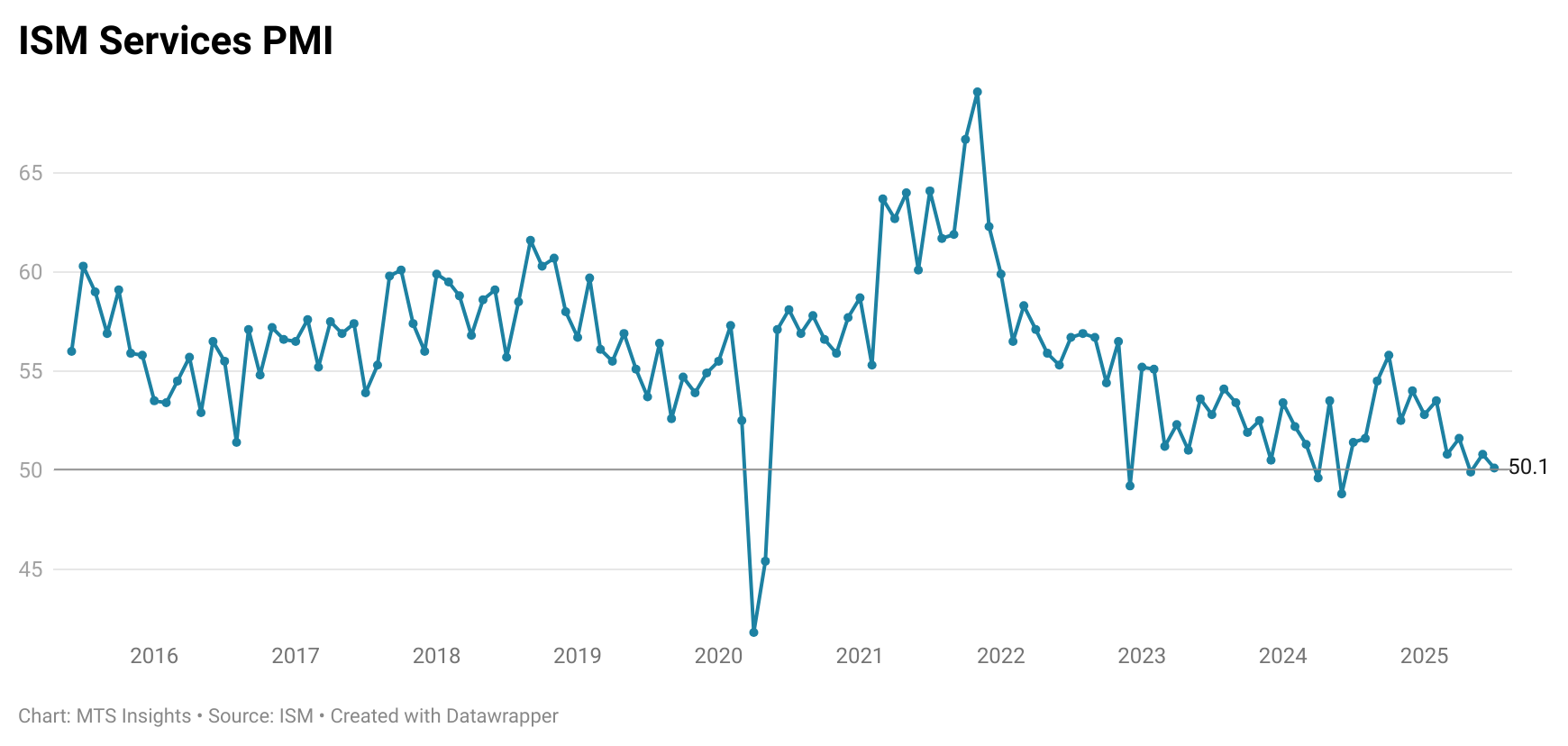

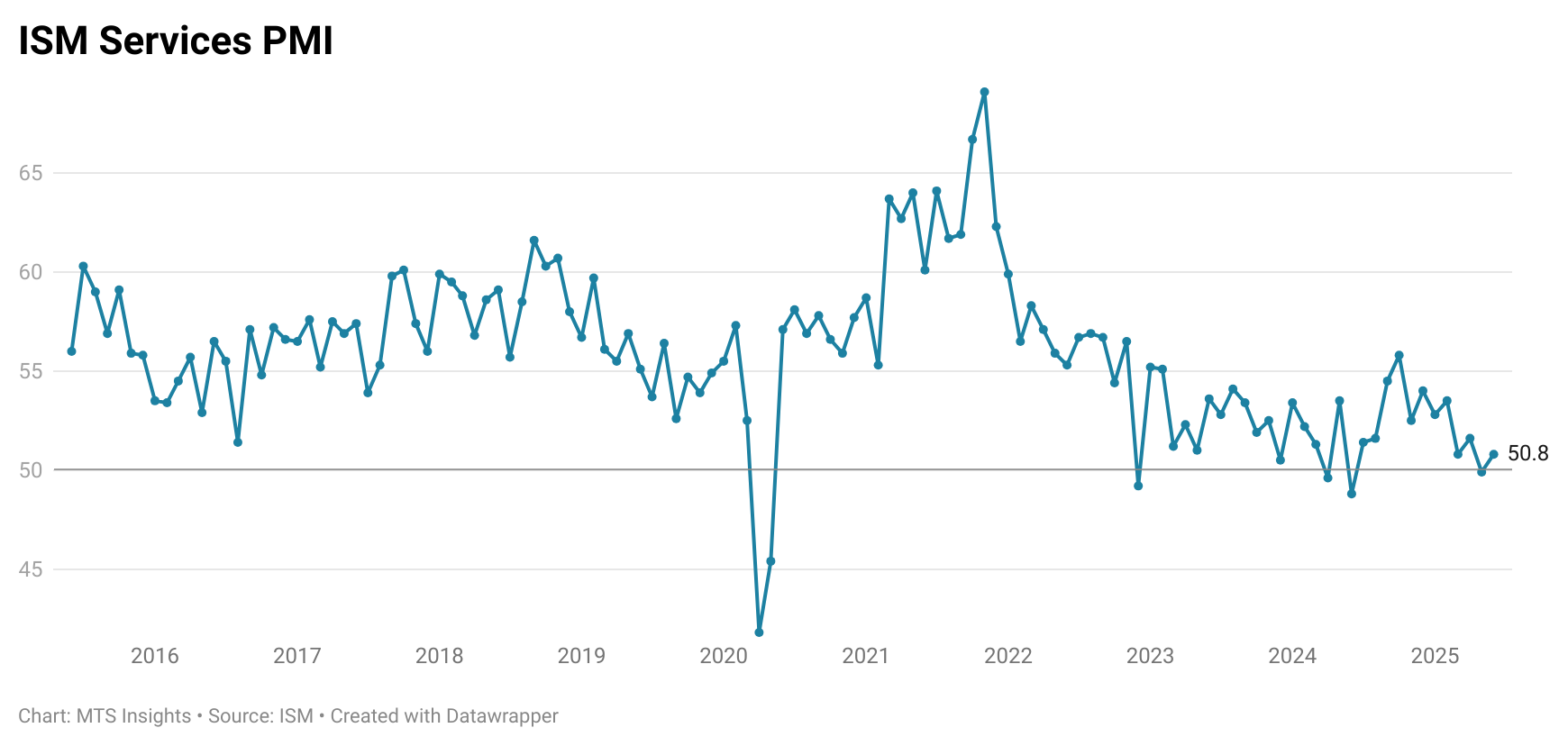

