The Reserve Bank of Australia cut its cash rate target for the second time this year at the conclusion of its May meeting in response to further progress on inflation and heightened uncertainty in the economic outlook. The market was surprised by the dual softening on inflation and growth and responded with a significant shift in the bond market.

Monetary Policy Decision

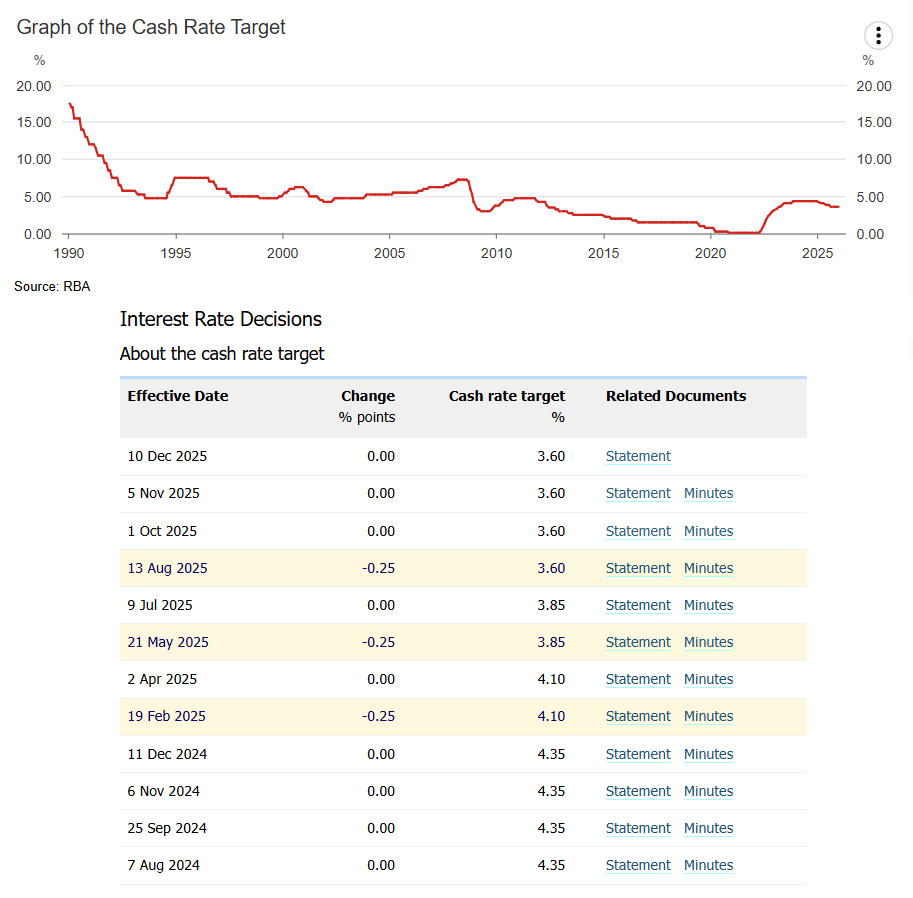

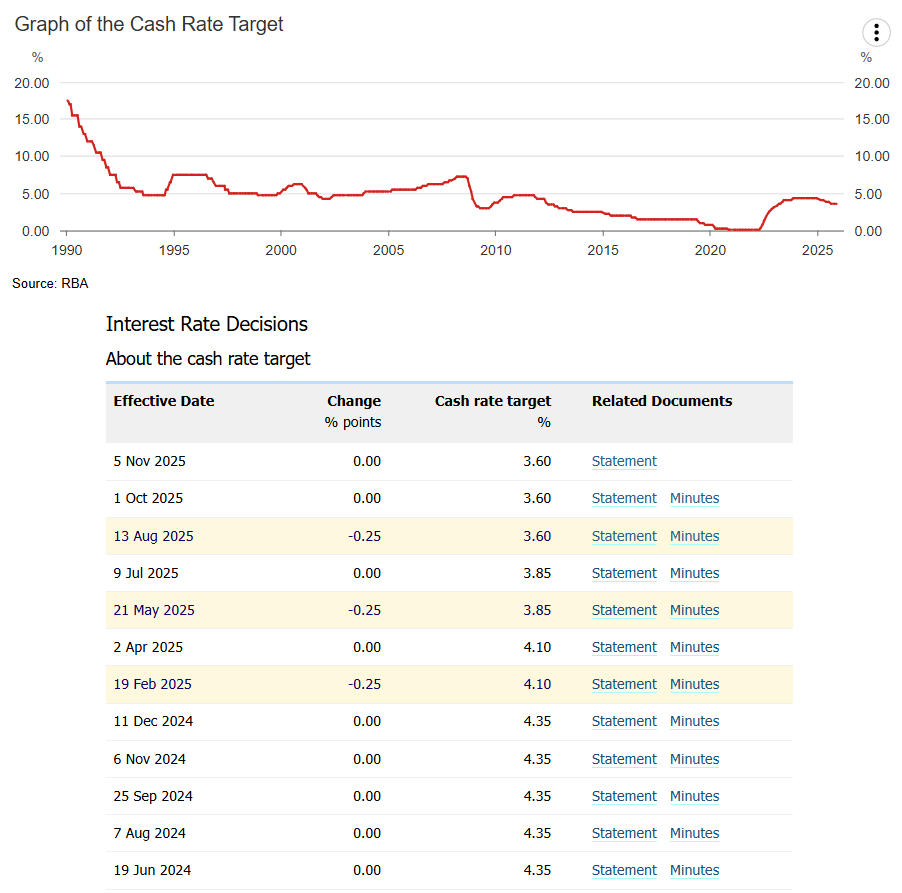

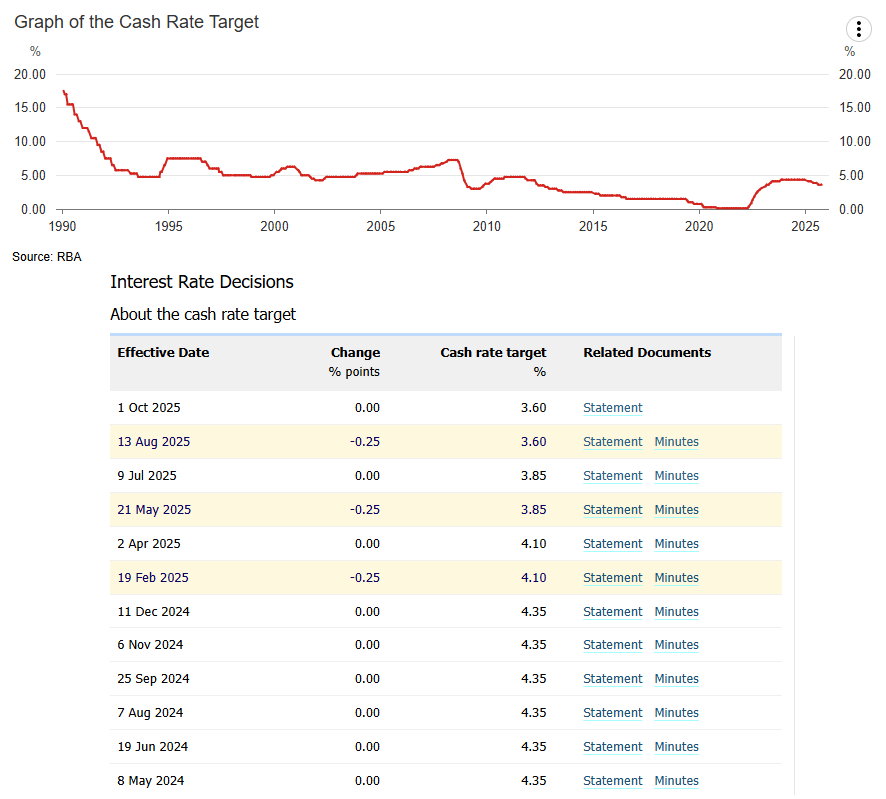

