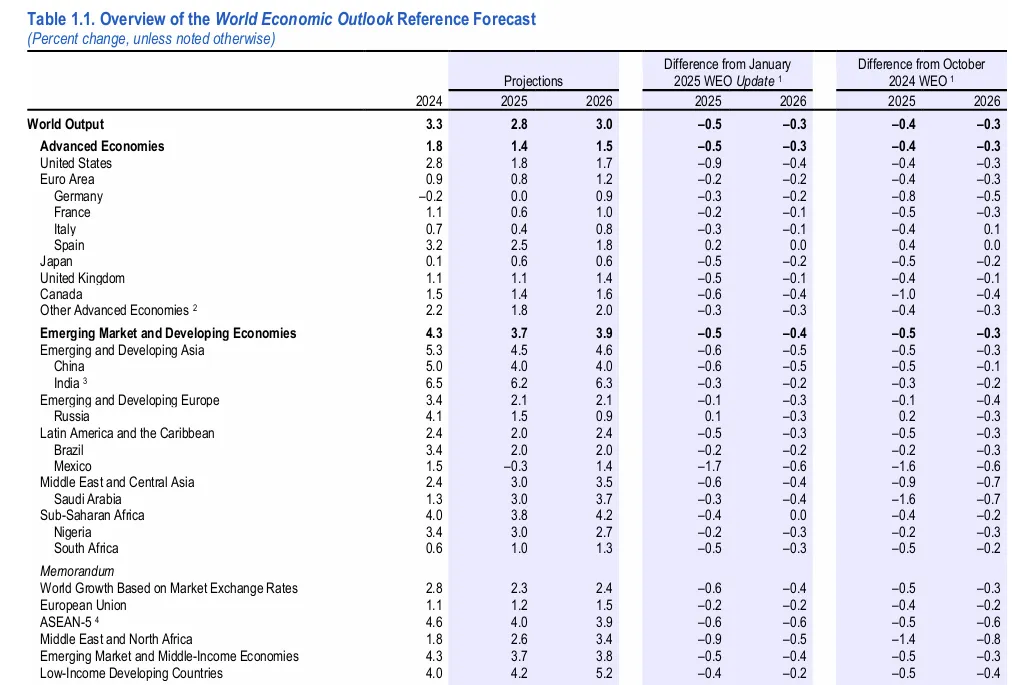

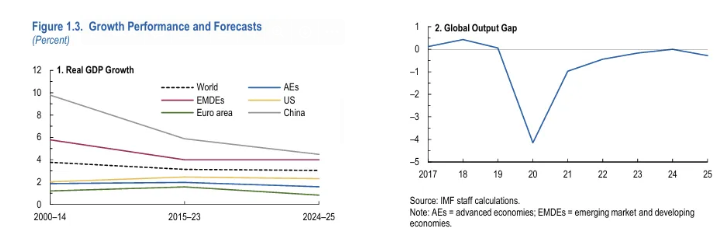

The IMF released the latest edition of its keynote publication, the World Economic Outlook, that is used across the globe as a primary source for the economic outlook. The April update gives the IMF its first chance to review its projections following the massive shifts in US trade policy including the tariffs against Mexico, China, and Canada and the broader “Liberation Day” tariffs. As one might expect, the IMF’s outlook has become significantly more pessimistic as it cuts growth forecasts across the board.

Growth Outlook

In the three months since the release of the January update of the World Economic Outlook (WEO), there has been a significant increase in uncertainty that has left businesses in the dark on their own outlooks. The IMF is also dealing with this as it admits that “extremely high levels of policy ambiguity, making it more difficult than usual to establish a central global growth outlook.” The growth outlook it put together includes all US tariff announcements between February 1st and April 4th and some of the retaliation from China. While that seems like current assumptions for a thorough economic outlook, trade policy has been in flux on a daily basis, highlighting the uncertainty that contextualizes these WEO forecasts.

