Federal Reserve Monetary Policy Decision

Federal Reserve Monetary Policy Decision

- Source

- Federal Reserve

- Source Link

- https://www.federalreserve.gov/

- Frequency

- 8-times a year

- Next Release(s)

- January 28th, 2026 2:00 PM

-

March 18th, 2026 2:00 PM

-

April 29th, 2026 2:00 PM

-

June 17th, 2026 2:00 PM

-

July 29th, 2026 2:00 PM

-

September 16th, 2026 2:00 PM

-

October 28th, 2026 2:00 PM

-

December 9th, 2026 2:00 PM

-

January 27th, 2027 2:00 PM

-

March 17th, 2027 2:00 PM

-

April 28th, 2027 2:00 PM

-

June 9th, 2027 2:00 PM

Latest Updates

-

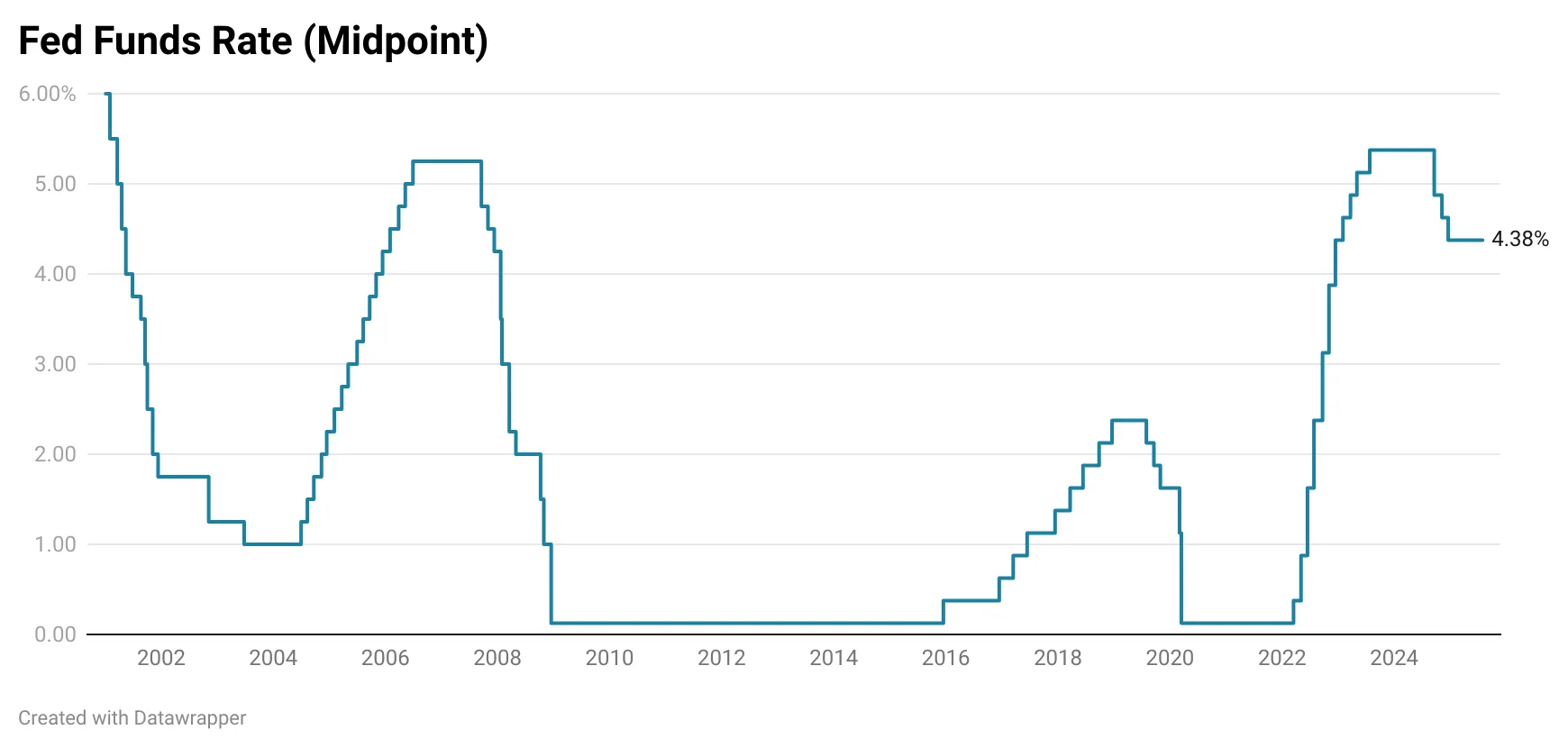

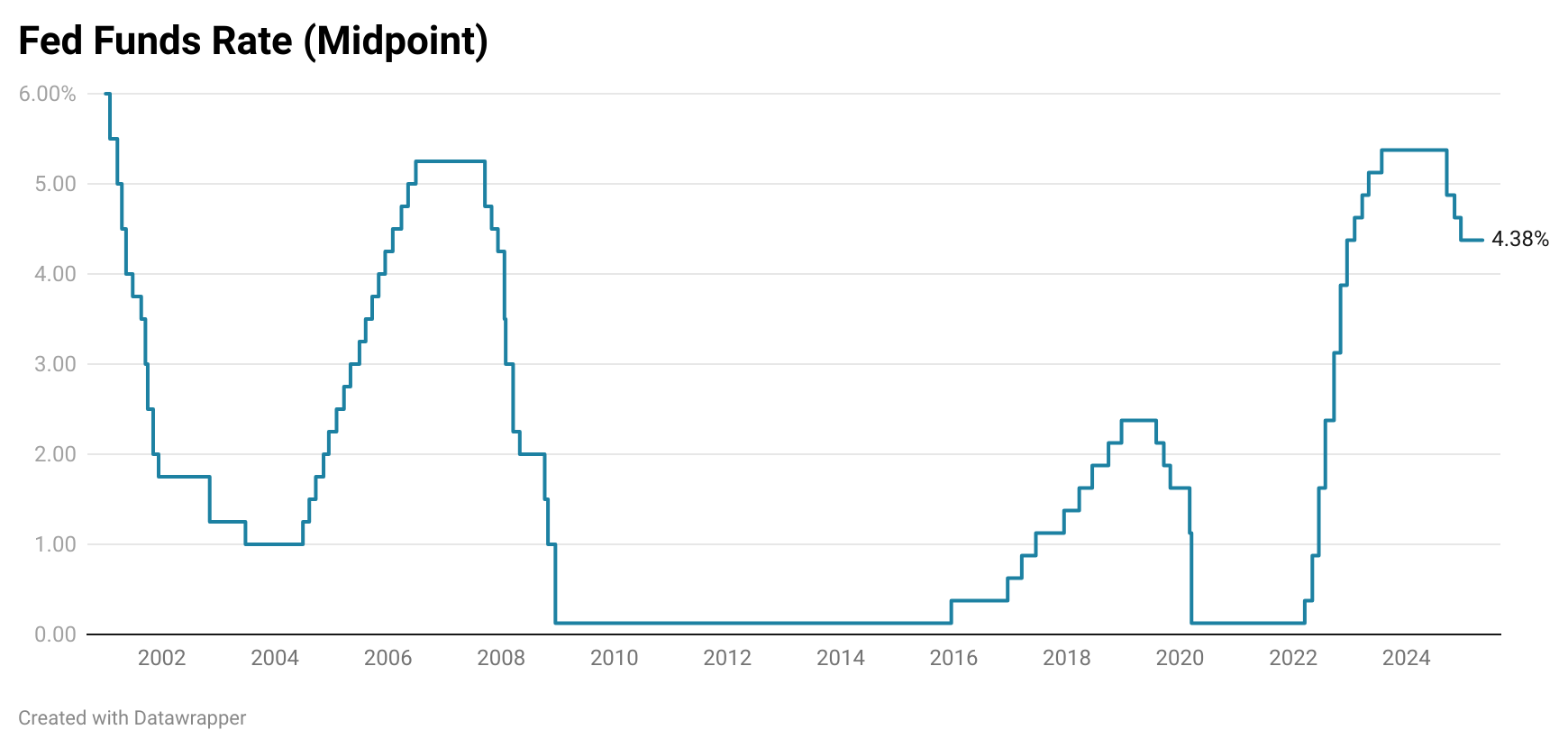

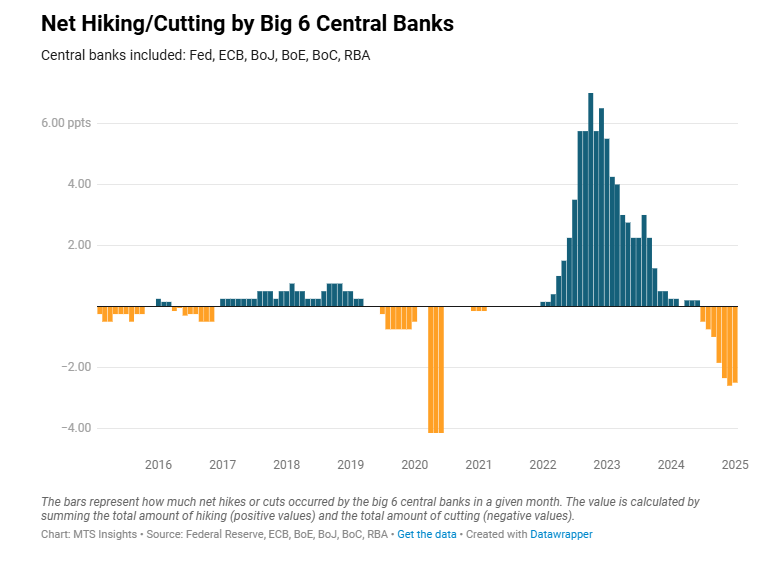

The Federal Reserve cut the federal funds rate by 25 bps to 3.50–3.75%, marking its third cut of the year and reflecting subtle but important shifts in its assessment of labor market softness and inflation risks.

