ISM Manufacturing PMI

ISM Manufacturing PMI

- Source

- Institute of Supply Management

- Source Link

- https://www.ismworld.org/

- Frequency

- Monthly

- Next Release(s)

- February 2nd, 2026 10:00 AM

-

March 2nd, 2026 10:00 AM

-

April 1st, 2026 10:00 AM

-

May 1st, 2026 10:00 AM

-

June 1st, 2026 10:00 AM

-

July 1st, 2026 10:00 AM

-

August 3rd, 2026 10:00 AM

-

September 1st, 2026 10:00 AM

-

October 1st, 2026 10:00 AM

-

November 2nd, 2026 10:00 AM

-

December 1st, 2026 10:00 AM

-

January 4th, 2027 10:00 AM

Latest Updates

-

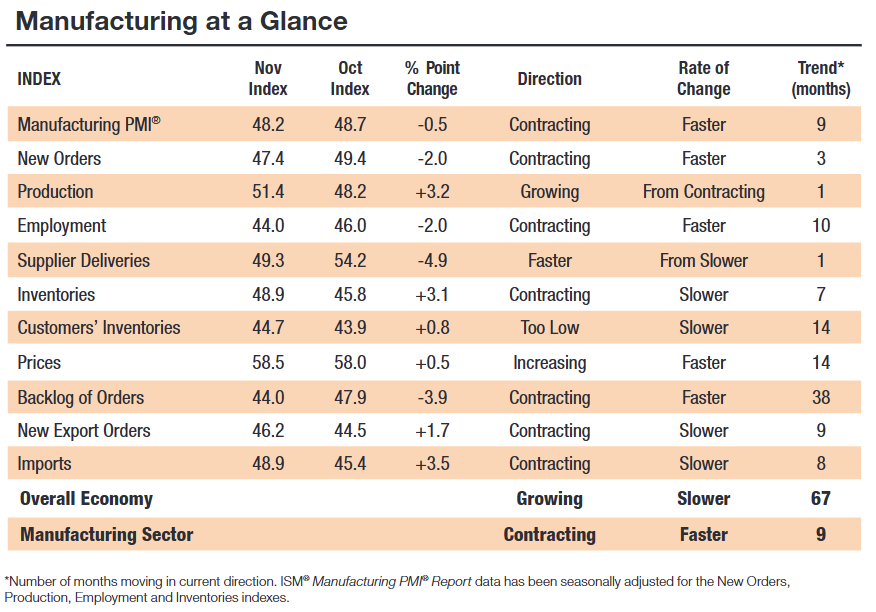

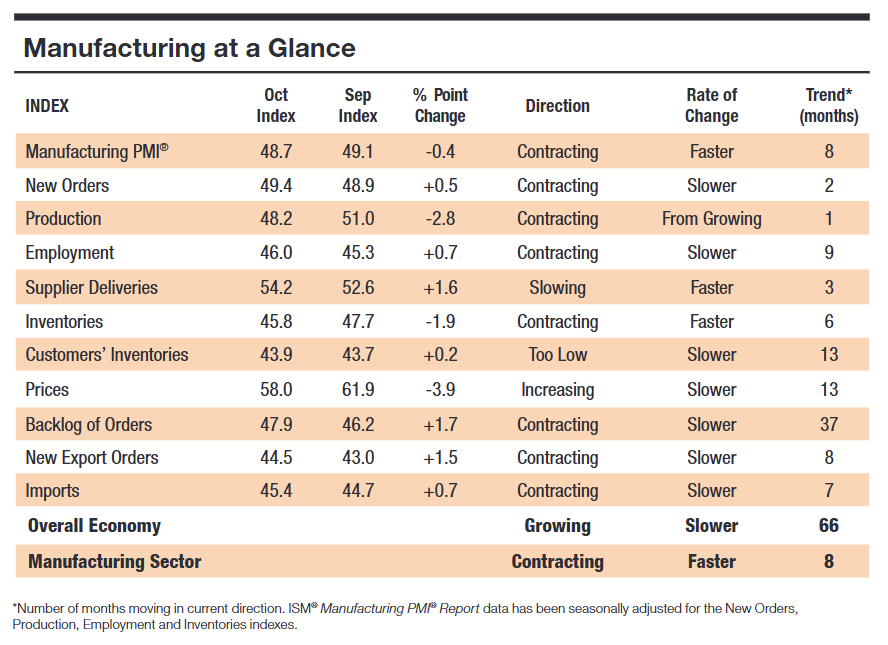

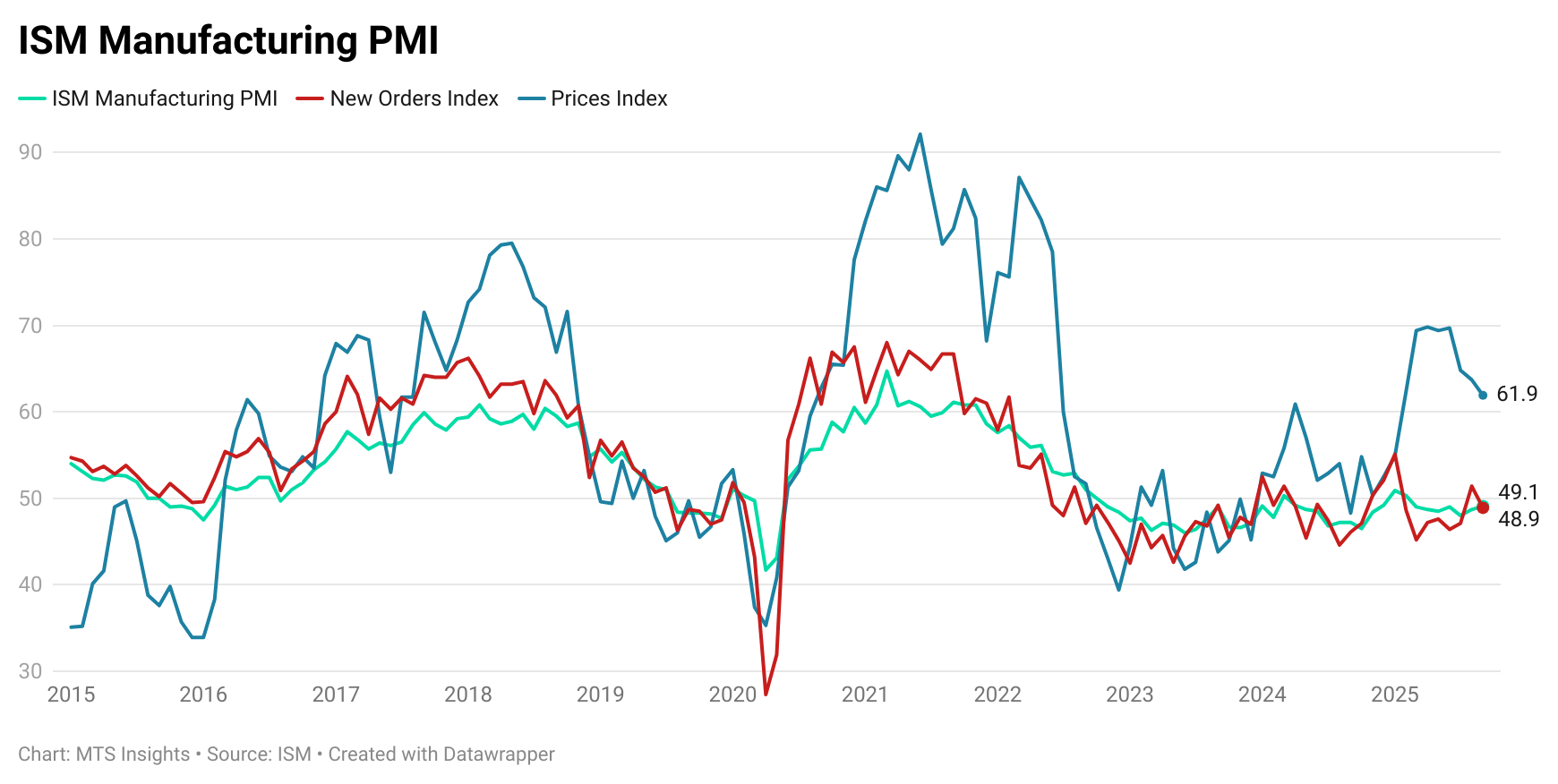

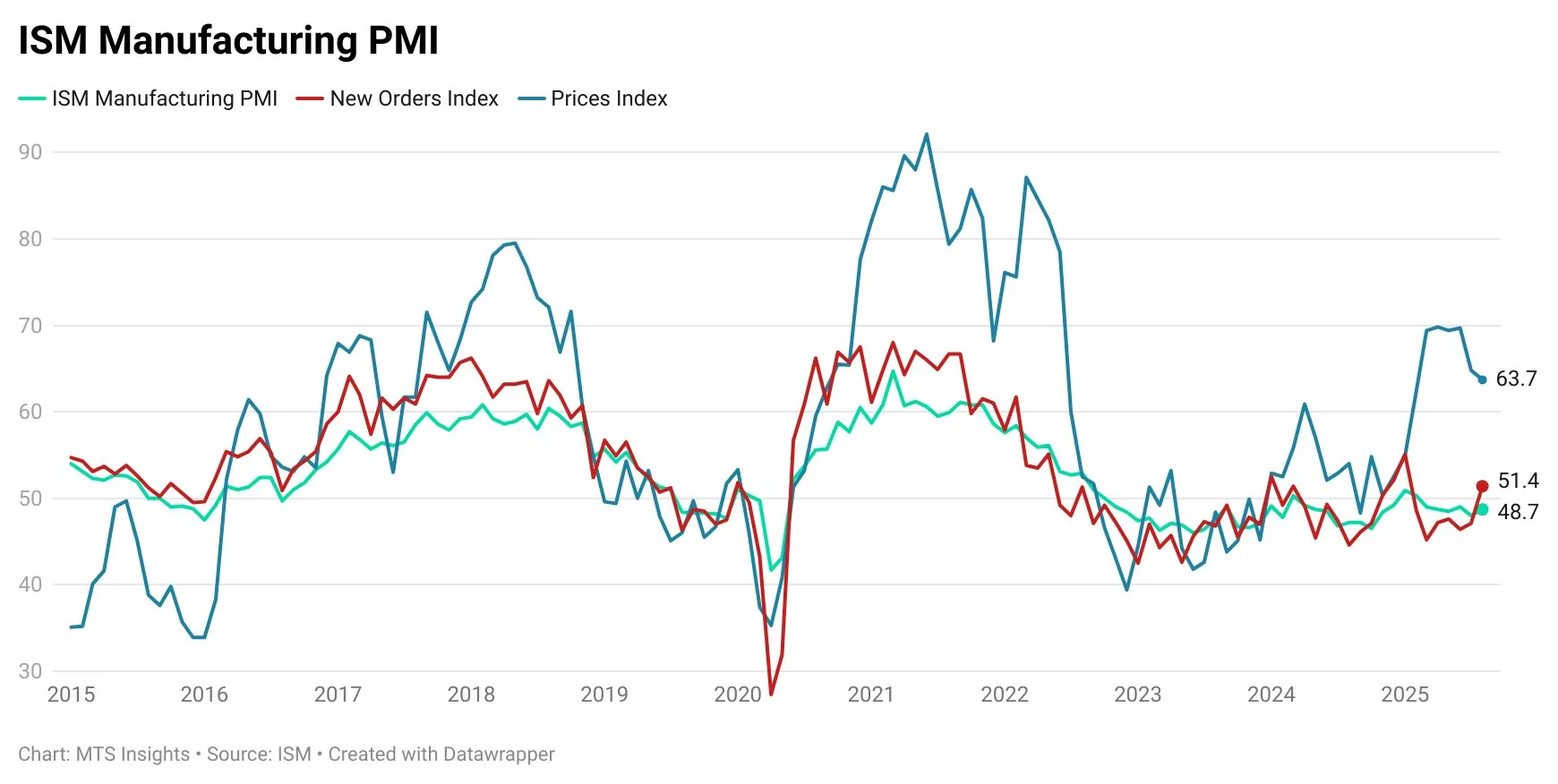

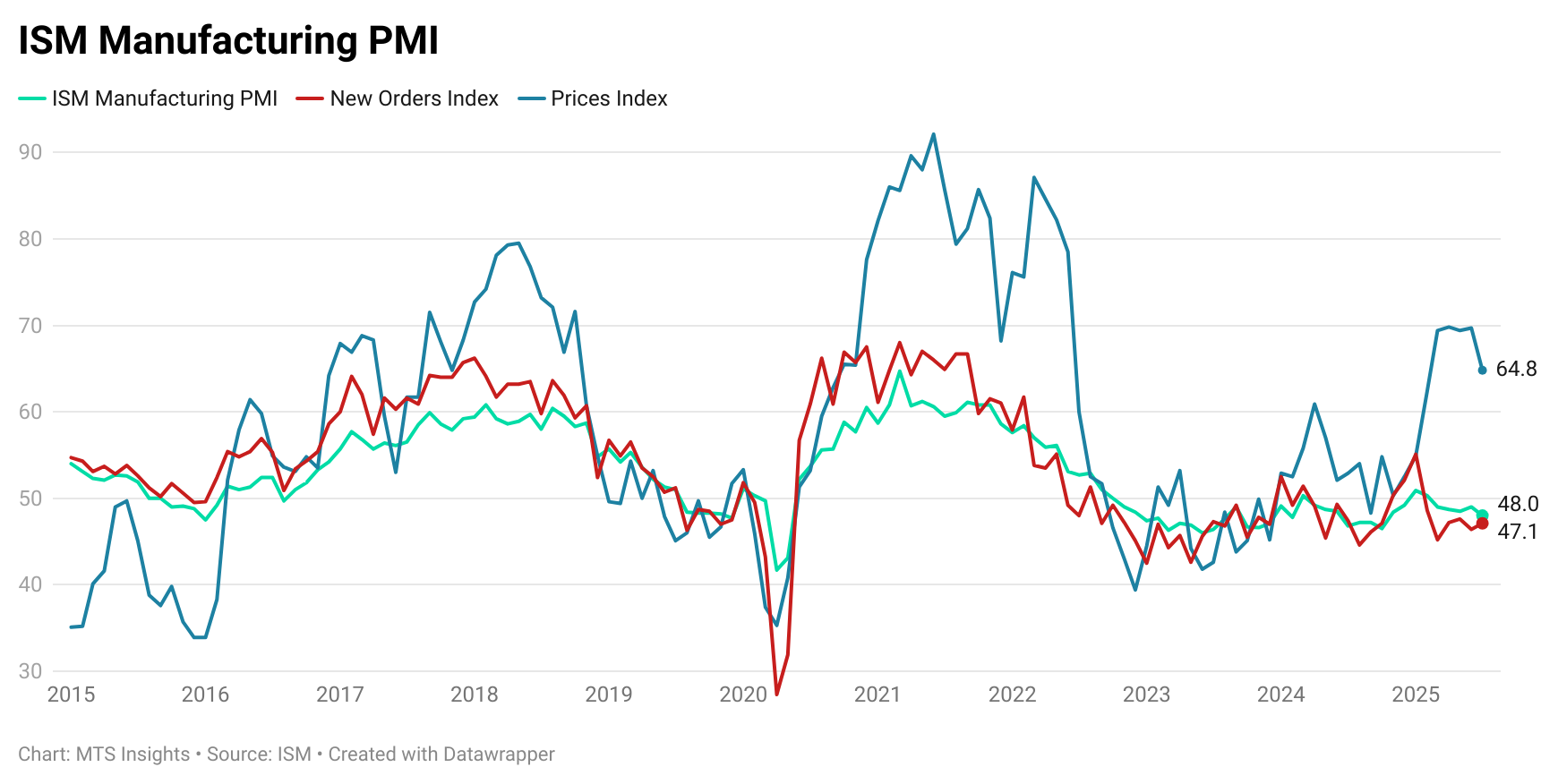

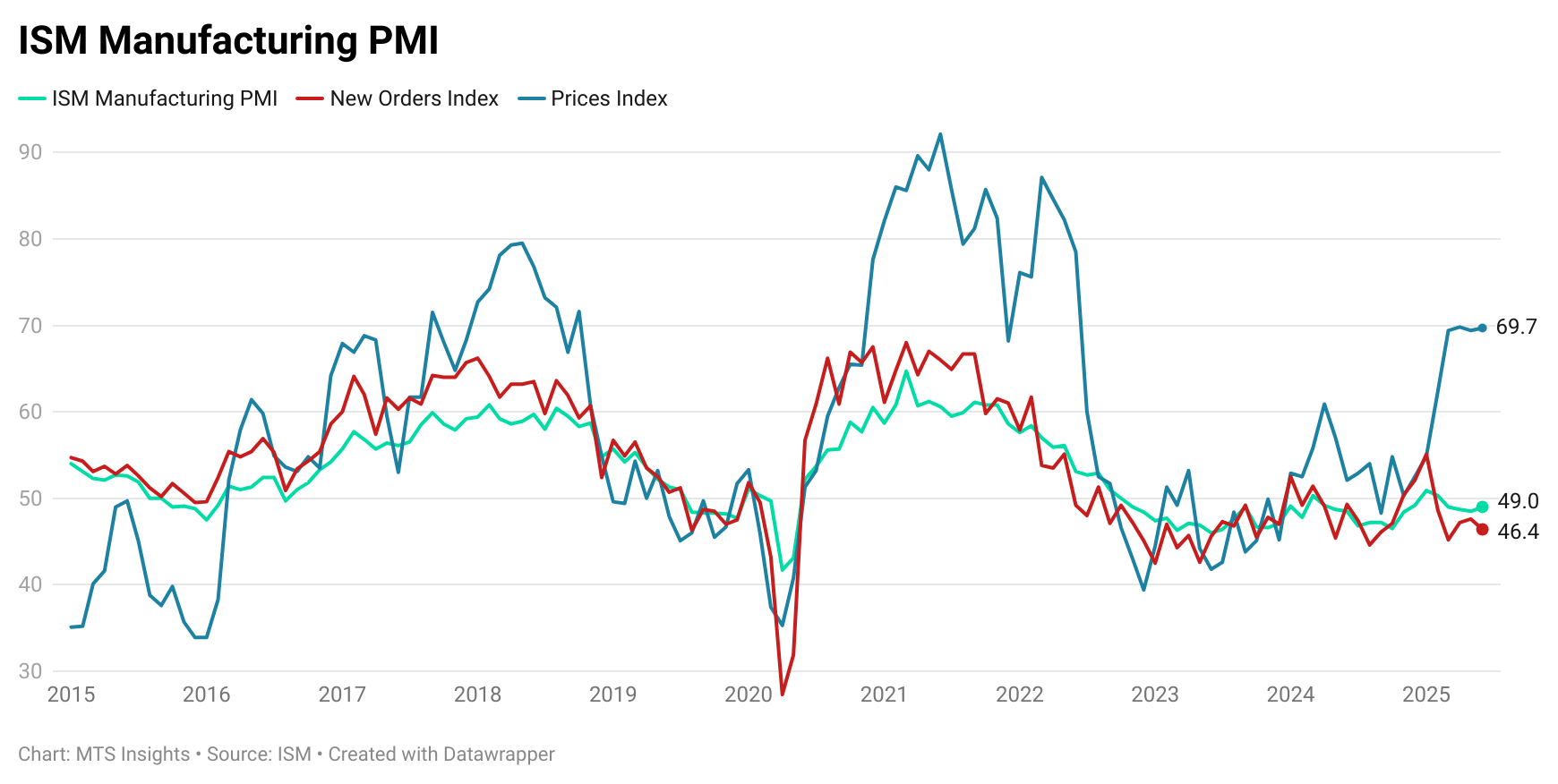

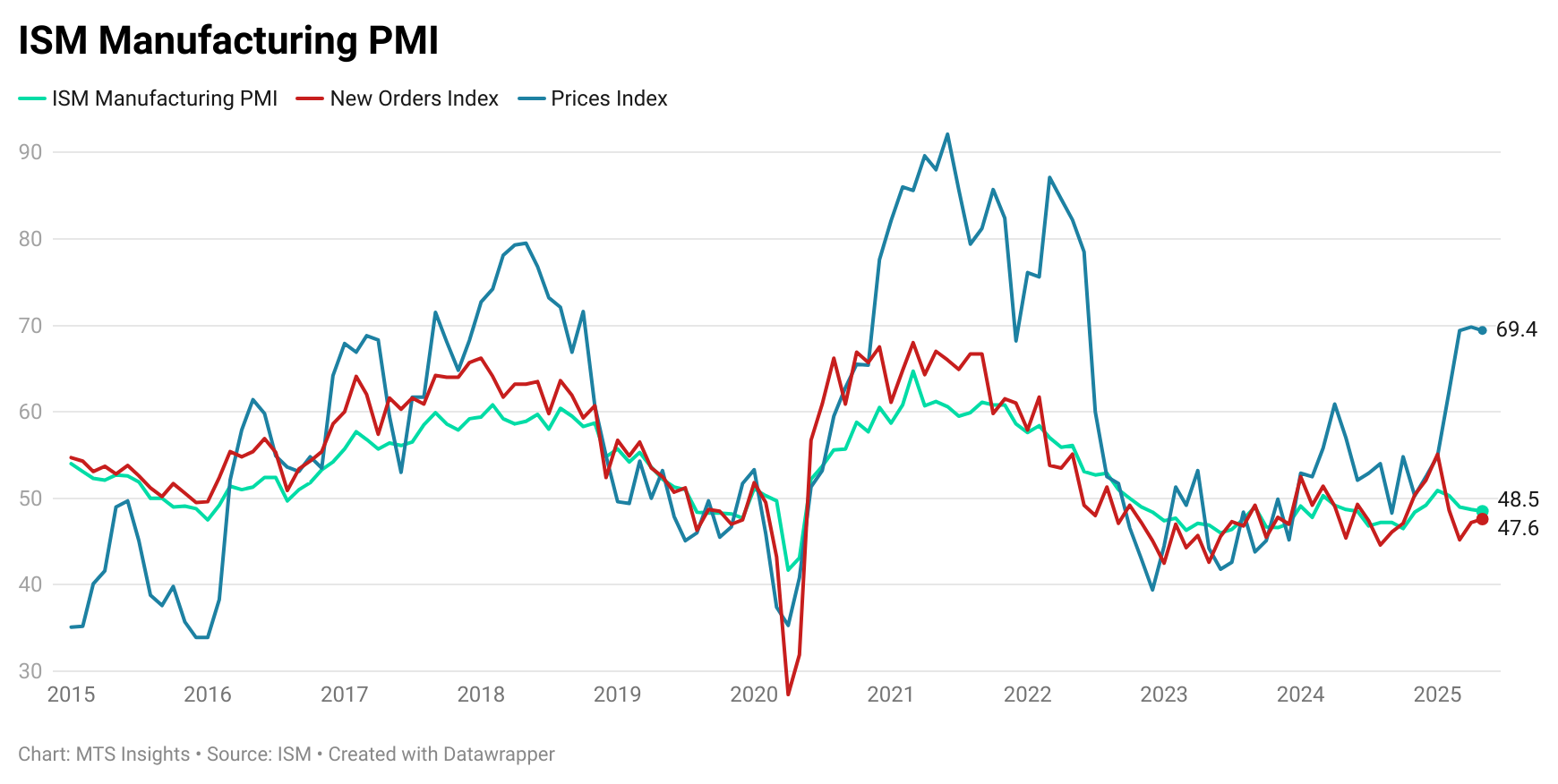

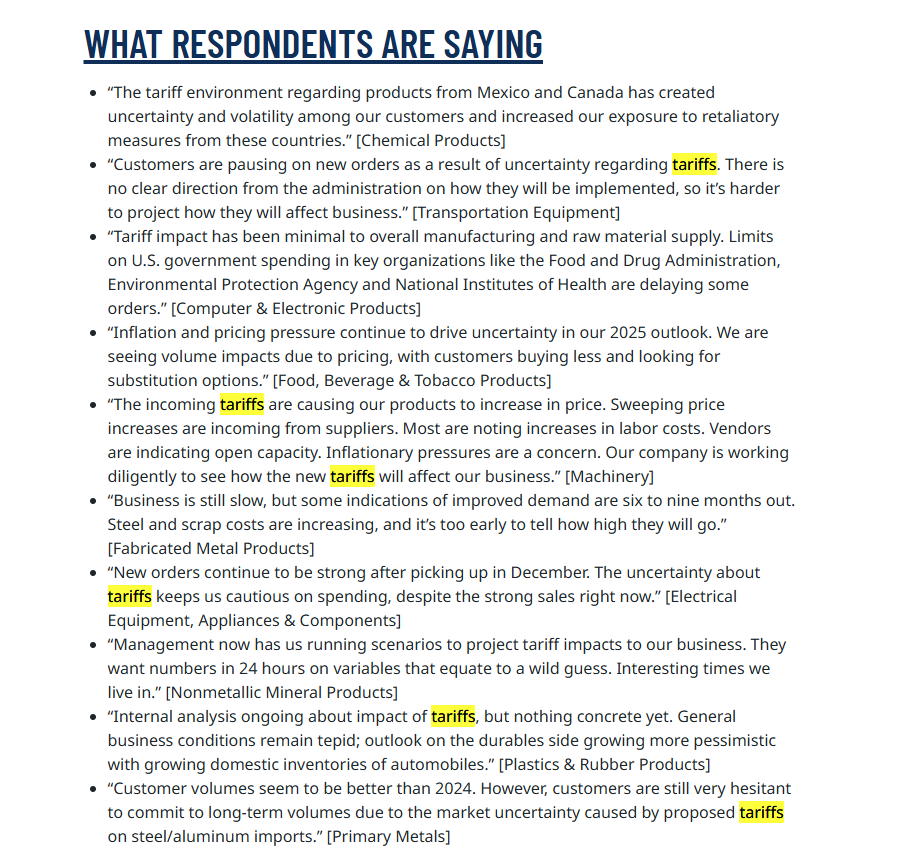

