UK International Trade

UK International Trade

- Source

- ONS

- Source Link

- https://www.ons.gov.uk/

- Frequency

- Monthly

- Next Release(s)

- October 16th, 2025 2:00 AM

Latest Updates

-

The UK trade deficit was mostly unchanged at -£5.26 billion in July, slightly higher than -£5,02 billion in June. The goods trade balance was also mostly unchanged at -£22.24 billion (vs -£21.75 billion expected)

-

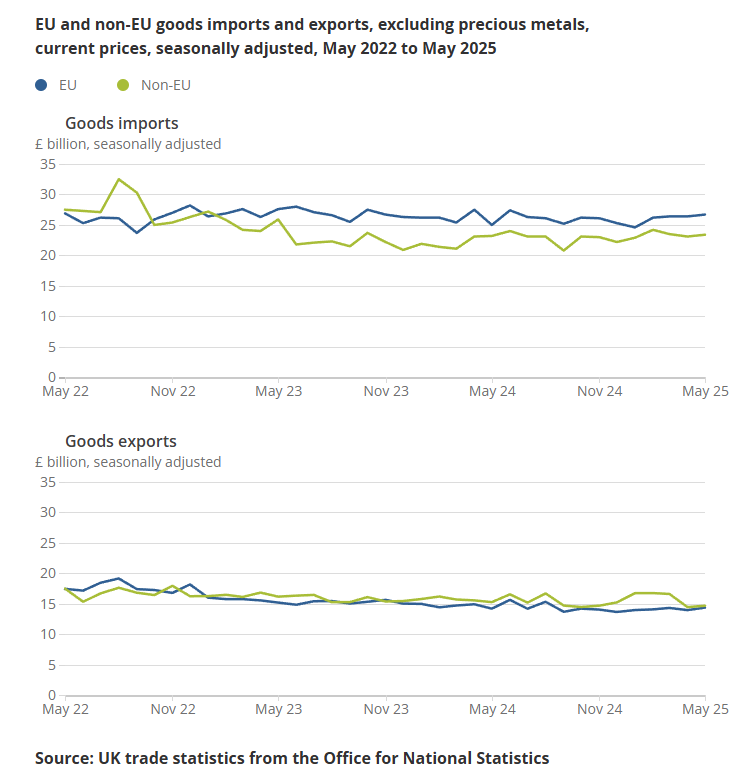

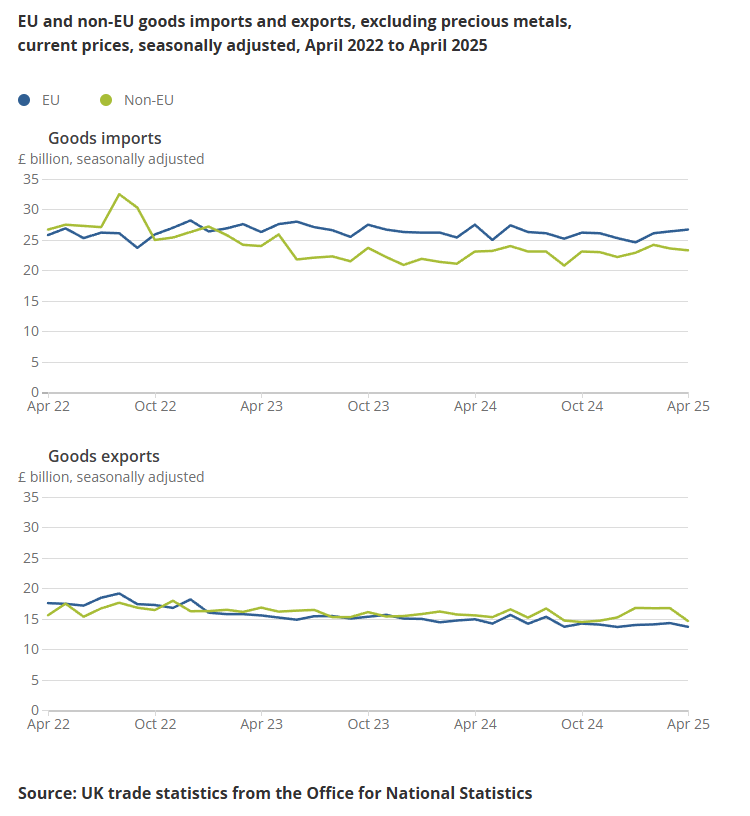

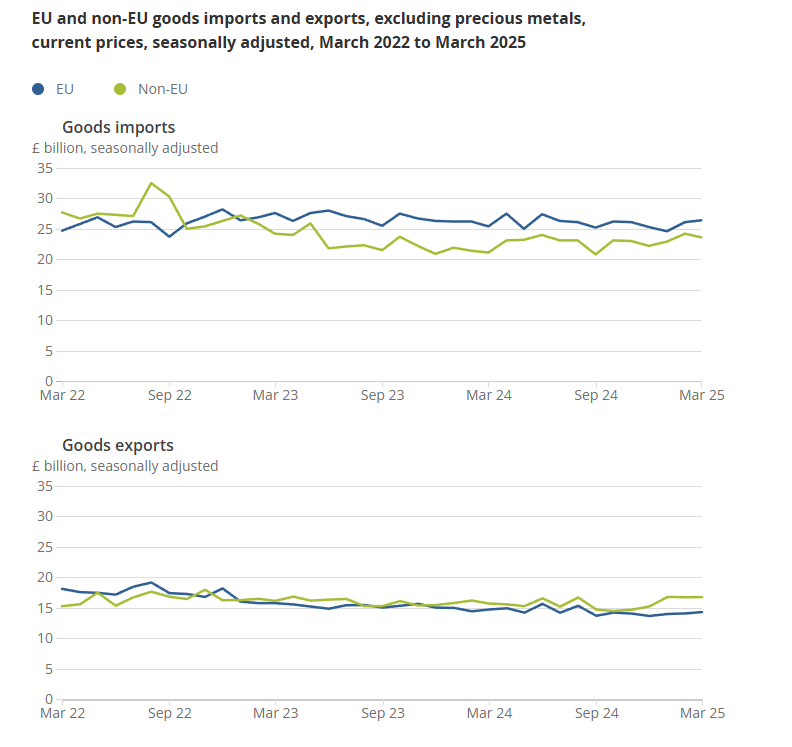

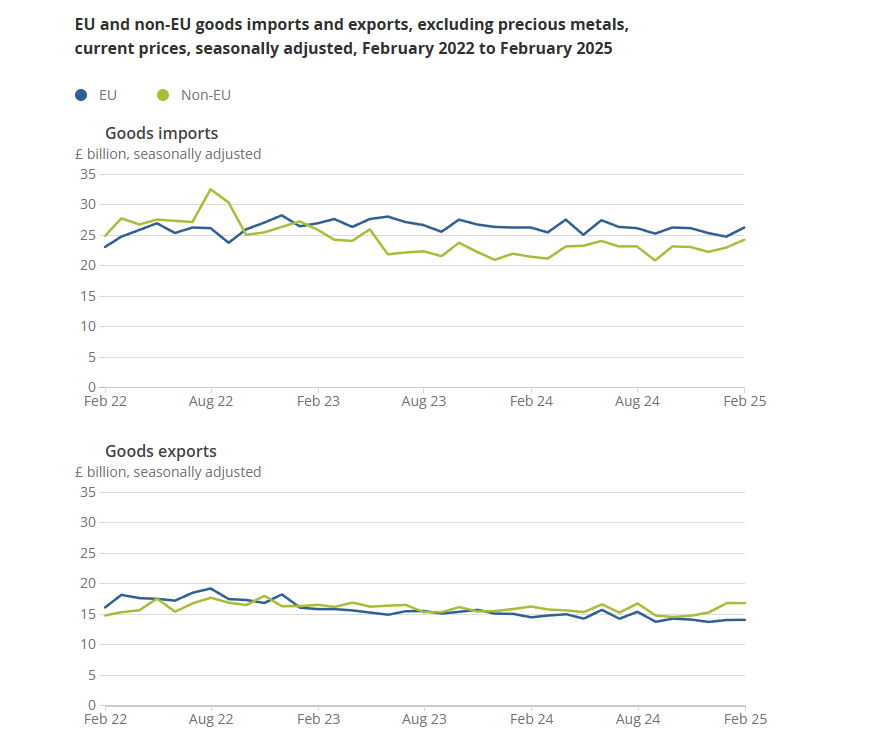

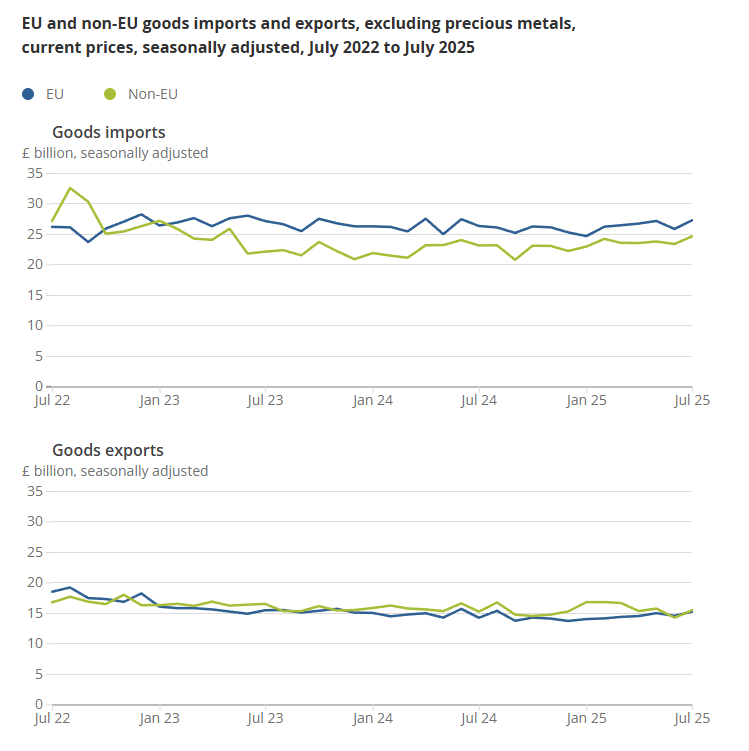

UK goods imports rose +5.4% MoM in July while goods exports increased +6.6% MoM, reflecting a broad pickup across EU and non-EU trade but a still-wide overall deficit.

