Investment Manager Index

Investment Manager Index

- Source

- S&P Global

- Source Link

- https://www.pmi.spglobal.com/

- Frequency

- Monthly

- Next Release(s)

- October 9th, 2025 10:00 AM

Latest Updates

-

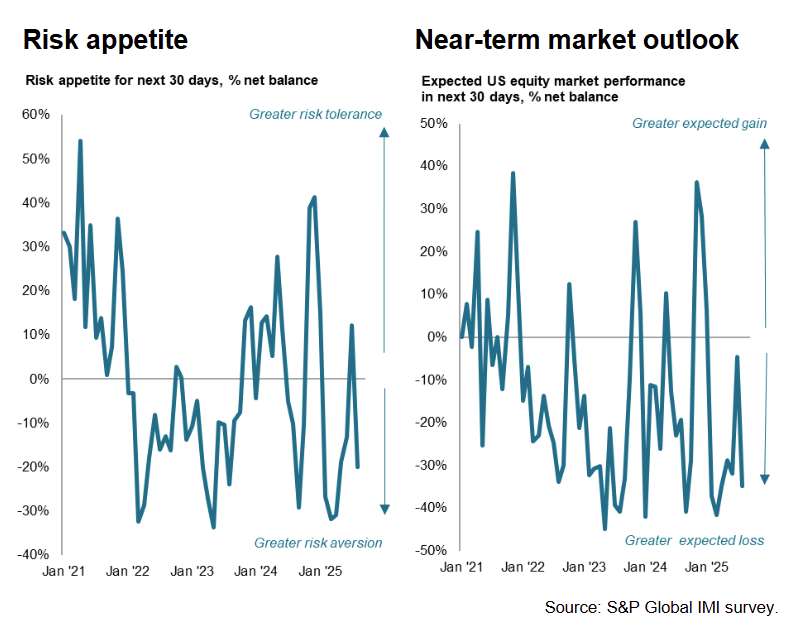

