S&P Global Flash PMIs

S&P Global Flash PMIs

- Source

- S&P Global

- Source Link

- https://www.pmi.spglobal.com/

- Frequency

- Monthly

- Next Release(s)

- October 22nd, 2025 12:00 AM

Latest Updates

-

- Australia - 8/20/2025

- Japan - 8/21/2025

- India - 8/21/2025

- France - 8/21/2025

- Germany - 8/21/2025

- Eurozone - 8/21/2025

- UK - 8/21/2025

- US - 8/21/2025

Key Results

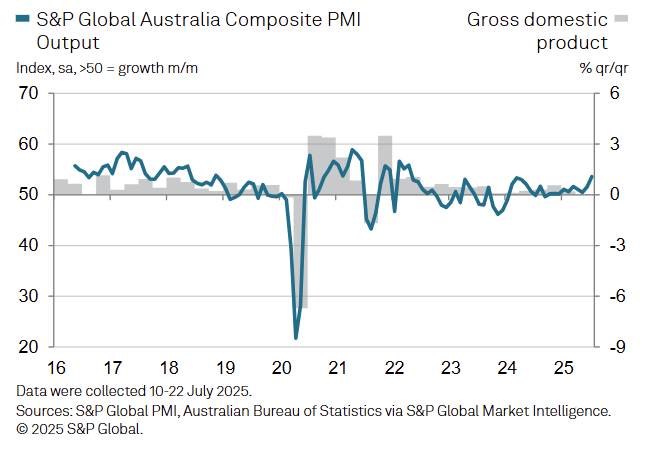

Australia

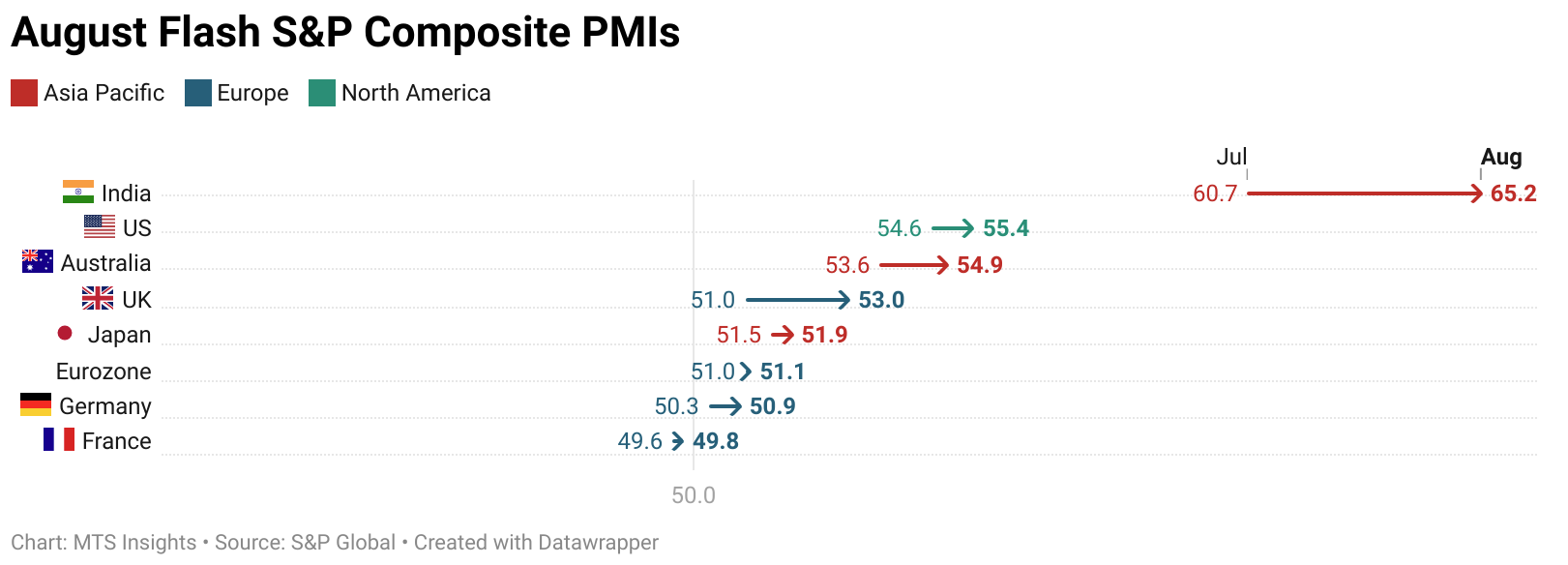

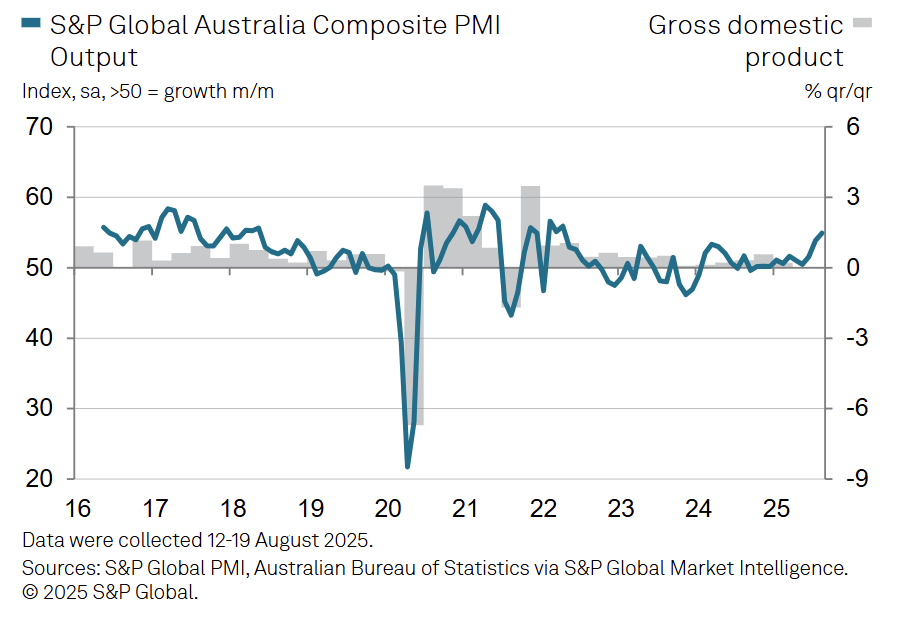

Australia’s Flash Composite PMI rose to 54.9 in August (Jul: 53.8), the highest since April 2022, signaling the fastest private sector output growth in over three years.

-

Services Business Activity Index increased to 55.1 (Jul: 54.1), marking the strongest pace in 40 months.

-

Manufacturing PMI rose to 52.9 (Jul: 51.3), with the Output Index at 53.9, both showing the fastest expansion since 2022.

