NFIB Small Business Optimism Survey

NFIB Small Business Optimism Survey

- Source

- NFIB

- Source Link

- https://www.nfib.com/

- Frequency

-

Monthly

2nd Tuesday of the month

- Next Release(s)

- October 14th, 2025 6:00 AM

-

November 11th, 2025 6:00 AM

Latest Updates

-

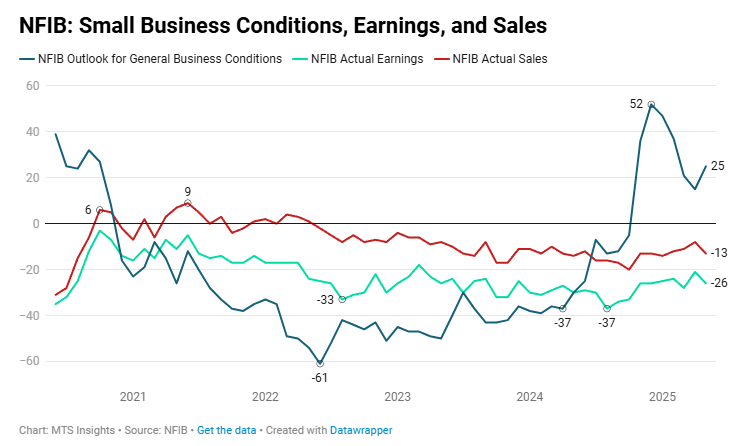

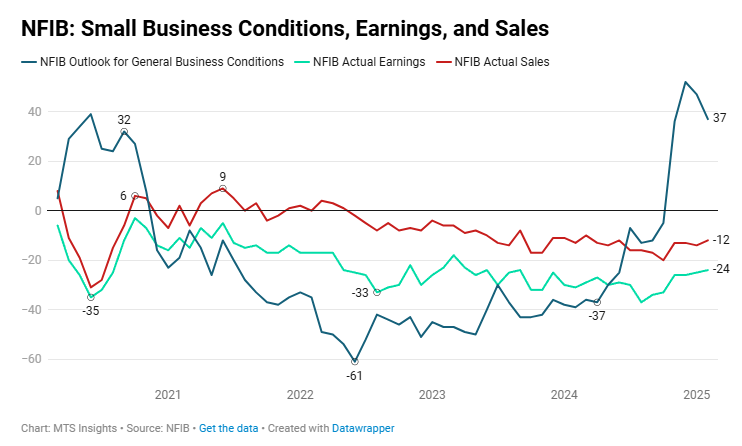

The NFIB Small Business Optimism Index this morning presented a slightly more optimistic view of small business conditions, with the headline index edging up 0.5 pts to 100.8 in August, the highest since January, and mostly in line with expectations of a reading of 101. Over the last year, small business sentiment has been volatile, but the broad trend in the data suggests that small business owners are feeling better than they did when supply chain issues and inflation were at their peak in 2021-2022. That is, in large part driven by an improvement in soft data, which was only temporarily shaken by the tariff volatility earlier this year.

NOTE: It is worth noting that the NFIB is an advocacy group that often reflects the concerns of small business owners who tend to lean more conservative, and its survey is sometimes viewed through that lens. That said, the index is widely followed across the political spectrum as a gauge of small business sentiment.