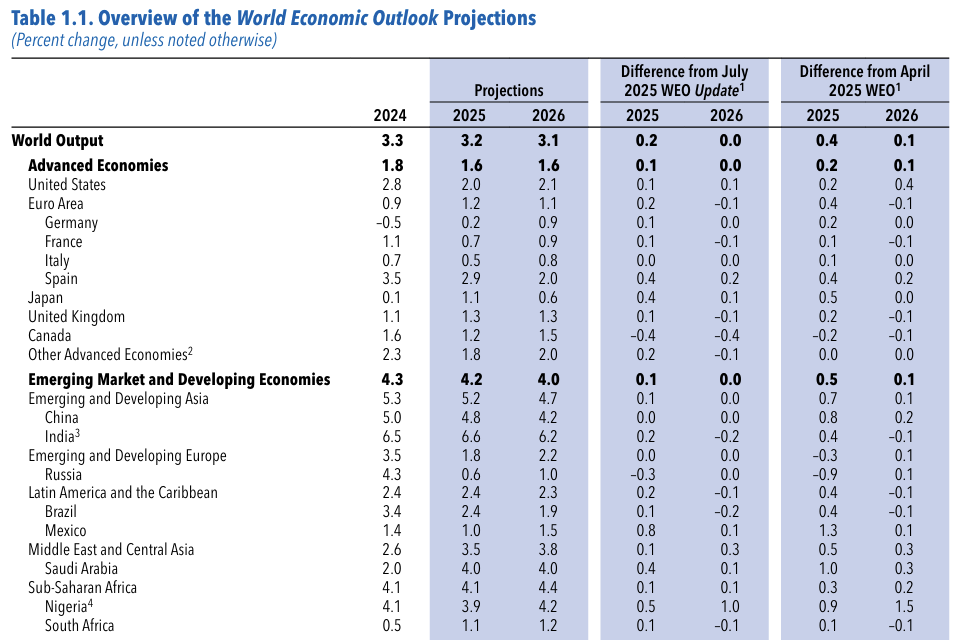

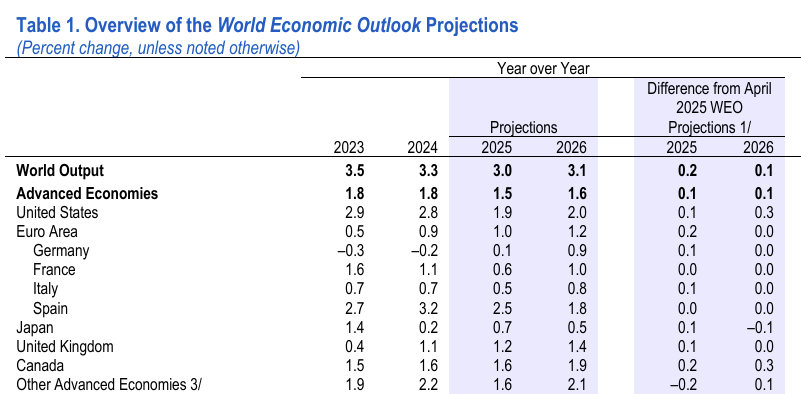

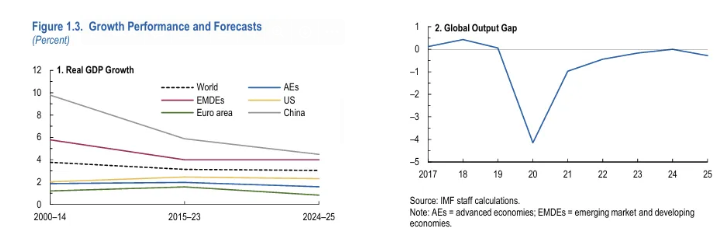

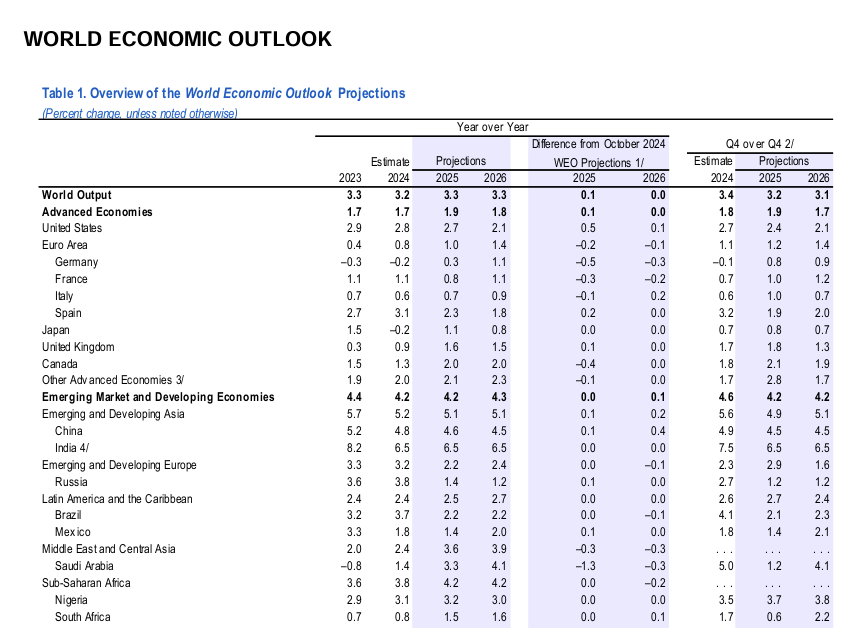

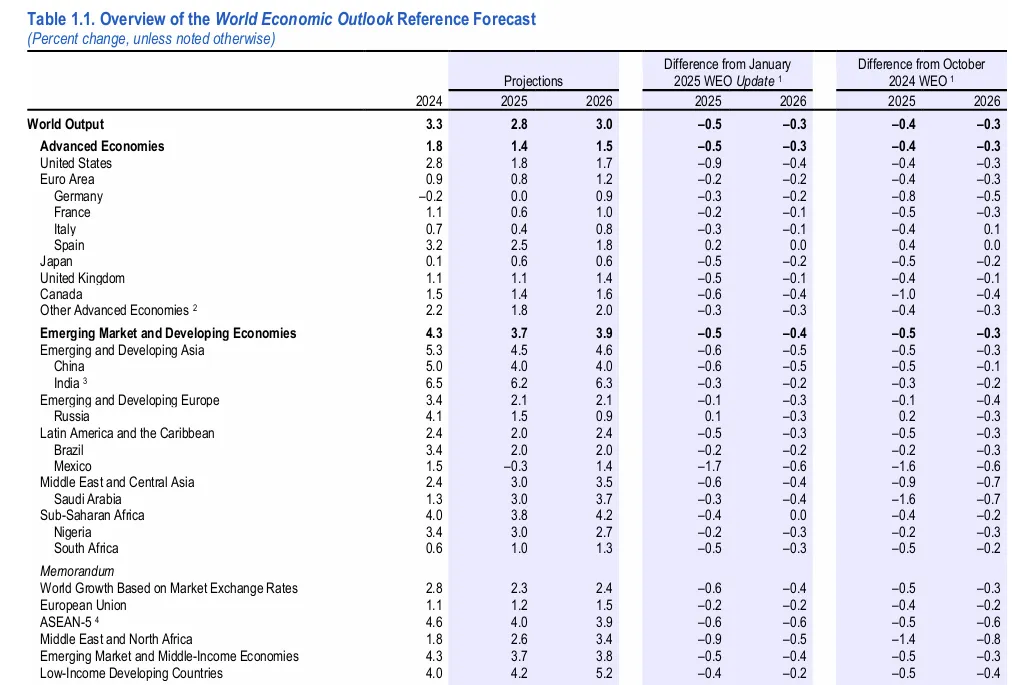

The headline forecasts for global economic growth for the next two years saw large downward revisions from the January WEO Update: the 2025 estimate was revised down -0.5 ppts to 2.8%, and the 2026 estimate was revised down -0.3 ppts to 3.0%. This included broad downgrades across countries:

- US GDP growth forecast was revised down -0.9 ppts to 1.8% for 2025 and -0.4 ppts to 1.7% for 2026.

- Euro area growth forecast was revised down -0.2 ppts to 0.8% for 2025 and -0.2 ppts to 1.2% for 2026. Germany’s growth was revised down -0.3 ppts to 0.0% in 2025 and -0.2 ppts to 0.9% in 2026.

- Japan’s growth forecast was revised down -0.5 ppts to 0.6% for 2025 and -0.2 ppts to 0.6% for 2026.

- China’s growth forecast was revised down -0.6 ppts to 4.0% for 2025 and -0.5 ppts to 4.0% for 2026.

- Canada and Mexico both had major downward revisions to 2025 GDP growth, down -0.6 ppts to 1.4% and down -1.7 ppts to -0.3% respectively.

- The ASEAN-5, which includes countries that might have benefitted from hard tariffs on China, saw expectations for 2025 and 2026 growth decline -0.6 ppts to 4.0% and 3.9% respectively.

The sour outlook is predicated on a sharp decline in the forecast for global trade volumes. Advanced economies are expected to grow imports by 1.9% (revised down -0.3 ppts) and exports by 1.2% (revised down -0.9 ppts). The impact on emerging economies is expected to be harsher. In 2024, emerging market import and export growth were both over 5.5%, and global trade tensions are expected to bring that growth down to just 2.0% and 1.6%, downward revisions of -3.0 ppts and -3.4 ppts respectively. The IMF explicitly blames tariffs for increased “restrictions affecting trade flows” and mentions cyclicality as a lesser secondary driver of weaker trade flows.

