S&P Global Services PMIs

S&P Global Services PMIs

- Source

- S&P Global

- Source Link

- https://www.pmi.spglobal.com/

- Frequency

- Monthly

- Next Release(s)

- February 4th, 2026 12:00 AM

-

March 4th, 2026 12:00 AM

-

April 3rd, 2026 12:00 AM

-

May 5th, 2026 12:00 AM

-

June 3rd, 2026 12:00 AM

-

July 6th, 2026 12:00 AM

-

August 5th, 2026 12:00 AM

-

September 3rd, 2026 12:00 AM

-

October 5th, 2026 12:00 AM

-

November 4th, 2026 12:00 AM

-

December 3rd, 2026 12:00 AM

-

January 6th, 2027 12:00 AM

Latest Updates

-

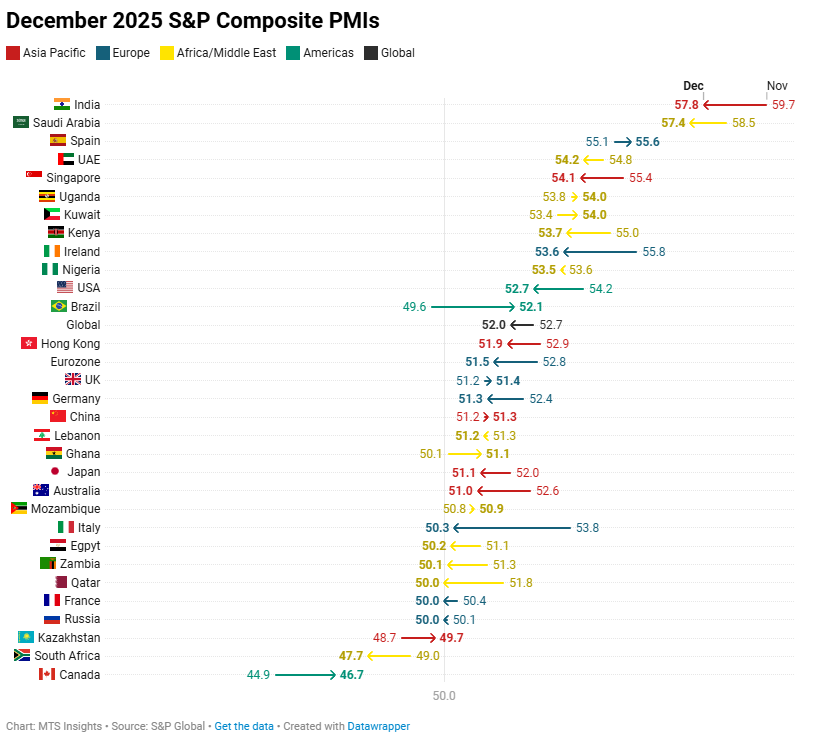

Global - 1/6/2026

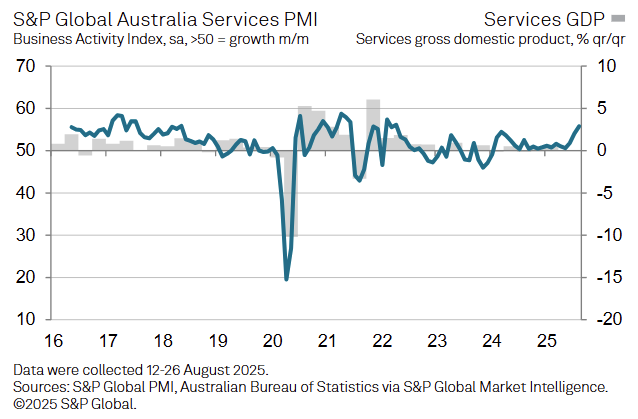

Asia Pacific

- Australia - 1/5/2026

- Singapore (Composite only) - 1/6/2026

- Hong Kong (Composite only) - 1/6/2026

- Japan - 1/7/2026

- China - 1/5/2026

- India - 1/6/2026

- Russia - 12/30/2025

- Kazakhstan - 1/6/2026

Africa & Middle East

- Nigeria (Composite only) - 1/2/2026

- Qatar (Composite only) - 1/6/2026

- Kuwait (Composite only) - 1/6/2026

- Egypt (Composite only) - 1/6/2026

- UAE (Composite only) - 1/6/2026

- Uganda (Composite only) - 1/6/2026

- South Africa (Composite only) - 1/6/2026

- Lebanon (Composite only) - 1/7/2026

- Ghana (Composite only) - 1/6/2026

- Zambia (Composite only) - 1/6/2026

- Saudi Arabia (Composite only) - 1/5/2026

