US Manufacturers' Shipments, Inventories, and Orders

US Manufacturers' Shipments, Inventories, and Orders

Data

Industry

- Source

- Census Bureau

- Source Link

- https://www.census.gov/

- Frequency

- Monthly

- Next Release(s)

- January 29th, 2026 10:00 AM

Latest Updates

-

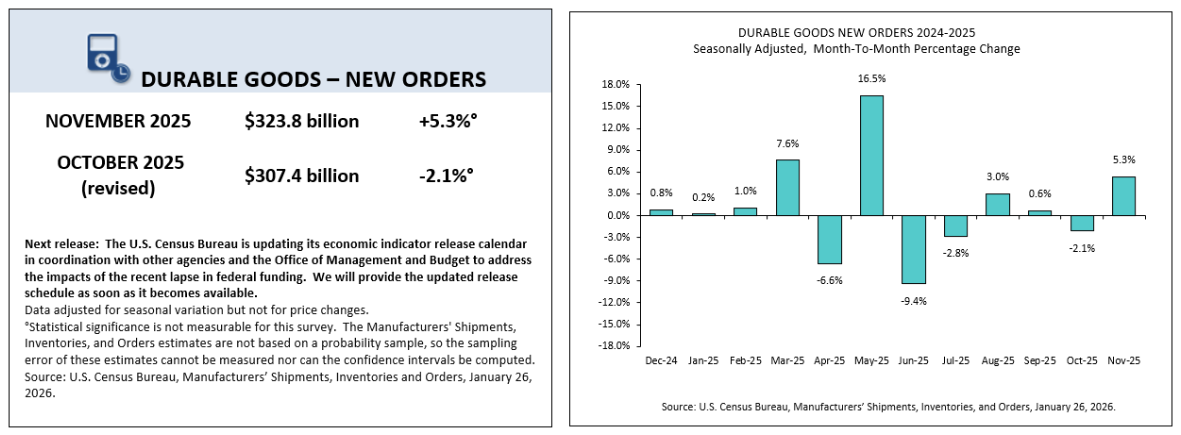

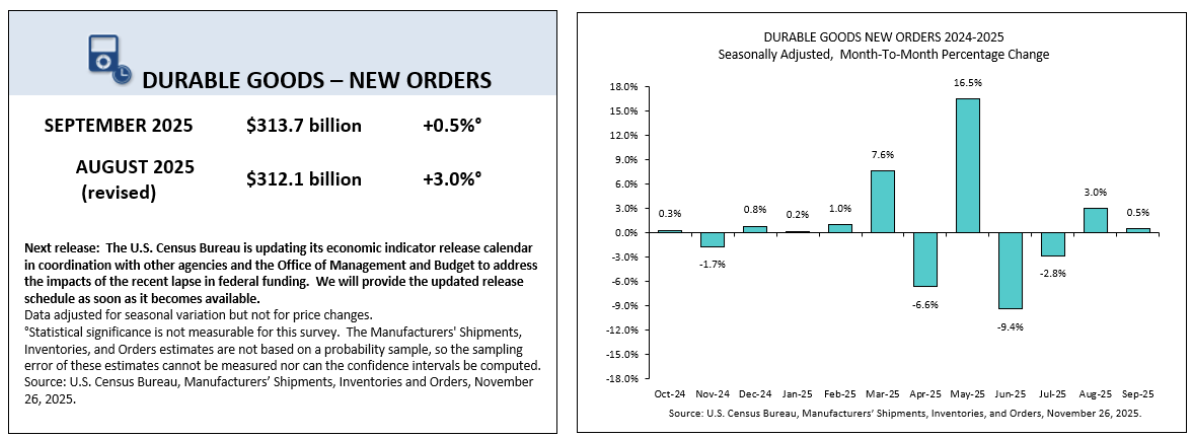