-

New orders expanded solidly, with manufacturing new orders growing at the quickest pace in nearly three years and exports posting their strongest rise in six months.

-

Employment gains were concentrated in services, where hiring reached the fastest rate since Apr 2023, while manufacturers shed staff slightly despite stronger demand.

-

Input and output price inflation eased from July highs, leaving output prices only slightly above the long-run average.

India

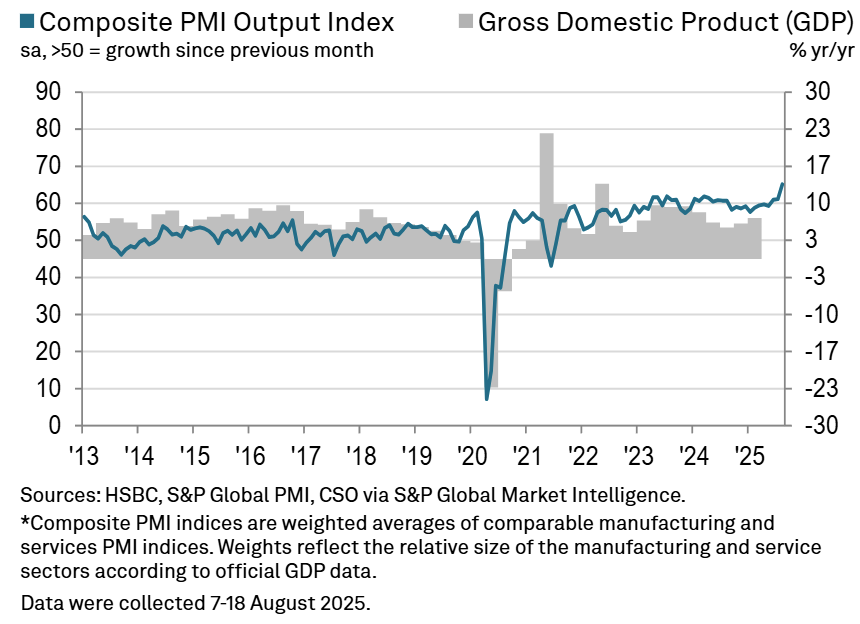

India’s Flash Composite PMI surged to 65.2 in August (Jul: 61.1), the highest on record since the series began in 2005, signaling unprecedented private sector expansion.

-

Services Business Activity Index rose to 65.6 (Jul: 60.5), marking a fresh survey high driven by strong new business orders.

-

Manufacturing PMI increased to 59.8 (Jul: 59.1), its highest since Jan 2008, supported by a sharp rise in domestic demand.

-

Manufacturing Output Index rose to 64.2 (Jul: 62.5), while overall new export orders grew at the fastest pace since composite data began in 2014.

-

Employment growth accelerated, led by services, with jobs growth above the long-run average for a 38th straight month.

-

Output charge inflation hit a 12.5-year high as firms passed higher wage and input costs onto customers amid robust demand.

