Freightos Weekly Update

Freightos Weekly Update

- Source

- Freightos

- Source Link

- https://www.freightos.com/

- Frequency

-

Weekly

Tuesday

- Next Release(s)

- February 3rd, 2026 12:00 PM

-

February 10th, 2026 12:00 PM

-

February 17th, 2026 12:00 PM

-

February 24th, 2026 12:00 PM

-

March 3rd, 2026 12:00 PM

-

March 10th, 2026 12:00 PM

-

March 17th, 2026 12:00 PM

-

March 24th, 2026 12:00 PM

-

March 31st, 2026 12:00 PM

-

April 7th, 2026 12:00 PM

-

April 14th, 2026 12:00 PM

-

April 21st, 2026 12:00 PM

Latest Updates

-

Analysis

Almost as abruptly as President Trump’s tariff and possibly military threats related to Greenland came, they went. Trump called off the proposed tariffs on eight NATO allies following talks with NATO leadership in Davos last-Wednesday that the president said yielded an accepted framework for a future deal.

This chain of events joins several other examples of Trump threatening and then scrapping tariffs due either to concessions gained, backlash, or both since taking office last year. President Trump issued more tariff threats on social media this week, promising 25% tariffs on all exports from South Korea if parliament does not pass the bill approving the terms of the US-Korea trade deal negotiated last year. And, prompted by Canada’s recent trade agreement with China centering on Chinese EVs and Canadian canola seeds, Trump also threatened Canada with 100% tariffs if it enters a comprehensive free trade deal with China.

This development reflects growing tensions between the US and Canada ahead of a possible US review of the USMCA this summer. In addition to resolving tariff issues with China, Canada is also holding trade cooperation talks with India, as they and other countries are increasingly looking to diversify away from an over-reliance on the US as trade tensions stretch on.

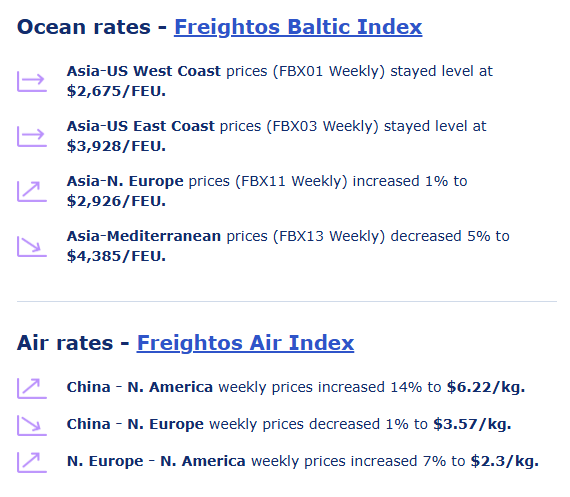

Asia - Europe ocean rates were level to N. Europe and dipped 5% to the Mediterranean as the pre-Lunar New Year rush starts to ease. A five-day rail worker strike in Belgium started on Sunday which could cause delays and additional congestion in Antwerp and knock-on impacts on ports like Rotterdam and Hamburg, which are already struggling with congestion.

Transpacific container prices were stable last week as well, with reports that carriers are starting to offer discounts. Rates starting to slide a little earlier than usual suggests carriers are working to capture volumes that may be proving weaker than expected, as retailers exercise caution in ordering decisions given the trade war-driven uncertainty.

The massive winter storm that brought snow, sub-zero temperatures and ice to much of the northeast, southeast and parts of the midwest US over the weekend significantly disrupted rail services, road transport and container port operations across the impacted regions. Ports in the southeast have started to recover slowly, but as snowfall in the northeast continued through Monday, the major hubs including New York/New Jersey remained closed.

The storm also led to more than 11,000 flight US cancellations on Sunday – the most since the pandemic – with that number dropping to 6,000 on Monday as some southeast and midwest airports were able to restart. Still, more than 1,000 Tuesday flights were scrapped, now concentrated in the northeast. Extremely cold temperatures that may linger and keep conditions icy could slow the speed of recovery.

Air cargo rates from China to the US climbed to more than $6.20/kg and back to early January levels, with prices increasing 9% to $4.57/kg out of South East Asia, possibly helped by storm-driven backlogs and the beginning of some pre-LNY frontloading. China - Europe rates were level at about $3.60/kg.

The possibility of a US strike on Iran is leading several European carriers to cancel flights to the Middle East, with rising tensions also relevant to ocean freight as the Houthis have threatened to renew attacks on passing vessels in the event of US military action. -

Analysis

President Trump announced on social media over the weekend intent to impose 10% tariffs starting February 1st on Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands and Finland for opposing the sale of Greenland to the US, and that tariffs will increase to 25% in June if there is no deal by then.

The EU accounts for 20% of total US imports by value. Last year Germany – the largest European exporter to the US – the UK and France exported more than $300B in goods to the US through October, with pharmaceuticals, medical supplies and devices, and vehicles and automotive goods accounting for most of it.

While Europe opted not to retaliate for US tariffs last year, this time seems different. EU leaders have scheduled an emergency meeting in Brussels to discuss their options. They could let retaliatory tariffs on $100B of US exports – approved last year but suspended until February 7th – go into effect; withhold pending approval of parts of the EU-US trade deal like reducing tariffs on some US goods to zero; or even close US military bases.

The EU also has an anti-coercion instrument, aka “the bazooka,” at its disposal which, among other steps, allows it to tariff services, limit intellectual property rights and access to public contracts, and control exports in response to economic aggression.

With a short runway before February transatlantic ocean frontloading isn’t an option. Freightos Air Index Europe - N. America rates have inched up 2% to $2.21/kg since the announcement, but this gain continues a gradual January rate rebound from the $2.00/kg mark at the end of last year.