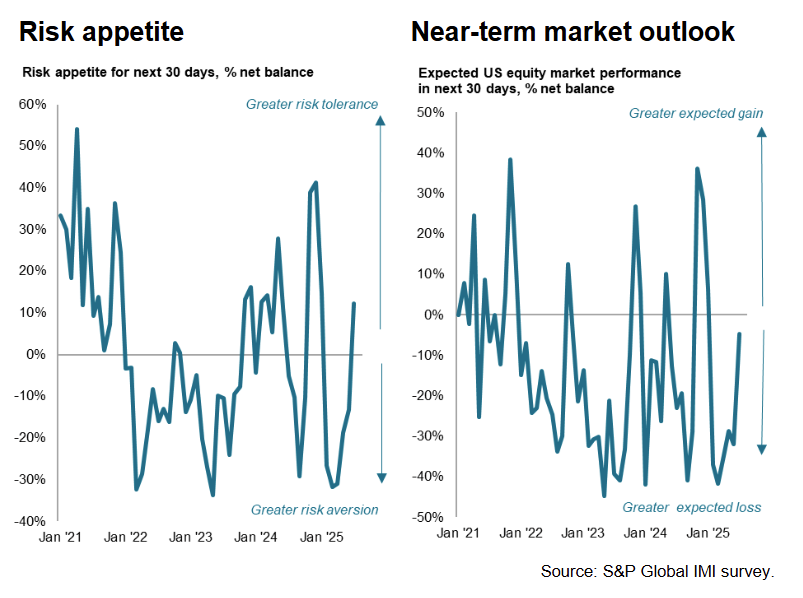

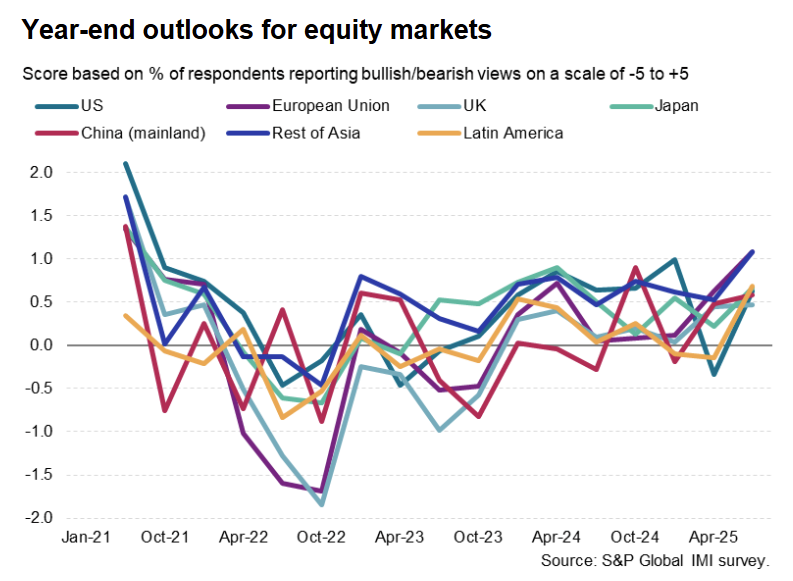

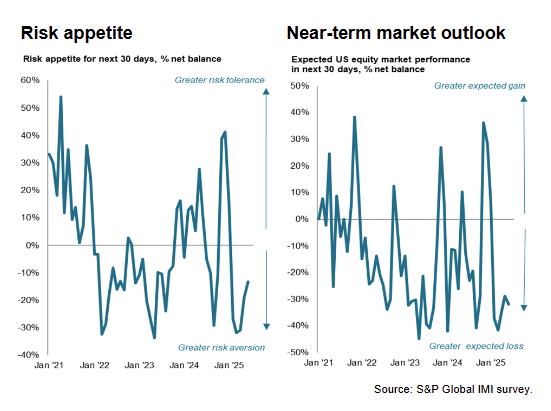

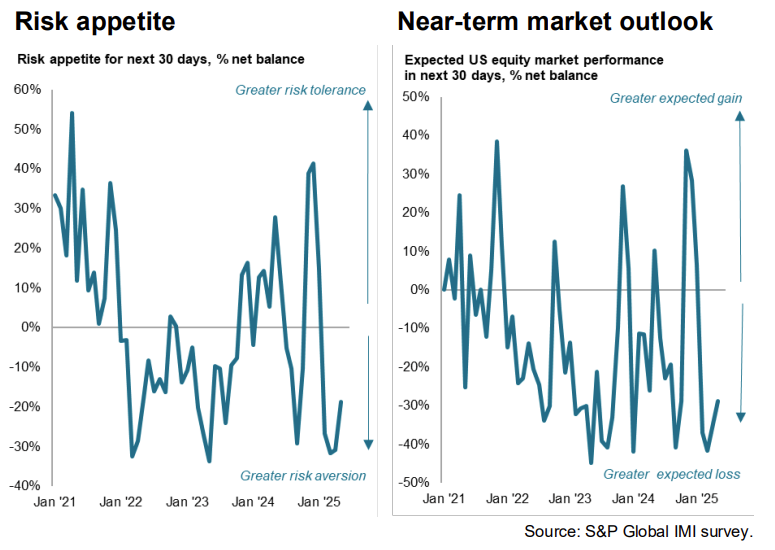

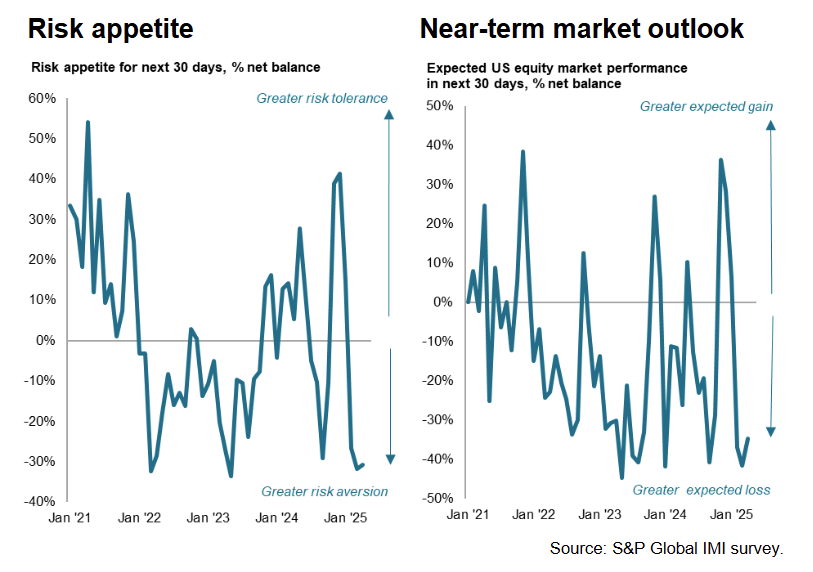

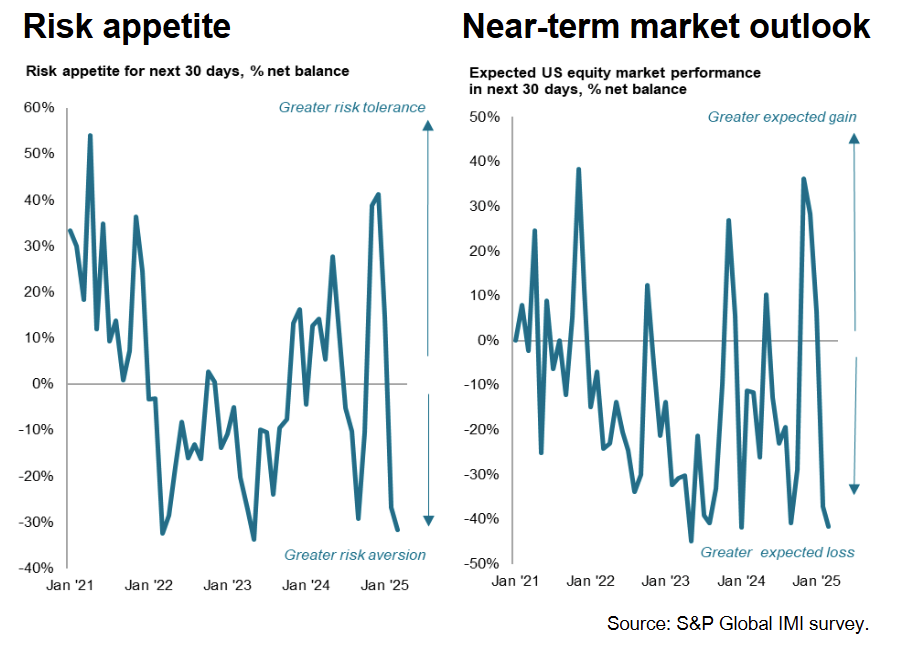

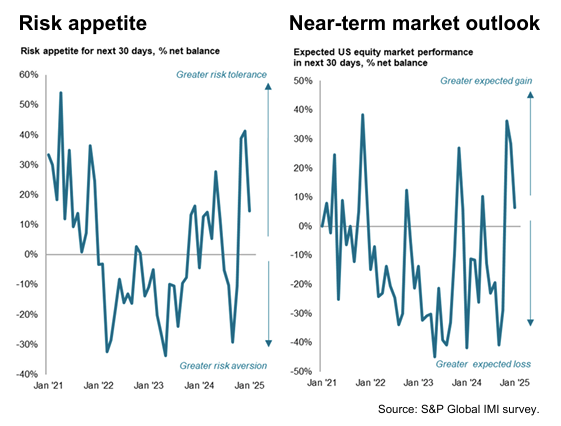

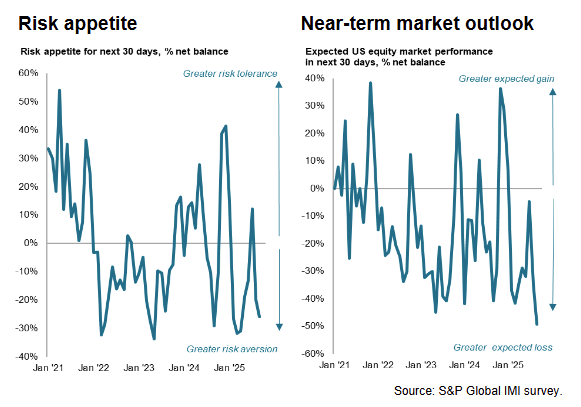

The S&P Global Investment Manager Index Risk Appetite Index fell to -26% in September 2025 from -20% in August, its lowest since April, signaling heightened equity investor risk aversion despite easing recession fears.