- Mozambique (Composite only) - 1/6/2026

- Kenya (Composite only) - 1/6/2026

Europe

- Ireland - 1/6/2026

- Spain - 1/6/2026

- Italy - 1/6/2026

- France - 1/6/2026

- Germany - 1/6/2026

- Eurozone - 1/6/2026

- UK - 1/6/2026

North & South America

Key Results

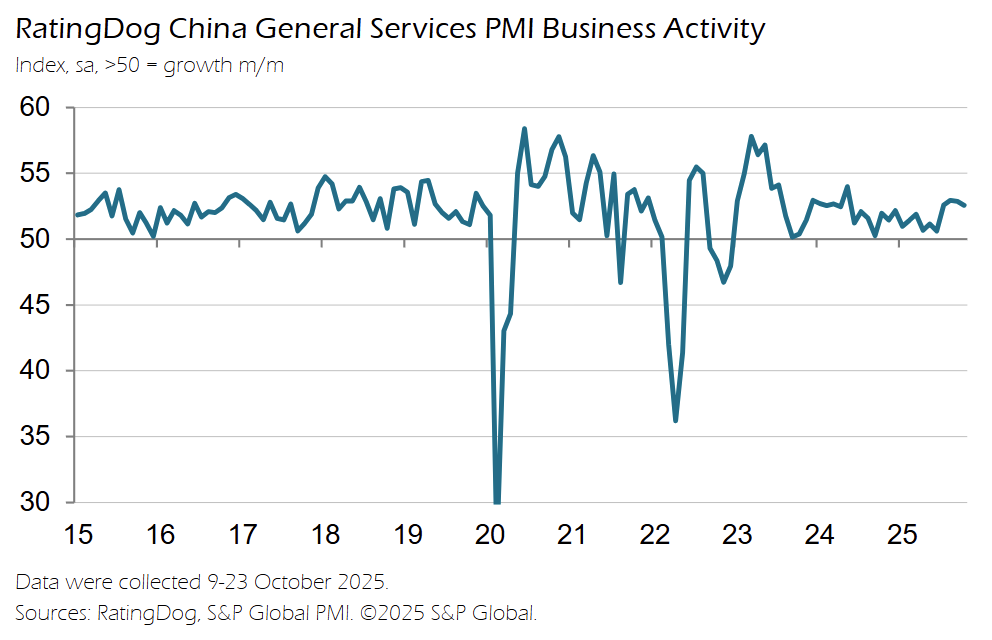

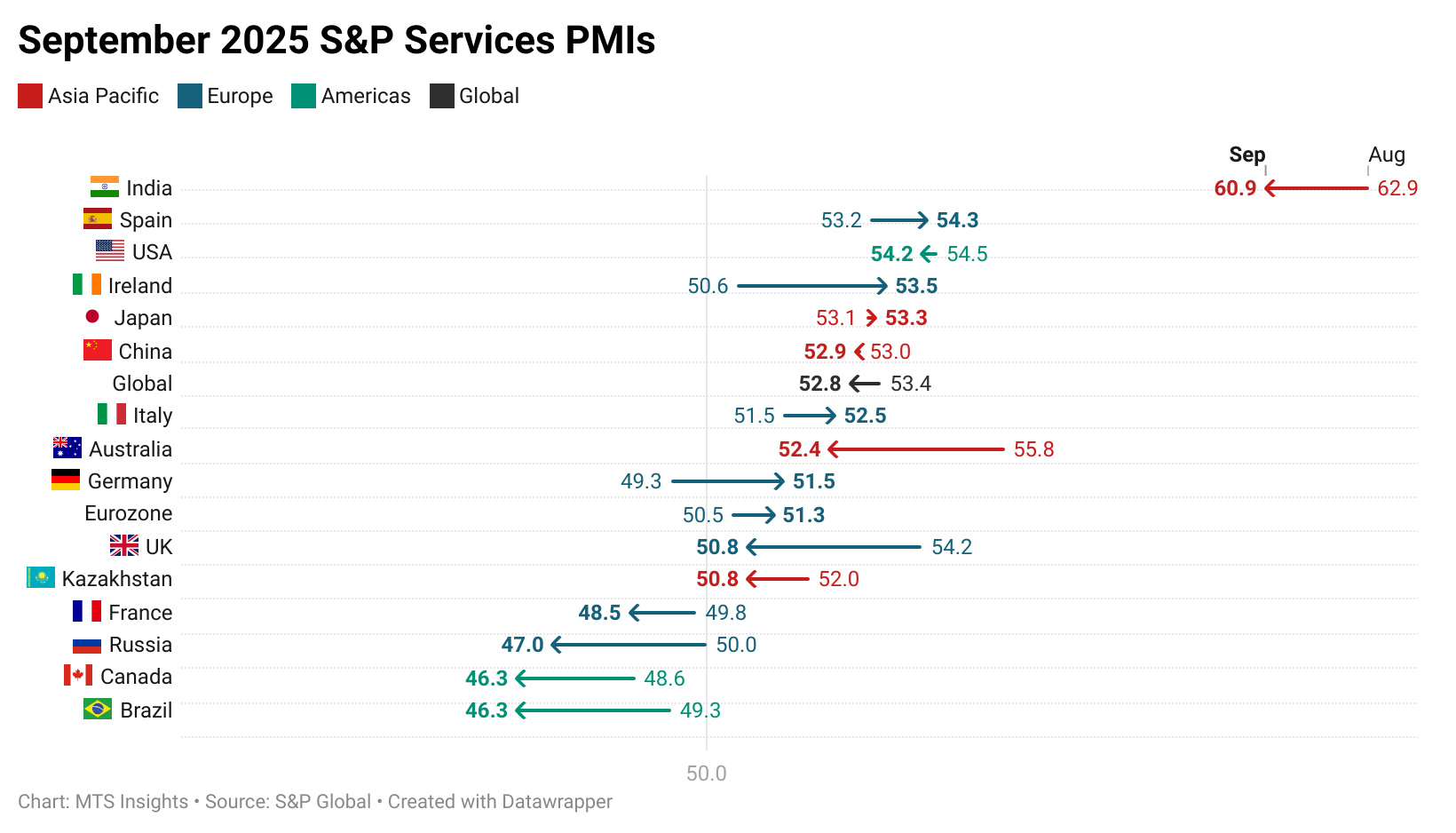

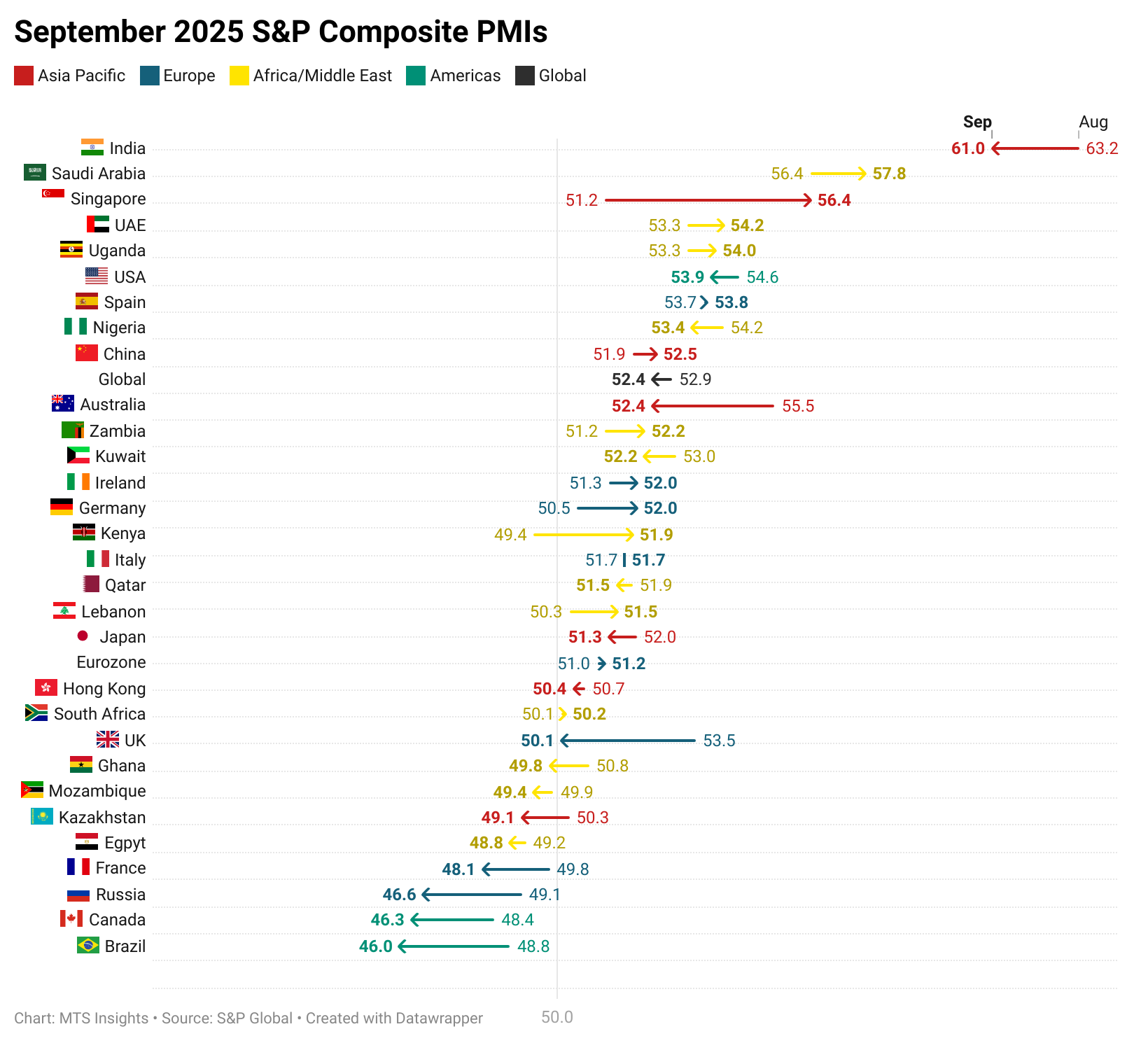

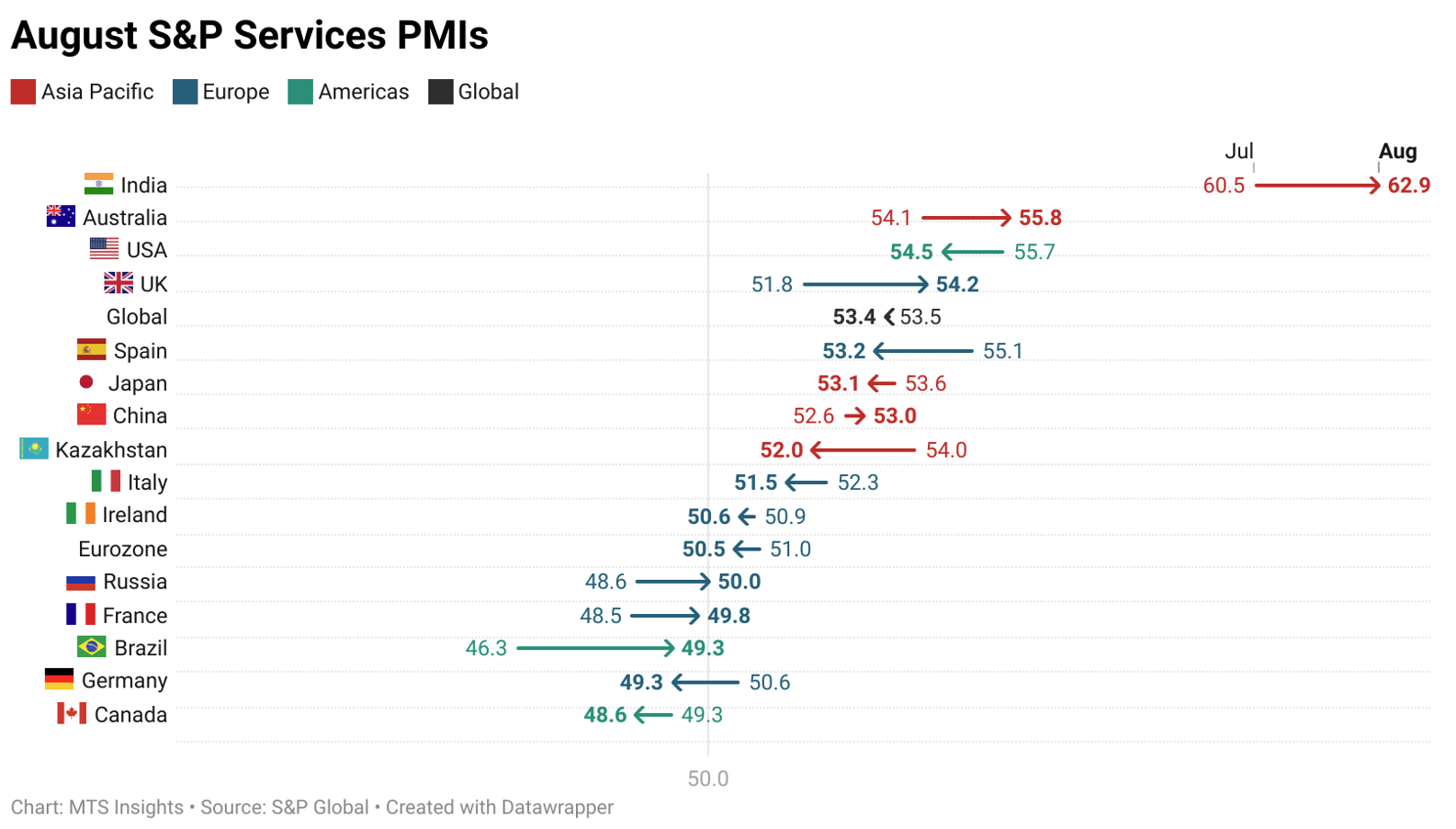

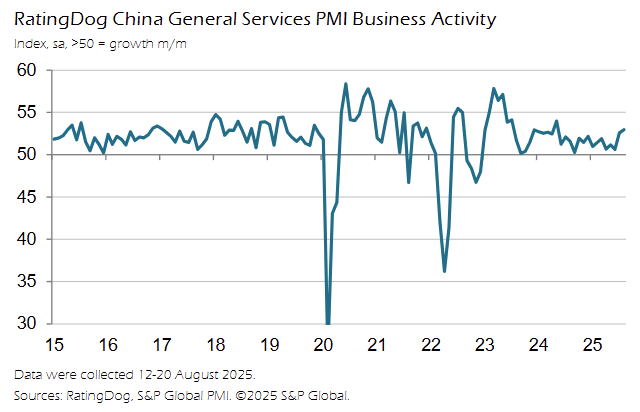

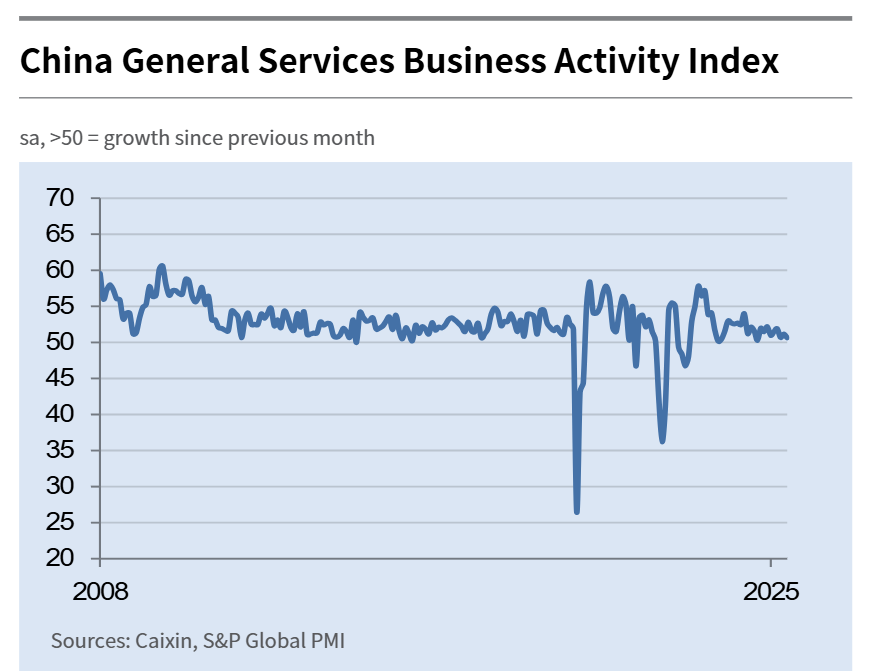

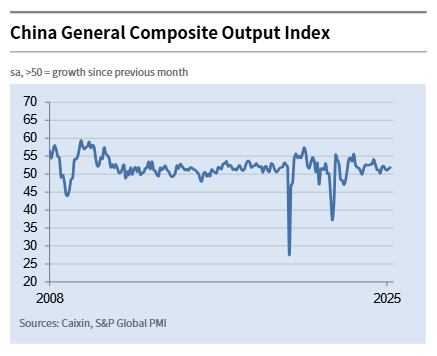

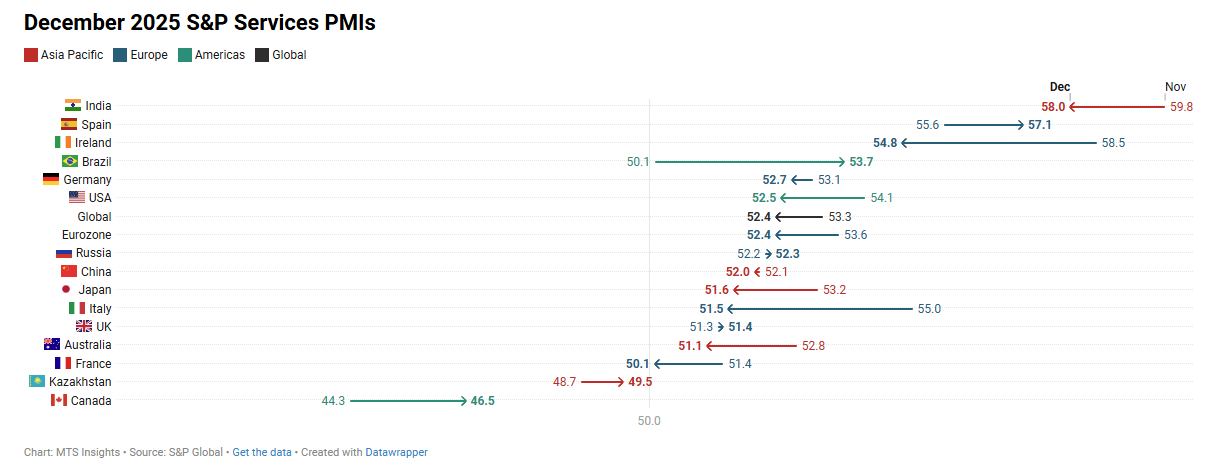

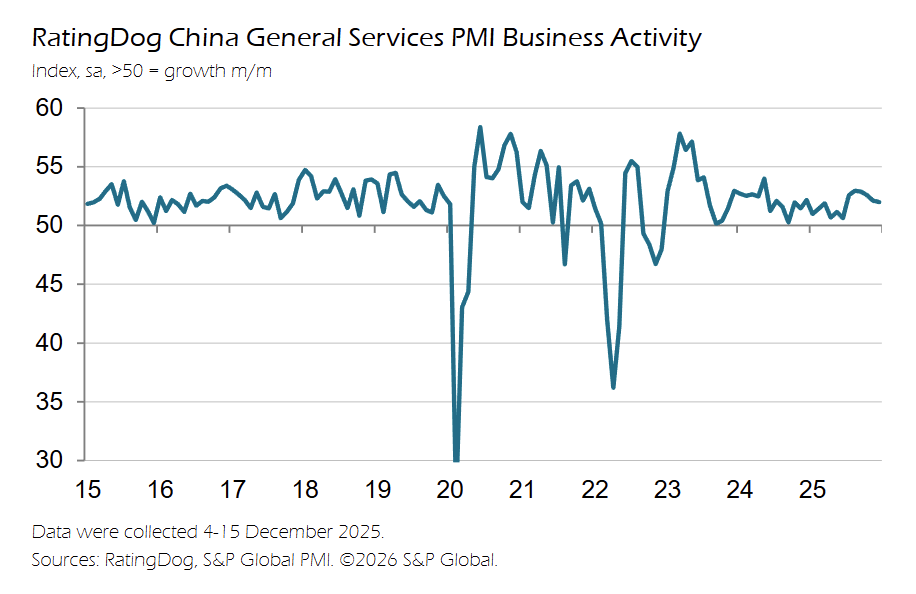

China

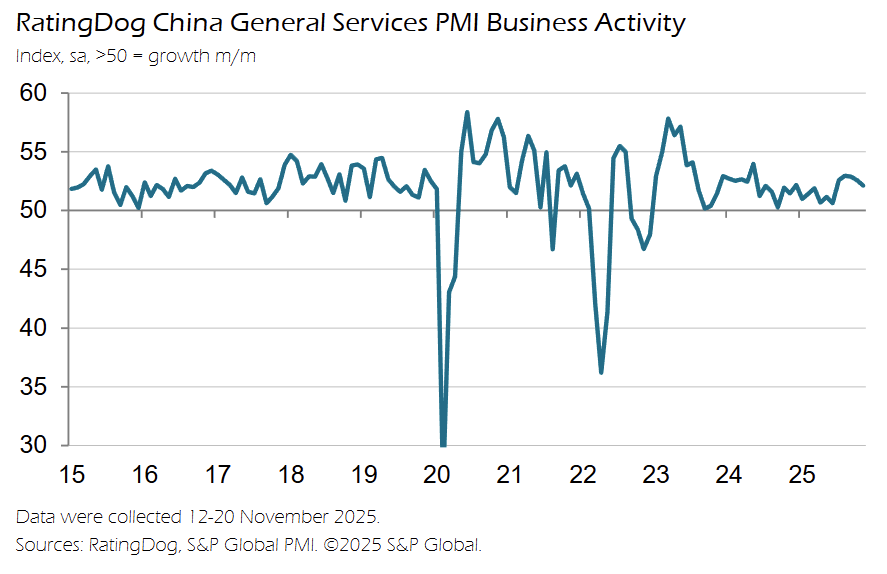

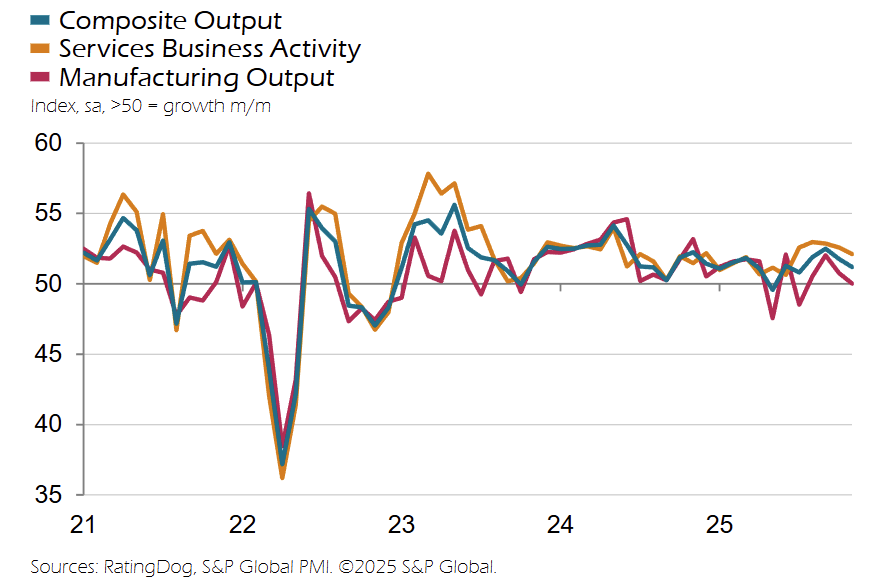

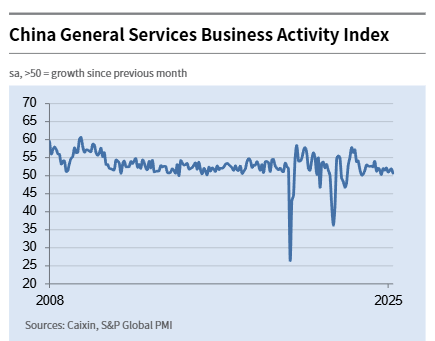

China’s RatingDog General Services Business Activity Index eased to 52.0 in December (from 52.1 in November), marking the slowest services expansion since June amid softer new orders growth and continued job shedding.

-

Services activity remained in expansion at 52.0 (Nov: 52.1), extending the services growth run to three years, but with a modest pace that was the softest in six months.

-

New business increased again, supported by promotions and improved customer interest, but the rate of growth slowed to a six-month low as new export business contracted after a brief improvement in November.

