S&P Global Manufacturing PMIs

S&P Global Manufacturing PMIs

- Source

- S&P Global

- Source Link

- https://www.pmi.spglobal.com/

- Frequency

- Monthly

- Next Release(s)

- February 2nd, 2026 12:00 AM

-

March 2nd, 2026 12:00 AM

-

April 1st, 2026 12:00 AM

-

May 1st, 2026 12:00 AM

-

June 1st, 2026 12:00 AM

-

July 1st, 2026 12:00 AM

-

August 3rd, 2026 12:00 AM

-

September 1st, 2026 12:00 AM

-

October 1st, 2026 12:00 AM

-

November 2nd, 2026 12:00 AM

-

December 1st, 2026 12:00 AM

-

January 4th, 2027 12:00 AM

Latest Updates

-

Global - 1/2/2026

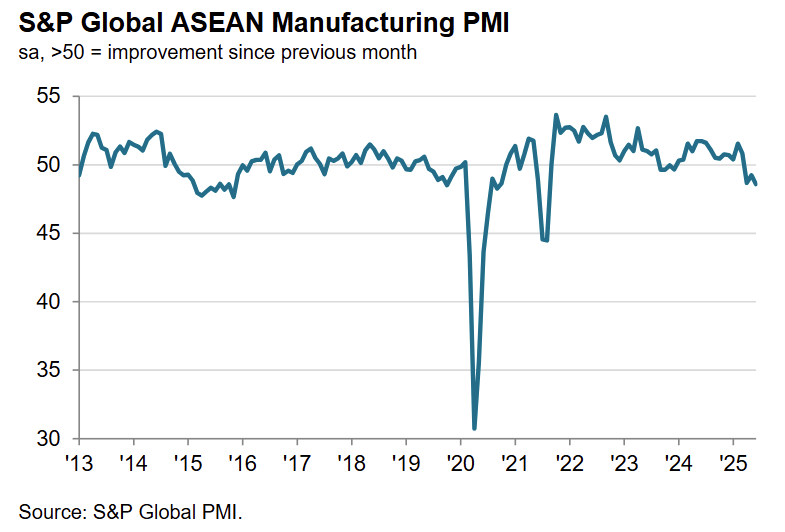

Asia Pacific

- Australia - 1/1/2026

- Malaysia - 1/2/2026

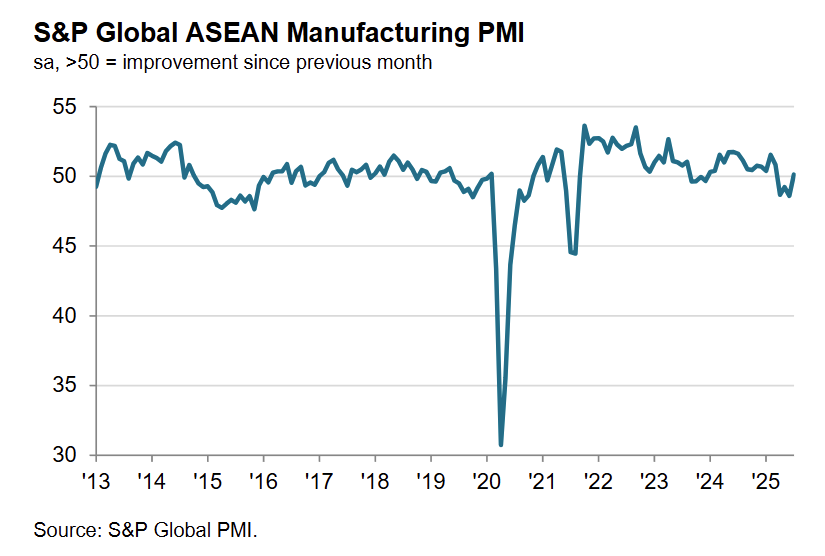

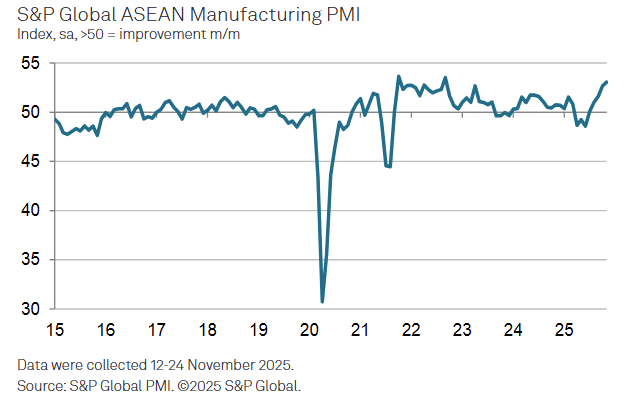

- ASEAN - 1/5/2026

- Myanmar - 1/5/2026

- Philippines - 1/2/2026

- Thailand - 1/5/2026

- Vietnam - 1/2/2026

