Richmond Fed Services Survey

Richmond Fed Services Survey

- Source

- Richmond Fed

- Source Link

- https://www.richmondfed.org/

- Frequency

- Monthly

- Next Release(s)

- February 24th, 2026 10:00 AM

-

March 24th, 2026 10:00 AM

-

April 28th, 2026 10:00 AM

-

May 27th, 2026 10:00 AM

-

June 23rd, 2026 10:00 AM

-

July 28th, 2026 10:00 AM

-

August 25th, 2026 10:00 AM

-

September 22nd, 2026 10:00 AM

-

October 27th, 2026 10:00 AM

-

November 24th, 2026 10:00 AM

-

December 22nd, 2026 10:00 AM

Latest Updates

-

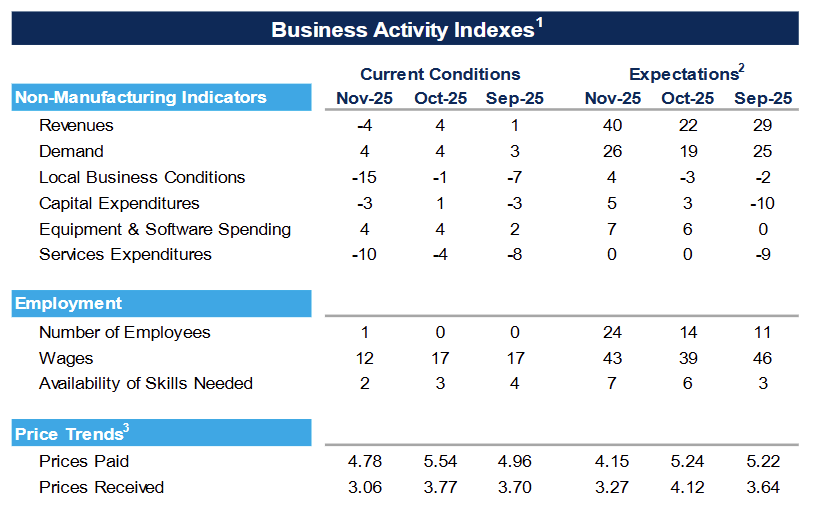

Fifth District non-manufacturing activity was essentially flat in January, with modest MoM improvements in revenues and demand alongside softer input cost growth.