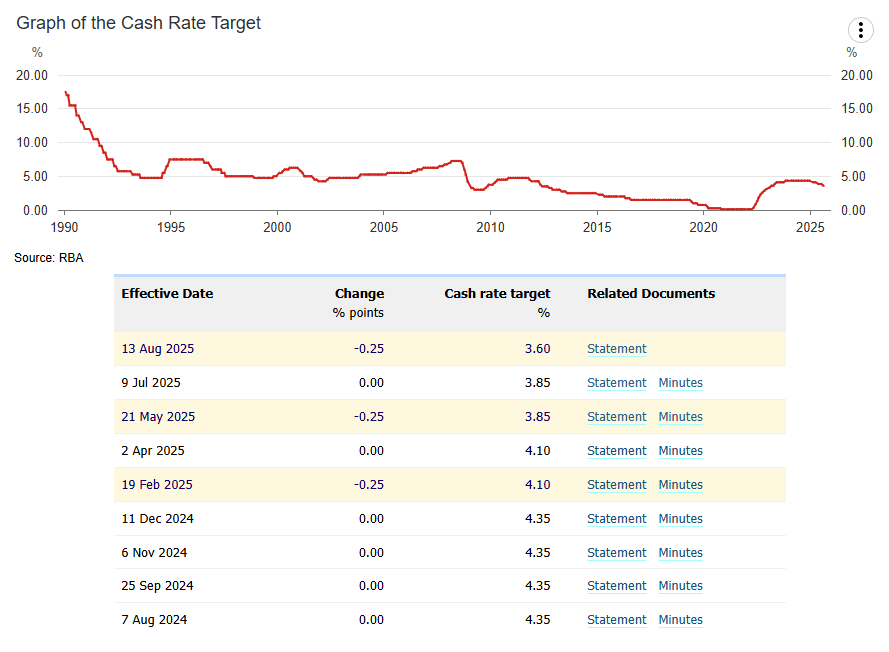

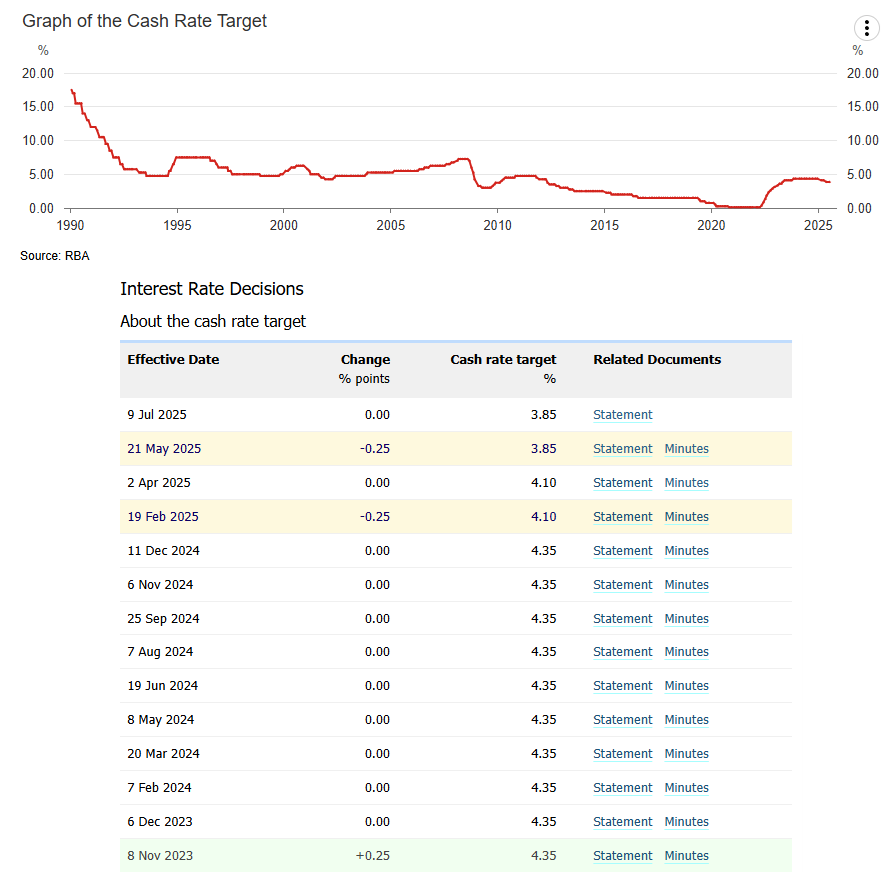

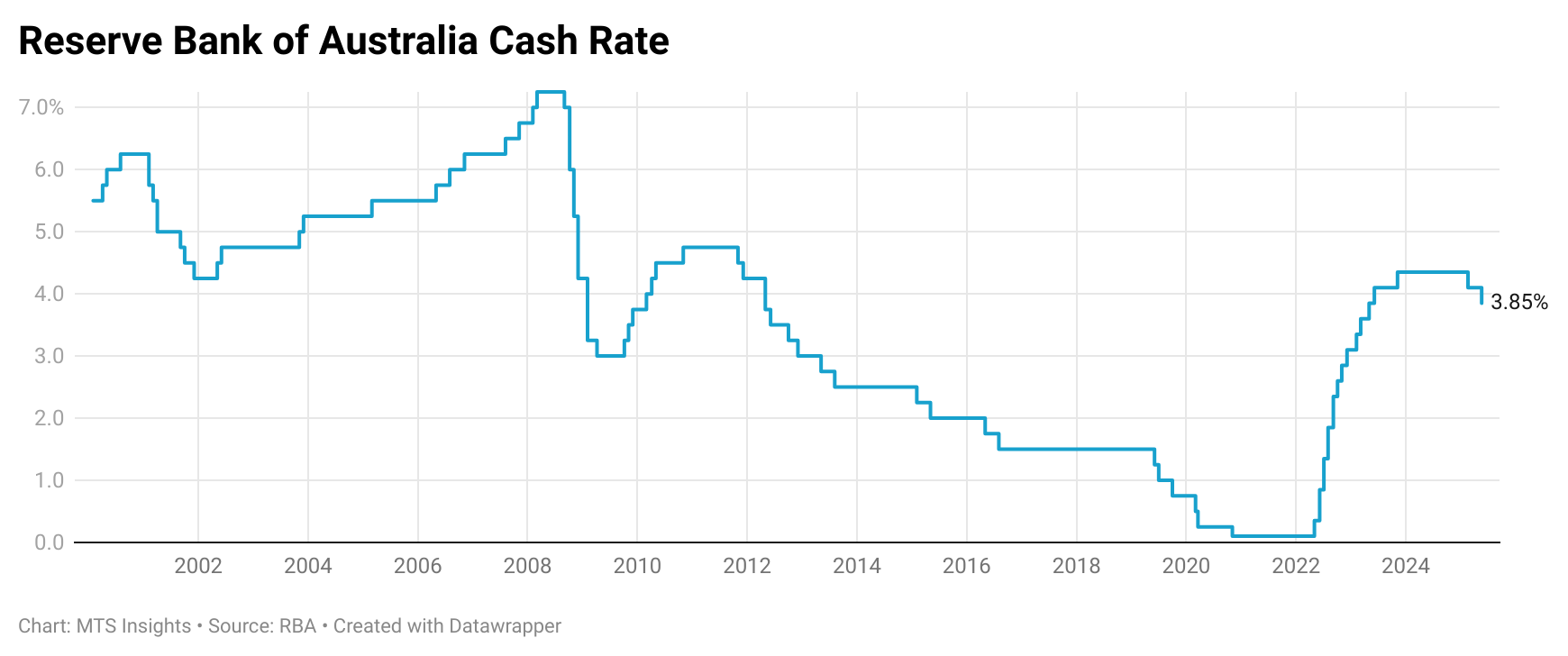

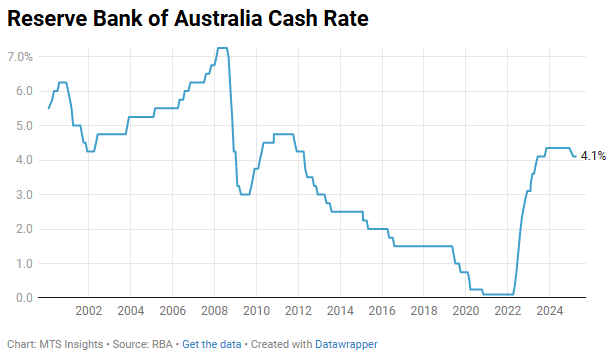

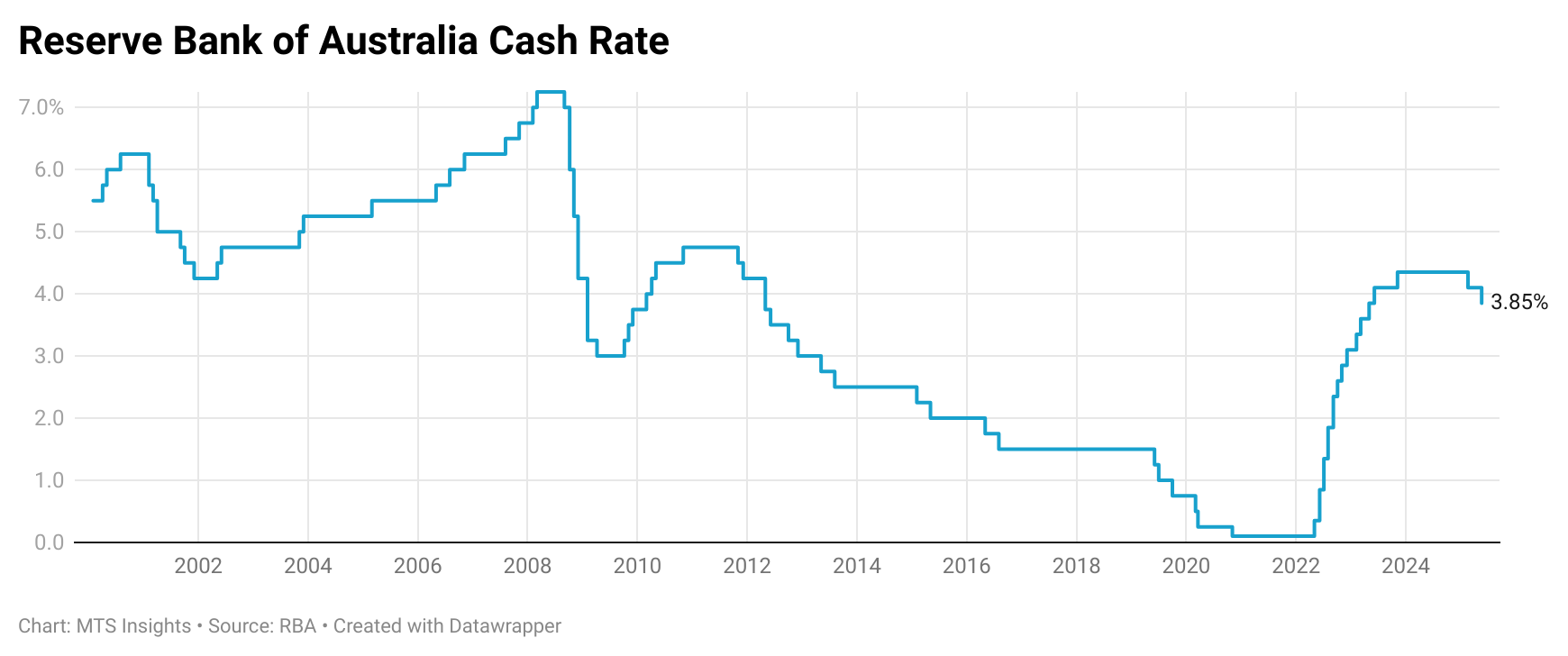

The Reserve Bank of Australia announced a 25 bps cut to its cash rate target, bringing it down to a two-year low of 3.85% as analysts broadly expected. The decision to cut was the second since the February 2025 meeting when the RBA decided to lower the rate from the 4.35% level it had established back in November 2023. February’s and today’s cuts were separated by a pause in early April, suggesting that the Reserve Bank Board is beginning a gradual cutting cycle to slowly pull back from what it sees as restrictive monetary policy.