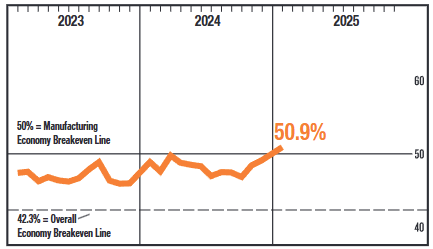

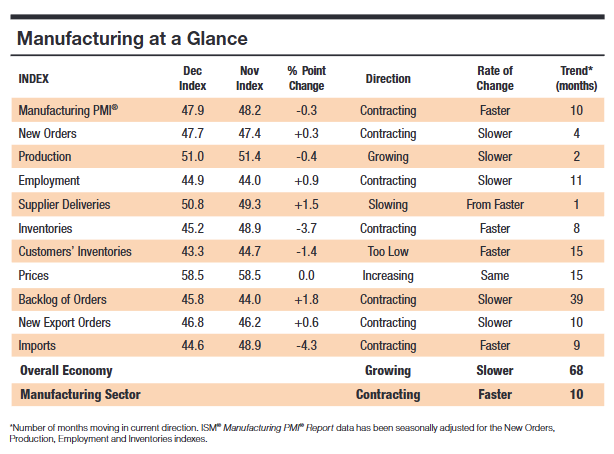

The US ISM Manufacturing PMI fell -0.3 pts MoM to 47.9 in December 2025, marking a tenth consecutive month of contraction while the broader economy remained in expansion.

-

Manufacturing PMI at 47.9 (Nov: 48.2) stayed below the 50 threshold, extending the contraction streak to 10 months, though the level remained above 42.3, which ISM associates with continued overall economic growth.

