Paychex Small Business Employment Watch

Paychex Small Business Employment Watch

- Source

- Paychex

- Source Link

- https://www.paychex.com/

- Frequency

-

Monthly

the 2nd Tues following the Thurs between the 17th and 23rd of the reference month, prior to the monthly BLS report.

- Next Release(s)

- February 3rd, 2026 8:30 AM

-

March 3rd, 2026 8:30 AM

-

March 31st, 2026 8:30 AM

-

May 5th, 2026 8:30 AM

-

June 2nd, 2026 8:30 AM

-

June 30th, 2026 8:30 AM

-

August 4th, 2026 8:30 AM

-

September 1st, 2026 8:30 AM

-

September 29th, 2026 9:00 AM

-

November 3rd, 2026 8:30 AM

-

December 1st, 2026 8:30 AM

-

January 5th, 2027 8:30 AM

Latest Updates

-

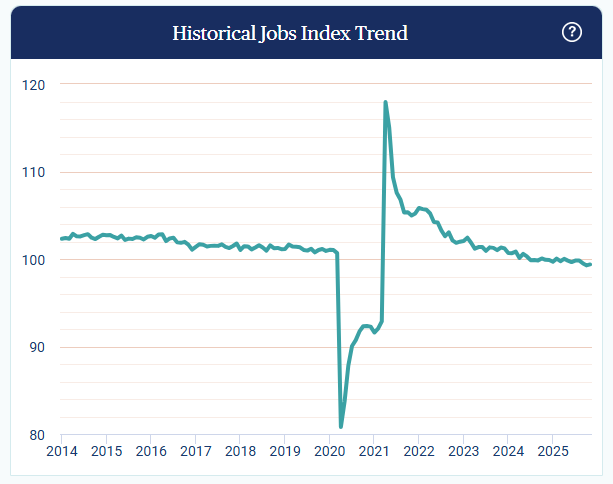

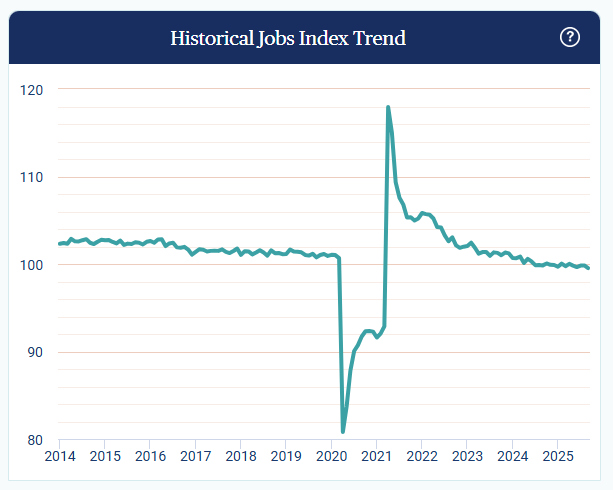

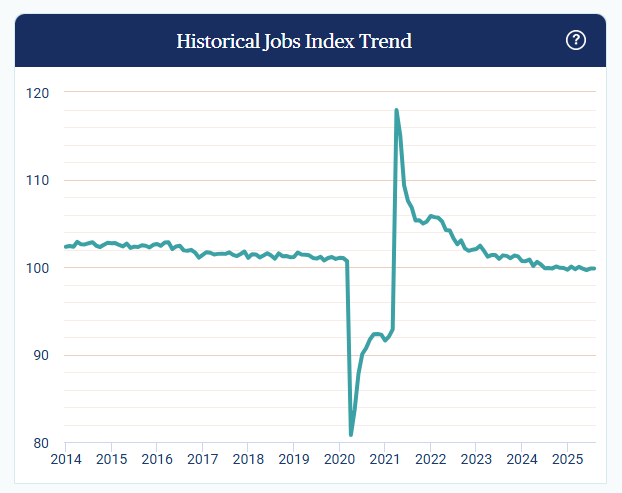

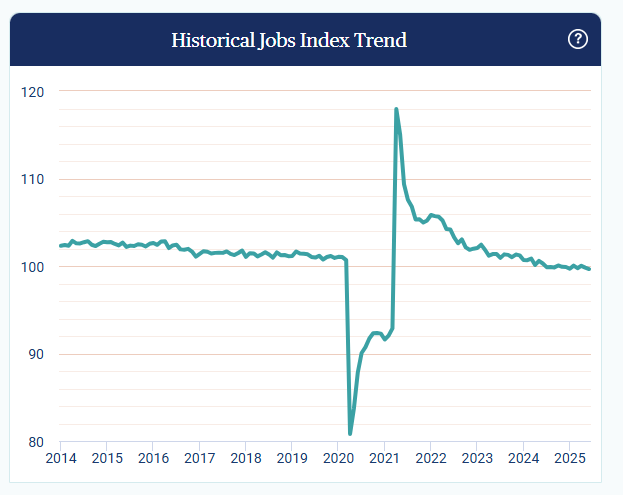

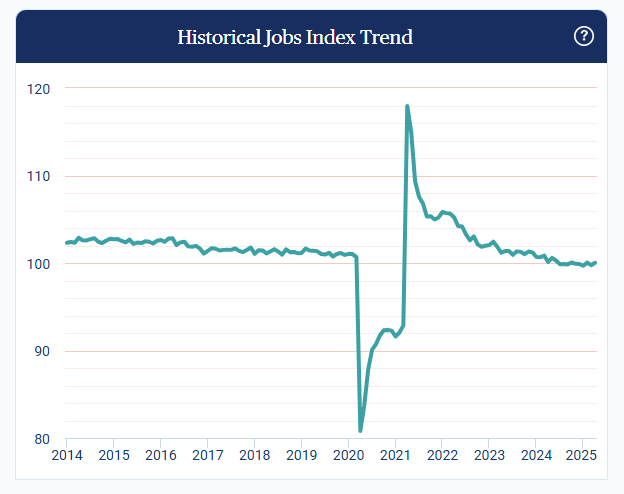

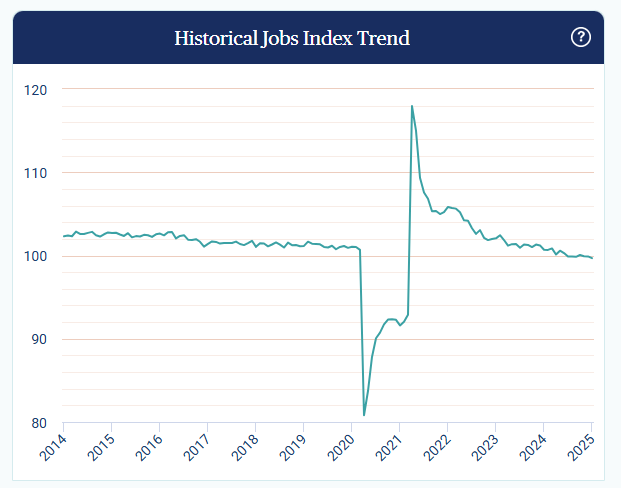

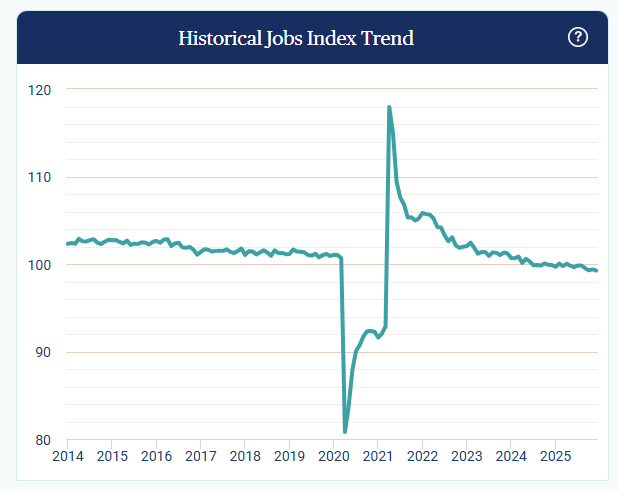

The Paychex Small Business Jobs Index ended December at 99.26 (2025 avg: 99.67 vs 100.22 in 2024), underscoring a continued multi-year slowdown in small business hiring.