- Indonesia - 1/2/2026

- Japan - 1/5/2026

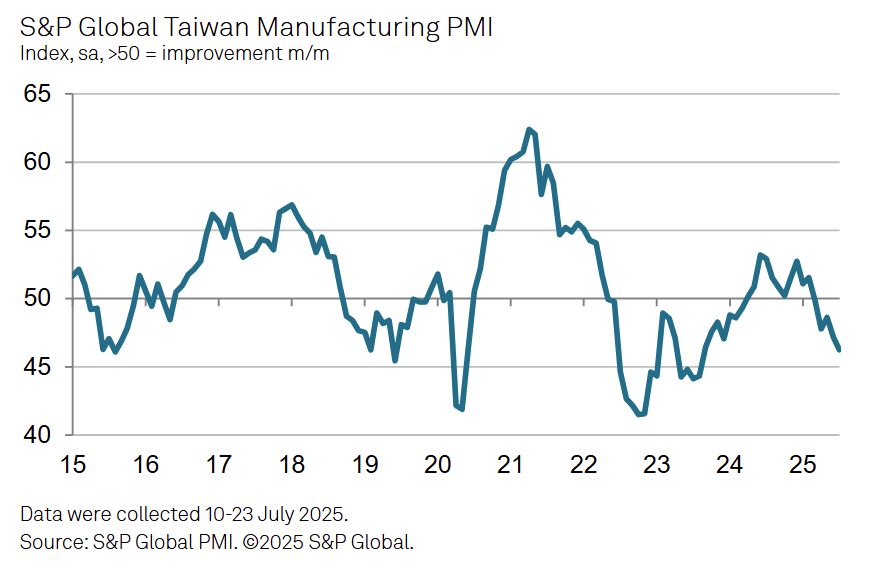

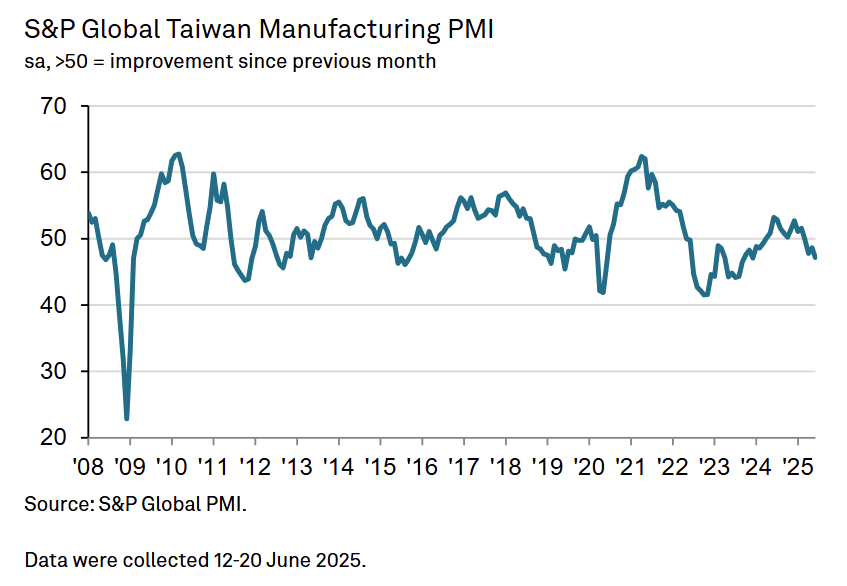

- Taiwan - 1/2/2026

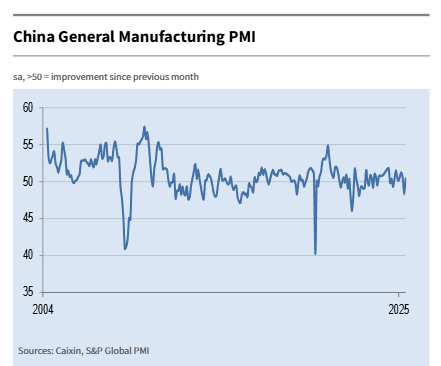

- China - 12/31/2025

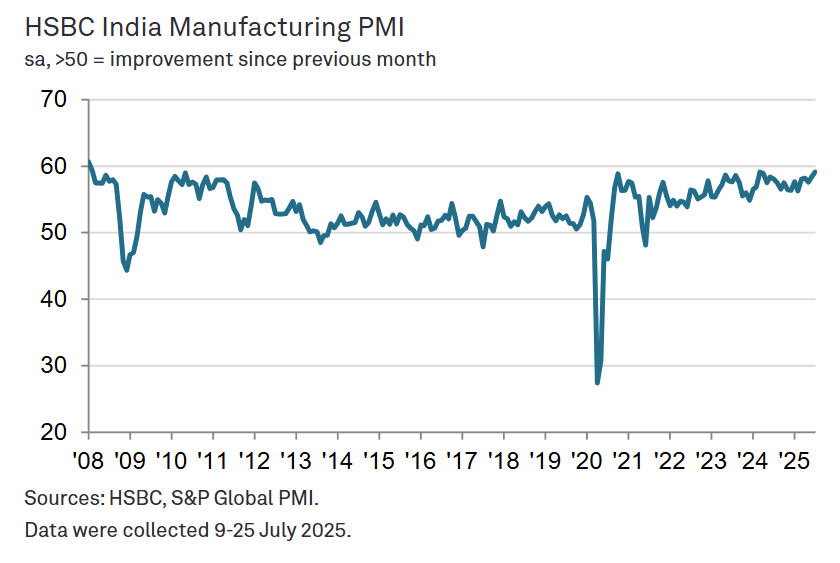

- India - 1/2/2026

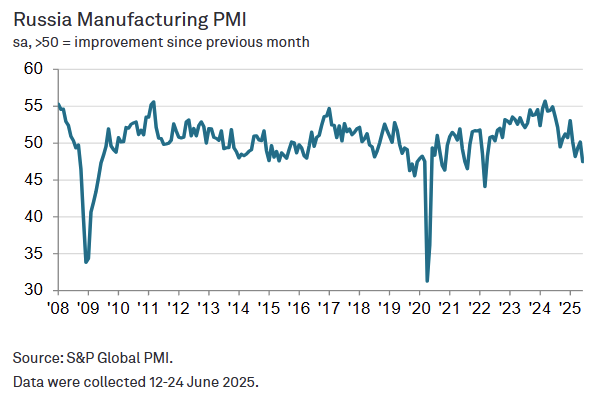

- Russia - 12/29/2025

- Kazakhstan - 1/5/2026

- South Korea - 1/2/2026

- Pakistan - 1/2/2026

Europe

- Austria - 12/29/2025

- Ireland - 1/2/2026

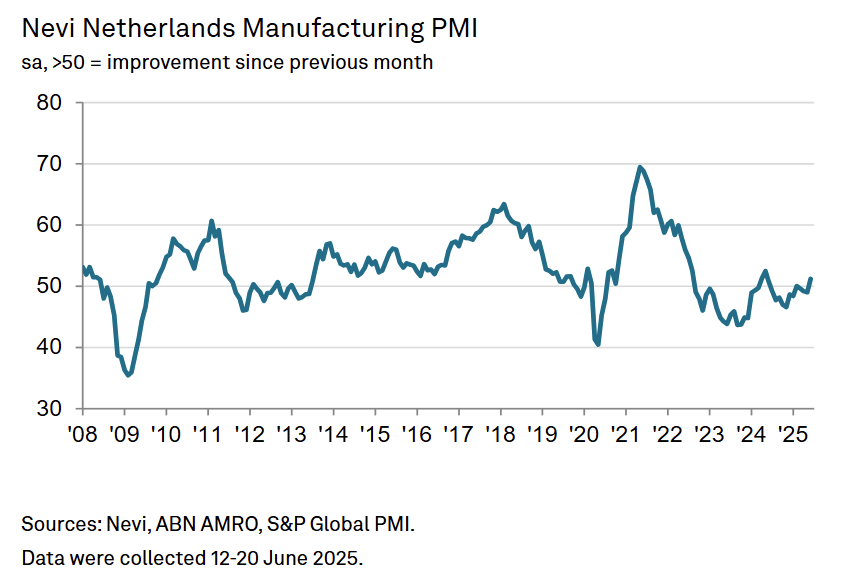

- Netherlands - 1/2/2026

- Romania - 1/5/2026

- Turkiye - 1/2/2026

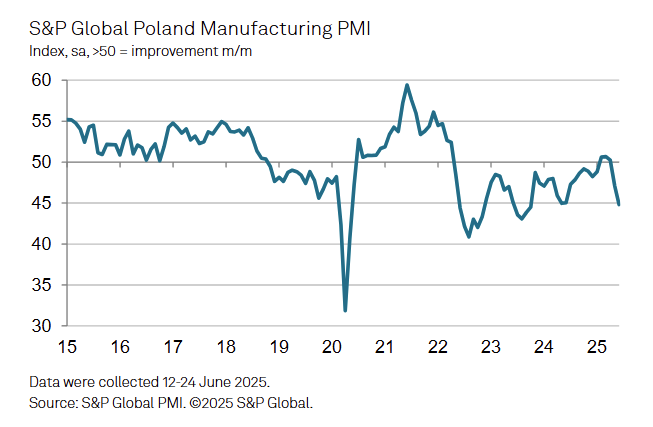

- Poland - 1/2/2026

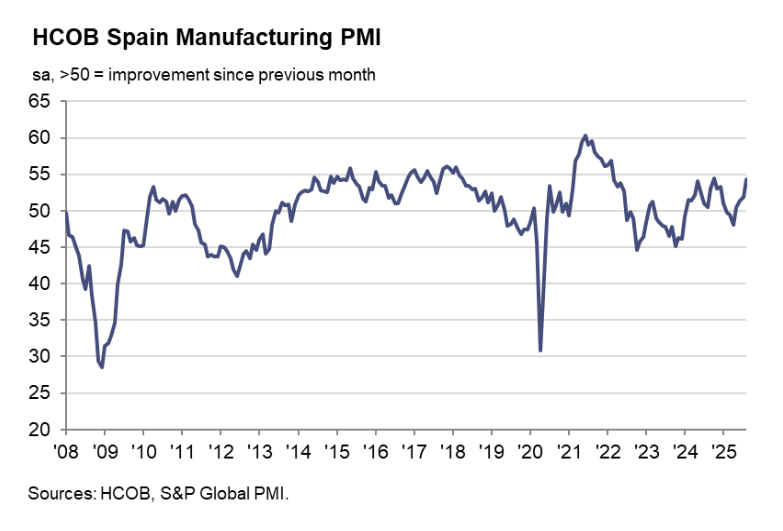

- Spain - 1/2/2026

- Czechia - 1/2/2026

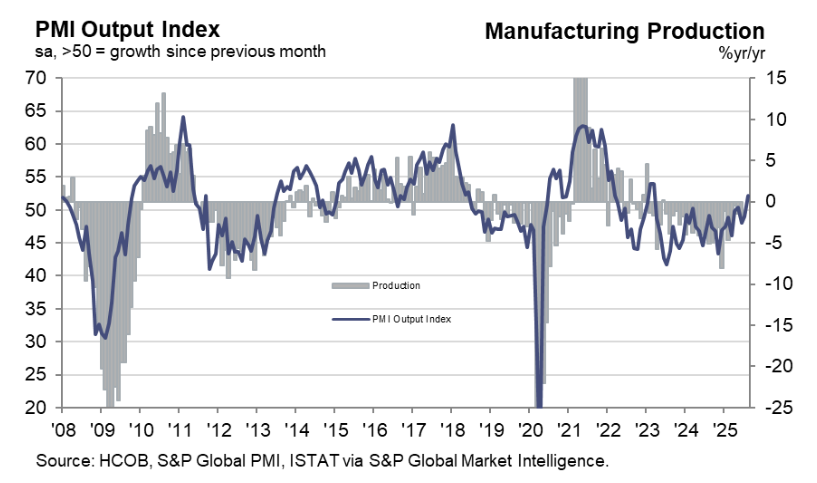

- Italy - 1/2/2026

- France - 1/2/2026

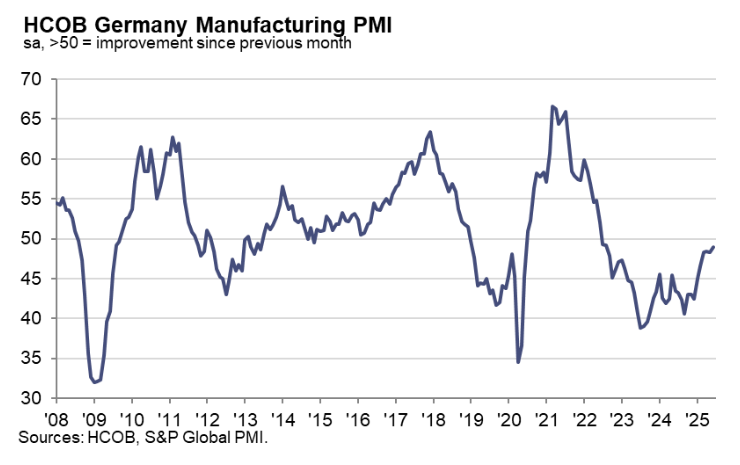

- Germany - 1/2/2026