-

New export business fell in December, with respondents citing reduced tourist numbers, contrasting with the prior month’s increase in overseas sales.

-

Employment declined for a fifth straight month, with firms citing cost concerns and restructuring, and the reduced workforce capacity contributed to a slight rise in outstanding business.

-

Input prices rose for a tenth consecutive month, driven by higher raw material and wage costs, with inflation described as among the highest seen in 2025 despite remaining modest.

-

Output charges declined as firms lowered prices to support sales amid intense competition, indicating limited pricing power even as input costs increased.

-

Business sentiment improved to a nine month high, linked to expectations of stronger market conditions and expansion plans for 2026, though confidence remained below the survey’s long run average.

-

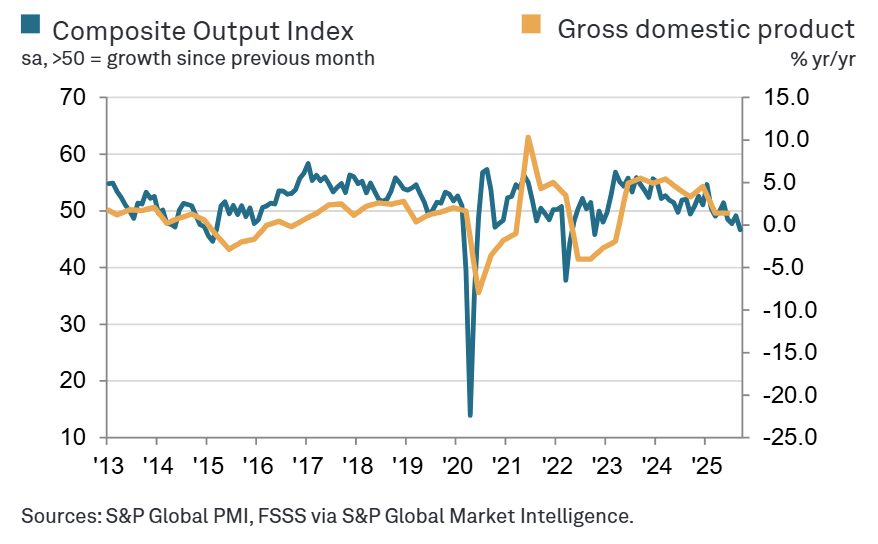

The Composite Output Index edged up to 51.3 (Nov: 51.2), indicating a seventh consecutive month of overall private sector expansion supported by higher services activity and a renewed increase in factory production, while overall selling prices continued to fall despite slightly firmer cost pressures.