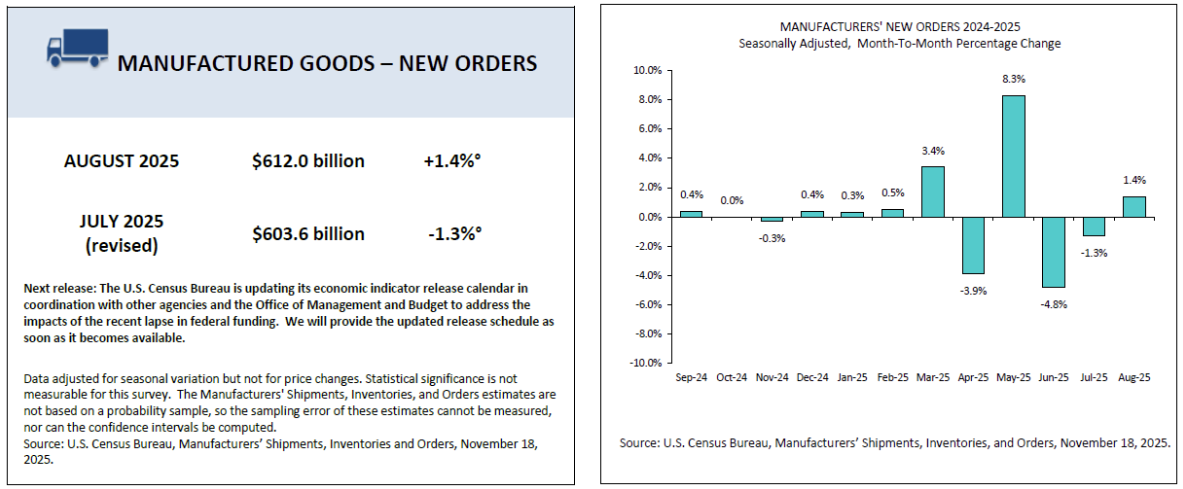

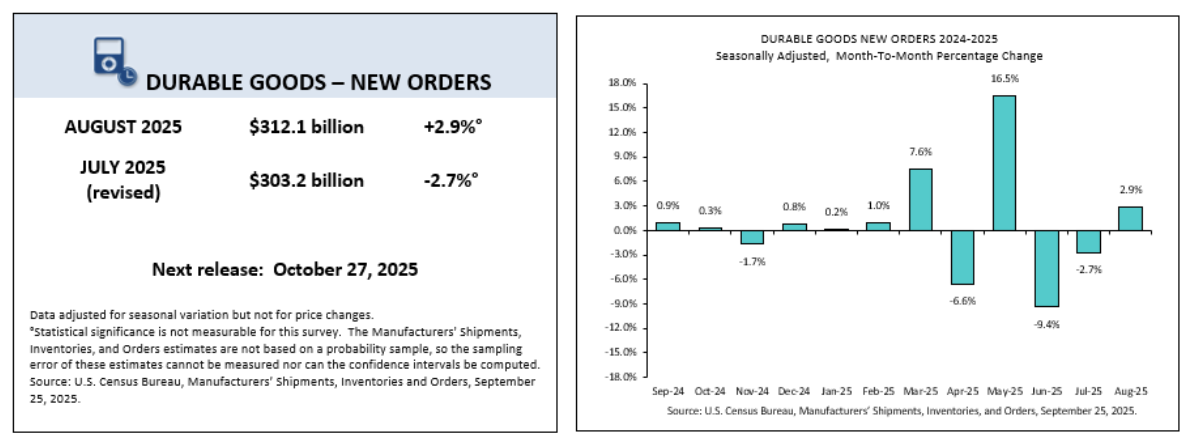

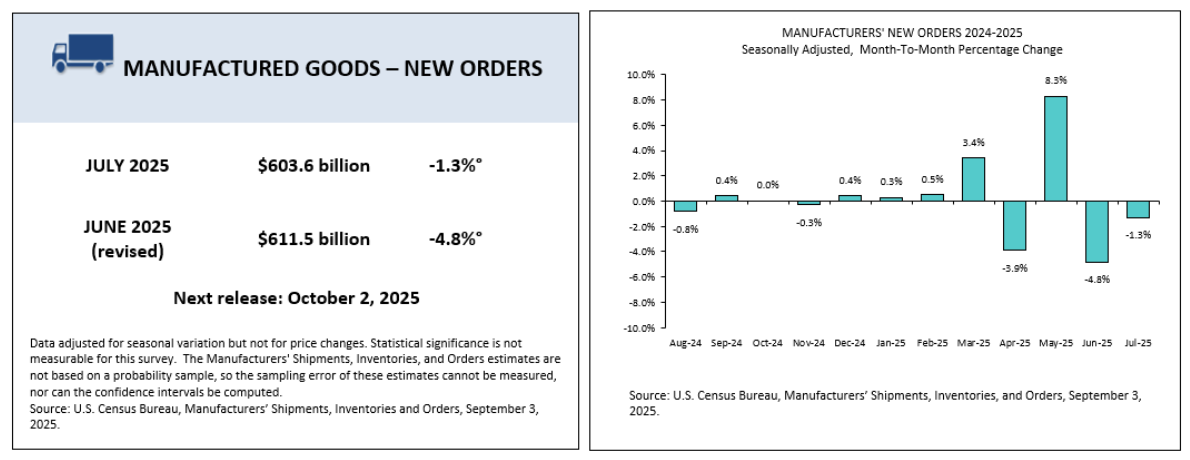

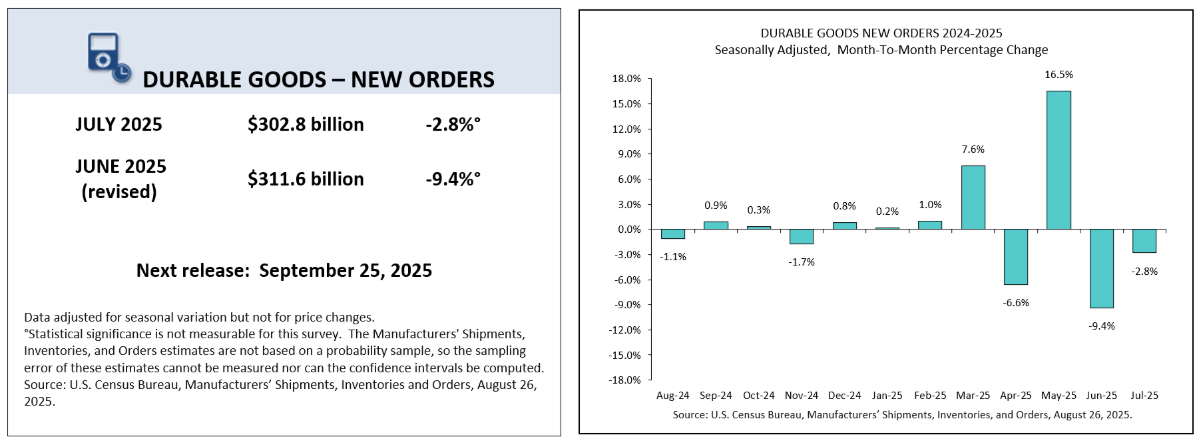

Durable goods new orders jumped 5.3% MoM (vs 3.7% MoM expected) in November, the largest monthly gain since May 2025.

- Durable goods (ex transport) new orders increased 0.5% MoM (vs 0.3% MoM expected). The headline result was heavily affected by a 14.7% MoM increase in new orders for transport equipment.

- The strongest segments were machinery (+0.5% MoM), fabricated metal products (+1.0% MoM), and electrical equipment (+1.7% MoM).

- Core capital goods shipments and new order growth were both solid in November, at 0.4% MoM and 0.7% MoM, respectively. YoY new order growth remained at 3.1% YoY.

-1.png)

-1.png)

-1.png)