UK Public Sector Borrowing

UK Public Sector Borrowing

- Source

- ONS

- Source Link

- https://www.ons.gov.uk/

- Frequency

- Monthly

- Next Release(s)

- October 21st, 2025 2:00 AM

Latest Updates

-

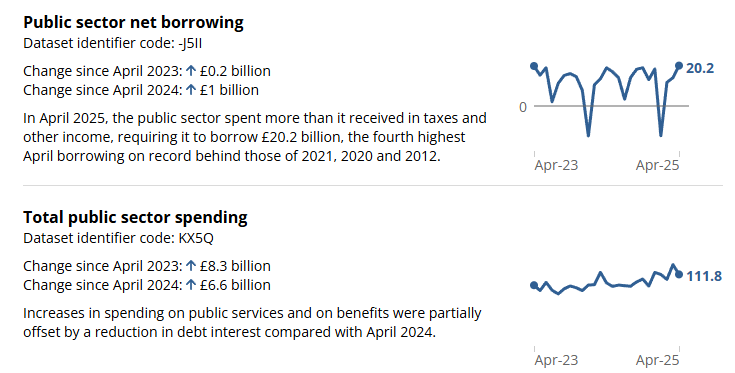

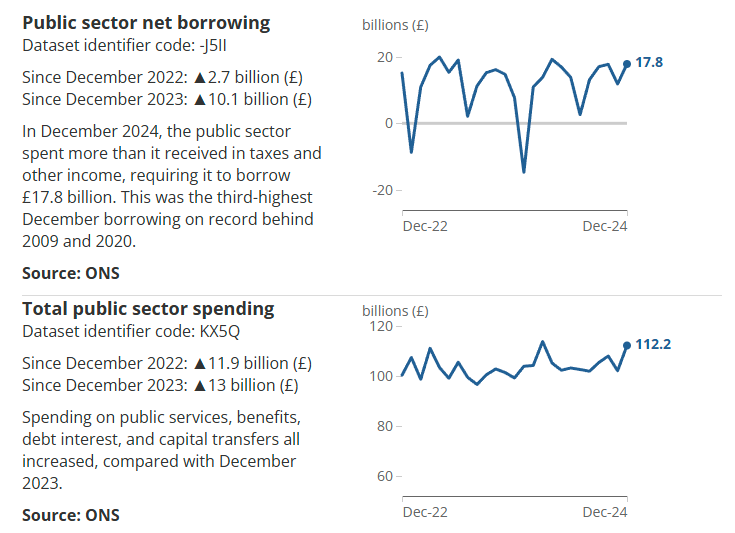

UK public sector net borrowing was £18.0 billion in August 2025, up +£3.5 billion YoY and the highest August in five years, reflecting stronger current spending and debt interest.

-

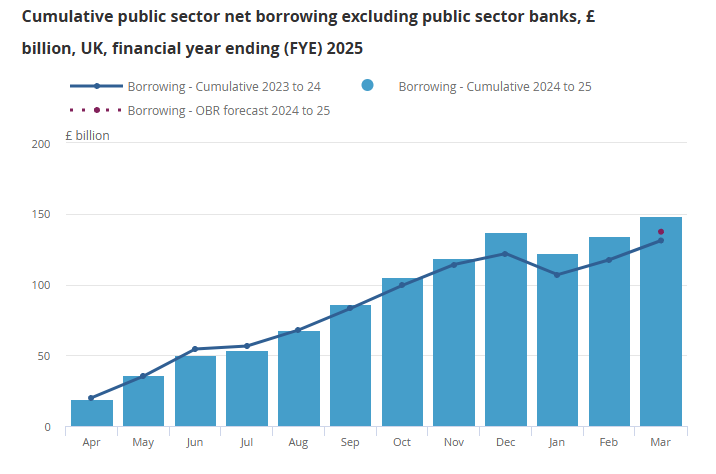

FY-to-date (Apr–Aug) borrowing reached £83.8 billion, +£16.2 billion YoY and £11.4 billion above the OBR’s March profile; August alone exceeded the £12.5 billion forecast by £5.5 billion.

-

The current budget deficit was £13.6 billion in August (+£3.7 billion YoY), with net investment at £4.3 billion (-£0.2 billion YoY).

-

Debt metrics edged higher: public sector net debt (ex-banks) was 96.4% of GDP (+0.5 ppts YoY); public sector net financial liabilities were 84.5% of GDP (+2.5 ppts YoY).

-

By subsector, central government borrowed £13.1 billion (+£3.9 billion YoY) and local government £4.2 billion (+£0.6 billion YoY); the Bank of England contribution fell to £1.0 billion (-£0.8 billion YoY).

-

Central government receipts were £84.3 billion (+£4.3 billion YoY): taxes +£1.6 billion (Income Tax +£1.0 billion; VAT +£0.2 billion; Corporation Tax +£0.1 billion) and compulsory social contributions +£2.6 billion after April NICs changes.

-

Self-assessed Income Tax total for Jul–Aug was £16.8 billion, +£2.5 billion YoY; August alone was £1.3 billion (-£0.2 billion YoY).

-

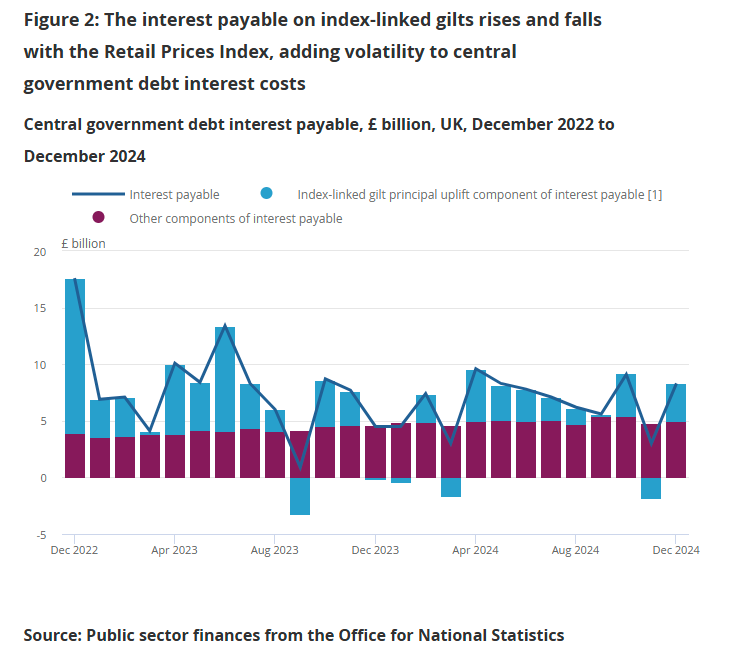

Central government current expenditure rose to £89.1 billion (+£7.8 billion YoY), driven by departmental spending +£3.7 billion, debt interest £8.4 billion (+£1.9 billion, including £2.6 billion RPI “capital uplift”), and social benefits +£1.1 billion.

-

Central government net investment in August was £4.7 billion (roughly unchanged YoY); FY-to-date net investment is £36.1 billion (-£13.1 billion YoY), partly reflecting lower transfers to the BoE APF.

-