US International Trade

US International Trade

- Source

- Bureau of Economic Analysis

- Source Link

- https://www.bea.gov/

- Frequency

- Monthly

- Next Release(s)

- January 29th, 2026 8:30 AM

-

February 5th, 2026 8:30 AM

-

March 5th, 2026 8:30 AM

-

April 2nd, 2026 8:30 AM

-

May 5th, 2026 8:30 AM

-

June 9th, 2026 8:30 AM

-

July 7th, 2026 8:30 AM

-

August 4th, 2026 8:30 AM

-

September 3rd, 2026 8:30 AM

-

October 6th, 2026 8:30 AM

-

November 4th, 2026 8:30 AM

-

December 8th, 2026 8:30 AM

Latest Updates

-

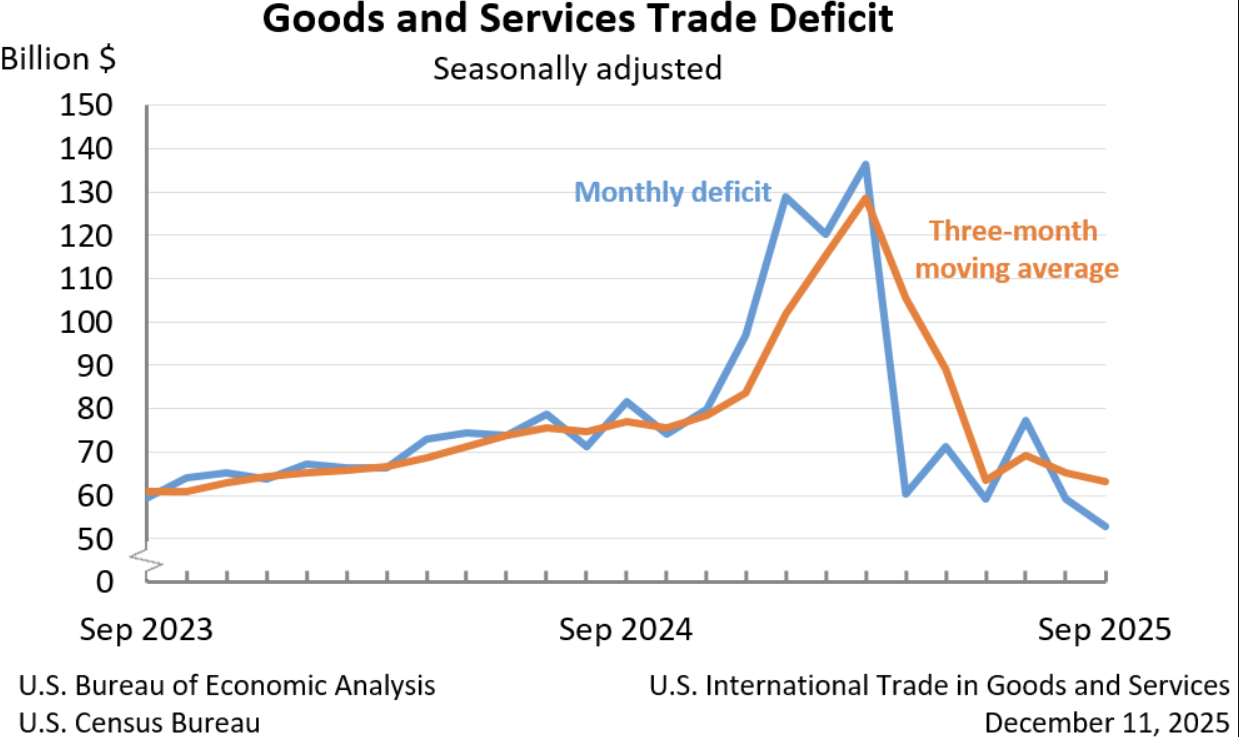

