GDP

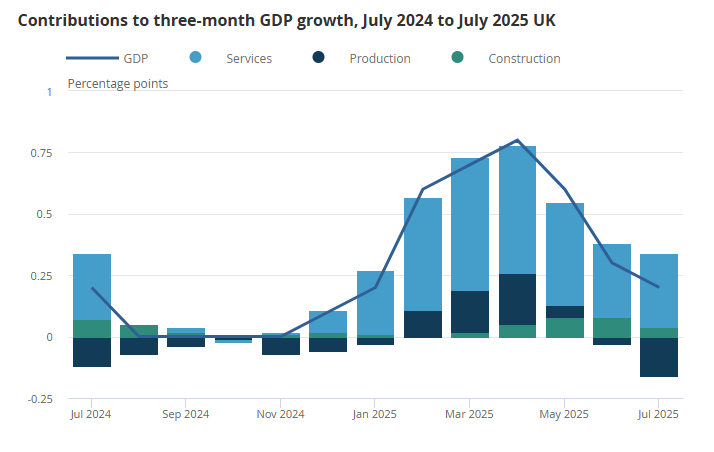

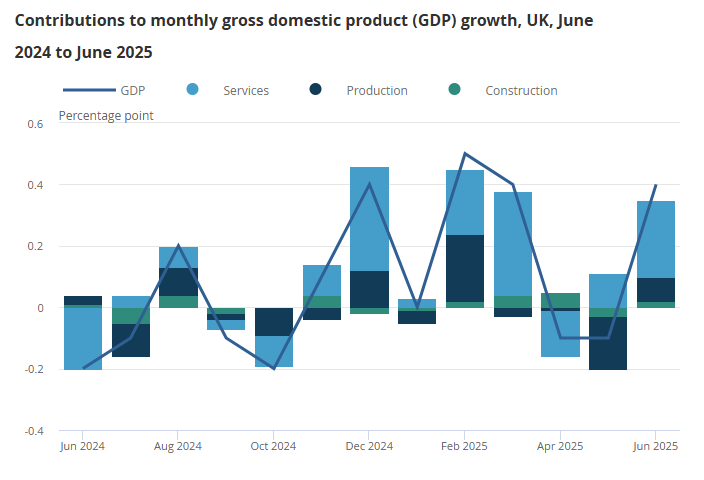

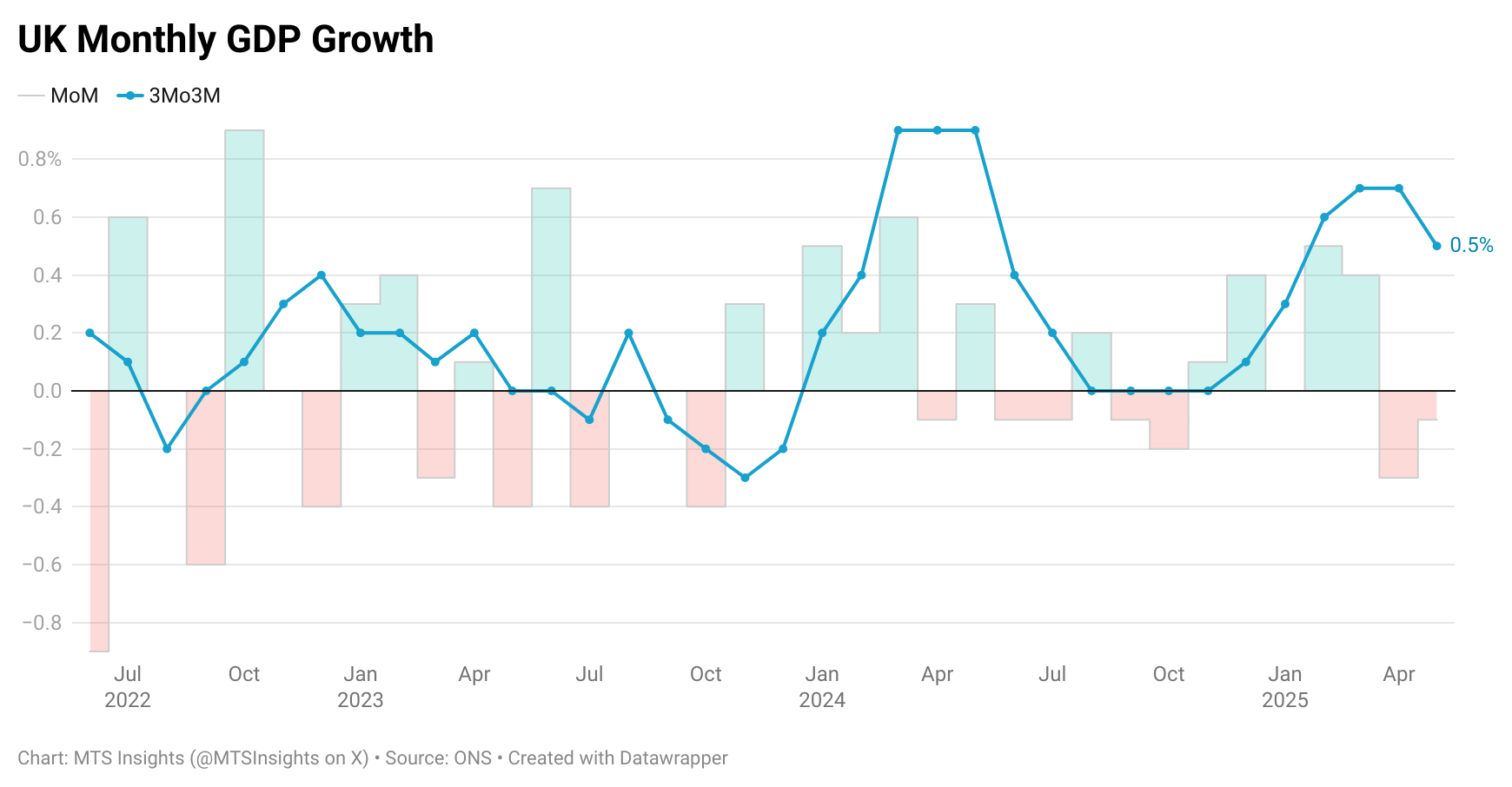

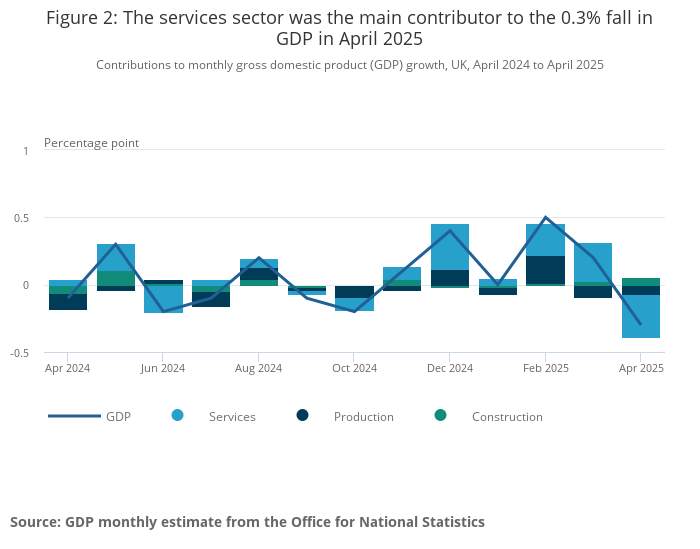

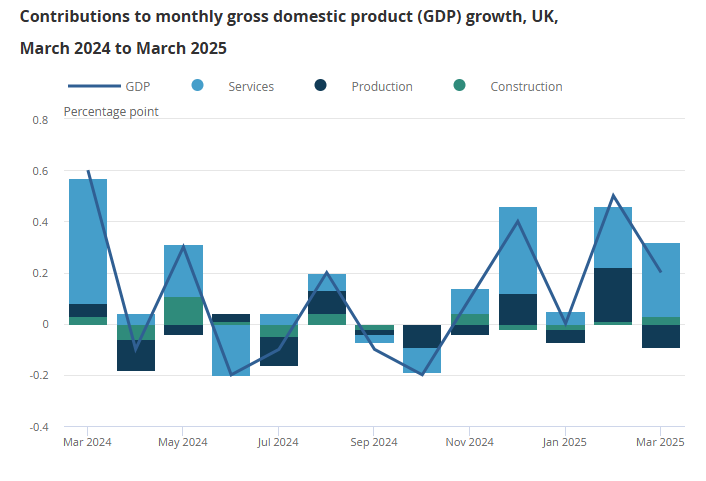

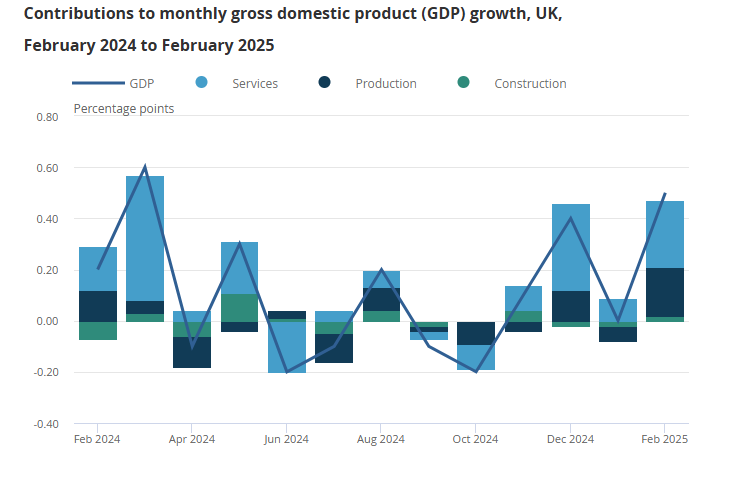

