Money and Credit

Money and Credit

Data

Monetary Policy

- Source

- Bank of England

- Source Link

- https://www.bankofengland.co.uk/

- Frequency

- Monthly

- Next Release(s)

- January 30th, 2026 4:30 AM

-

March 2nd, 2026 4:30 AM

-

March 30th, 2026 4:30 AM

-

May 1st, 2026 4:30 AM

-

June 2nd, 2026 4:30 AM

-

June 29th, 2026 4:30 AM

-

September 1st, 2026 4:30 AM

-

September 29th, 2026 4:30 AM

-

October 29th, 2026 4:30 AM

-

November 30th, 2026 4:30 AM

-

January 5th, 2027 4:30 AM

-

February 1st, 2027 4:30 AM

Latest Updates

-

Total net lending to individuals increased 0.3% MoM, or £6.6 billion, in November, with the annual growth increasing slightly to 4.1% YoY (up from 4.0% YoY in October).

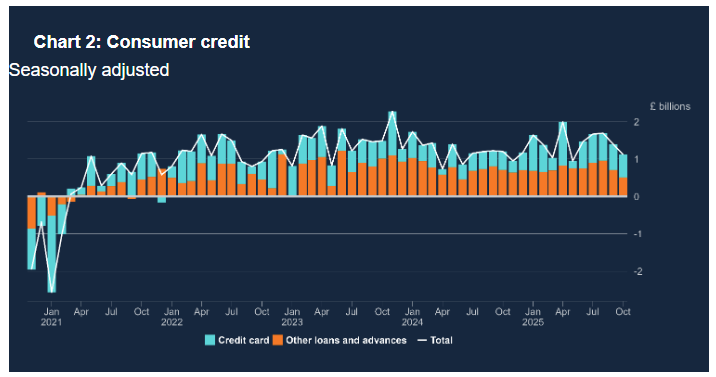

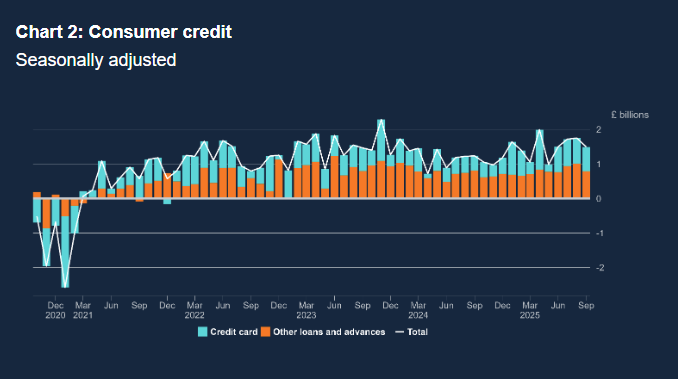

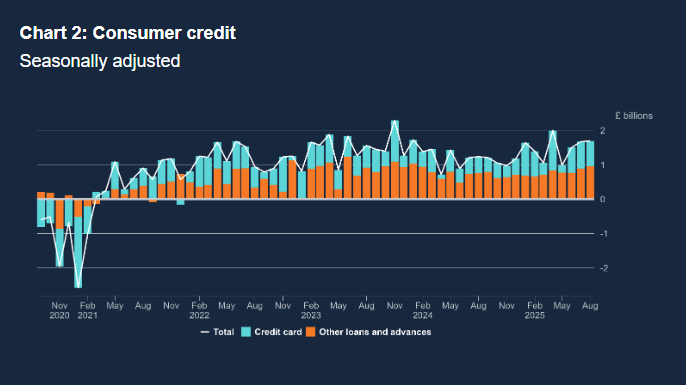

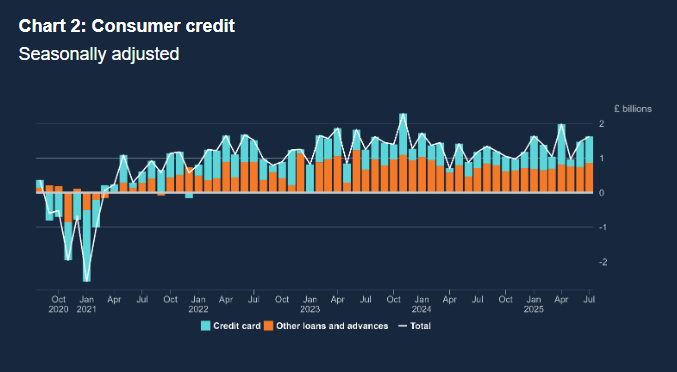

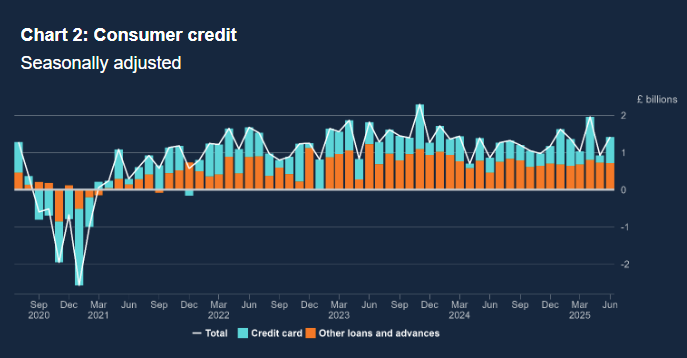

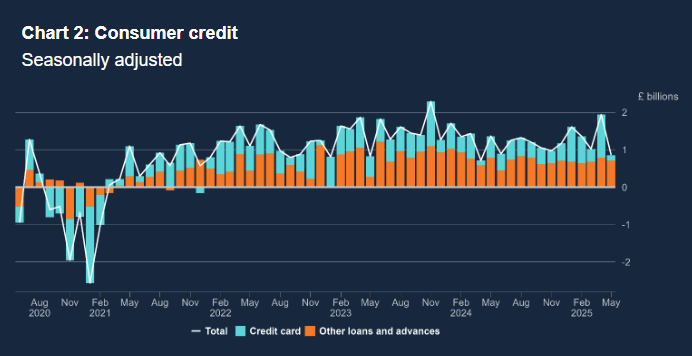

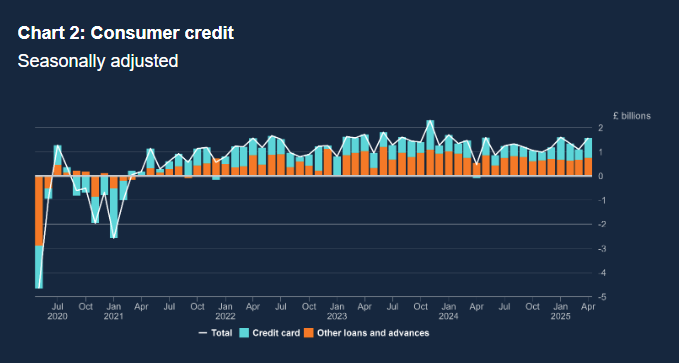

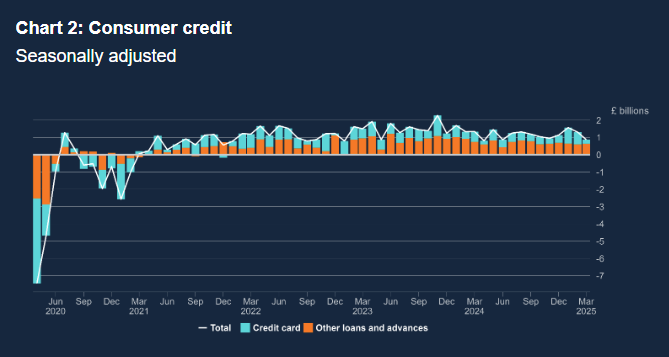

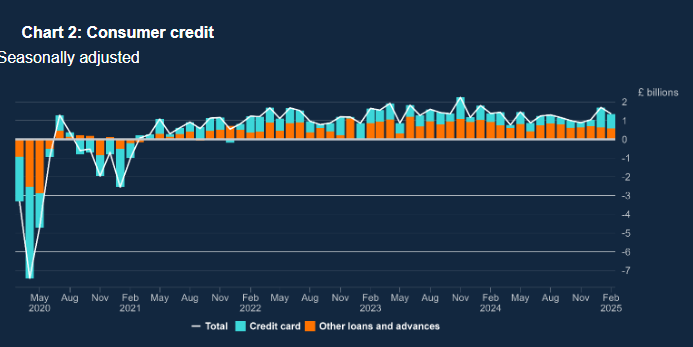

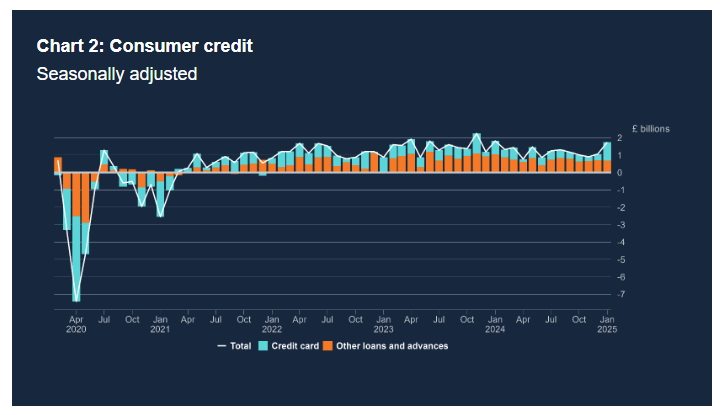

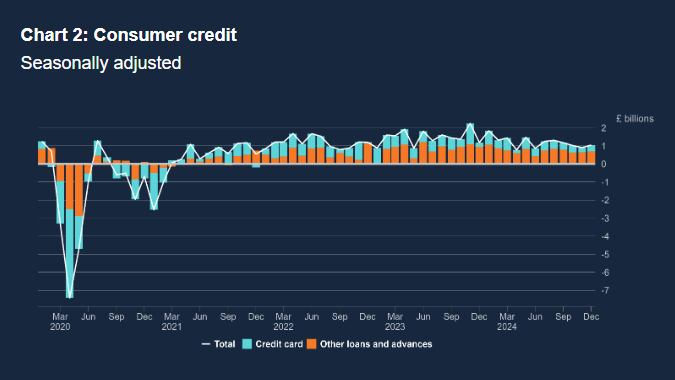

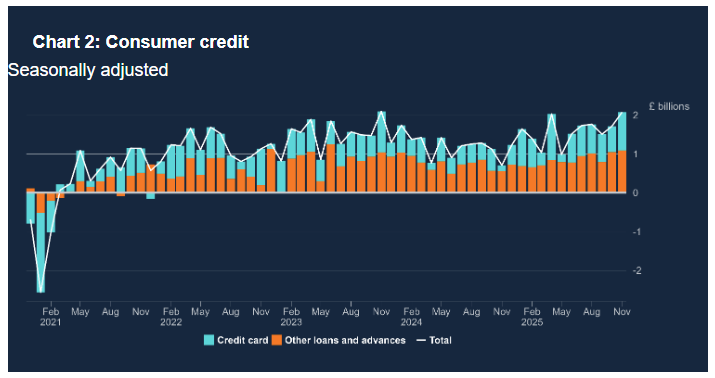

