RCM-TIPP Consumer Sentiment Survey

RCM-TIPP Consumer Sentiment Survey

- Source

- RealClear Media Group

- Source Link

- https://www.realclearmarkets.com/

- Frequency

- Monthly

- Next Release(s)

- February 3rd, 2026 10:00 AM

Latest Updates

-

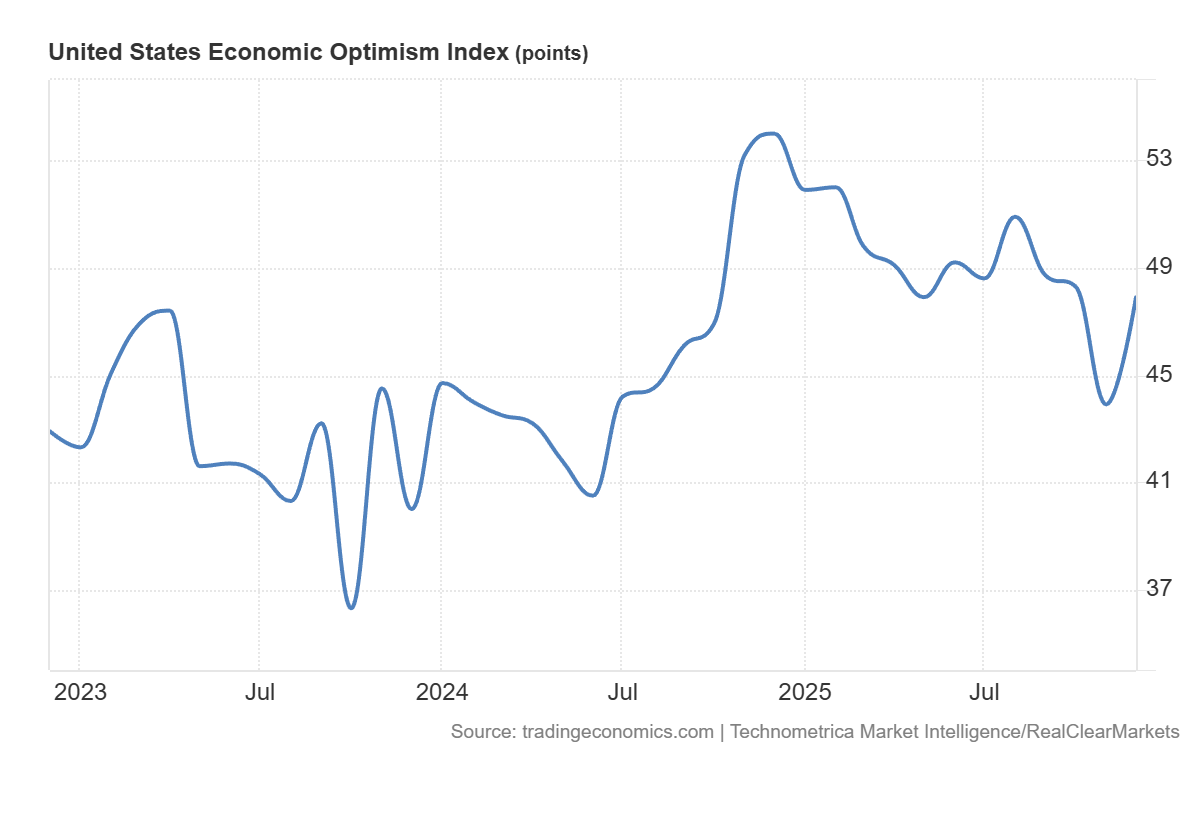

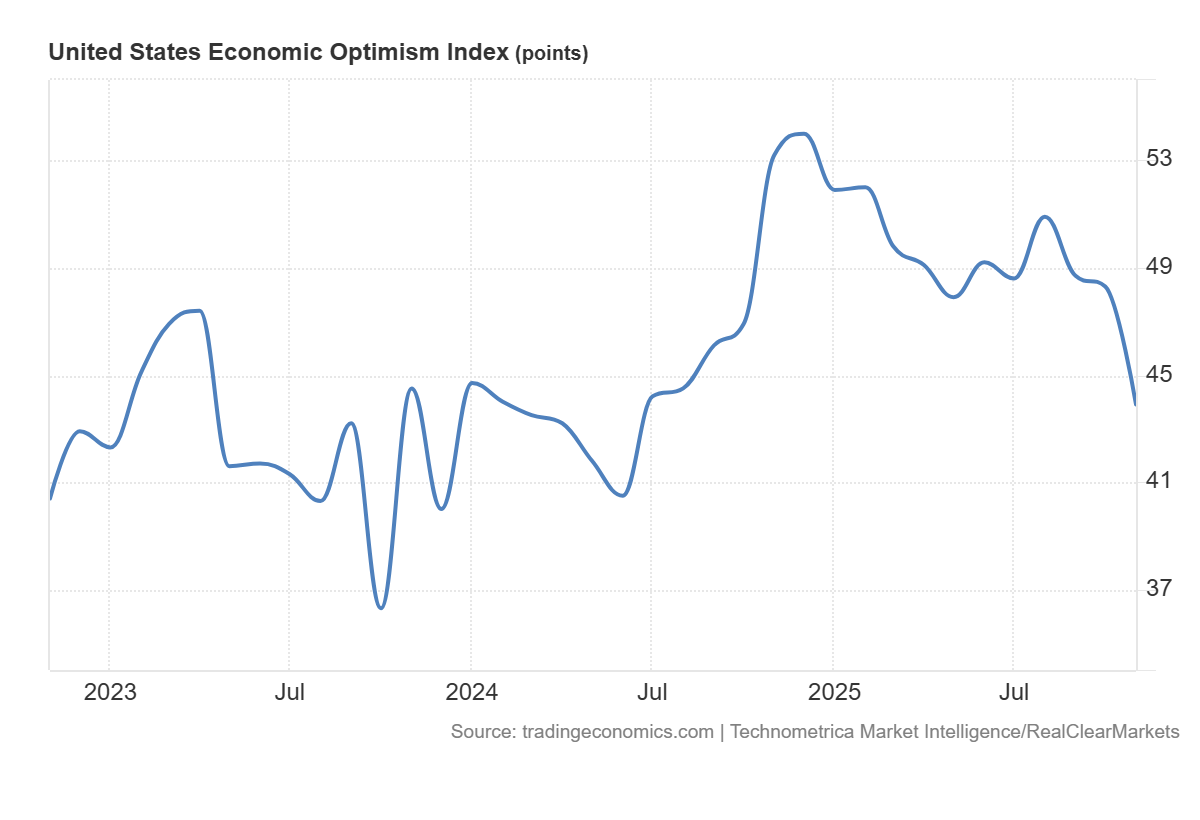

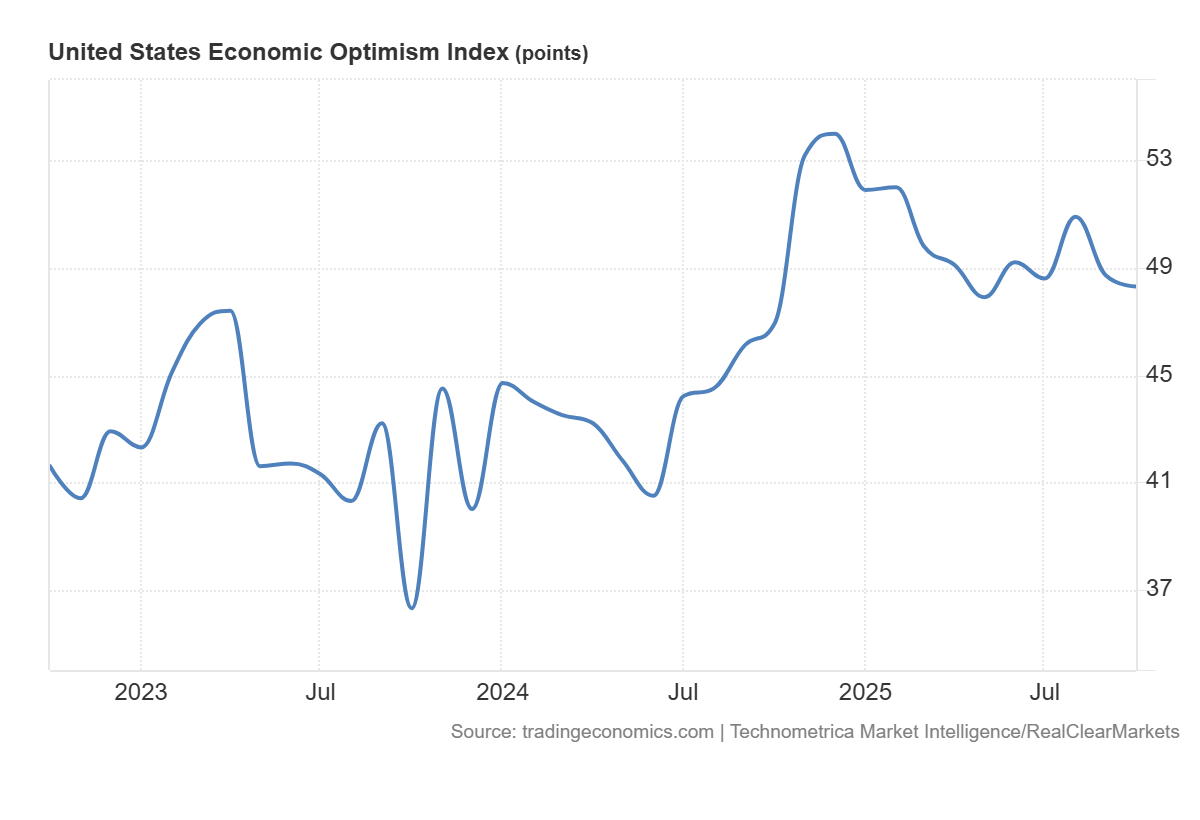

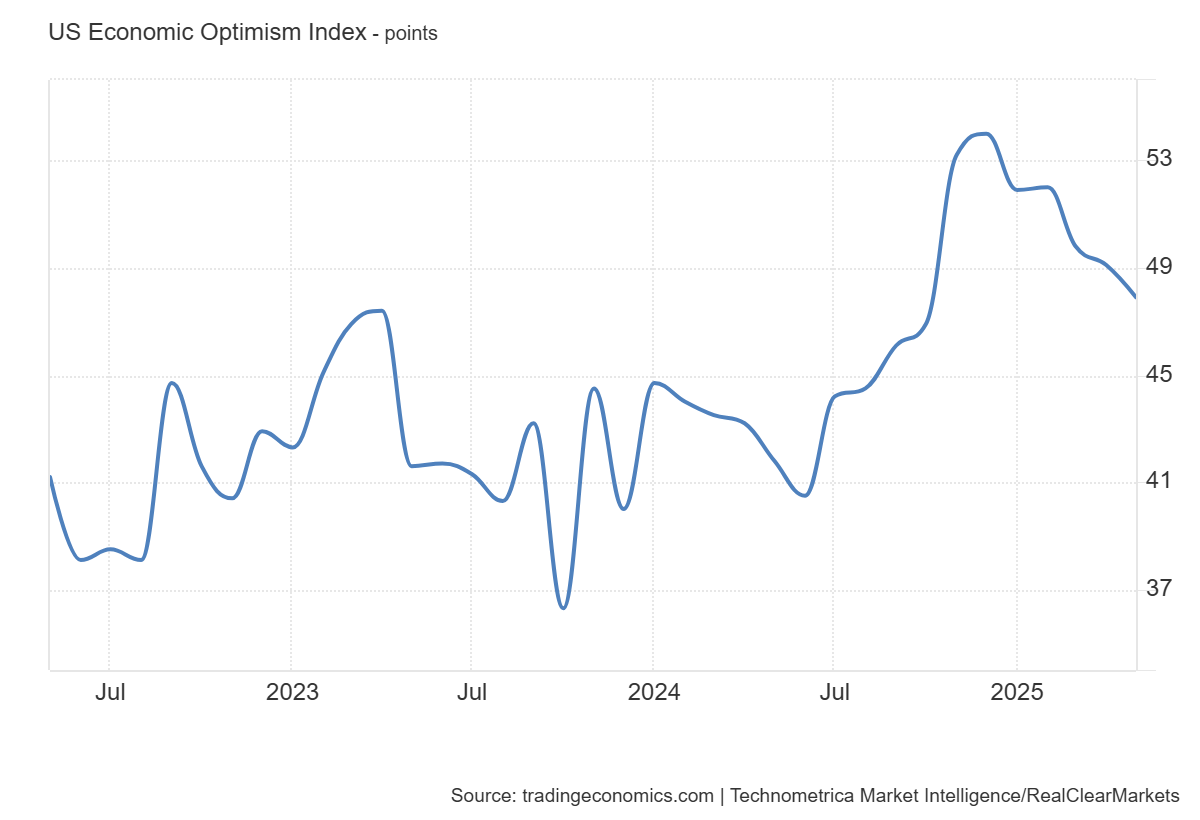