The RBA’s decision to cut was driven by two key factors which are common factors across most of the major central banks, moderating inflation and intensifying uncertainty:

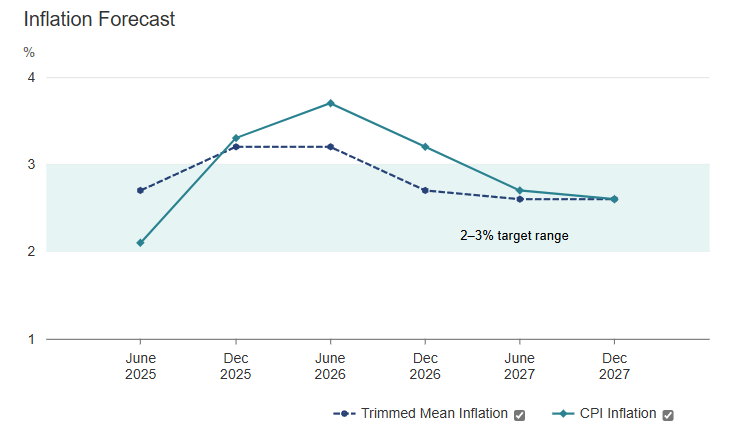

- Its first justification for a rate cut is based in the RBA’s observation that inflation continues to moderate. It points to data in Q1 2025 as “evidence that inflation continues to ease.” Forecasts released following the May meeting suggest inflation could rise over the next year to the top of the inflation target range, but the RBA expects underlying inflation to be “around the midpoint of the 2–3% range throughout much of the forecast period.”

- The other reasoning for a rate cut was the increase in uncertainty in the economic outlook due to “international developments.” The RBA dismisses some of the recent de-escalation between the US and China and says that there is still “considerable uncertainty about the final scope of the tariffs and policy responses in other countries.” The developments have led the RBA to have a weaker outlook for Australian growth, employment, and inflation. It is important to note that the Board sees trade uncertainty as a factor weakening inflation and not stoking it.

As expected, the RBA does not end its announcement with clear guidance on a path forward but rather the usual insistence that it will remain “attentive to the data.” That more neutral stance gives way to more dovish hints that it sees risks as more heavily weighted to the downside “given the heightened level of uncertainty about both aggregate demand and supply.” In fact, the Board wanted to make it clear that it considered “a severe downside scenario” in which “monetary policy is well placed to respond to international developments.” This suggests to me that the RBA will continue with a more gradual pace of easing, if inflation trends as expected, but it will accelerate easing if economic conditions demand it.

Statement on Monetary Policy

The May monetary policy decision coincided with the release of updated forecasts and commentary on the outlook that were last updated during the February meeting. This gap means the RBA has had a chance to digest the trade developments over the last three months and consider how it impacts the economic outlook. Here are some key results.

