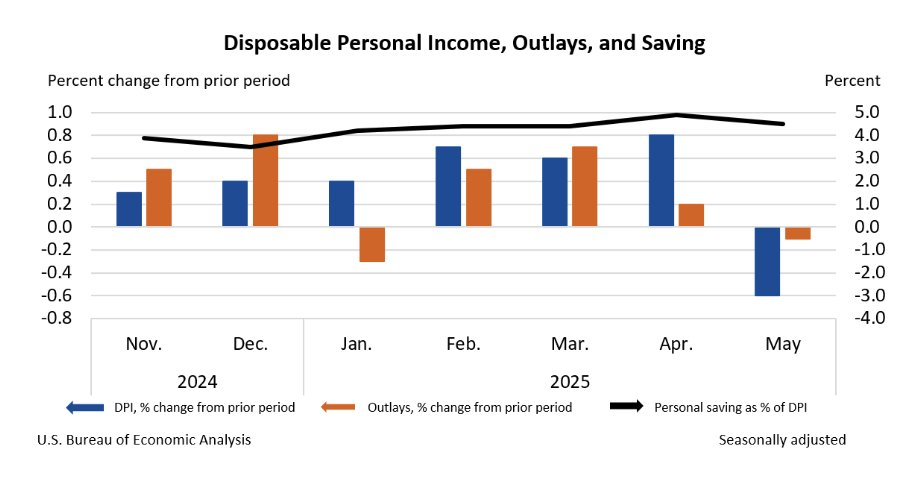

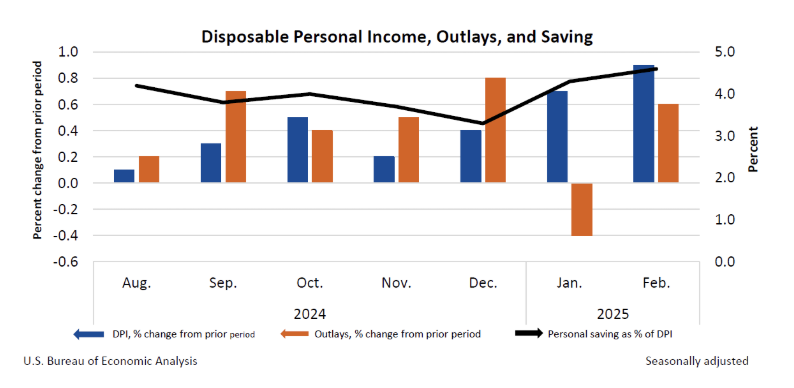

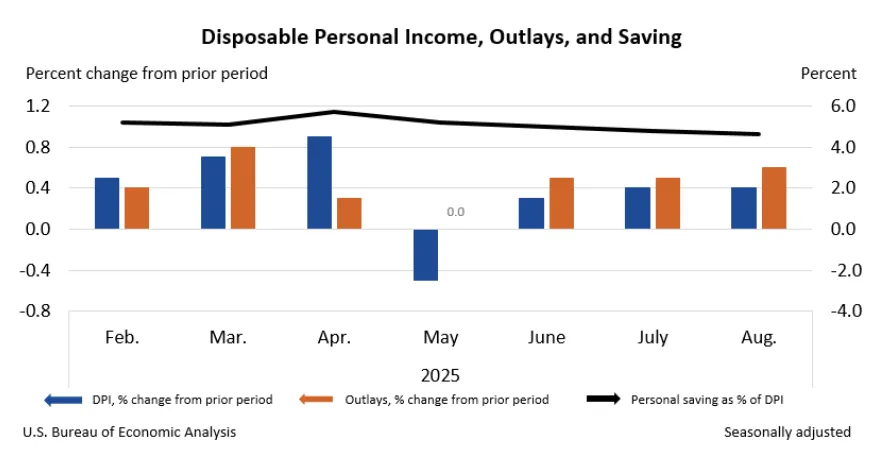

Growth in income in August continued the solid pace that we have seen earlier in the summer. Personal income increased 0.4% MoM in August, matching the pace seen in July and slightly ahead of the June increase. The increase in headline income led to a similar 0.4% MoM increase in disposable income. Both rates were in line with what analysts expected and the strongest monthly gains since April. When adjusted for inflation, income gains look a bit tamer with real disposable income growth at just 0.1% MoM.

In August, income growth was driven by two main factors:

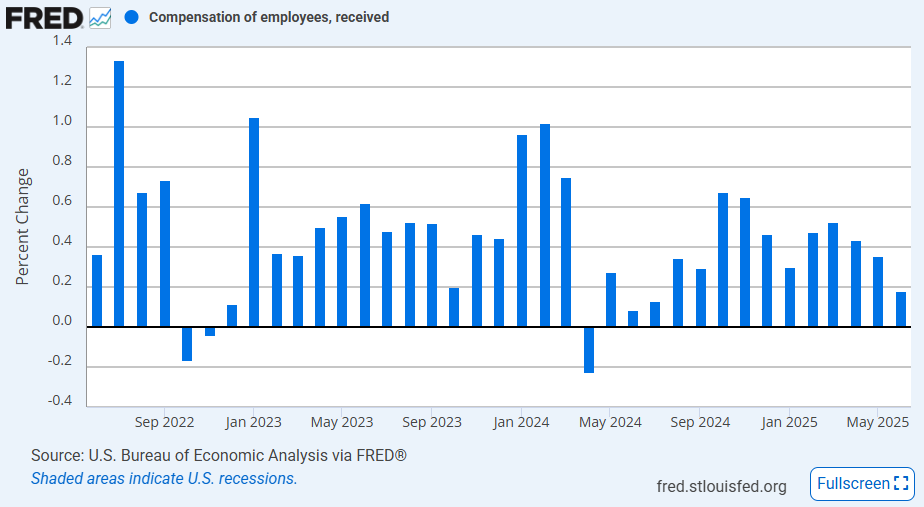

- Employee compensation continued to increase at a decent clip, rising 0.3% MoM, supported by similar gains in wages & salaries and supplements to wages & salaries. Details point to wage gains coming almost entirely from the service sector which accounted for $28.8 billion of the increase, while the goods sector actually saw wages drop -$0.1 billion. The manufacturing industry in particular was the largest drag on wage growth, with a decline of -$2.1 billion.