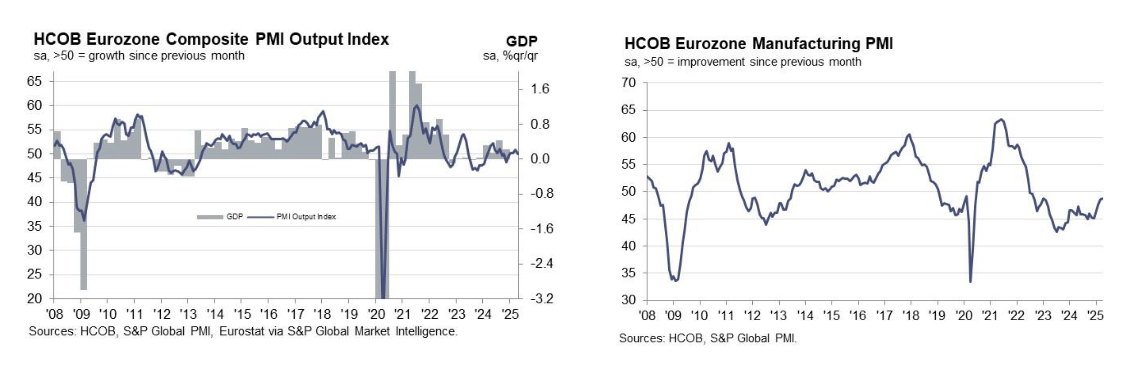

Eurozone

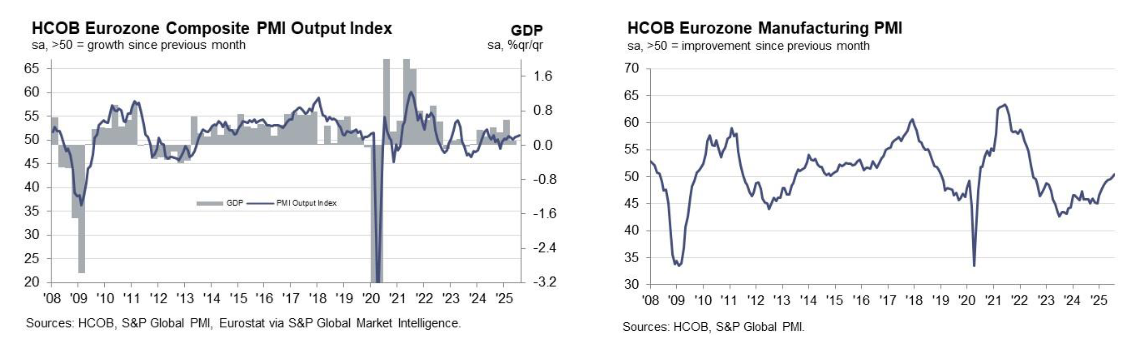

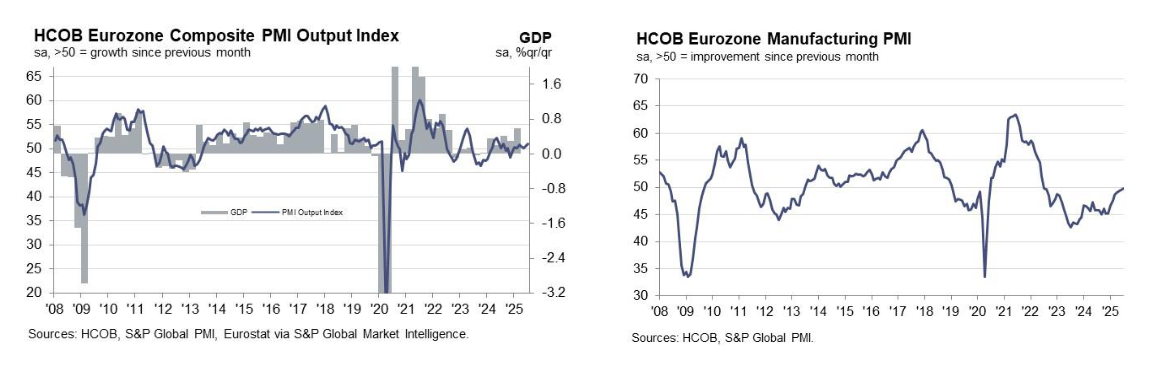

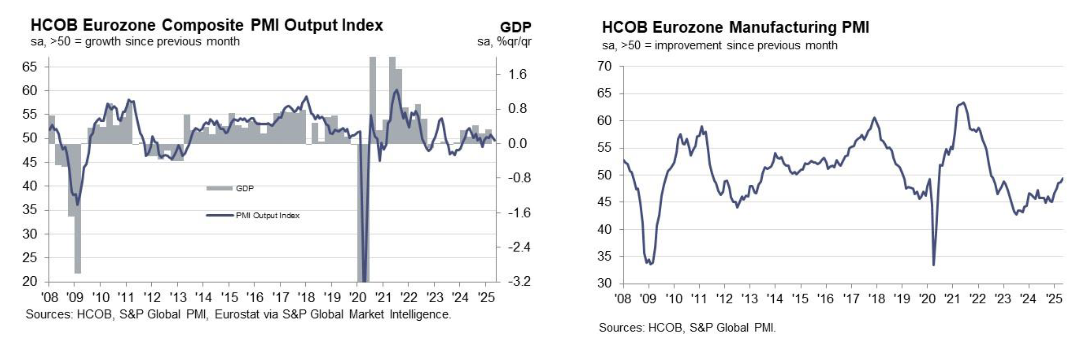

The Eurozone Composite PMI Output Index rose to 51.1 in August (Jul: 50.9), a 15-month high, signaling the strongest private sector expansion since May 2024.

-

Services PMI edged down to 50.7 (Jul: 51.0), showing only slight growth and a 2-month low in business activity.

-

Manufacturing PMI rose to 50.5 (Jul: 49.8), its highest in 38 months, while the Manufacturing Output Index climbed to 52.3 (Jul: 50.6), a 41-month high.

-

New orders increased for the first time since Apr 2022 in manufacturing and ended a 14-month decline overall, though export orders fell at the sharpest pace in five months.

-

Employment rose for the sixth straight month, led by services, while manufacturing jobs continued to decline; overall job creation was the strongest since Jun 2024.

-

Input costs and output prices accelerated, with services seeing the sharpest rise in input costs since Mar, leading to the fastest overall output price inflation in four months.

-

Business confidence weakened for a second month, dropping to a four-month low, with French firms turning pessimistic on output for the first time in nine months.