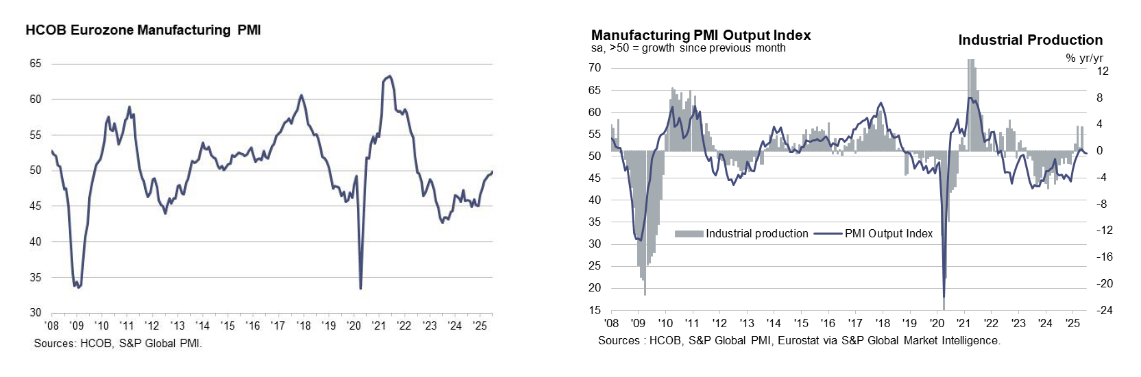

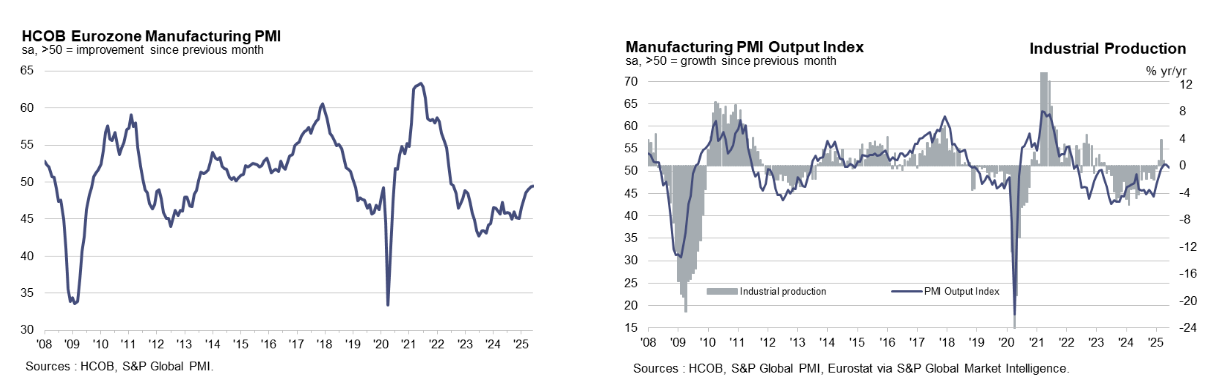

- Eurozone - 1/2/2026

- Greece - 1/2/2026

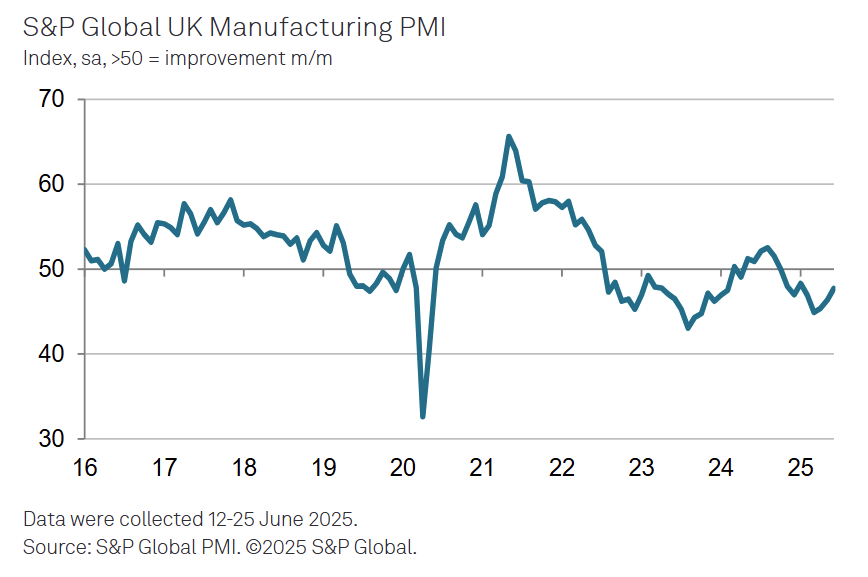

- UK - 1/2/2026

North & South America

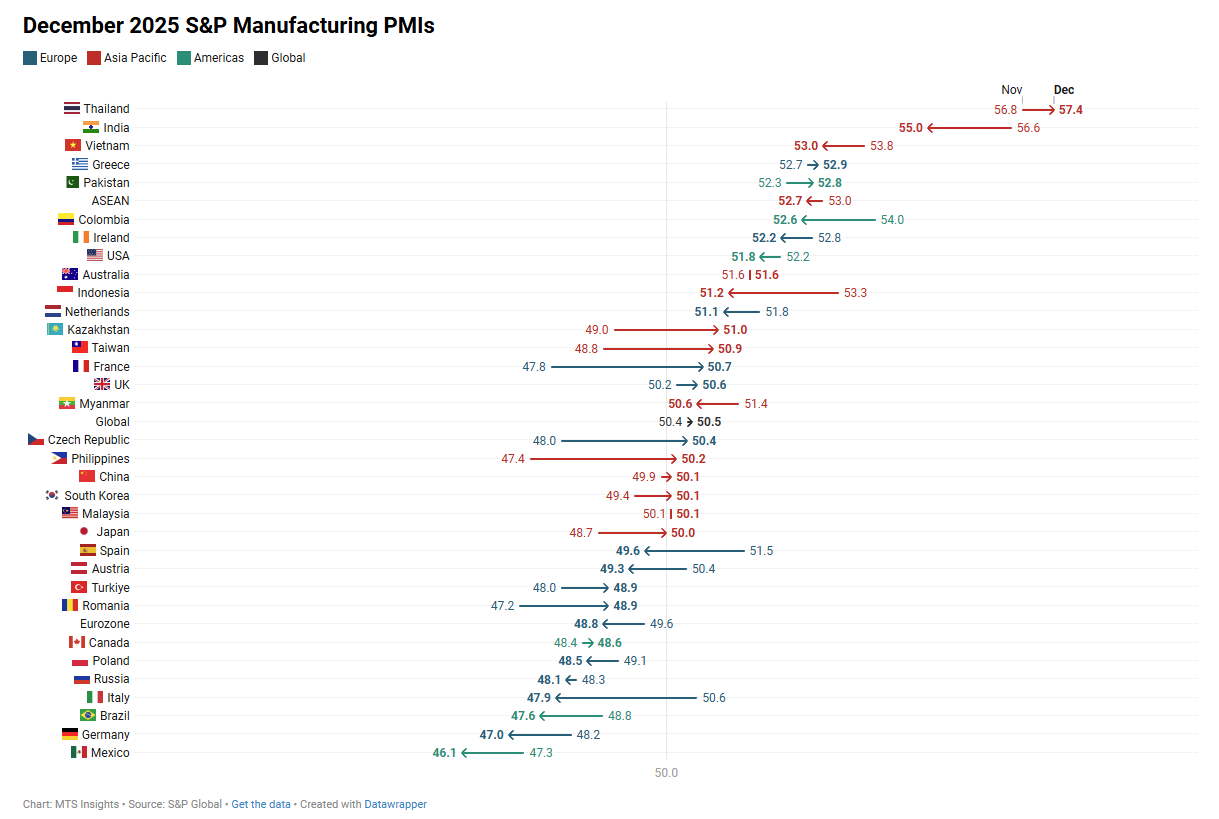

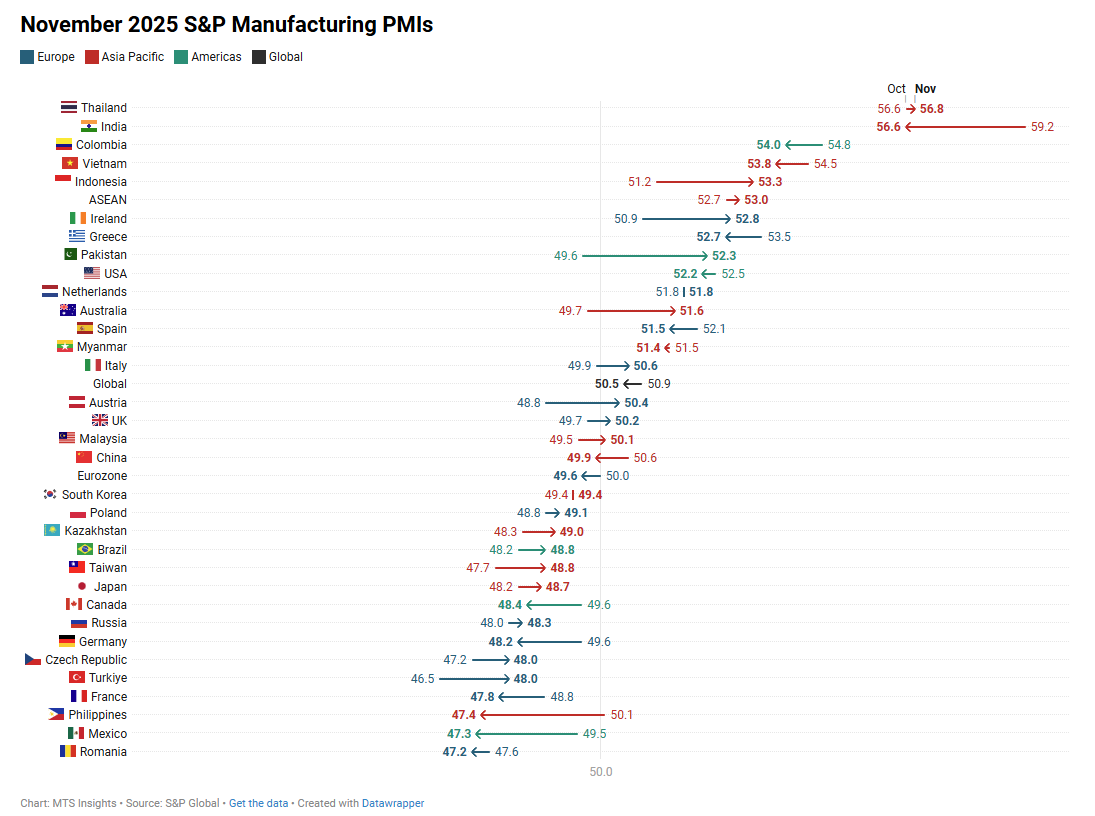

Key Results

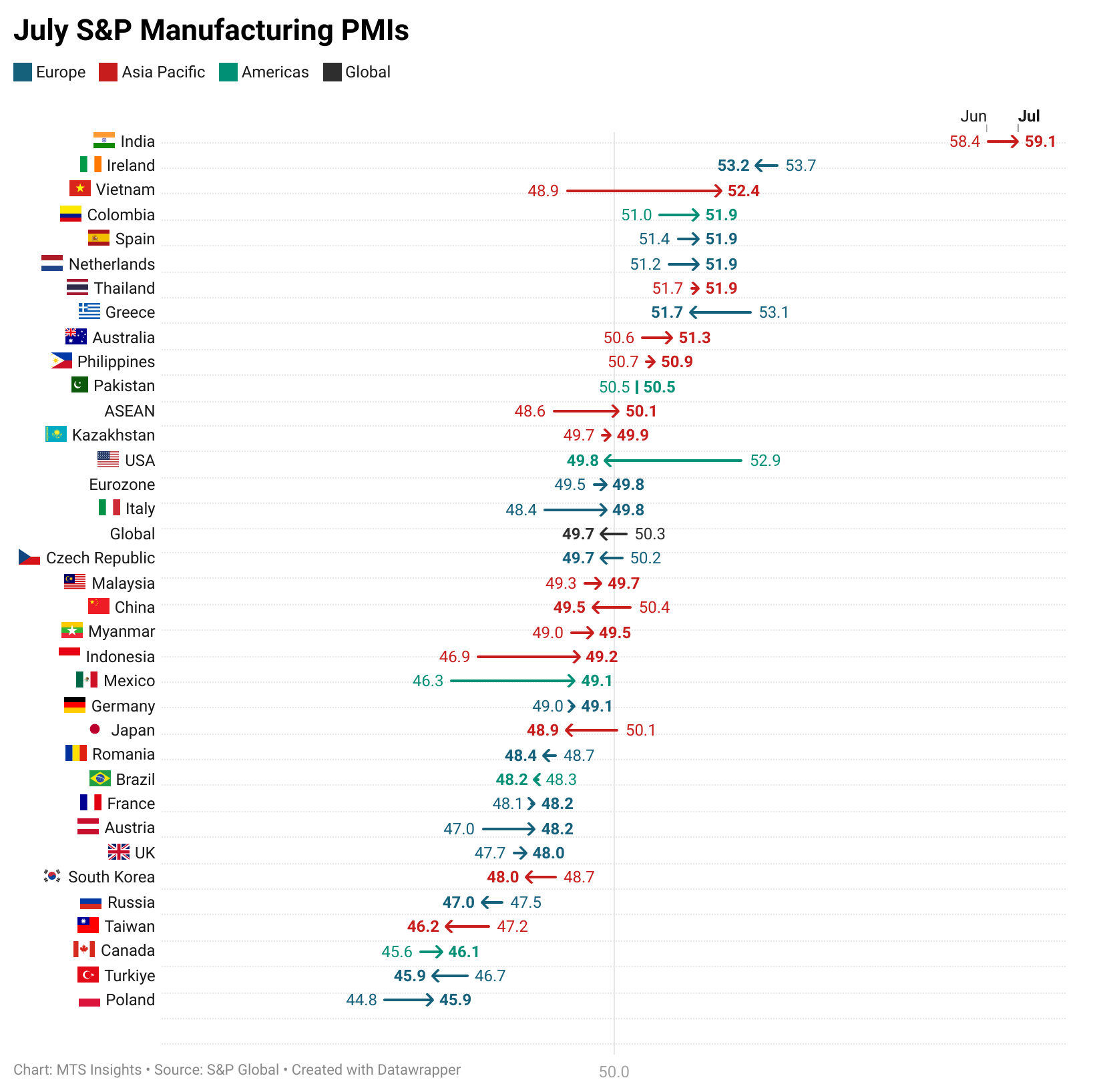

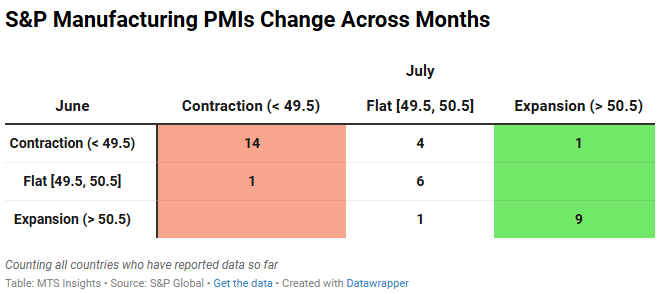

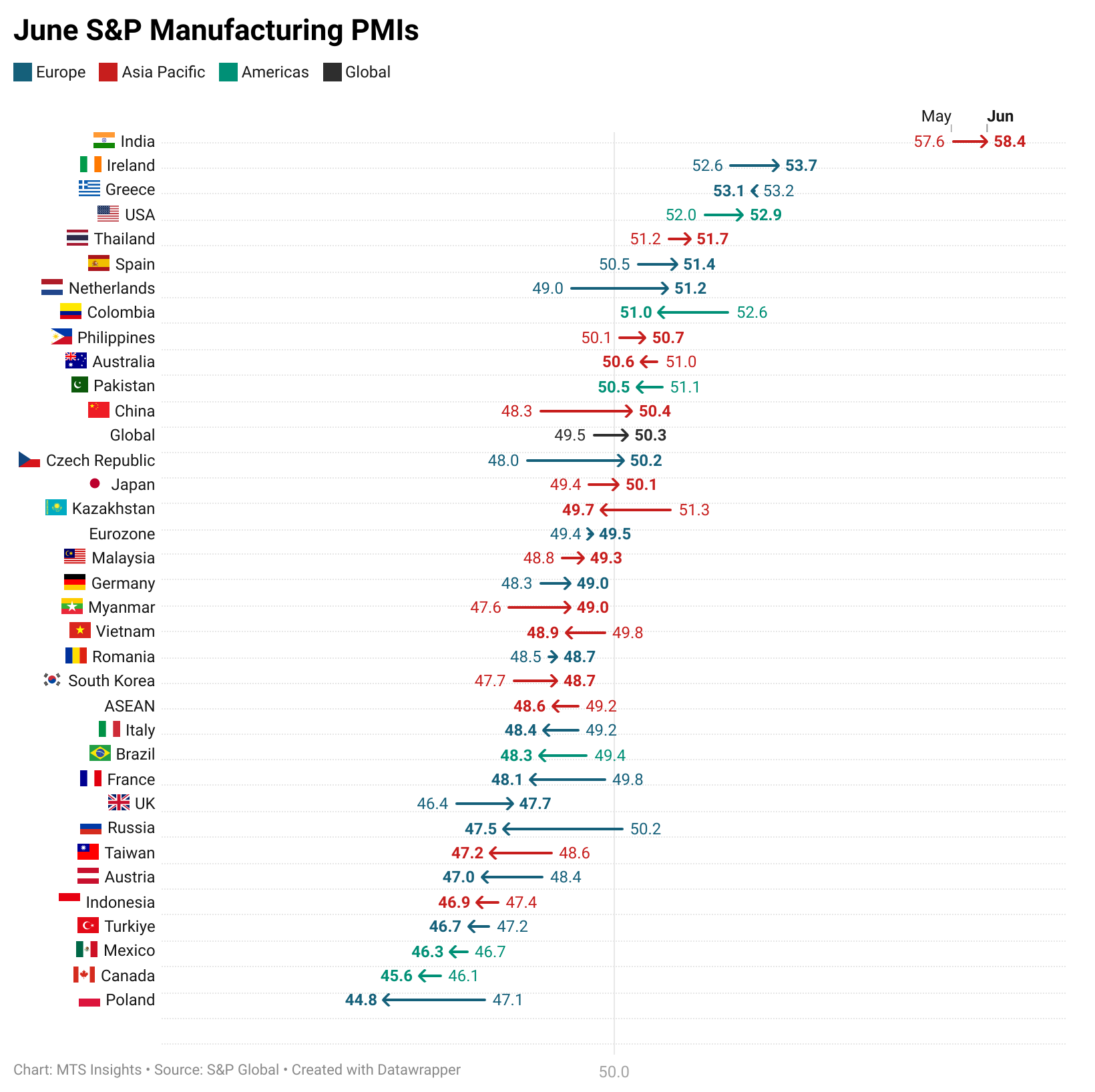

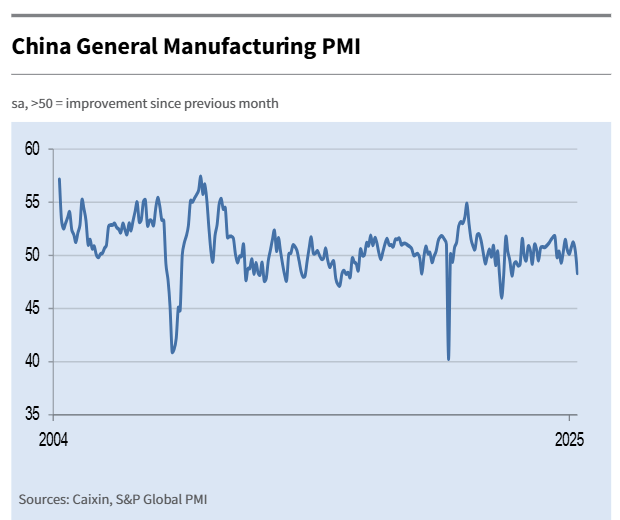

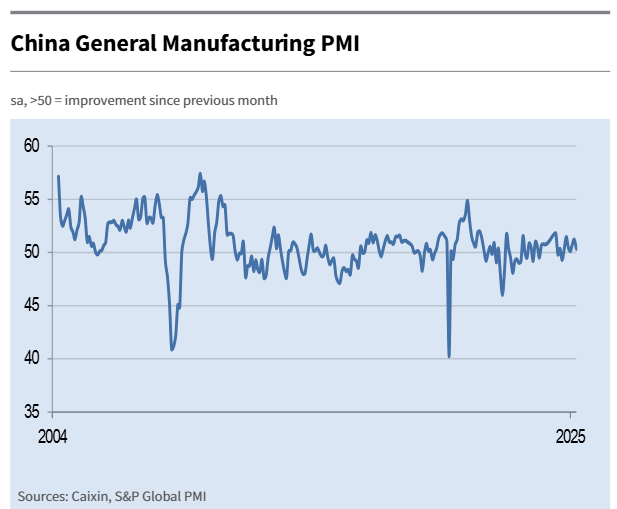

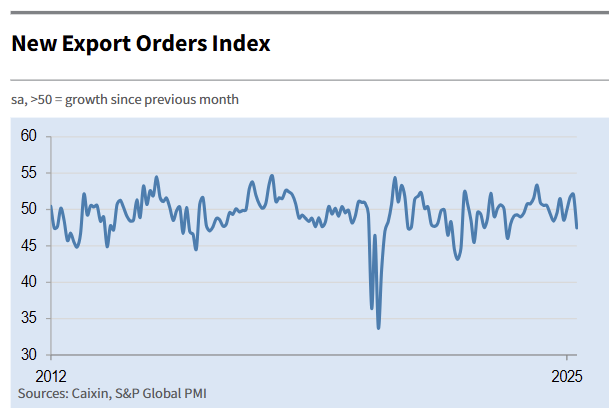

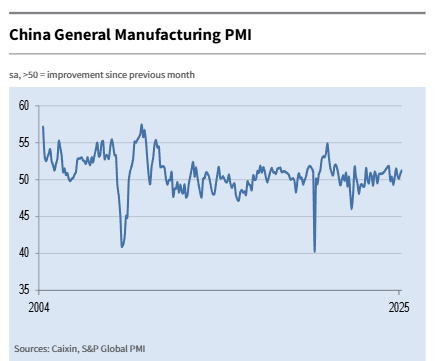

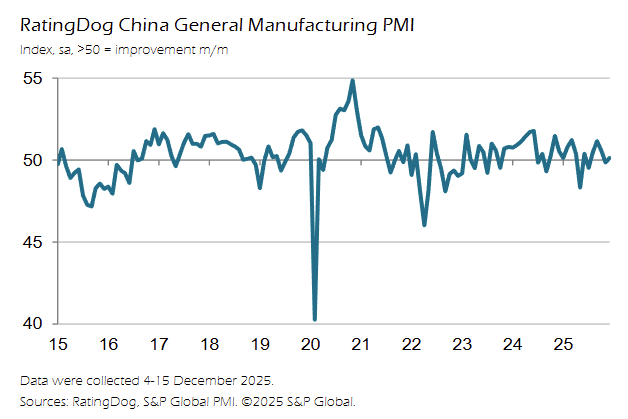

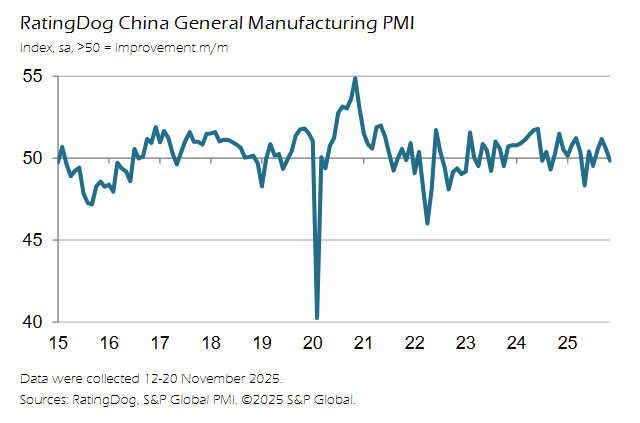

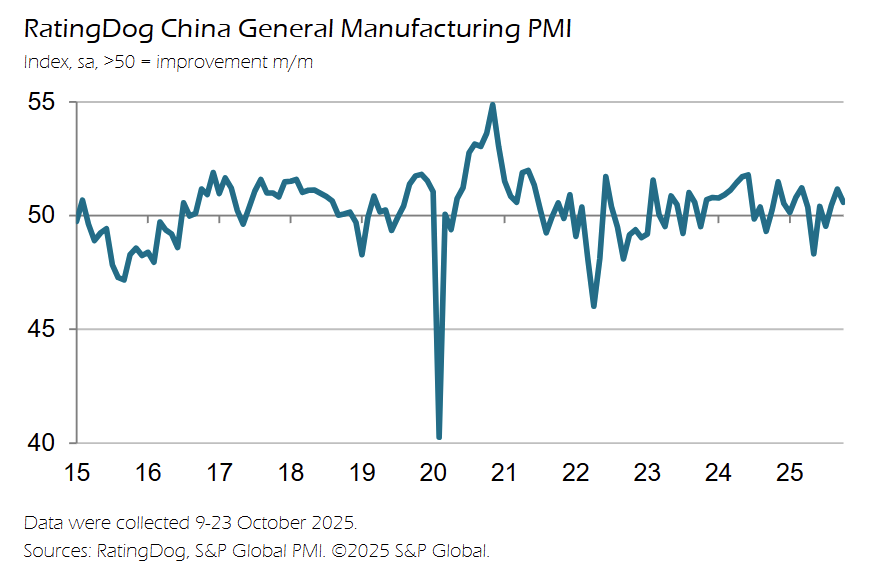

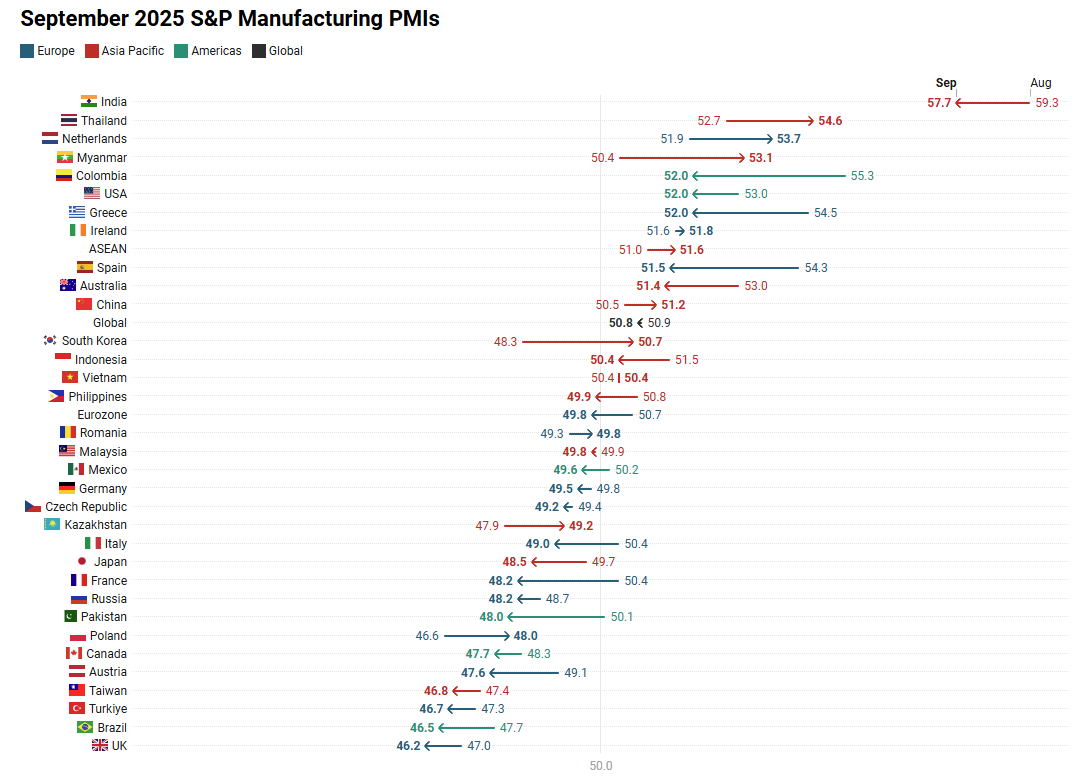

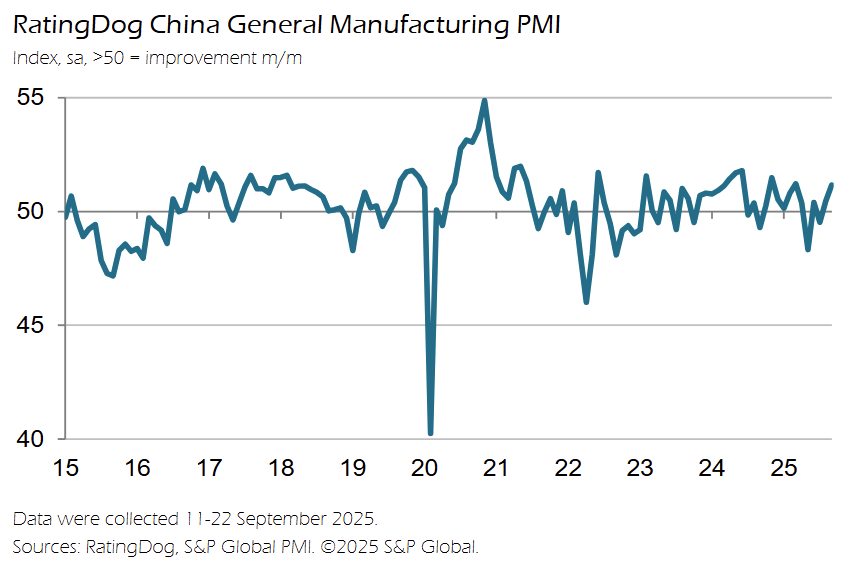

China

China’s Manufacturing PMI rose to 50.1 in December (from 49.9 in November), signaling a marginal return to expansion at year-end.

-

Manufacturing output returned to growth after stalling in late Q4, supported by higher inflows of new work and improved domestic demand conditions.

-

Total new orders expanded again, marking a seventh consecutive month of growth, while new export orders fell for a second time in three months, indicating demand strength was domestically driven.

-

Purchasing activity was unchanged, reflecting reports that firms held sufficient raw material and semi-finished goods inventories.

-

Stocks of purchases increased after a November decline, while supplier delivery times shortened, pointing to improved vendor performance and logistics coordination.

-

Employment declined for a second consecutive month, with firms citing restructuring efforts and cost pressures as drivers of lower staffing levels.