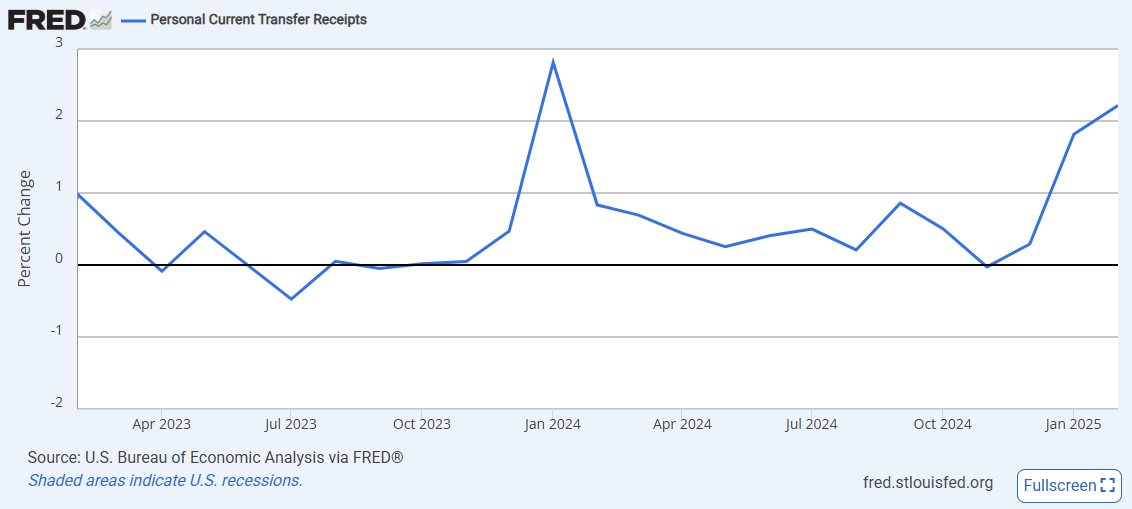

- Personal current transfer receipts were the other force pushing incomes higher, with an increase of 0.6% MoM. The rise was caused by an increase in Medicare (+$10.7 billion), Medicaid (+$5.0 billion), and Social Security (+$4.8 billion) benefits, and a large $12.9 billion influx that came from a settlement with a domestic health insurance provider.