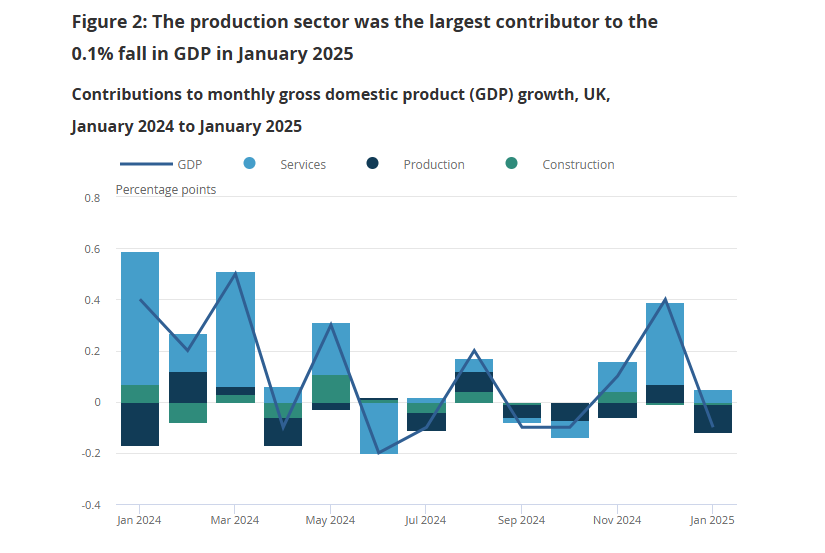

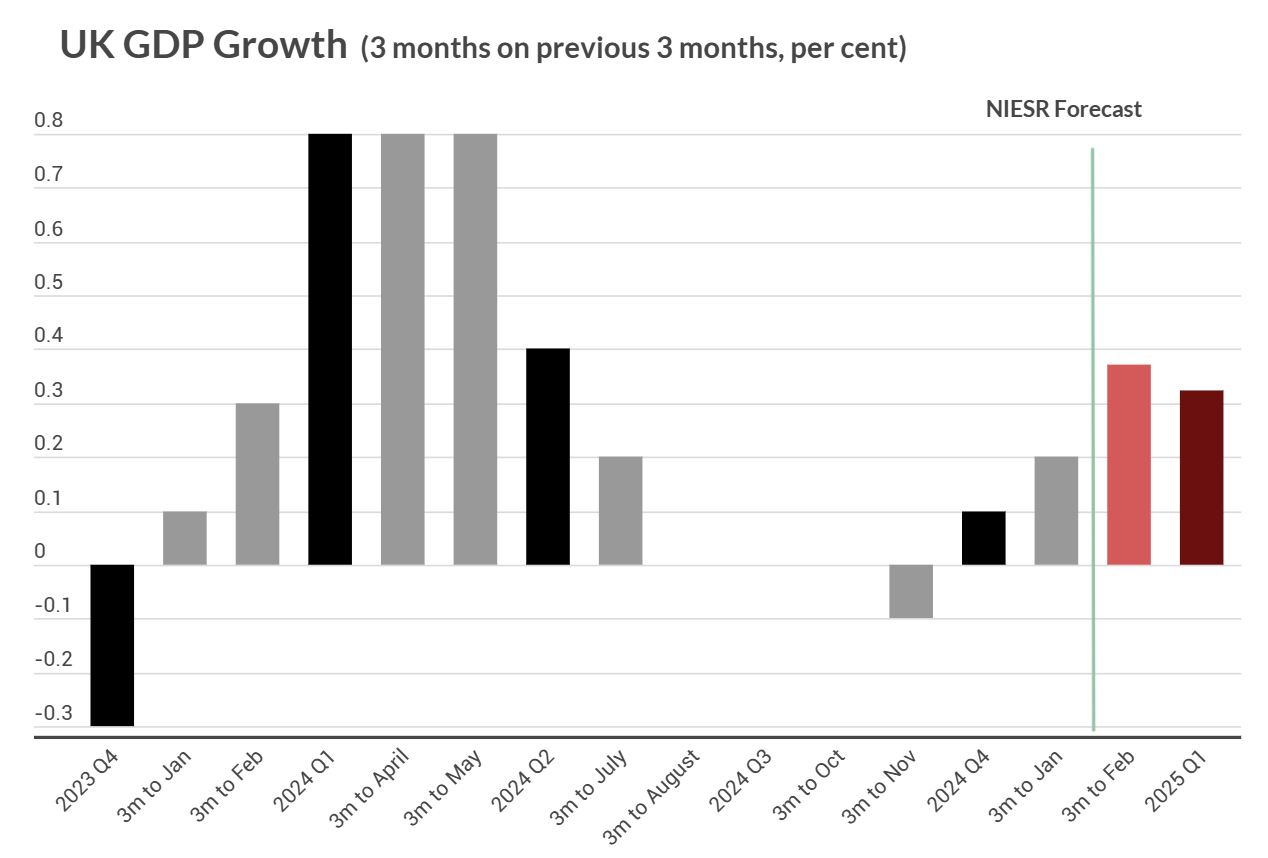

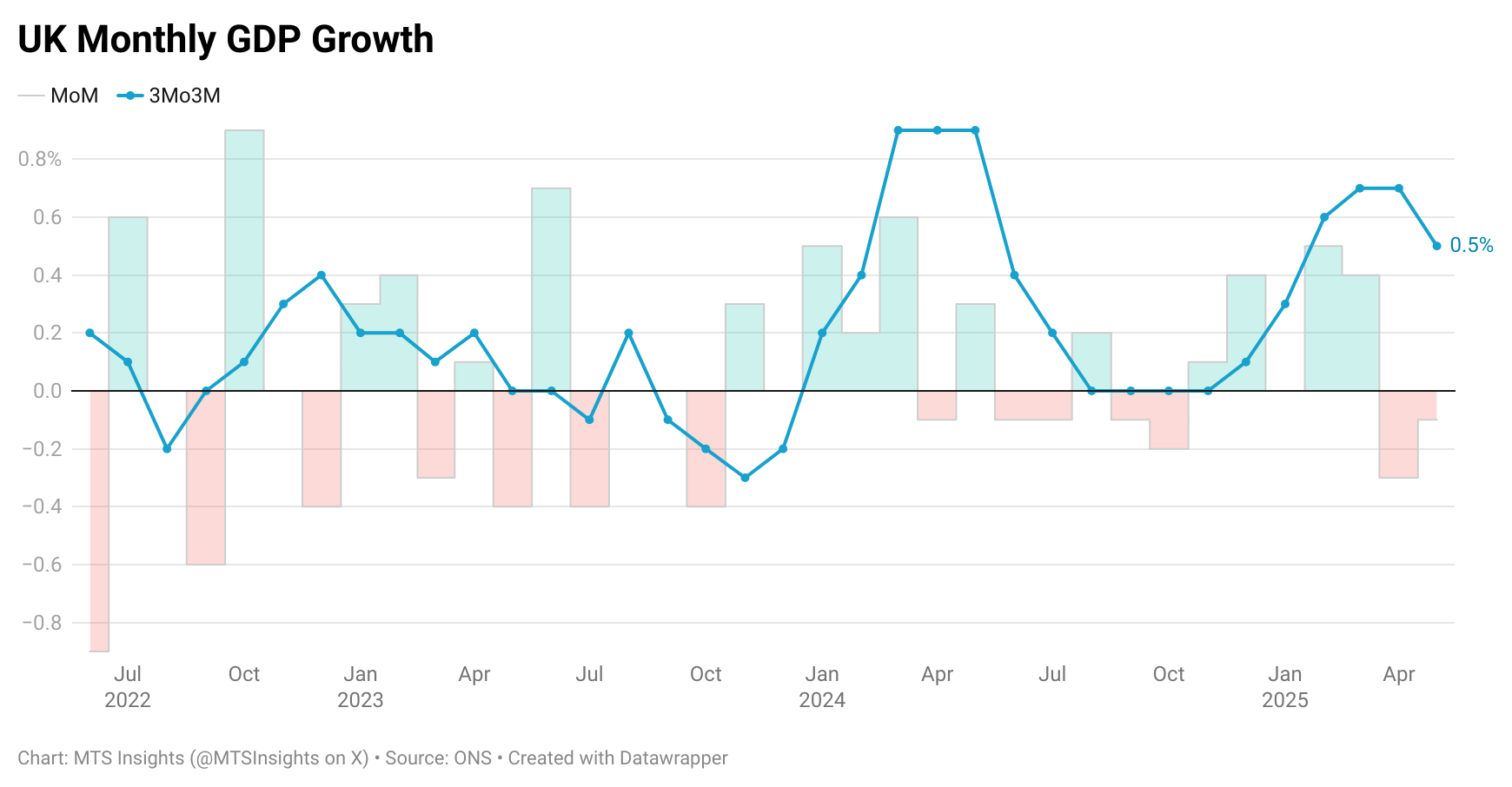

UK GDP was reported to have fallen for the second straight month in May with a drop of -0.1% MoM. The decline was below expectations of a small 0.1% MoM. While there was a downside surprise in the monthly move, GDP growth in the last three months, compared to the three months before, was 0.5%, slightly ahead of expectations of a 0.4% increase. That positive surprise was a result of an upward revision in March's monthly GDP growth from 0.2% MoM to 0.4% MoM. Still, the overall trend in the quarterly data is a deceleration in growth at a 0.5% increase is down from 0.7% in March and April, and the weakest since February.