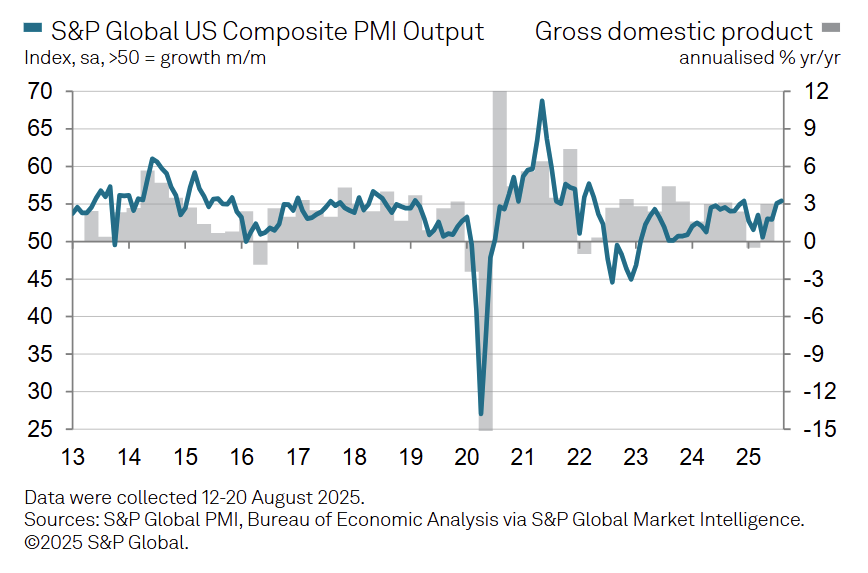

US

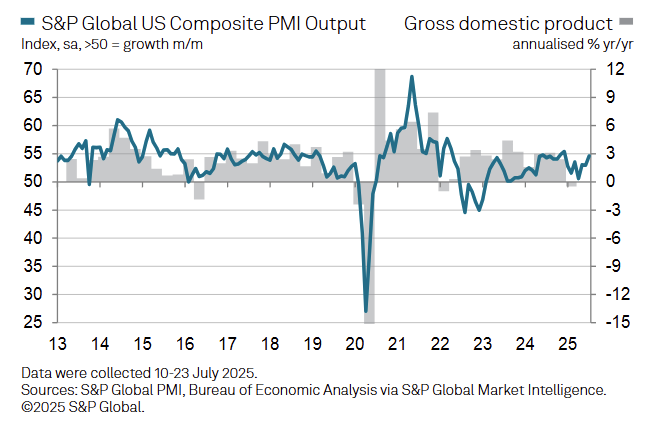

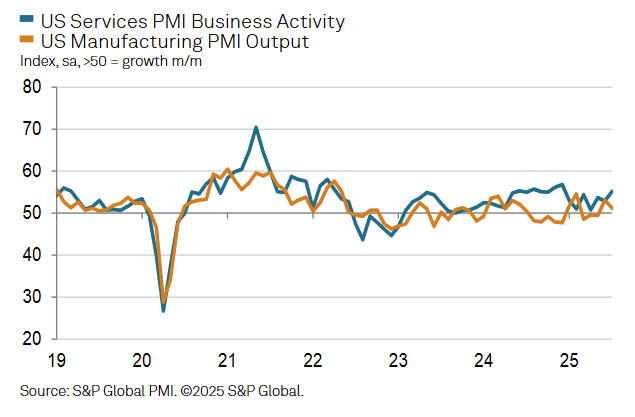

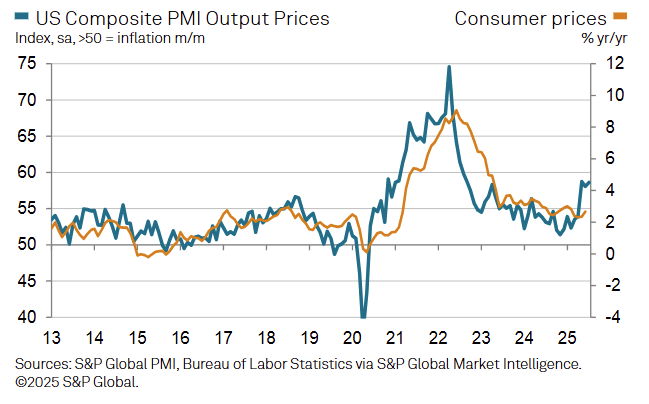

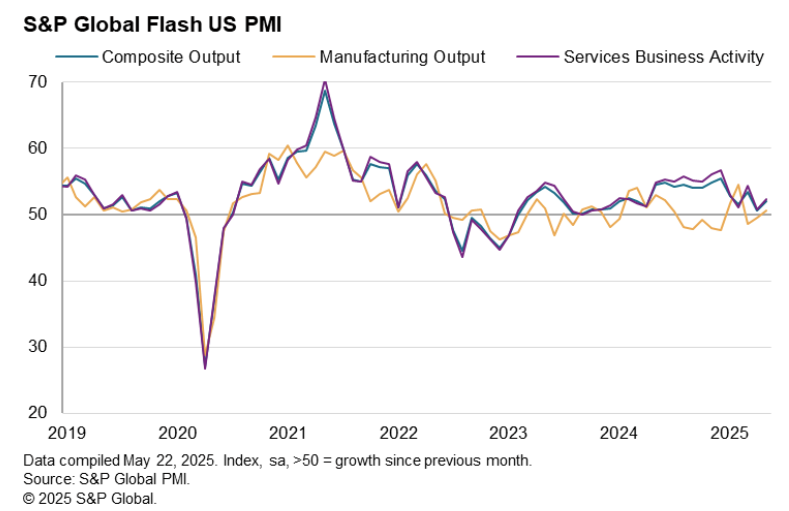

US business activity expanded at the fastest pace of 2025 so far, with the S&P Global Flash Composite PMI rising to 55.4 in August (Jul: 55.1), while average selling prices saw their sharpest increase in three years.

-

The Manufacturing PMI jumped to 53.3 (Jul: 49.8), the highest since May 2022, as production growth accelerated and new orders rose at the strongest pace since Feb 2024.

-

Services activity remained robust at 55.1 (Jul: 55.3), supported by the steepest sales growth since Dec 2024 and a modest recovery in export demand.

-

Employment rose for the sixth month, with job creation reaching one of the strongest rates in three years; service hiring hit a seven-month high, while factory payrolls posted the largest gain since Mar 2022.

-

Backlogs of work increased at the fastest pace since May 2022, reflecting strong demand and capacity pressures, while inventories of finished goods rose at a survey-record rate.

-

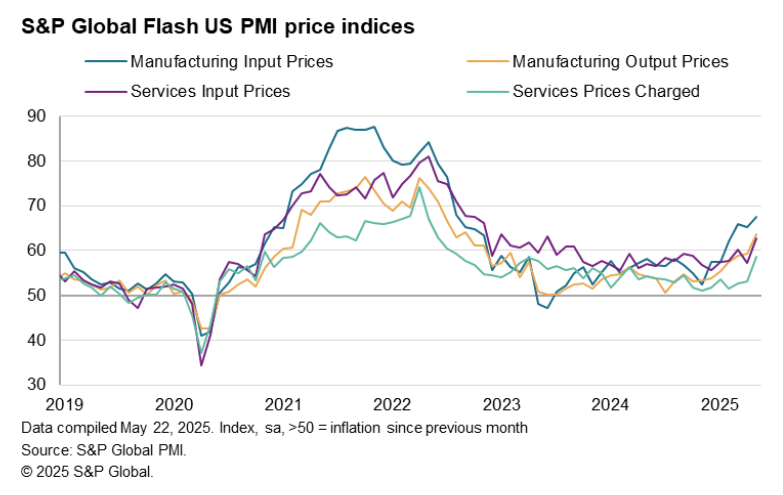

Input costs surged, driven by tariffs, with manufacturing seeing the second-largest rise since Aug 2022; firms passed these costs through, pushing services price inflation to the highest since Aug 2022.

-

- Australia - 7/23/2025

- Japan - 7/24/2025

- India - 7/24/2025

- France - 7/24/2025

- Germany - 7/24/2025

- Eurozone - 7/24/2025

- UK - 7/24/2025

- US - 7/24/2025

Key Results

Australia

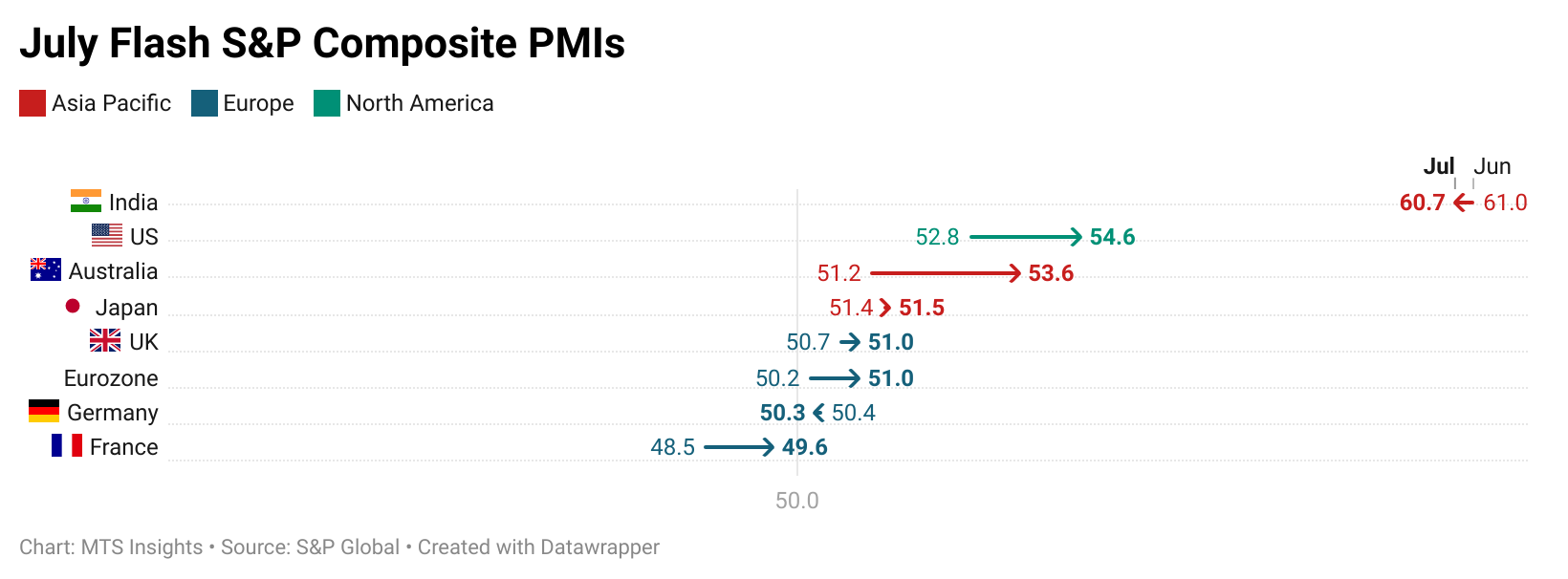

Australia’s Flash Composite PMI rose to 53.6 in July (from 51.6 in June), the highest since April 2022, signaling the fastest private sector output growth in over two years.