-

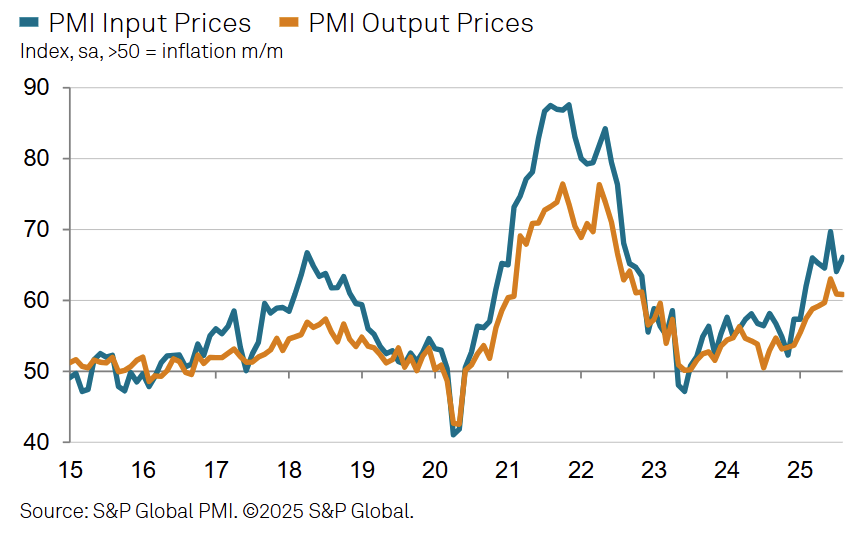

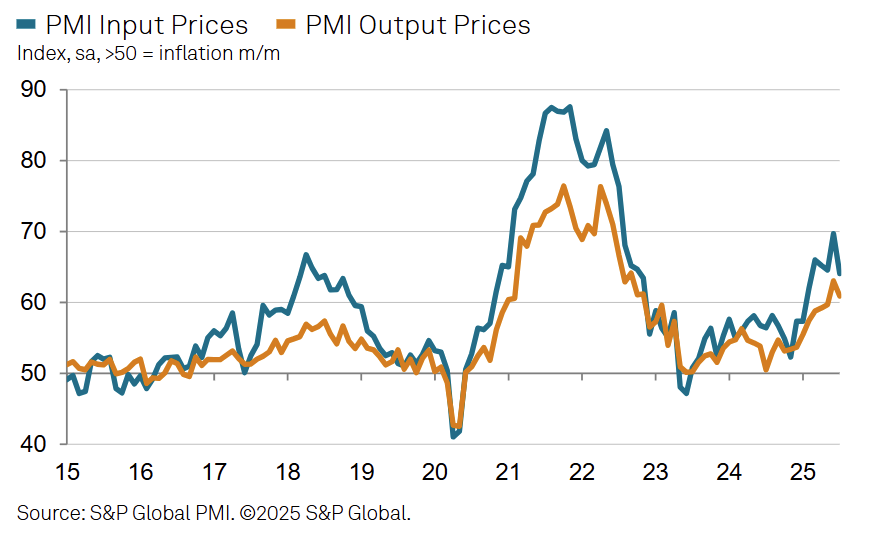

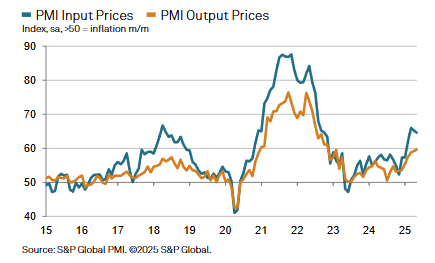

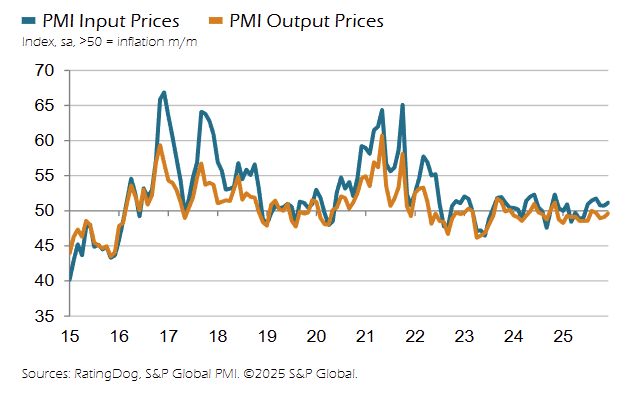

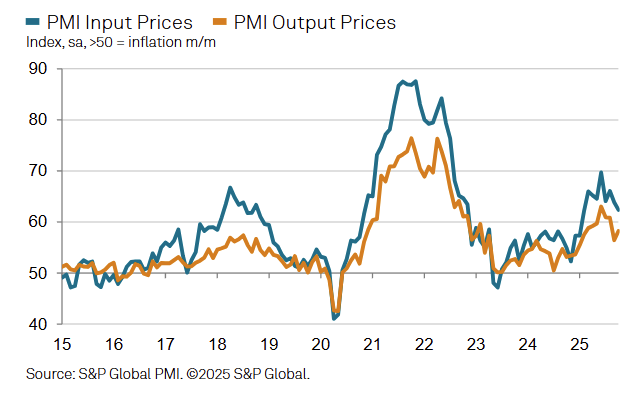

Input price inflation intensified, rising for a sixth straight month and at the fastest pace since September, driven largely by higher raw material and metal prices.

-

Output prices continued to fall as manufacturers cut selling prices to support sales and reduce inventories, though export prices rose for the first time in three months.

-

Business sentiment remained positive but eased from November and stayed below its historical average, indicating cautious optimism about growth prospects in 2026.

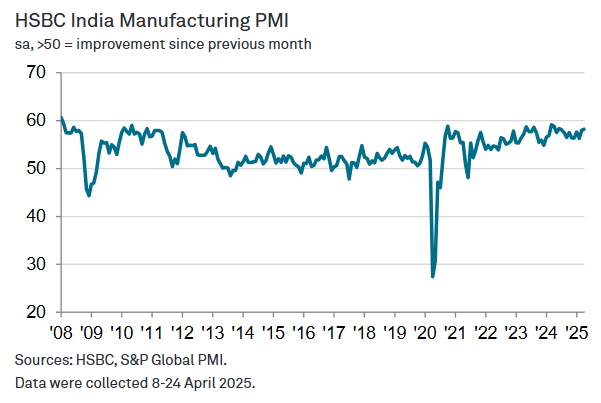

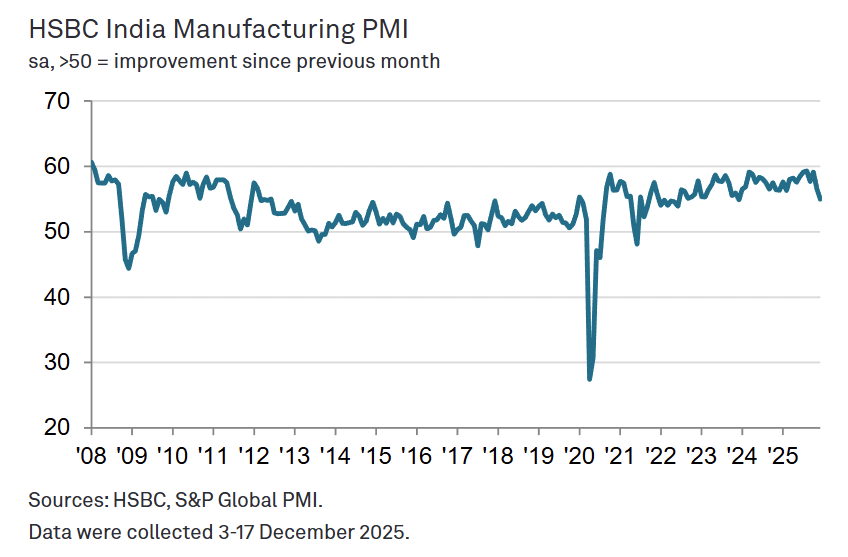

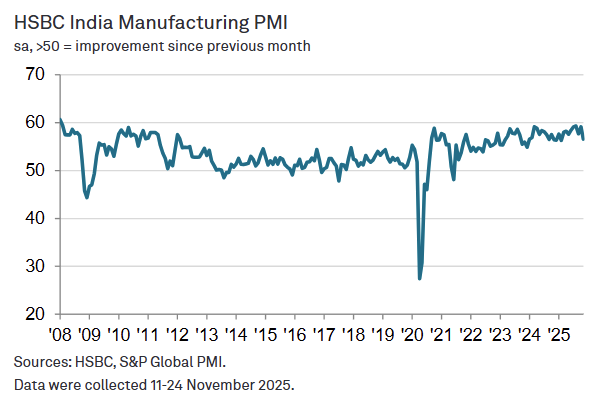

India

India’s HSBC Manufacturing PMI fell to 55.0 in December (from 56.6 in November), marking easing growth momentum while remaining firmly in expansion.

-

New business intakes rose sharply but at the weakest pace since December 2023, indicating continued demand growth with some loss of momentum.

-

Manufacturing output expanded at its slowest rate since October 2022, reflecting softer sales growth and competitive pressures despite ongoing expansion.

-

New export orders increased at the mildest pace in 14 months, showing a moderation in external demand even as gains were reported across Asia, Europe, and the Middle East.

-

Purchasing activity rose but slowed to a two-year low, as firms limited input buying in response to softer growth in new orders.

-

Employment increased only marginally, with job creation at the slowest pace in the current 22-month expansion, pointing to reduced pressure on operating capacity.

-

Input cost inflation remained historically subdued and little changed from November, while output price inflation eased to a nine-month low, signaling limited pricing pressures.

-

Input inventories rose sharply, while finished goods inventories declined at one of the fastest rates in eight months, indicating reliance on existing stock to meet demand.

-

Business confidence eased to its lowest level in nearly three-and-a-half years, despite expectations for higher output in 2026.