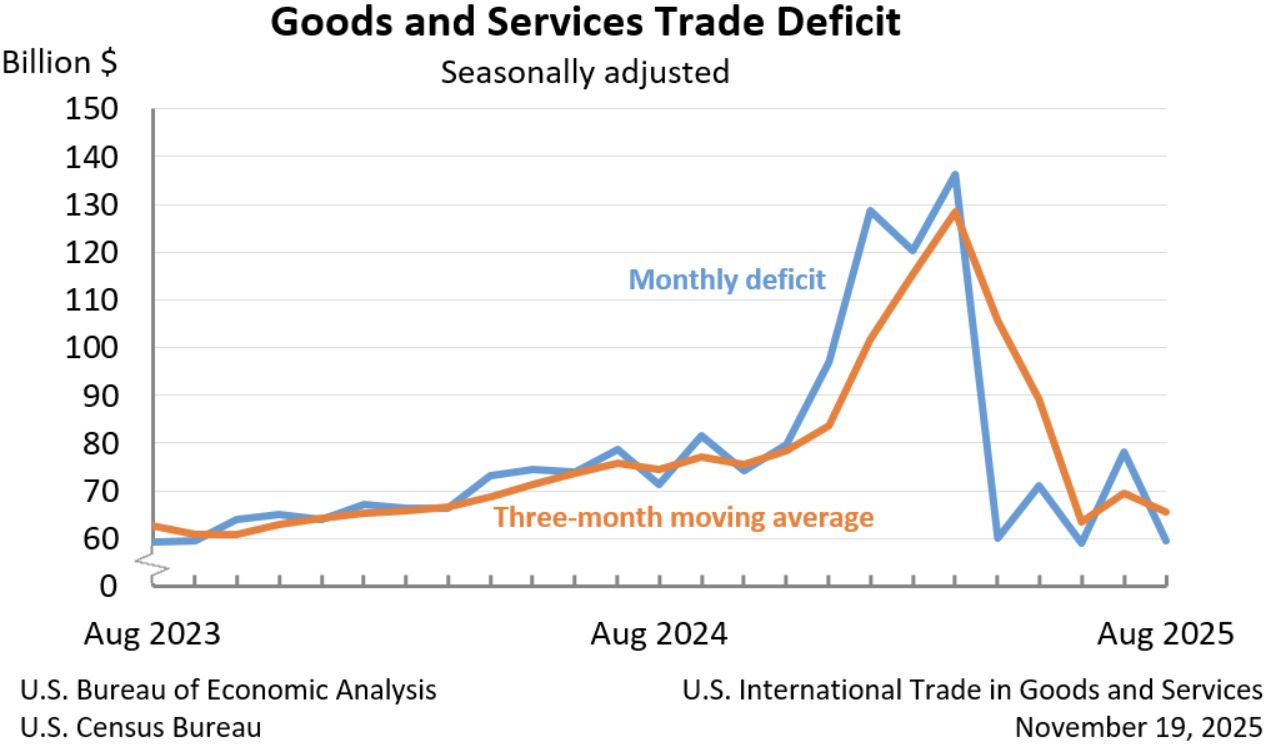

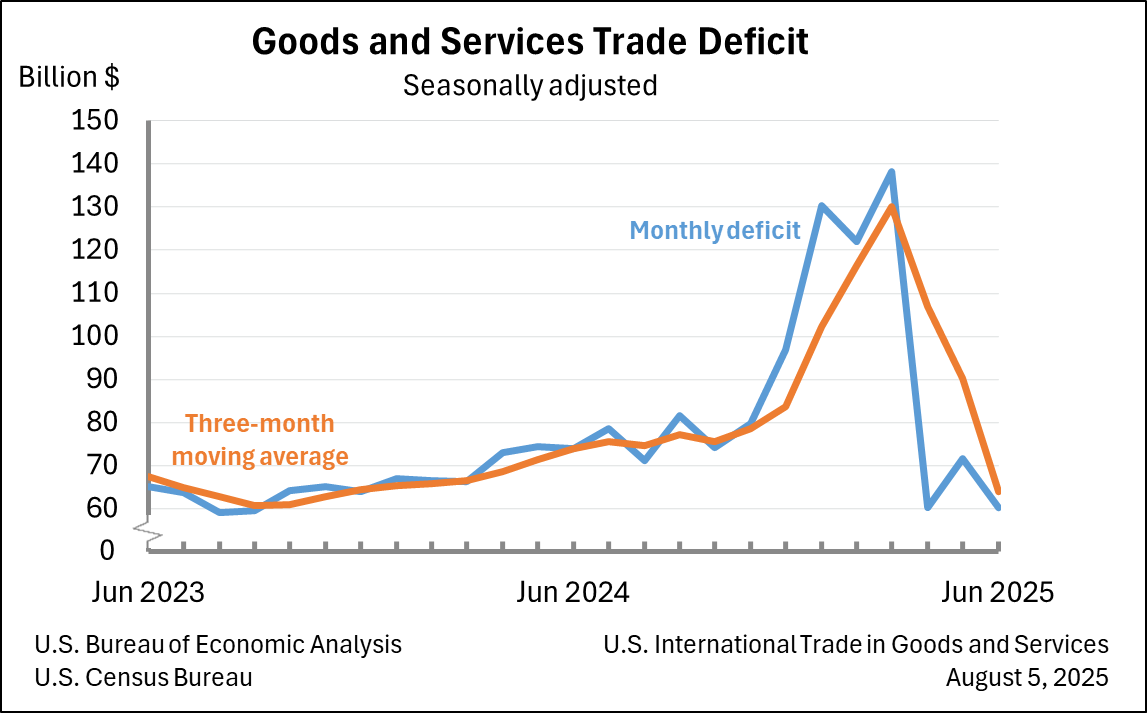

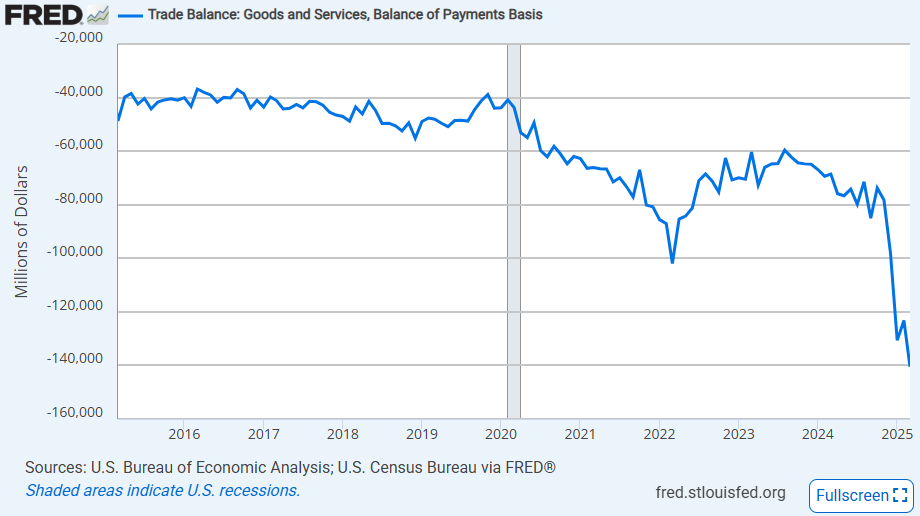

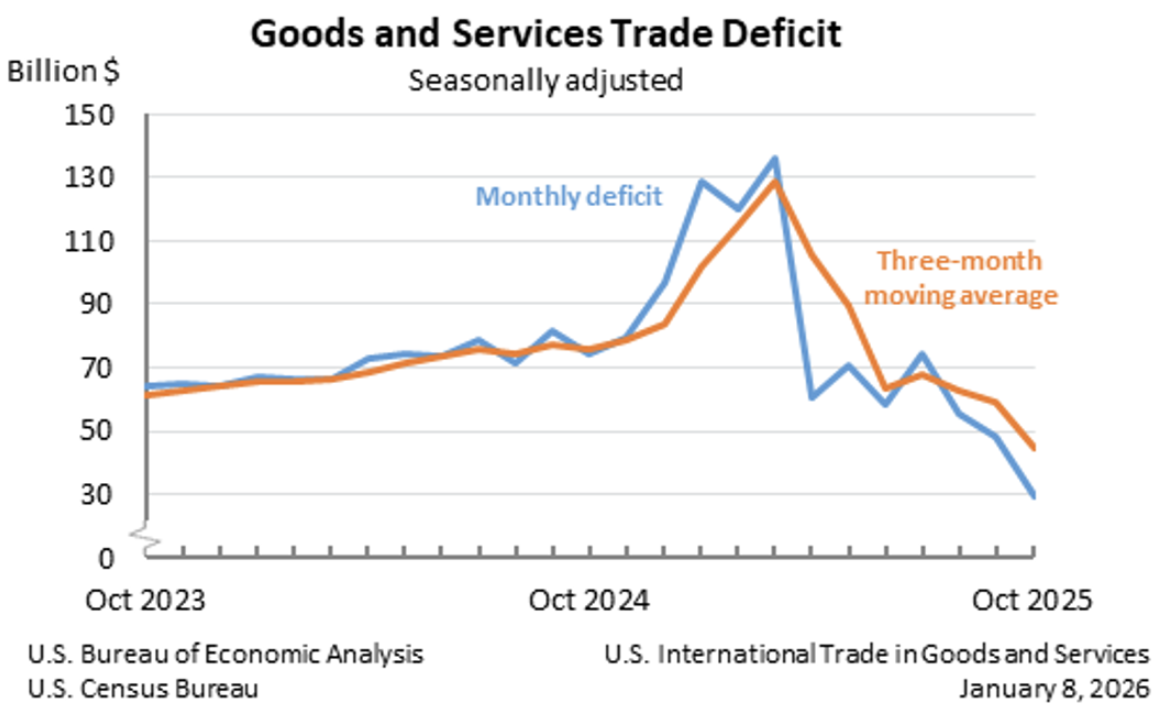

The U.S. goods and services trade deficit narrowed to $29.4B (vs $58.9 bil expected) in October (-39.0% MoM), the lowest since 2009 amid record exports and falling imports.