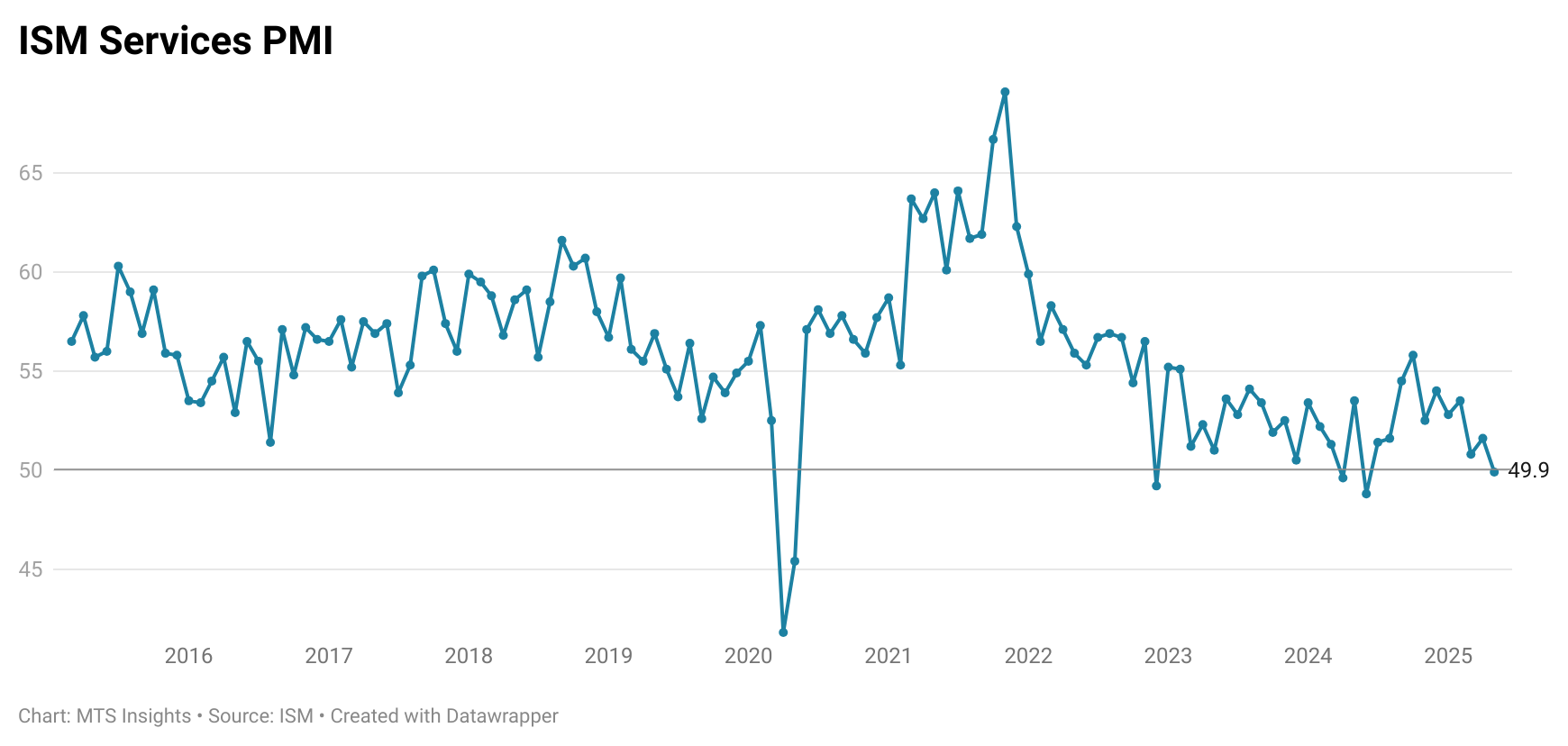

ISM Services PMI

ISM Services PMI

- Source

- Institute of Supply Management

- Source Link

- https://www.ismworld.org/

- Frequency

- Monthly

- Next Release(s)

