NRA Restaurant Performance Index

NRA Restaurant Performance Index

- Source

- National Restaurant Association

- Source Link

- https://restaurant.org/

- Frequency

-

Monthly

Last business day of month

- Next Release(s)

- January 30th, 2026 9:00 AM

Latest Updates

-

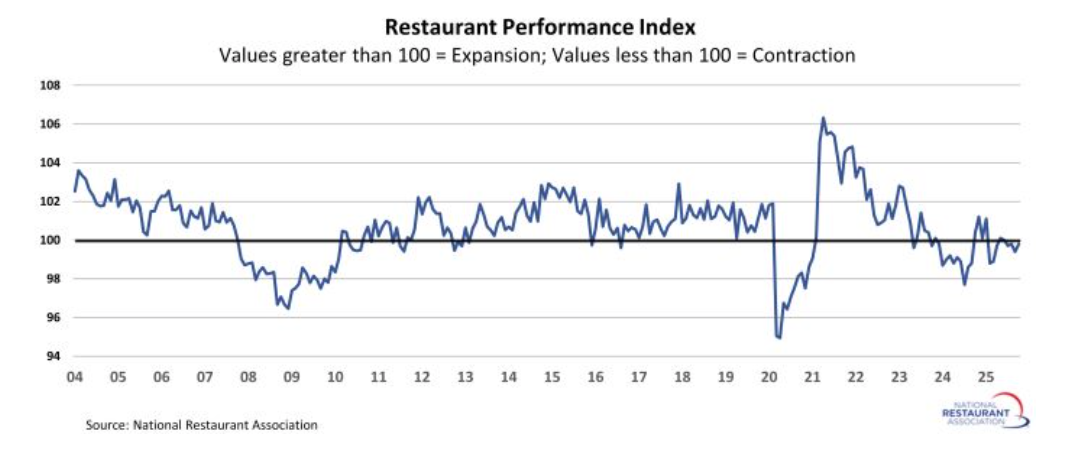

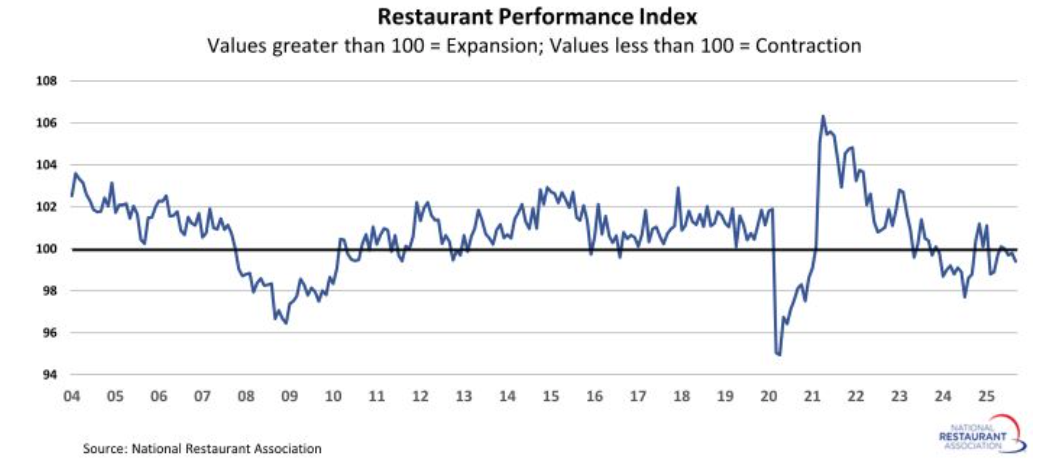

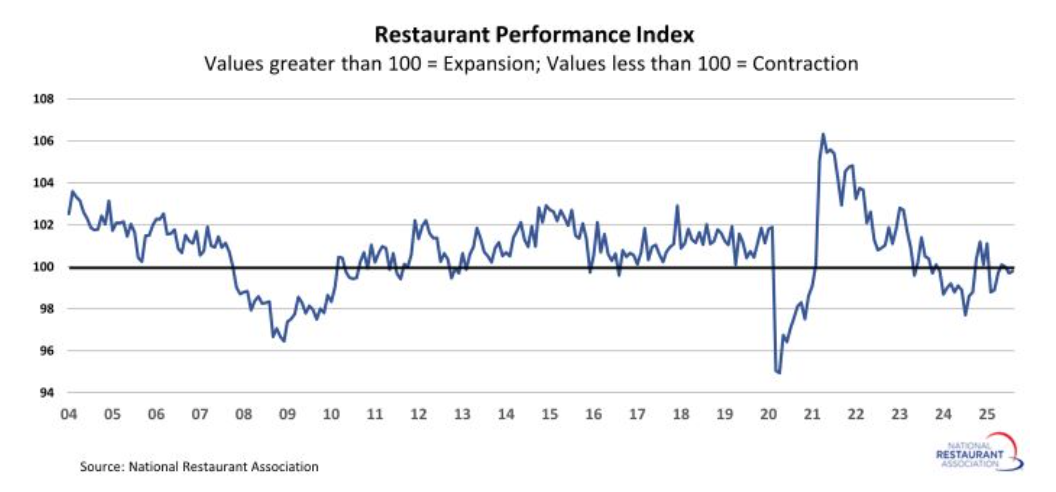