- Net consumer credit increased 0.8% MoM, or £2.1 billion (vs £1.1 billion expected), which is the strongest monthly growth rate since April.

- Within this, net borrowing through credit cards was £1.0 billion in November, up from £0.7 billion in October. Net borrowing through other forms of consumer credit (such as car dealership finance and personal loans) slightly increased in November, to £1.1 billion from £1.0 billion.

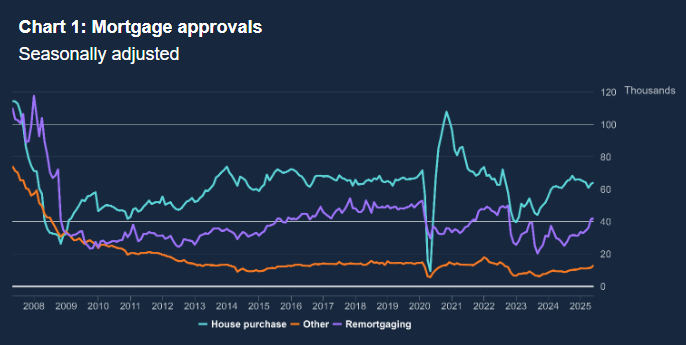

- Net borrowing of mortgage debt by individuals increased to £4.5 billion in November, following a decrease of £1.0 billion to £4.2 billion in October.