- February 4th, 2026 10:00 AM

-

March 4th, 2026 10:00 AM

-

April 3rd, 2026 10:00 AM

-

May 5th, 2026 10:00 AM

-

June 3rd, 2026 10:00 AM

-

July 6th, 2026 10:00 AM

-

August 5th, 2026 10:00 AM

-

September 3rd, 2026 10:00 AM

-

October 5th, 2026 10:00 AM

-

November 4th, 2026 10:00 AM

-

December 3rd, 2026 10:00 AM

-

January 6th, 2027 10:00 AM

Latest Updates

-

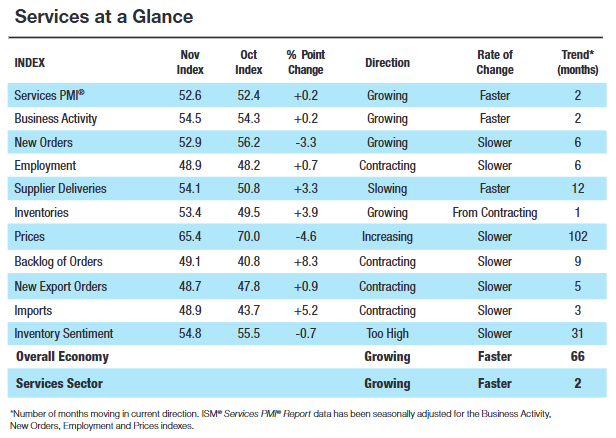

