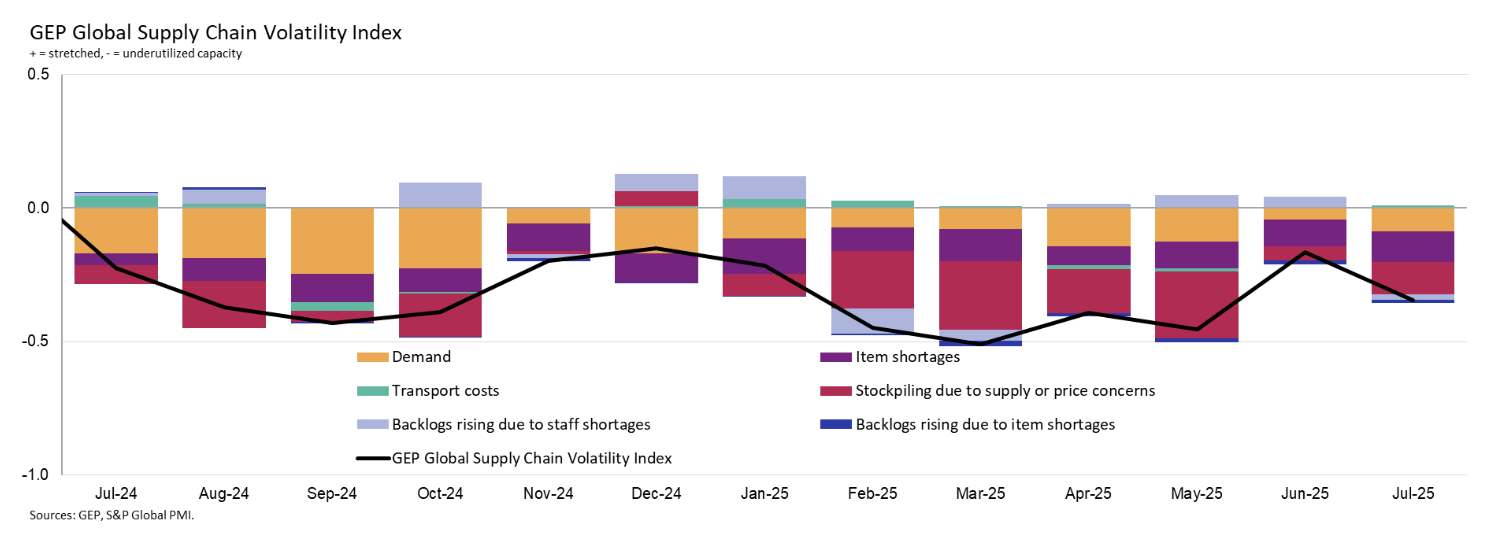

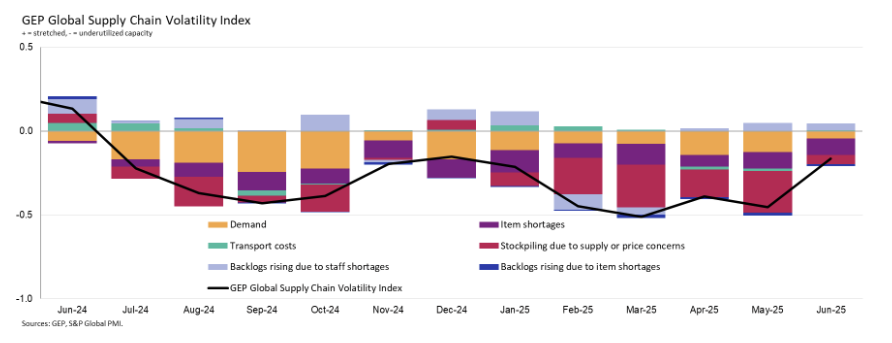

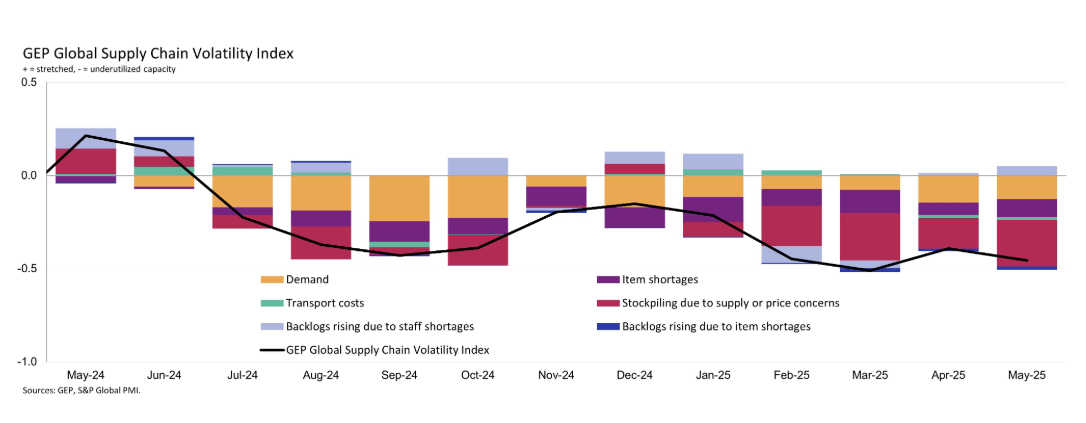

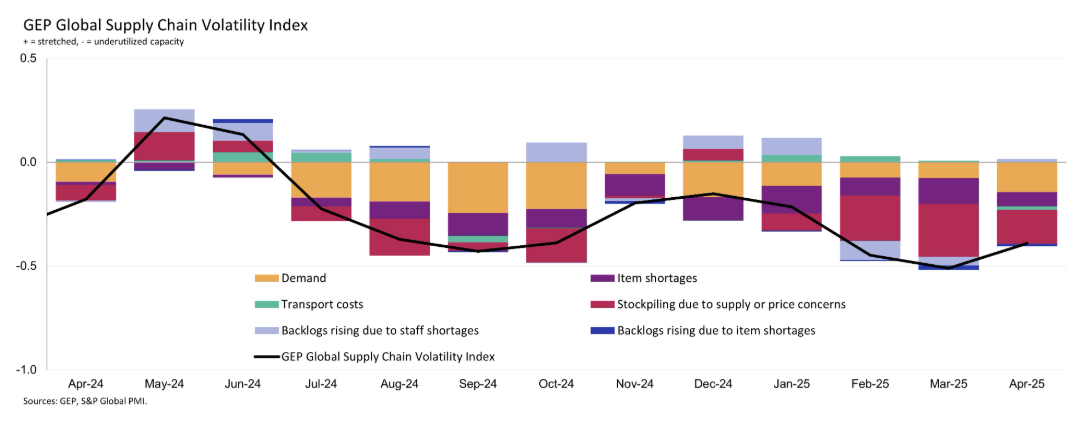

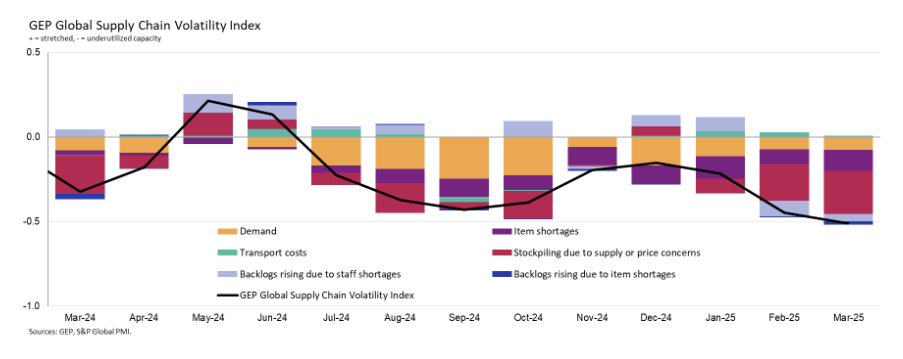

