Logistics Managers’ Index

Logistics Managers’ Index

- Source

- Logistics Managers’ Index

- Source Link

- https://www.the-lmi.com/

- Frequency

-

Monthly

1st Tuesday of every month

- Next Release(s)

- February 3rd, 2026 6:00 AM

-

March 3rd, 2026 6:00 AM

-

April 7th, 2026 6:00 AM

-

May 5th, 2026 6:00 AM

-

June 2nd, 2026 6:00 AM

-

July 7th, 2026 6:00 AM

-

August 4th, 2026 6:00 AM

-

September 1st, 2026 6:00 AM

-

October 6th, 2026 6:00 AM

-

November 3rd, 2026 6:00 AM

-

December 1st, 2026 6:00 AM

Latest Updates

-

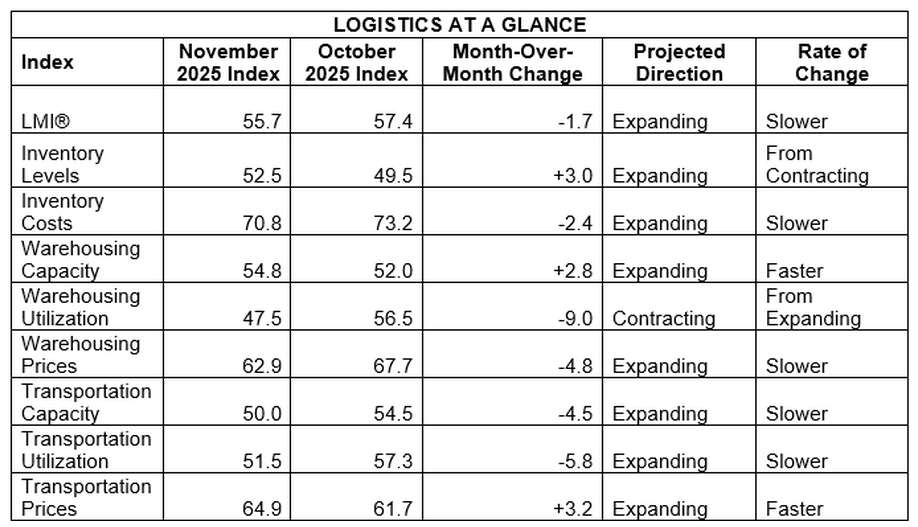

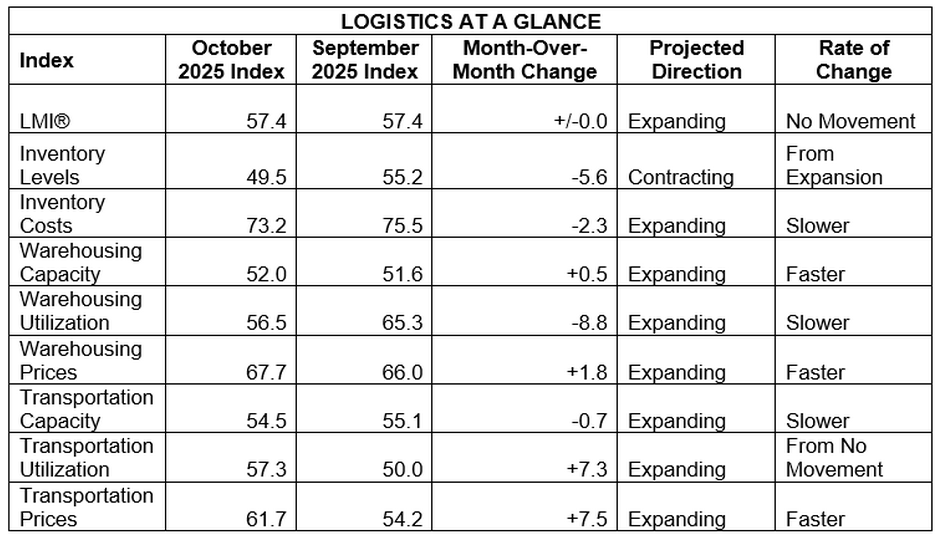

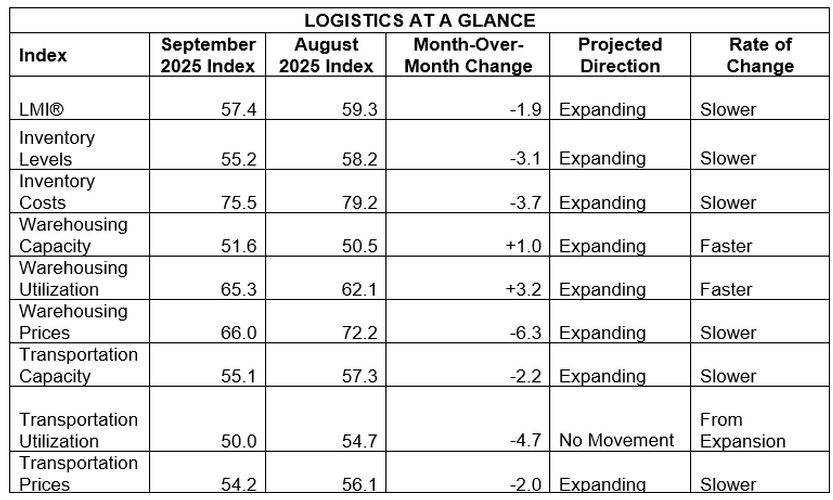

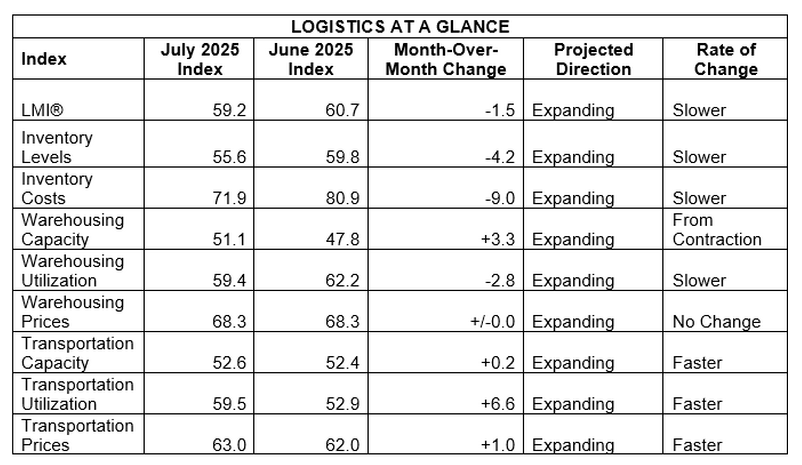

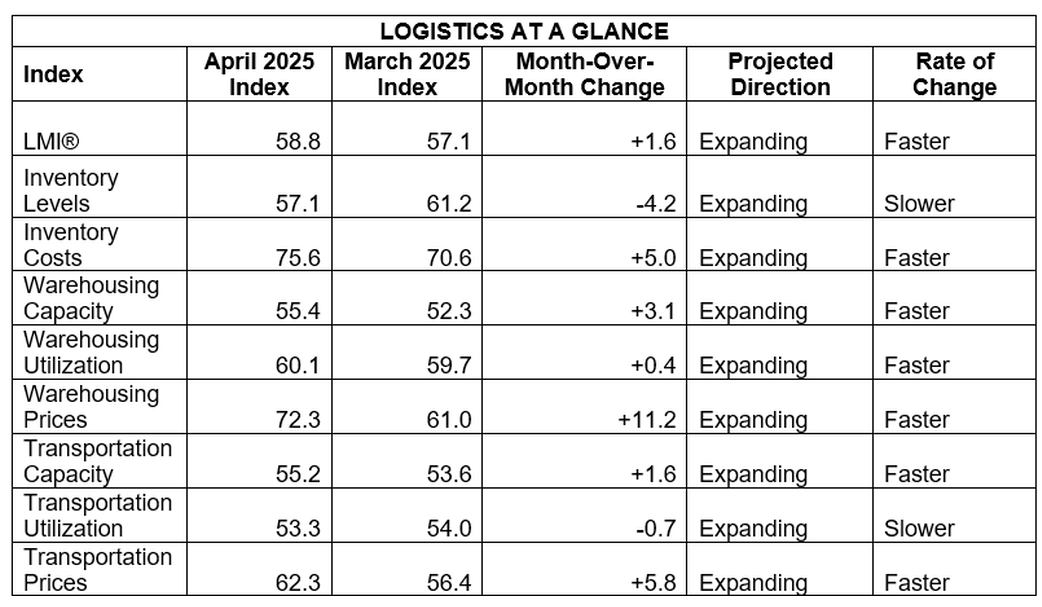

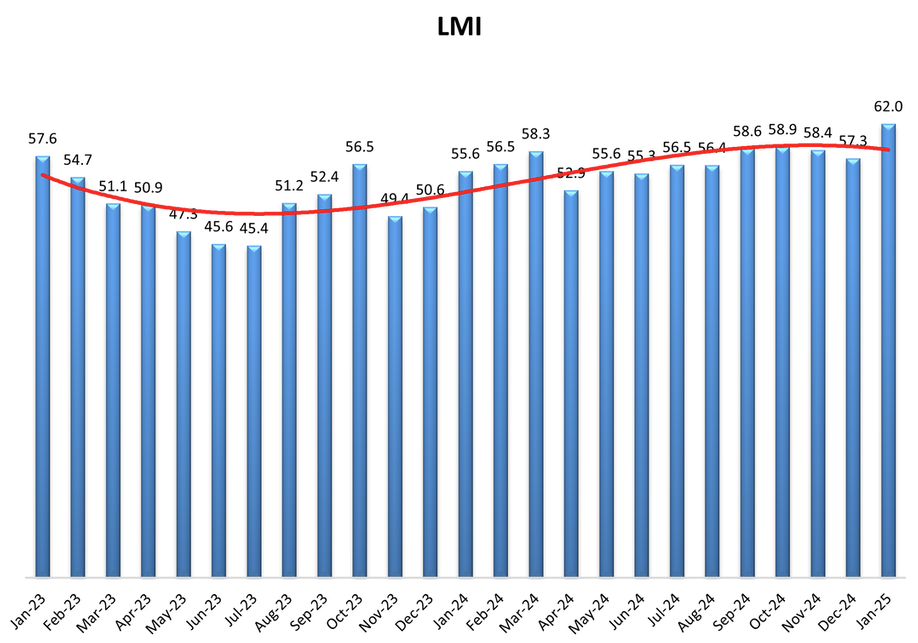

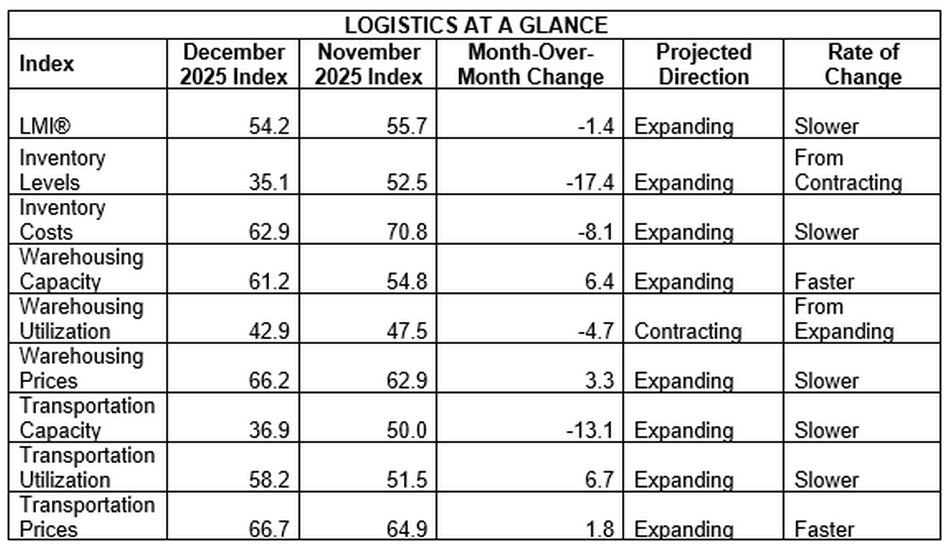

The December Logistics Manager’s Index eased to 54.2 (from 55.7 in November), marking the slowest expansion since April 2024 amid an extreme inventory drawdown and softer warehousing conditions.