-

The jobs index has decelerated steadily over the past four years, averaging 104.50 in 2021, 103.80 in 2022, 101.44 in 2023, 100.22 in 2024, and 99.67 in 2025, indicating a persistent cooling in small business employment growth.

-

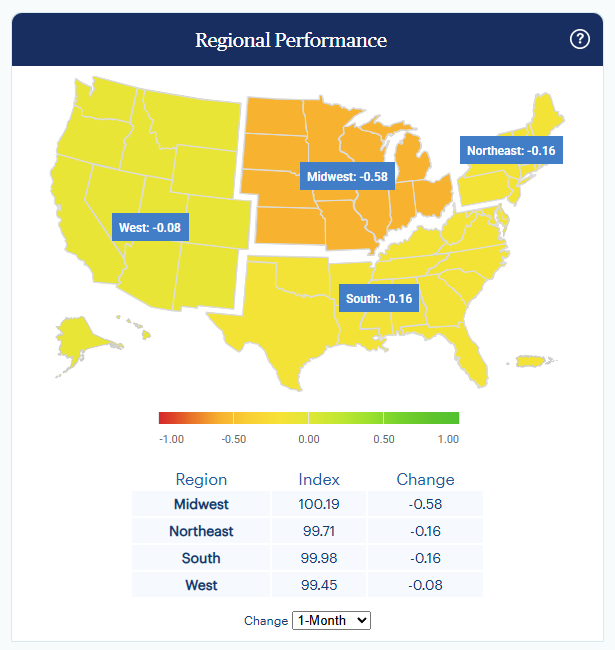

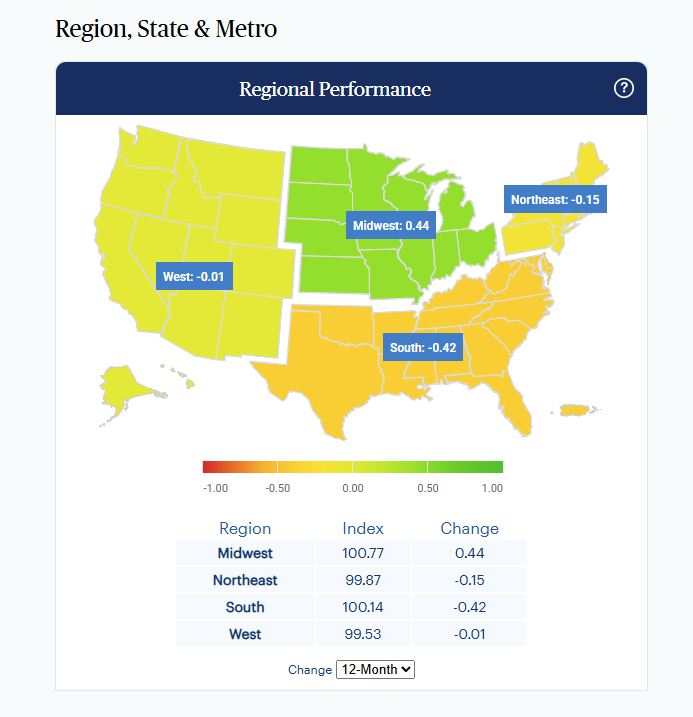

The Midwest averaged 99.65 in 2025 and tied with the Northeast at 99.65 in December, making it the strongest region for small business employment growth over the year.

-

The West averaged 98.72 in 2025 and has remained below the 100 baseline for 21 consecutive months, ranking last among regions every month since February 2025.