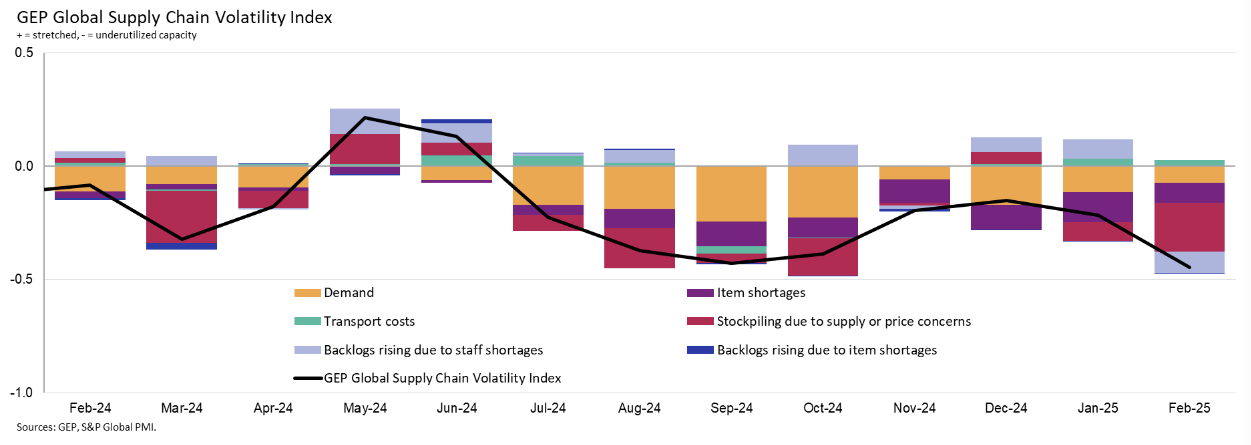

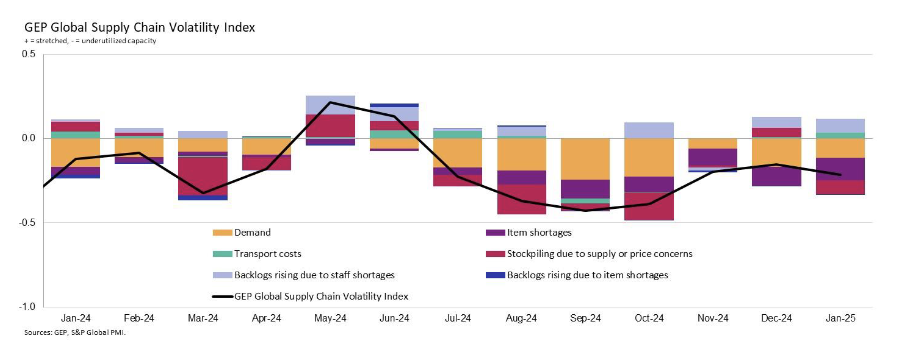

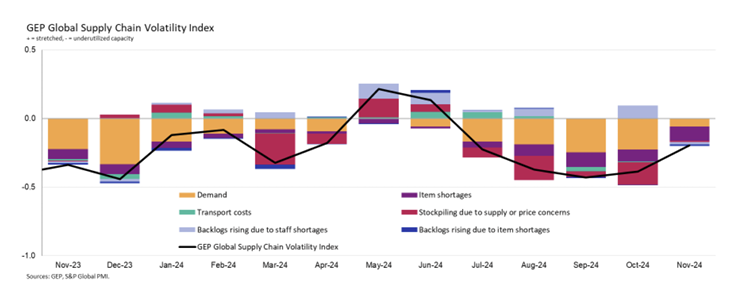

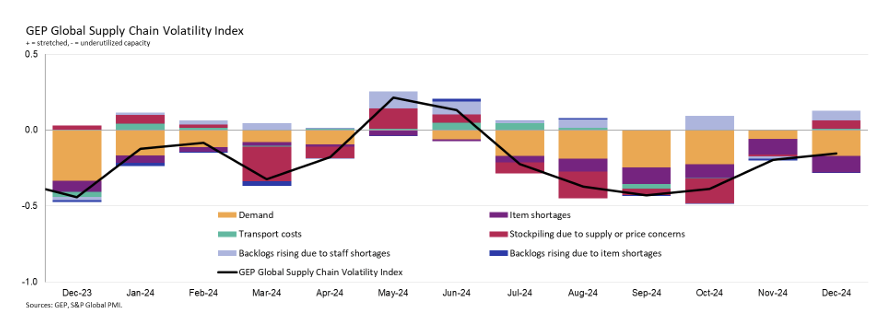

GEP Global Supply Chain Volatility Index

GEP Global Supply Chain Volatility Index

- Source

- S&P Global

- Source Link

- https://www.gep.com/

- Frequency

- Monthly

- Next Release(s)