-

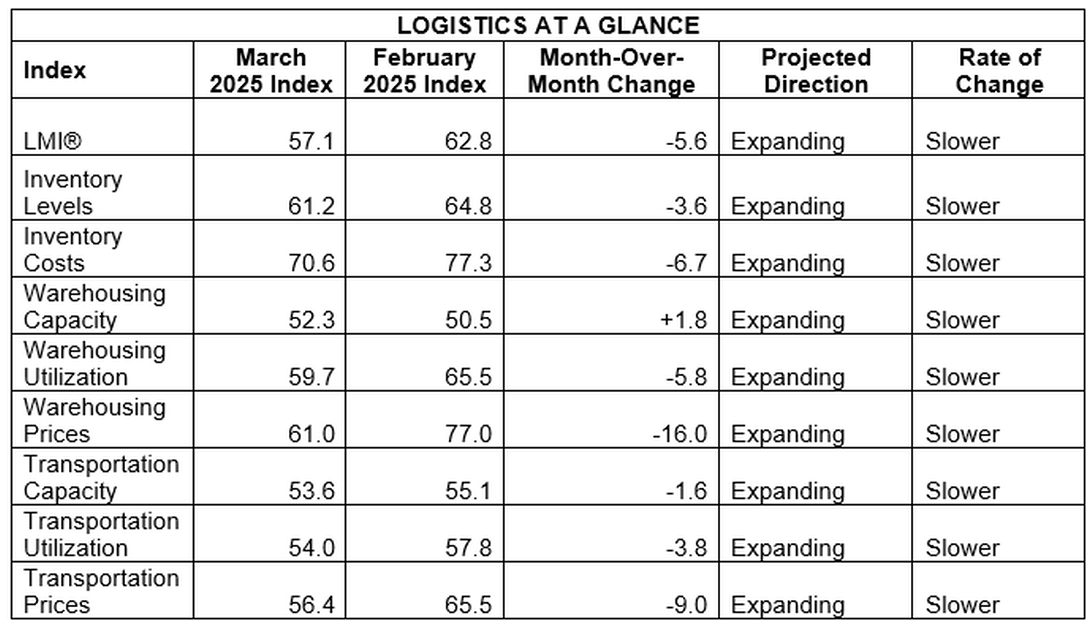

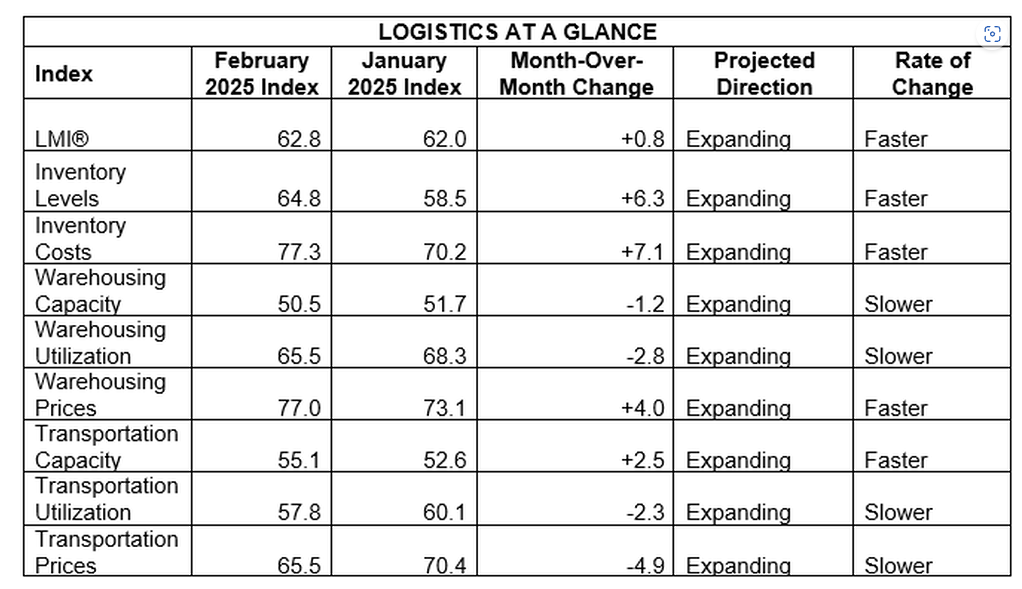

The headline LMI fell -1.5 pts MoM to 54.2, remaining in expansion but logging its tenth consecutive reading below the long-run average of 61.4, with most of the drag coming from inventory and warehousing components.