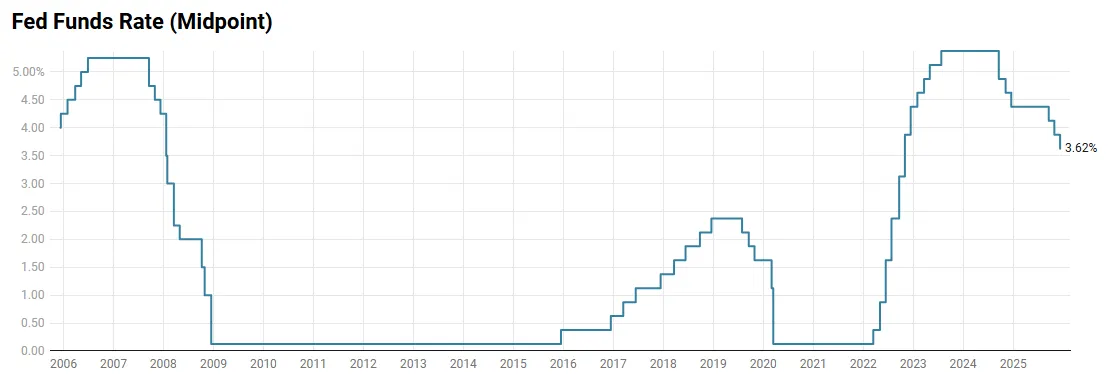

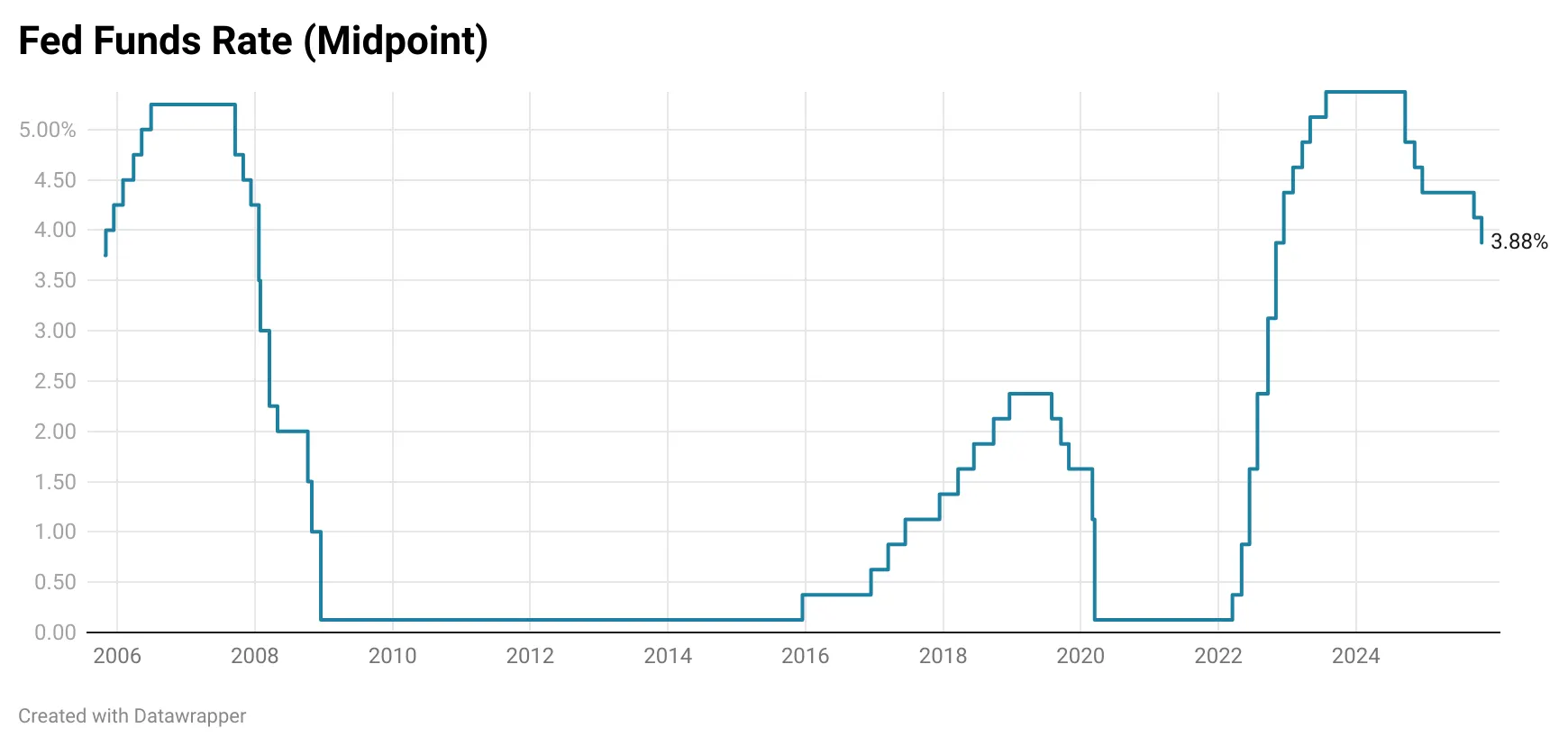

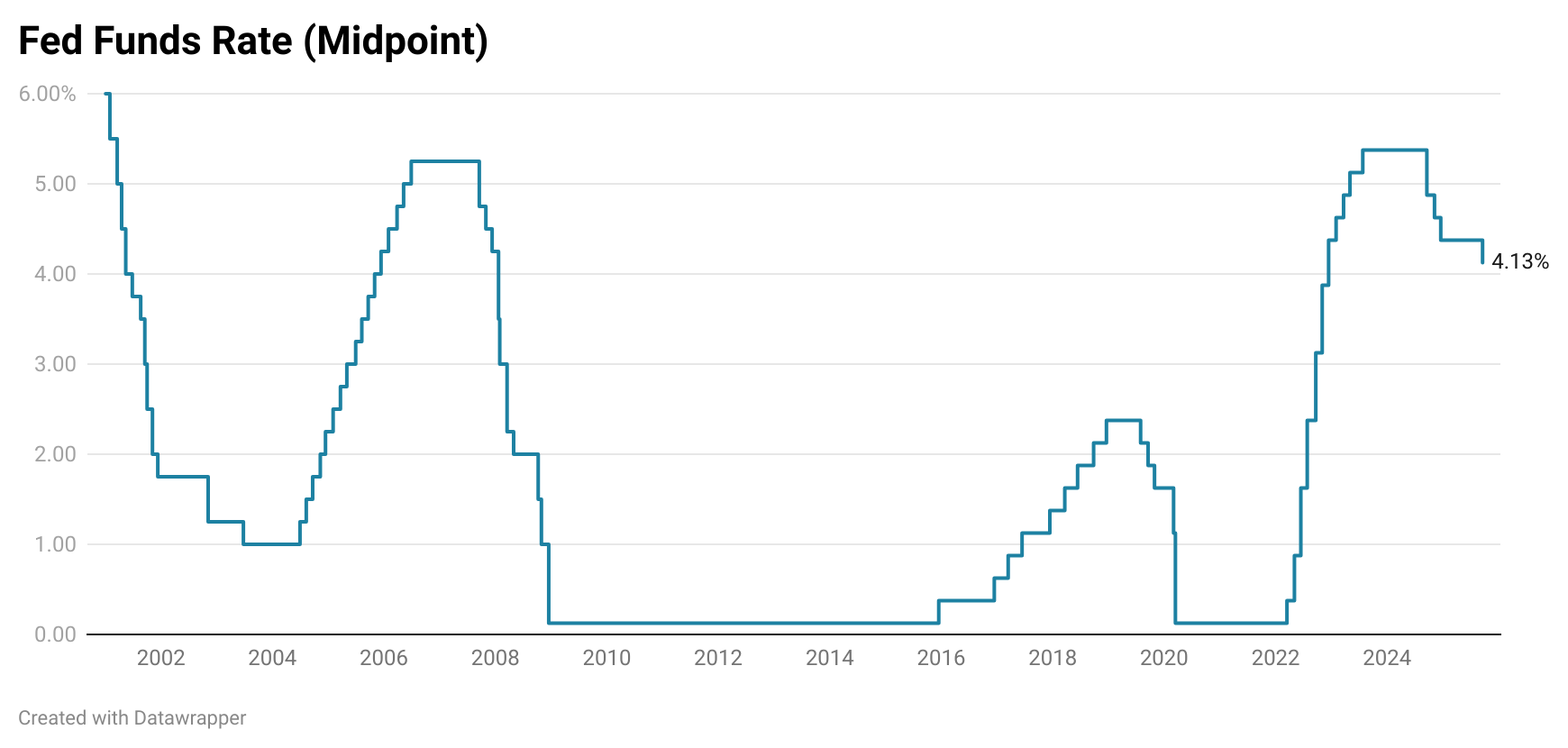

- The Fed has lowered rates by a cumulative 175 bps since September 2024, bringing the policy rate to its lowest level since November 2022 and aligning it with what officials describe as a broad range of neutral estimates. This suggests the Committee is becoming more cautious about additional near-term cuts.

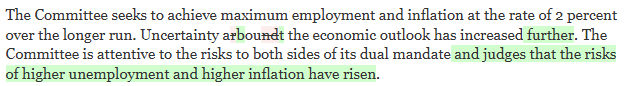