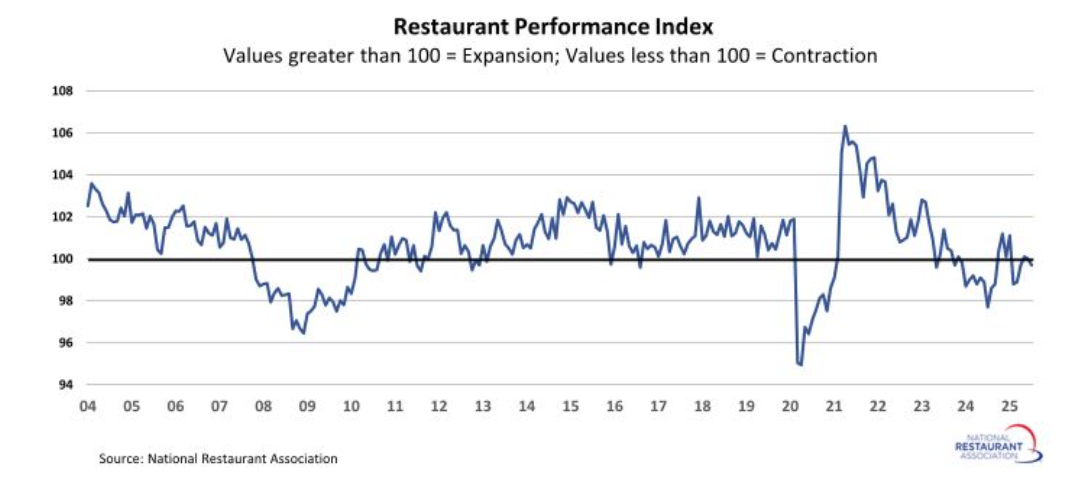

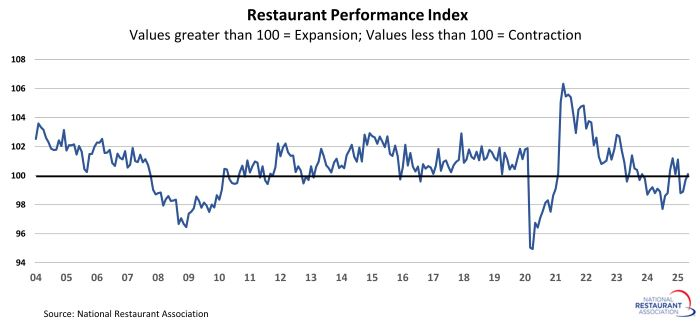

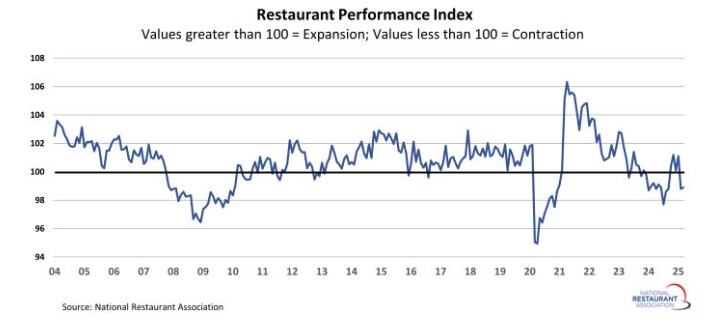

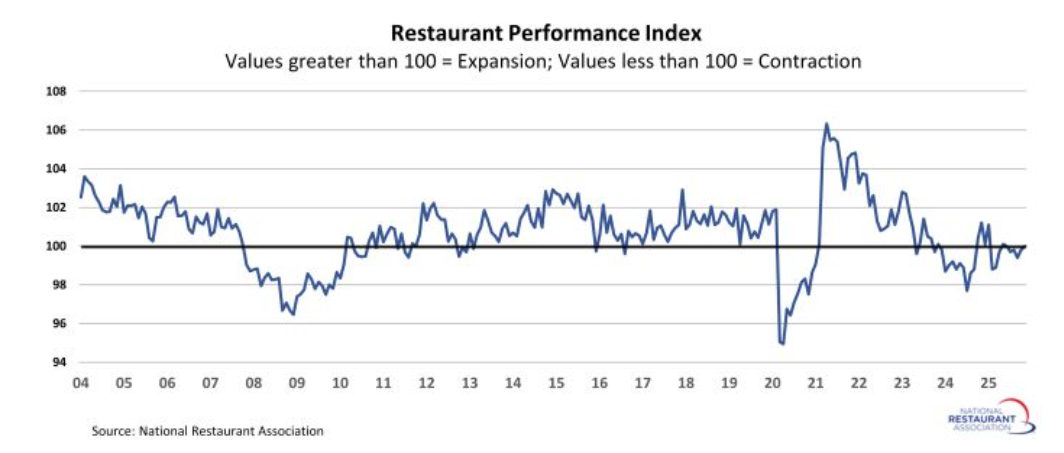

The Restaurant Performance Index (RPI) increased to 100.0 from 99.8 in October (+0.2% MoM), reaching its highest level since June and signaling overall industry conditions at the expansion threshold.