-

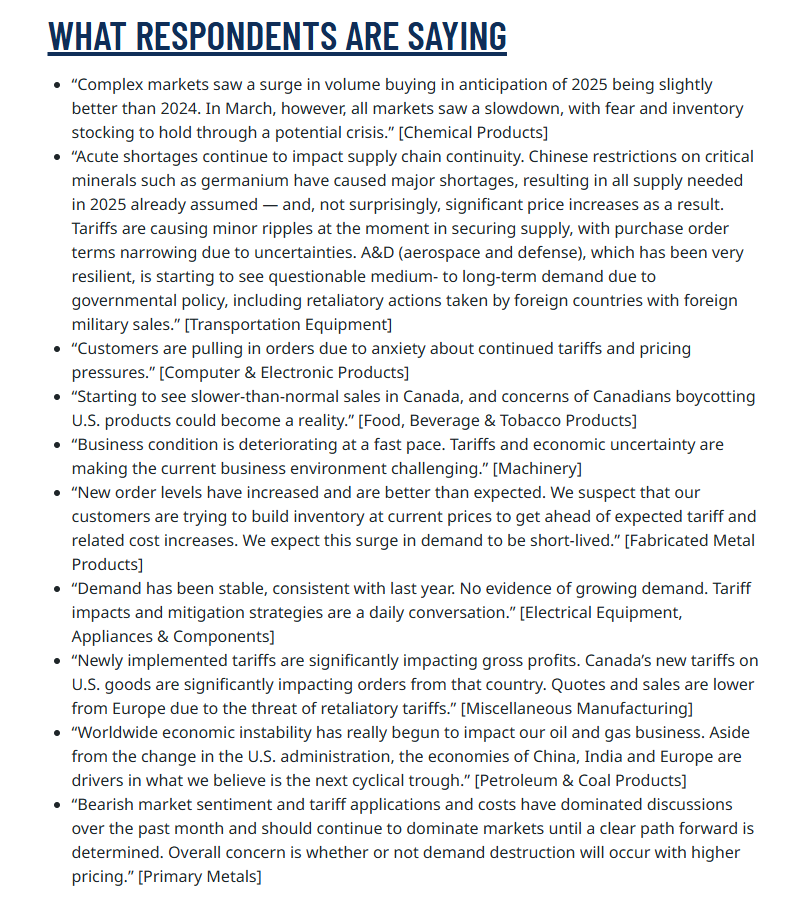

New Orders rose modestly to 47.7 (+0.3 pts MoM) but remained in contraction for a fourth straight month and below the 12-month average of 48.5, indicating persistently soft demand conditions.

-

The Production Index held in expansion at 51.0 (Nov: 51.4), showing output continued to grow, albeit at a slower pace, with only two of six large industries reporting higher production.

-

Employment increased to 44.9 (+0.9 pts MoM) but remained deeply contractionary for the 11th consecutive month, reflecting ongoing headcount reductions driven by uncertain near- to mid-term demand.

-

Supplier Deliveries moved back into slowing territory at 50.8 (Nov: 49.3), indicating deliveries became slower after one month of improvement, consistent with renewed supply-side frictions in some industries.