- In November, net mortgage approvals for house purchase fell by 500 to 64,500. By contrast, approvals for remortgaging rose by 3,200 to 36,600 in November.

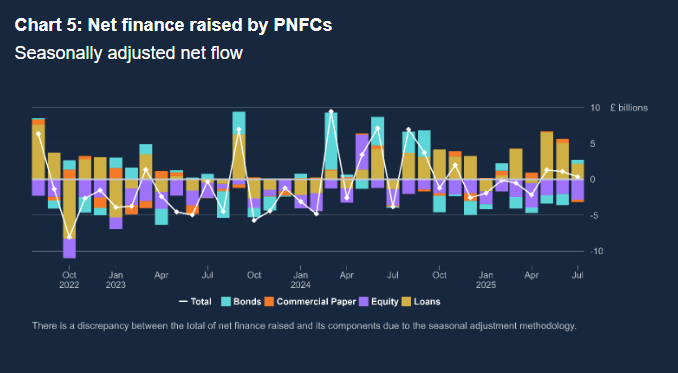

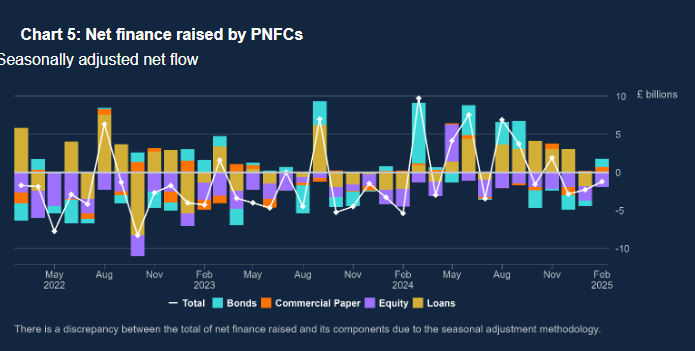

- Private non-financial corporations (PNFCs) borrowed, on net, £5.8 billion from capital markets and banks and building societies in November, following net repayments of £4.8 billion in October.