- Services Business Activity Index rose to 53.8 (Jun: 51.8), while Manufacturing PMI increased to 51.6 (Jun: 50.6).

- Manufacturing Output Index rose to 52.3 (Jun: 49.9), marking the first expansion in three months.

- New orders grew at the fastest pace in over three years, though export orders remained in contraction.

- Input and output price inflation both rose, surpassing their long-run averages.

- Business confidence eased to an 8-month low despite continued job gains and output growth.

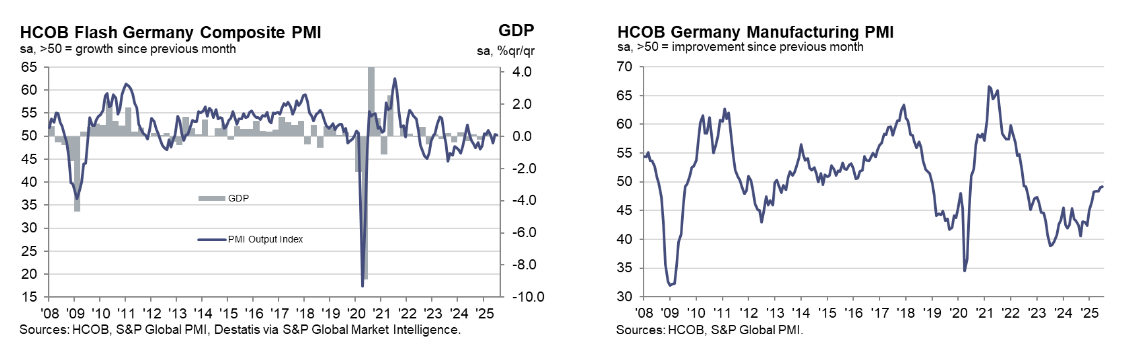

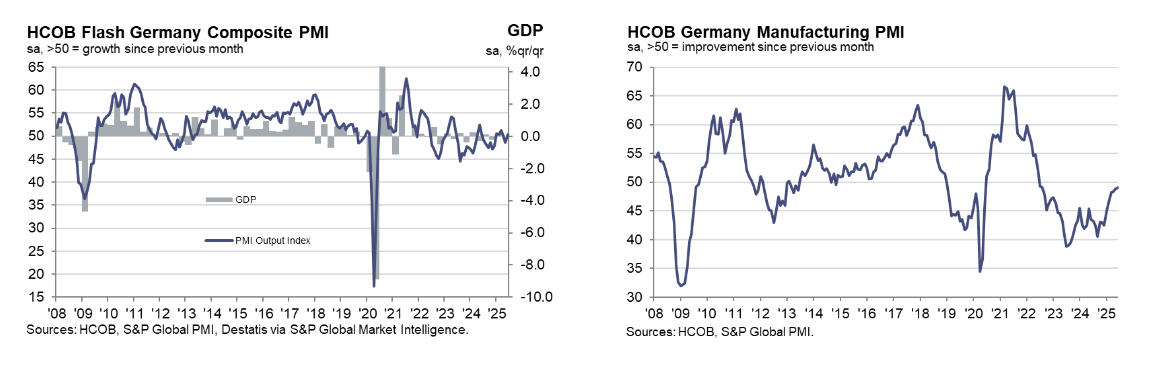

Germany

Germany’s Flash Composite PMI edged down to 50.3 in July (from 50.4 in June), signaling marginal private sector growth for a second consecutive month.

- Services Business Activity Index rose to 50.1 (Jun: 49.7), ending a 3-month contraction streak.

- Manufacturing Output Index slowed to 50.6 (Jun: 51.9), while Manufacturing PMI improved slightly to 49.2 (Jun: 49.0).

- Input and output price inflation eased to the lowest levels since October 2024, with factory gate prices falling for the third straight month.

- Employment declined modestly for a second month, with broad-based job cuts across services and manufacturing.

- Business expectations rose to the highest since May 2024, led by stronger sentiment in the services sector.

Eurozone

The Eurozone’s Flash Composite PMI rose to 51.0 in July (from 50.6 in June), marking an 11-month high and the seventh straight month of private sector expansion.

- Services Business Activity Index rose to 51.2 (Jun: 50.5), while Manufacturing Output Index dipped slightly to 50.7 (Jun: 50.8).

- Manufacturing PMI rose to 49.8 (Jun: 49.5), a 36-month high despite remaining in contraction.

- New orders stabilized after 13 months of decline; services new business rose but manufacturing orders fell.

- Input cost inflation eased to a 9-month low; output price inflation was steady overall, with services charges rising more slowly.

- Employment rose modestly, driven by gains outside of Germany and France, even as those two posted continued job losses.

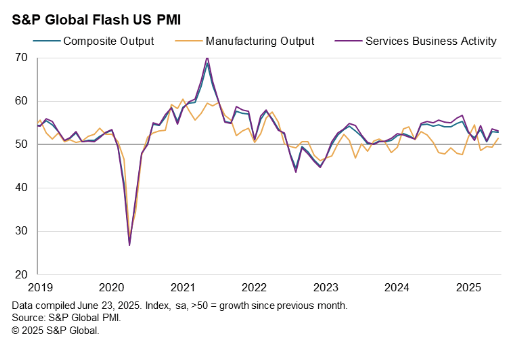

US

US Composite PMI rose to 54.6 in July (from 52.9 in June), marking a 7-month high as services strength offset weaker manufacturing.

- Services Business Activity Index jumped to 55.2 (June: 52.9), the fastest growth since December 2024.

- Manufacturing PMI fell to 49.5 (June: 52.9), the first sub-50 reading since December, signaling renewed contraction.

- Employment rose overall, but factory jobs fell as backlogs declined in manufacturing; services backlogs rose at a 3-year high pace.

- Business confidence dipped further, with firms citing concerns over tariffs and federal spending cuts.

- Prices charged for goods and services rose at the second-fastest pace since September 2022, just below May’s recent peak.

- Services price inflation accelerated, marking the second-steepest monthly rise since April 2023.

- Factory gate price inflation eased slightly but remained historically high, the second-largest increase since November 2022.

- Input cost inflation picked up again in July, registering the second-steepest rise since January 2023.

- Manufacturing input costs remained especially elevated, though slightly lower than June’s post-pandemic peak.

- About two-thirds of manufacturers citing higher input costs attributed them to tariffs; nearly half also linked selling price hikes to tariffs.

- Roughly 40% of service firms reporting price increases explicitly mentioned tariffs as a key driver.