-

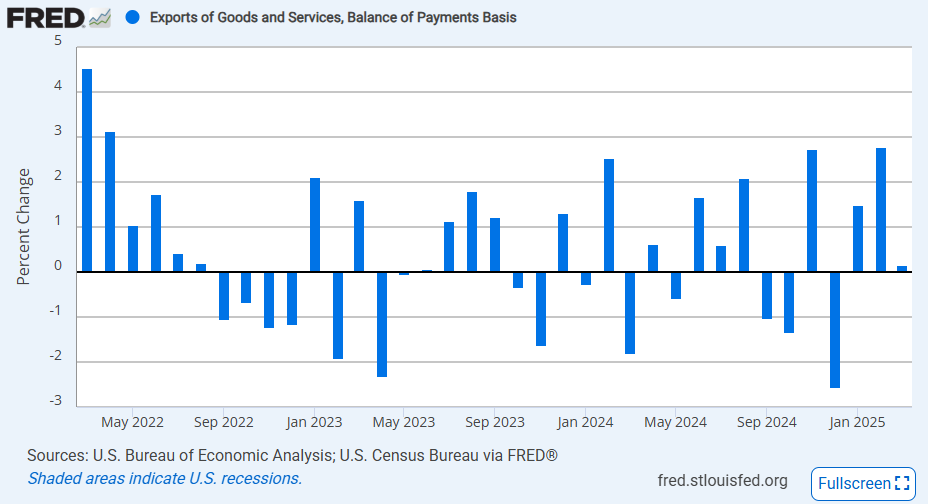

Exports rose to a record $302.0B (+$7.8B MoM; +2.6% MoM), driven by a $7.1B increase in goods exports to $195.9B and a $0.7B rise in services exports to a record $106.1B, indicating broad-based export strength.