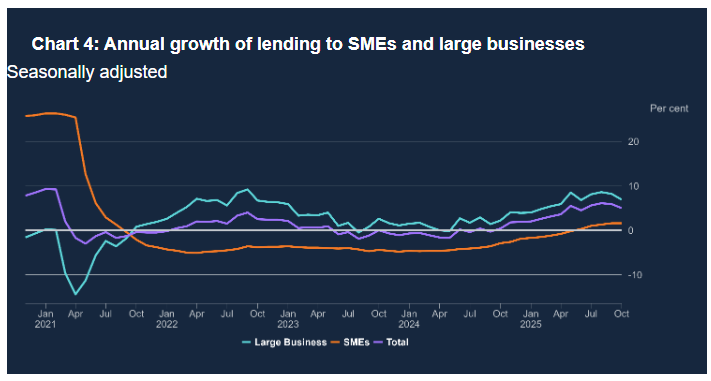

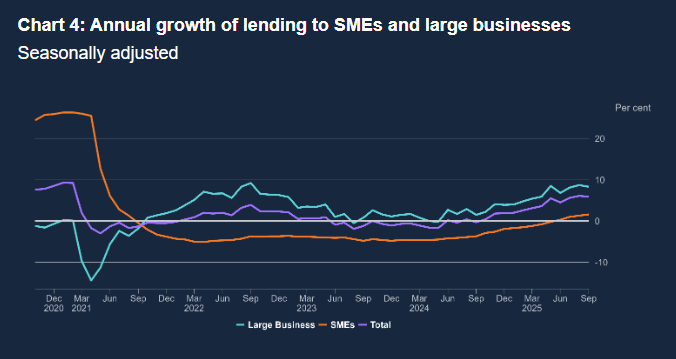

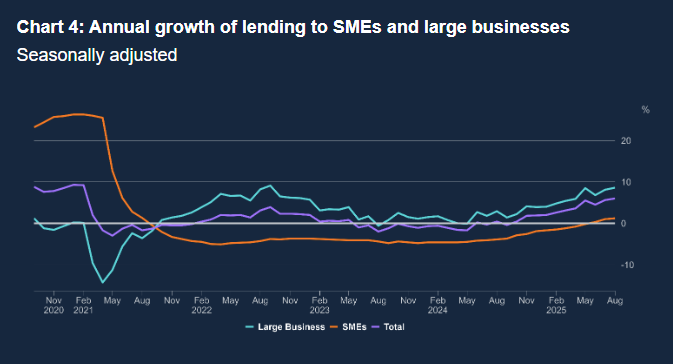

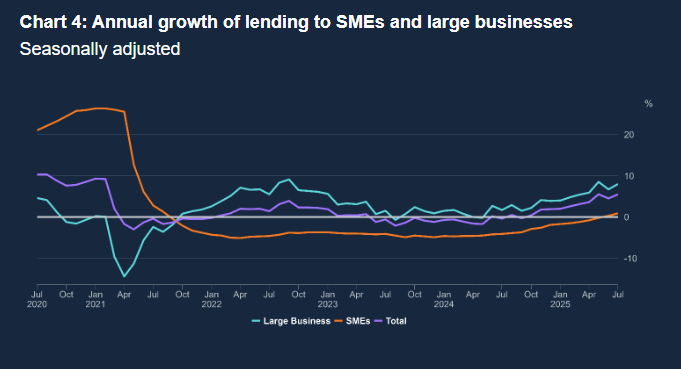

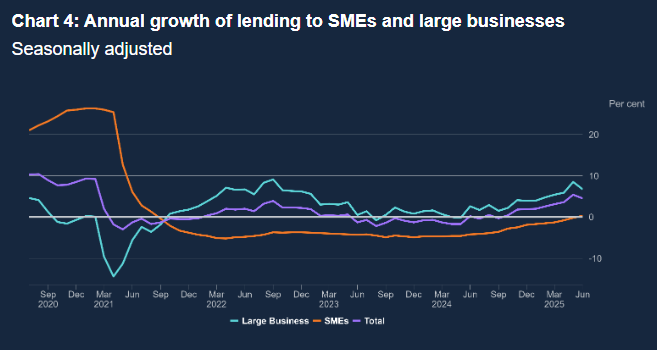

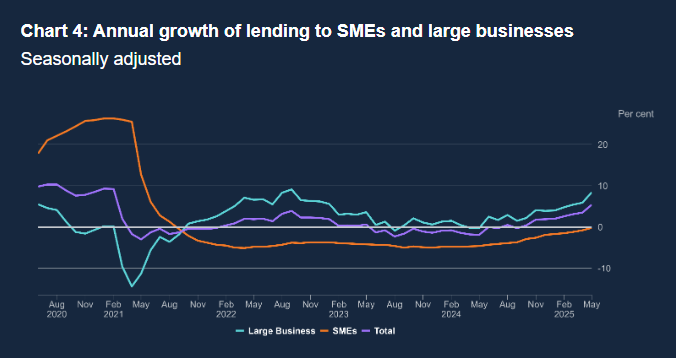

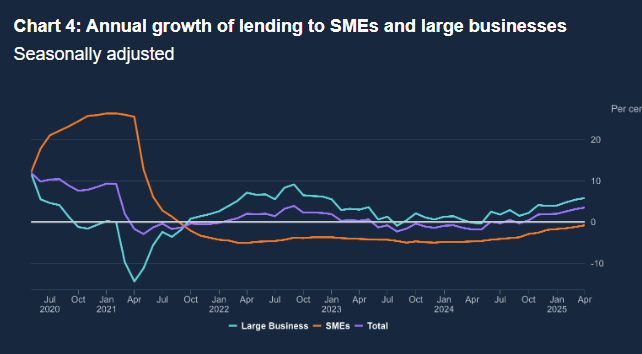

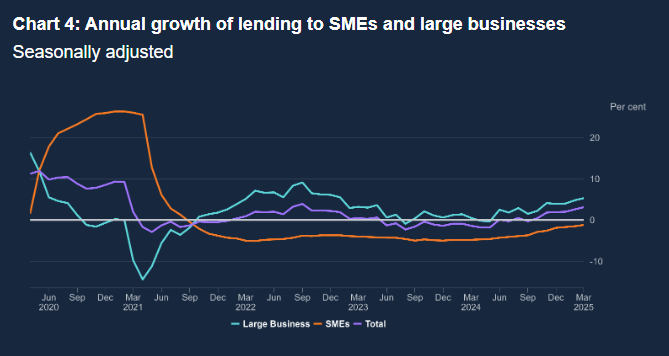

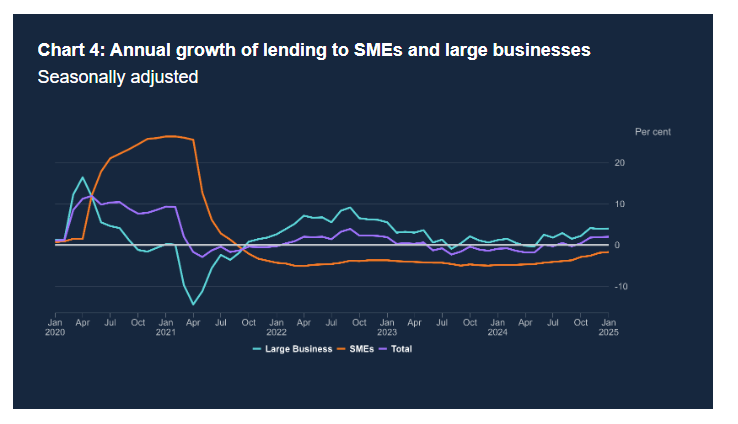

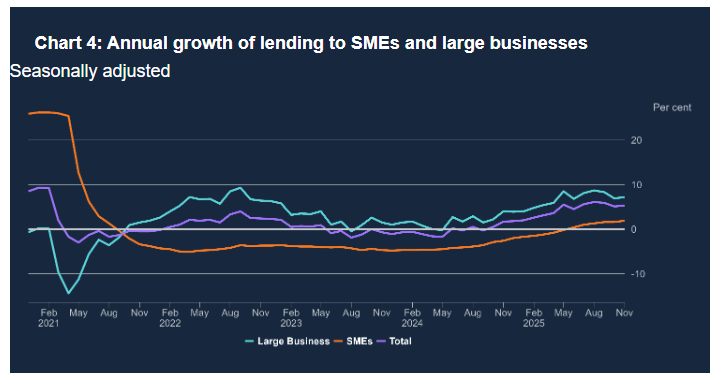

- PNFC loan growth accelerated from 5.1% YoY in October to 5.3% YoY in November. Large firm loan growth was 7.2% YoY (up from 6.9% YoY), and small firm loan growth was 1.9% YoY (up from 1.6% YoY), the strongest since July 2021.

- The broadest level of the M4 money supply increased 0.8% MoM (vs -0.1% MoM expected), or £24.4 billion, pushing the annual growth to 4.3% YoY in November, up from 3.5% YoY in October and the strongest since October 2022.