-

- Australia - 6/22/2025

- Japan - 6/23/2025

- India - 6/23/2025

- France - 6/23/2025

- Germany - 6/23/2025

- Eurozone - 6/23/2025

- UK - 6/23/2025

- US - 6/23/2025

Key Results

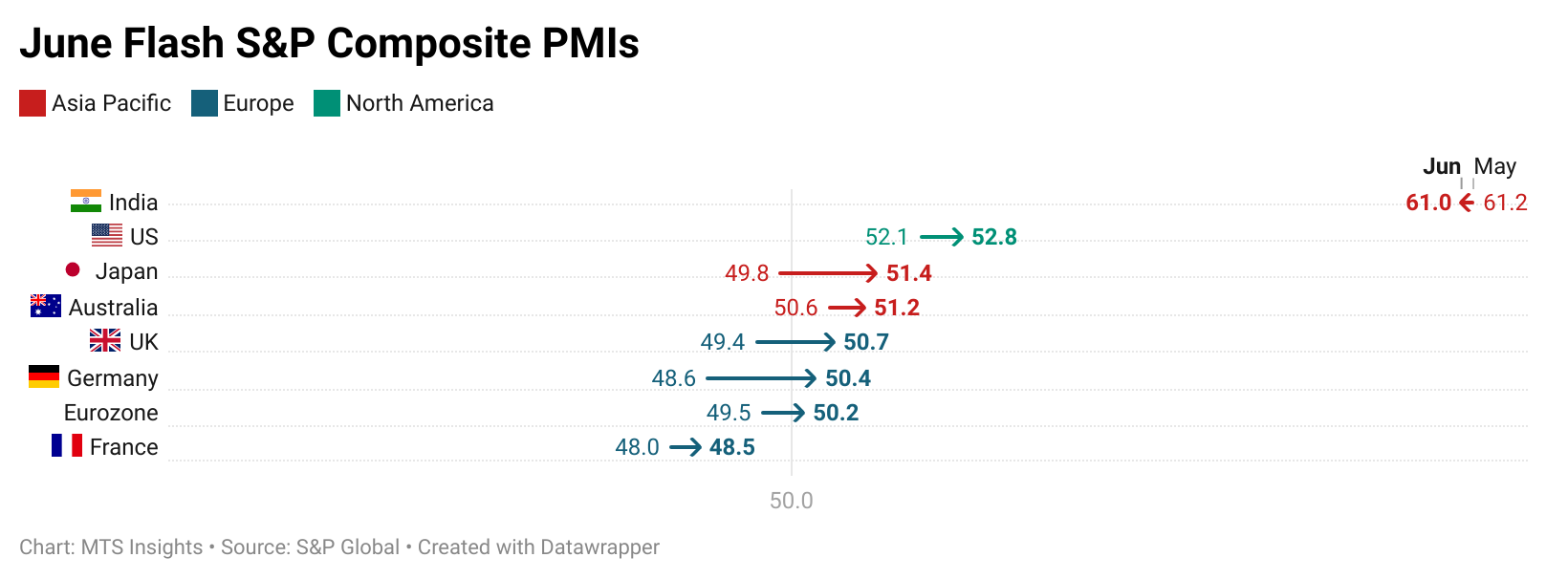

Germany

The German S&P Flash Composite PMI increased 1.9 pts to 50.4 in June, the highest in three months as the manufacturing sector improved.

- The S&P Flash Manufacturing PMI Output index improved 1.2 pts to 52.6, the highest in over three years. Manufacturing sentiment improved to the highest since February 2022.

- Underlying demand conditions showed signs of strengthening at the end of the second quarter, as underscored by the first rise in total inflows of new work across the private sector since May last year.

US

The S&P Global Flash US Composite PMI fell slightly to 52.8 in June (from 53.0 in May), a 2-month low, as goods price inflation surged while job growth accelerated.

- The Manufacturing Output Index rose to 51.5 (from 49.4), a 4-month high, while the Manufacturing PMI held steady at 52.0.

- Services Business Activity Index fell to 53.1 (from 53.7), with services export demand posting its worst quarterly drop since late 2022.

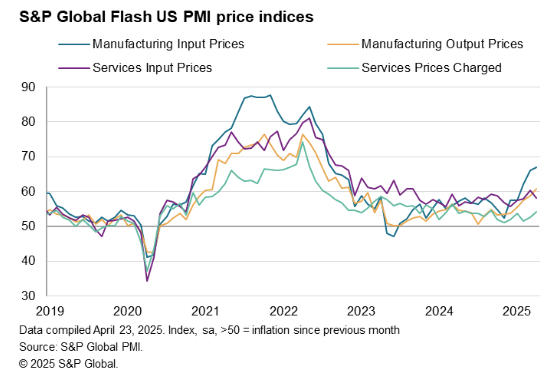

- Input prices in manufacturing rose at the fastest rate since July 2022, largely due to tariffs; services prices also rose but at a slower pace than in May.

- Employment rose at the fastest pace in over a year, driven by rising backlogs and domestic demand.

- Business confidence dipped modestly, with manufacturers slightly more upbeat than service providers, who expressed concern over policy uncertainty.

