PBoC Financial Statistics

PBoC Financial Statistics

- Source

- People’s Bank of China

- Source Link

- http://www.pbc.gov.cn/

- Frequency

- Monthly

- Next Release(s)

- October 14th, 2025 4:00 AM

Latest Updates

-

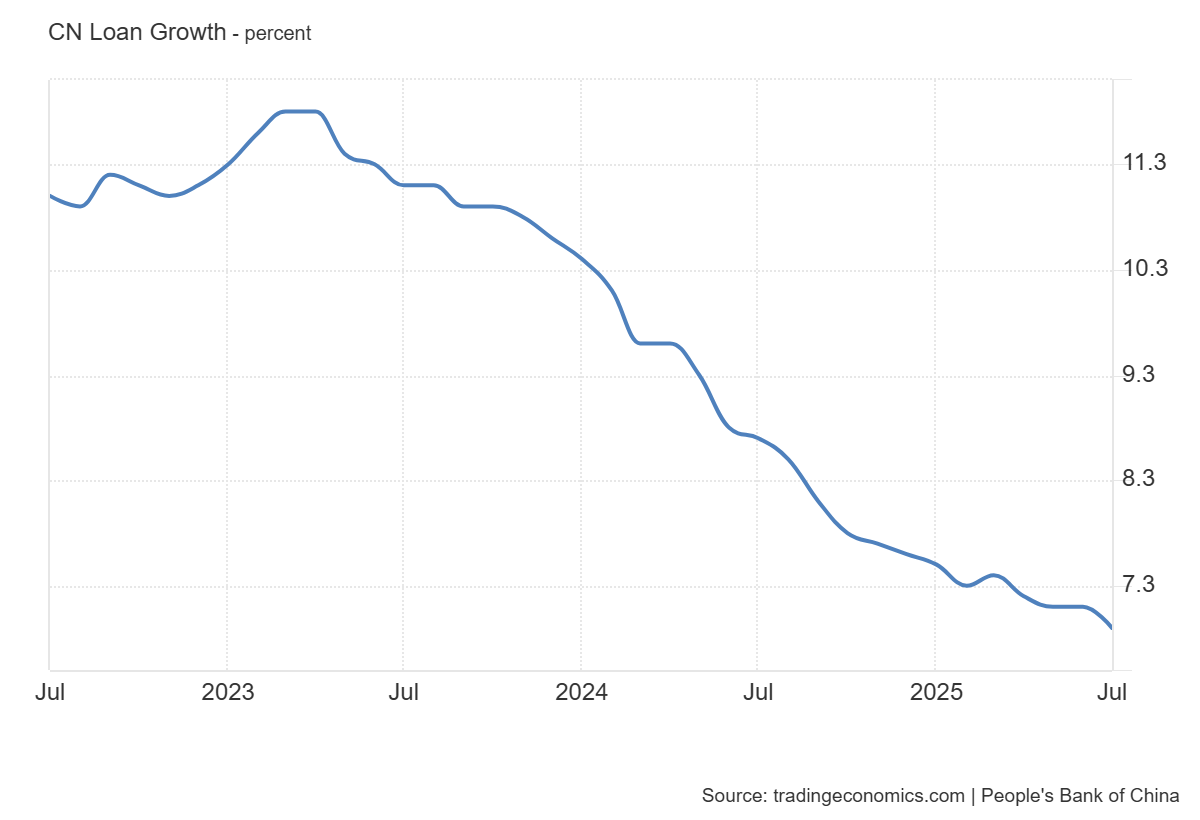

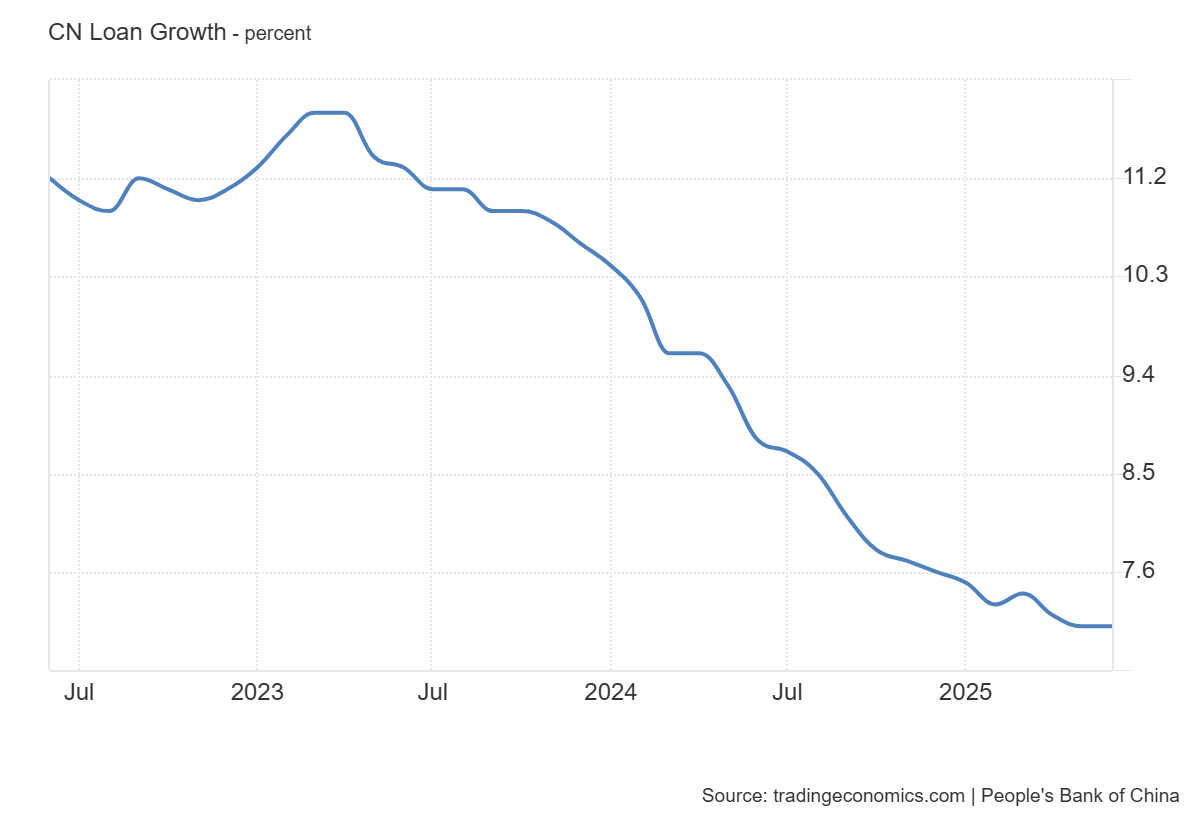

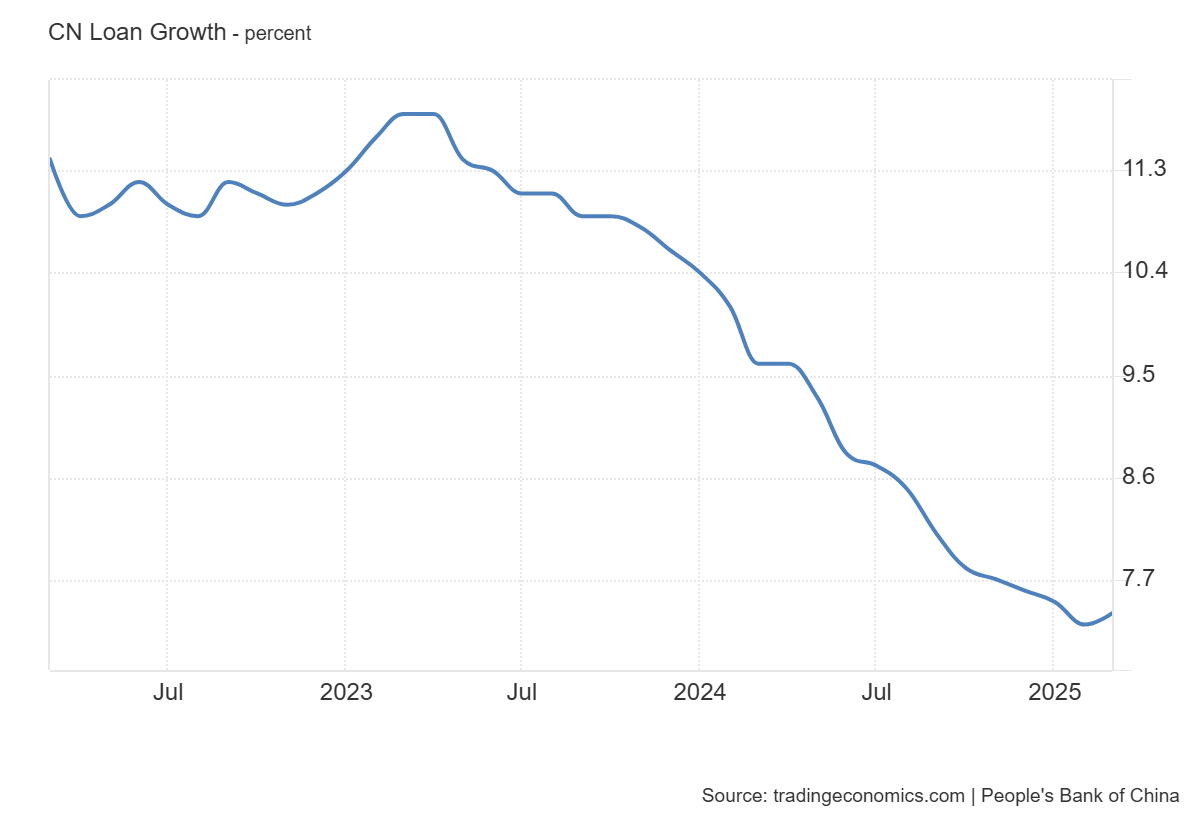

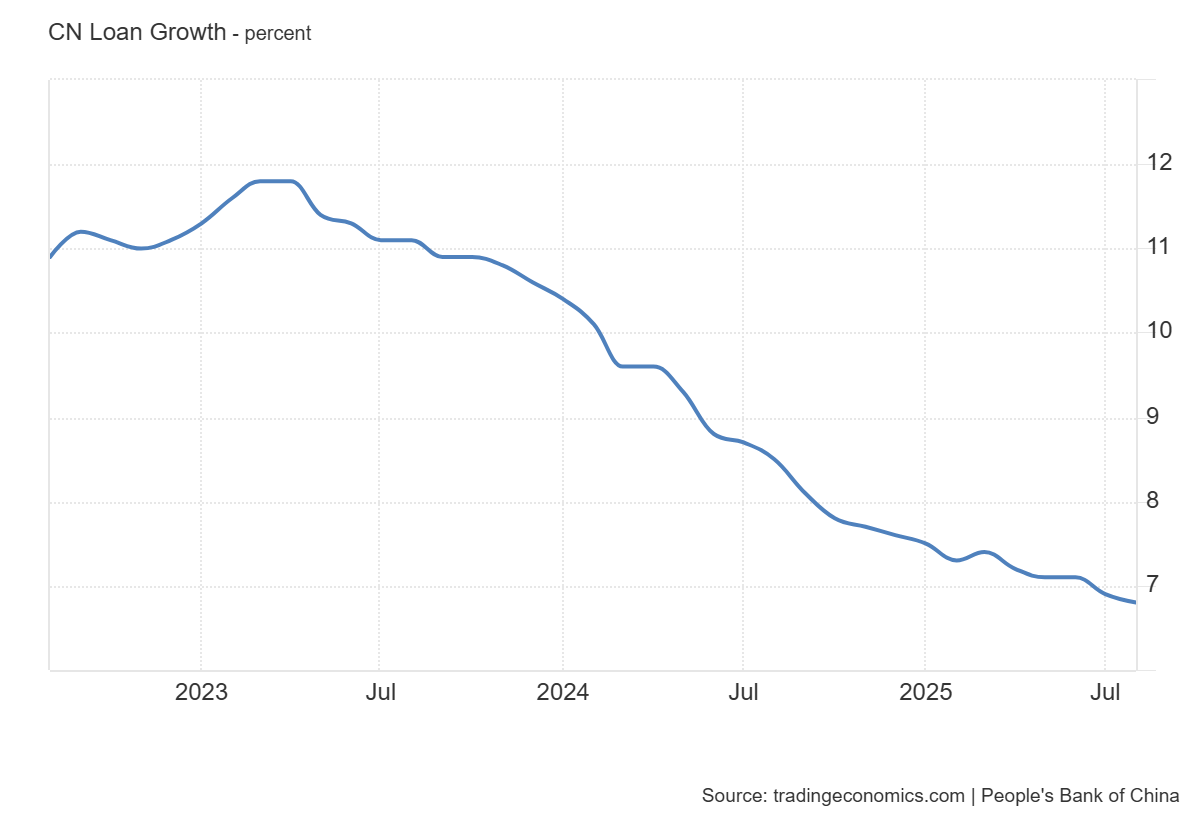

China’s M2 money supply rose 8.8% YoY (vs 8.7% YoY expected) in August 2025, unchanged from July, while RMB loan growth slowed to 6.8% YoY (vs 6.9% YoY expected), reflecting softer credit expansion despite steady liquidity growth.