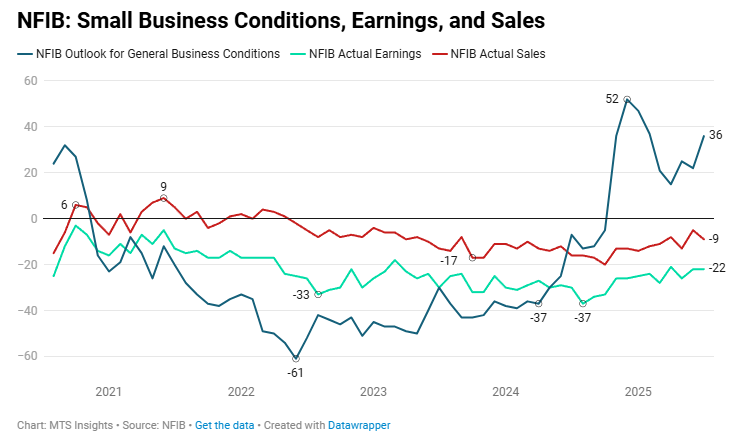

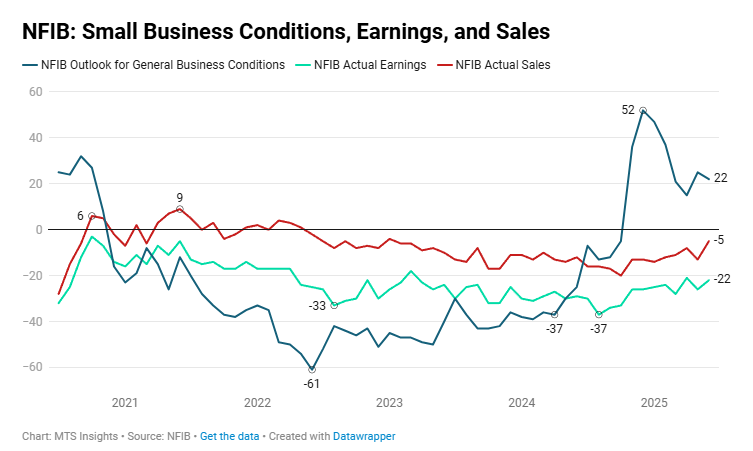

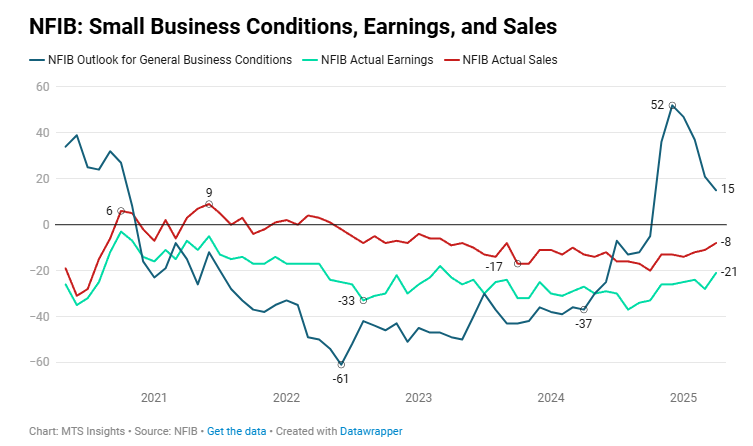

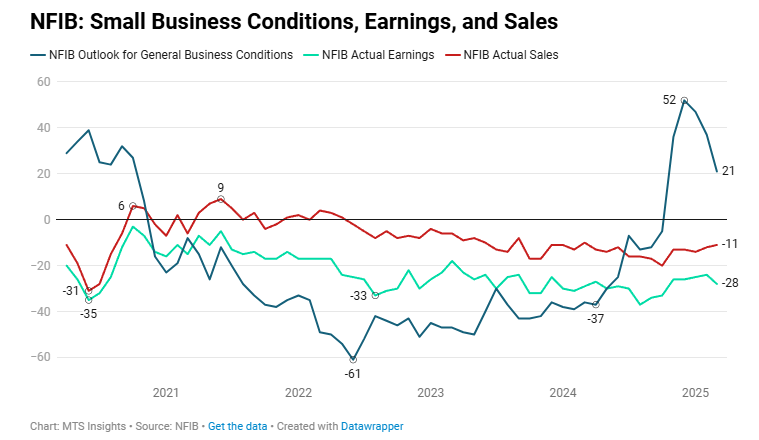

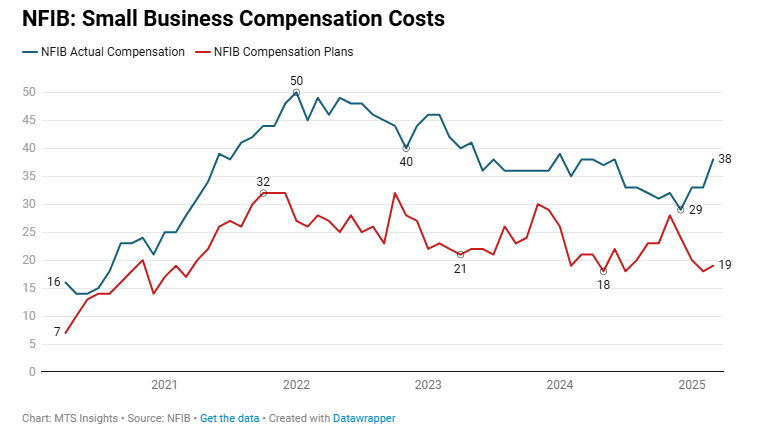

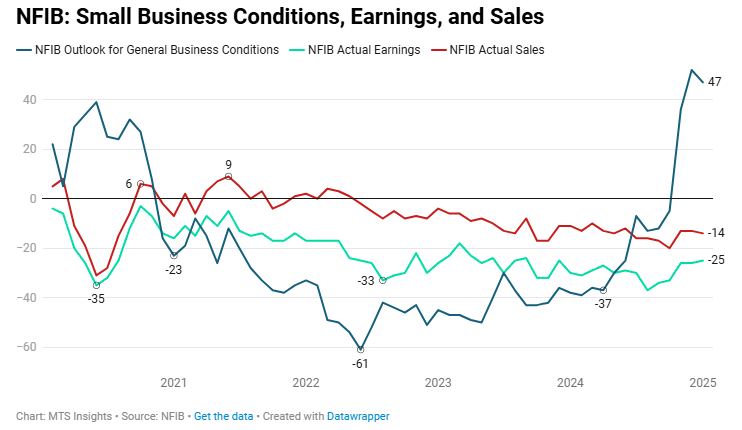

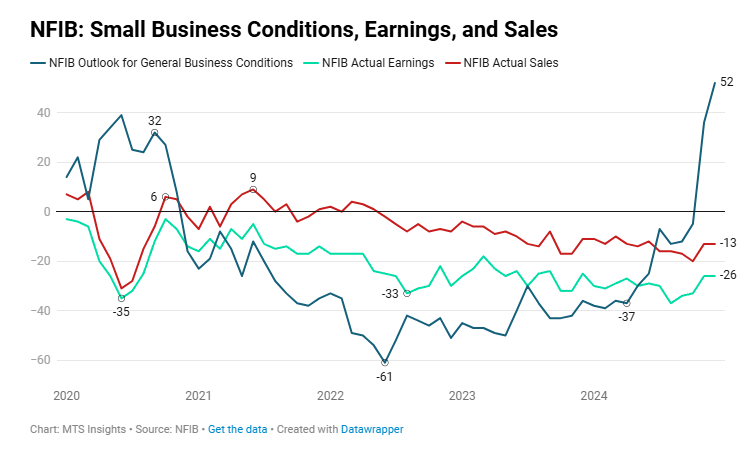

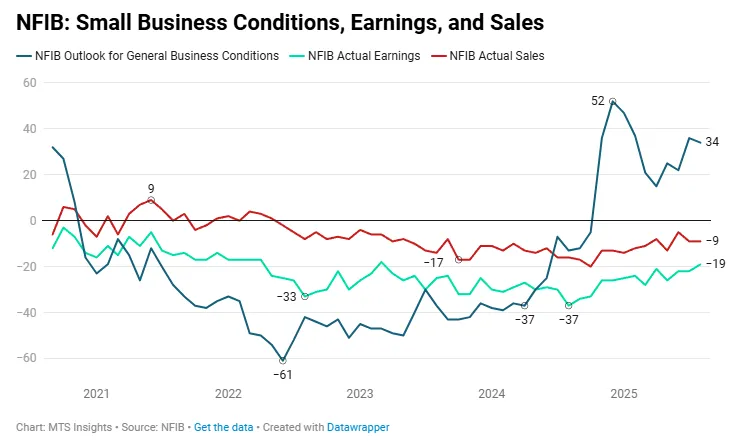

Just as we have seen in the previous months, the improvement in the survey’s soft data points since the 2024 election has been the basis for the improvement in the headline index. While the subindexes tracking the outlooks for expansion and general business conditions eased in August, they remain at their highest levels since the beginning of the year, with the former at 14 and the latter at 34. The hard data points remain negative but are slowly improving. The subindex tracking actual earnings trends has been one key indicator rising over the last two years, and in August, it improved 3 pts to -19, the highest since March 2023. The actual sales index trend has been similar, but in August, it maintained a reading of -9.