The president is scheduled to meet with relevant world leaders to discuss the issue in Davos, and Treasury Secretary Scott Bessent is urging calm. Last year provided more than one example of Trump announcing maximalist tariff – including the April 2nd reciprocal tariffs – and other threats, that proved to be mostly leverage for pressurized negotiations and aimed at concessions somewhere short of the initial ask. Another factor adding to the uncertainty is that the White House would likely rely on the International Emergency Economic Powers Act to authorize these tariffs even while a Supreme Court decision on IEEPA-based tariffs’ validity looms.

What is certain is that the latest drama increases uncertainty yet again just as the US deescalation with China and announced agreements with several major trading partners toward the end of last year had seemed to firm up the 2026 trade war and tariff landscape.

Maersk announced last week that its MECL – Middle East and India to US East Coast – service will resume Red Sea transits starting next week. Maersk and CMA CGM are the first carriers to revert some full services back through the Suez Canal. But CMA CGM just advised that it will now reroute some of those services around the Cape of Good Hope once again, citing the current “uncertain international context.”

These steps forward and back suggest a full Red Sea return some time soon is still not a sure thing, and that the resumption may be quite gradual – and less disruptive than a wholecloth reboot – with carriers implementing a hybrid approach blending Red Sea transits for some sailings with the longer route for others for a while.

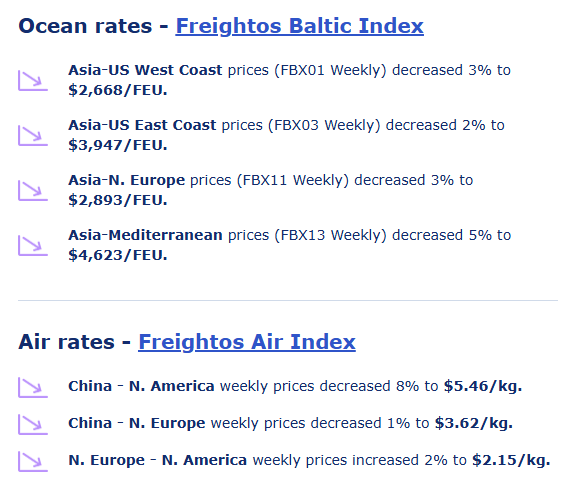

Ocean rates on the major east-west lanes eased slightly last week with no signs of a rebound so far this week, suggesting carriers aren’t moving forward with planned mid-month GRIs and that pre-Lunar New Year demand may have already reached its peak. Asia - Mediterranean prices fell 5% to $4,623/FEU and are down about $200/FEU from a January high two weeks ago. Rates to Europe decreased 3% to $2,893/FEU, down from about $3,000/FEU to start the month. These dips mark the first rate reductions for these lanes since prices started climbing in mid-October.

Transpacific prices meanwhile, increased but then retreated several times in Q4 though carriers succeeded in holding on to incremental gains that kept rates above mid-October year lows. Prices eased 3% to $2,668/FEU to the West Coast and 2% to $3,947/FEU to the East Coast last week after reaching their January highs the week before. Rates for all these lanes are still likely to stay elevated in the near term as the holiday approaches and then face downward pressure as demand eases post-LNY, with carriers already announcing blanked sailings.

In air cargo, some carriers continue to avoid Iranian air space, resulting in longer Asia - Europe flights, though rates were stable at $3.62/kg out of China and about $2.90/kg from South East Asia. China - US prices continued to ease last week, falling 8% to $5.46/kg though rates out of SEA ticked up by 3% to $4.18/kg.

-

Analysis

Asia - Europe container rates remained steady but elevated last week – at about $3,000/FEU to Europe and $4,850/FEU to the Mediterranean – at levels last reached during the summer peak season as pre-Lunar New Year demand is now supporting the start of the year GRIs and carriers add capacity to service rising volumes.

This seasonal demand bump started earlier than usual and so may already be at about its peak as daily rates this week cool slightly. Some carriers have nonetheless announced mid-month GRIs aiming at $4k/FEU for Europe and more than $5,500/FEU for Mediterranean routes. The recent winter weather in Europe has caused disruptions at some key ports, which could help support rate levels.

Rates on the transpacific have been on the rise since mid-December and continued to climb about 5% last week. Prices so far this week have remained stable at about $2,750/FEU to the West Coast and $4,000/FEU to the East Coast, though some forwarders report that carriers are already starting to offer discounts as space remains available.

The current rate bumps to North America would also be earlier than normal for pre-LNY, but are in line with the latest National Retail Federation US ocean import projections. The report estimates January volumes will increase 6% compared to December for the first month-on-month increase since July, though these volumes would be 5% lower than last January, with annual deficits expected through April. The NRF’s January report however, projects stronger 2026 volumes than its report from a month ago did, suggesting importers may be getting slightly more optimistic about post-holiday restocking strength.

In geopolitical developments, the US Supreme Court has until the end of June to issue a ruling on the legality of IEEPA tariffs, though there is speculation that a decision could come as soon as tomorrow. It seems likely that SCOTUS will rule against the administration. Such a decision would raise significant question marks regarding whether or how quickly the White House might move to restore tariffs by other means, and what the decision will mean for tariff refunds.

The administration’s IEEPA-based tariffs on China were set at their current level until November of this year as part of the China-US deescalation back in November. Amid the turmoil in Iran though, President Trump released a statement on social media, though no executive order has been issued, saying 25% tariffs are in effect for any country that trades with Iran. If this move becomes law it could apply to China – Iran’s largest trading partner – and risk disrupting the China-US trade status quo.

The unrest in Iran could have other implications for freight as well. Iran has threatened to respond to a US attack with actions against US shipping interests. These steps could include closing the Strait of Hormuz. While closing the passage would be disruptive to oil flows, only 2% - 3% of global container volumes, according to Container Trade Statistics, transit the Strait, so disruptions to the container market would mostly be felt locally.