-

Narrow money (M1) rose 6.0% YoY, while cash in circulation (M0) accelerated to +11.7% YoY, with ¥520.8 billion net cash invested YTD.

-

RMB loans increased ¥590 billion (vs ¥800 billion expected) in August and ¥13.46 trillion YTD, led by enterprise lending (+¥12.22 trillion), while household loans rose only ¥711 billion as short-term credit contracted.

-

RMB deposits expanded ¥20.5 trillion YTD, with household deposits (+¥9.77 trillion) and non-bank financial institutions (+¥5.87 trillion) the main drivers.

-

Foreign currency loans fell -7.1% YoY, while foreign currency deposits surged +19.4% YoY, highlighting ongoing FX liquidity shifts.

-

Interbank rates remained low: lending averaged 1.4% (-5 bps MoM; -37 bps YoY) and repo 1.41% (-5 bps MoM; -38 bps YoY), supporting ample liquidity conditions.

-

Social financing stock reached ¥433.66 trillion (+8.8% YoY), with government bonds (+21.1% YoY) the strongest contributor, while corporate bond growth slowed (+3.7% YoY) and trust loans picked up (+5.5% YoY).

-

Cumulative social financing rose ¥26.56 trillion YTD, up ¥4.66 trillion YoY, driven mainly by record government bond issuance (+¥10.27 trillion, +¥4.63 trillion YoY).

-