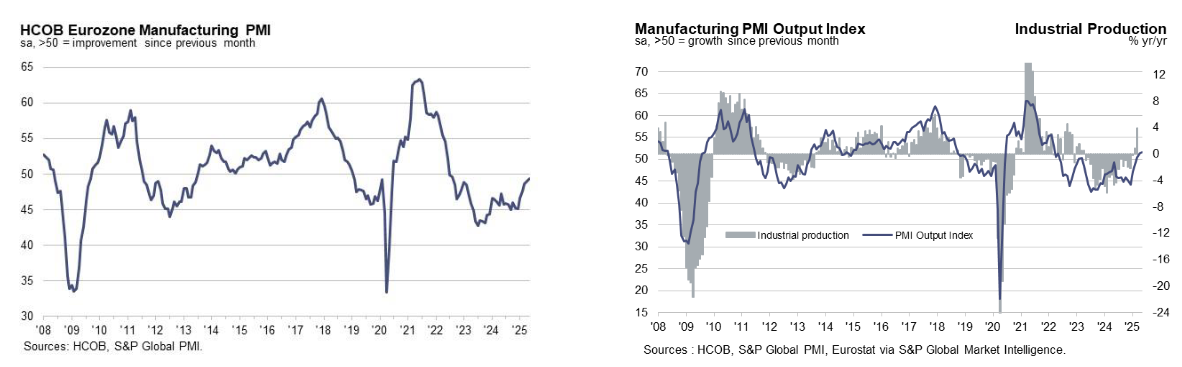

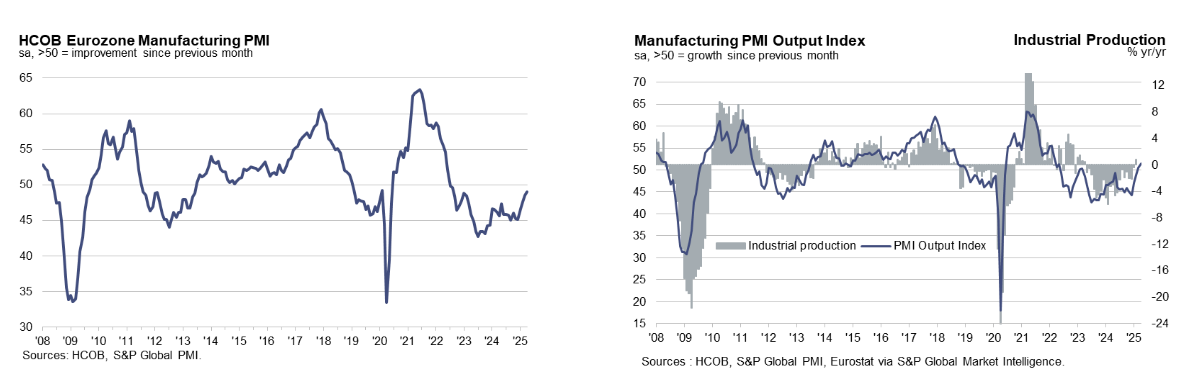

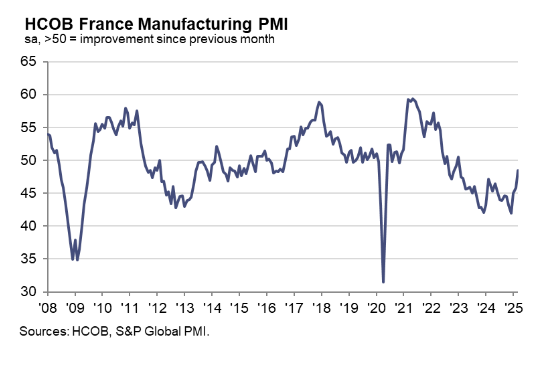

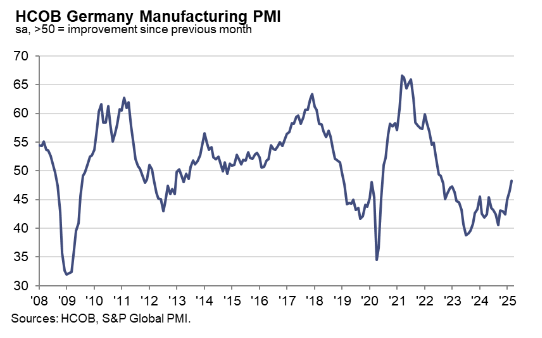

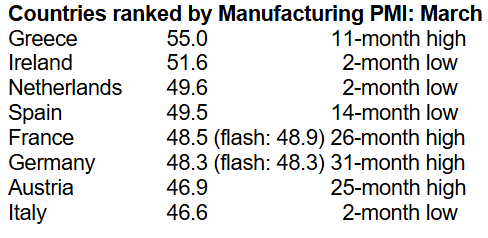

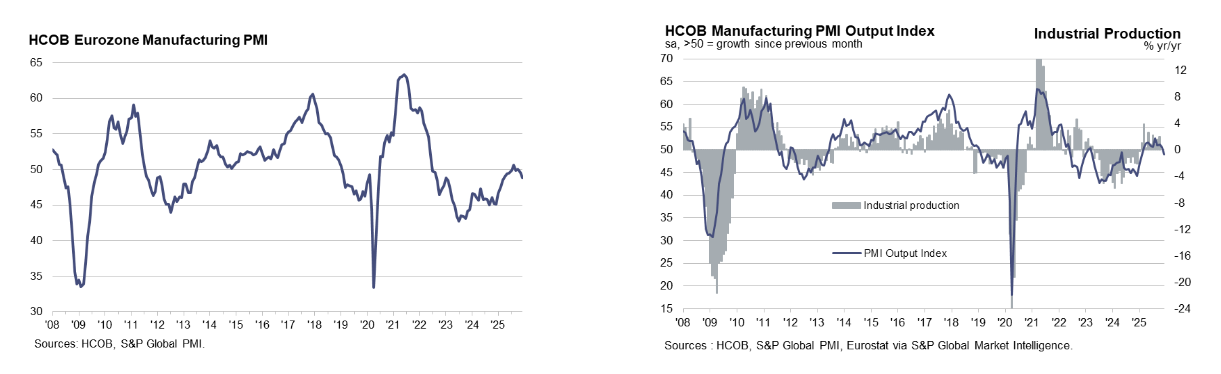

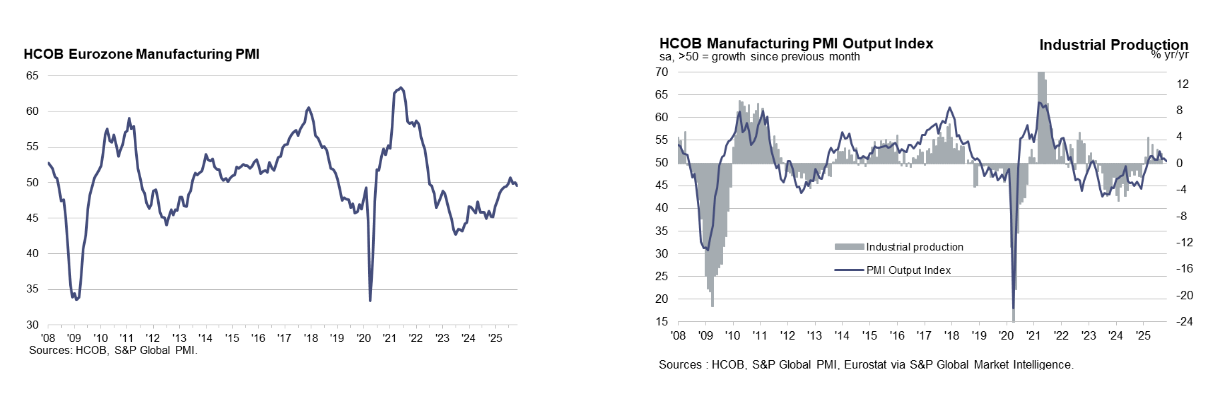

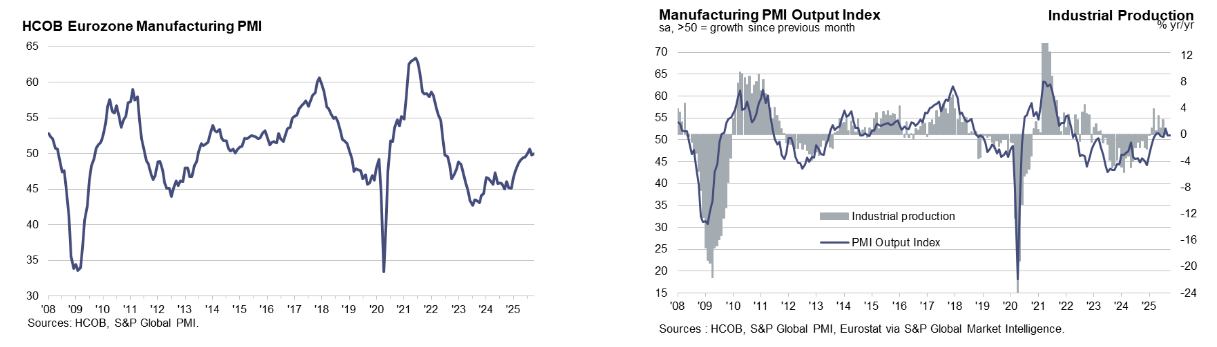

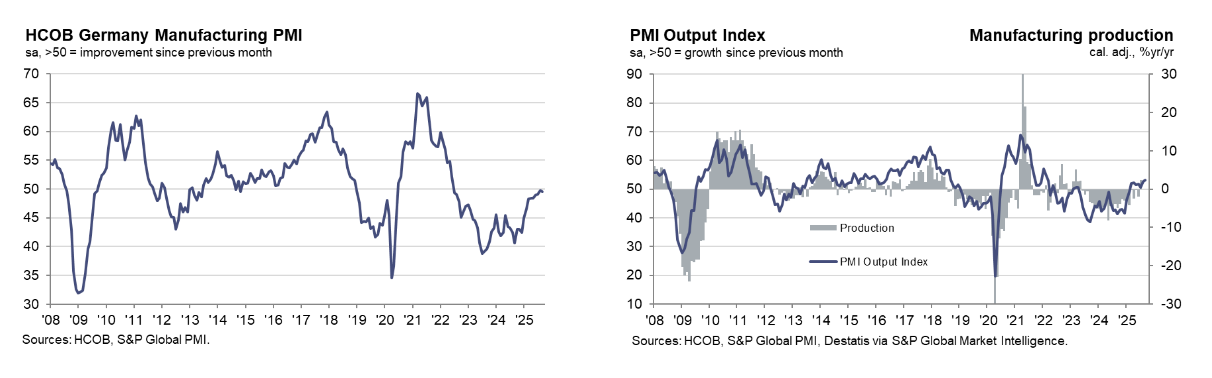

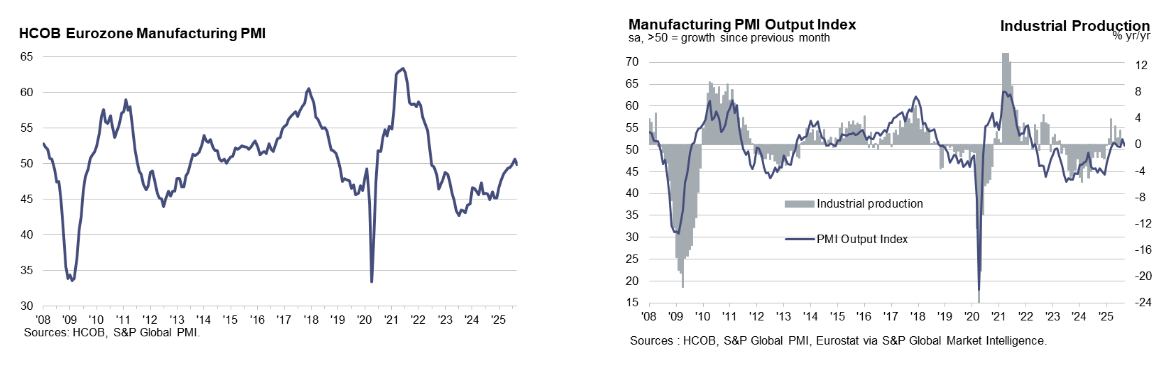

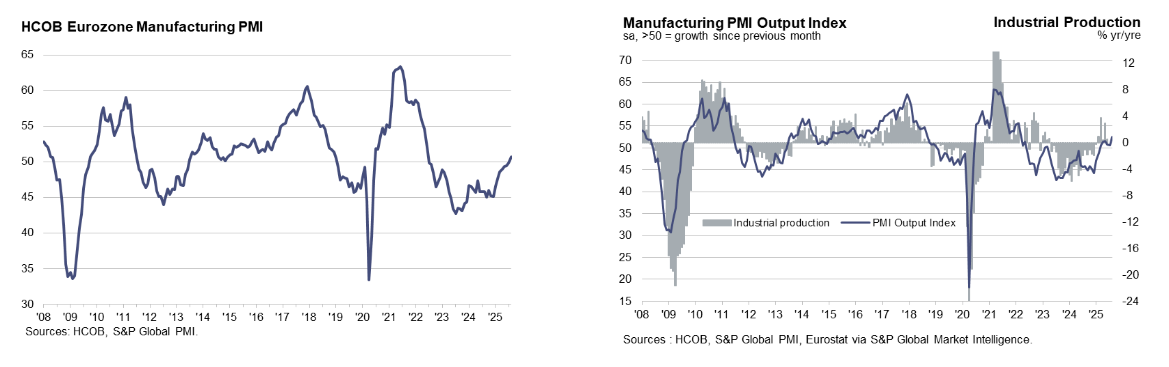

Eurozone

Eurozone manufacturing activity weakened further in December, with the HCOB Eurozone Manufacturing PMI falling to 48.8 (from 49.6 in November), reflecting a renewed decline in output and faster demand deterioration.

-

Factory output declined for the first time since February 2025, as the Output Index fell to 48.9 (from 50.4), its weakest reading in 10 months.

-

New orders fell at the fastest pace in nearly a year, marking a second consecutive monthly decline and pointing to worsening demand conditions.

-

New export orders drove much of the weakness, with international demand contracting at the sharpest rate in 11 months.

-

Purchasing activity was cut at the strongest pace since March 2024, while stocks of raw materials and intermediate goods declined sharply, indicating active retrenchment.

-

Finished goods inventories continued to fall, though at the slowest pace since September 2024, suggesting ongoing reliance on existing stock to meet demand.

-

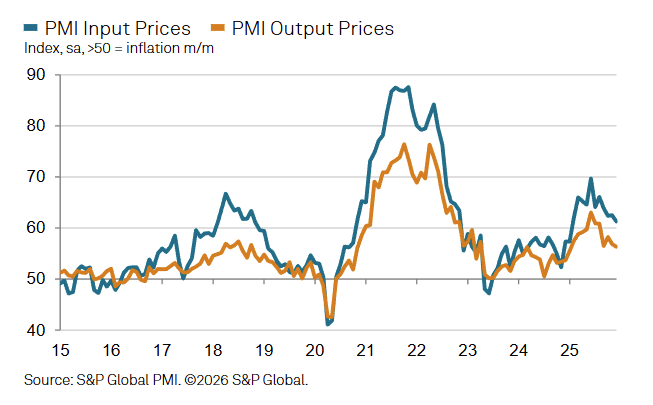

Input cost inflation accelerated to a 16-month high amid lengthening supplier delivery times, while output prices fell for the seventh time in eight months, highlighting continued discounting.

-

Employment declined for a 30th consecutive month, but backlogs of work were reduced, indicating sufficient capacity despite falling staffing levels.

-

Despite current weakness, business confidence improved, with year-ahead production expectations reaching their highest level since February 2022.