-

Indiana averaged 101.50 during 2025 and ranked first among states at both the start and end of the year, standing out as one of the few states with consistent above-baseline growth.

-

California and Washington both averaged below 99 in 2025, while Maryland was the only other state to remain below 99 for the full year, highlighting regional weakness concentrated on the coasts.

-

Texas averaged 100.44 in 2025 but fell to 98.56 in December, its lowest reading since March 2021 and nearly three points below its level at the end of last year.

-

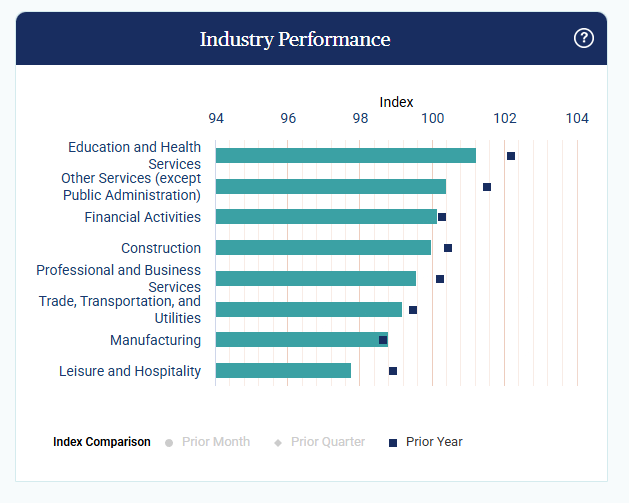

Education and Health Services led all sectors with a 2025 average of 100.49 and has posted positive growth for nearly five consecutive years, while Financial Activities slipped below 100 in December and Leisure and Hospitality ended 2025 as the weakest sector by both one- and three-month changes.