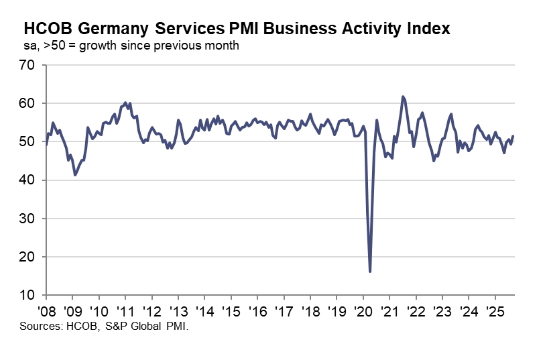

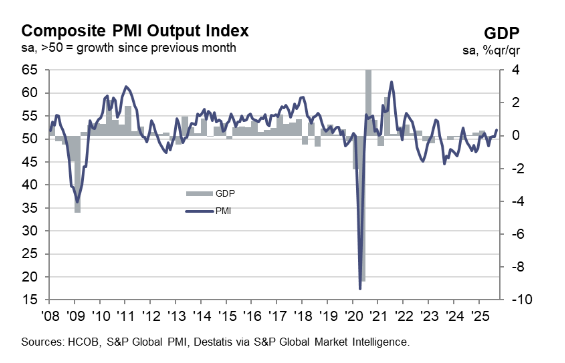

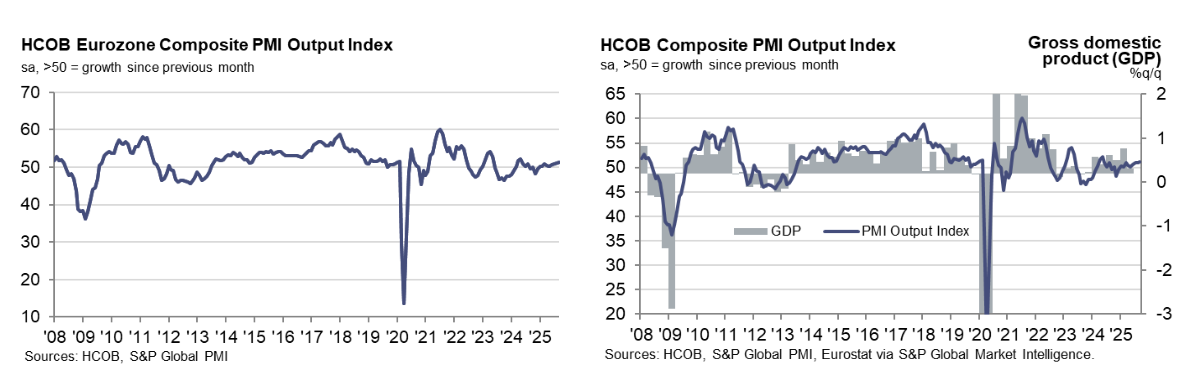

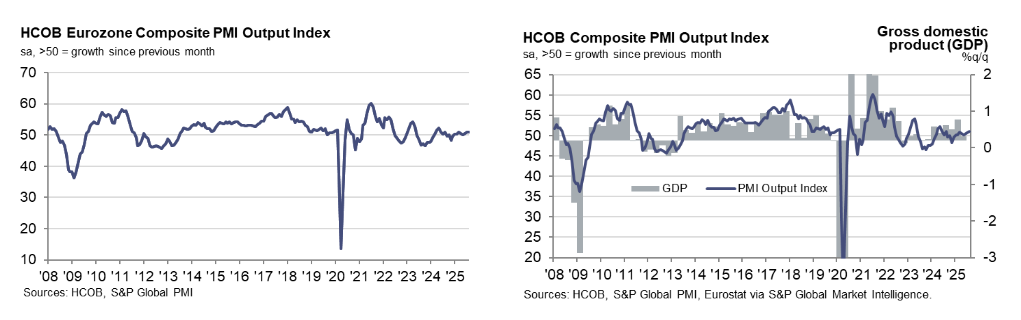

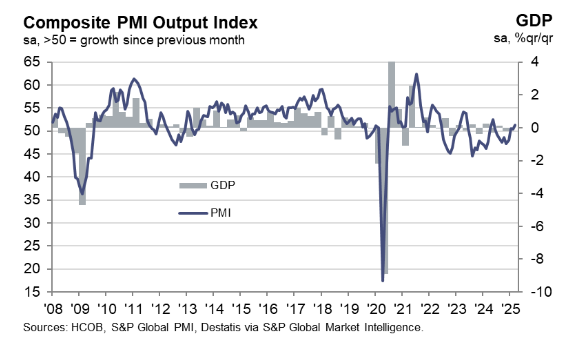

Euro Area

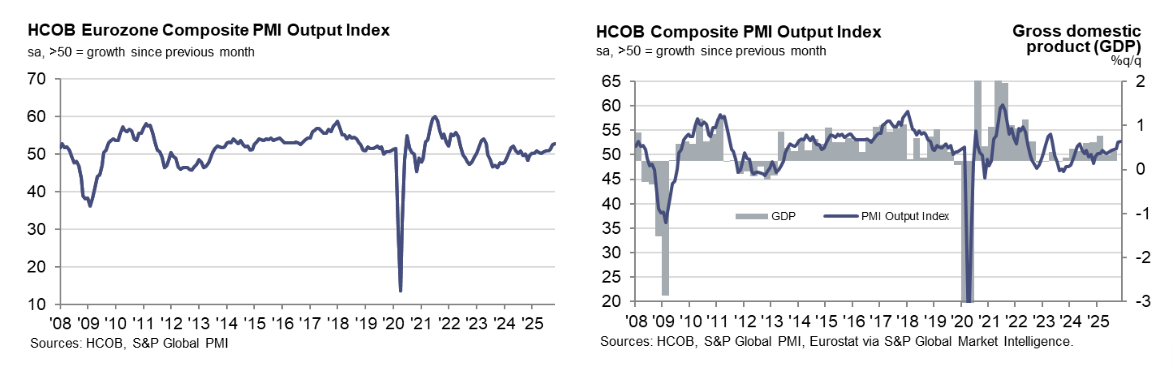

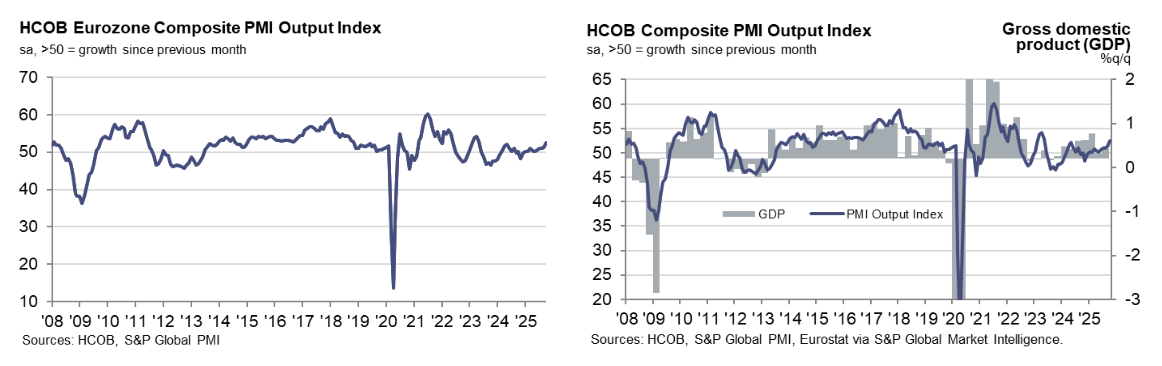

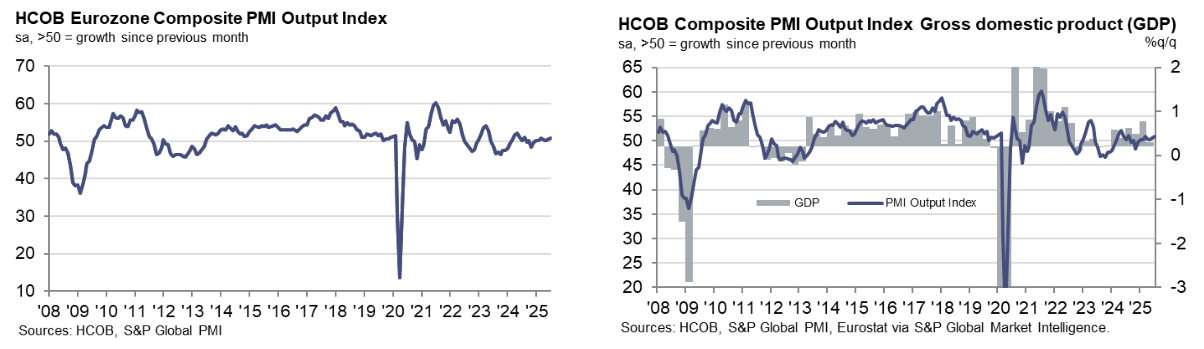

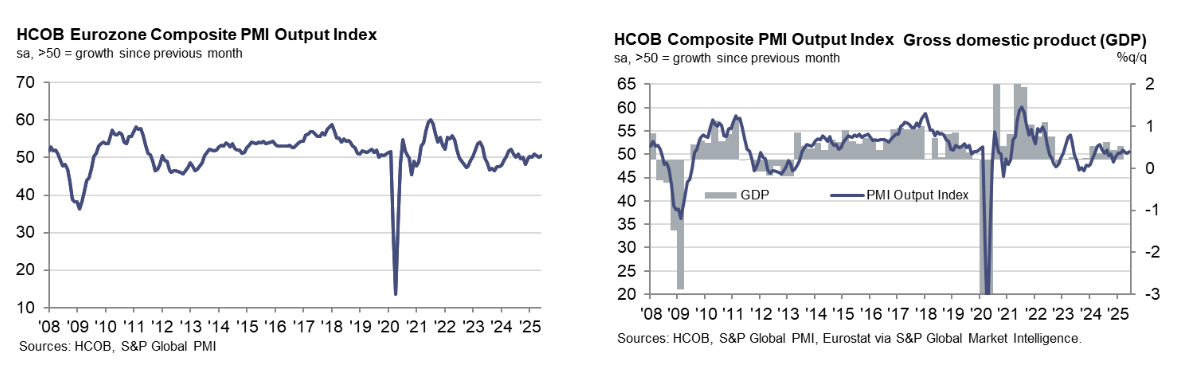

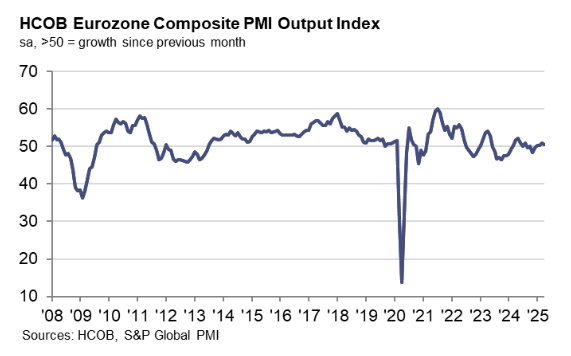

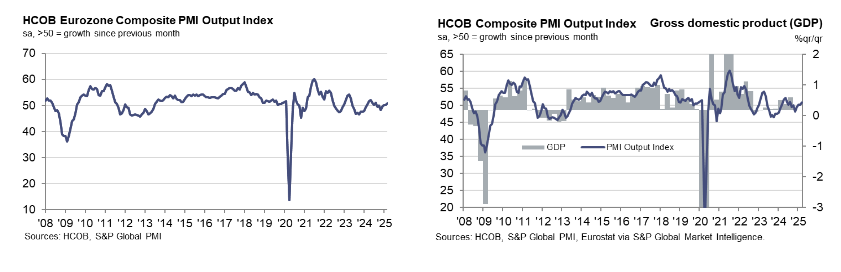

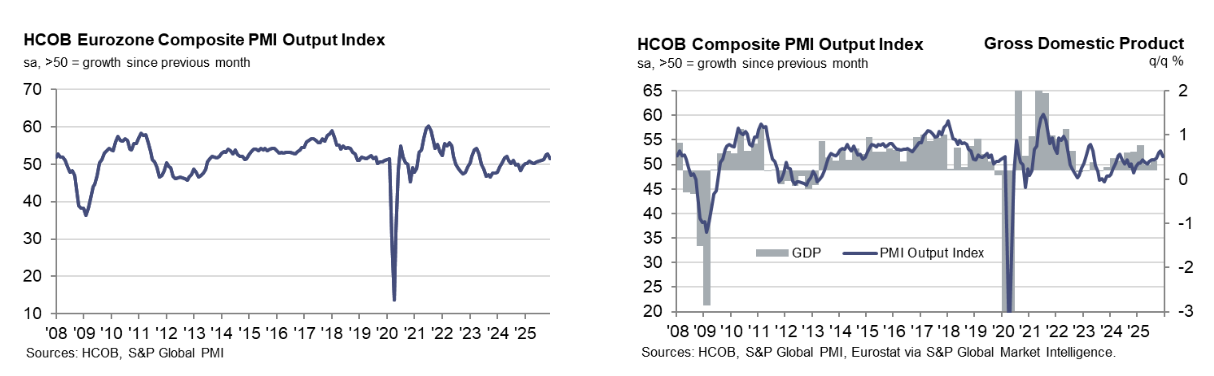

The HCOB Eurozone Composite PMI Output Index eased to 51.5 in December (from 52.8 in November), marking slower private-sector growth but rounding out the strongest quarterly expansion since Q2 2023.

-

The Composite PMI fell -1.3 pts MoM to 51.5, a three-month low, indicating continued expansion but at the weakest pace since September as momentum softened late in the year.

-

The three-month average Composite PMI for Q4 stood at 52.3, the highest since Q2 2023, underscoring that December’s slowdown followed a solid quarter overall.

-

Services activity remained expansionary but cooled, with the Services PMI Business Activity Index slipping to 52.4 (from 53.6), also a three-month low, reflecting softer demand growth.

-

New business rose for a fifth consecutive month, but the pace slowed to the weakest since September, as faster declines in manufacturing orders offset a softer increase in services sales.

-

New export business contracted more sharply, falling to the greatest extent since March 2025, indicating weaker demand from non-domestic clients.