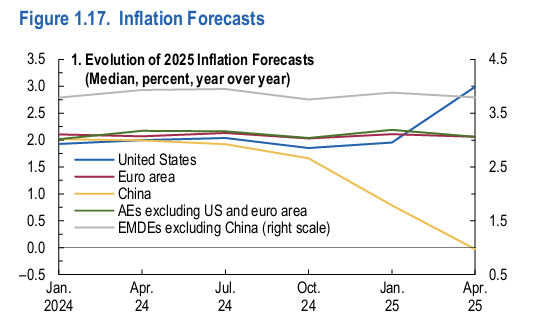

Inflation Outlook

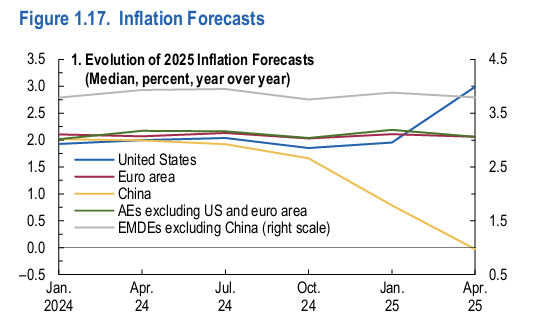

The IMF’s global inflation outlook is a bit more mixed. In general, it sees global inflation at 4.3% in 2025 which would be a decline from the elevated 5.7% rate in 2024. That forecast is a slight upward revision of 0.1 ppts from the previous edition, and appears to be largely impacted by its view on oil prices which are would offset the growth in nonenergy costs. Indeed, the IMF sees oil prices down -15.5% in 2025, a downward revision of -3.8 ppts, which would offset the expected increase of nonfuel commodity prices of 4.4% this year, up 1.9 ppts from the previous outlook and above growth of 3.7% in 2024. With that being said, if the IMF were to have a view on core inflation, it would probably be significantly higher than three months ago but still shrouded in uncertainty. It points out that the inflation outlook does depend on how sticky higher US tariff rates are and “the extent to which firms adjust margins to offset increased import costs.”

The slight upward revisions in the global and advanced economy inflation forecasts were heavily impacted by the US and and the UK specifically.

- US inflation was forecasted to fall to the 2% target in 2025 three months ago, but the latest April update has inflation at 3.0% this year, unchanged from the 3.0% rate in 2024. The IMF points to sticky services inflation, a rebound in core goods inflation, and a “supply shock from recent tariffs” as the drivers of the outlook.

- The UK inflation rate was revised up 0.7 ppts to 3.1% in 2025, well above the 2.2% forecast for the rest of the advanced economies in Europe, primarily reflecting “one-off regulated price changes.”

Risks to the Outlook

The IMF’s new outlook, focused on the recent trade developments, affirms the perspective that the escalation in trade policy uncertainty and the blowback in financial markets will impact just about every economy across the globe. One of the key downside risks that is highlighted is that current headlining trends in markets, a sharp depreciation of the US dollar and an increase in US interest rates, would have severe financial repercussions. The IMF hints that the former could lead to “a sudden reset” in the international monetary system, while that latter could lead to a “a debt spiral dynamic in which borrowing costs escalate as fiscal adjustments become increasingly unattainable.”

One of the more damning aspects of this WEO is that the upside risks appear very limited. The primary upside risk that the IMF mentions is “next-generation trade agreements” which basically means the US retreats from its current tariff policies (that are on a 90-day pause). So far, the outlook for trade deals is not an optimistic one as the Trump administration looks dug in, and the recent news about trying to shake up the Federal Reserve suggests that it is looking for economic solutions outside of rescinding trade restrictions. Outside of trade resolutions, the IMF sees upsides in the “mitigation of conflicts” and, of course, growth prospects driven by artificial intelligence.

Overall, the IMF’s April update of the World Economic Outlook is a bleak one. Growth estimates have been downgraded across the board on the expectation that trade volumes would suffer this year. The inflation outlook is very uncertain and cushioned by the expectations that energy prices would fall sharply this year due to weaker growth prospects. Downside risks heavily outweigh upside risks.

The importance of these adjustments should not be underestimated. Markets have largely priced the change in the economic outlook, but businesses (who don’t have their own macro departments) across the world that look to the IMF for guidance on the global economy will now be expecting much weaker business conditions and will plan accordingly.

IMF World Economic Outlook

IMF World Economic Outlook