-

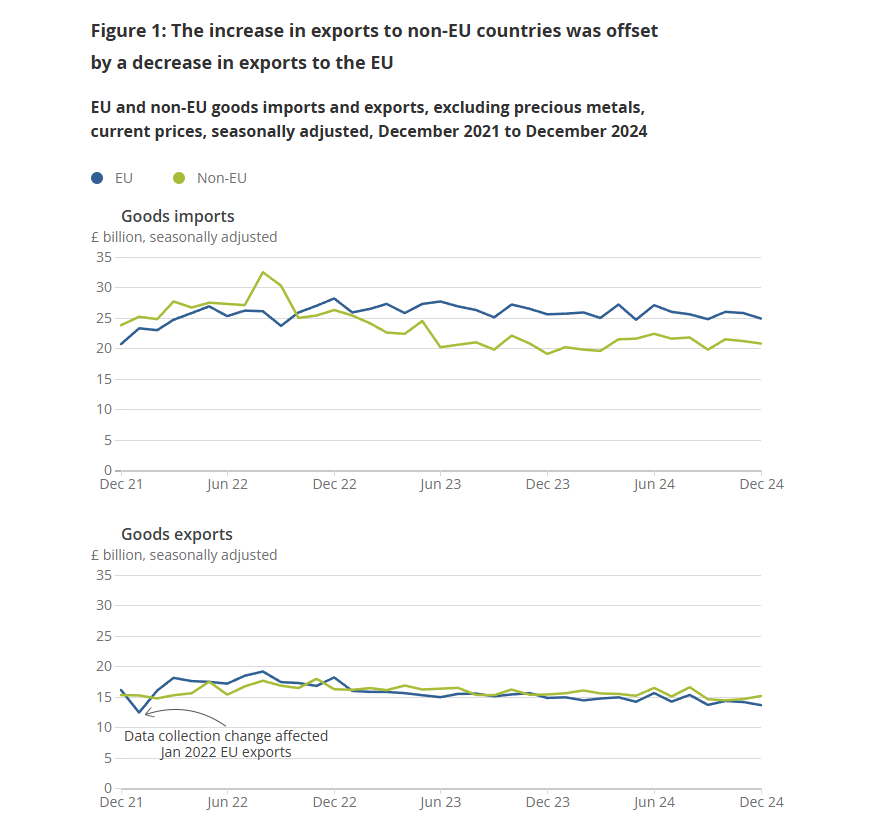

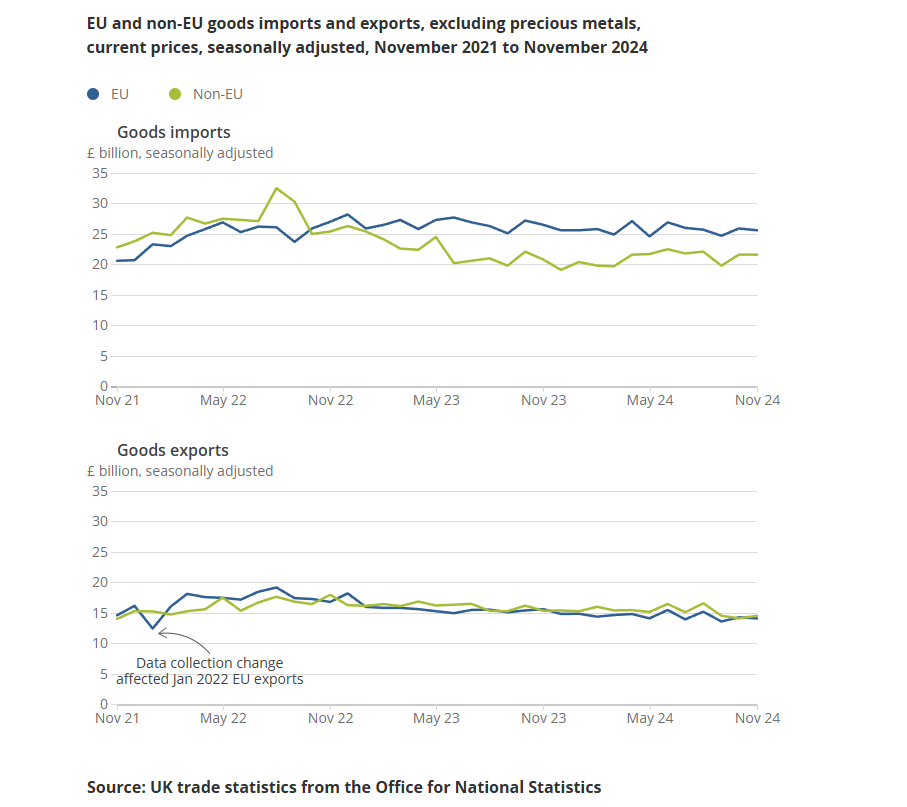

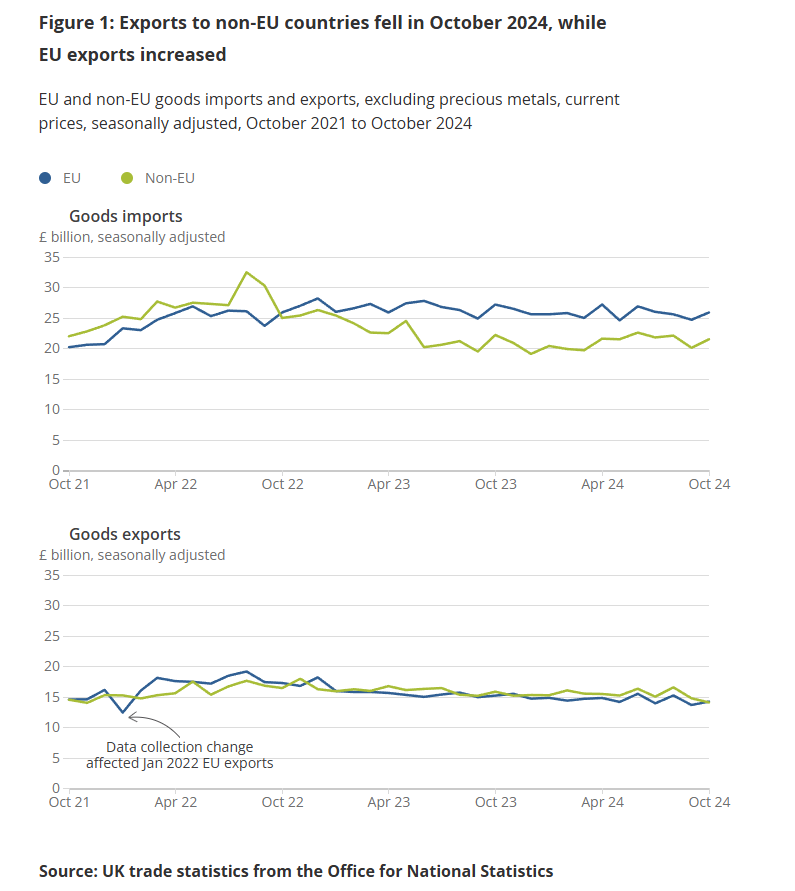

In value terms, imports climbed £2.7 billion MoM (EU +£1.4 billion, +5.5%; non-EU +£1.3 billion, +5.4%), outpacing exports by £0.8 billion.