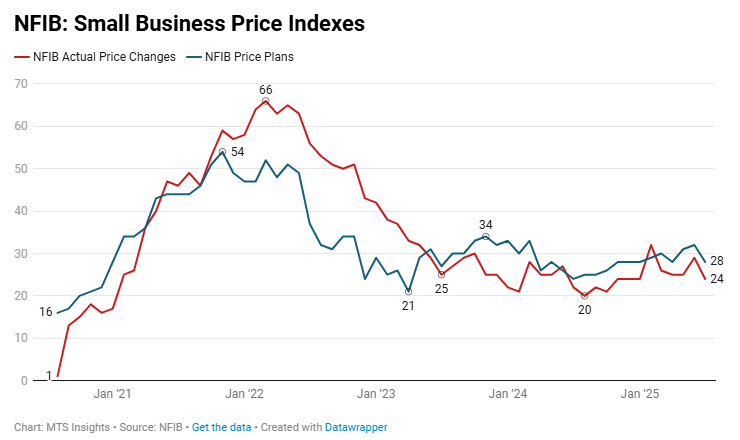

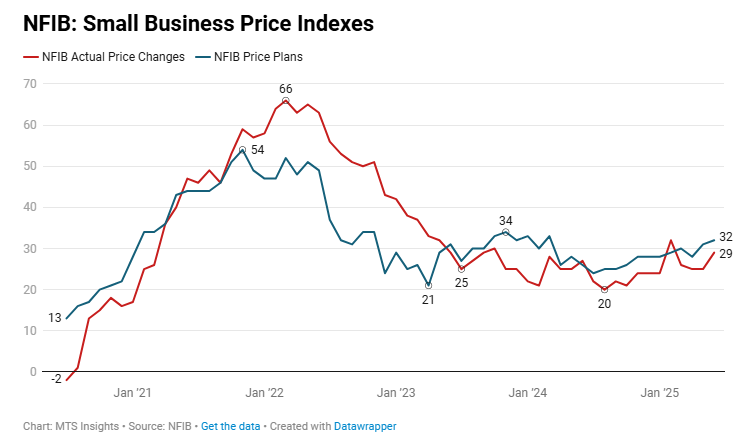

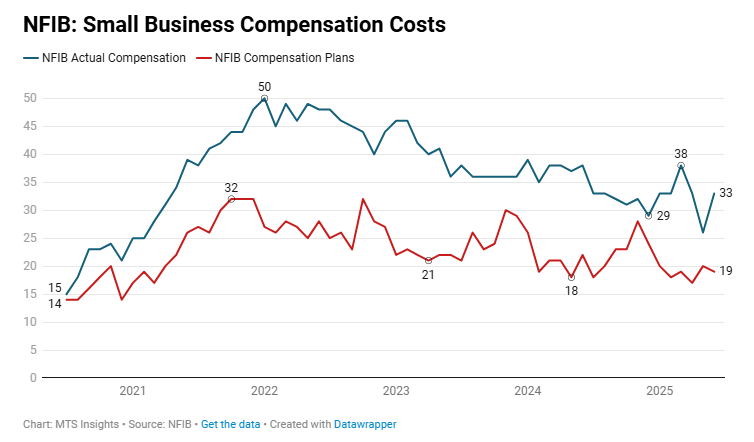

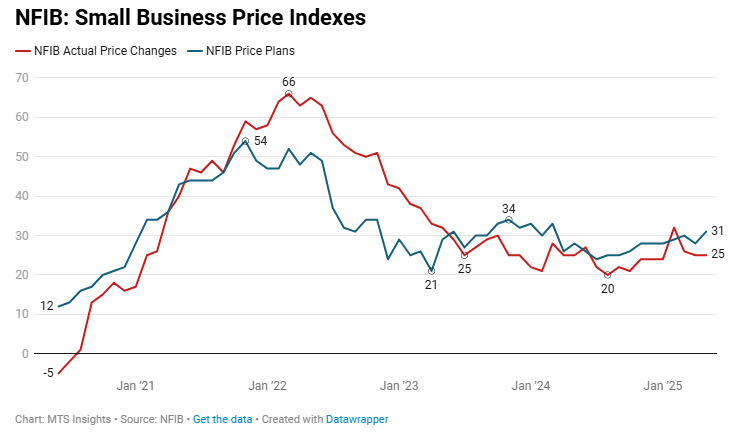

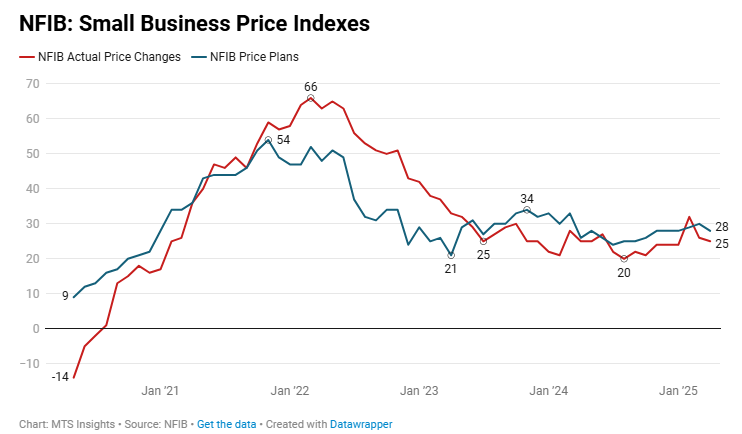

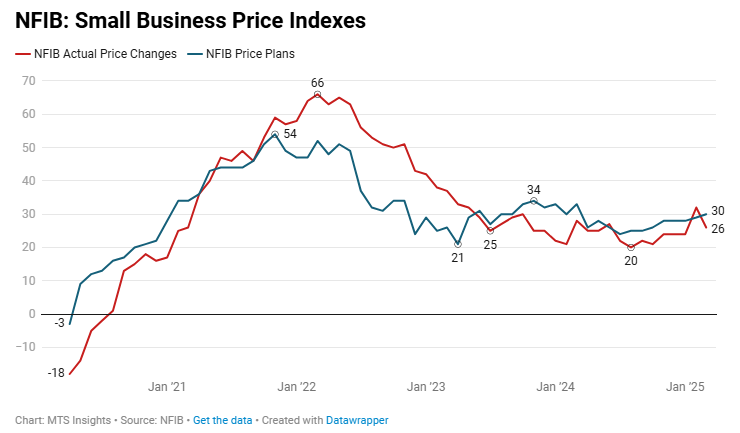

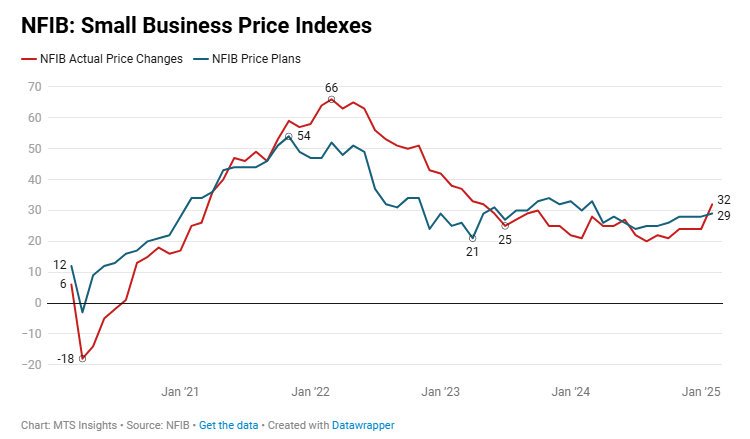

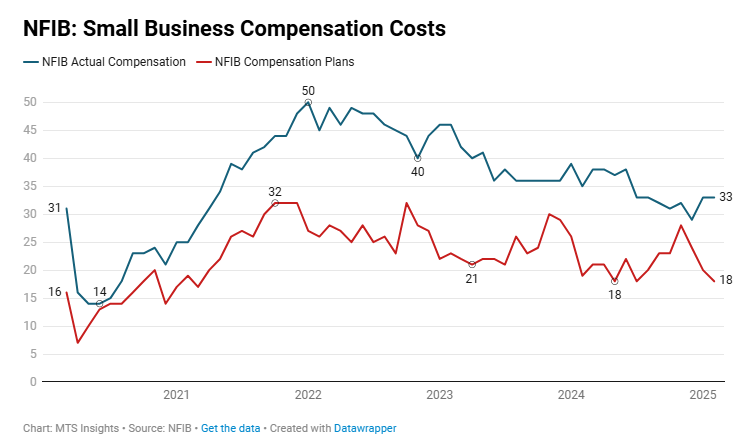

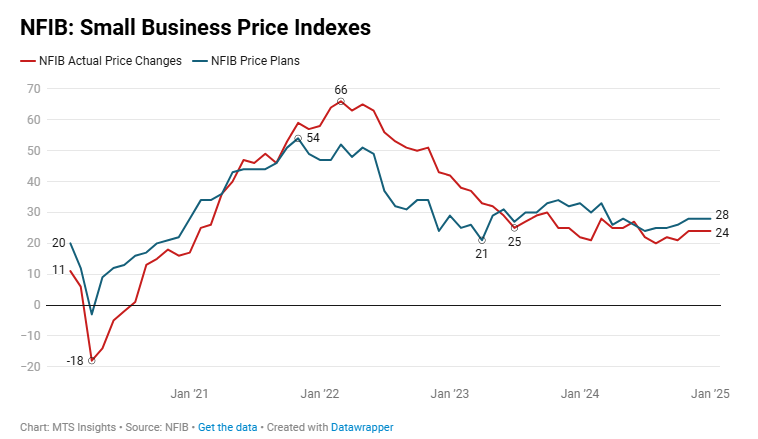

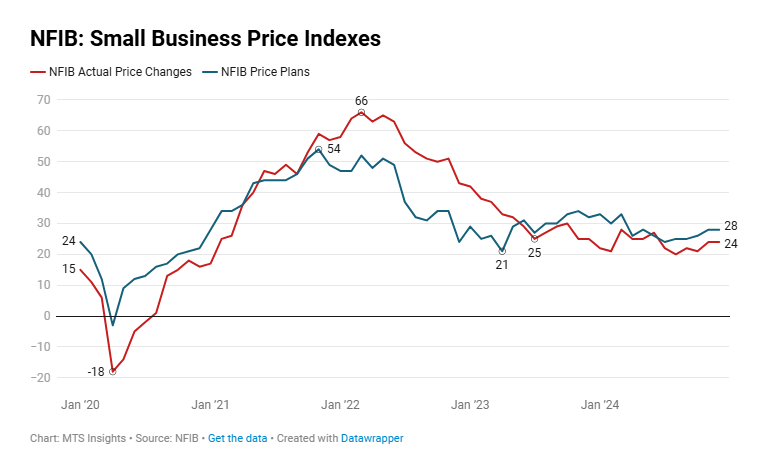

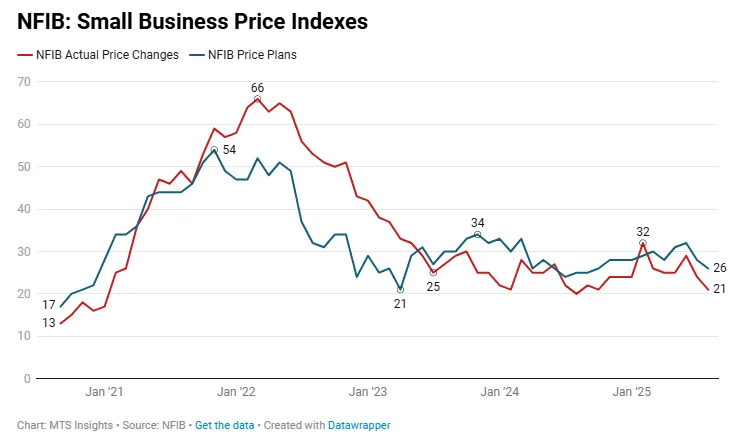

The improvement in earnings might be linked to an easing in price pressures in August. Both of NFIB’s price indexes indicated that this might be the case. The subindex tracking current price changes dropped -3 pts to 21 in August, the lowest reading since October 2024, and the indicator tracking expected price increases eased -2 pts to 26, the lowest since January. The moves this past month suggest that the near-term upward pressure on prices from new tariffs has receded, though it’s worth noting that these indexes are still above their long-run averages.