- The decision was unusually divided, with 3 dissents (2 preferring no change and 1 favoring a 50 bp cut), the highest number since 1990. The mixed views highlight differing assessments of inflation pressures and labor market deterioration heading into 2026.

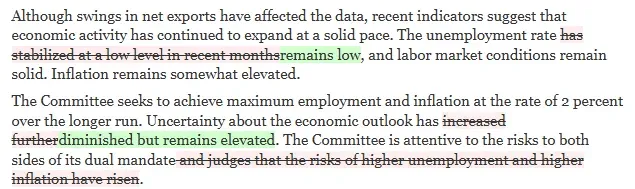

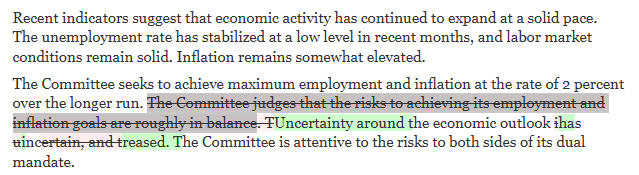

- Statement wording shifted modestly but meaningfully, removing the phrase “remained low” when describing the unemployment rate and adding “the extent and timing of” when referencing future adjustments, indicating that policymakers no longer view unemployment as consistent with maximum employment and are likely to pause as new data arrives.

- The NY Fed announced the start of Reserve Management Purchases, including about 40 billion dollars in monthly T bill purchases beginning December 12, to maintain ample reserves amid expected increases in non reserve liabilities. The article notes that these operations are not QE, as they target only short maturities and are intended to stabilize reserve balances rather than ease financial conditions.