-

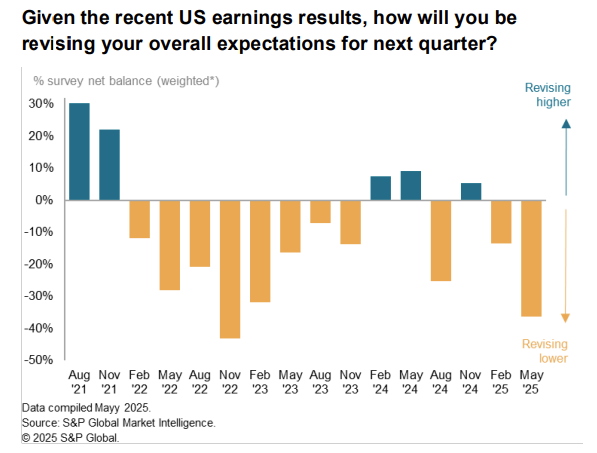

Near-term equity return expectations dropped to the lowest level since the survey began in October 2020, contrasting with optimism seen at the start of 2025.

-

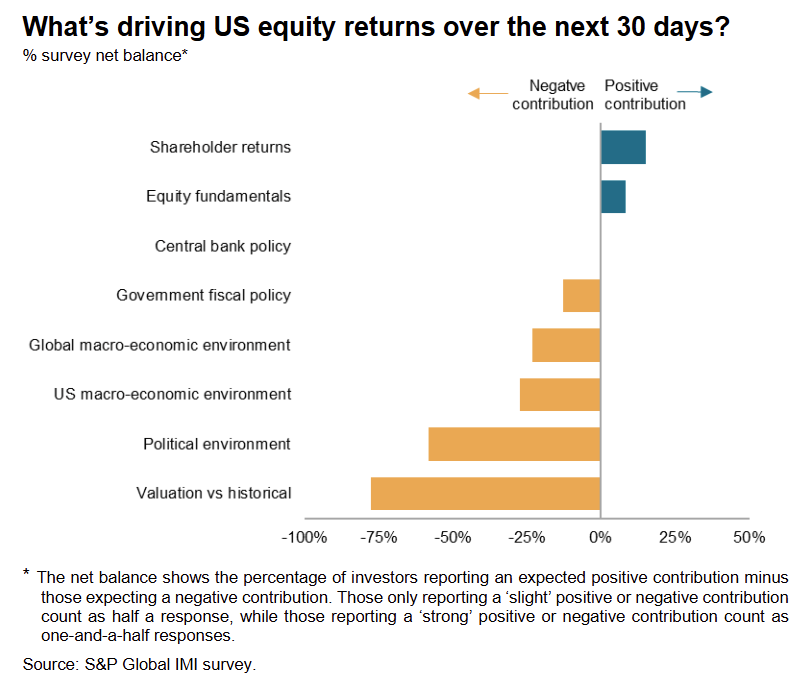

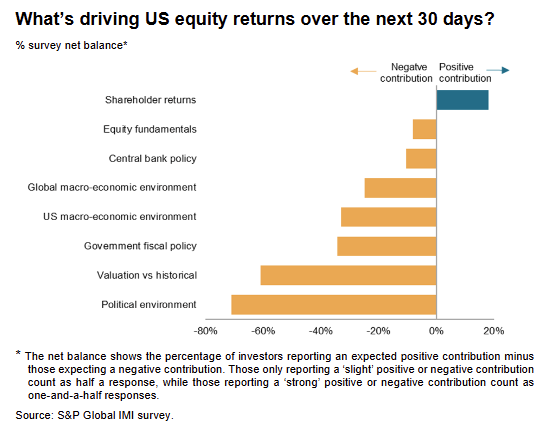

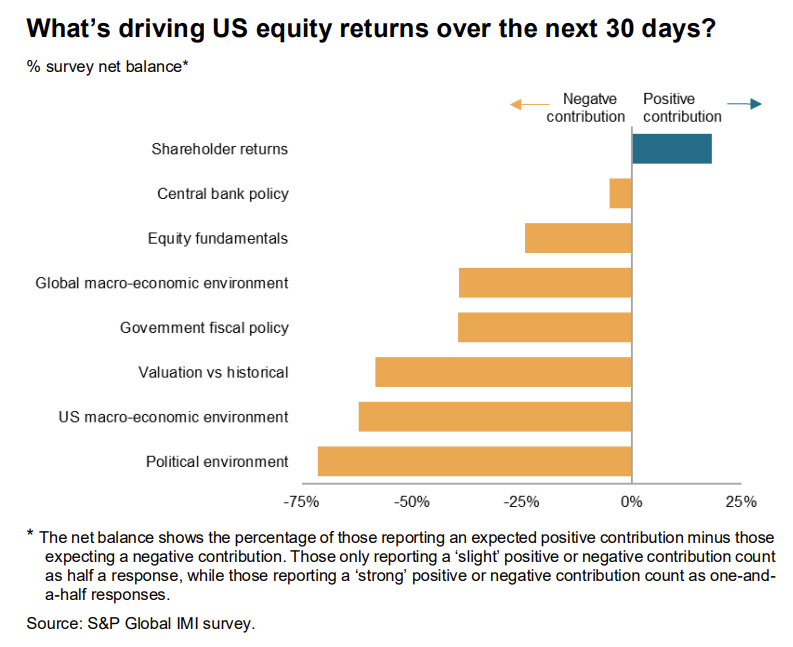

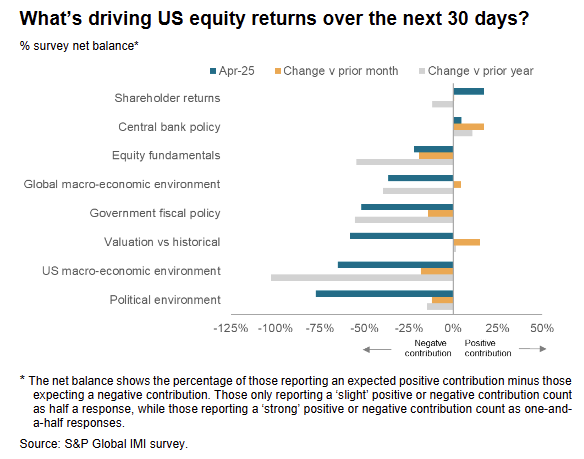

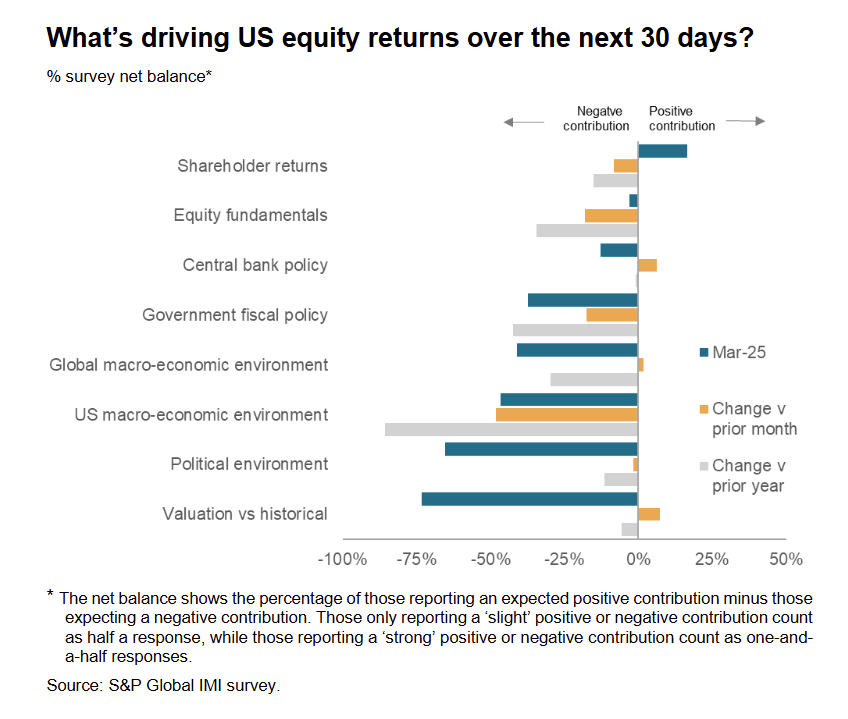

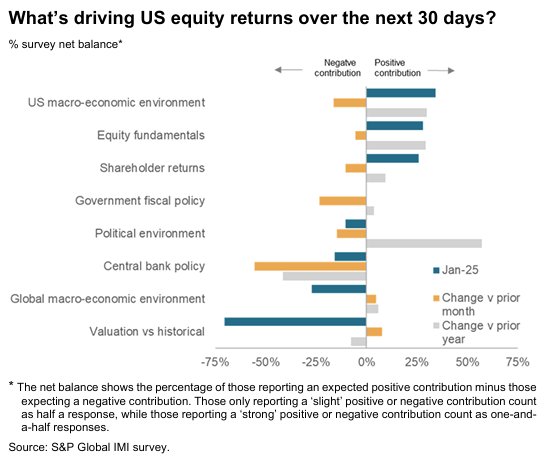