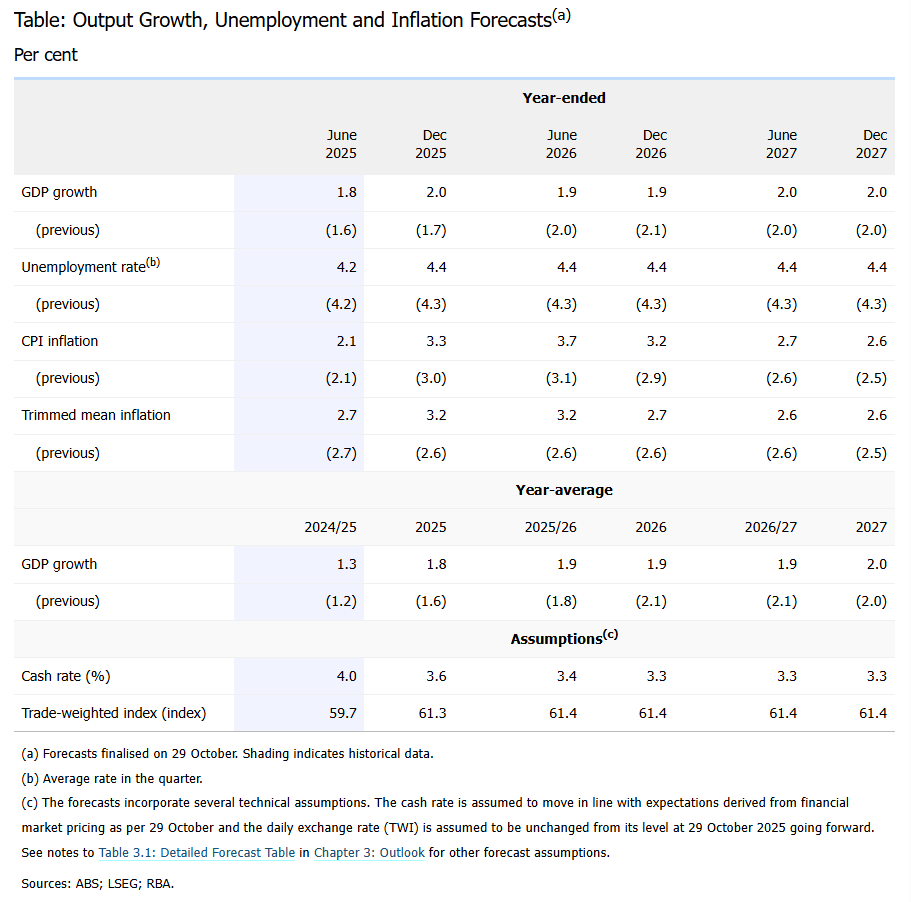

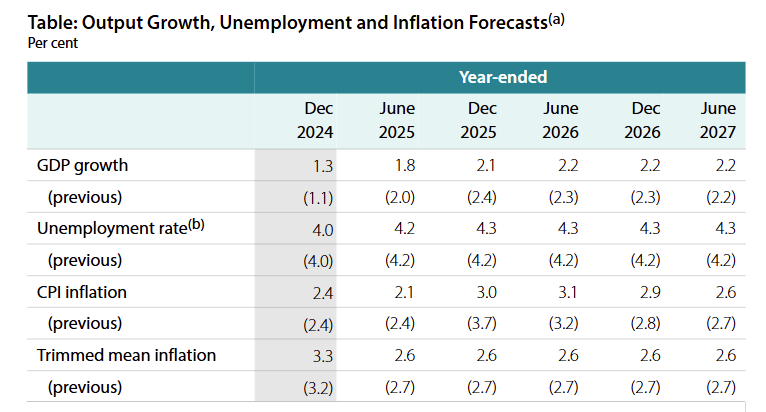

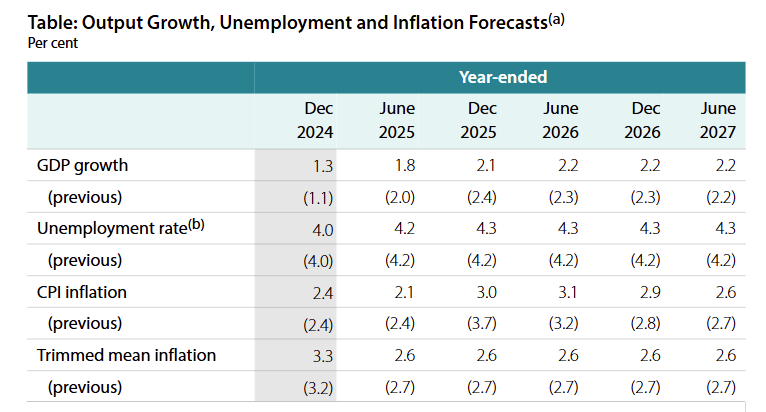

- The RBA broadly revised its forecast for growth over the next two years with the most significant downgrades in 2025. While it continues to see growth accelerating out of Q4 2024, the projection of that acceleration through Q2 2025 and through Q4 2025 have fallen -0.2 ppts and -0.3 ppts, respectively. It also sees weaker long-term baseline growth through 2027. The forecast update is almost entirely based on a deterioration in the outlook for the global economy which is expected to result in “softer global demand and weaker consumption momentum.” The RBA also notes that the forecast assumption includes a “lower market path for the cash rate” which means that the lowering of growth expectations was cushioned by the expectation of less restrictive policy.