-

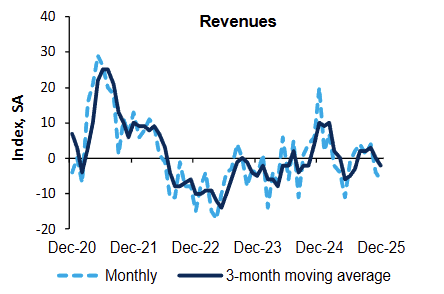

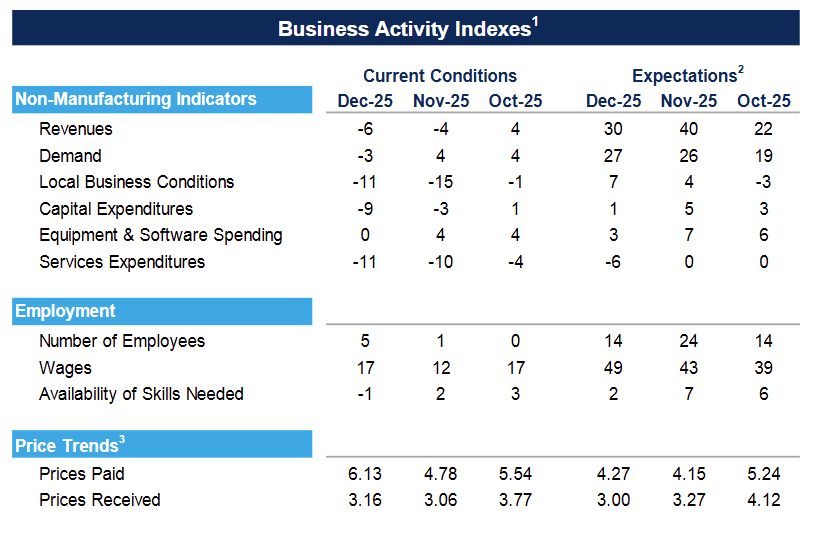

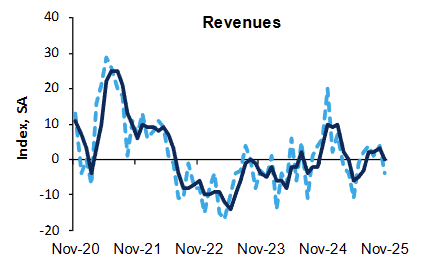

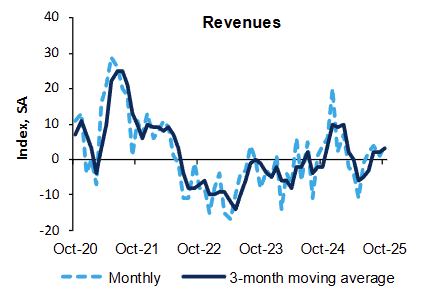

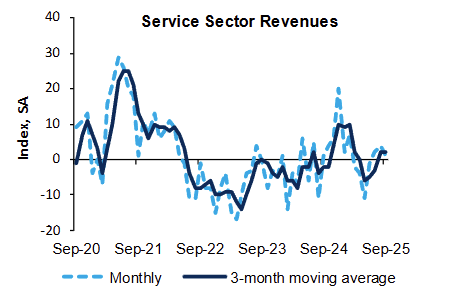

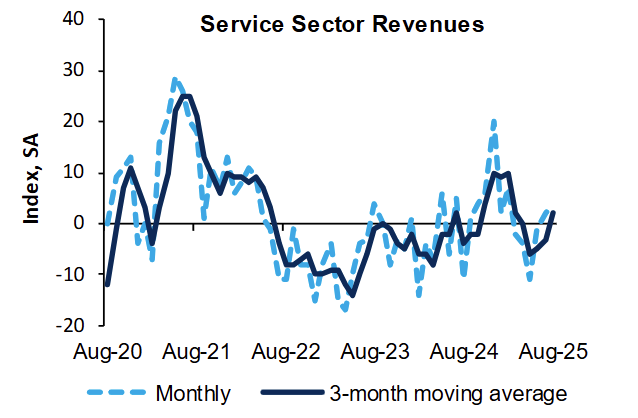

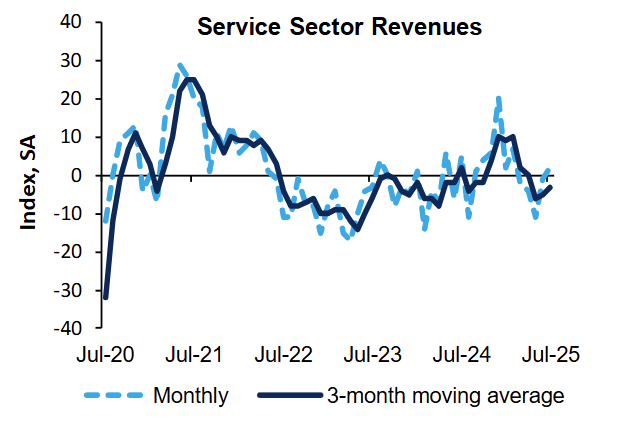

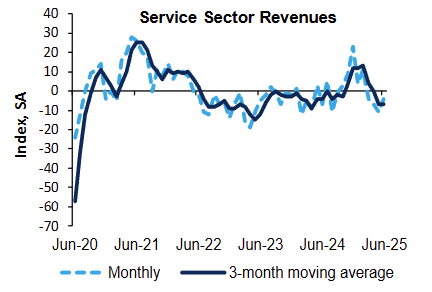

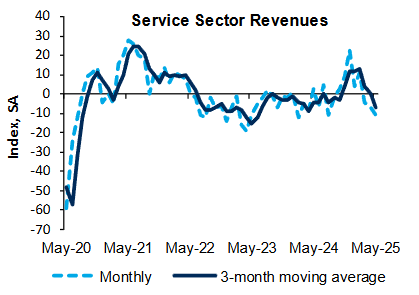

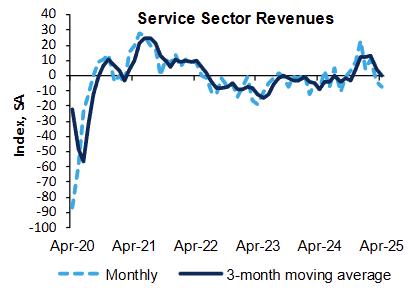

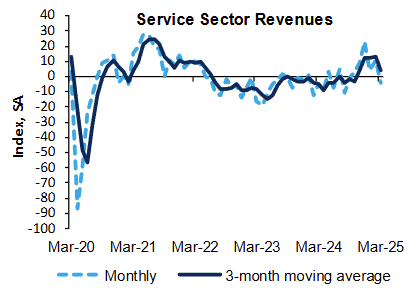

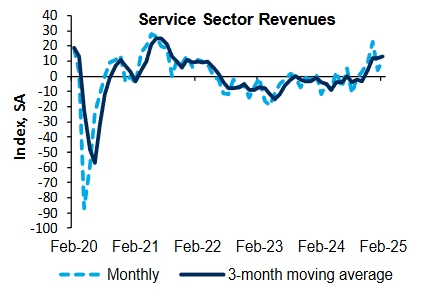

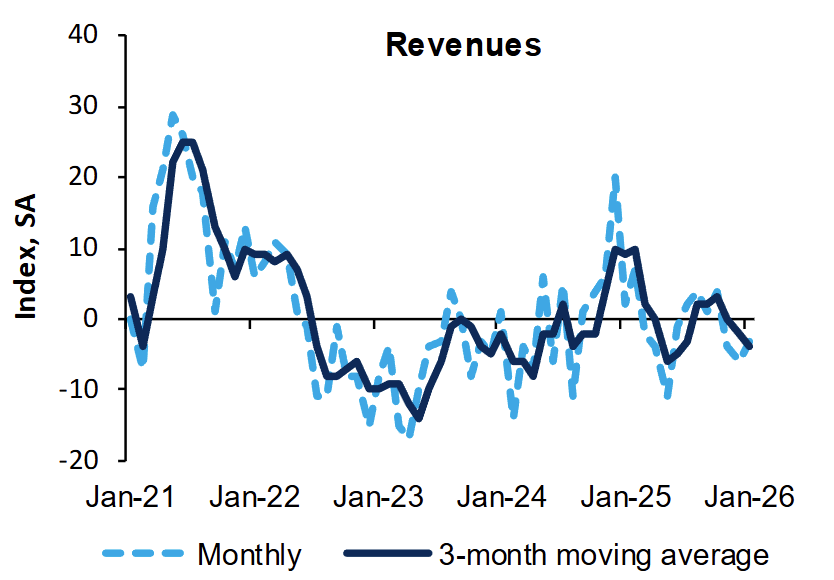

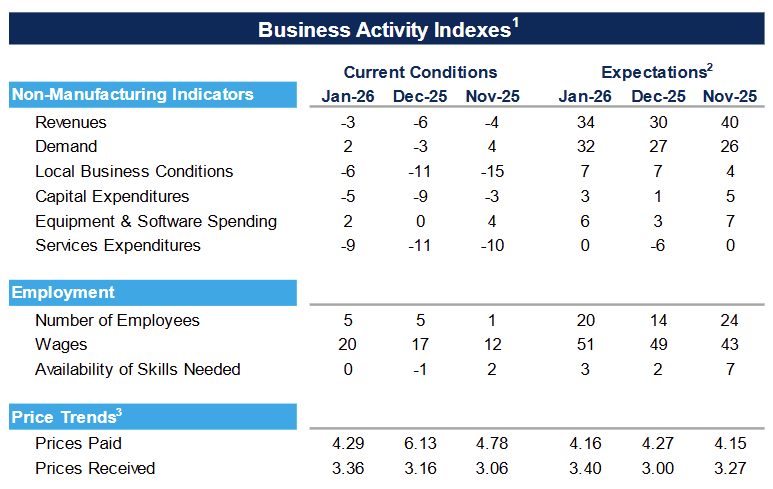

The revenues index increased to -3 (Dec: -6; Nov: -4), indicating a smaller contraction in current service-sector revenue conditions.

-

The demand index rose to 2 (Dec: -3; Nov: 4), shifting from slight contraction back into modest expansion.

-