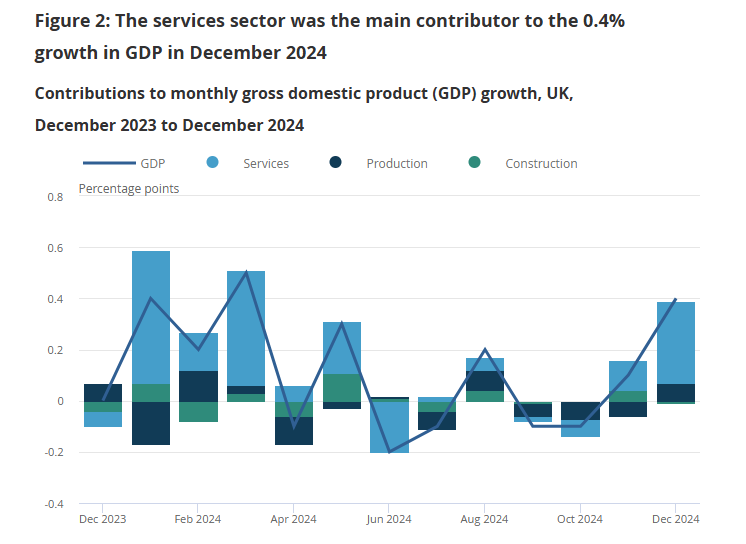

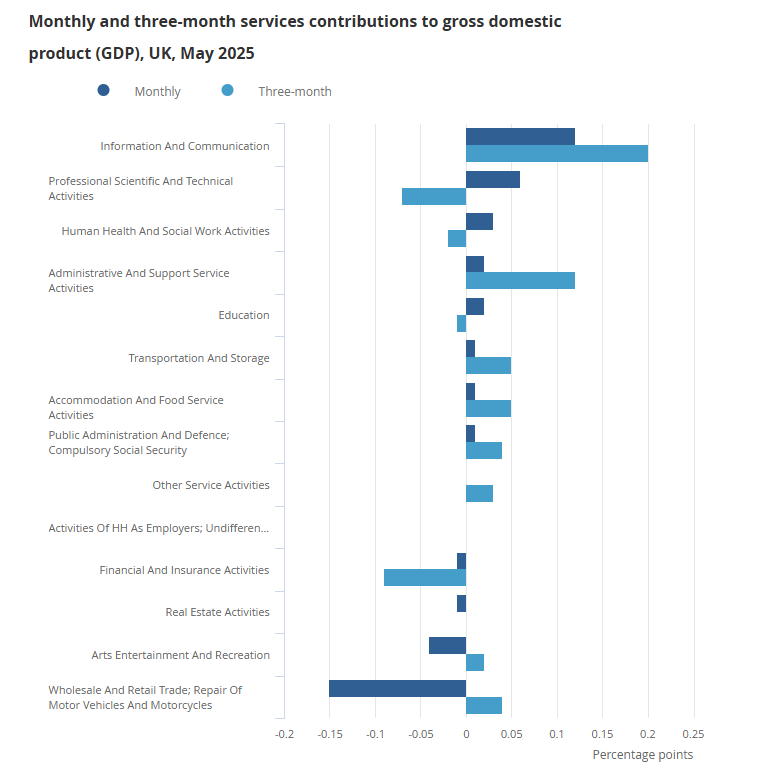

Services

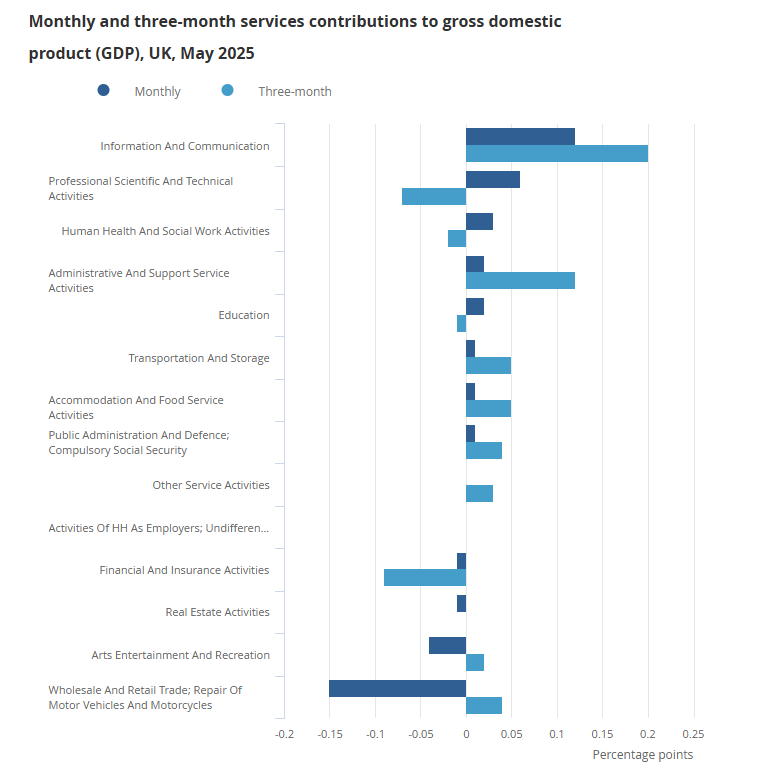

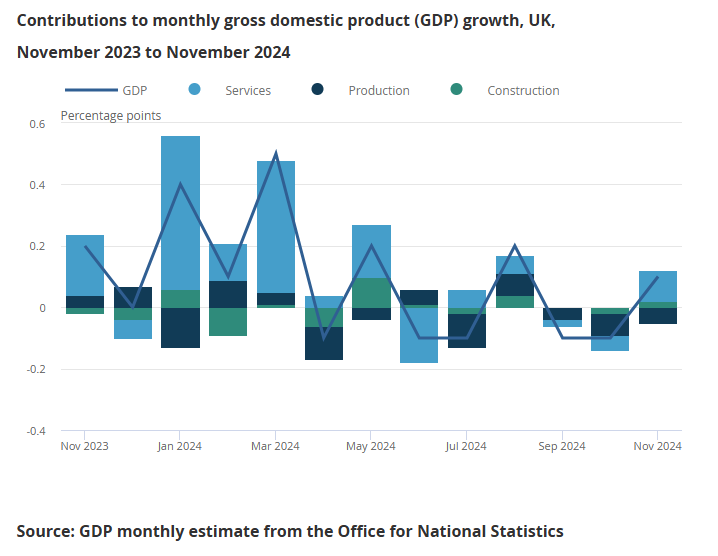

The expansion over the last three months was driven by the services sector, which saw output edge up 0.1% MoM in May and grew 0.4% in the three months to May. Within the services sector, the expansion in May was broad-based as 10 of 14 subsectors saw growth, led by the information and communication (+2.0% MoM) and professional and technical activities (+0.8% MoM) subsectors. Solid growth in these categories was weighed down by weakness in wholesale and retail trade (-1.5% MoM) that was caused by a decline in non-auto retail sales (-2.7% MoM). Indeed, the ONS retail sales report for May found a decline of -2.7% MoM in retail sales volumes, the largest one-month drop since December 2023, although this followed a strong April increase of 1.3% MoM. While retail and wholesale trade caused monthly GDP growth to be lower by -15 bps, its contribution to the three-month growth rate is positive at 4 bps.