Valuation concerns reached unprecedented levels in the survey, while political uncertainty intensified to the highest since June, both acting as major drags on sentiment.

-

The macro environment was viewed as increasingly negative, but worries specific to the US economy and fiscal policy moderated; US growth expectations improved modestly.

-

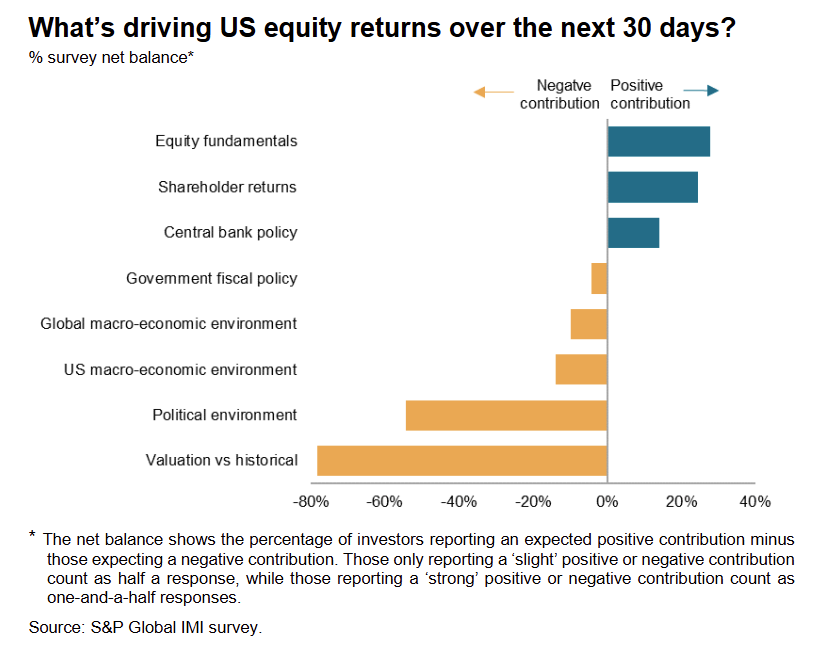

Monetary policy shifted to being the strongest perceived driver of markets, reflecting conviction that the FOMC will cut rates more aggressively in late 2025.

-

Lower rate expectations did not improve equity fundamentals, as earnings prospects were seen deteriorating; shareholder returns were viewed more positively in contrast.

-

Sector preferences tilted defensive: healthcare ranked highest, followed by financials and utilities, while consumer discretionary remained weakest amid household spending concerns.

-

Negative sentiment toward real estate, energy, materials, and staples moderated, while tech remained favored but saw appetite fall to its lowest since April due to valuation worries.

-