S&P CoreLogic Case-Shiller Home Price Index

S&P CoreLogic Case-Shiller Home Price Index

- Source

- S&P Global

- Source Link

- https://www.spglobal.com/

- Frequency

-

Monthly

9 am EST on the last Tuesday of every month

- Next Release(s)

- February 24th, 2026 9:00 AM

-

March 31st, 2026 9:00 AM

-

April 28th, 2026 9:00 AM

-

May 26th, 2026 9:00 AM

-

June 30th, 2026 9:00 AM

-

July 28th, 2026 9:00 AM

-

August 25th, 2026 9:00 AM

-

September 29th, 2026 9:00 AM

-

October 27th, 2026 9:00 AM

-

November 24th, 2026 9:00 AM

-

December 29th, 2026 9:00 AM

Latest Updates

-

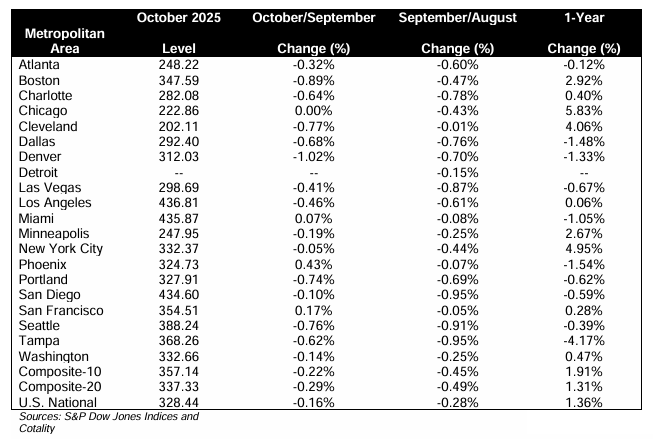

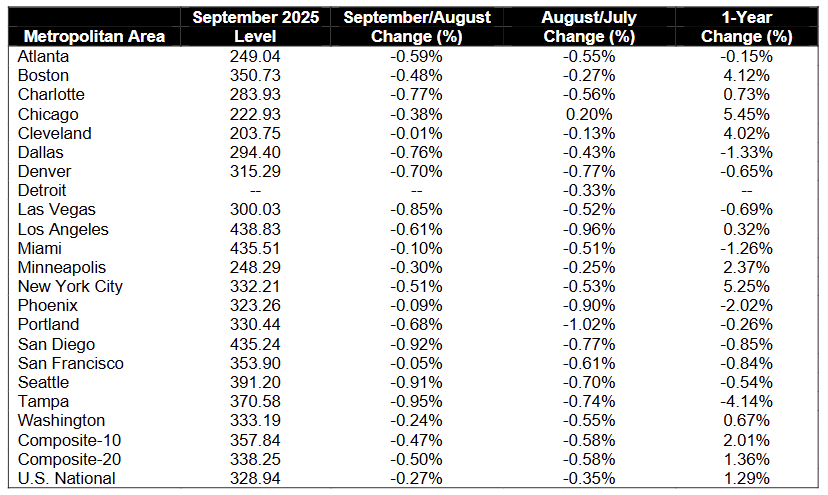

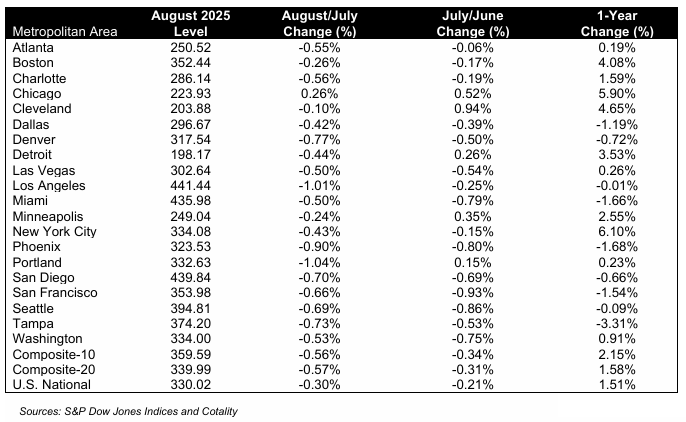