A closure would cut off access to Dubai’s Port of Jebel Ali, a major transhipment hub between the Far East and points to the west, especially Europe, with a share moving from ocean to air in Dubai. Tranship volumes would need to be shifted elsewhere, possibly to South Asian hubs, which could cause some congestion and higher freight rates, but would not represent a major disruption to the overall container market. If protests do topple the regime, leaving the Houthis without Iranian support, the collapse could hasten a container traffic return to the Red Sea, where carriers like Maersk continue to test the waters.

Last week’s storms and cold in Europe disrupted flights along with container ports, though operations are recovering this week. Air rates continue to cool post the December peak on the transpacific, with Freightos Air Index China - US prices below $6.00/kg for the first time since October, and prices from South East Asia slumping below $4.00/kg.

While transpacific volumes fell sharply following US de minimis suspensions in May, capacity and volumes have gradually recovered. This rebound is driven partly by a recovery in e-commerce volumes, but mostly by general cargo growth from China and South East Asia – especially Vietnam – as demand for AI hardware and trade war shifts in electronics sourcing push more volumes to the air.

-

Analysis

The US operation in Caracas over the weekend, which facilitated the US military’s capture of Venezuela’s President Maduro, included strikes on the city’s La Guaira container port and a nearby military base.

La Guaira is Venezuela’s second largest container port, and tits closure will disrupt operations and cause delays for importers and exporters who normally rely on La Guaira. Even before the US action, there were reports of some tranship volumes shifting away from Venezuela due to the growing instability. But the larger Port of Cabello is only about 60 miles to the west, and as Venezuela overall is a small market for container trade – with handling capacity of around a million TEU per year – impacts from the strike on La Guaira are unlikely to be felt beyond Venezuela.

In trade war developments, the US delayed its planned January 1st tariff increase on lumber products including furniture, for one year. The Department of Commerce also stepped back from plans for a sharp tariff hike on Italian pasta imports. These deescalations may partially be motivated by cost of living concerns that are putting some pressure on the White House. These responses add more uncertainty as to how the administration – whose stated intention is to quickly reinstate tariffs by other means – may react if the Supreme Court decision invalidates its IEEPA-based, country-specific tariffs introduced last year.

In ocean freight, start of year GRIs pushed Asia - Europe rates up 9% to the $3,000/FEU mark last week, and Asia - Mediterranean prices up more than 20% to $4,800/FEU, reflecting 23% and 45% climbs since mid-December, respectively.

These hikes – pushing Mediterranean rates even with their peak season 2025 high and Europe prices to their highest since late August – reflect growing pre-Lunar New Year demand on these lanes, even as carriers add capacity to service these volumes. These rate levels are well above long term pre-LNY norms, but even with Red Sea diversions continuing and volumes likely stronger than last year, Asia - Europe prices remain 40% lower than last year, likely an effect of a growing fleet.

Transpacific container rates, which started climbing in mid-December, continued their ascent last week via January 1st GRIs. Prices to the West Coast increased 22% to $2,617/FEU, and are more than 30% higher than in mid-December. East Coast rates climbed 12% to $3,757/FEU and are up 20% in less than a month.

That prices haven’t retreated at all from December increases – like they had following several GRI attempts in Q4 – suggests that LNY demand is picking up and supporting prices on these lanes too. Even if demand has started to pick up, volumes are projected to be 10% lower than last year, likely contributing, along with capacity growth, to significantly lower year on year rate levels for these lanes.

In air cargo, ex-China rates eased to $6.18/kg to the US and $3.44/kg to Europe – down from peak season highs of $8.00/kg and $4.00/kg – as post-peak demand slows. Prices out of South East Asia are likewise cooling, with rates to the US down to $4.28/kg last week from a mid-December high of $5.80/kg, and prices to Europe sliding to $2.90/kg from a peak of $4.00/kg.

-

Analysis

Ocean rates on the major East-West lanes trended up to close the year. Asia - Europe prices increased 1% last week to $2,742/FEU but are 12% higher than mid-month and are up to levels last seen at the tail end of peak season. Asia - Mediterranean rates climbed 4% to reach the $4,000/FEU mark for the first time since early July, with prices 20% higher than during the first half of the month.

Current rate levels are supported by an early start to pre-Lunar New Year demand on these lanes as shippers face longer lead times due to Red Sea diversions. As such, prices are likely to stay elevated or continue climbing as we get closer to the holiday.

Periodic GRIs since October have generally been less successful in keeping rates elevated for very long on transpacific lanes than they’ve been for Asia - Europe trades. Price hikes since mid-December have pushed West Coast rates up 9% to $2,145/FEU and raised prices to the East Coast 15% to $3,364/FEU. But rates will be under upward pressure when transpacific pre-LNY demand picks up, and prices increased to start both 2024 and 2025. The holiday begins later than usual – February 17th – this year, which could mean another rate slide in the near term before demand increases. But if volumes do start to rise to start the new year, rate levels should keep climbing too.

Despite transpacific ocean import contractions and an overall dip in US ocean imports due to the trade war this year, ex-Asia volume strength to Europe, Africa and LATAM – as China diversified trading partners – saw global volumes grow 4% through early Q4.

S&P projects US ocean imports will fall again, by 2%, in 2026, making 2025-2026 – after the 2008-2009 financial crisis years and the 2022 - 2023 unwind from the pandemic – the third instance of consecutive years of US container import contraction over the last two decades. Like this year, observers like BIMCO expect global volumes will continue to grow nonetheless.

Freightos Air Index shows air cargo rates fading post peak season. China-US prices fell 16% to about $6.25/kg, its lowest level since early November. South East Asia - US rates fell 19% to $4.60/kg and transatlantic prices dropped 14% to $2.16/kg. China - Europe prices slid 5% to $3.52/kg and SEA - Europe rates decreased more than 20% to $3.12/kg.