-

The Current Situation Index declined -0.4% MoM to 99.2, remaining below 100 for a fifth consecutive month and indicating ongoing contraction in current operating conditions.

-

Within current conditions, same-store sales eased to 100.3 (-0.9% MoM), customer traffic fell to 98.0 (-0.6% MoM), and labor slipped to 98.3 (-0.2% MoM), while capital expenditures edged up to 100.4 (+0.1% MoM).

-

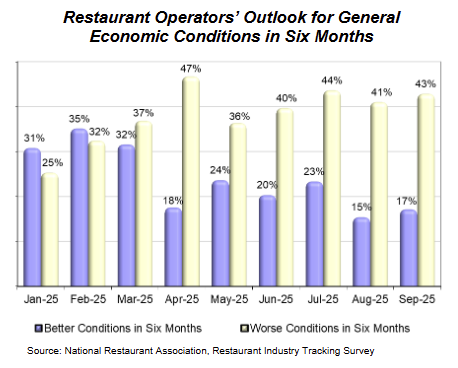

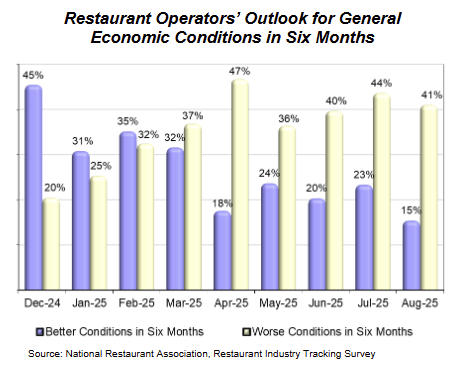

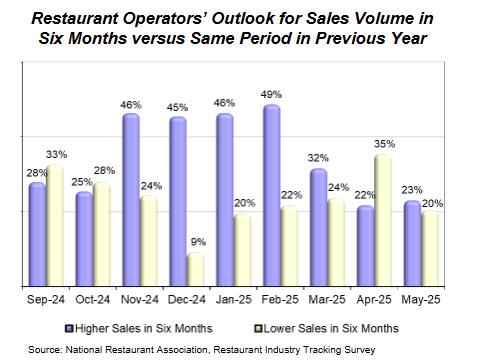

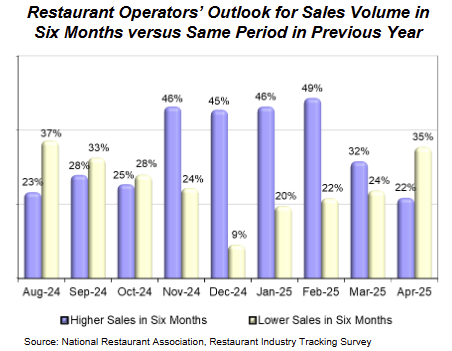

The Expectations Index rose +0.8% MoM to 100.8, the highest reading in 10 months, reflecting improved six-month outlooks among operators.

-

Sales expectations strengthened notably, with the expectations same-store sales index jumping to 102.7 (+2.0% MoM), the strongest component gain within the expectations category.

-

Expectations for business conditions increased to 99.0 (+1.4% MoM), while staffing expectations dipped slightly to 100.7 (-0.3% MoM), showing mixed forward-looking signals.

-

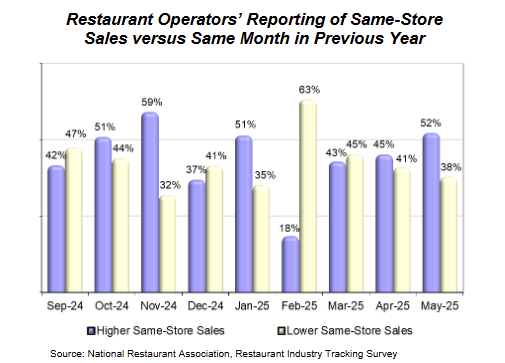

On the activity side, 47% of operators reported YoY same-store sales gains in November, while 44% reported declines, and 51% reported lower customer traffic YoY, marking the 10th consecutive month of net traffic declines.

-

Capital spending remained active, with 52% of operators reporting investment over the past three months and 55% planning capital expenditures over the next six months, extending a multi-month trend above the 50% threshold.

-