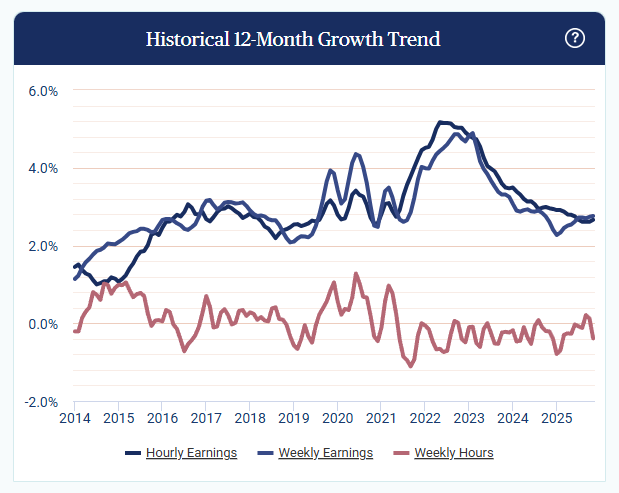

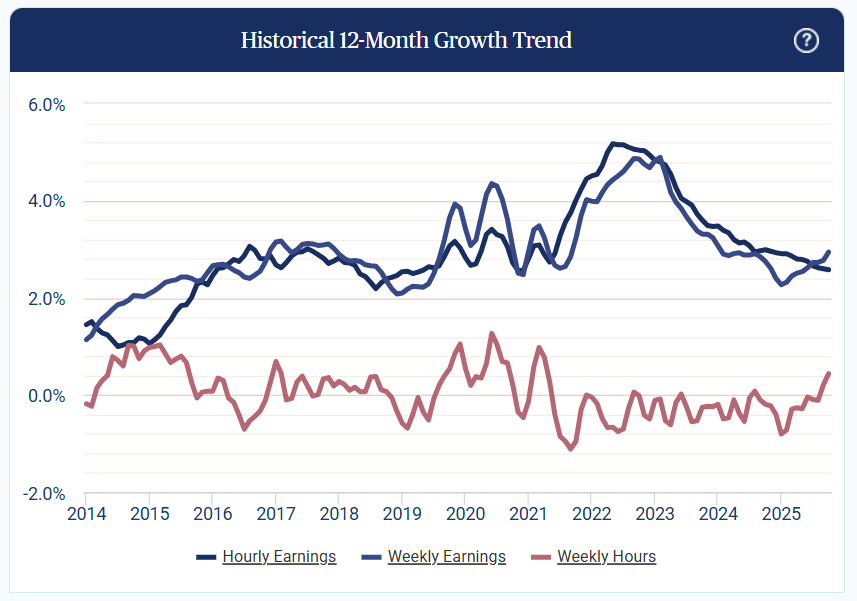

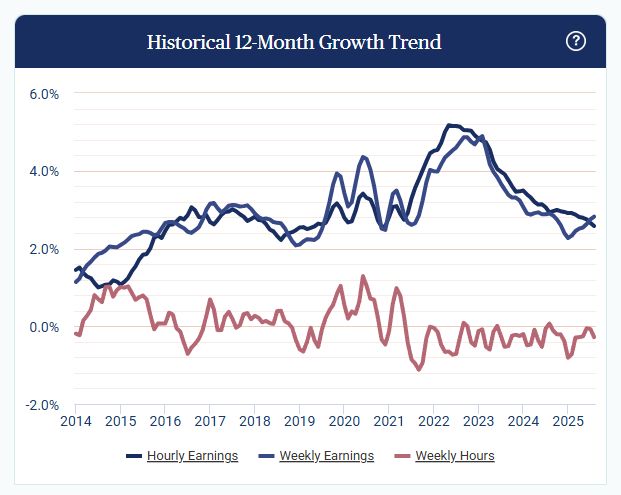

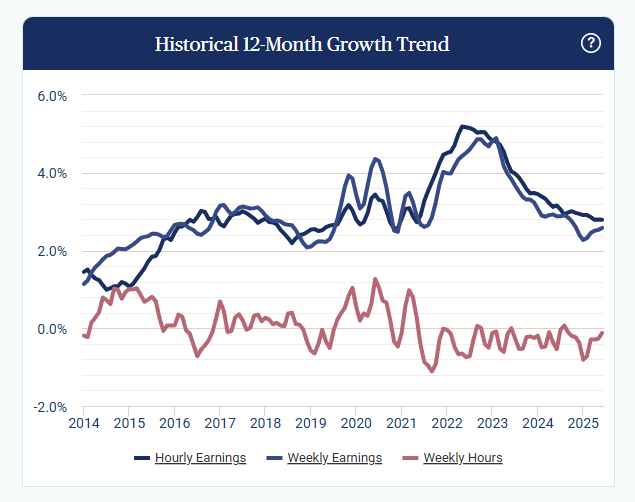

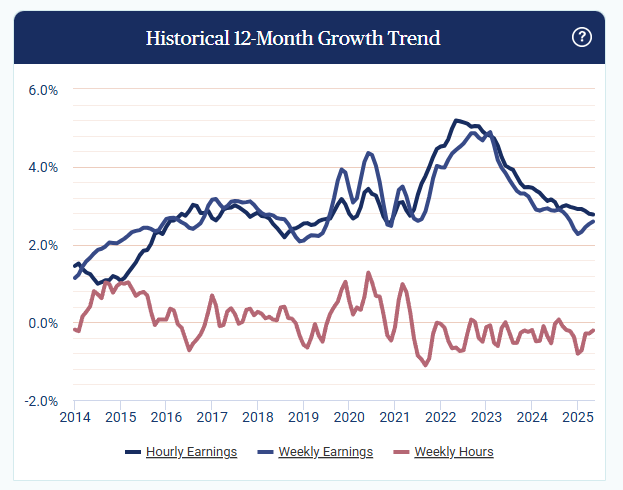

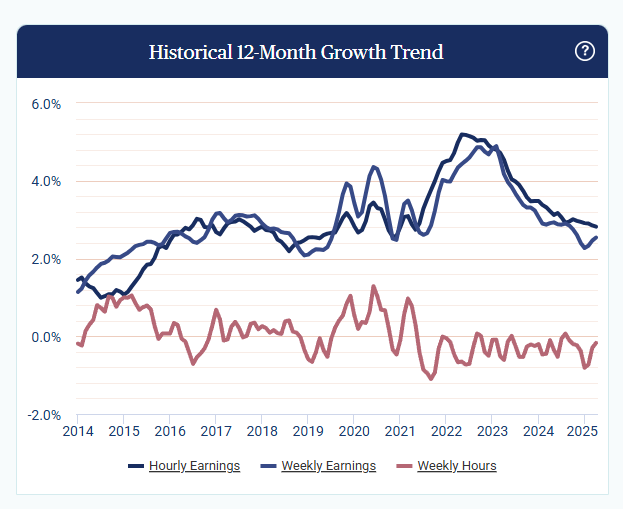

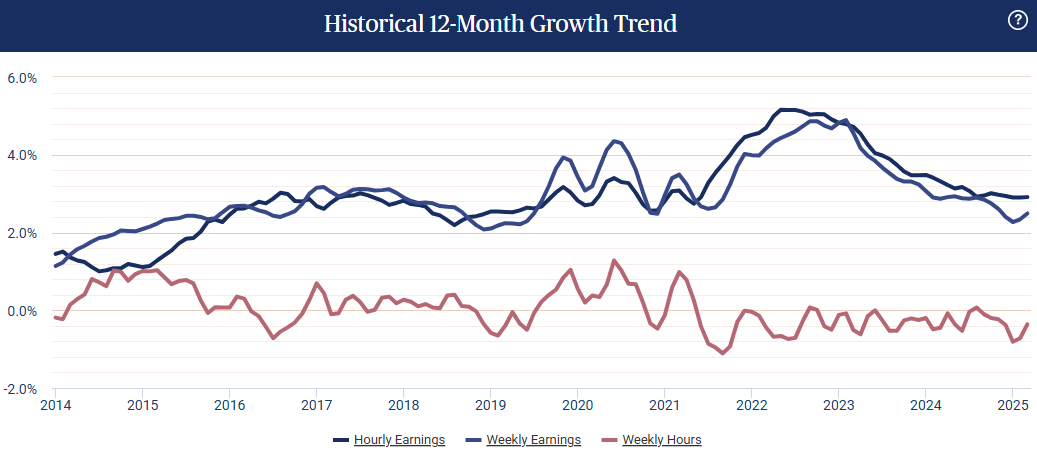

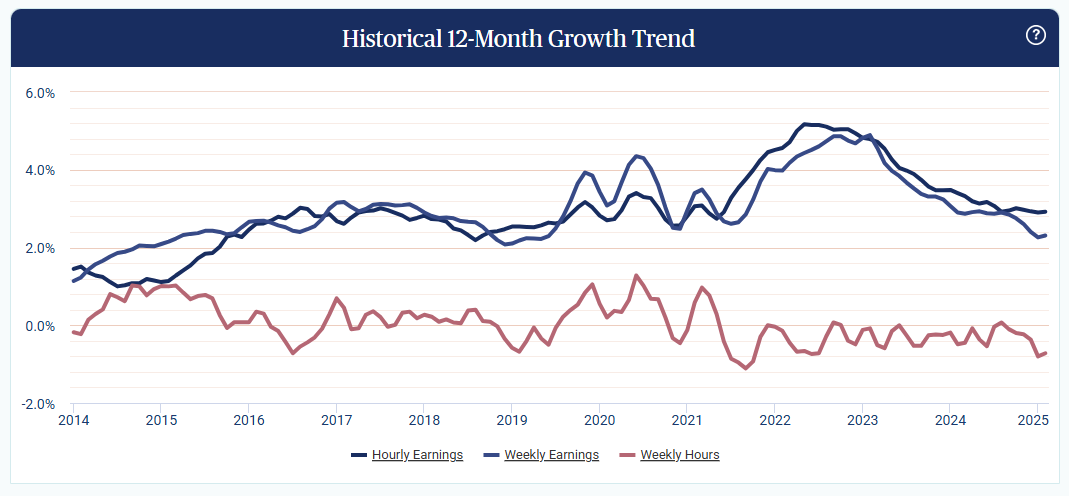

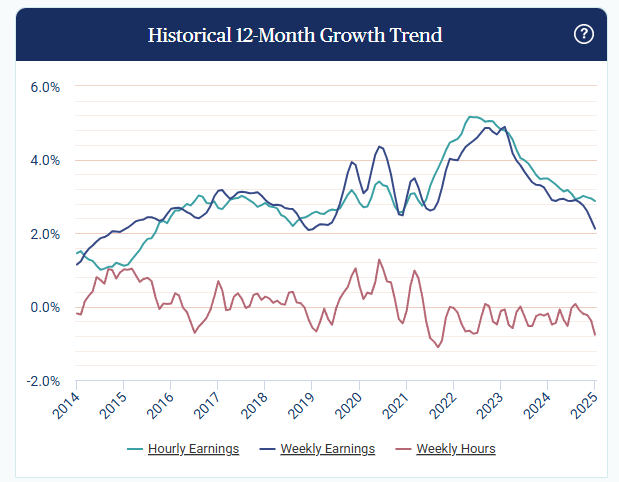

Hourly earnings growth rose to 2.71% YoY in December (vs 2.74% 2025 avg), as the short-term 1-month rate annualized accelerated to 3.43%, the highest of 2025.

-

Hourly earnings growth has remained below 3% since August 2024, marking 17 consecutive months of subdued annual wage growth despite recent incremental improvement.