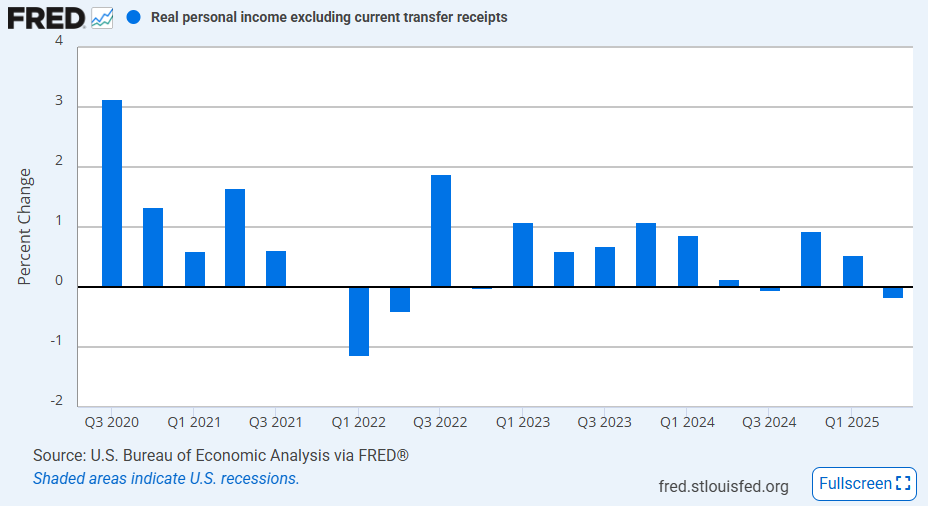

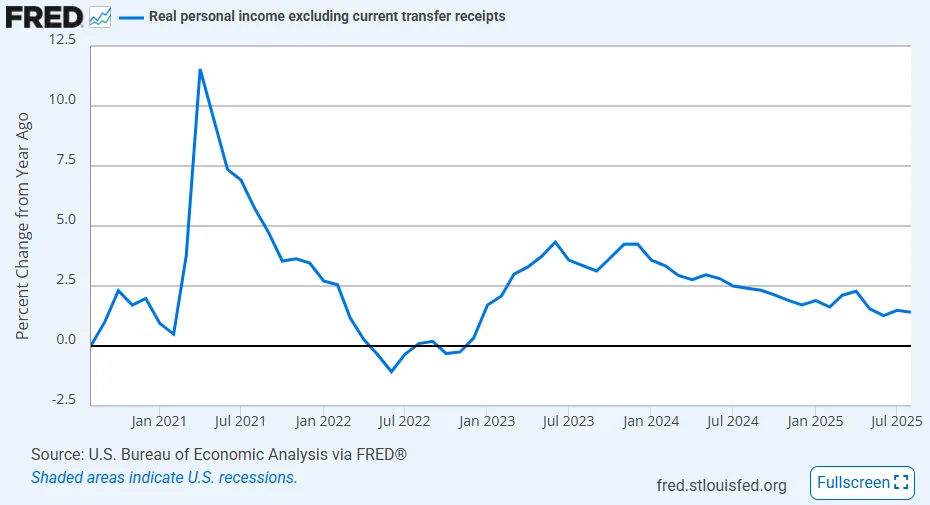

Since current transfer receipts played a significant role in boosting incomes in August, the solid rise is actually a bit misleading. When excluding transfer receipts from real personal income, there was basically no growth on a monthly basis, significantly slower than the 0.3% MoM increase in July but better than the negative prints in May and June. After the tepid reading in August, real income (ex transfer receipts) is up 1.4% YoY, down slightly from 1.5% YoY in July but significantly slower than the 2.4% YoY increase seen a year ago. Thus, the medium-trend points to a gradual slowdown in non-transfer receipt income adjusted for inflation.