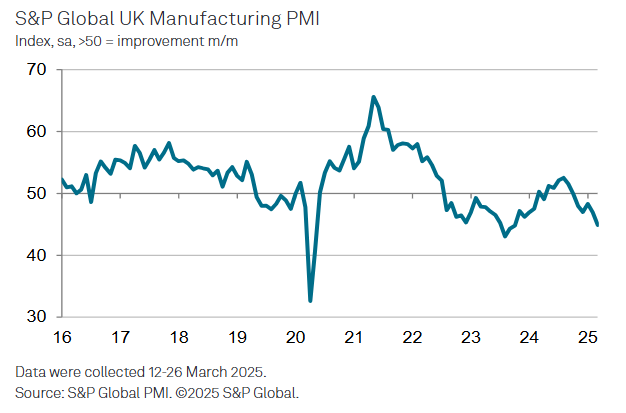

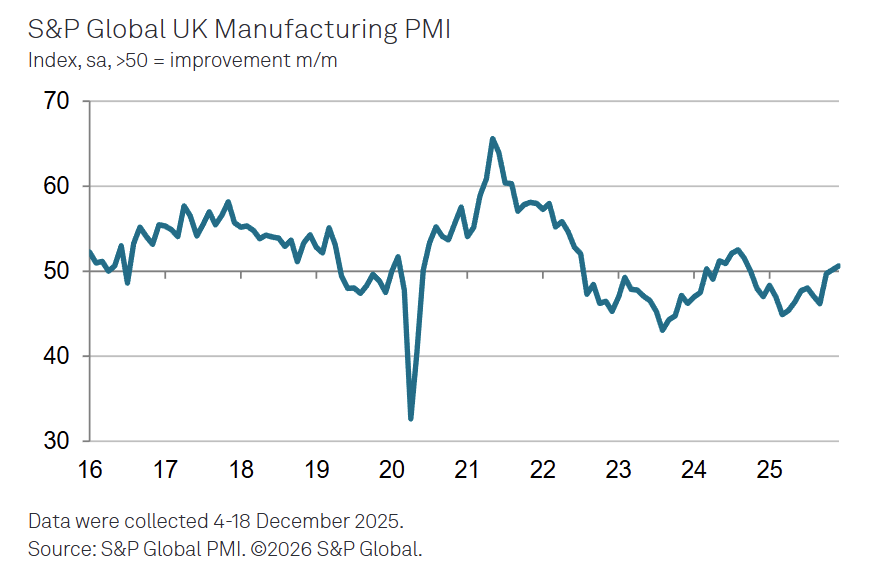

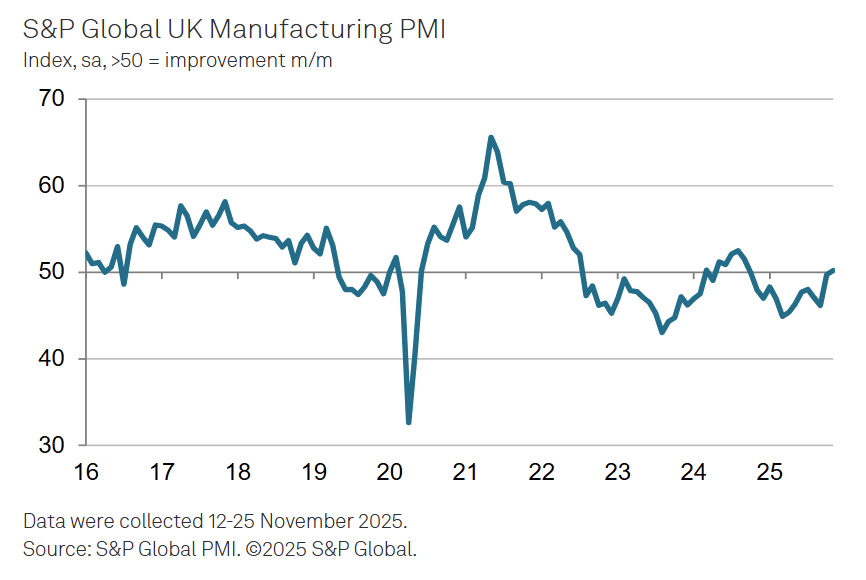

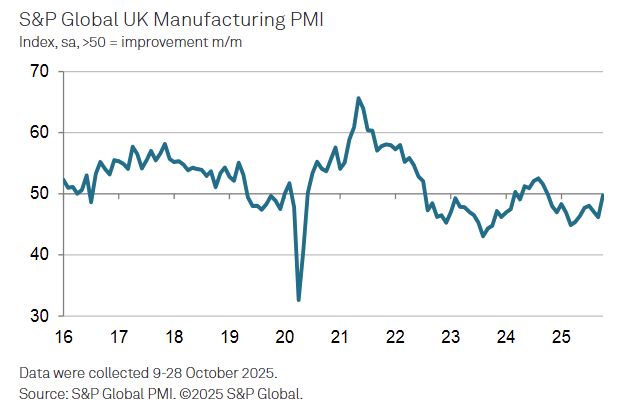

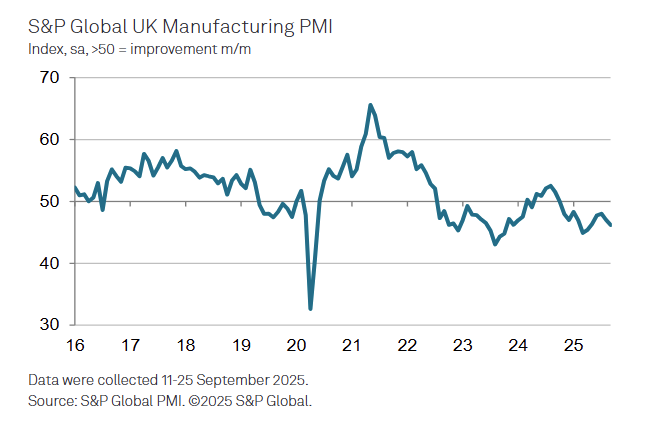

UK

The UK Manufacturing PMI rose to 50.6 in December (from 50.2 in November), marking a 15-month high and signaling continued, modest expansion.

-

Manufacturing output increased for a third consecutive month, supported largely by stock building and efforts to clear backlogs rather than a strong acceleration in demand.

-

New orders rose for the first time since September 2024, indicating a tentative improvement in demand conditions after a prolonged downturn.

-

Growth was uneven by firm size, with large manufacturers driving gains while small and medium-sized firms continued to report contraction in both output and new orders.

-

Domestic demand remained the main source of support, while new export orders fell for a forty-seventh straight month, though the pace of decline was among the weakest in that sequence.

-

Employment declined for a fourteenth consecutive month, but the rate of job losses slowed to its weakest pace over that period, suggesting easing labor market contraction.

-

Purchasing activity and stocks of purchases continued to fall, albeit less sharply than in November, pointing to ongoing caution in inventory management.

-

Input price inflation accelerated in December, reflecting higher costs for energy, metals, electronics, and packaging, while output prices rose again after a brief decline in November.

-

Business optimism slipped from November’s nine-month high, with firms citing concerns over high costs, taxation, competitiveness, and policy uncertainty despite recent stabilization signs.