-

Backlogs of work declined at the fastest pace in three months, showing firms made quicker progress clearing outstanding orders amid softer demand pressures.

-

Employment increased marginally and at a slightly faster rate than in November, with job gains in services offset by continued cutbacks in manufacturing.

-

Input cost inflation accelerated to a nine-month high, while output price inflation was unchanged from November and remained among the weakest since October 2024, indicating rising cost pressures without faster pass-through.

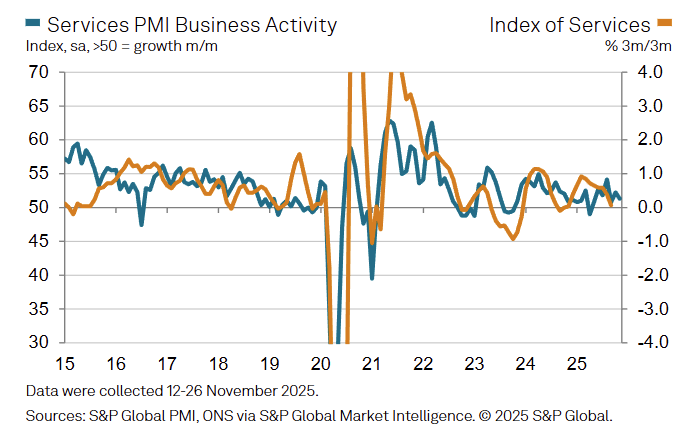

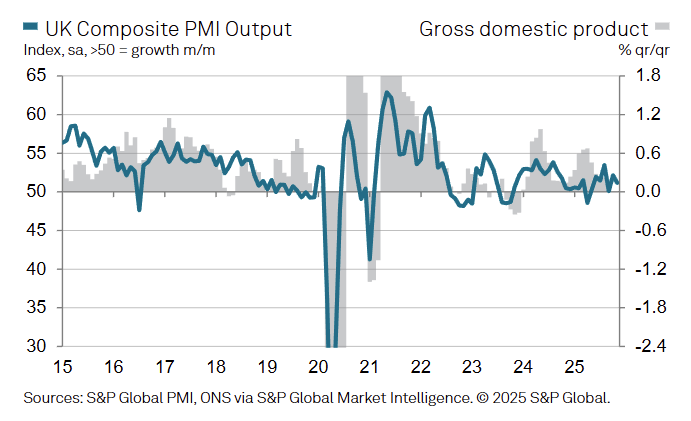

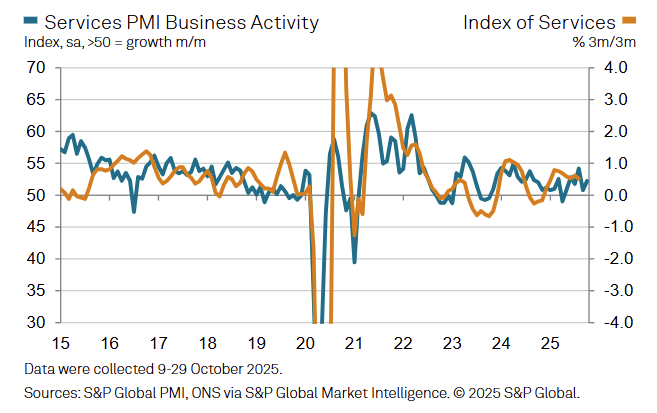

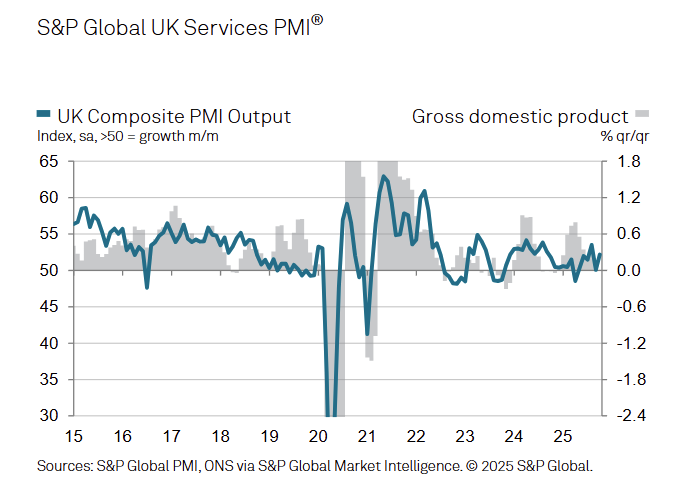

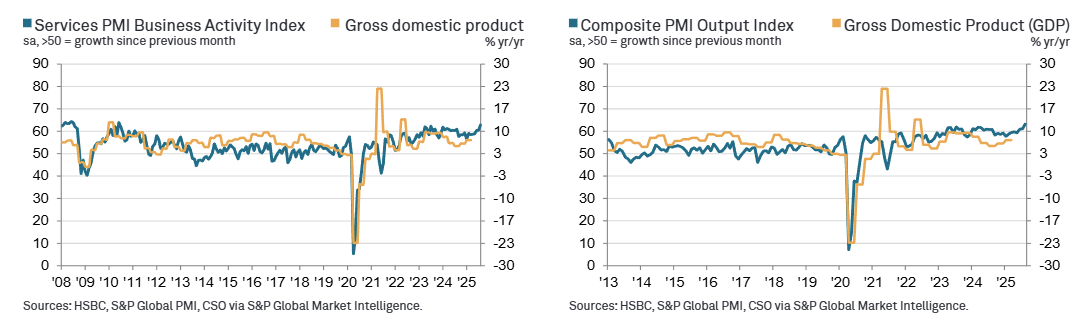

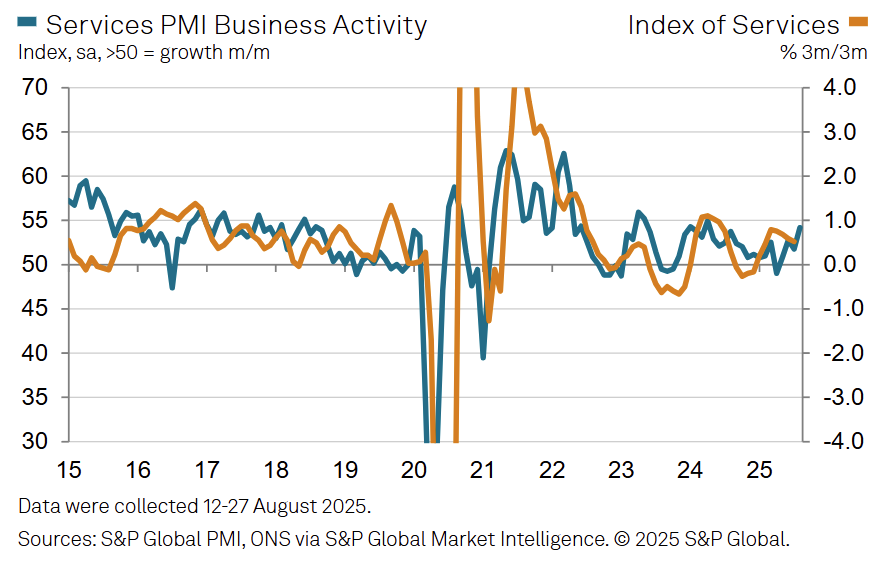

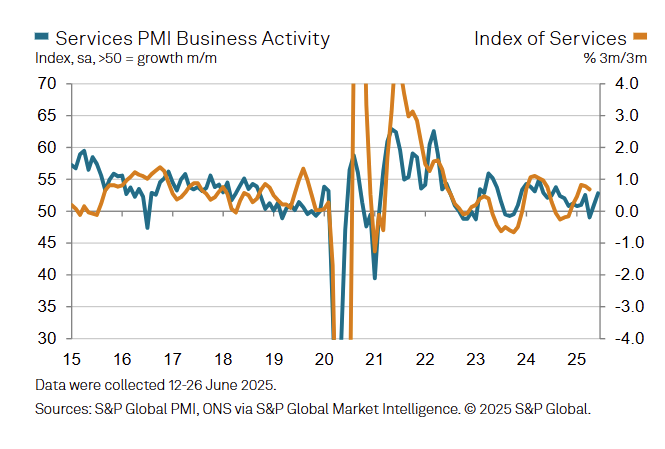

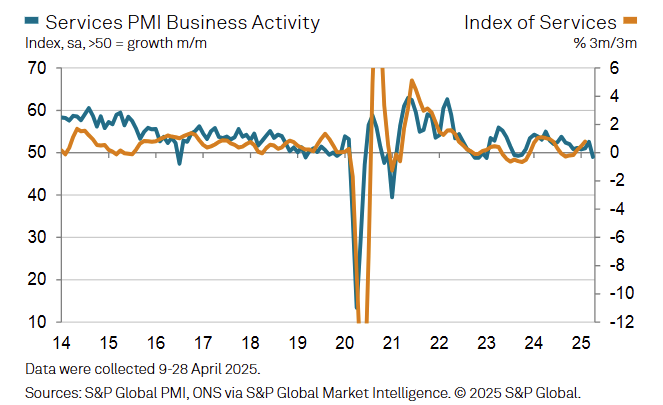

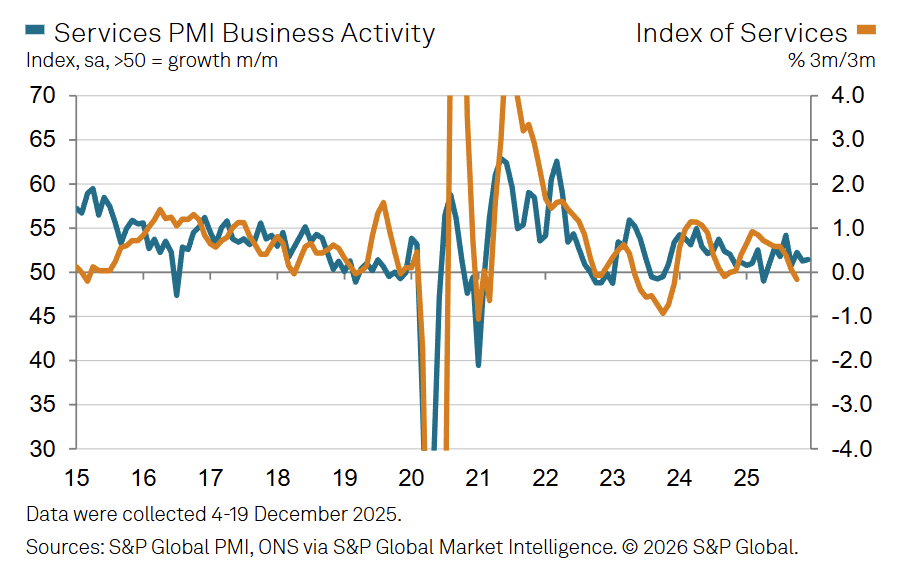

UK

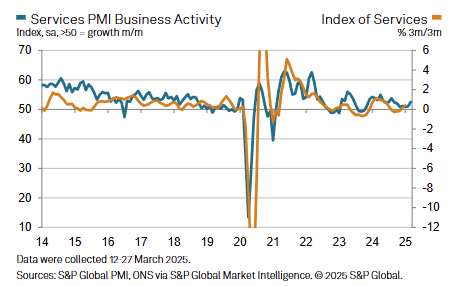

The S&P Global UK Services PMI edged up to 51.4 in December (from 51.3 in November), indicating continued but marginal expansion amid subdued demand conditions.

-

Business activity rose for an eighth consecutive month, but at 51.4 remained well below the long-run average of 54.2 and slightly weaker than the earlier flash estimate of 52.1, showing persistently soft growth momentum.

-

Total new work returned to expansion after a marginal decline in November, with the pace of growth modest but faster than the 2025 average, pointing to a tentative improvement in demand.

-

New export business increased moderately, ending a three-month contraction, with respondents citing stronger demand from the US but continued weakness in EU markets.

-

Backlogs of work increased for the first time since May 2023, reflecting higher-than-expected new business and some renewed capacity pressures, including supplier delays.

-

Employment fell for a fifteenth consecutive month, as around 21% of firms reported staff reductions versus 12% reporting increases, though the pace of job cuts eased compared with November.

-

Input cost inflation accelerated to a seven-month high, driven mainly by wage pressures and higher fuel costs, indicating rising cost burdens across the service sector.

-

Output charges rose at the fastest pace in four months, rebounding from November’s near five-year low despite reports of squeezed margins and limited pricing power.

-

The UK Composite PMI Output Index ticked up to 51.4 (from 51.2), marking an eighth straight month of private-sector expansion, supported by a modest rebound in total new work but ongoing declines in employment.