-

- Australia - 5/21/2025

- Japan - 5/22/2025

- India - 5/22/2025

- France - 5/22/2025

- Germany - 5/22/2025

- Eurozone - 5/22/2025

- UK - 5/22/2025

- US - 5/22/2025

Key Results

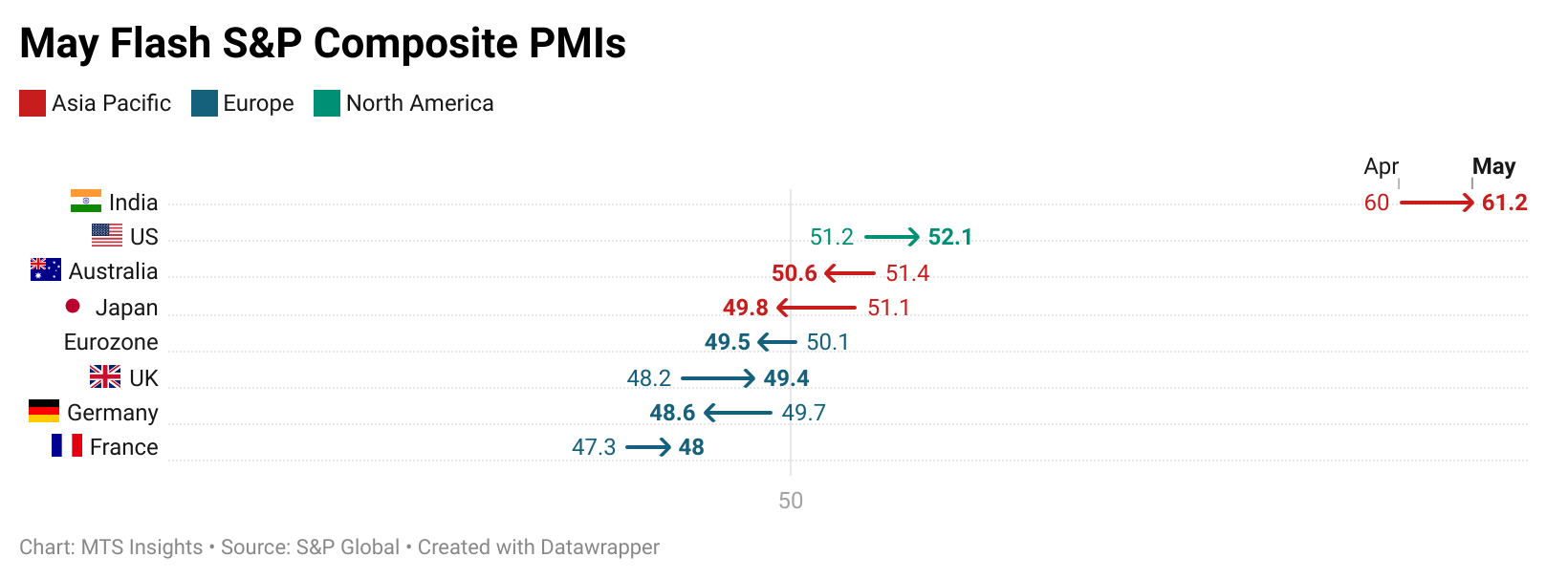

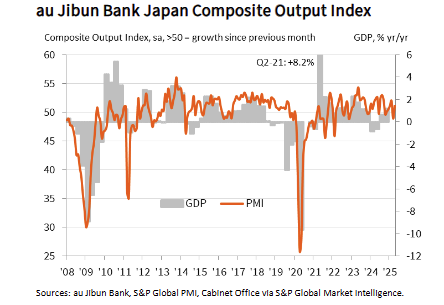

Japan

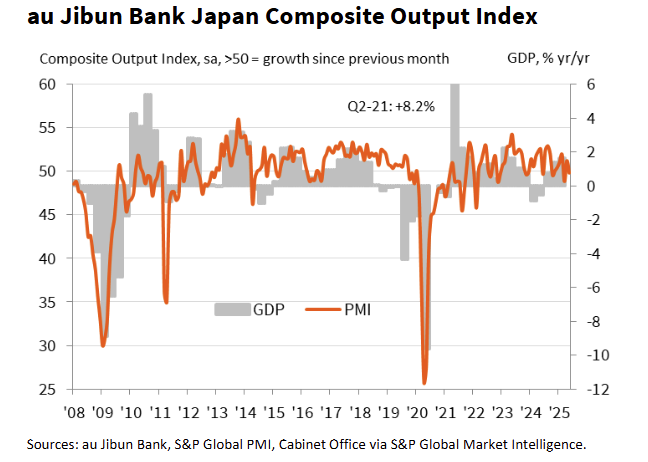

Japan’s S&P Flash PMI results pointed to weaker growth in May as the Flash Composite Output Index fell -1.4 pts to 49.8, signaling a slight decline in private sector growth.

- Service sector growth slowed from a moderately strong growth rate (52.4) in April to a weaker expansion in May (50.8) as domestic and foreign new order growth weakened.

- The contraction in manufacturing output worsened in May as the index fell -0.9 pts to 48.0. Industrial sentiment was the lowest seen since the pandemic.

India

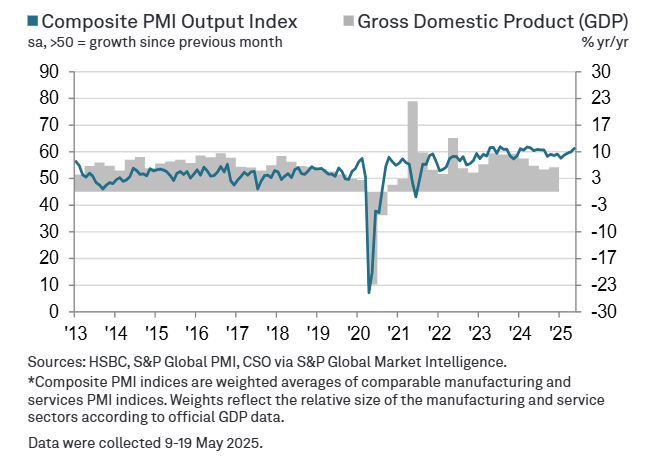

India’s private sector expansion strengthened further in May as the Composite Output Index added 0.5 pts to 59.7, the highest since April 2024.

- Manufacturing output growth eased slightly, but a strong acceleration in service sector growth to the highest in 14 months led to the headline expansion.

Eurozone

Private sector growth in the Eurozone fell to a 6-month low on mixed factors as the Flash Composite PMI fell -0.9 pts to 49.5 in May.

- The Flash Manufacturing PMI improved 0.4 pts to 49.4, the highest in 33-months, as output grew for the third month in a row.

- The Flash Services PMI dropped -1.2 pts to 48.9, a 16-month low and the first decline since November 2024.

US

The Flash US Composite PMI increased 1.5 pts to 52.1 in May as private sector growth bounced off the 19-month low in April.

- The US Services PMI increased 1.5 pts to 52.3, and the US Manufacturing PMI increased 2.1 pts to 52.3 as both sectors saw healthier activity in May.

- Exports of services (which includes spending by foreigners in the US) fell at the sharpest rate since the pandemic lockdowns of early 2020, and before that, late 2014.

- Average prices charged for goods and services jumped higher in May, rising at a rate not witnessed since August 2022. Manufacturers’ selling prices grew at the fastest pace since August 2022, and services selling price inflation was the strongest since April 2023.

- General sentiment improved as activity improved and was the highest since January.