-

Inventories fell sharply to 45.2 (-3.7 pts MoM), signaling faster inventory contraction, while Customers’ Inventories declined to 43.3 (-1.4 pts MoM) and remained firmly in “too low” territory.

-

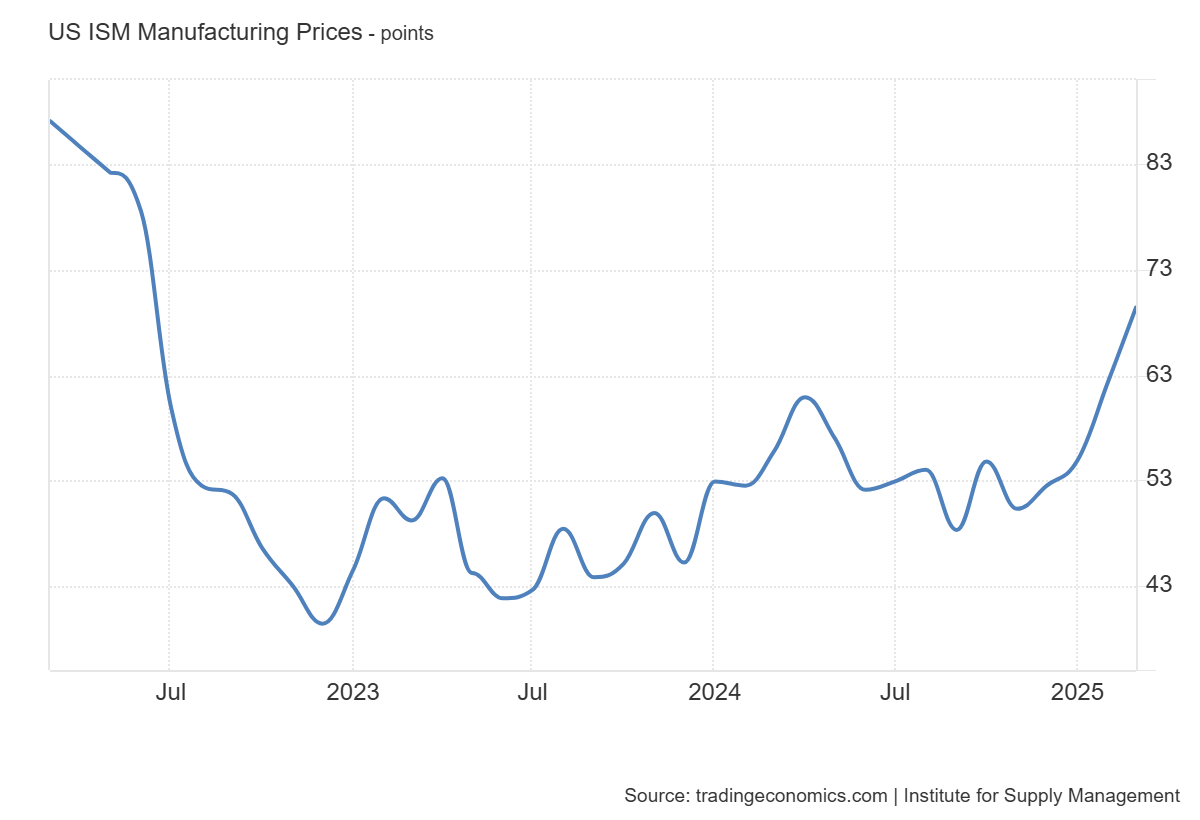

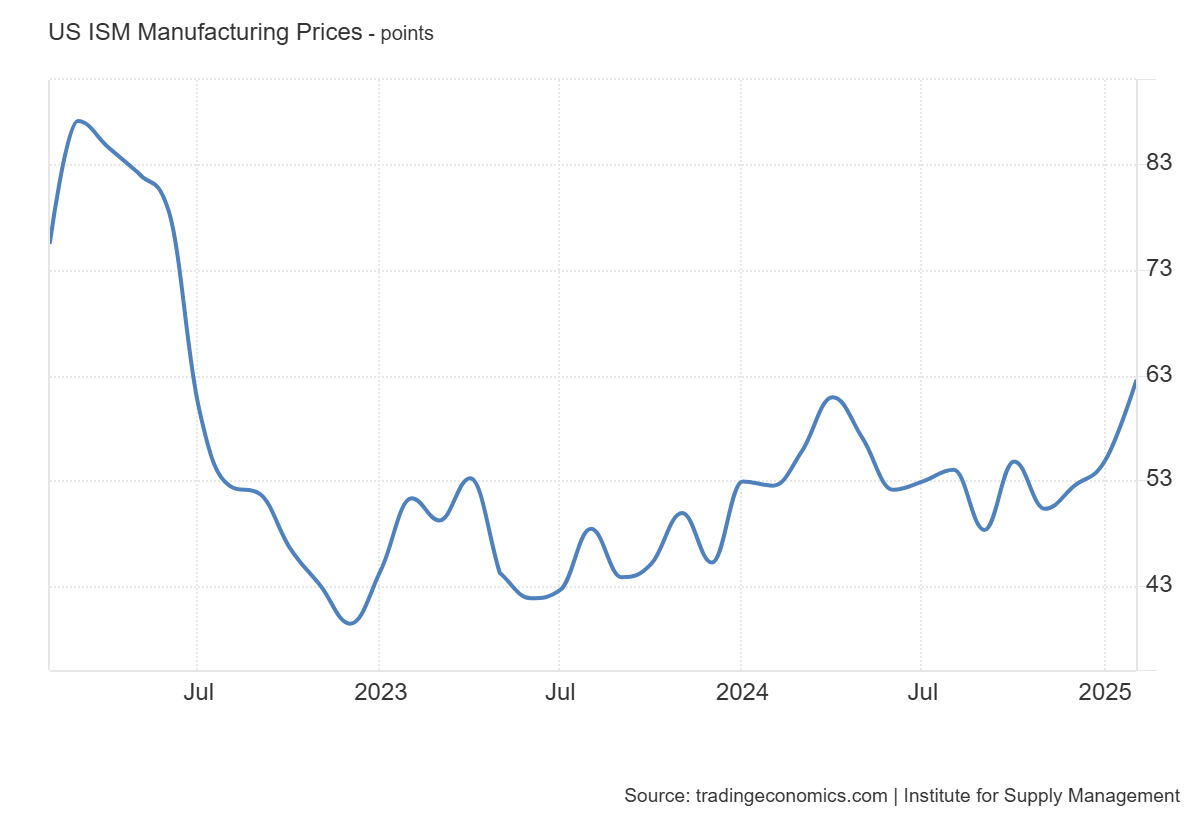

Prices held steady at 58.5 (unchanged MoM), marking the 15th consecutive month of rising input costs, with respondents continuing to cite steel, aluminum, and tariff-related pressures.