-

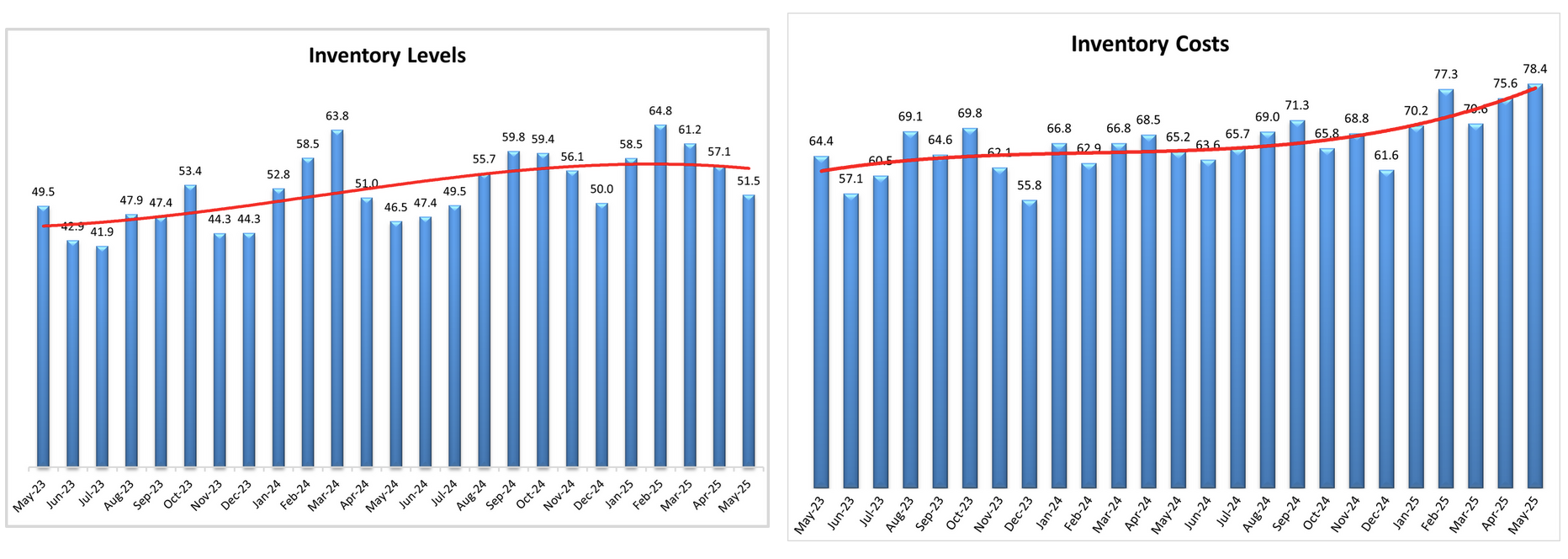

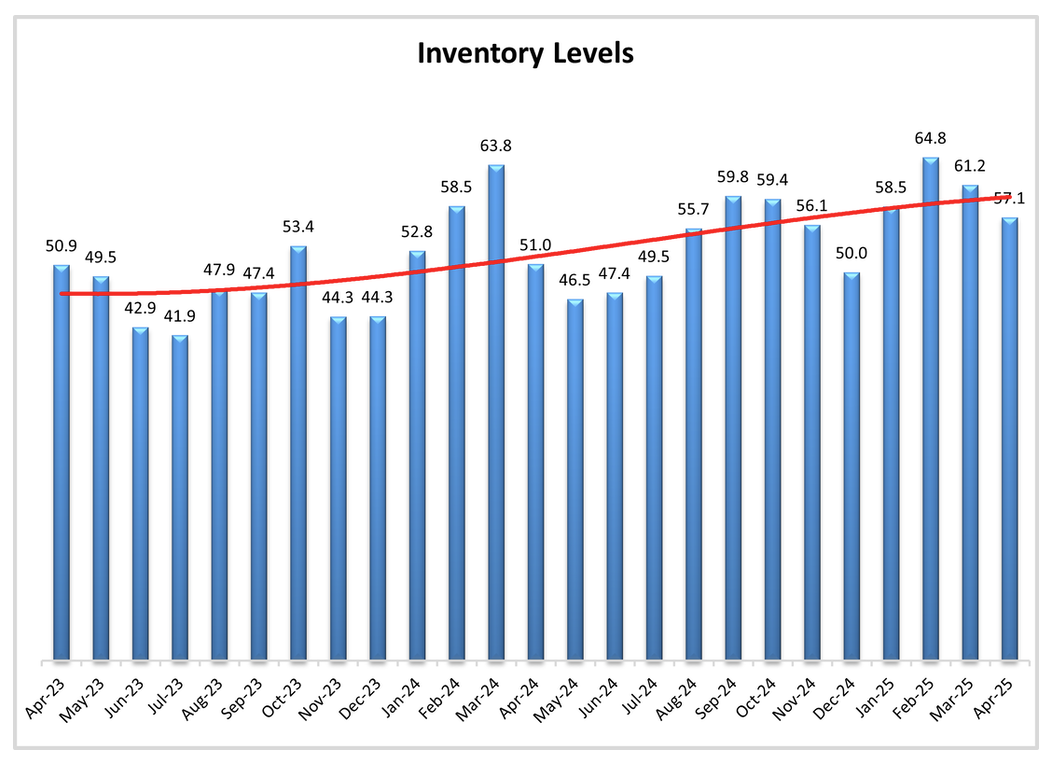

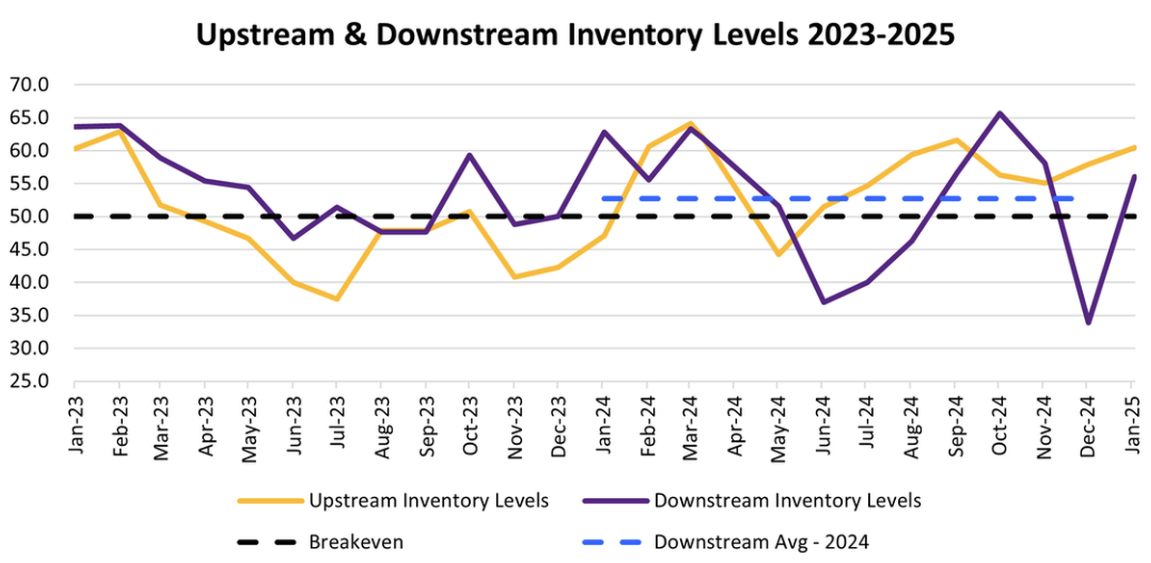

Inventory Levels collapsed to 35.1 (from 52.5, -17.4 pts), the largest MoM decline in the history of the index, indicating an unprecedented drawdown as firms pushed goods downstream to meet strong holiday demand.