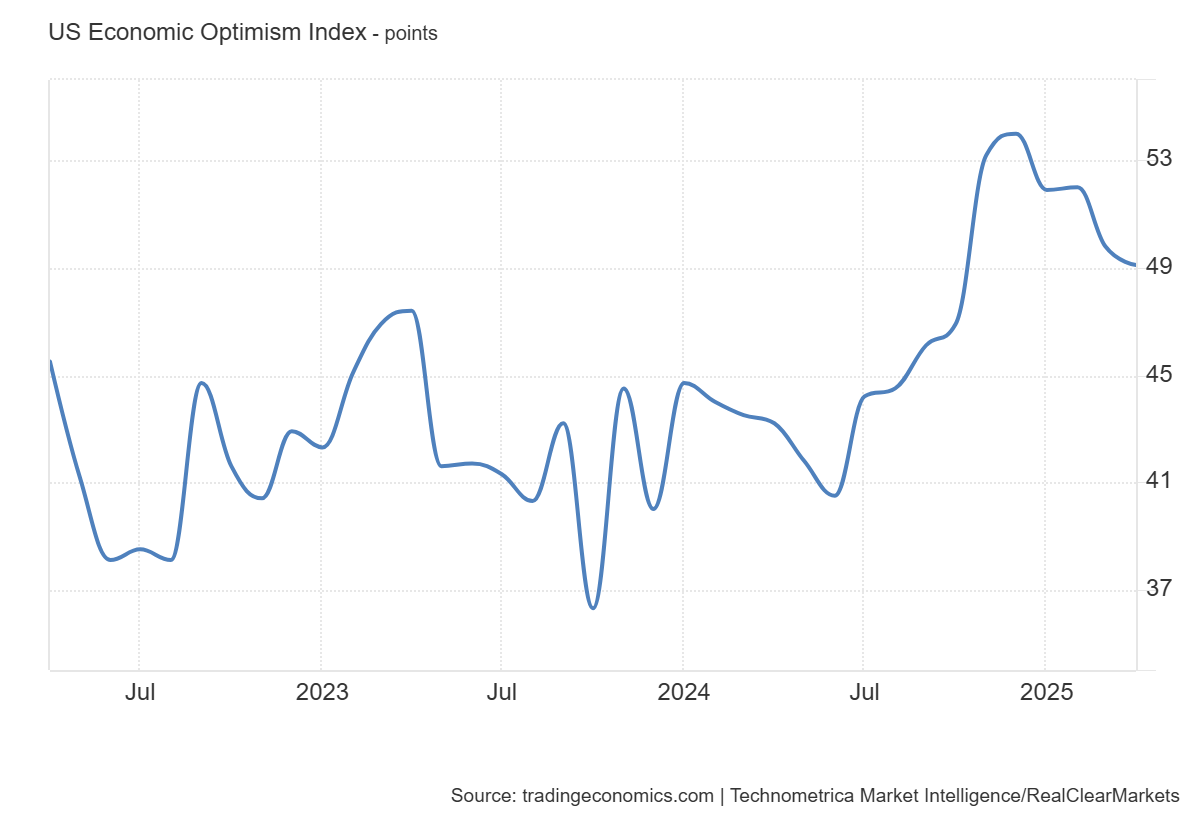

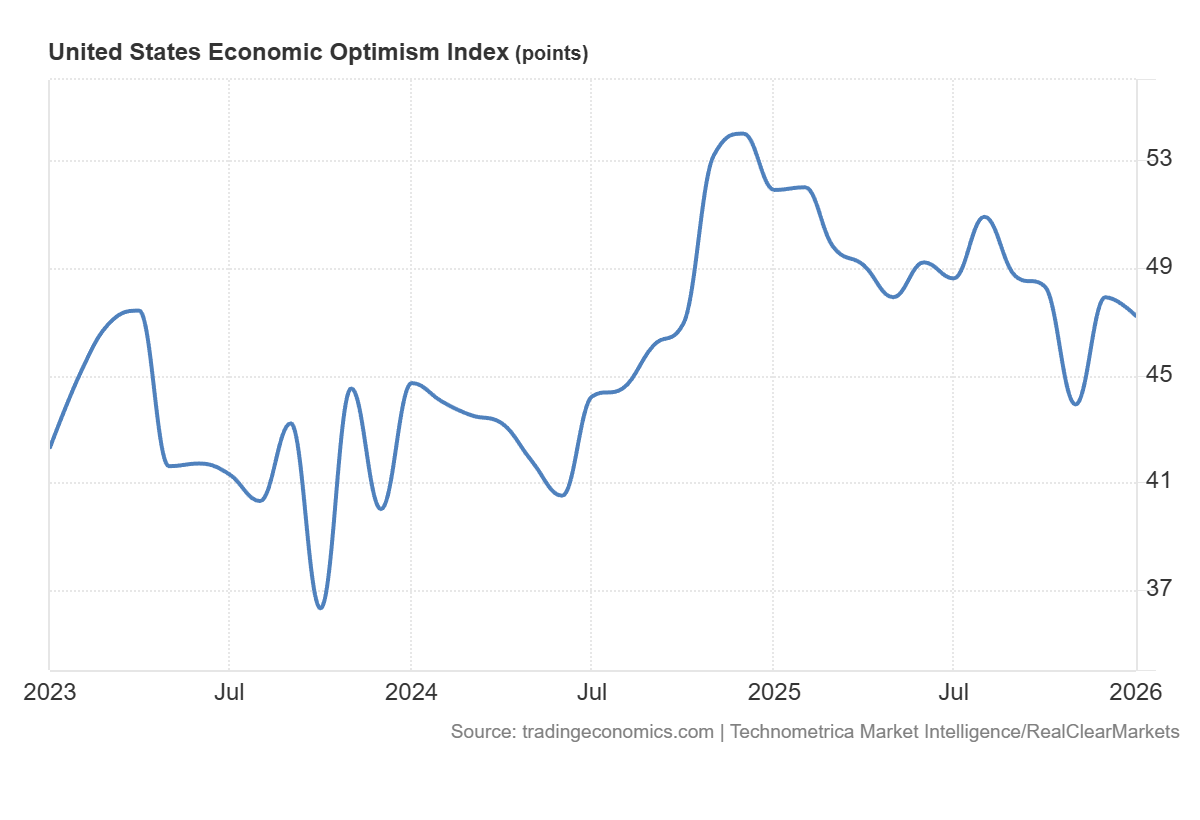

The RCM/TIPP Economic Optimism Index slipped to 47.2 in January (-1.5% MoM, -3.9% vs long-run average), showing slightly softer consumer confidence while remaining below the neutral 50 threshold.

-

The headline index fell 0.7 pts MoM from 47.9 to 47.2, leaving optimism below 50 for a fifth straight month and keeping sentiment in the report’s “pessimistic zone.”

-

January’s 47.2 reading is 3.9% below the 300-month historical average of 49.1, indicating confidence remains subdued relative to longer-run norms.

-

Investor confidence weakened -9.0% MoM (-5.4 pts) to 54.5, while non-investor confidence rose +4.1% (+1.7 pts) to 43.5, narrowing the investor/non-investor gap from 18.1 to 11.0 pts.

-

The Six-Month Economic Outlook declined -2.5% MoM from 44.4 to 43.3, indicating softer expectations for near-term economic conditions.

-

The Personal Financial Outlook rose +1.7% MoM from 54.0 to 54.9, the only one of the three major components to improve in January.

-

Confidence in Federal Economic Policies fell -4.2% MoM from 45.4 to 43.5, pointing to weaker assessments of government economic policy effectiveness.

-

The Financial-Related Stress Index declined -2.0% MoM (-1.3 pts) from 64.2 to 62.9, signaling slightly easing financial strain, though stress remained +4.0% above the long-run average of 60.5.

-

Demographic breadth weakened: 7 of 21 groups were above 50 in January (vs 6 in December), but only 9 groups improved (vs 21 improving in December), showing less broad-based momentum.

-