-

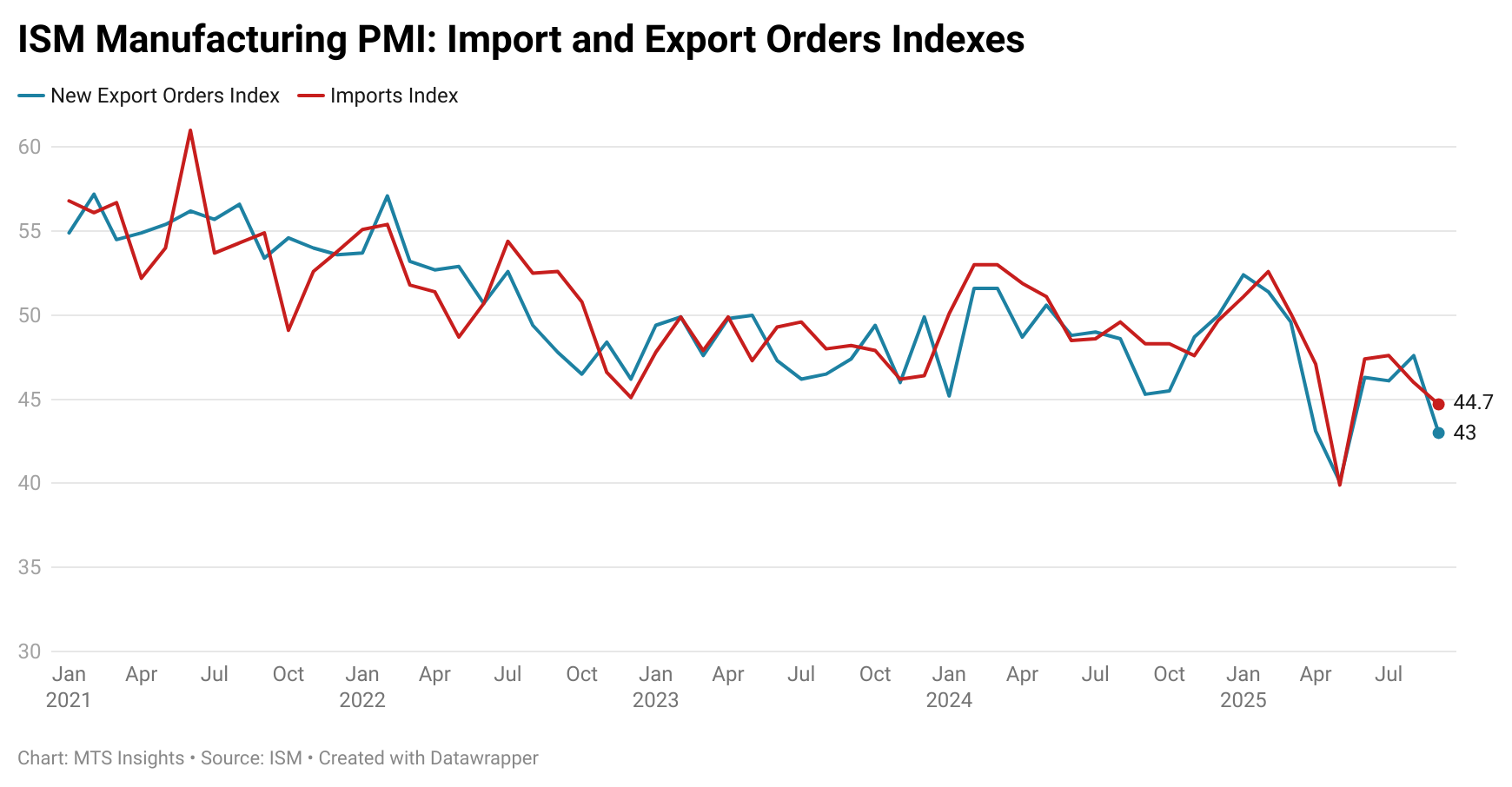

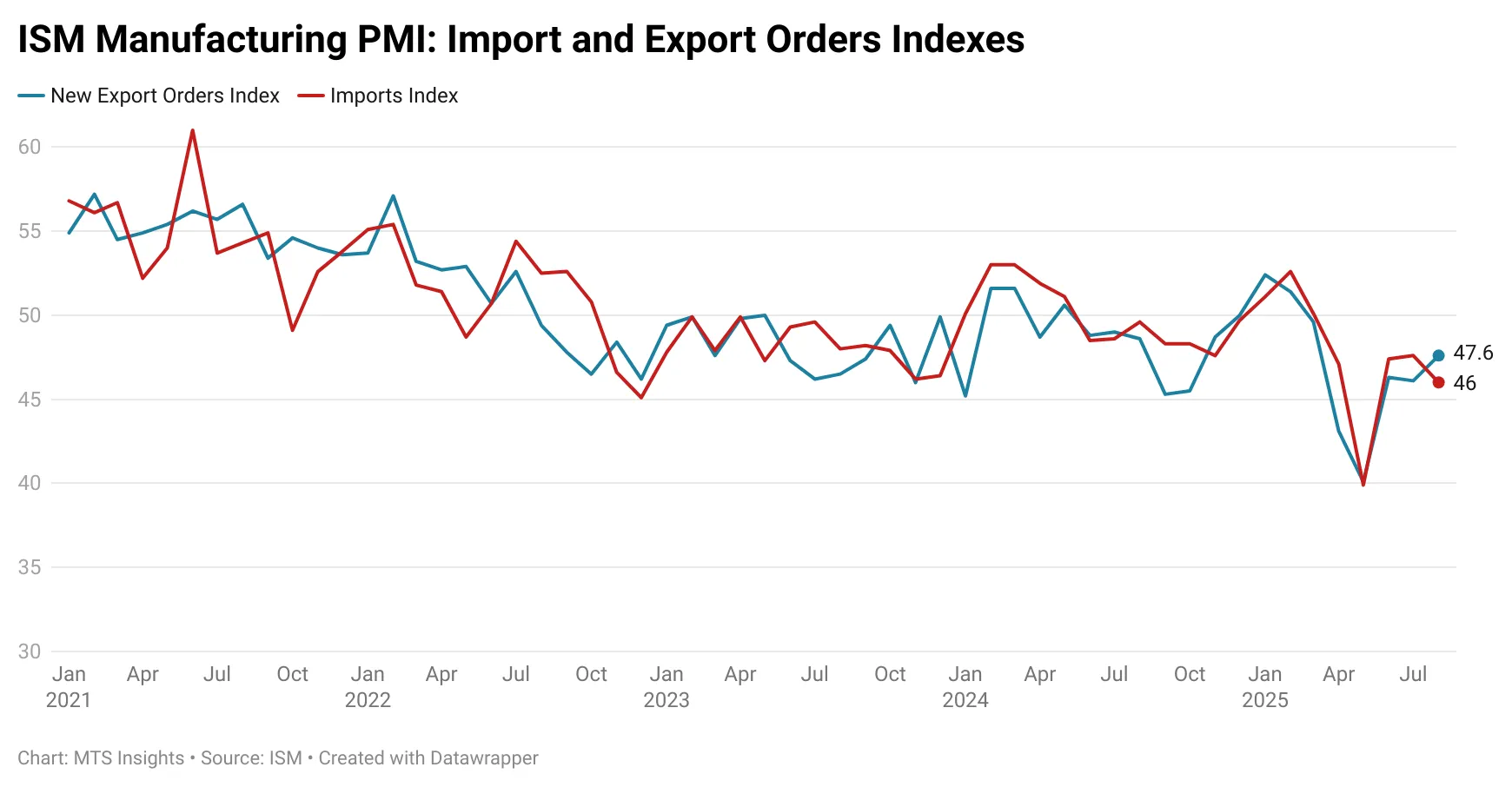

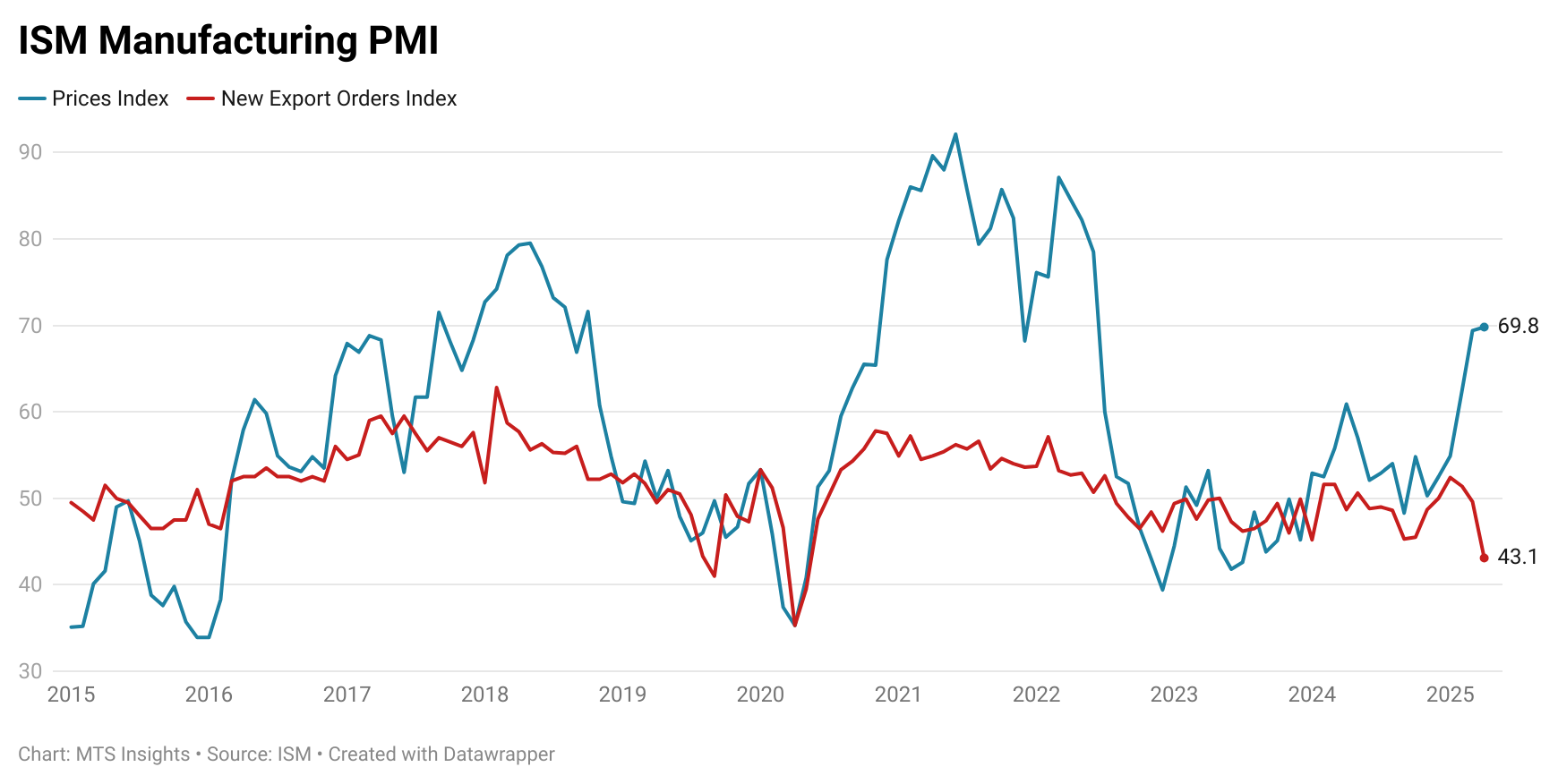

Backlogs of Orders rose to 45.8 (+1.8 pts MoM) but contracted for a 39th straight month, while New Export Orders improved slightly to 46.8 (+0.6 pts MoM) and Imports dropped sharply to 44.6 (-4.3 pts MoM), underscoring continued weakness in trade-related demand.

-