-

Goods exports rose £1.9 billion MoM (+6.6%), driven by non-EU (+£1.2 billion, +8.5%) and EU (+£0.7 billion, +4.6%) shipments.

-

After inflation adjustment (CVM), goods imports increased +£2.1 billion (+4.1%) MoM, with non-EU +£1.2 billion (+4.5%) and EU +£0.9 billion (+3.7%); goods exports rose +£1.5 billion (+5.2%) MoM (non-EU +£1.3 billion, +9.3%; EU +£0.2 billion, +1.4%).

-

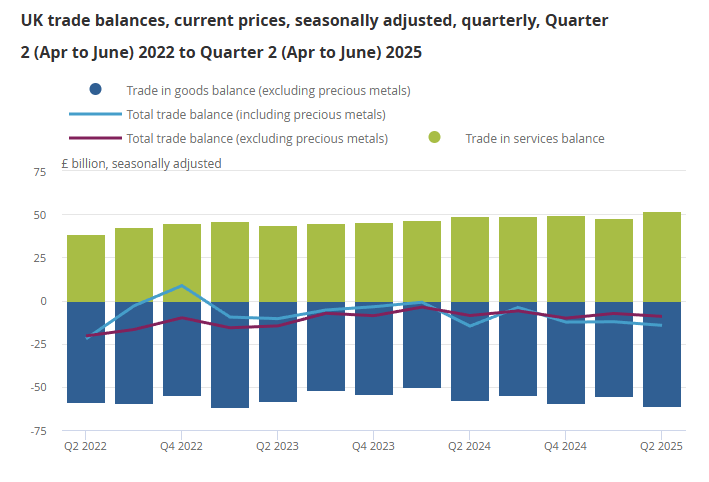

The total goods & services trade deficit widened by £0.4 billion to £10.3 billion in the three months to July, as imports grew faster than exports.

-

The goods deficit widened by £3.0 billion to £61.9 billion over the three-month period, while the services surplus widened by £2.6 billion to £51.6 billion.