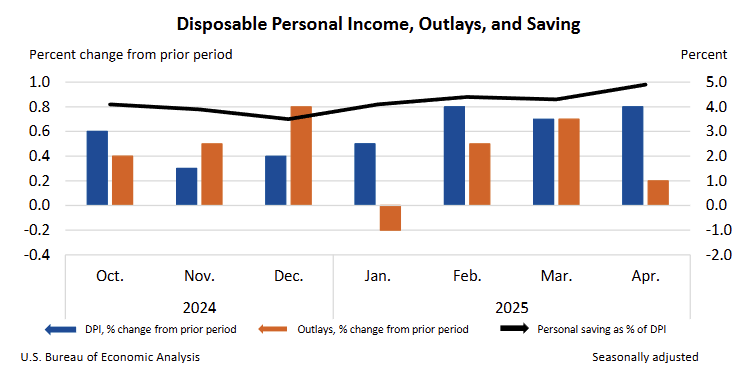

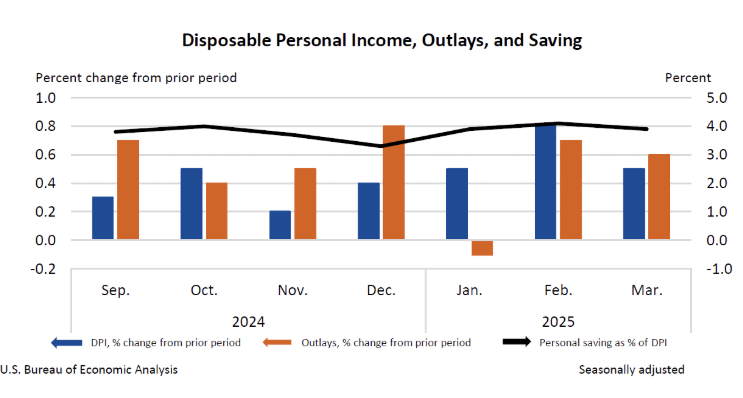

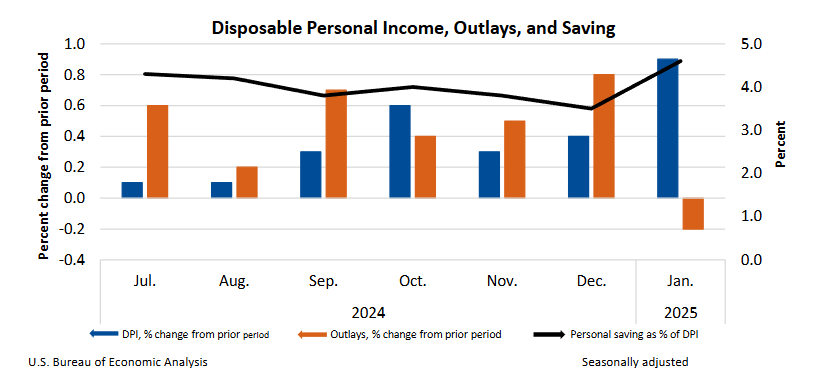

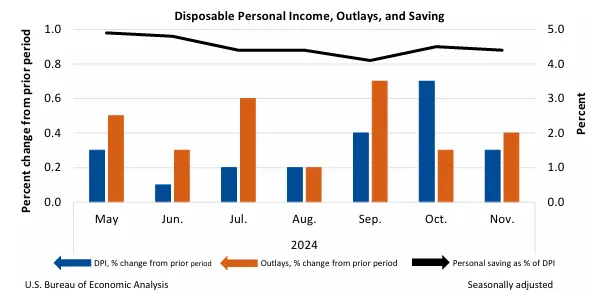

Personal Spending

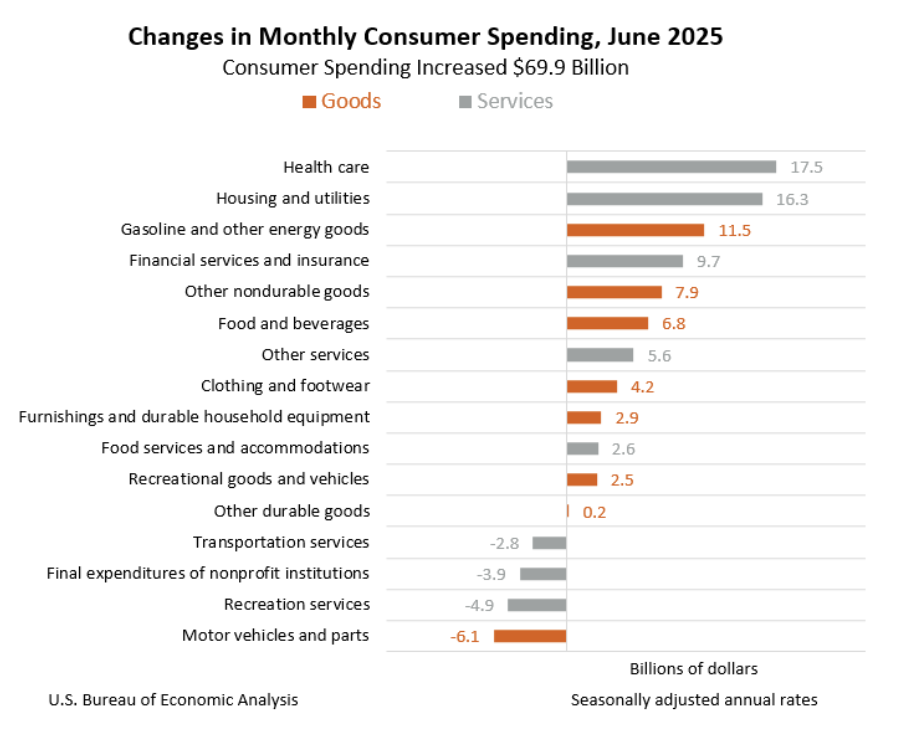

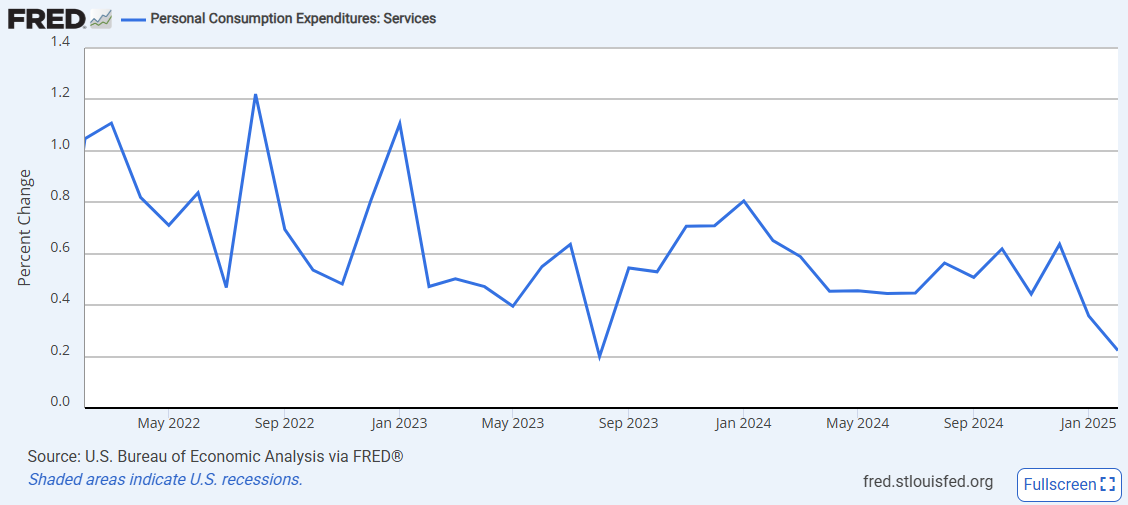

For the fourth consecutive month, personal consumption expenditures (PCE) growth outpaced the gains in disposable income. In August, PCE was up 0.6% MoM, slightly ahead of expectations and the strongest increase since March of this year. Spending increased in both goods and services categories, with the former up 0.8% MoM and the latter up 0.5% MoM. Both categories of spending have been strong over the summer, suggesting the consumer has been stable enough to make purchases even though prices continue to rise. Indeed, even when adjusted for inflation, consumption growth was still a solid 0.4% MoM in August.