IATA estimates that – after sharp, e-commerce-driven, 11% growth in 2024 – 2025 global air volumes will be 3.1% stronger than last year. IATA also expects this year’s resilience to stretch into 2026 in the form of 2.6% annual growth. Opinions differ as to whether cargo capacity growth will outpace volume growth next year or not, making rate projections for next year difficult as well.

-

Analysis

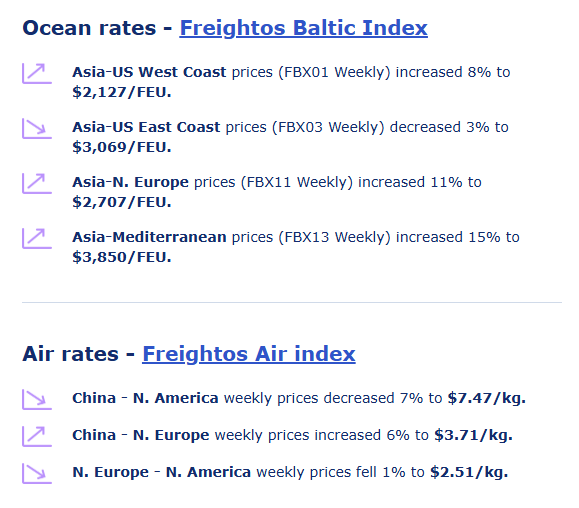

Transpacific ocean rates continued their Q4 trend of ups and downs last week with West Coast prices climbing 8% and $200 to $2,100/FEU as carriers increase blanked sailings during this low demand period to try and introduce – and hold on to, at least partially – General Rate Increases every two weeks.

East Coast rates dipped 3% last week, but daily rates this week are up $300 to more than $3,350/FEU. As has been the case since mid-October, rates may retreat again somewhat in the near term. But a more sustained increase could be coming as we get closer to Lunar New Year. Even with the rises and falls though, carriers have succeeded in overall residual gains that have kept prices above year lows set in early October.

More disciplined capacity management on the Asia - Europe lanes have kept rates climbing for much of Q4. But reports of increasing demand as Europe’s importers get an early start on pre-LNY orders now has volume strength supporting the latest GRIs too, with some carriers even restoring some announced blankings. Asia - N. Europe prices rose 11% to more than $2,700/FEU last week, and rates to the Mediterranean increased 15% to $3,850/FEU, with daily rates already above $4,000/FEU – both back to levels last seen this past summer.

This early start – also seen last year – is likely due to continued Red Sea diversions that, for shippers who don’t stock up enough inventory before the holiday, will mean a much longer than usual post-LNY wait to receive goods.

But there are more signs that carriers are taking cautious steps toward resuming Red Sea transits. Maersk sent a vessel through the Bab el-Mandeb Strait late last week for the first time in more than two years, and stated that a few more sailings will follow as they test the feasibility of a full scale return. ONE also joined the group of carriers offering some Red Sea services, though through a charter slot agreement with regional carriers. Insurance premiums for Red Sea transits have fallen somewhat, but shipper concerns over exposure to risk and insurance costs are still a barrier to return, even when some carriers, like Hapag-Lloyd, are ready for a Red Sea trial run.

When Red Sea traffic does resume it will cause worse and significant vessel bunching and congestion at European hubs, and likely drive equipment shortages at Far East origin ports as carriers seek to shorten vessel time spent at berth. The shift back will be disruptive and cause delays and rate increases whenever it occurs, though the effect would be weaker if the return is in the low demand, spring months post-LNY and pre-peak season, and stronger if it coincides with peak season demand increases.

Once that congestion unwinds though, the Red Sea return will increase the amount of capacity available in an already oversupplied market. New vessel deliveries will decrease in 2026 compared to 2025, but the impact of the increase in supply on rates – even if Red Sea diversions continue – will likely be significant nonetheless, with higher levels of newbuild deliveries set for 2027 and 2028.

The Freightos Air Index shows China - US rates have started to come down from year highs as peak season comes to end, with prices falling 7% to $7.47/kg last week and daily rates down to about $6.50/kg. South East Asia - N. America rates are also starting to fall after climbing more than 20% to about $6.00/kg since mid-October. Overall transpacific traffic has proved resilient despite significant China-US volume drops following de minimis changes – and shifts of Chinese e-commerce tonnage to alternative markets – as electronics volumes out of SEA, especially Vietnam, and Taiwan have grown due to tariff introductions.

China - Europe daily rates are at $3.86/kg, about level with earlier in the month and well below the $5.00/kg mark seen a year ago, with SEA - Europe prices at a year high of $4.15/kg, with daily rates easing.

-

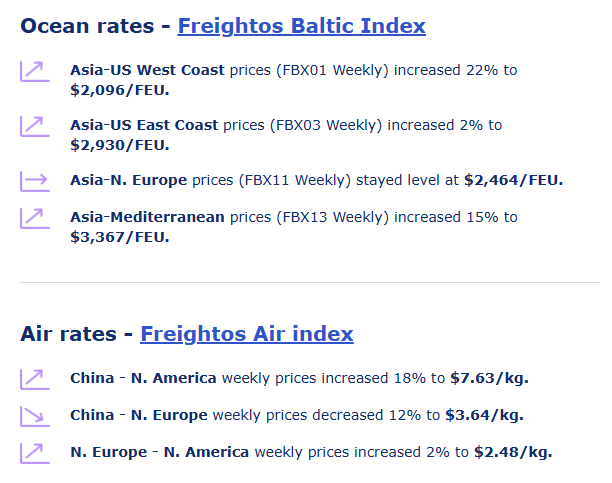

Analysis

Despite growing signs of ocean freight overcapacity, container rates on Asia - Europe lanes have maintained their increases from recent GRIs.