-

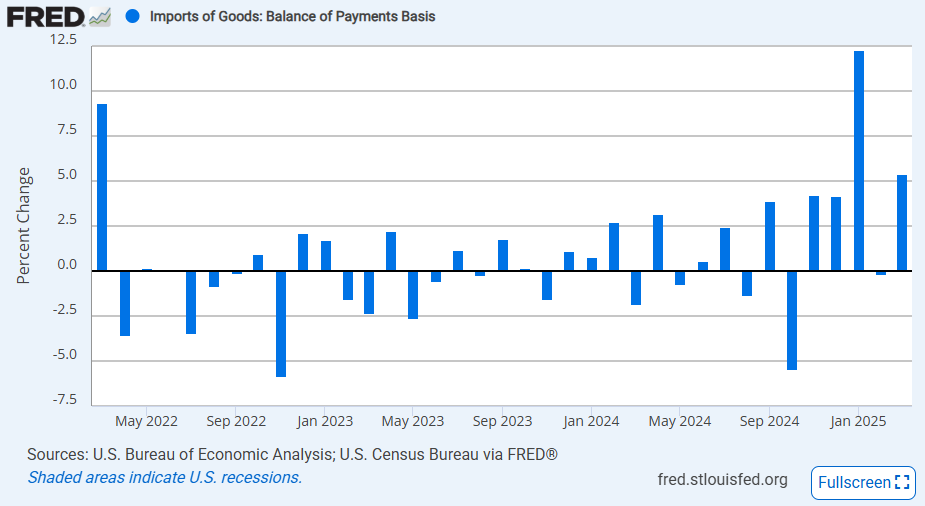

Imports declined to $331.4B (-$11.0B MoM; -3.2% MoM), with goods imports falling $12.1B to $255.0B, led by sharp declines in consumer goods (-$14.0B) and pharmaceuticals (-$14.3B).

-

The goods deficit narrowed -$19.2B MoM to $59.1B, the lowest since March 2016, while the services surplus edged down -$0.4B to $29.8B, showing the improvement was concentrated in merchandise trade.

-

Year-to-date, the total trade deficit widened +$56.0B (+7.7% YoY), as imports (+6.6% YoY) continued to outpace exports (+6.3% YoY) despite October’s sharp monthly improvement.

-

The three-month average deficit fell to $44.4B (-$15.0B), with average exports up $6.0B and average imports down $9.0B, pointing to a sustained recent narrowing trend.

-

Real goods trade improved materially, with the real goods deficit shrinking -19.8% MoM to $63.1B; real exports rose +3.9% MoM while real imports fell -4.2% MoM, reinforcing the strength of volume-adjusted trade flows.

-

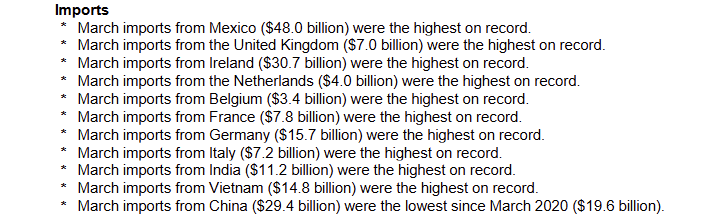

By partner, the deficit with Ireland narrowed sharply to $3.2B (-$15.1B MoM), while deficits widened with Taiwan (+$6.3B to $15.7B) and Mexico remained elevated at $17.9B, highlighting divergent bilateral trade dynamics.

-