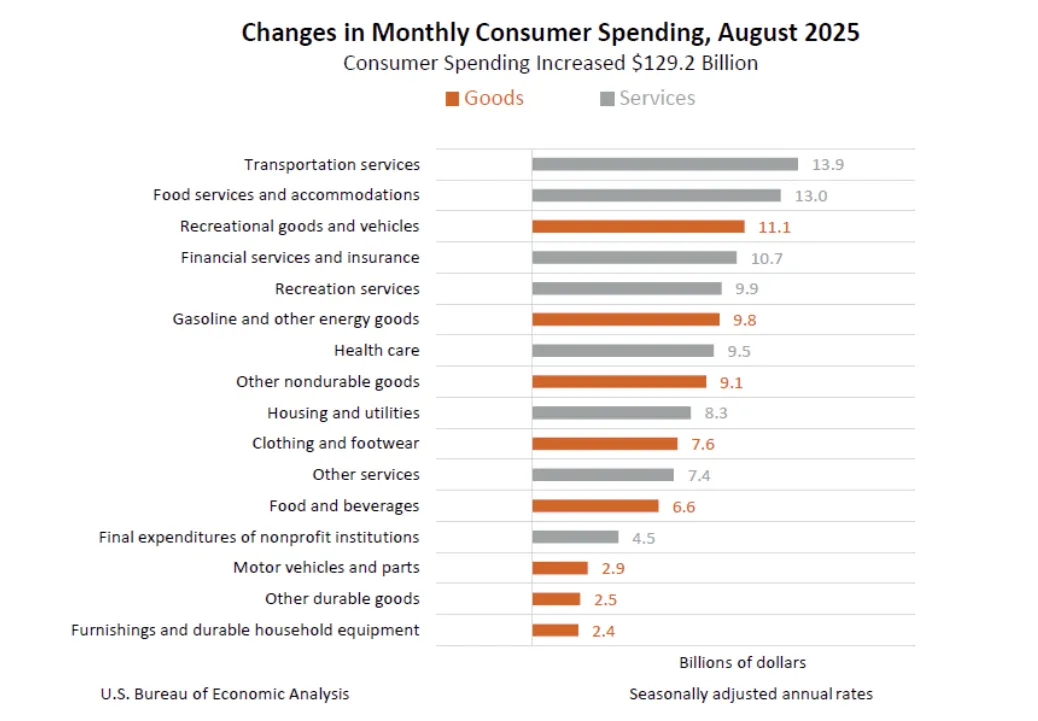

Within the segments of consumer spending, we see a lot of the increase driven by discretionary categories. The categories that especially stick out are food services & accommodations (+$13.0 billion), recreational goods & vehicles (+$11.1 billion), and recreation services (+$9.9 billion). It is also notable to point out that these weren’t the only categories that saw increases; spending in every goods and services category grew. When consumers are spending more on everything, especially discretionary goods, it is usually a signal that they feel pretty confident in their financial situations.

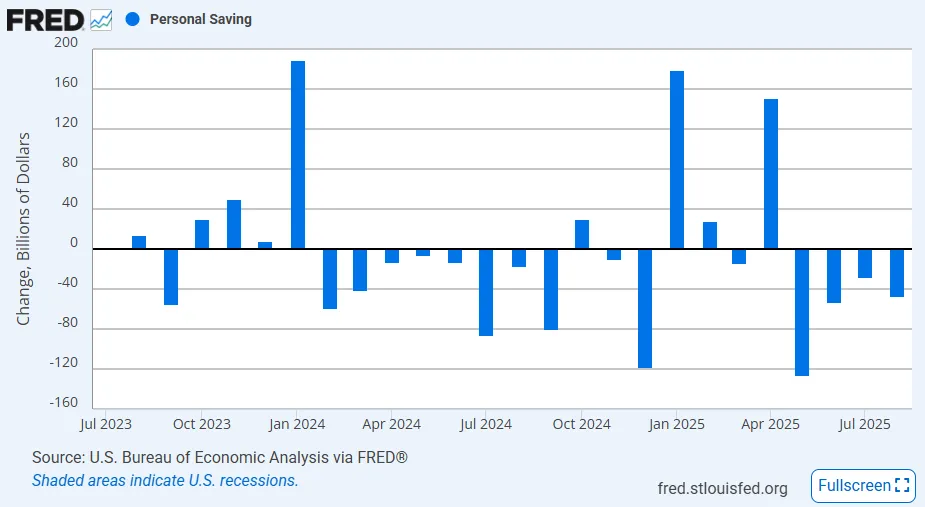

However, it is unclear how much longer this trend can continue. As mentioned before, income growth is slowly but consistently fading away and not keeping pace with consumption growth which is putting most consumers’ finances in the red. Monthly personal savings were negative for the fourth straight month, and over that time period, consumers have drained over $250 billion from stored savings (or they are increasing debt loads). This trend isn’t necessarily new, but the last few months of negative savings have been particularly high, making the magnitude of the decline unusually high (of course that was offset by a strong $150.7 billion increase in savings in April).