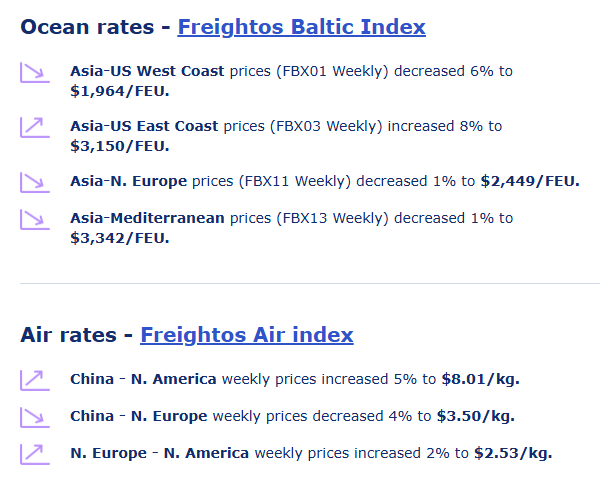

Asia - Mediterranean rates were level last week at $3,342/FEU after climbing 15% to start the month for its fourth consecutive successful GRI since mid-October, before which prices dipped to a year low of about $2,000/FEU.

Asia - N. Europe prices were stable last week at $2,449/FEU, and level with rates set in early November, but still well above its mid-October nadir of $1,700/FEU. For most of the last two months rates on these lanes have climbed bi-monthly via capacity reductions as demand eased. But carriers and forwarders are now reporting an uptick in demand as some shippers are getting an early start to pre-Lunar New Year ordering – a trend also seen in Asia - Europe rate behavior in 2023 and 2024 when December prices climbed sharply, possibly in response to Red Sea-driven longer lead times.

Carriers are now increasing capacity to meet demand, with some planning mid-month Asia - Europe and Mediterranean GRIs to the $4,200/FEU and $4,750/FEU levels respectively. Through October, year to date Asia - Europe volumes were up 8.6% according to CTS. December demand is likely stronger than last year as well, with some speculating that some shippers are expecting a return to the Red Sea soon and are therefore building inventory buffers now in expectation of disruptions. But even with both Red Sea diversions still in place and volume growth, spot rates have consistently been lower than last year. Current Asia - N. Europe rates are down 54% compared to last December, pointing to capacity growth as an important factor to current price levels.

On the transpacific meanwhile, even with capacity reductions – and additional blanked sailings announced for the coming weeks – carriers are having difficulty getting the series of recent GRIs to stick. Last week West Coast rates retreated 6% from a start of the month GRI bump, to $1,963/FEU. Prices to the East Coast increased 8% to $3,150/FEU this week, but are down 15% from a month ago. Even with these ups and downs, though, carriers have succeeded in keeping rates above October lows of $1,400/FEU and $3,000/FEU respectively, likely with benefits of higher rates for short periods in between the dips.

Slumping Q4 demand, in addition to growing fleets, is an important factor to rate levels, making planned mid-month GRIs unlikely to hold, and a more sustained rate rebound more likely only as we get closer to LNY. There are some indications that part of current demand levels is due to some US manufacturers pausing imports in the hopes that a Supreme Court decision invalidating IEEPA tariffs will come soon and result in lowered duties. Though the White House maintains that if IEEPA is struck down, it is ready to quickly restore tariffs by other means, some speculate that the administration – under growing pressure from cost of living concerns – could use a court decision against them as a tariff off-ramp.

Watch our recent 2025 Freight Year in Review and 2026 Lookahead webinar here.

But even with seasonal increases in demand in 2026 – and following an estimated 1.4% decline for 2025 year total US ocean imports – S&P projects year totals in 2026 will fall 2% before a 6% rebound in 2027.

And slumping demand next year will coincide with capacity that will continue to grow. Though most of the new vessels are large and used on the main east-west trades, these new deliveries are also having knock-on effects on secondary lanes, like regional and feeder markets. As these new large vessels are introduced, older large vessels are being shifted to secondary lanes increasing capacity on these lanes, but also leading to an aging smaller-vessel fleet, which could set up a shortage of right-sized ships for these lanes even as total capacity grows.

Capacity levels will be even higher once Red Sea diversions end. But regardless of when carriers feel ready to resume traffic through the Suez, vessels won’t be able to return until vessel and cargo insurers also agree that the risk of attack has dropped sufficiently. Some experts suggest insurers will need at least another 60-90 days of quiet before considering a Red Sea return.

In other geopolitical developments, Mexico announced significant upcoming tariffs on many goods from countries with which they do not have trade agreements, including China. This step would be a blow to China, as Chinese exports to and investment in Mexico have grown sharply over the last few years. But despite this year’s trade war, China has shown export growth driven by diversification of trade partners.

In air cargo too, global volumes have grown from trade diversification even as changes to de minimis rules in N. America – including Mexico – have meant fewer e-commerce volumes entering those markets by air.

But even on the transpacific, air demand has rebounded, if not fully recovered from the de minimis cancellations, both from some e-commerce recovery but also from significant general cargo growth from Vietnam as well as from China. IATA estimates that – after sharp e-commerce-driven 11% growth in 2024 – 2025 global air volumes will be 3.1% stronger than last year and that in 2026 demand will grow by 2.6%.

As air peak season enters its final week Freightos Air Index China-US rates climbed to a year high of more than $8.00/kg, stretching past last year’s $7.30/kg peak, with South East Asia - US prices up to $5.50/kg from $5.00/kg in October. China - Europe rates dipped to $3.50/kg last week as capacity, following the fast growth in volumes, has shifted to this lane.

-

Analysis

The past week has offered more signs of encouragement for a container market return to the Red Sea. In addition to the Houthis’ release of crew members held in Yemen since a vessel attack in July, CMA CGM and its Ocean Alliance announced some of their services – escorted by French naval vessels – will now transit the Suez Canal for all backhaul voyages, with another also sailing headhaul via the Red Sea.