-

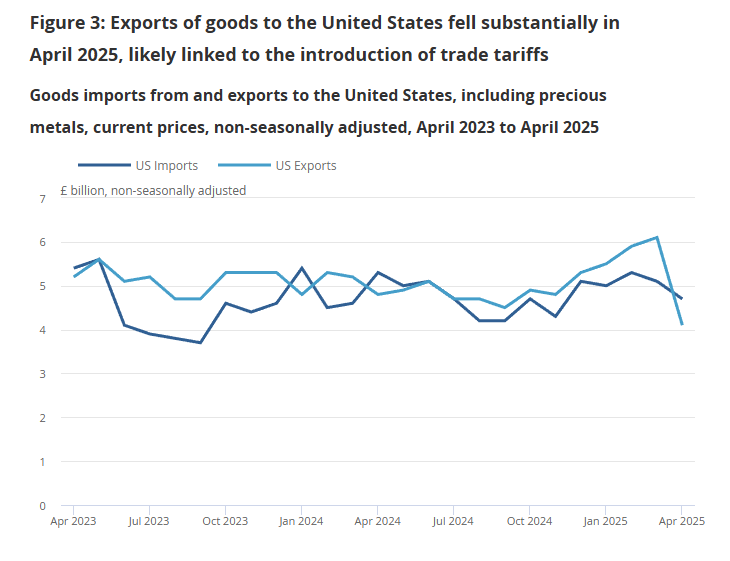

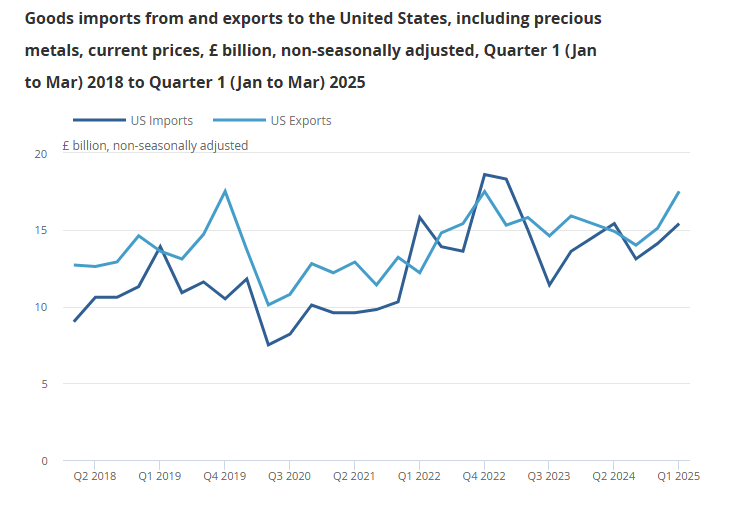

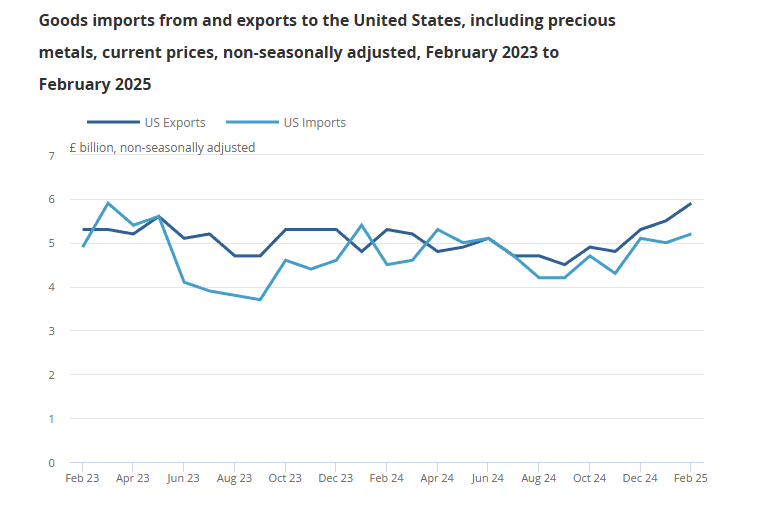

U.S. trade: goods exports to the United States (incl. precious metals) rose £0.8 billion MoM on material manufactures, chemicals, and machinery/transport equipment, but remain below pre-tariff levels; imports from the U.S. fell £0.5 billion on lower aircraft.

-

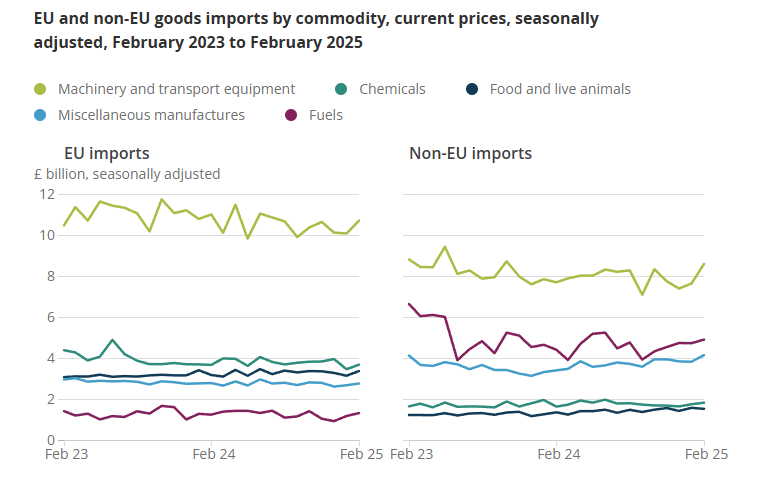

Commodity detail: EU import gains were led by machinery & transport equipment (+£0.6 billion), food & live animals (+£0.3 billion); non-EU imports were lifted by ships from South Korea (+£1.1 billion in machinery & transport equipment), partly offset by lower fuels (–£0.3 billion).

-

Early services estimates: July services imports were broadly flat, while services exports dipped £0.2 billion (–0.4%) MoM, consistent with softer external demand noted by survey evidence.

-