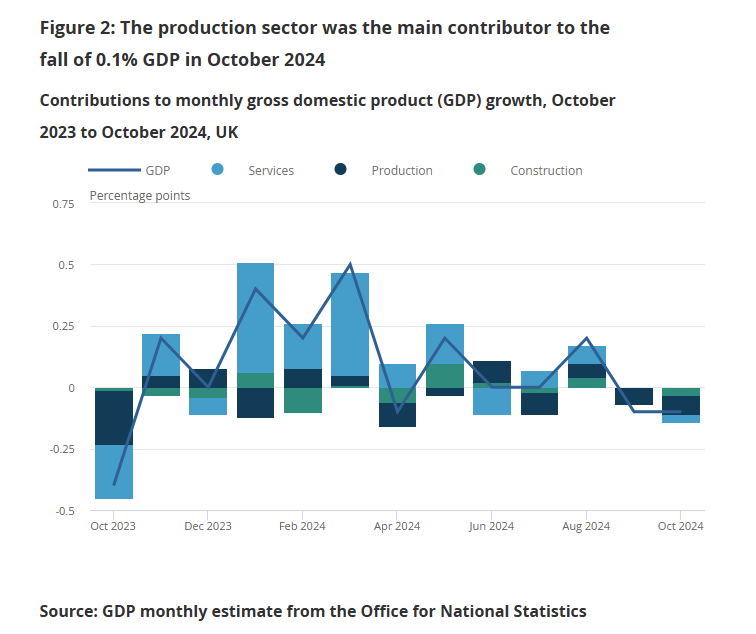

Production

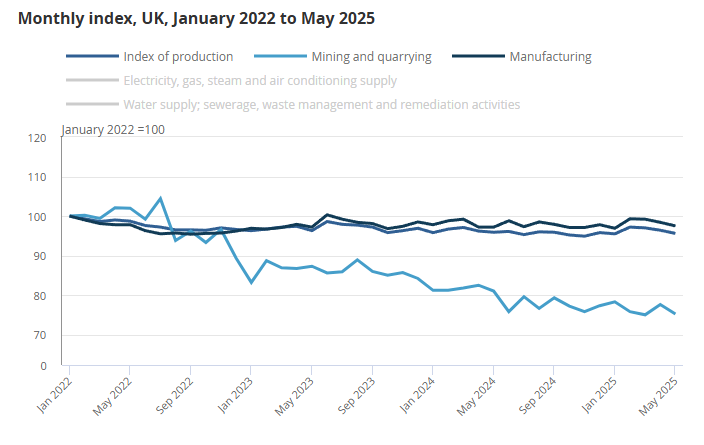

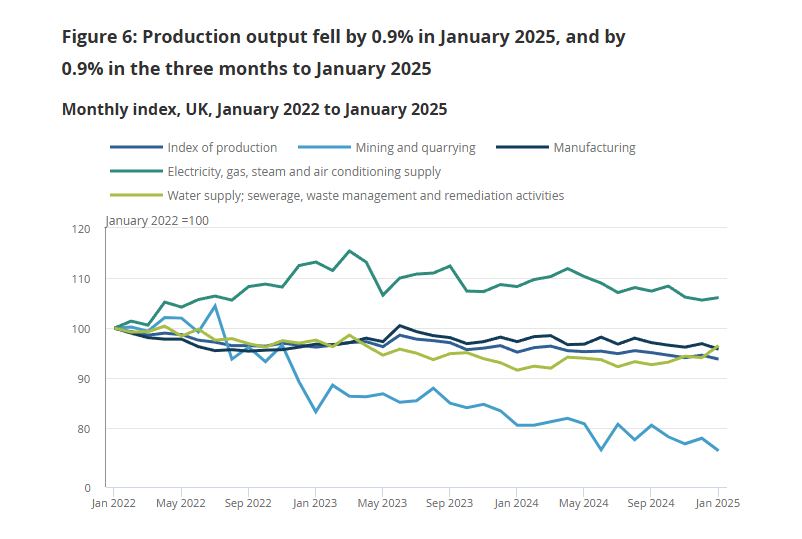

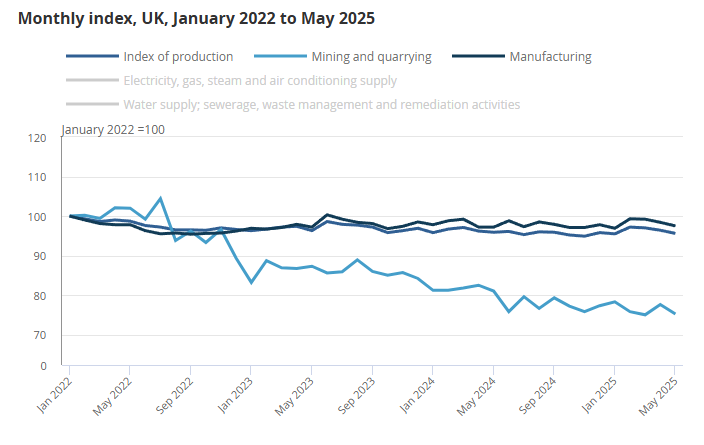

The main sector of the economy that is stymying growth is the production sector, which saw a drop of -0.9% MoM in its output in May. With a contribution of -12 bps to monthly GDP growth, the production impact on growth in May was the worst since January 2024. Additionally, the monthly decline of -0.9% was a big miss below expectations of production growth being flat. In the three months to May, the sector has only grown 0.2%. Manufacturing output was particularly weak in May, down -1.0% MoM as 9 out of 13 manufacturing subsectors contracted. The largest negative contributions came from basic