-

- Australia - 4/22/2025

- Japan - 4/23/2025

- India - 4/23/2025

- France - 4/23/2025

- Germany - 4/23/2025

- Eurozone - 4/23/2025

- UK - 4/23/2025

- US - 4/23/2025

Key Results

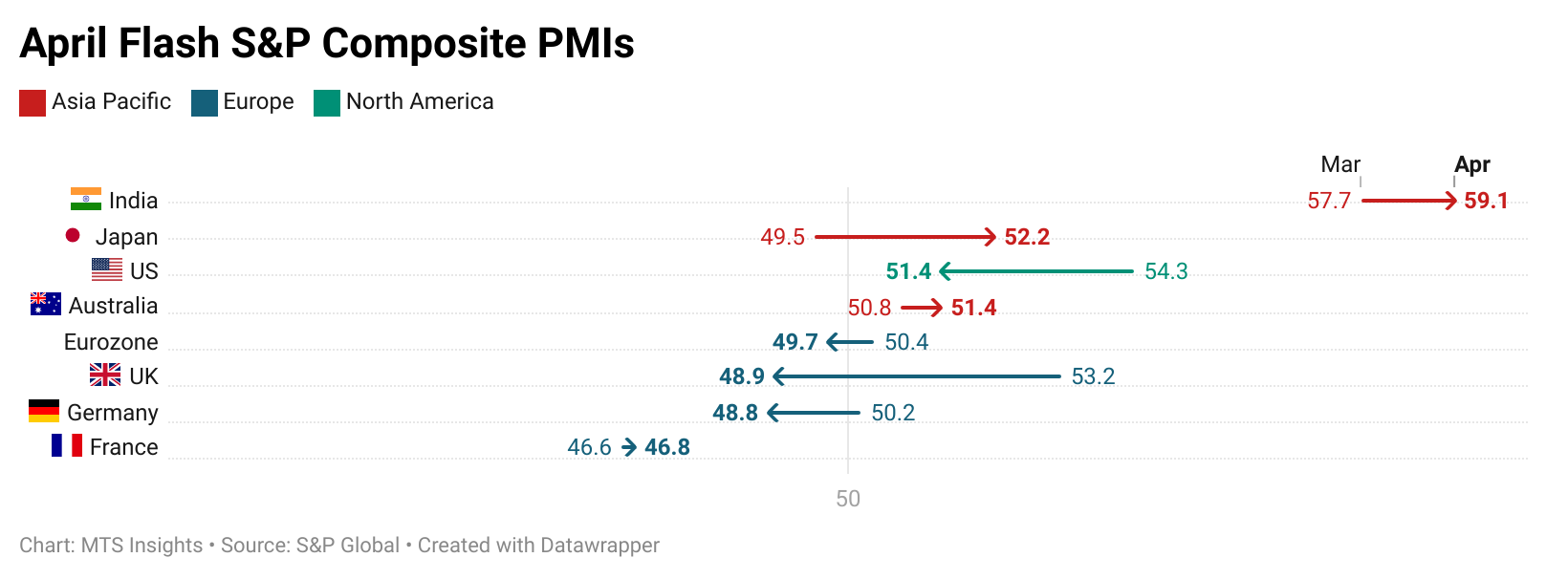

Japan

Japan’s S&P Flash PMI pointed to renewed growth in private sector academy in April with the manufacturing seeing a weaker decline and the services sector returning back to growth.

- The Services PMI index jumped 2.2 pts to 52.2, and the Manufacturing Output index increased 2.3 pts to 48.9.

- The manufacturing PMI reading was the second-lowest seen for just over a year, but was consistent with a modest deterioration overall.

- Helping to lift the index slightly was the softest drop in factory production for four months.

- However, overall new orders declined at a solid pace that was the fastest since February 2024, with the downturn in new export business also gathering pace.

- Supporting the fresh rise in service sector activity was a further improvement in customer demand, with overall sales increasing at the strongest rate in three months.

- As a result, companies hired additional staff at the quickest pace since January, while backlogs continued to expand modestly.

Eurozone

The S&P Flash Eurozone PMI revealed a weaker service sector offsetting a stronger manufacturing sector in April.

- The Manufacturing PMI increased 0.1 pts to 48.7, a 27-month high, and the Manufacturing Output index improved 0.7 pts to 51.2, a 35-month high.

- The Services PMI flipped from a moderate increase in March at 51.0 to a slight contraction at 49.7 in April.

- Companies were generally reluctant to expand output given a further reduction in new orders during April, the eleventh straight month.

- New export orders (which include intra-Eurozone exports) also decreased, and at a broadly similar pace to that seen for total new business. New export orders have decreased continuously since March 2022.

- April saw a sharp drop in business confidence in the euro area, with sentiment down to the lowest since November 2022.

- After having risen for the first time in eight months during March, employment broadly stagnated in April.

- Input costs increased at the slowest pace since November last year, and at a rate that was below the series average. Output prices also increased at a weaker pace in April, with the rate of inflation easing to a five-month low.

UK

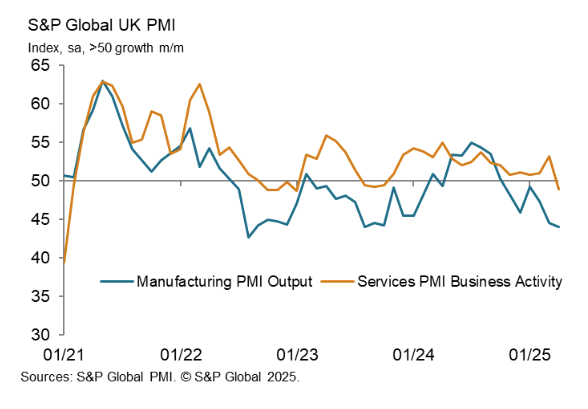

The S&P Flash UK Composite PMI fell -3.4 pts to 48.2 in April, a 29-month low and a drop below expectations of a 50.4 reading.

- Both the services and manufacturing sectors saw sharper contractions with the Services PMI down -3.6 pts to 48.9 (27-month low) and the Manufacturing Output PMI down -1.3 pts to 44.0 (32-month low).

- The degree of optimism towards the year ahead outlook slumped to its lowest since October 2022.

- S&P: “Total new work received by UK private sector firms decreased for the fifth month running and at a solid pace in April. Anecdotal evidence suggested that US tariff uncertainty and general concerns about the economic outlook had encouraged a wait-and-see approach to major spending decisions among clients. This led to the fastest reduction in new work from abroad since May 2020.”

US

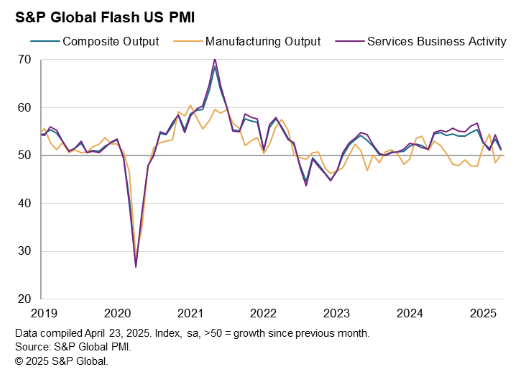

The S&P Flash US Composite PMI fell -2.3 pts to 51.2 as private sector growth slowed to a 16-month low.

- Demand growth was subdued in particular by a fall in exports of services (which includes tourism) on a scale not seen since Jan 2023.

- Sentiment among companies about their output over the coming year fell for a third successive month, dropping sharply to register the least optimistic outlook since July 2022.

- Avg prices charged for goods and services rose in Apr at the sharpest rate for 13 months, increasing especially steeply in manufacturing (where it was at a 29-month high).

- Higher charges were attributed to rising costs, linked to tariffs, rising import prices, and labor costs.