-

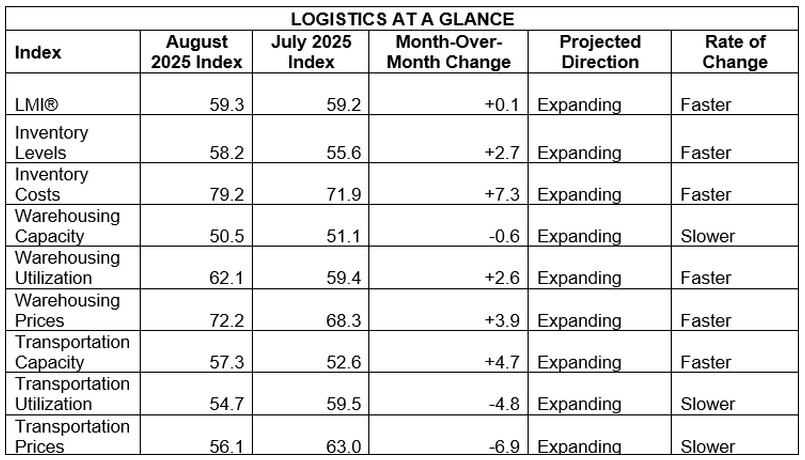

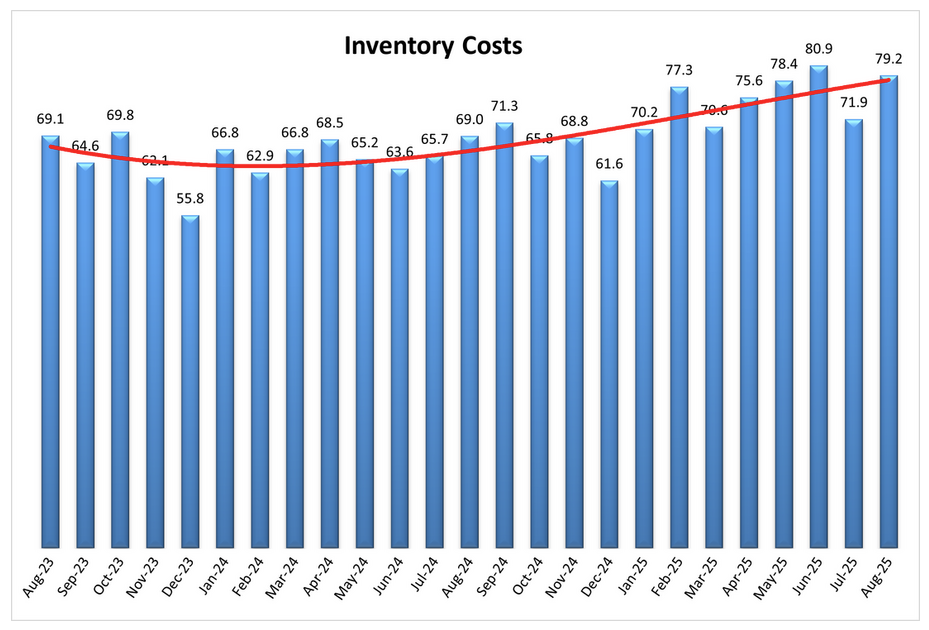

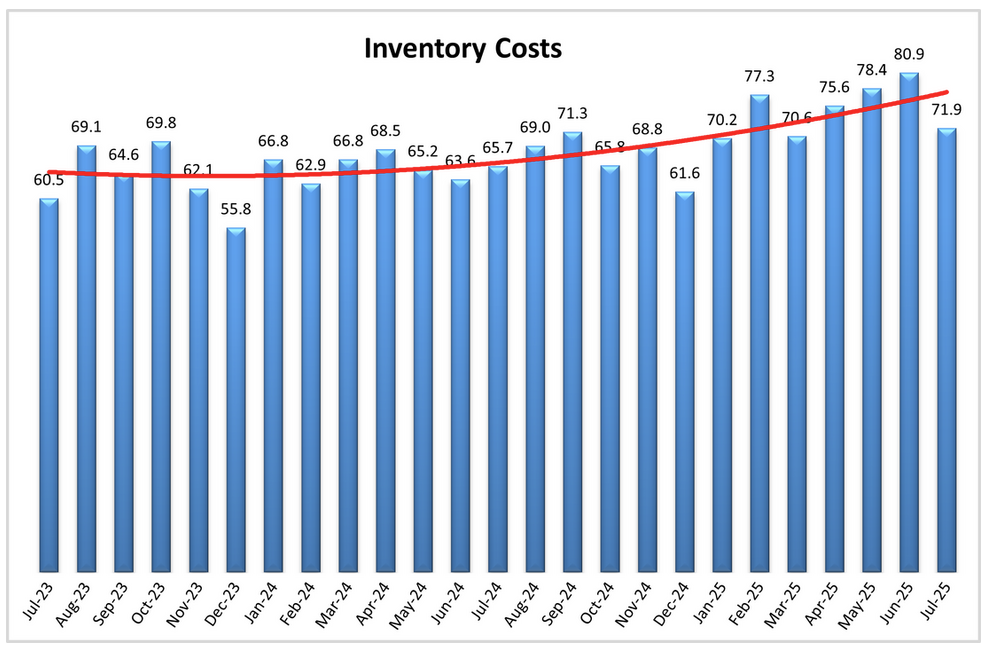

Inventory Costs slowed but stayed firmly expansionary at 62.9 (from 71.0, -8.1 pts), showing that carrying and handling costs continued to rise even as physical inventory volumes fell sharply.