pharmaceutical products (-4.2% MoM), transport equipment (-1.3% MoM), and basic metals and metal products (-1.8% MoM). Weakness in the mining and quarrying subsector has also been a growth headwind. Its output fell another -3.2% MoM in May.

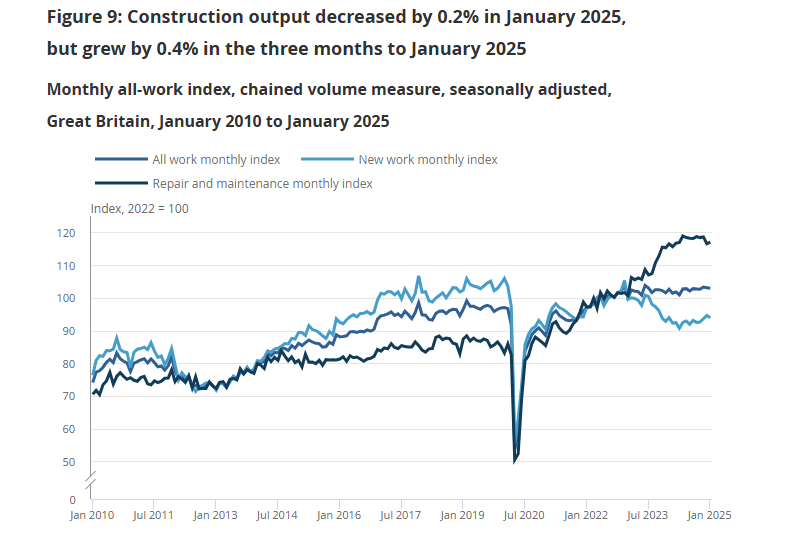

Construction

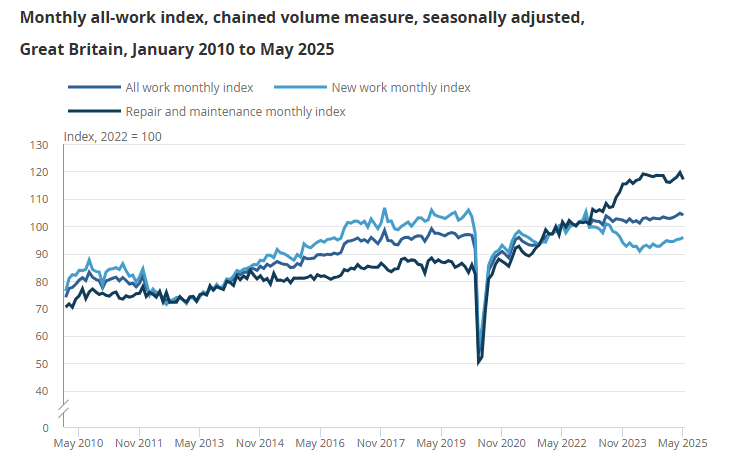

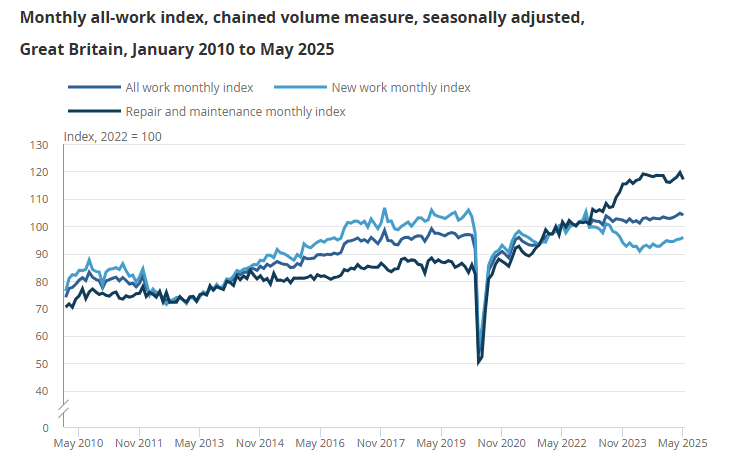

The smaller construction sector also weighed on growth. Construction output dropped -0.6% MoM in May, dragged down by a -2.6% MoM decline in repair and maintenance that was partially offset by a 0.6% MoM increase in the new work index. Unlike the production sector, the three-month trend is a lot stronger with an increase of 1.2%, driven by growth in new infrastructure work of 5.3% in the last three months.