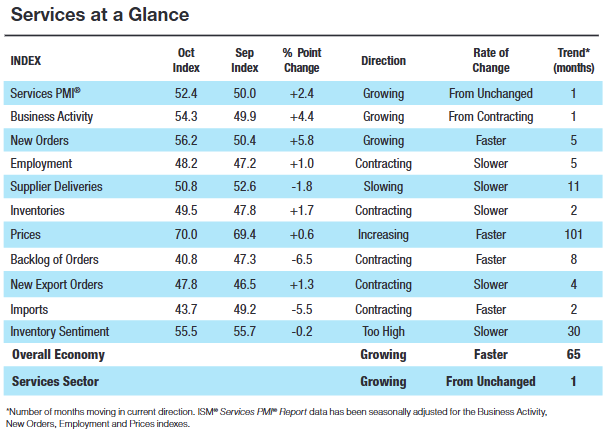

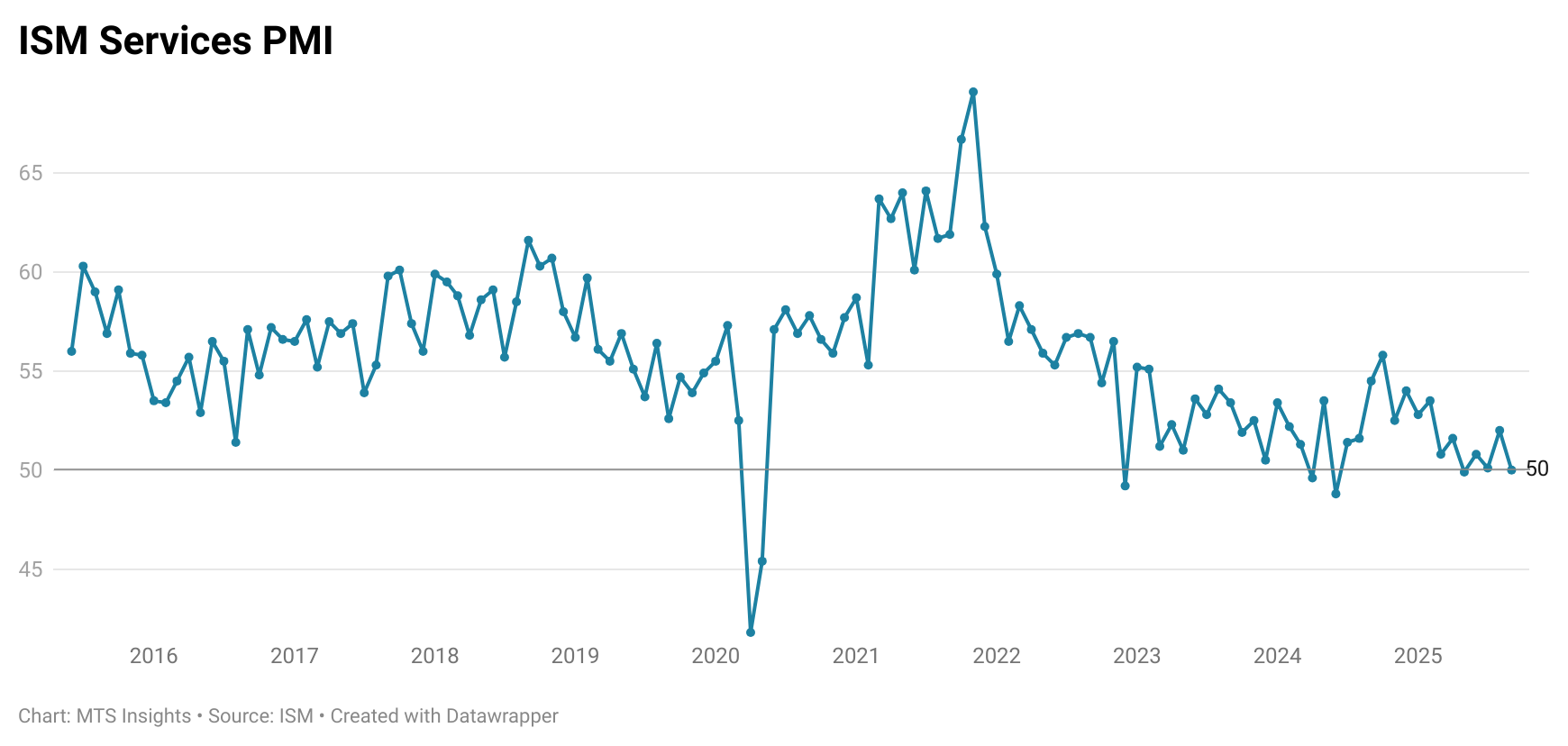

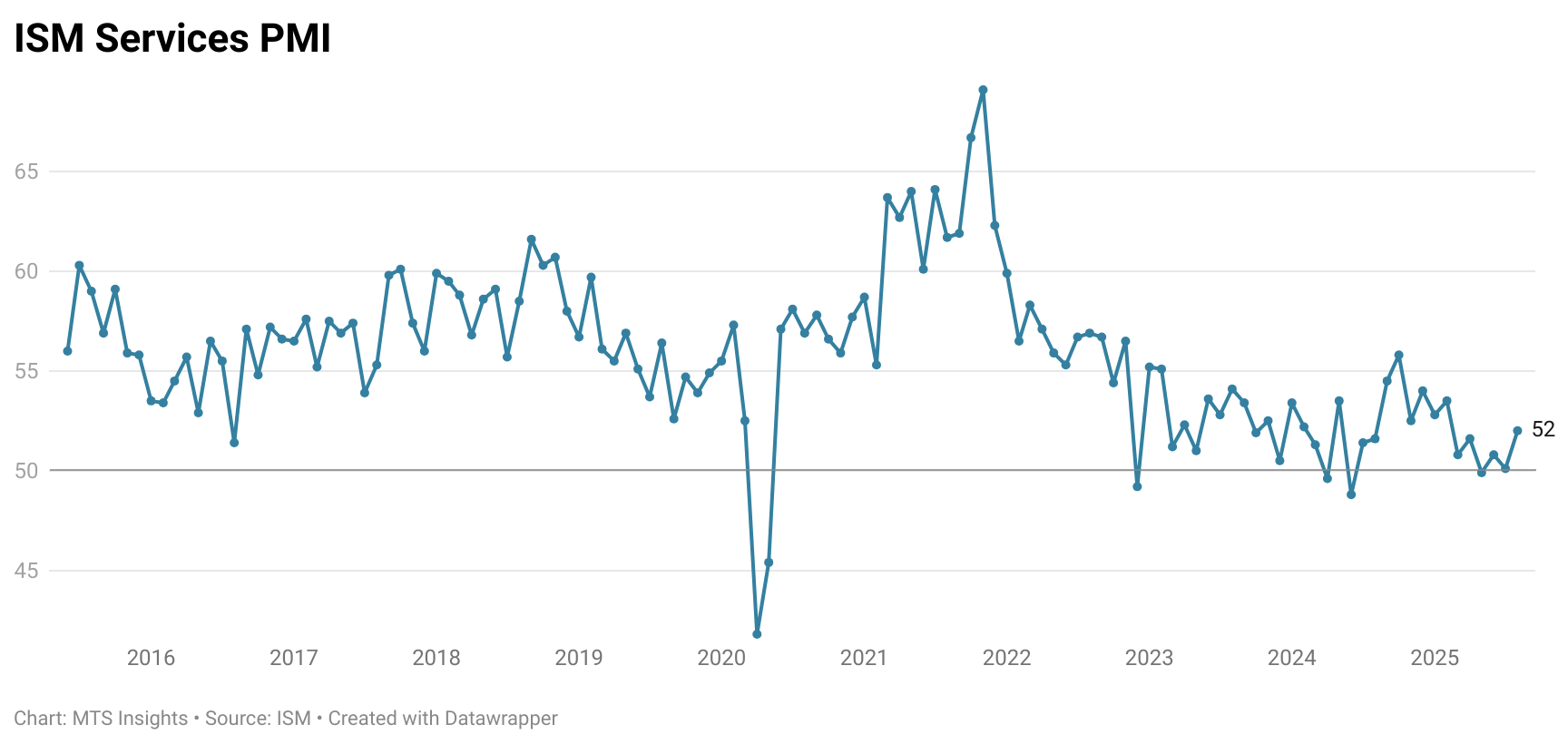

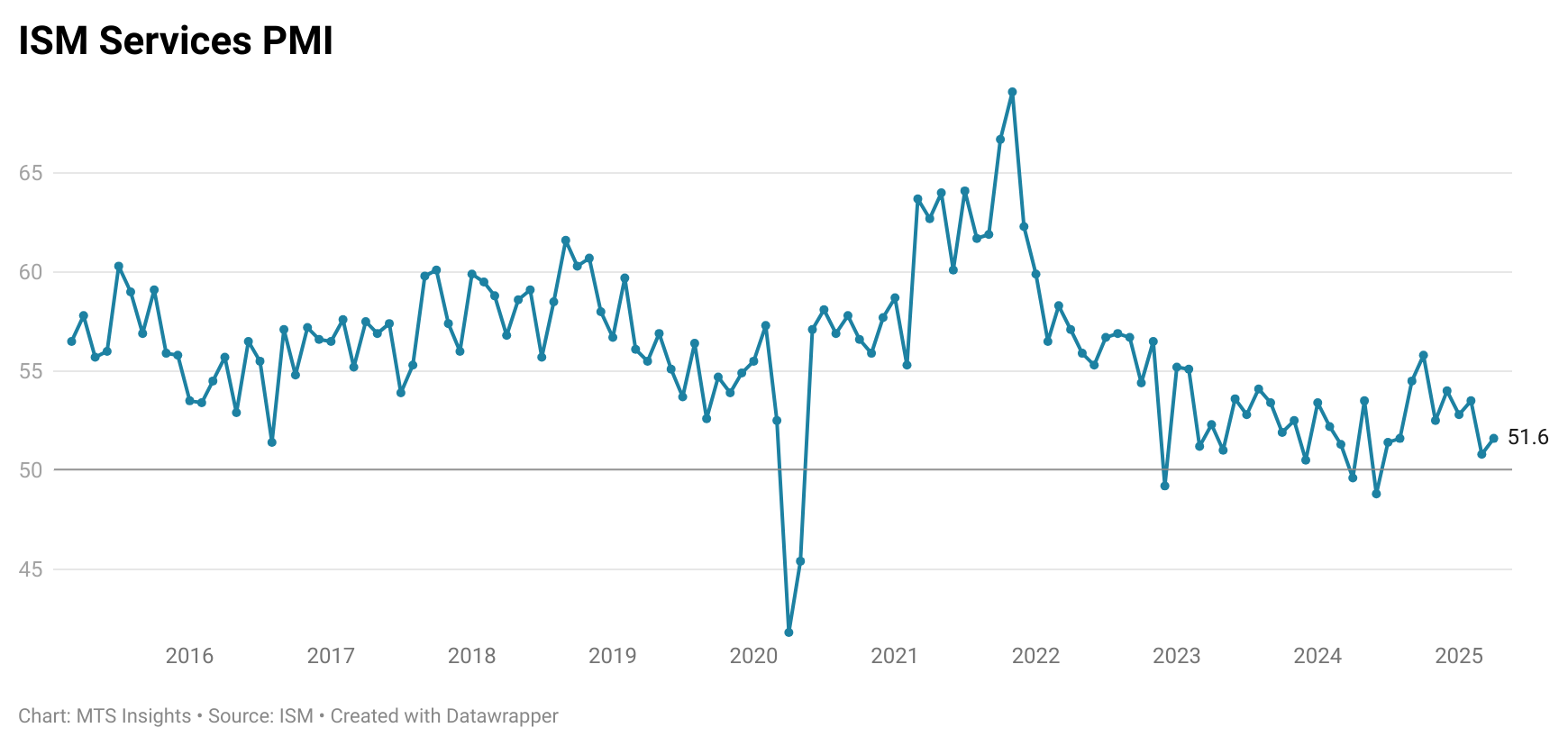

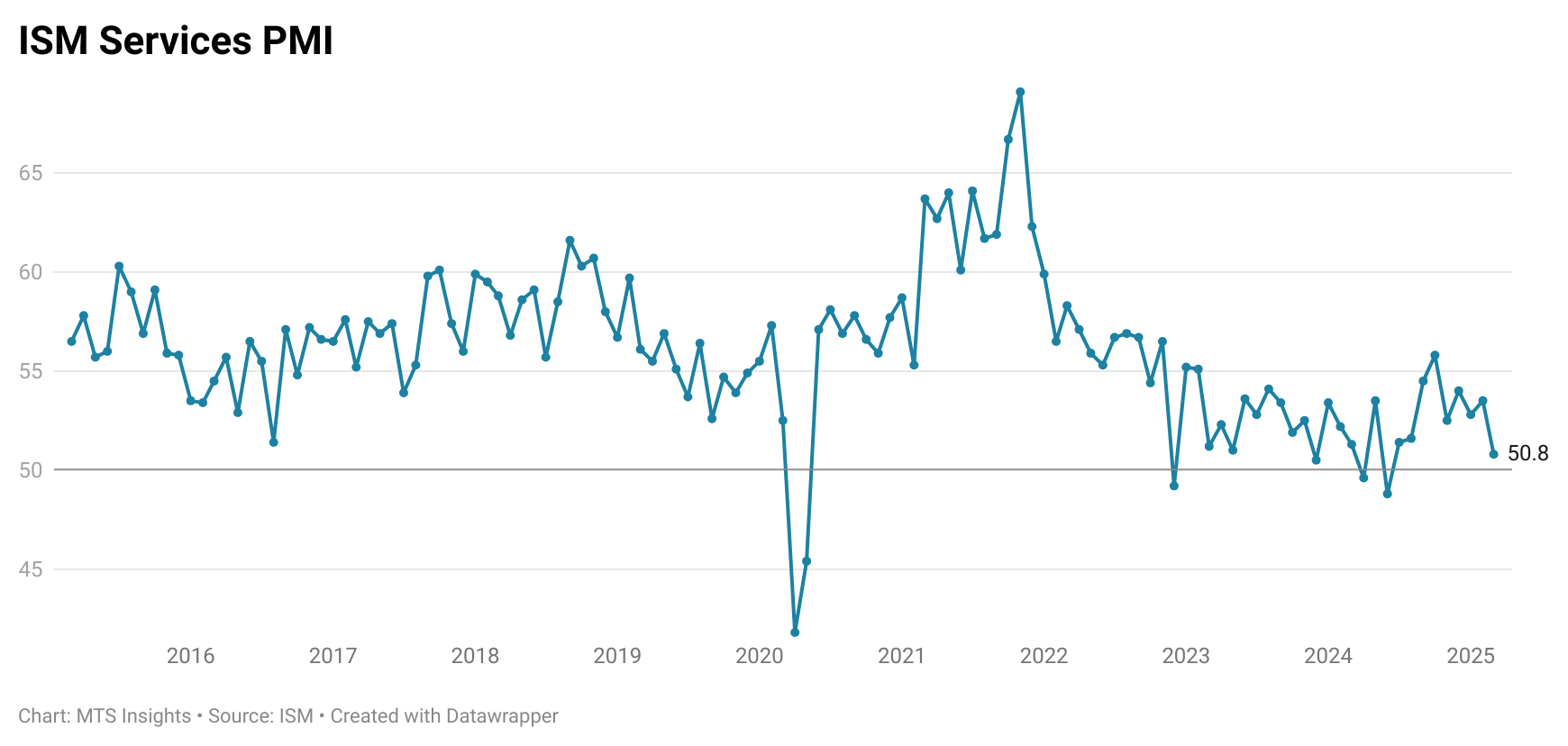

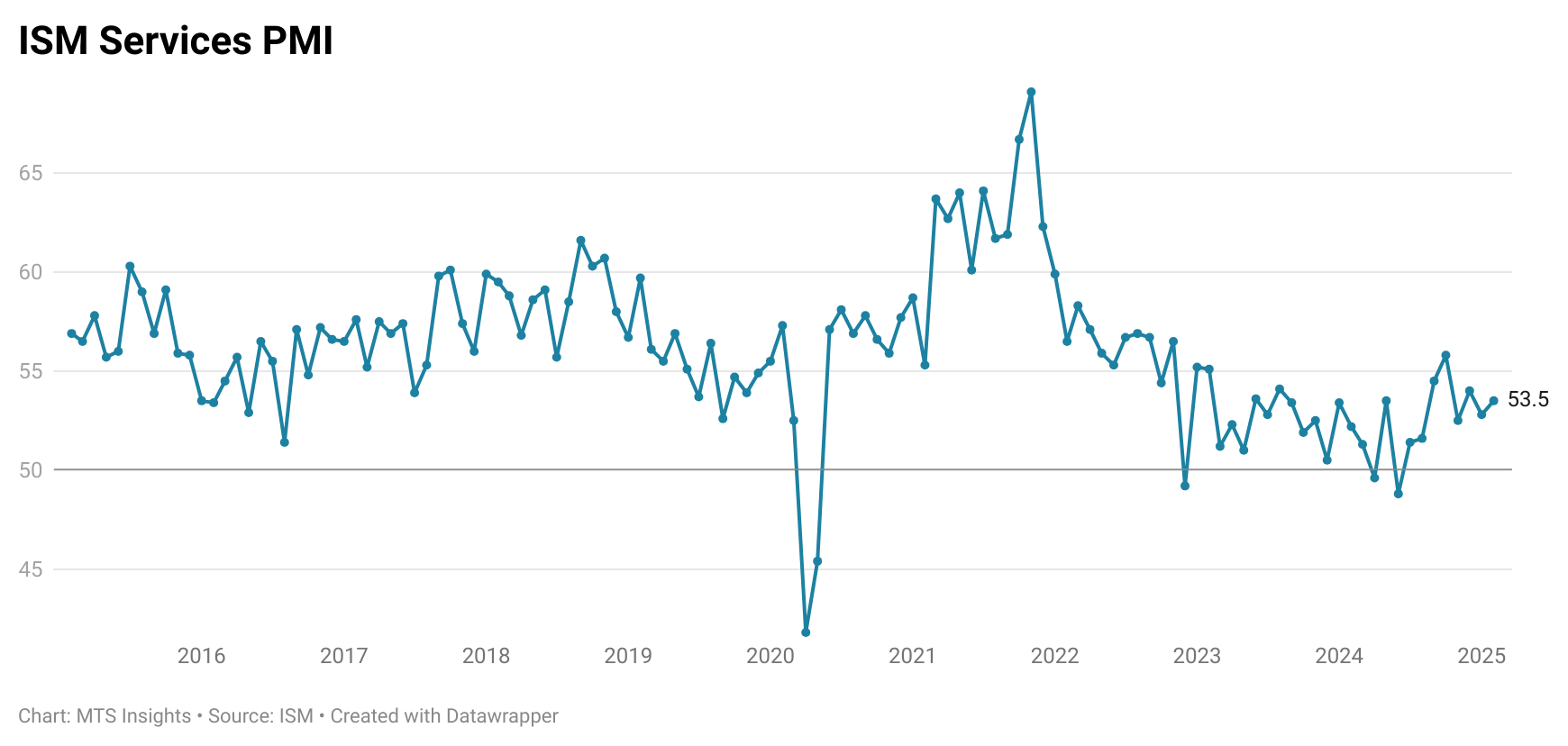

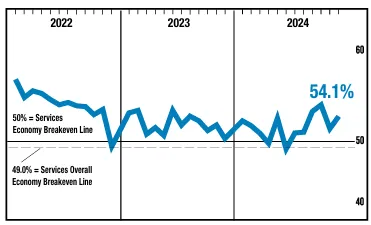

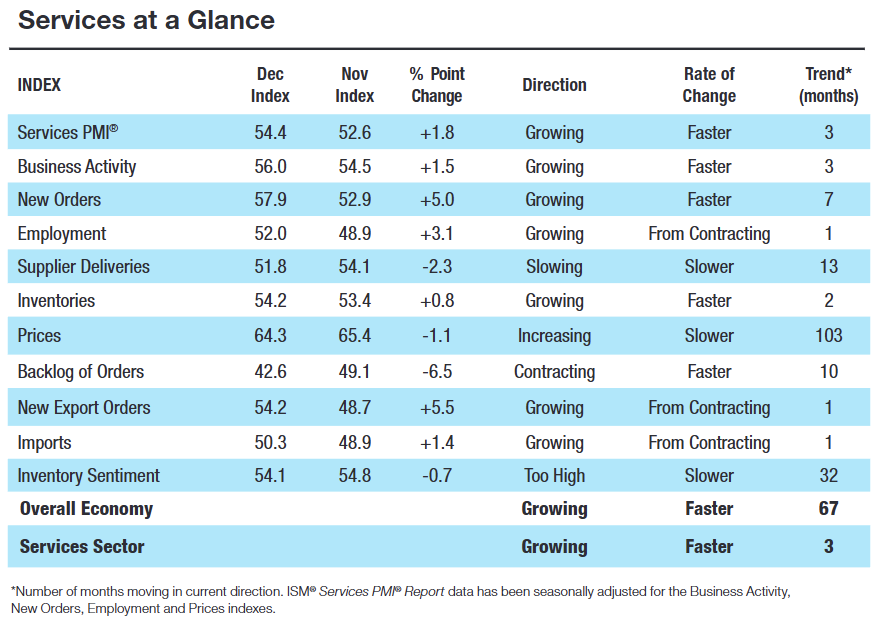

The ISM Services PMI rose +1.8 pts to 54.4 in December 2025 (from 52.6 in November), the highest reading since October, signaling faster services-sector expansion at year-end.