None of these developments make a Red Sea rebound imminent however, and a full return could still be quite a ways off. But the eventual return of container traffic to the Red Sea will ultimately release a surge of capacity back into a market already struggling with oversupply.

Transpacific container rates to the West Coast hit a low for the year of about $1,400/FEU in early October. Since then, carriers have sought to reduce capacity and introduce GRIs, resulting in a (relatively slow-moving) rollercoaster for prices on these lanes as supply-driven rates rise, retreat and repeat.

Carriers were able to push West Coast rates up in mid-October and again to start November, resulting in an early-November climb to about $3,000/FEU only to see prices fall to $1,700/FEU by the end of the month.

But prices ticked up again to start December – despite volumes projected to be the lowest of the year – with rates to the West Coast up 22% last week to $2,100/FEU. Some carriers are introducing smaller, incremental increases on a weekly basis as opposed to the more typical bi-monthly GRIs in the hopes that the market will accept smaller price bumps more easily than sharper increases. This trend may be reflected in daily rates for this week up another $100/FEU to $2,200/FEU to the West Coast and to more than $3,000/FEU to the East Coast, though once again this month there is skepticism that these prices will hold.

Despite some observers expecting the US market to enter a restocking cycle that would spur ocean volume growth next year, others are less optimistic. The NRF anticipates retailer expectations for negative trade war impacts on consumer behavior will result in double-digit percentage year on year ocean import volume declines through April of next year, with demand lower than 2024 levels as well.

Trade war frontloading is partly to blame for lower US ocean import volumes now, and for the sharply negative year on year comparisons for those expecting weak volumes for Q1 2026. Europe’s ocean imports meanwhile – especially as China has shifted focus away from the US and toward other markets including Europe – have been stronger and more consistent than N. America’s. CTS data shows total ocean imports to Europe eased 2% in month-on-month October, but were still 1% higher than a year ago. Asia - Europe volumes fell 3% year over year in October for the first annual decrease since February.

Despite easing, slow-season volumes, carriers have had more success propping up Asia-Europe rates in Q4 than they have on the transpacific partly due to more aggressive blanked sailings as these lanes enter the home stretch of their annual ocean contract negotiation period.

GRIs starting mid-October have pushed Asia - Europe rates up 40% to $2,463/FEU through last week, though prices have been level since late November. Asia - Mediterranean rates are up 56% to $3,366/FEU including a $500/FEU bump to start December. Some carriers have announced additional GRIs for mid-December, aiming to push N. Europe rates to $3,500/FEU and Mediterranean prices to $4,200/FEU or higher.

As the air cargo market enters its final peak season weeks, Freightos Air Index data suggests transpacific demand strength. China - US rates climbed from around $5.30/kg in mid-October to $6.50/kg to close November, and are now pushing past the $7.50/kg mark – above last year’s $7.30/kg peak – during the end-of-season rush.

Demand is likely stronger on Asia - Europe lanes as China’s e-commerce export focus has also shifted to Europe. But the parallel shift of capacity away from the transpacific and to Asia-Europe lanes – also a factor in the current, higher transpacific rates – has kept Asia - Europe prices from spiking. China - Europe rates eased 12% to $3.64/kg last week and are about on par with a year ago.

The EU and the UK have announced plans to close their de minimis exemptions within the next few years, with several countries planning handling fees for low value imports even before the rule change. US de minimis closures initially led to a sharp decrease in China-US e-comm air cargo volumes. And though volumes remain below April levels, some reports show much of that e-comm demand has returned to the China-US air market as e-commerce platforms have adapted to the new rules.

-

AnalysisLast week, statements by the Suez Canal Authority indicated that Maersk’s return to the Red Sea was imminent. Maersk quickly denied they had set a date, and now it appears all the excitement may have been mostly a misunderstanding, though there are signs that Maersk is at least dipping some toes back to the lane through third parties.

So a Red Sea rebound may not be coming as soon as it seemed a few days ago, but a return is likely still closer than it has been for the last two years. The resumption, whenever it occurs, will cause congestion at European hubs – where congested ports are leading some carriers to already adjust port call plans – during the transition back before releasing significant amounts of capacity back into rotation and adding downward pressure on rates once schedules normalize.

You can see our full analysis of a Red Sea rebound here.

Even before a Red Sea reset, there are already signs of growing overcapacity in the market. This fleet growth even with Red Sea diversions still in place has meant lower container rates year on year for most of 2025.

Transpacific rates fell further to close November, with West Coast rates down 10% to $1,715/FEU and East Coast rates easing 17% to $2,863/FEU. These dips brought transpacific prices within a couple hundred dollars of year lows after climbing on mid-October and early November GRIs Demand is estimated to be at its lowest since early 2023, but supply side growth is also contributing to lower rates. Daily rates this week are trending up though, which could signal another GRI attempt to start December.

More aggressive capacity management on Asia - Europe lanes are likely responsible for carriers succeeding to maintain October and November GRIs on these trades. Prices were level last week at about $2,500/FEU to Europe and $2,900/FEU to the Mediterranean. Daily rates to the Mediterranean are up to about the $3,400/FEU level so far this week suggesting a GRI push, though prices to Europe have stayed about level. New EU emissions surcharges will mean higher costs to carriers on these lanes that will start to be passed on to customers in January.

Severe storms in South East Asia last week disrupted ocean and air freight operations in countries including Sri Lanka, Thailand, Vietnam and Malaysia. Of these, Sri Lanka may have been the hardest hit, with delays reported at the Port of Colombo as services restart.

Also late last week, Airbus grounded 6,000 of its A320s for a critical software update with a hardware fix needed for about 1,000 of these aircraft. Most vessels were updated and returned to service over the weekend, with no significant delays reported yet. FedEx and UPS have grounded their MD11s following a deadly crash, and though FedEx anticipated a rapid inspection process, aircraft are taking longer than expected to get back in the air.