-

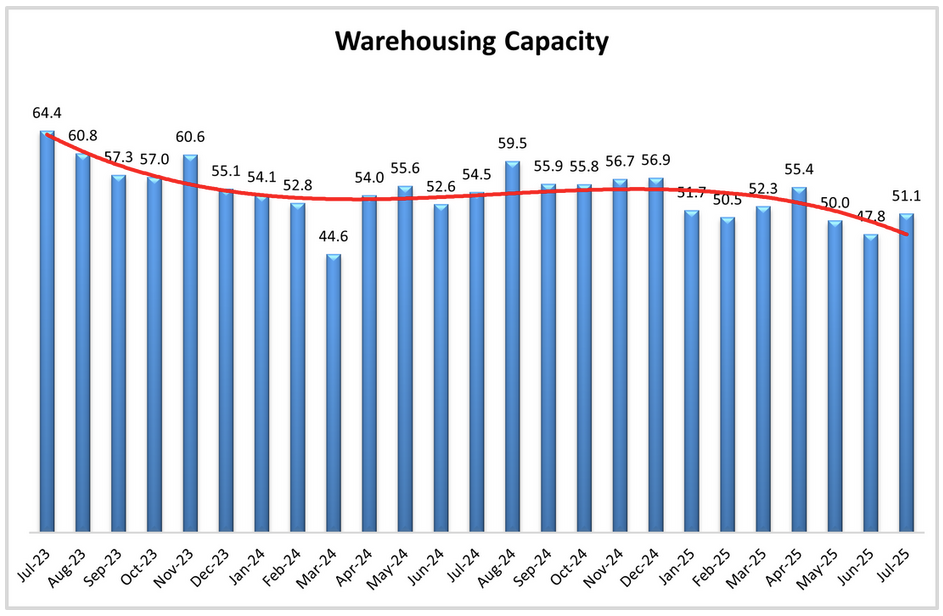

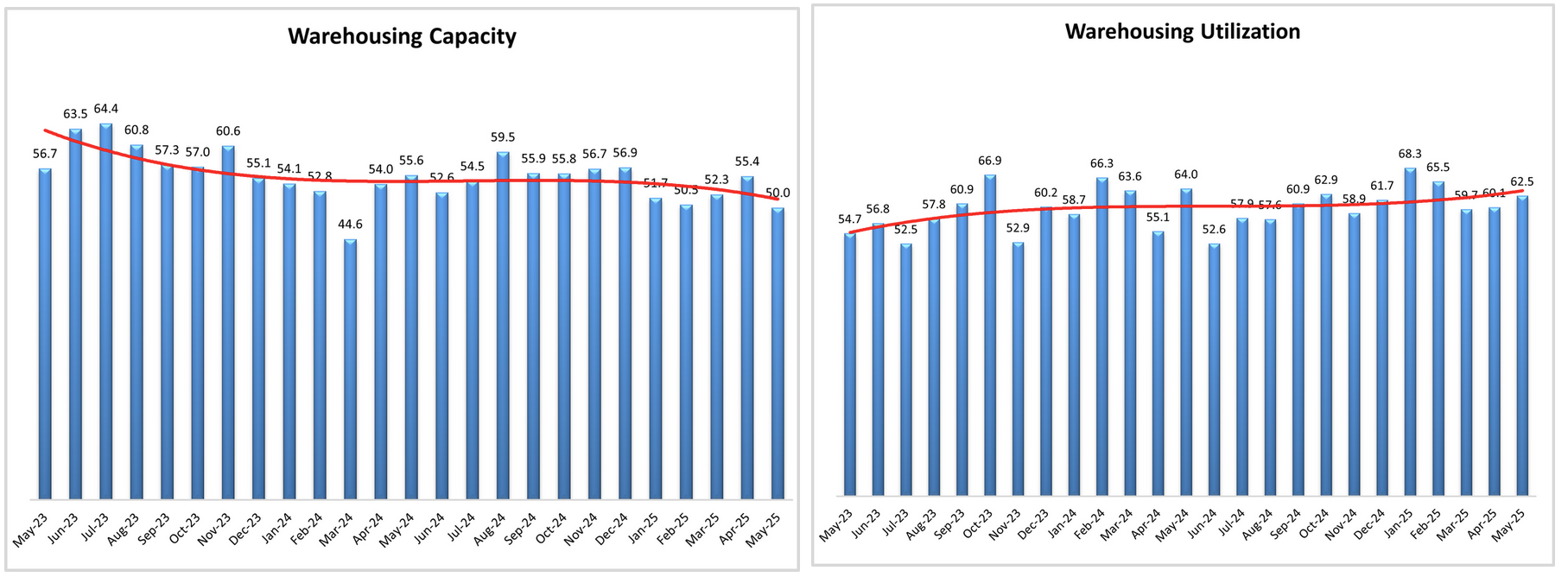

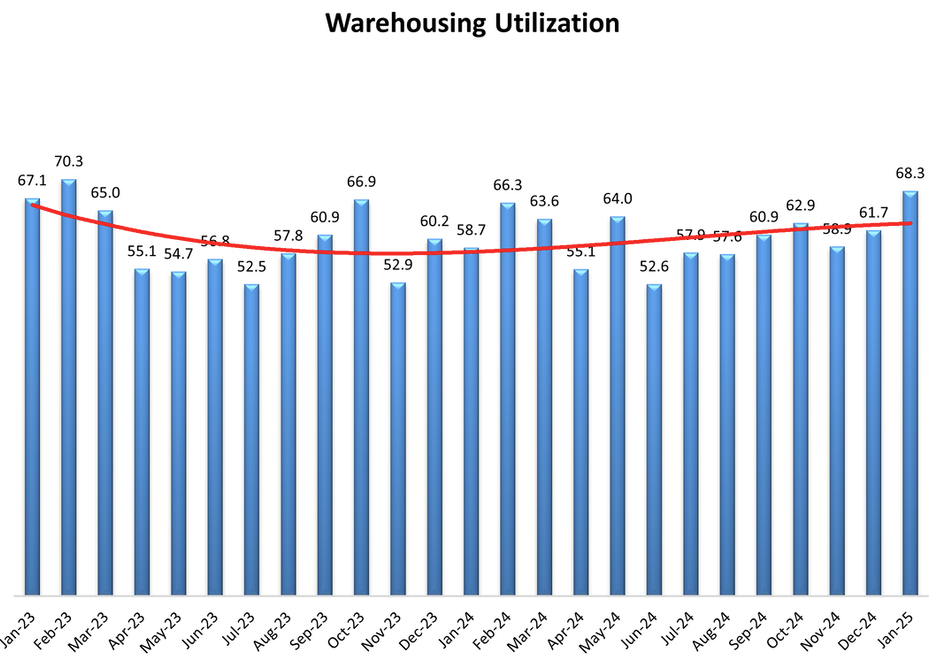

Warehousing Utilization dropped to a second consecutive all-time low at 42.9 (from 47.6, -4.7 pts), while Warehousing Capacity rose to 61.2 (from 54.8, +6.4 pts), pointing to looser space conditions amid destocking.

-

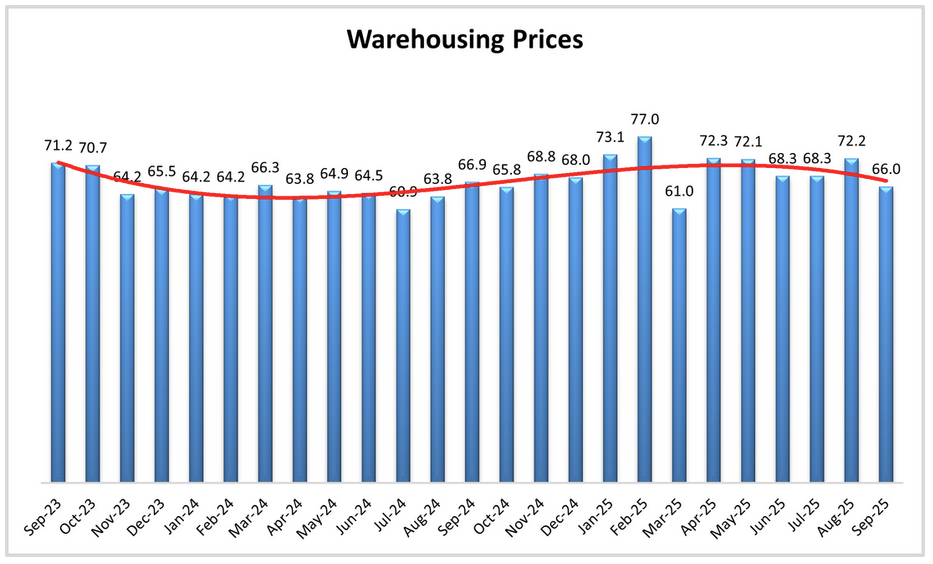

Warehousing Prices continued to increase at a strong pace, rising to 66.2 (+3.3 pts), remaining the only LMI component that has never contracted since the index’s inception.