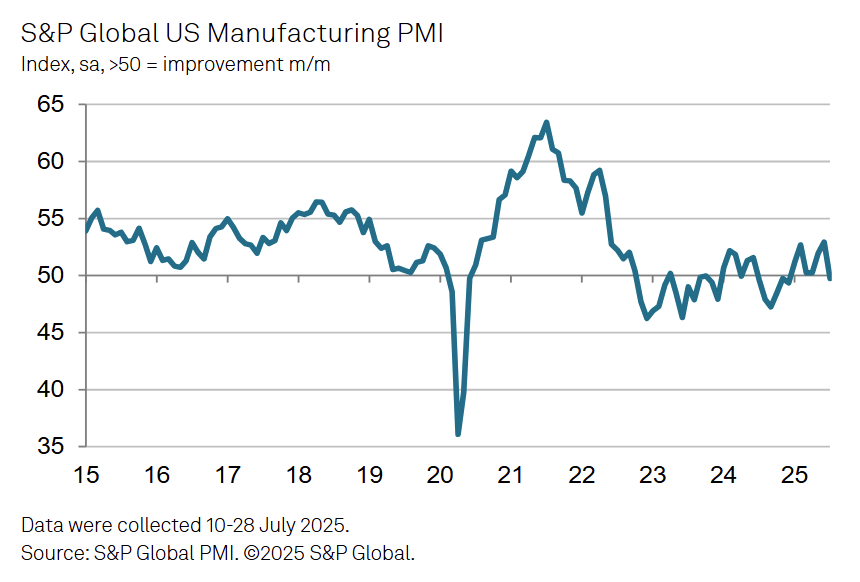

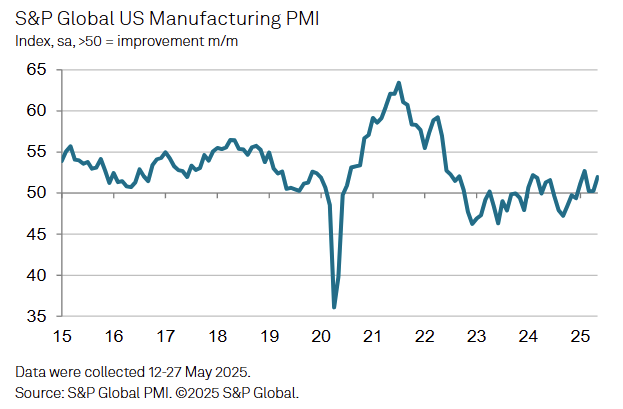

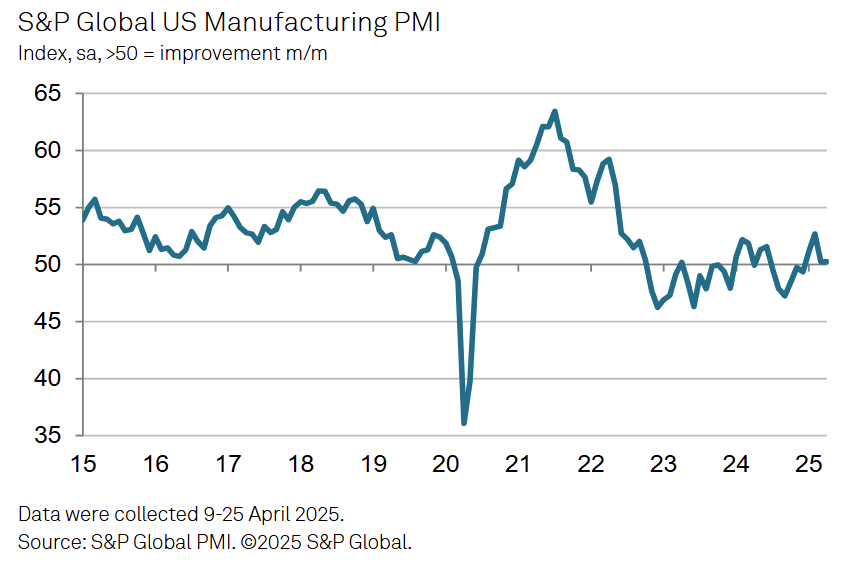

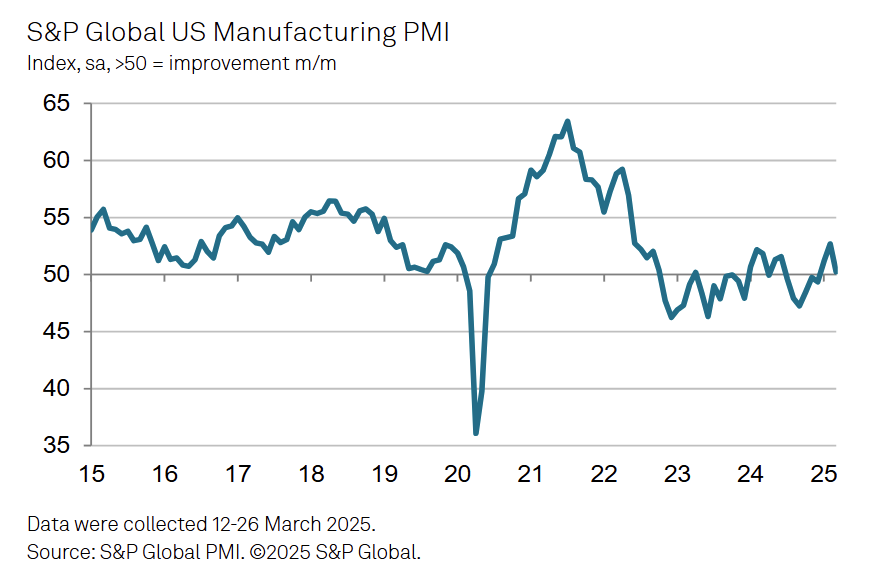

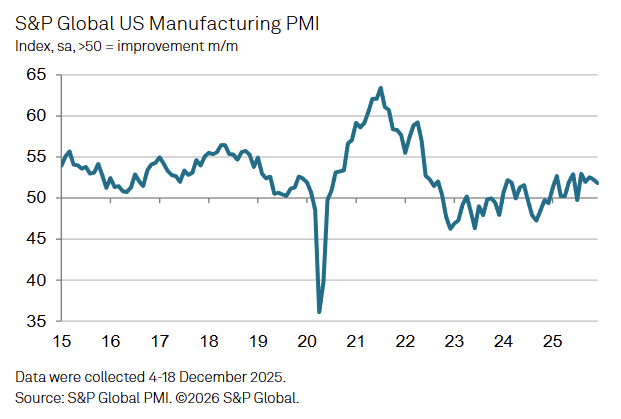

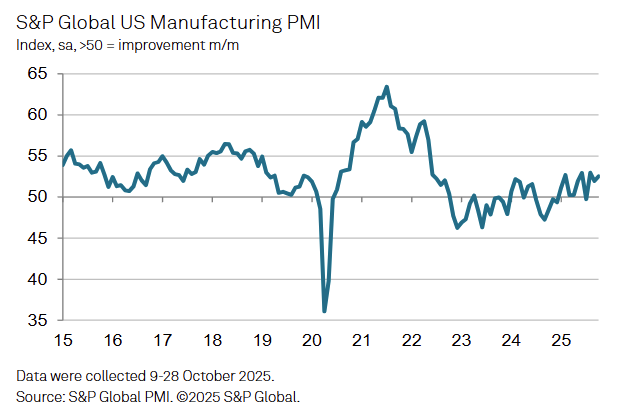

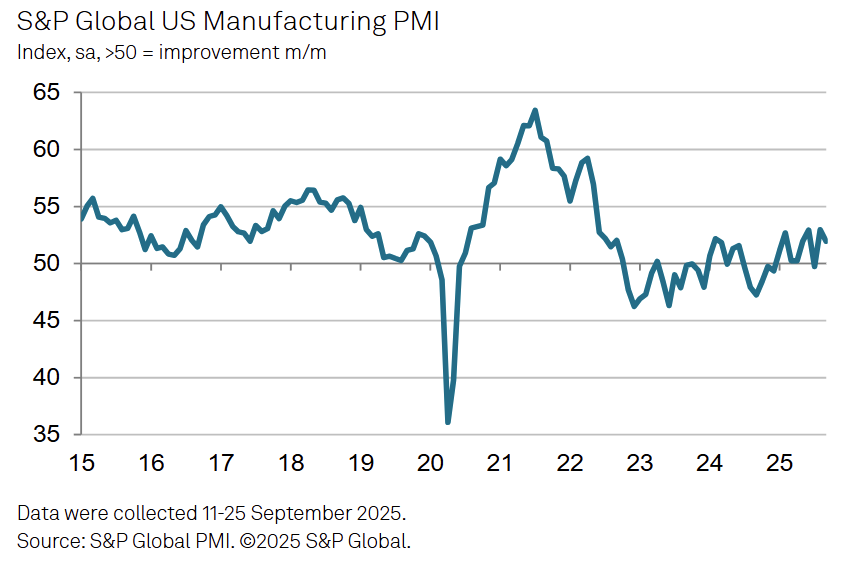

US

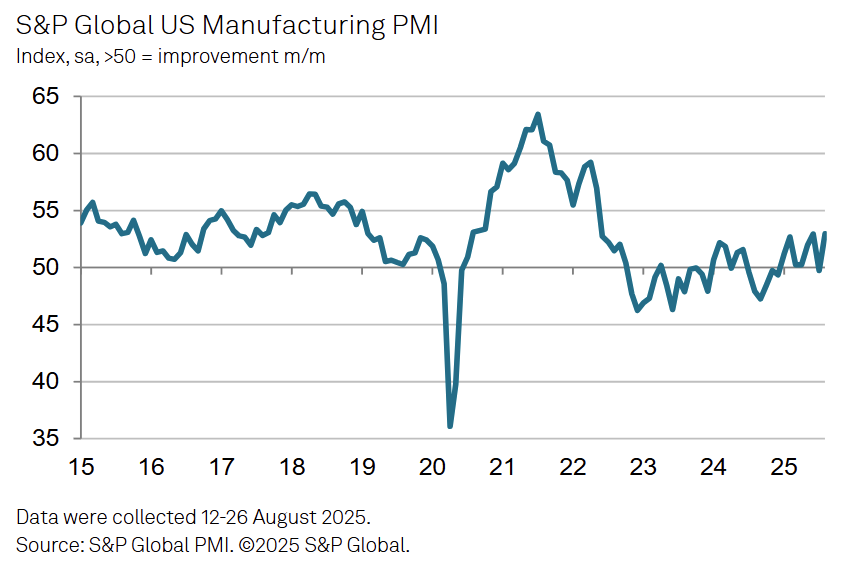

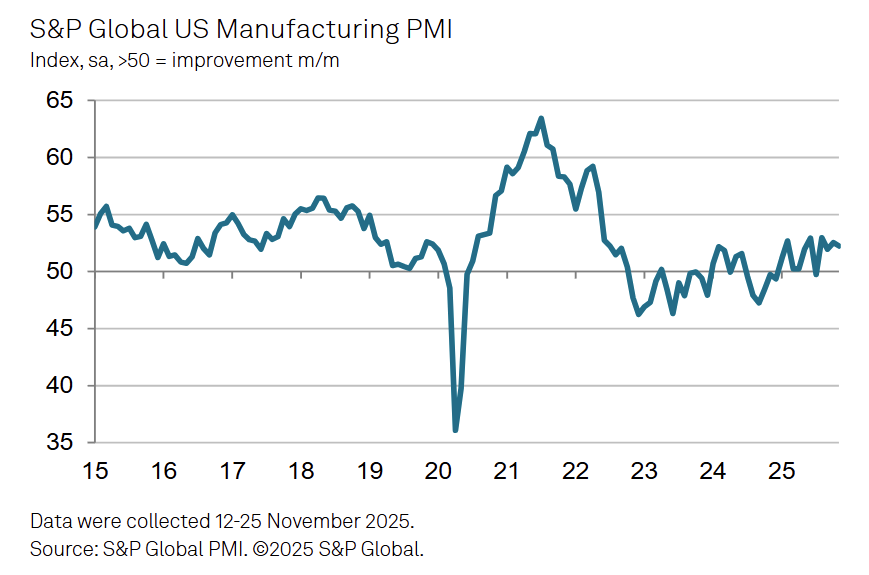

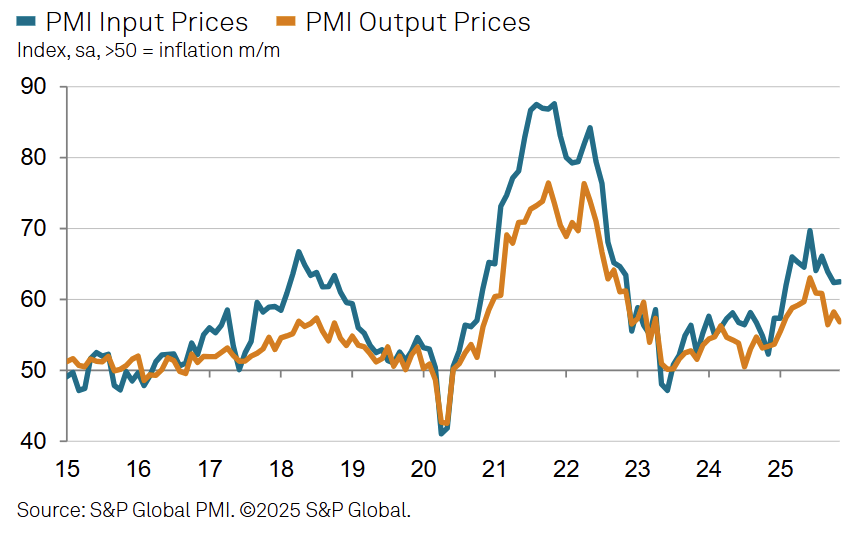

The US S&P Manufacturing PMI eased to 51.8 in December (from 52.2 in November), marking a slower pace of expansion as demand weakened despite continued output growth.

-

New orders declined for the first time in exactly one year, signaling a mild but notable softening in demand conditions after a prolonged expansion.

-

Output continued to grow but at the slowest pace in three months, as production remained solid even amid weaker sales momentum.

-

New export orders fell for a seventh consecutive month, with tariffs cited as a key factor weighing on international demand, particularly exports to Canada.

-

Finished goods inventories increased for a fifth straight month, though the pace of accumulation slowed sharply from November’s record, indicating production continued to outpace sales.

-

Employment growth strengthened to its most pronounced level since August, reflecting firms filling vacancies in anticipation of stronger conditions in 2026.

-

Backlogs of work declined for a fourth consecutive month, pointing to expanding labor capacity and limited workload pressures.

-

Input cost inflation moderated to an 11-month low but remained historically elevated, while output price inflation also slowed to its weakest rate since early 2025, still reflecting tariff-related cost pressures.

-

Business confidence remained positive but eased from November, as firms cited uncertainty around tariffs and insufficient new orders to replace existing demand.

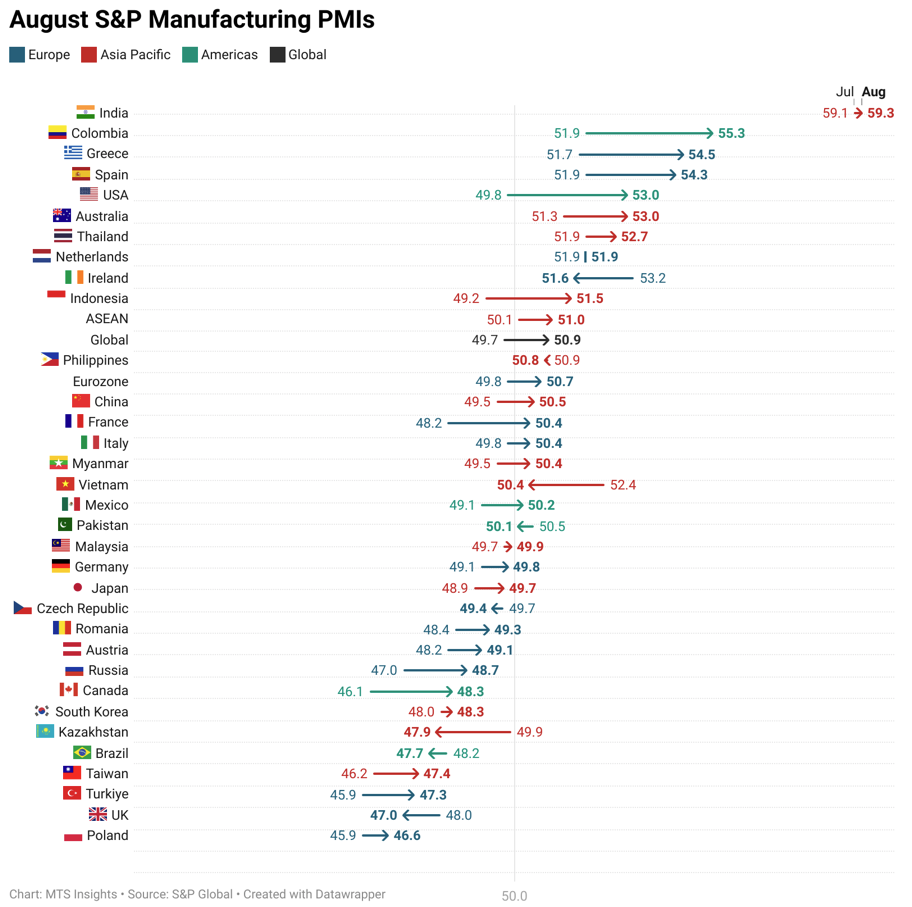

The Eurozone Manufacturing PMI rose to 50.7 in August 2025 (from 49.8 in July), the first expansion since June 2022, driven by the strongest output growth in over three years and a rebound in new orders.

The Eurozone Manufacturing PMI rose to 50.7 in August 2025 (from 49.8 in July), the first expansion since June 2022, driven by the strongest output growth in over three years and a rebound in new orders.