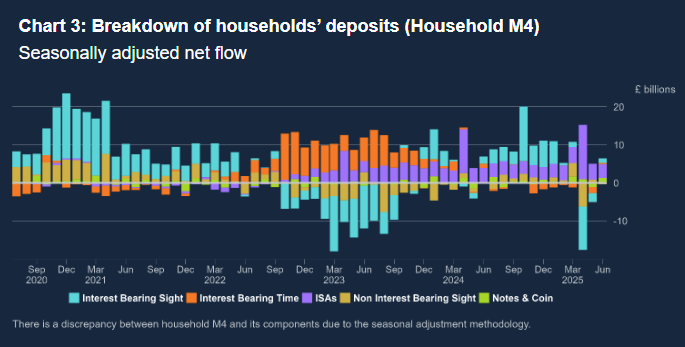

- The net flow of sterling money (known as M4ex) was £15.3 billion in November, compared to £8.8 billion in October, and the highest since January 2025 (£25.4 billion). This was largely driven by households and non-intermediate other financial corporations (NIOFCs) increasing their holdings of money by £8.1 billion and £6.1 billion respectively.

- The flow of sterling net lending to private sector companies and households (M4Lex) was £15.5bn in November, compared to £13.3 billion in the previous month. November’s lending was driven by NIOFCs, households, and PNFCs borrowing £5.9 billion, £5.5 billion, and £4.1 billion respectively.