-

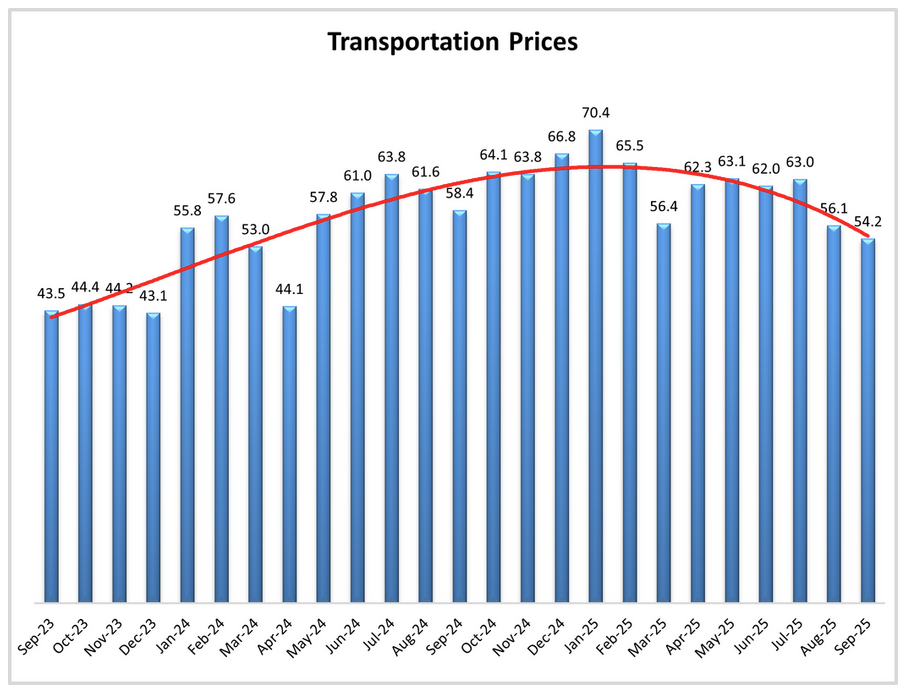

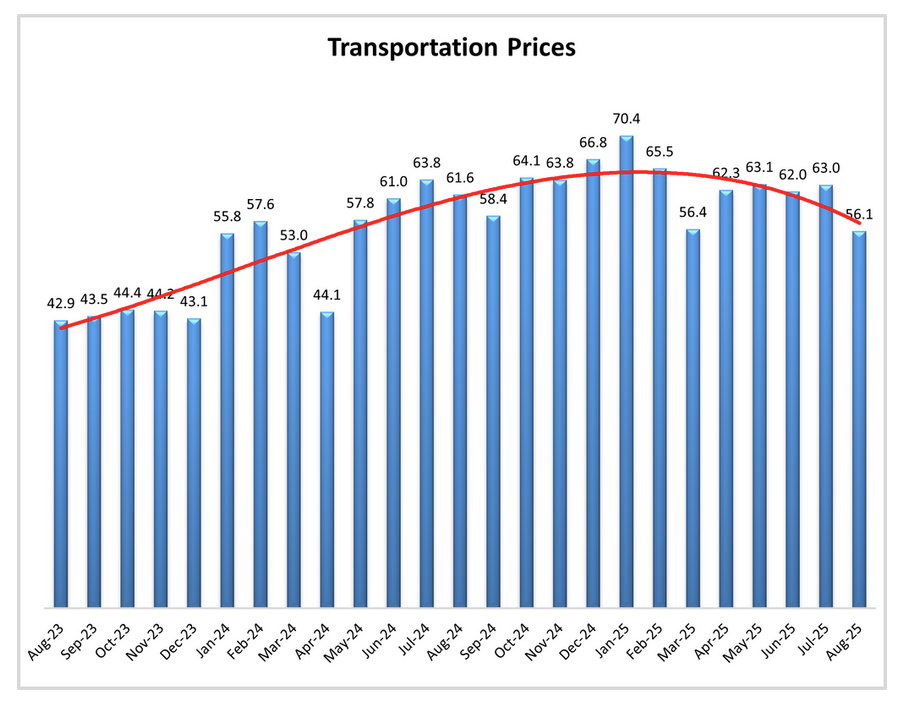

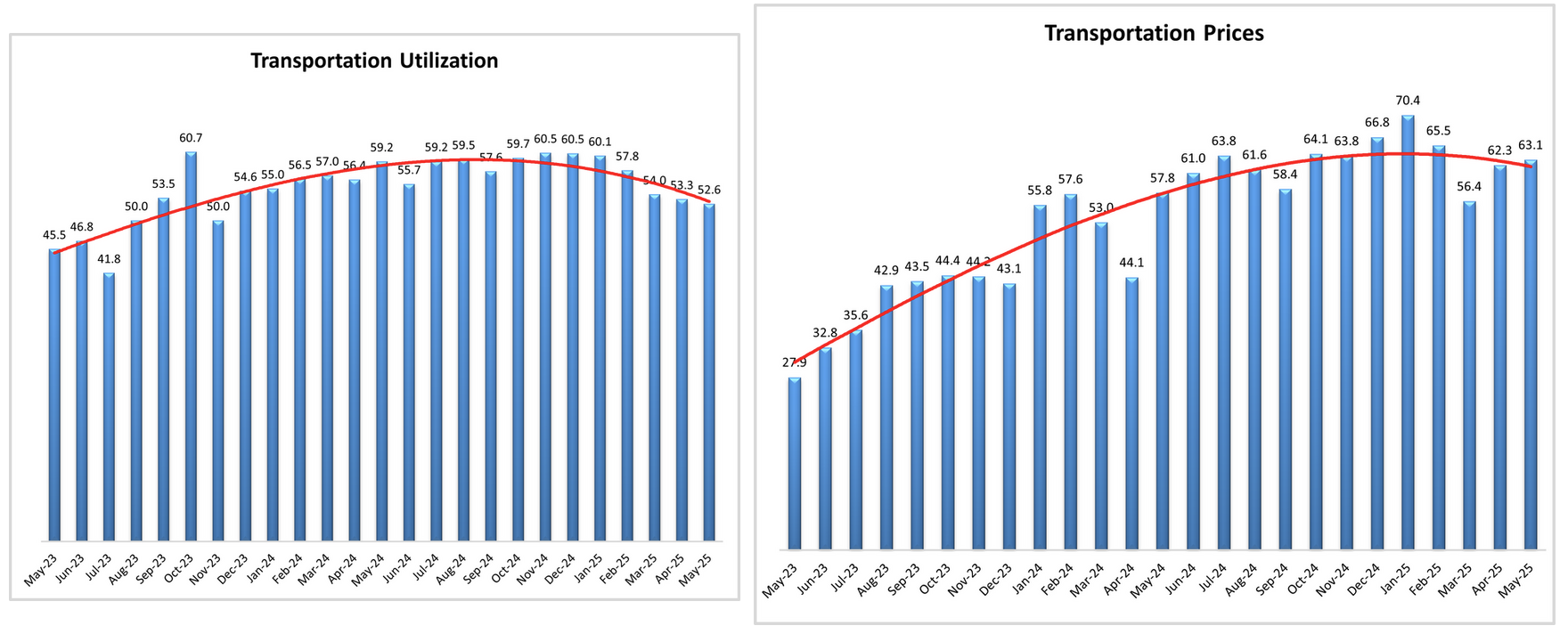

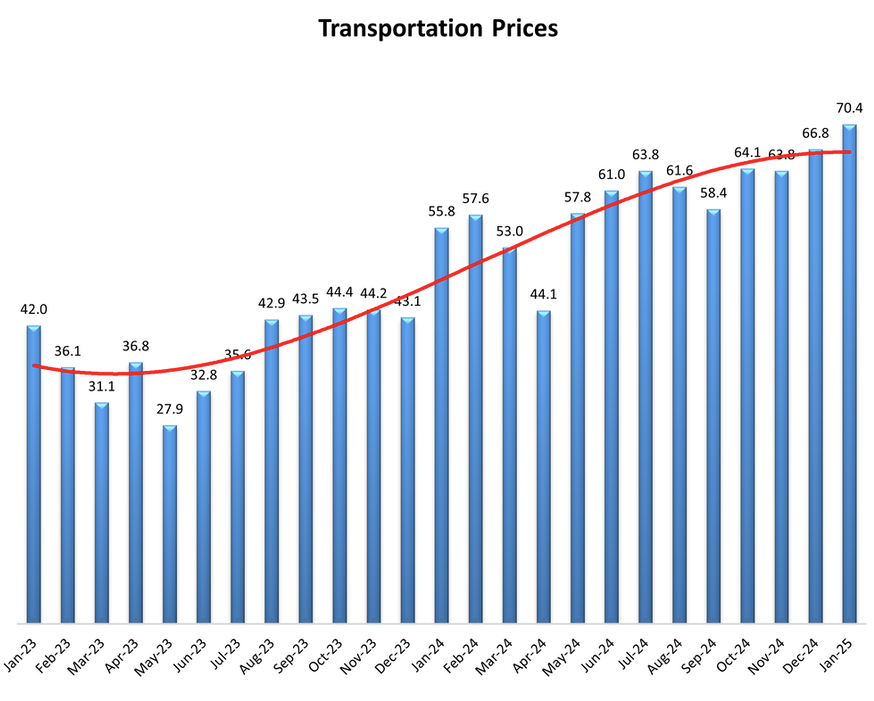

Transportation Capacity moved back into contraction at 36.9 (from 50.0, -13.1 pts), its lowest level since October 2021, signaling a sharp tightening in available freight capacity during peak holiday activity.

-

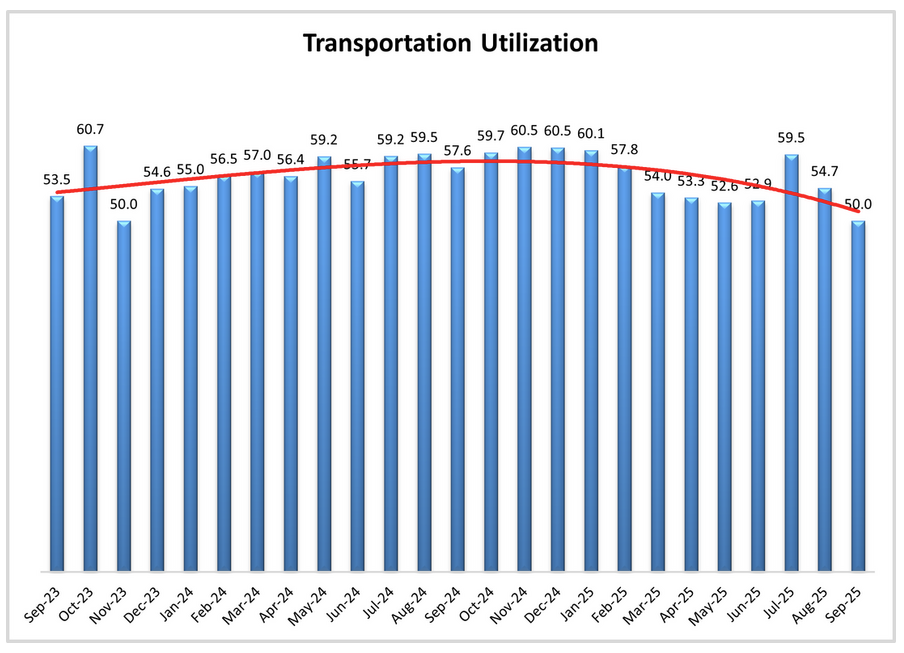

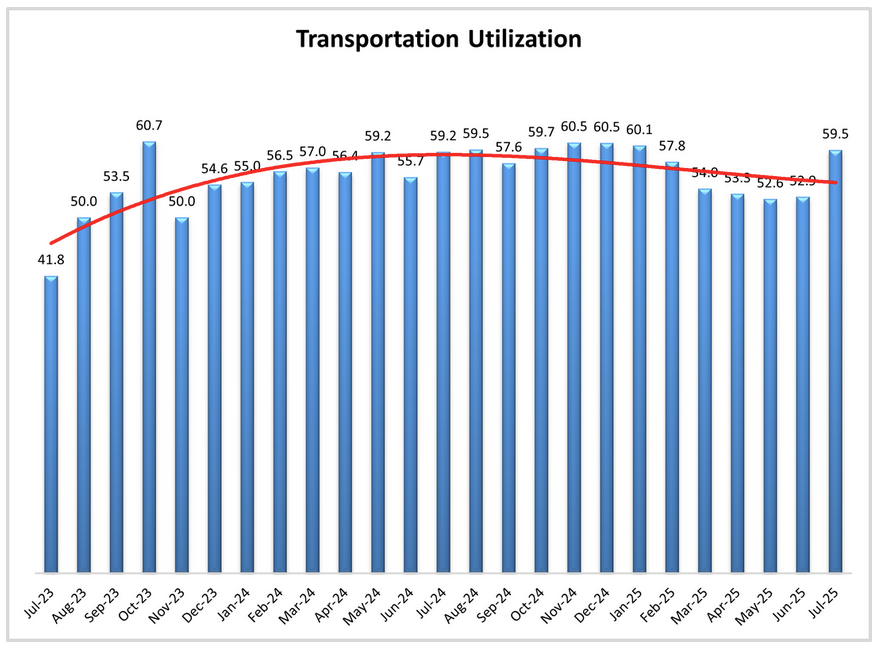

Transportation Utilization expanded to 58.2 (+6.7 pts) and Transportation Prices climbed to 66.7 (+1.8 pts), the fastest price expansion since January, reflecting strong seasonal freight demand despite lower diesel prices.

-

Forward-looking expectations rose, with respondents projecting the overall LMI at 65.3 in 12 months, alongside moderate inventory rebuilding but persistently high inventory, warehousing, and transportation costs in 2026.

-