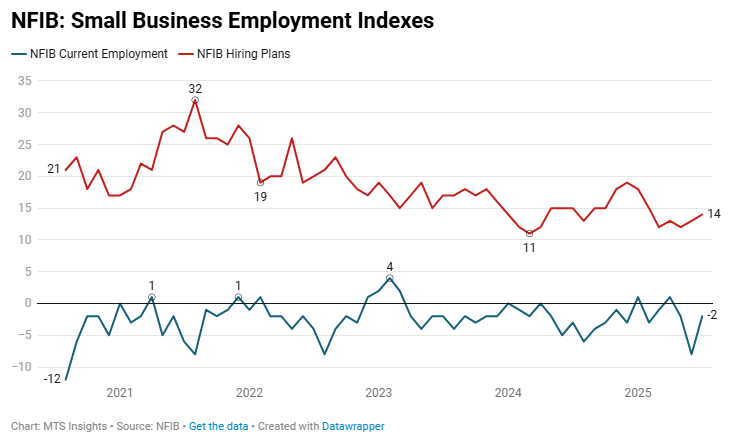

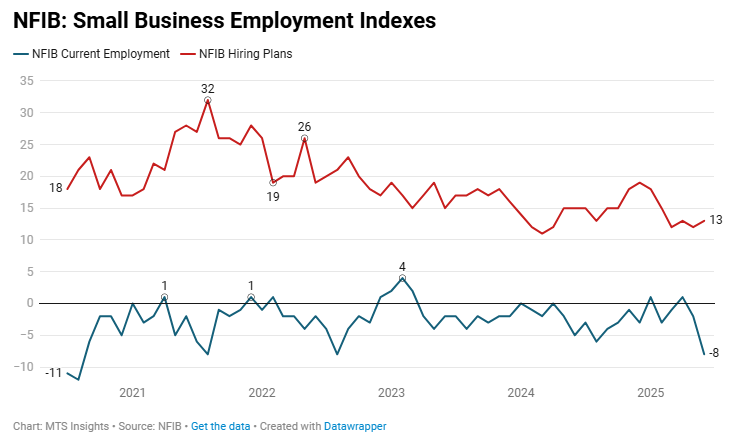

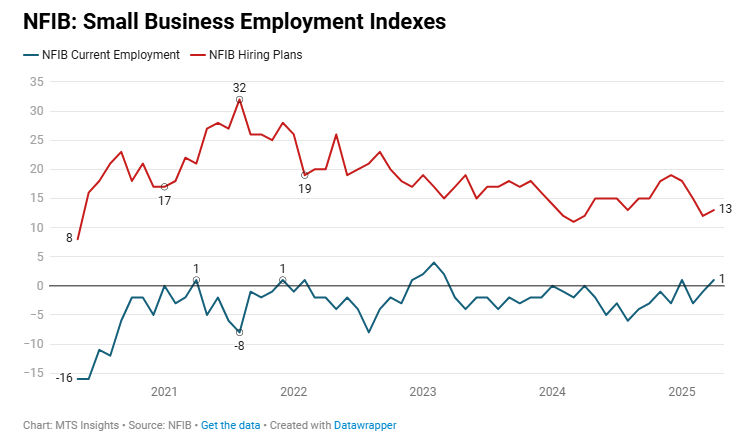

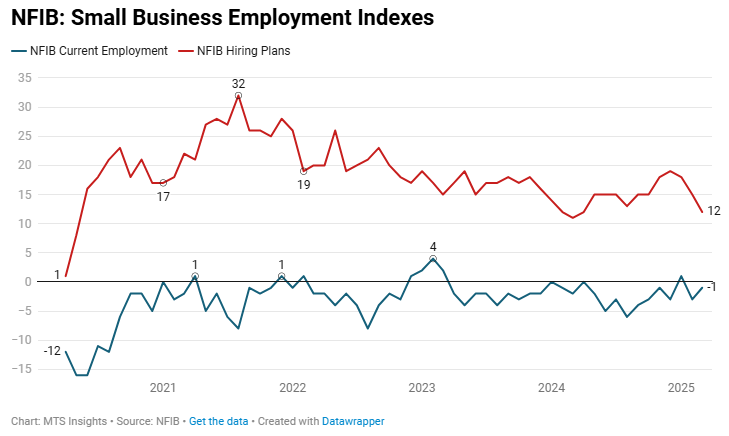

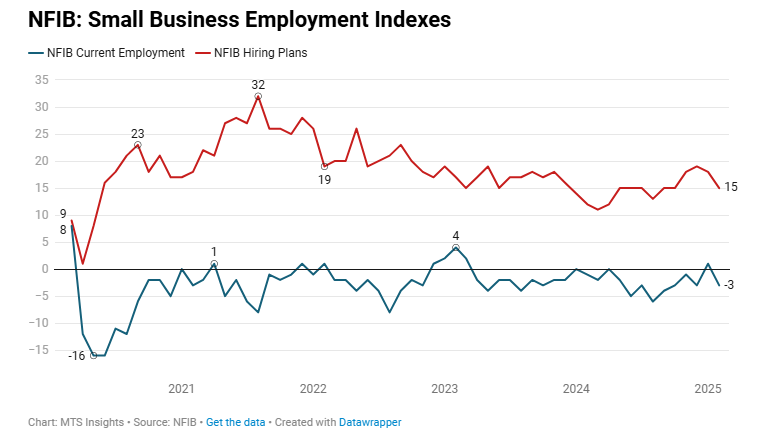

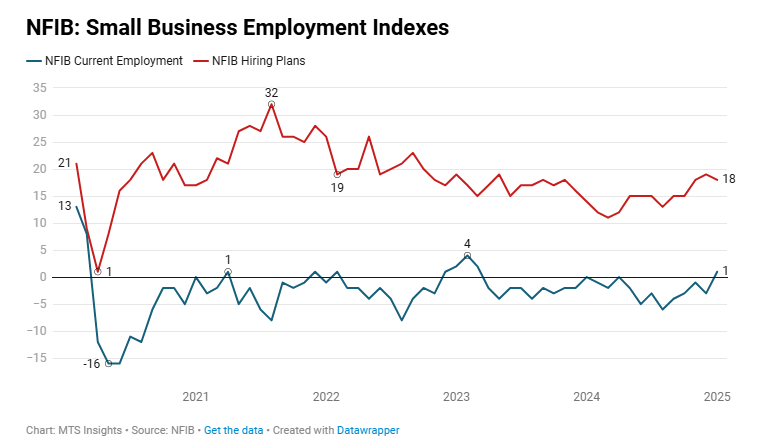

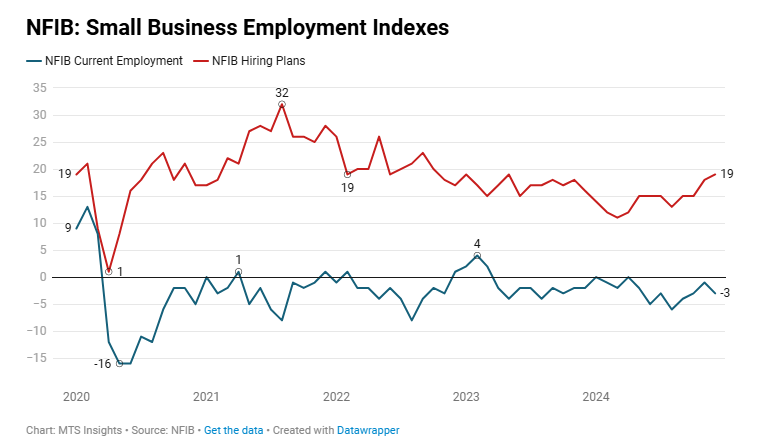

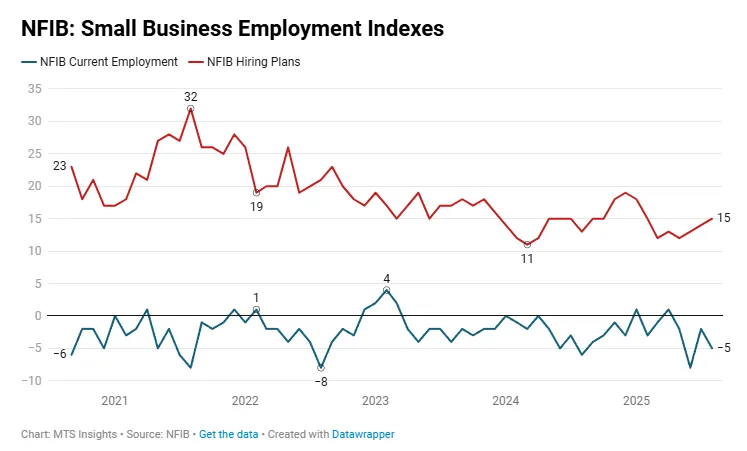

Small business employment trends broadly point to some weakness in hiring within that segment of the economy. The subindex tracking actual employment changes fell -3 pts to -5, and has been negative for the last four months. The last time this index trended this way was in the summer of 2024 when the Fed cut by 50 bps. The index tracking hiring plans was a bit rosier, rising 1 pt to 15, the highest since February. One index that saw a larger move was the measure tracking qualified applicants. It fell -5 pts to 43, the lowest it has been since June 2020. This index's decline is a signal that labor markets are easing since any shift in the quality of the labor supply would be a gradual one that wouldn’t show up in survey data like this.

