Monthly Budget Review

Monthly Budget Review

- Source

- Congressional Budget Office

- Source Link

- https://www.cbo.gov/

- Frequency

-

Monthly

6th business day

- Next Release(s)

- October 8th, 2025 2:00 PM

-

November 10th, 2025 2:00 PM

-

December 8th, 2025 2:00 PM

Latest Updates

-

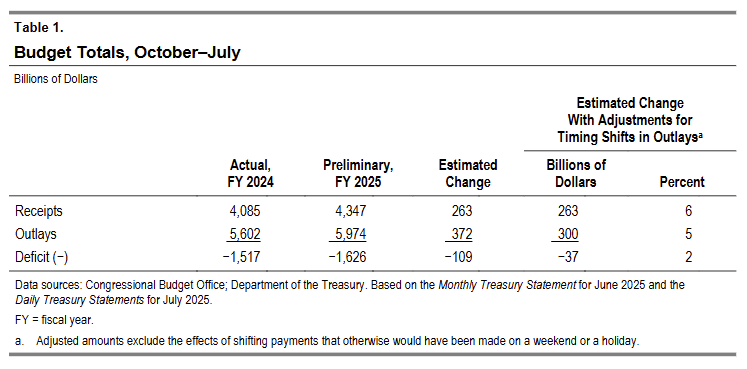

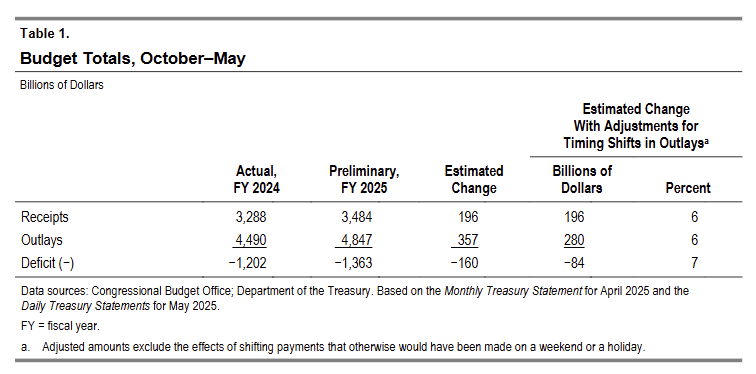

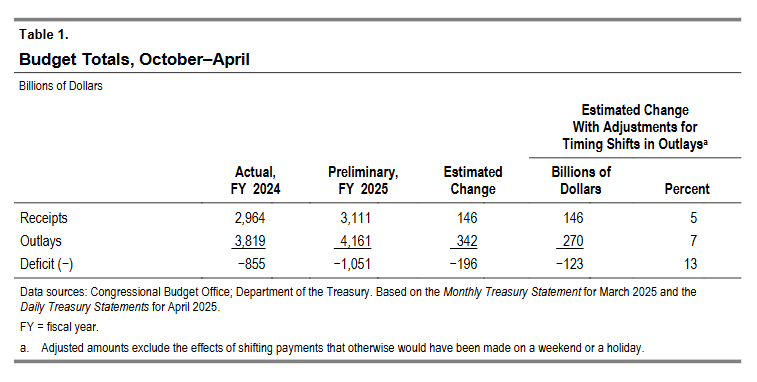

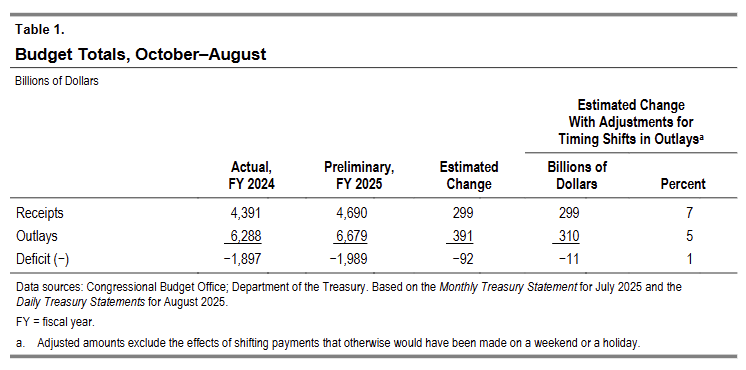

The U.S. federal budget deficit totaled $2.0 trillion in the first 11 months of FY2025, up $92 billion (+5% YoY), as revenues rose 7% YoY while outlays increased 6% YoY.

-

Revenues rose $299 billion (+7% YoY) to $4.7 trillion; individual income & payroll taxes were up $229 billion (+6% YoY), while corporate income taxes fell -$32 billion (-8% YoY).

-

Customs duties surged +$95 billion (+137% YoY) to $165 billion, boosted by higher tariffs; excise taxes (+$4 billion, +4%) and Fed remittances (+$2 billion, +75%) also increased.

-

Outlays rose $391 billion (+6% YoY) to $6.7 trillion; excluding timing shifts, the increase was $310 billion (+5%).

-

Social Security spending rose $111 billion (+8%), Medicare +$64 billion (+8%), and Medicaid +$47 billion (+8%), reflecting higher enrollment and costs.

-

Net interest on public debt climbed $72 billion (+8%), while defense (+$36 billion, +5%) and veterans’ benefits (+$36 billion, +12%) also drove higher spending.

-

Education outlays fell -$110 billion (-44%), largely from lower student loan costs, while FDIC (-$63 billion) and SBA (-$32 billion) spending also declined.

-

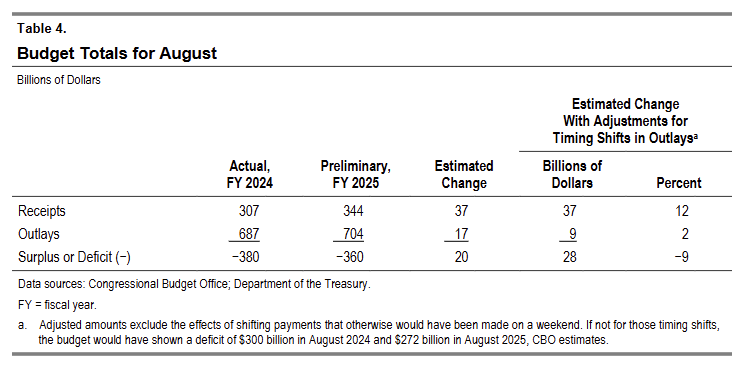

The August 2025 monthly deficit was $360 billion, -$20 billion (-5% YoY), as revenues (+12% YoY) outpaced outlays (+3% YoY).

-

The CBO projects a full-year FY2025 deficit of $1.8 trillion, slightly below January’s forecast, partly reflecting a $130 billion outlay reduction from student loan program modifications.

-