- The RBA’s views of the labor market are the most optimistic. While it does have weaker growth expectations, it doesn’t necessarily see that translating to a significant rise in unemployment. The updated forecast for unemployment was only revised up 0.1 ppt through the end of 2025 with a higher baseline unemployment rate of 4.3% through 2027. This tight view of the labor market would give the RBA plenty of leeway to ease monetary policy if unemployment starts to trend against its forecasts.

- The inflation forecast saw the most significant changes from the February report to the May report. The projection of CPI inflation has shifted from moving significantly outside the target range in 2025 to 3.7% to staying just inside that range at 3.0%. The large adjustment is likely related to a lower energy commodity prices which have brough energy inflation expectations down sharply. The underlying inflation (trimmed mean inflation) outlook was broadly shifted down 1 ppt to 2.6% over the next two years. This downward revision comes from the expectation that “the trade conflict will be disinflationary for Australia and that the softer outlook for domestic growth will return the economy and labour market closer to balance.”

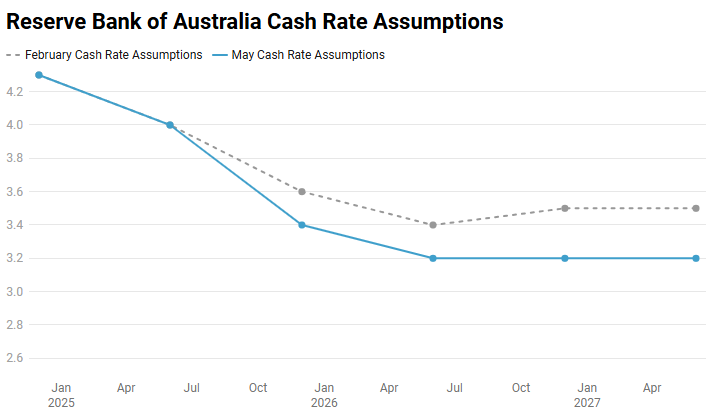

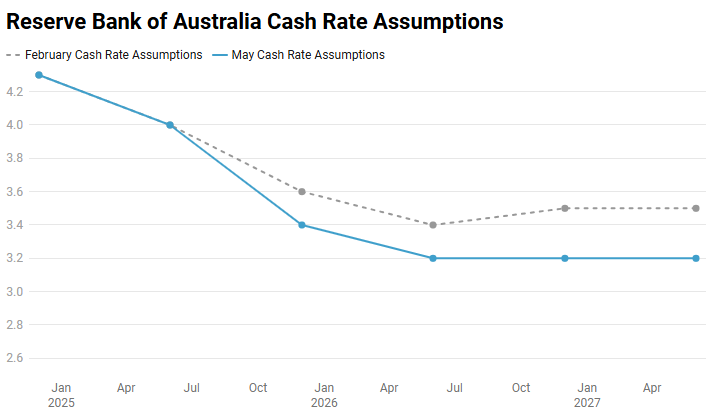

One further thing to note about the updated forecasts is that the assumptions used for the cash rate have moved significantly. This measure isn’t a forecast set by the RBA but, instead, are expectations derived from financial market pricing. It shows that the cash rate is expected to drop to 3.4% by the end of 2025 instead of the previous expectation of 3.6%. This roughly equated to an additional expected 25 bps rate cut this year than what was expected in February. At the current pace of cutting (one cut every two meetings), the RBA would reach 3.35% in the November 2025 meeting.

RBA Monetary Policy Decision

RBA Monetary Policy Decision