Tariff Impact

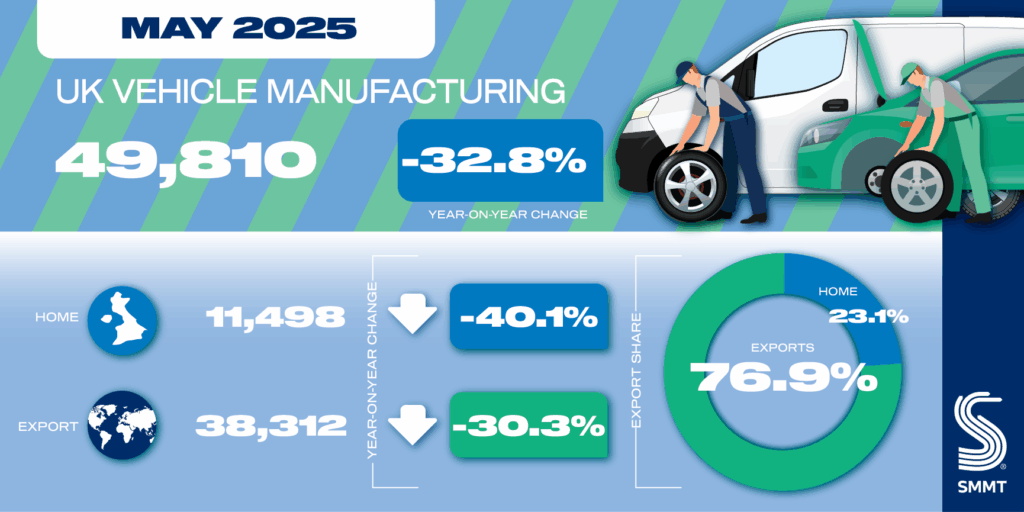

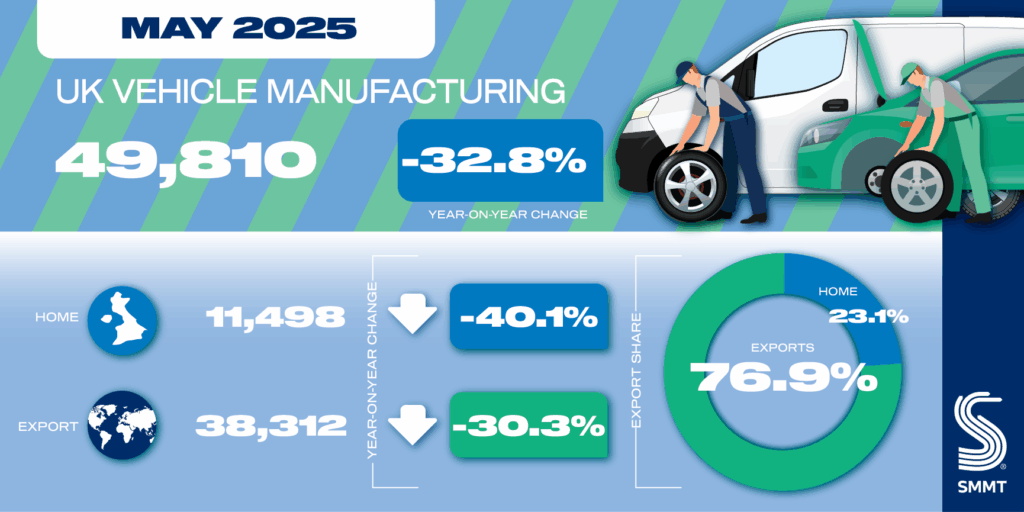

The US tariffs on the UK may have had an impact on growth in May, according to the ONS. In the notes highlighting cross-industry themes, it reported that “businesses who also export to the US cited the changes in tariffs on exports as a possible reason for reduced output,” with these comments mainly coming from auto manufacturing and wholesale firms, with other manufacturing areas also voicing their concern. This is consistent with the large drop in auto manufacturing reported by the UK’s Society of Motor Manufacturers & Traders (SMMT) in May. SMMT found that vehicle manufacturing had fallen by -32.8% YoY in May, with the production of vehicles meant for export down -30.3% YoY. Shipments to the US were down -55.4% YoY, and the US share of exports dropped -6.9 ppts to 11.3% due to the 25% Section 232 tariffs. However, the SMMT is hopeful that the trade agreement between the US and the UK will correct these numbers in June and help growth rebound in the final month of Q2 2025.

UK Monthly GDP

UK Monthly GDP