-

The Business Activity Index increased to 56.0 (+1.5 pts MoM), indicating a quicker pace of output growth and extending expansion to a third consecutive month.

-

The New Orders Index jumped to 57.9 (+5.0 pts MoM), its fastest growth in seven months, pointing to a notable acceleration in demand entering 2026.

-

The Employment Index moved back into expansion at 52.0 (+3.1 pts MoM) after six months in contraction, marking its first expansionary reading since May 2025.

-

The Supplier Deliveries Index eased to 51.8 (-2.3 pts MoM) but remained above 50 for a 13th straight month, indicating delivery times are still slowing, though at a reduced pace.

-

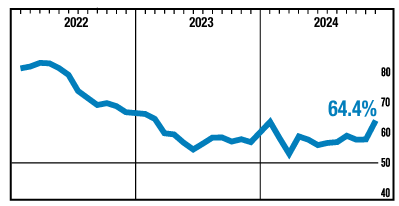

The Prices Index declined to 64.3 (-1.1 pts MoM), the lowest since March 2025, but stayed above 60 for a 13th consecutive month, showing cost pressures remain elevated despite some easing.

-

The Inventories Index rose to 54.2 (+0.8 pts MoM), signaling a second month of inventory expansion, while Inventory Sentiment stayed in “too high” territory at 54.1 (-0.7 pts).

-

The Backlog of Orders Index fell further into contraction at 42.6 (-6.5 pts MoM), extending the contraction streak to ten months and indicating faster clearing of outstanding work.

-