The US cancelled its de minimis exemptions over the summer driving a significant reshuffle of e-commerce air cargo volumes and capacity over the last few months. The EU has committed to revoking its de minimis rules by 2028, though it may do so as early as next year. The UK has now also decided to terminate the exception. But with a later target date of 2029, there is concern that an even stronger surge of e-comm goods could enter the country once de minimis to the other major markets close.

Freightos Air Index rates to Europe climbed 4% to $4.14/kg out of China last week and were about level at $3.67/kg out of South East Asia. China - N. America prices were level at $6.50/kg last week but show signs of increases this week as peak season enters its home stretch. SEA - N. America rates are at about $5.50/kg so far this week.

-

Analysis

Despite higher tariffs since early this year, US retail sales have proved resilient and are expected to grow through the holiday season. The solidifying tariff landscape is nonetheless facing destabilizing forces like recent China-Japan tensions, and the US Supreme Court’s pending decision on the legality of Trump’s IEEPA-based tariffs.

But the White House is signalling it is already taking steps to ensure that a SCOTUS loss will not open a low tariff window. So, if consumer spending remains strong, and the status quo of the trade war holds up, the US could enter a restocking cycle in 2026 as frontloaded inventories wind down. This restocking could mean stronger freight demand than some have anticipated for next year.

On the freight supply side though, there is more and more discussion of container traffic’s coming return to the Red Sea as the fragile Israel-Hamas ceasefire remains in effect. And while most carriers are not offering a timeline, ZIM’s CEO recently stated that a return in the near future is increasingly likely.

The shift of most of the 30% of global container volumes that normally transit the Suez Canal away from the Red Sea and around the Cape of Good Hope almost exactly two years ago added seven to ten days and thousands of miles to Asia - Europe journeys and to some Asia - N. America sailings as well.

The return of container traffic to the shorter Suez route will result in the sudden early arrival of these ships, which will mean significant vessel bunching and congestion at already persistently congested European hubs. This congestion will cause delays and absorb capacity which could push container rates up on the affected lanes, and possibly beyond.

Carriers have plans for a gradual phase in of the transition back to the Red Sea, with smaller vessels starting to transit first. This approach would still cause vessel bunching, but would be aimed at minimizing the impact of the reset as much as possible.

But some carriers are skeptical that an orderly phase-in will happen, as they expect pressure from customers who will want a return to the shorter route as quickly as possible. Analysis from Sea Intelligence suggests that the more gradual the transition, the less disruptive it will be, while the faster it is the more disruptive it will be, and the more pressure it will put on freight rates during the up to two months it will take for schedules to return to normal.

Ocean expert Lars Jensen also notes that a return during the lead up to Lunar New Year would coincide with an increase in demand, and would put more pressure on ports and rates than if the transition takes place post-LNY when demand is typically weak.

The capacity absorbed through Red Sea diversions pushed East-West rates up to highs of $8,000 - $10,000/FEU in 2024 and set a highly elevated floor of $3,000 - $5,000/FEU during low demand periods that year. But even with Red Sea diversions still in place this year, rates on these lanes have consistently been significantly lower than last year, with prices on some lanes reaching 2023 levels for a span in early October.

The transition back to the Suez Canal – be it more or less chaotic – will ultimately release more than two million TEU of container capacity back into the market. This surge will put even more downward pressure on rates and increase the challenge of effectively managing capacity for carriers seeking to keep vessels full and rates profitable.

The current overcapacity on the East-West lanes is the main reason that carriers’ November transpacific GRIs which had pushed West Coast rates up by $1,000/FEU this month to about $3,000/FEU have now fizzled.

Asia - N. America West Coast prices fell 32% last week to $1,900/FEU with daily rates this week down another $100 so far, but prices remain above the $1,400/FEU low for the year hit in early October. Last week’s vessel fire at the Port of LA does not seem to have had an impact on prices as operations have quickly recovered. Rates to the East Coast fell 8% to $3,400/FEU last week but are at $3,000/FEU so far this week, about even with levels in early October before these set of GRI introductions.

Meanwhile, October and November’s GRIs on Asia-Europe lanes have stuck, with rates to Europe and the Mediterranean both 40% higher than in early October at $2,500/FEU and $3,000/FEU respectively. These rate gains may be surviving on aggressive blanked sailings on these lanes.

Carriers are planning additional GRIs for December aiming for the $3k-$4k/FEU level as they continue to reduce capacity – with an announced labor strike in Belgium likely to help absorb some supply – but there are signs that these increases may not take.

In air cargo, peak season demand is driving rates up and should keep doing so for the next couple weeks. Freightos Air Index data show ex-China rates remaining strong at about $6.50/kg to N. America and $4.00/kg to Europe last week. Demand out of S. East Asia has grown significantly during this year’s trade war, with rates also elevated on these lanes at $5.40/kg to the US and $3.50/kg to Europe.

-

Analysis

The Trump administration – with the Supreme Court decision on the validity of its many IEEPA-based tariffs looming – announced additional tariff exemptions last week, focusing on agricultural products not produced in the US but also including beef, as the White House seeks ways to address cost of living concerns. The administration also announced frameworks for trade agreements with several South American countries and Switzerland.

Since October, container carriers have been contending with downward pressure on rates from both the seasonal lull in demand and growing capacity on the major East-West trades. Nonetheless, driven by significant steps to reduce capacity, they succeeded in pushing through mid-October GRIs that rescued rates from two-year lows, and pushed prices up again with November 1st rate increases.

But as we pass November’s midway point, transpacific rates have started to decrease sharply. Prices to the West Coast fell 6% last week, but daily rates so far this week have slipped more than 20% to about $2,100/FEU, erasing the November gains and, for now, back at about their mid-October GRI bump level.