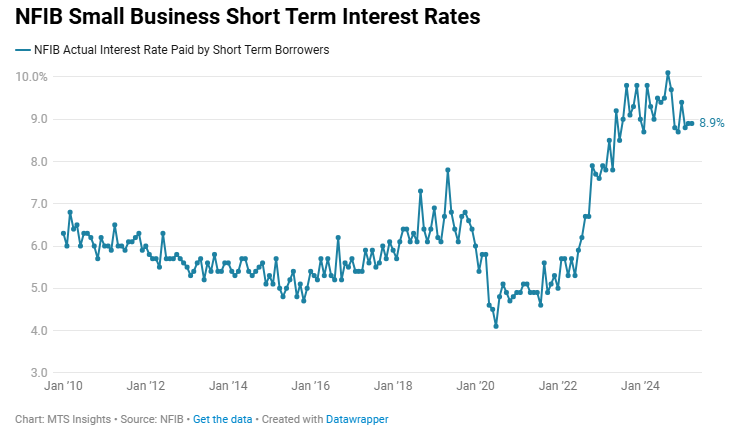

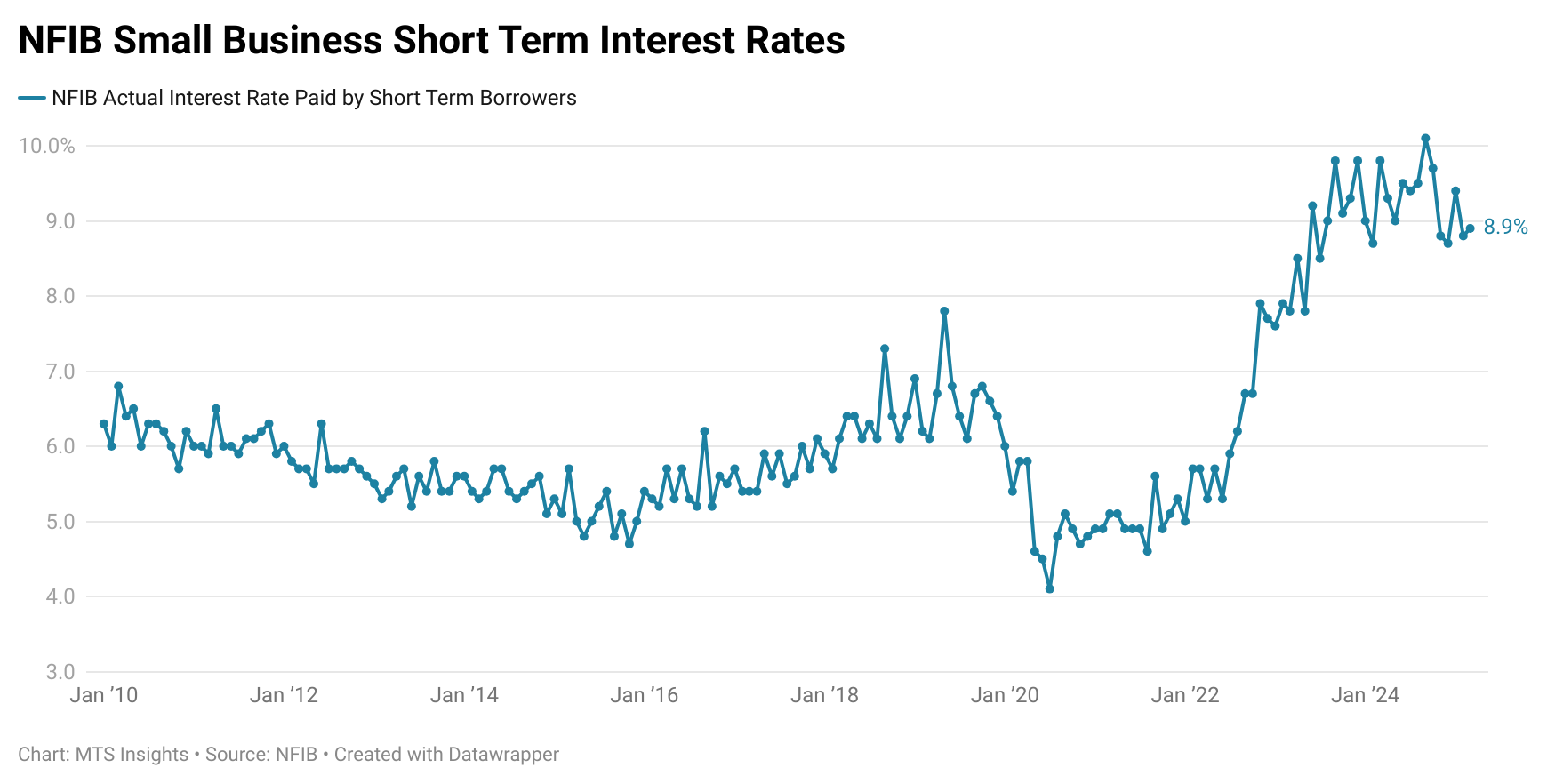

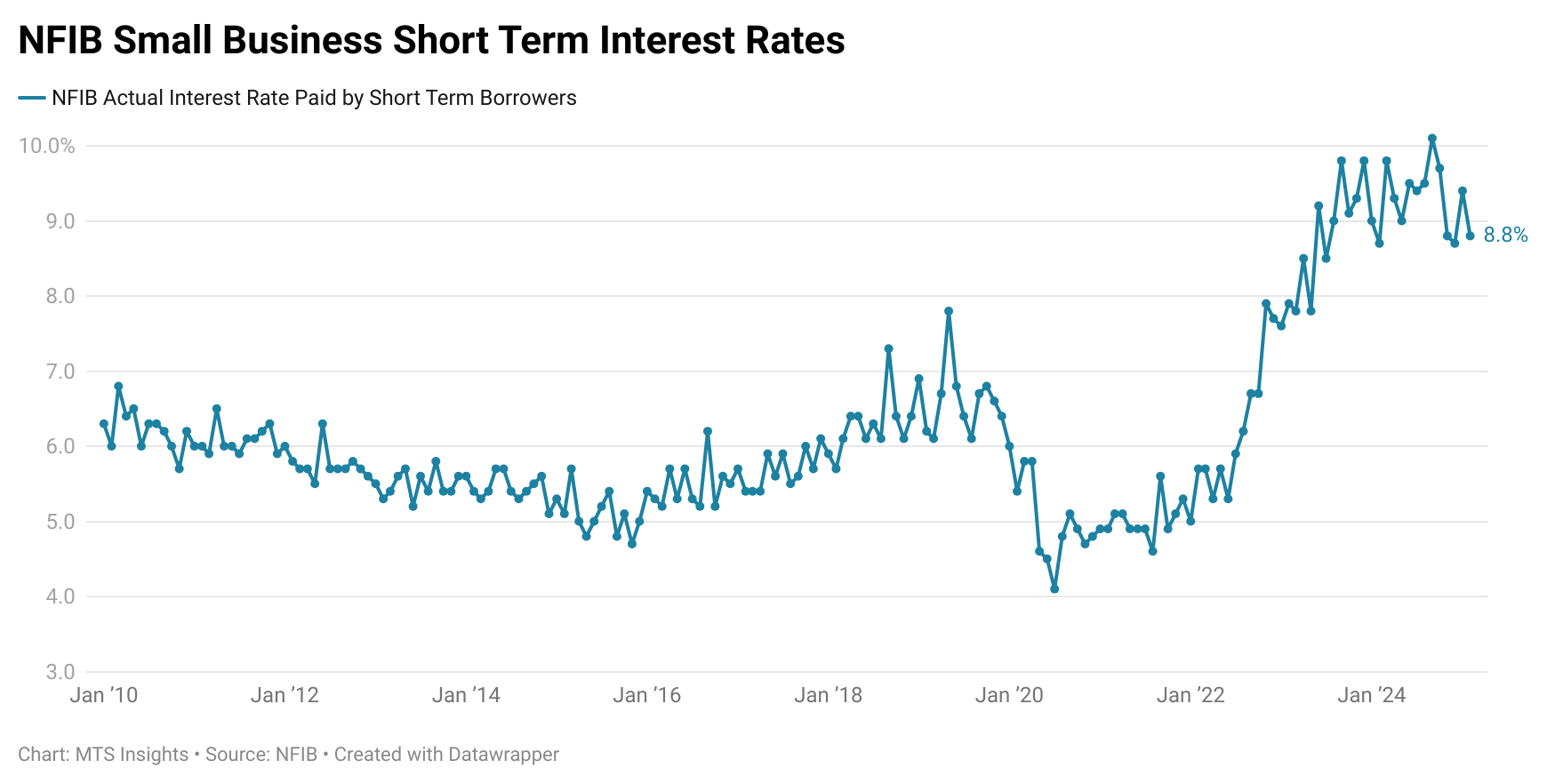

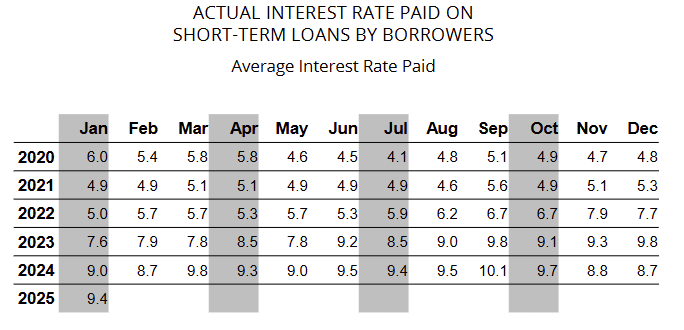

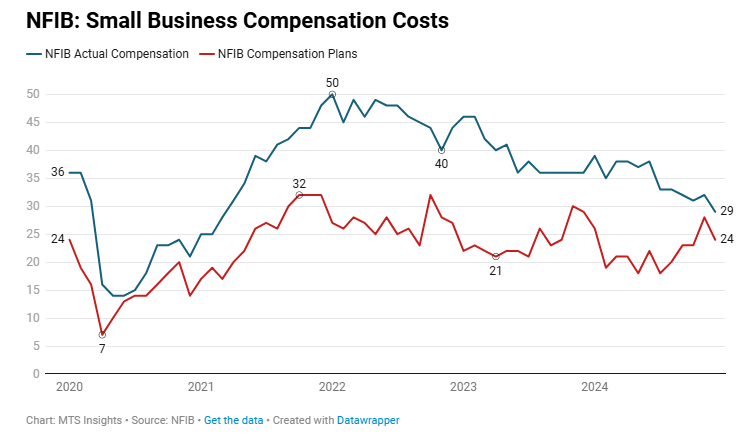

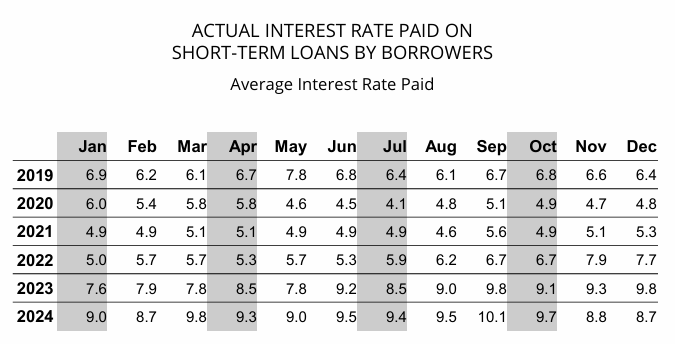

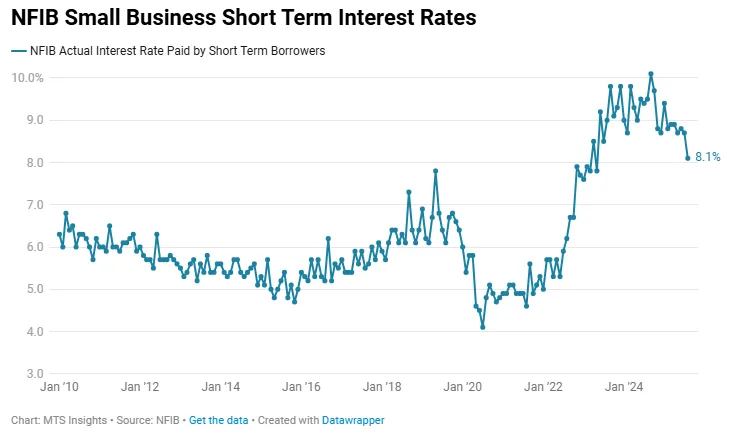

Amid the challenges seen in employment and inflation, the August NFIB survey pointed to a brighter spot in financing costs, where businesses reported some relief. The average interest rate paid (as reported by small business owners) dropped -0.6 ppts to 8.1% last month, the lowest average reported since March 2023. The easing in financial conditions is likely one of the key drivers of optimism and is likely to continue in September as bond markets see yields drop early this month in response to an increase in Fed rate cut expectations. The 10-year yield is down almost -20 bps so far in September.

Markets have been especially tuned into the trend in interest rates when it comes to investing in smaller-sized firms. The Russell 2000 ETF (IWM) saw its best month since November 2024 (when the results of the election sparked a broad market rally) in August, rising 7.2%. Small caps have started off the month well, but are facing a bit of a drop today in the morning trading session (around -0.9%) since Treasury yields are slightly higher. The big picture for investors in the NFIB survey is the following: it seems that most of the weaker indicators in employment and sales/earnings can be dismissed for the positives in a gradual decline in price pressures and better financial conditions.