-

One-month annualized hourly earnings growth accelerated to 3.43% in December, the highest level of 2025 and the strongest reading since January 2024, pointing to firmer short-term momentum.

-

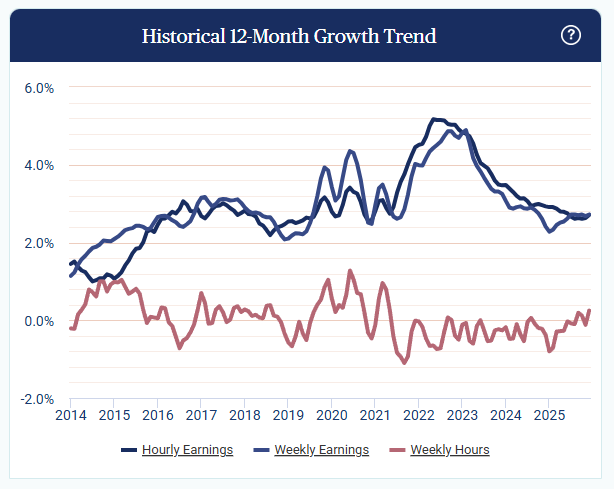

Weekly earnings growth increased to 2.72% YoY in December, ending the year above its 2025 average of 2.58%, suggesting broader gains when accounting for hours worked.

-

Weekly hours worked growth rose to +0.25% YoY, the highest level since May 2021, highlighting an improvement in labor utilization late in the year.

-

The Midwest led all regions in December and for full-year 2025, with hourly earnings growth at 2.95%, weekly earnings growth at 3.30%, and weekly hours worked growth at 0.42%.

-

The South posted the weakest hourly earnings growth at 2.47% for a seventh straight month, though weekly hours worked growth has remained positive for six consecutive months.

-

Indiana ranked first among states in December with hourly earnings growth of 4.21% and weekly earnings growth of 4.82%, followed by Illinois (3.51%) and Michigan (3.25%), reinforcing Midwest outperformance.

-

Manufacturing remained among the top three sectors for hourly earnings, weekly earnings, and weekly hours worked growth throughout 2025, while Education and Health Services ranked last for hourly earnings growth (2.40%) in Q4 and weekly earnings growth (2.23%) for the full year.

-