East Coast daily prices have also fallen by more than 20% so far this week to about $3,000/FEU, back to pre-October GRI levels. Some carriers have December GRIs planned, but they may reconsider given this week’s sharp retreat.

Asia - Europe and Mediterranean prices meanwhile, are proving stickier, with rates about level last week and into this week at $2,480/FEU and $2,827/FEU respectively. This stability may reflect more aggressive blanked sailing campaigns for these lanes during the current tendering season, with some carriers announcing additional GRIs to push prices up to the $3k - $4k/FEU level soon or to start December.

In air cargo, the end of the US government shutdown has meant the restart of air operations that had been hampered by a drop in available air traffic controllers. The slowdown mostly impacted domestic cargo, and the ramp up is expected to take a few days.

The US’s cancellation of its de minimis exemptions this year was a significant driver of a sharp drop in air cargo volumes to the US – especially in the months immediately following the rule change – and a shift of Chinese e-commerce volumes to other markets, especially Europe. The European Union voted last week to close its de minimis exemption by 2028, but will explore ways to collect duties on low-value goods as early as next year.

The shift in volumes has been accompanied by a shift in capacity, which has kept the air cargo spot market relatively stable and in line with seasonal demand changes. Freightos Air Index China - US rates increased 5% last week to $6.60/kg, up from less than $5.00/kg in early October and at its highest sustained level this year as peak season demand grows. Last year, rates hit a high of $7.30/kg in mid-December.

China - Europe prices increased 2% to $4.01/kg last week, up from about the $3.50/kg level held pre-Golden Week. Transatlantic rates increased 6% to $2.31/kg last week, up from $1.70/kg in mid-October and to its highest since March. Rates for this lane were at $2.60/kg a year ago.

-

Analysis

The US Supreme Court heard arguments last week in the appeal of lower court decisions that invalidated President Trump’s use of the International Emergency Economic Powers Act to impose fentanyl-related and reciprocal tariffs this year.

Questions and comments made by justices during the hearing gave the impression that the court is likely to rule against the administration. While there’s speculation that a decision could come as soon as the end of the year, the court has until the end of its term in June to issue a ruling.

Striking down this use of IEEPA could potentially open a low-tariff window for arriving goods from many countries. But the White House will certainly be motivated to close that window quickly and re-establish duties using other more-recognized legal paths for country-specific tariffs. These options include a trade law empowering the president to apply immediate 15% country-specific tariffs for 150 days which the administration could use as a first step to restoring tariffs through other means.

East-West ocean rates increased significantly on most lanes via November 1st General Rate Increases last week. Transpacific prices to the West Coast climbed 48% and $1,000/FEU to about $3,000/FEU, but daily rates so far this week are trending down slightly and rates to the East Coast remained about even with October levels.

There are reports indicating prices could fall back to their late October levels soon, which were themselves pushed up from year lows hit in early October via GRIs. Some carriers are announcing additional blanked sailings for the transpacific this month in moves to at least keep rates from backsliding to recent lows.

The current low demand period poses a challenge to carrier GRI ambitions. The latest National Retail Federation US ocean import report estimates October volumes sagged to about even with the previous lows for the year hit in May and June when US tariffs on China were at 145%. The report also projects that demand will ease further in November and December with double digit monthly decreases compared to last year as tariff frontloading has meant declining volumes since mid-August.

US ocean imports are expected to rebound during the lead up to Lunar New Year in January and early February, but these months are also projected to be down significantly year on year due to comparisons with Q1 2025 when frontloading began.

Asia - Europe rates climbed 9% to about $2,500/FEU last week with prices to the Mediterranean up 24% to $2,837/FEU on November GRIs. Some carriers have announced mid-month GRIs aiming to increase rates to the $3k/FEU mark for Asia-Europe as the long-term contract tendering season gets underway for this lane.

But in addition to the low demand challenge, carriers are also contending with continued fleet growth and climbing overcapacity. While Red Sea diversions last year were enough to keep rates well above long term norms, the monthly global rate benchmark has been lower year on year since March even as volumes have grown overall in 2025. A container traffic return to the Red Sea will, after a transition period, exacerbate the supply surplus. Reports this week of Houthis declaring an end to Red Sea attacks and carriers meeting with Suez Canal officials may mean the return to the Suez is getting closer.

In air cargo, the US government shutdown – which could end soon – has led to a shortage of air traffic controllers and the phase in of a 10% reduction in flights in the US which is disrupting domestic passenger travel and bellyhold air cargo operations along with it.

But as domestic freighters and international flights – which account for the bulk of the US air cargo market – are spared for now, the overall impact on air cargo should be minimal. Once the shutdown ends, airlines are expected to be able to restart their full flight schedules within 12-36 hours. Despite the delays, Freightos Air Index intra-North America rates have stayed stable at about $1.60/kg.

Changes to the US de minimis rules back in May meant a sharp initial drop in China-US e-commerce air cargo volumes, though recent data shows a gradual rebound in volumes since then as e-comm platforms adjust to the new rules – though not back to levels when de minimis was available.

Asia - Europe e-commerce air cargo volumes have shown nearly uninterrupted growth throughout the year as China’s e-commerce giants shifted focus to US alternatives, especially markets where de minimis exceptions are still in place. But there have been multiple signs of opposition to the flood of low cost goods entering these markets, including in the EU. Just this week France announced increased inspections of all e-commerce imports which is leading to backlogs at CDG.

But as has been the case since May, capacity shifts have meant that despite year on year volume declines transpacific rates remain elevated even if moderately below 2024 levels. China-US rates increased 4% to $6.30/kg last week on some likely peak season demand bump though prices were at about $7.00/kg last year. Likewise, despite volume growth, China-Europe rates which were at $3.92/kg last week, are about on par with prices in 2024.