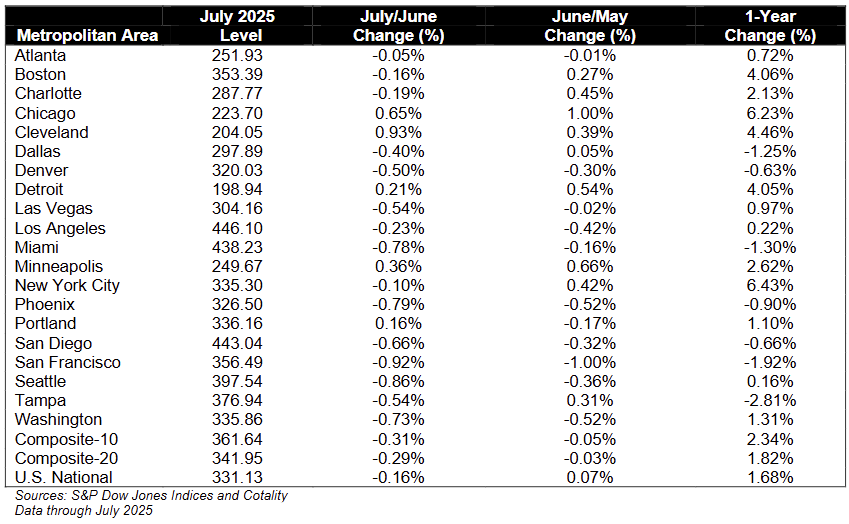

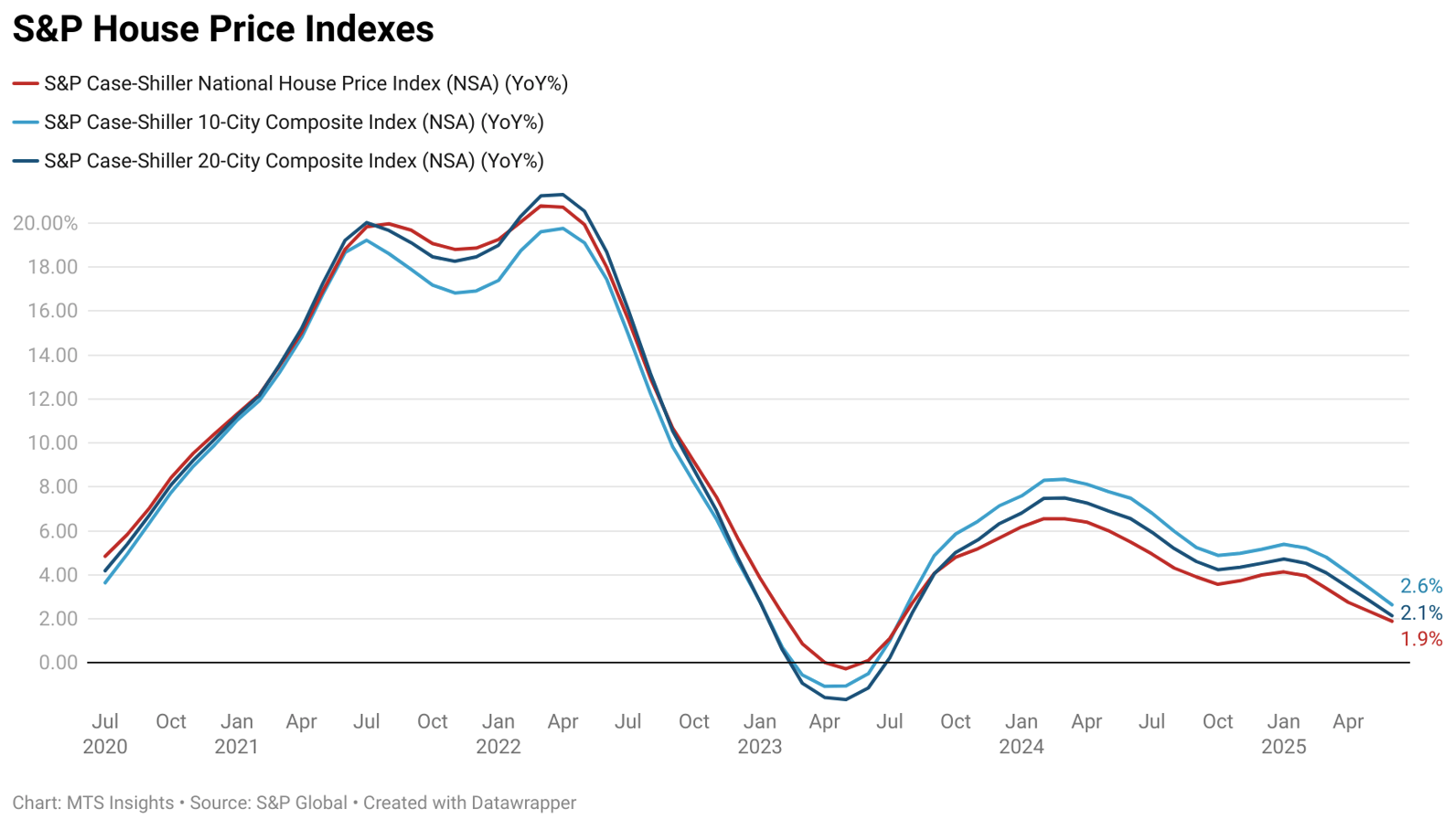

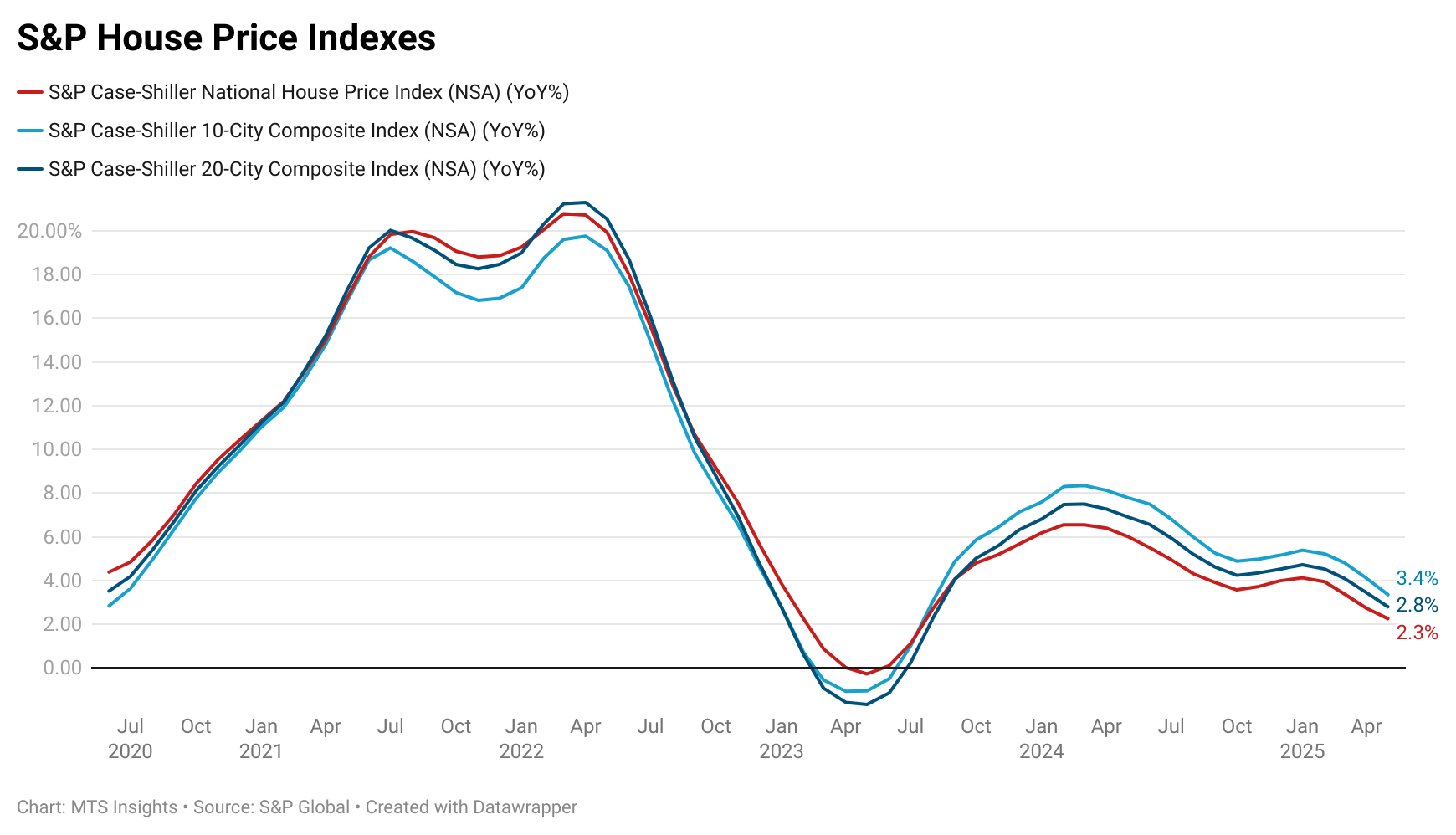

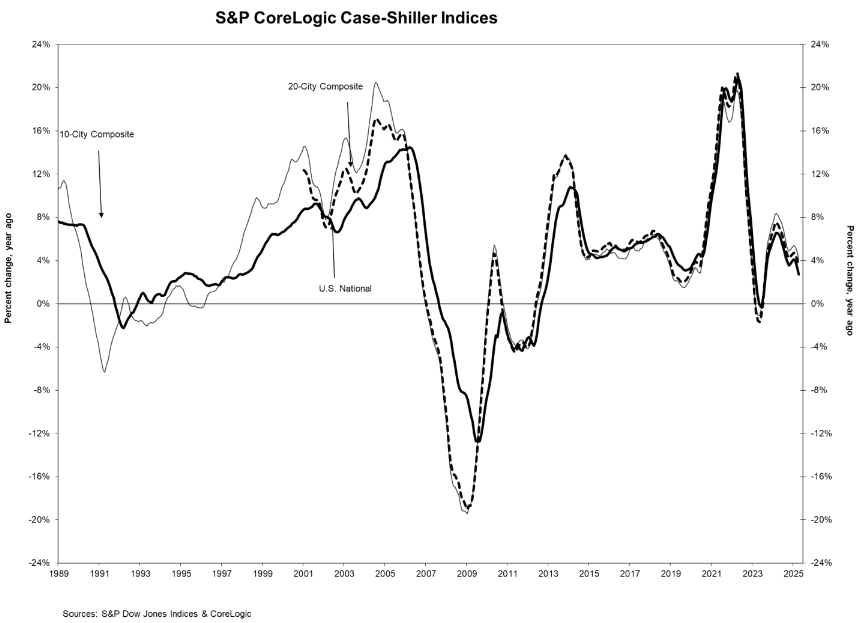

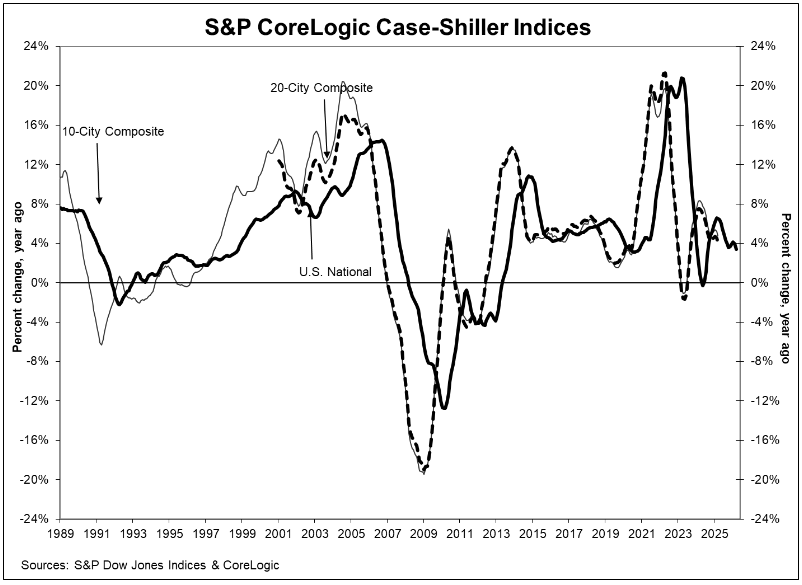

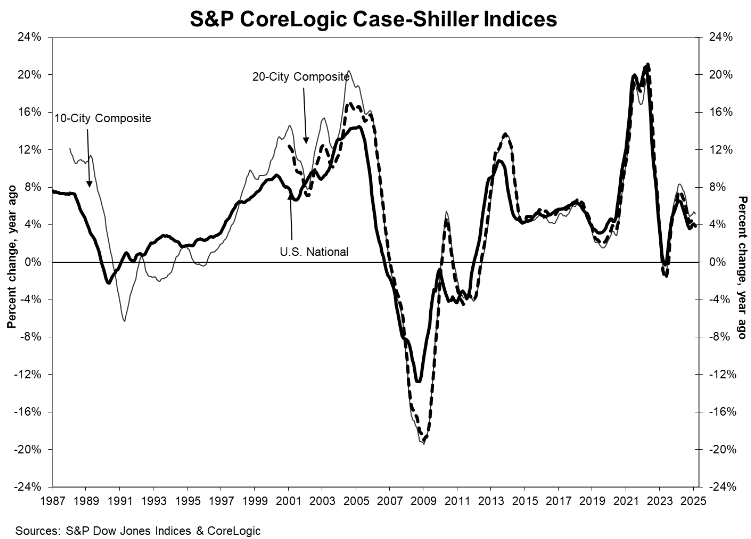

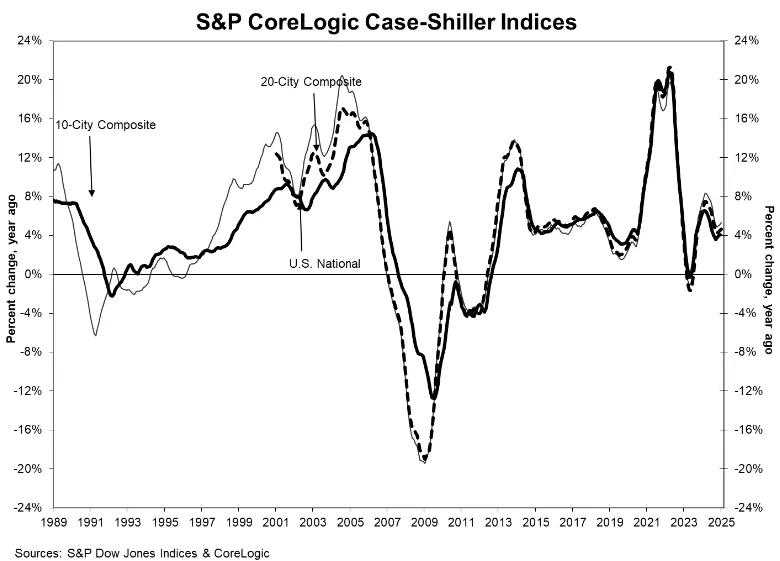

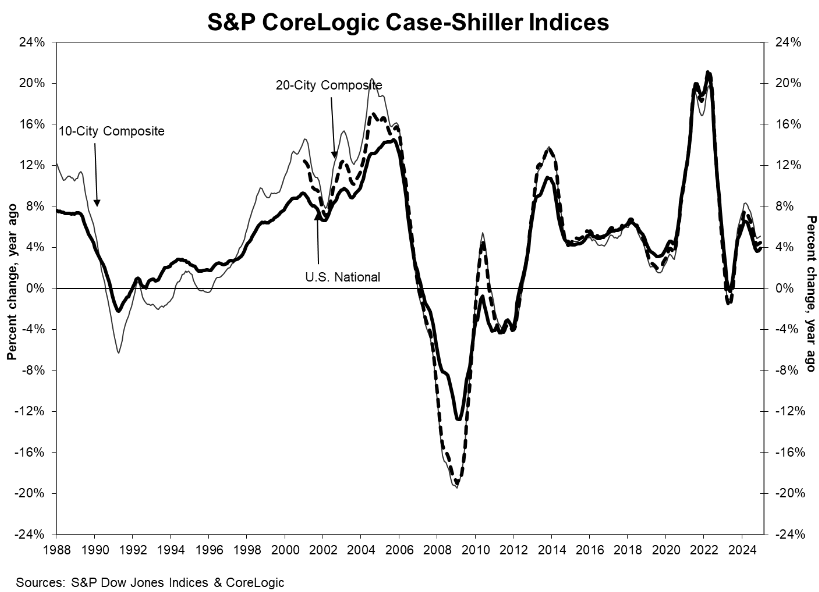

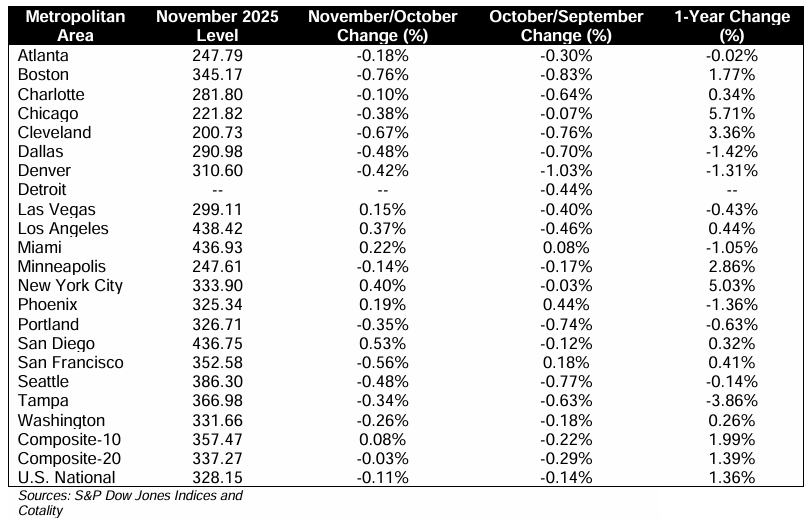

The S&P Case-Shiller U.S. National Home Price Index rose +1.4% YoY in November 2025, unchanged from October 2025, remaining near the weakest annual pace since mid-2023.

-

The 10-City Composite rose +2.0% YoY (up from +1.9%), while the 20-City Composite increased +1.4% YoY (up from +1.3%), showing slight firming in composite measures despite weak national growth.

-

On a non-seasonally adjusted basis, the National Index fell -0.1% MoM, with 15 of 20 major metro areas posting monthly declines, signaling broad short-term softness.

-

After seasonal adjustment, the National Index rose +0.4% MoM, while both the 10-City and 20-City Composites increased +0.5% MoM, indicating limited underlying momentum once seasonality is removed.

-

Regional divergence remained pronounced, led by Chicago (+5.7% YoY), New York (+5.0%), and Cleveland (+3.4%), while Sun Belt markets declined, including Tampa (-3.9%), Phoenix (-1.4%), Dallas (-1.4%), and Miami (-1.0%).

-

Mortgage rates remained in the mid-6% range during November, coinciding with muted monthly price changes and continued pressure on affordability.

-