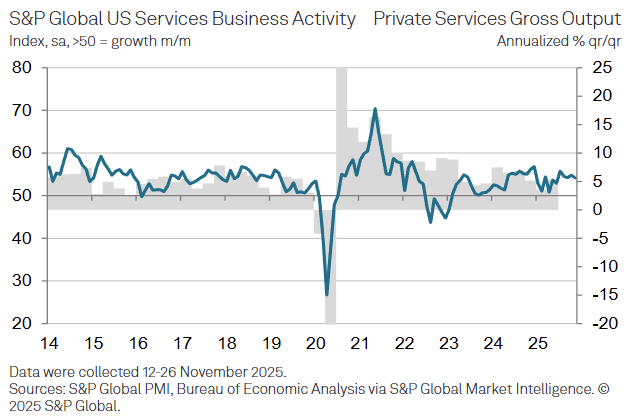

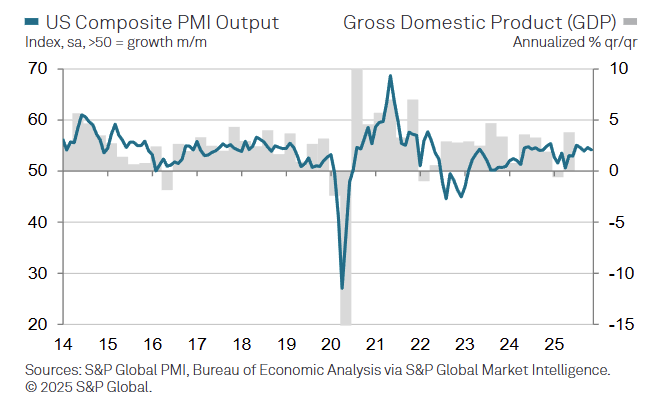

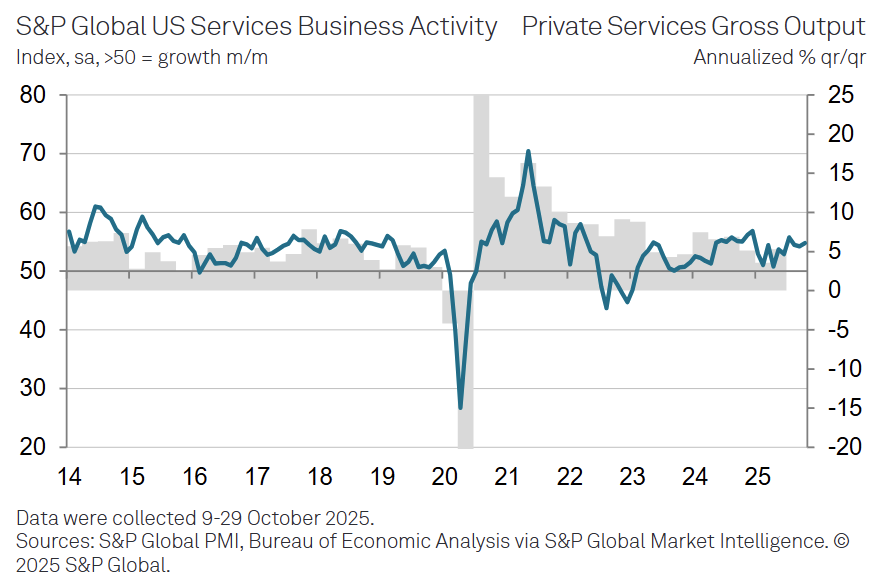

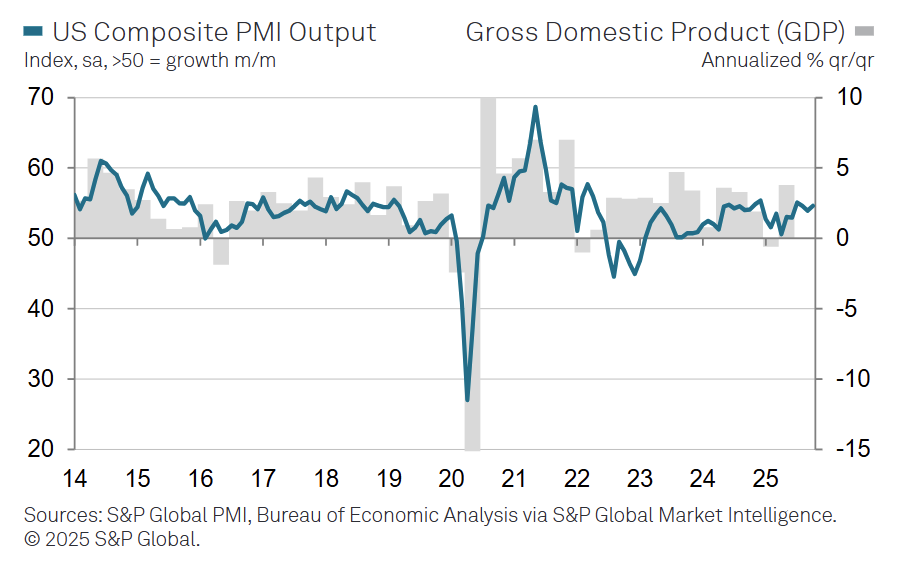

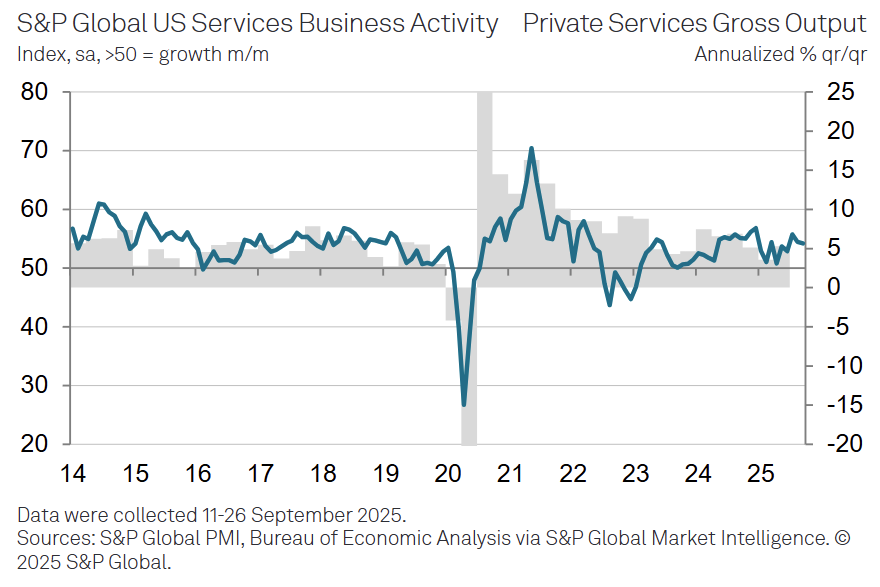

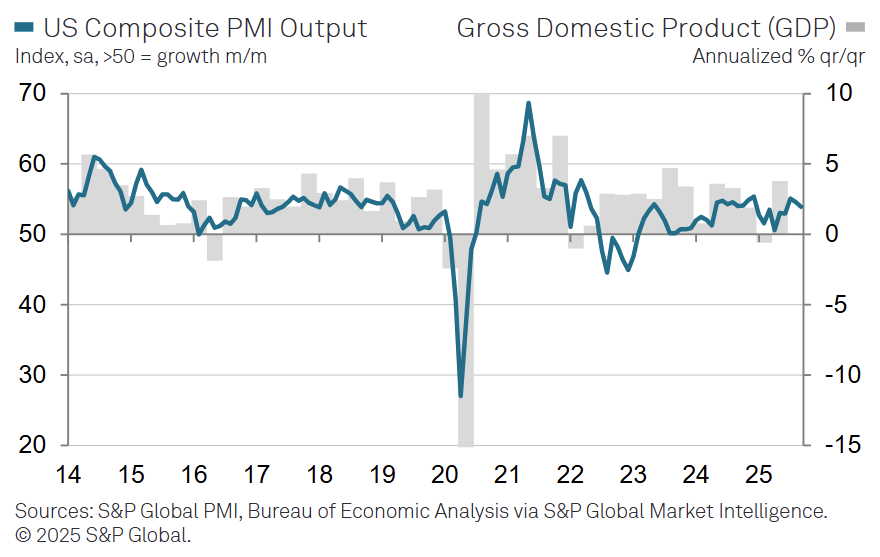

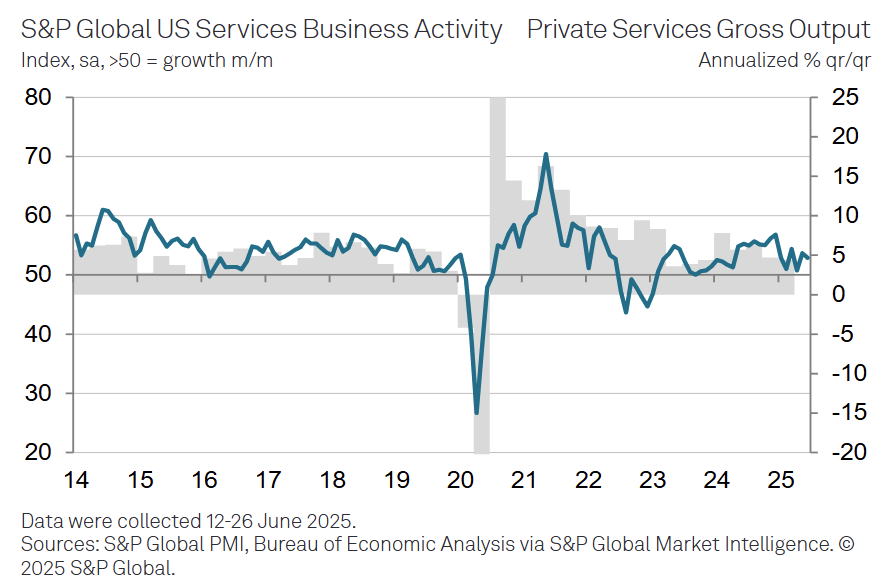

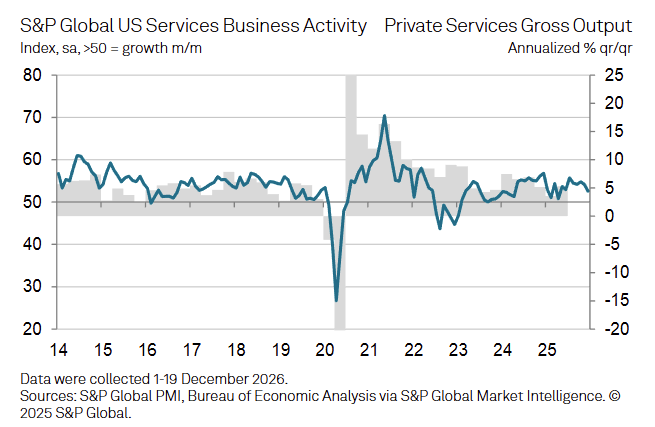

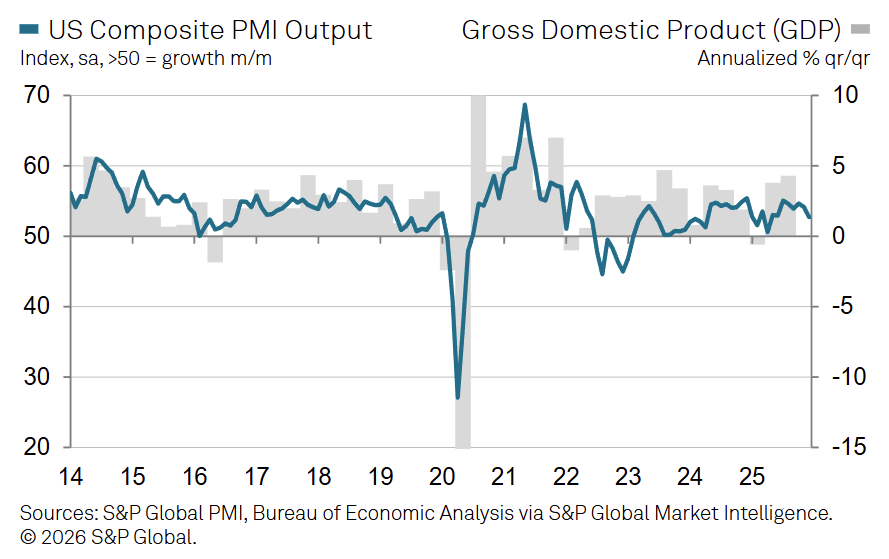

US

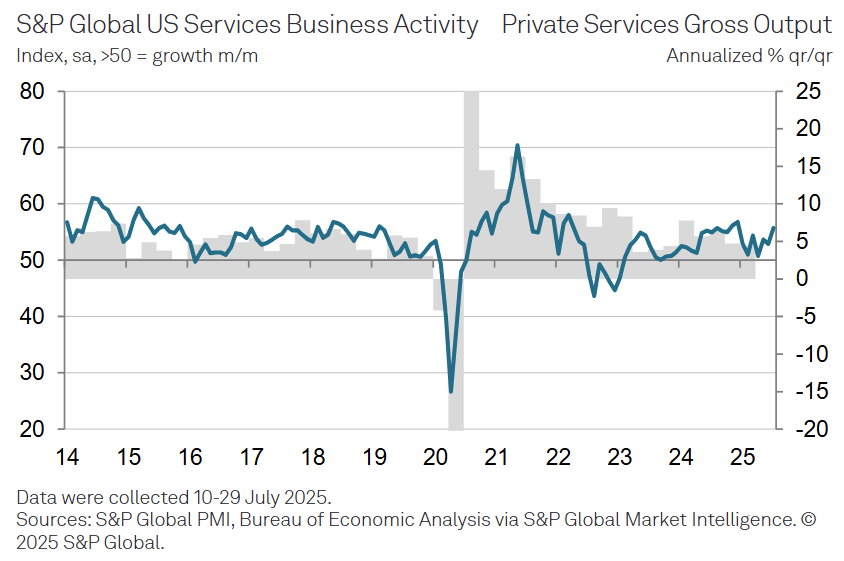

The S&P Global US Services PMI fell to 52.5 in December (from 54.1 in November), signaling slower services activity growth amid cooling demand late in the year.

-

Business activity remained in expansion for a 35th consecutive month, but December marked the slowest growth rate in eight months, reflecting softer momentum as 2025 closed.

-

New business rose only marginally, the weakest increase in 20 months, as firms cited squeezed client budgets, demand uncertainty, and tariff-related instability, particularly for foreign orders.

-

New export business declined for the second time in three months, with the pace of contraction the steepest since May, highlighting external demand softness.

-

Employment edged down slightly, ending a nine-month run of job growth, as cost pressures, budget constraints, and slower demand limited hiring despite modest increases in backlogs.

-

Input cost inflation accelerated to a seven-month high, driven by tariffs, higher supplier charges, and labor-related expenses, remaining well above the historical average.

-

Selling prices rose at a faster pace as firms attempted to pass through higher costs, marking the strongest increase since August and underscoring margin pressure.

-

The US Composite PMI eased to 52.7 (Nov: 54.2), consistent with slower growth across both services and manufacturing while remaining above the 50 threshold.