Local business conditions improved to -6 (Dec: -11; Nov: -15), showing a gradual easing in negative assessments of the regional environment.

-

Capital expenditures remained negative at -5 (Dec: -9), while equipment and software spending held positive at 2 (Dec: 0), pointing to mixed investment activity.

-

The employment index was unchanged at 5 (Dec: 5; Nov: 1), and the forward-looking employment index increased to 20 (Dec: 14), reflecting firmer hiring expectations.

-

The wages index rose to 20 (Dec: 17; Nov: 12), indicating continued upward pressure on compensation.

-

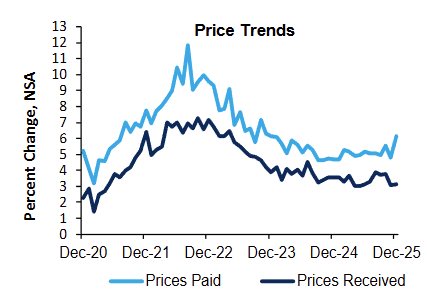

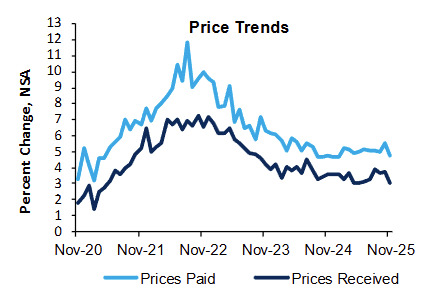

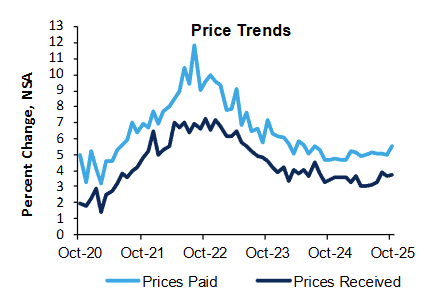

Prices paid growth slowed to 4.29% (Dec: 6.13%), while prices received edged up to 3.36% (Dec: 3.16%), showing easing input costs alongside slightly firmer selling price growth.

-