- October 10th, 2025 8:00 AM

Latest Updates

-

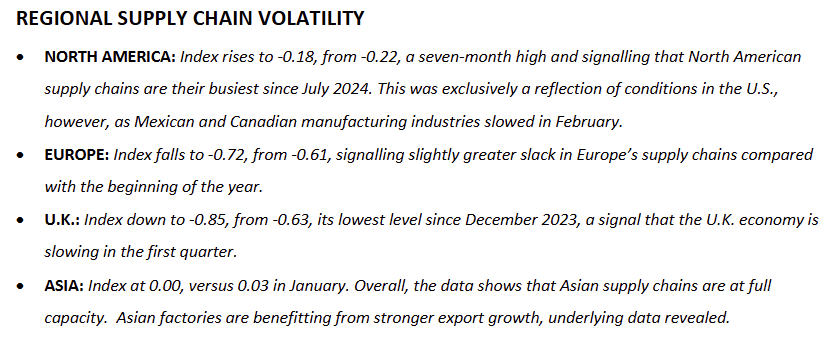

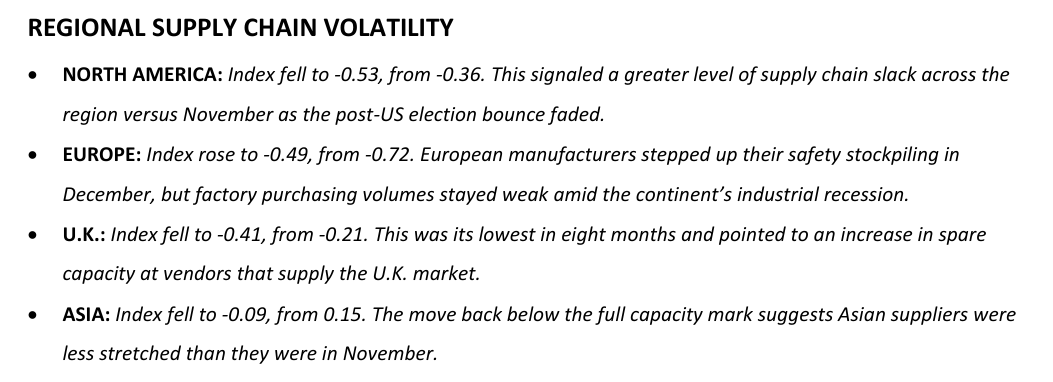

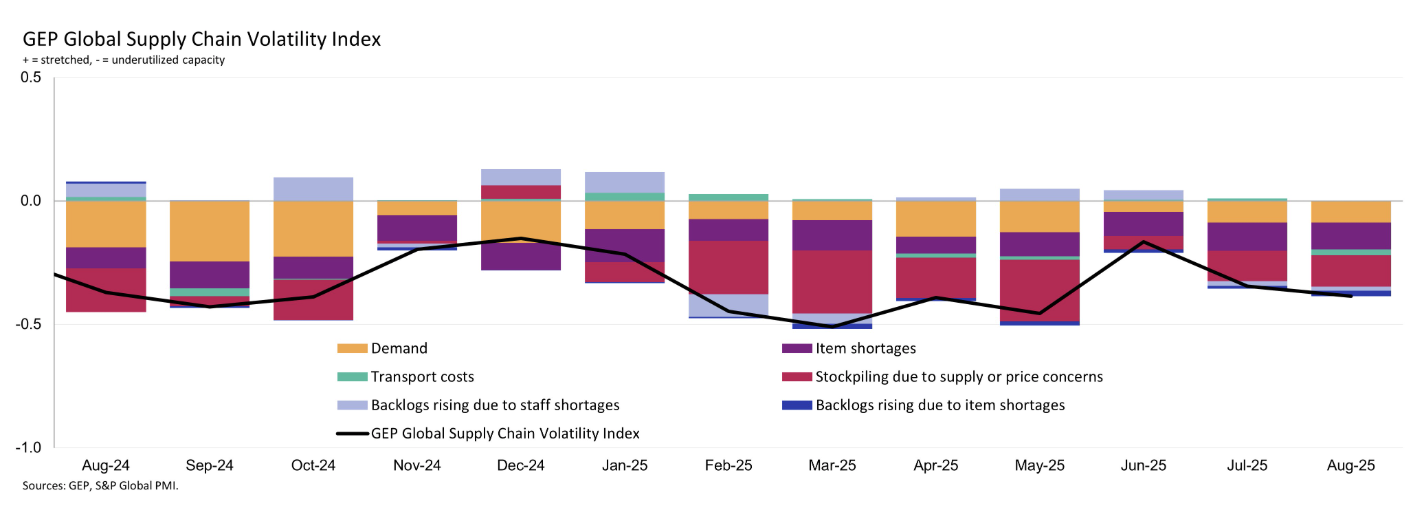

The GEP Global Supply Chain Volatility Index slipped to -0.39 in August from -0.35 in July, signaling rising spare capacity globally and reflecting contrasting regional dynamics between U.S. stockpiling and weakening demand in Europe and Asia.

-

North America’s index showed supply chains running near full capacity as firms stockpiled raw materials and components, especially in U.S. consumer goods industries like food & beverages and household products.

-

Asia’s index dropped to a three-month low, with notable weakness in Japan and Taiwan, while China’s consumer non-cyclicals sector remained flat and India, Indonesia, and South Korea saw increased procurement.

-

Europe’s index fell further to -0.90, one of the steepest drops since 2024, as Germany’s basic materials sector softened and UK manufacturing contracted sharply.

-

The divergence highlights how tariff fears are driving precautionary stockpiling in North America, while weaker purchasing and destocking weigh on Asia and Europe.

-

GEP noted tariffs have become a structural feature of global supply chains, requiring companies to build resilience through supplier diversification and stronger demand sensing capabilities.

-