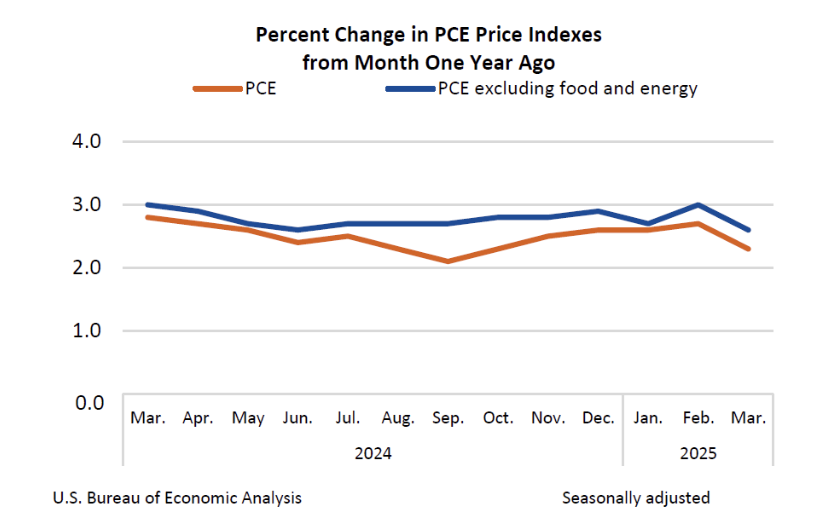

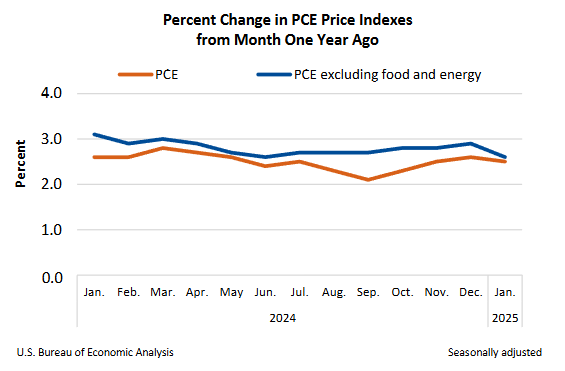

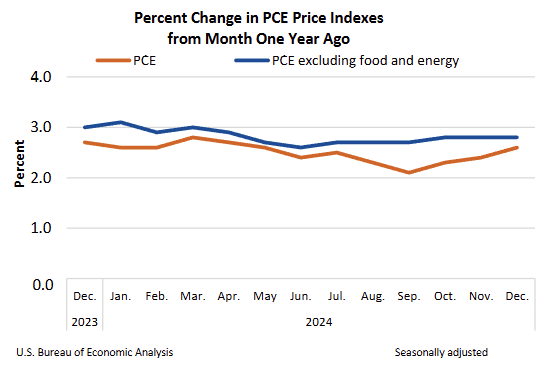

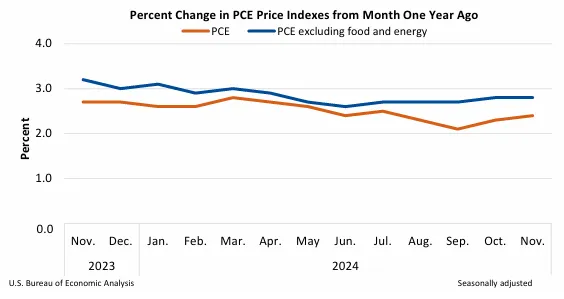

PCE Inflation

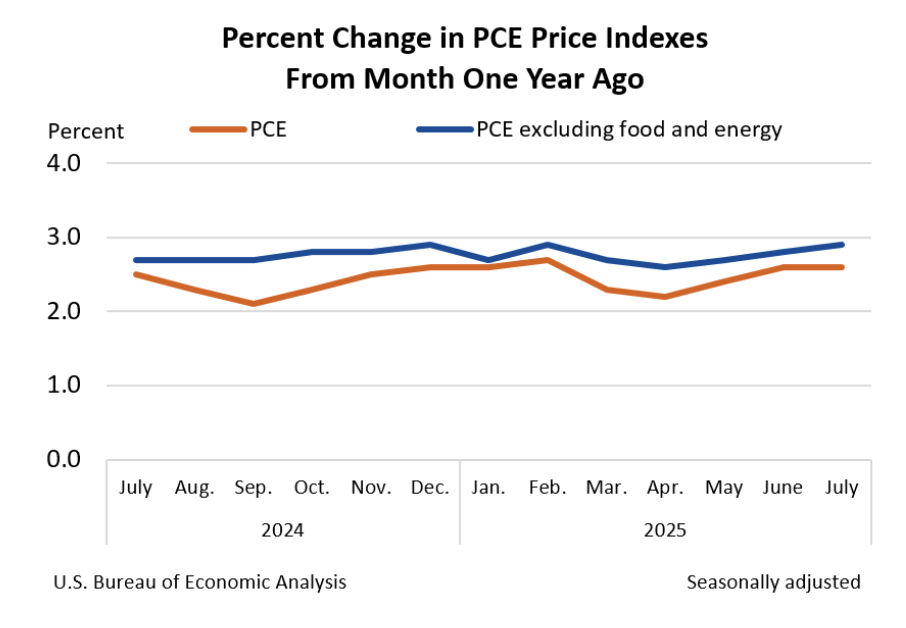

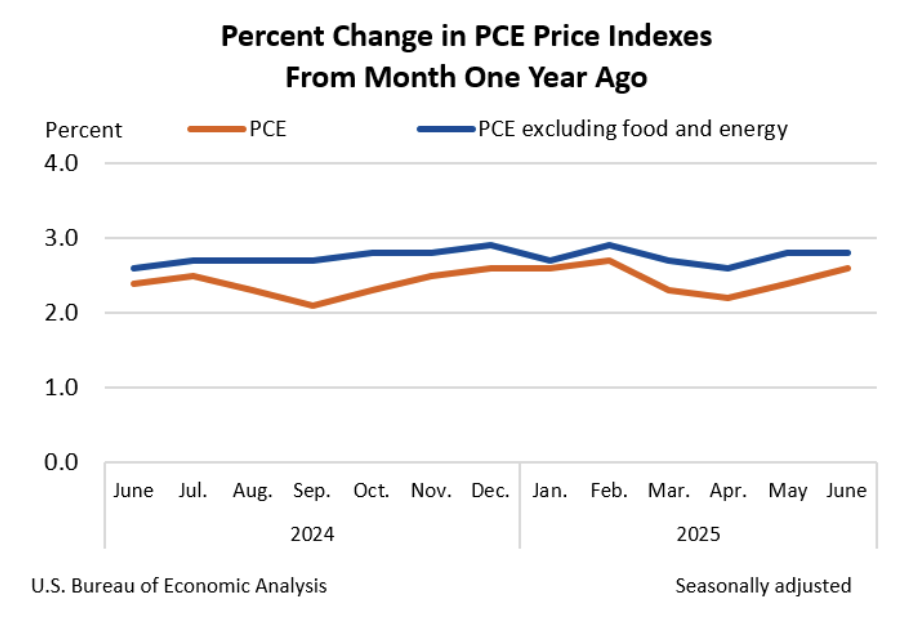

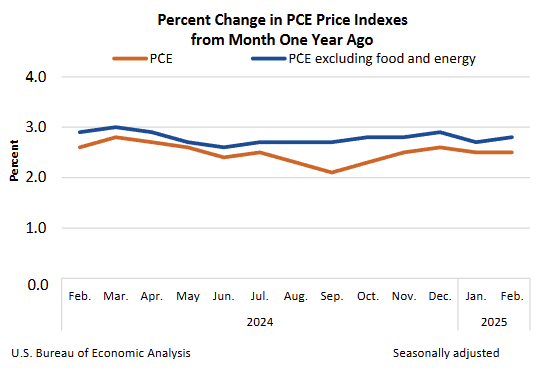

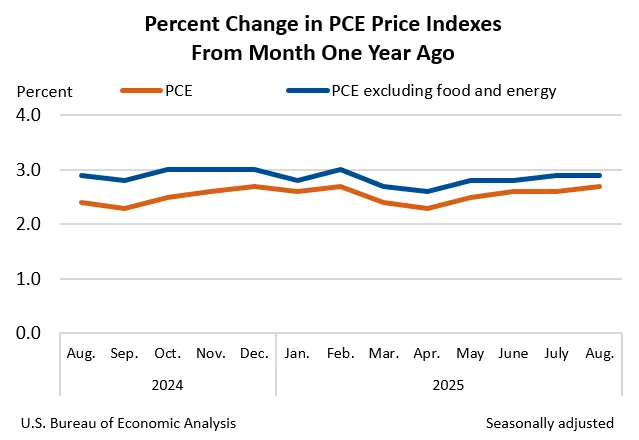

The PCE inflation figures for August were unsurprising as both the monthly and annual rates were in line with expectations. The headline PCE index increased 0.3% MoM and 2.7% YoY, up slightly from 2.6% YoY in July. Both rates were on the hotter side relative to data this year. The MoM increase was the strongest since February, and the annual rate was the strongest since April. This was caused by strong gains in the food and energy indexes, which were up 0.5% MoM and 0.8% MoM, respectively. Notably, food inflation has been on a consistent rise throughout the year and is now at 2.2% YoY, the highest since October 2023.

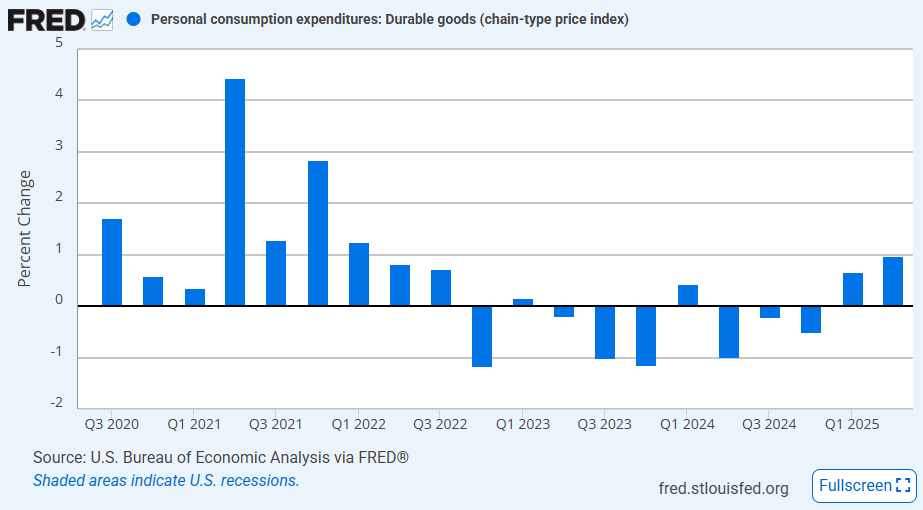

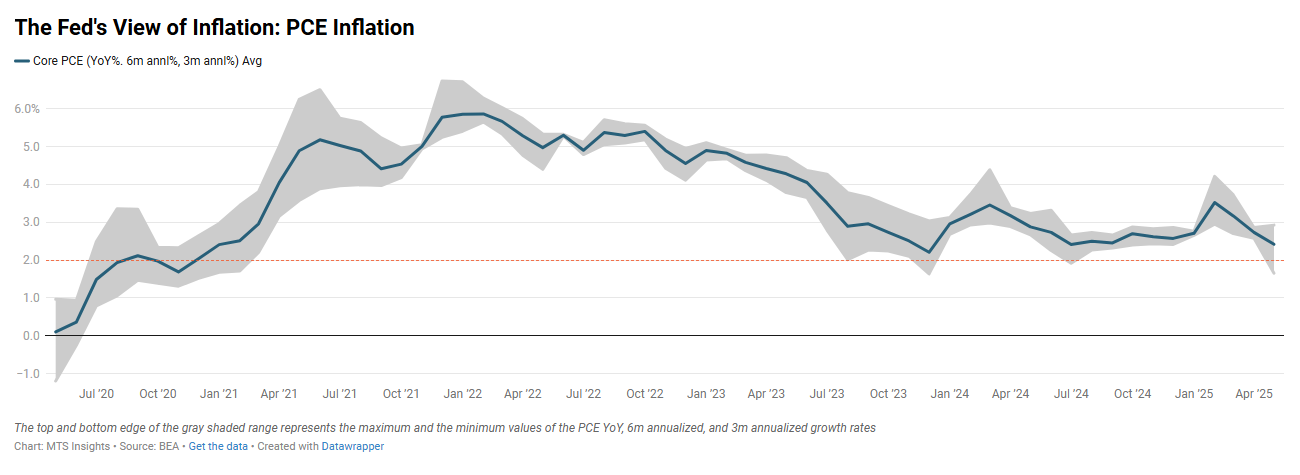

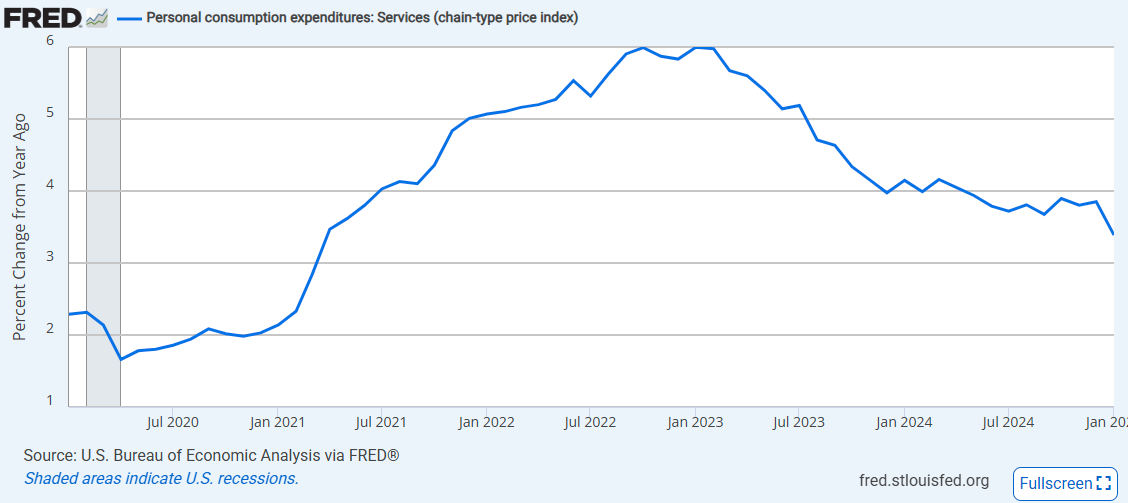

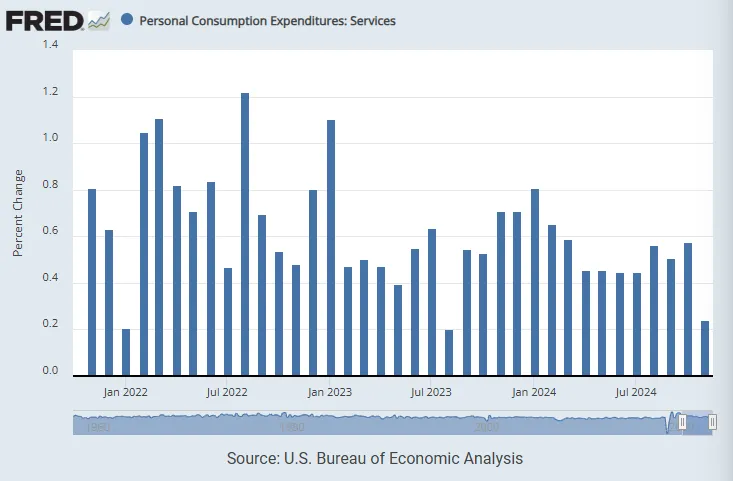

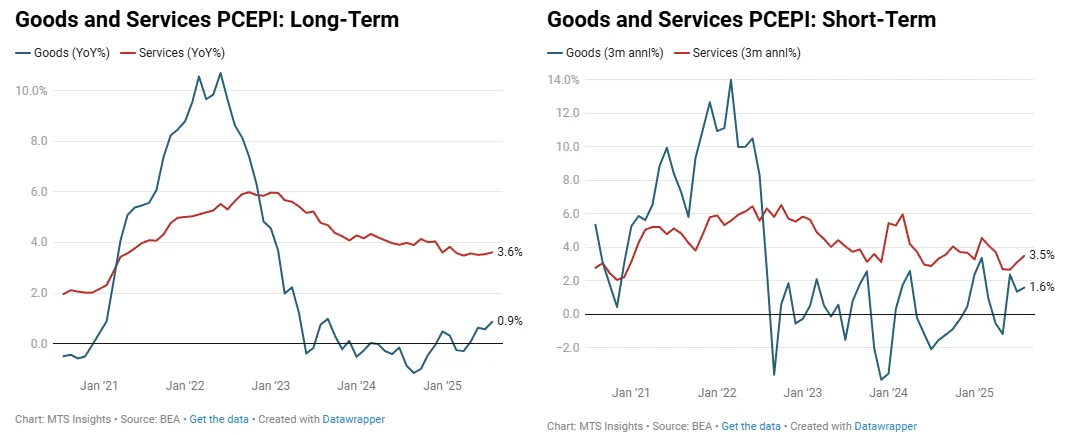

The Fed’s preferred inflation gauge, core PCE inflation, also saw a moderate rise of 0.2% MoM, but it wasn’t enough to move the annual rate above 2.9% YoY. Both readings were in line with expectations. The services segment was the main driver of price growth in August, rising 0.3% MoM, while goods prices were more contained at 0.1% MoM, thanks to a second straight -0.1% MoM decline in durable goods prices. Unlike the CPI report, we are not seeing as strong of an upward push from goods inflationary pressure in the PCE price data in the short-term. Instead, it is a bump up in short-term services inflation that is keeping core PCE inflation sticky (see chart on the right).