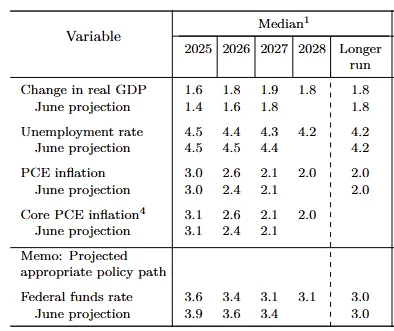

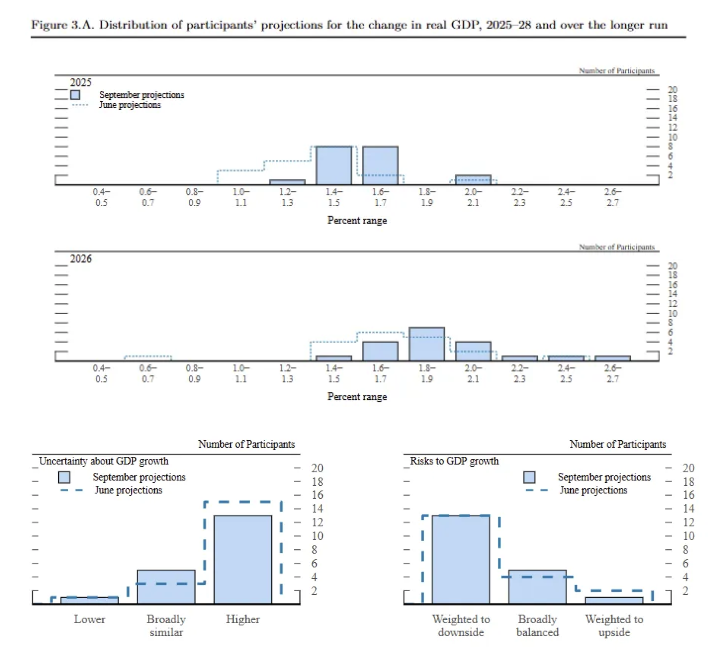

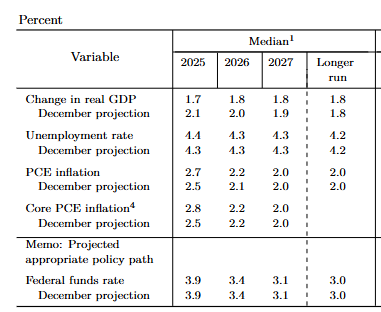

- The SEP showed upward revisions to GDP growth for 2025 and 2026, with the largest change for 2026 (+0.4 ppts to 2.3%), reflecting moderated tariff policy and expected fiscal support. Risk assessments shifted toward a more balanced view, suggesting fewer concerns about growth weakening.

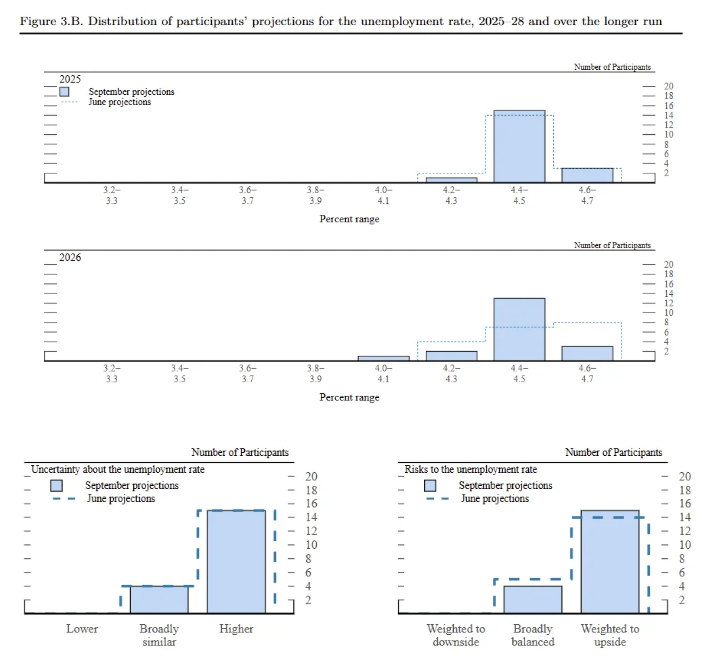

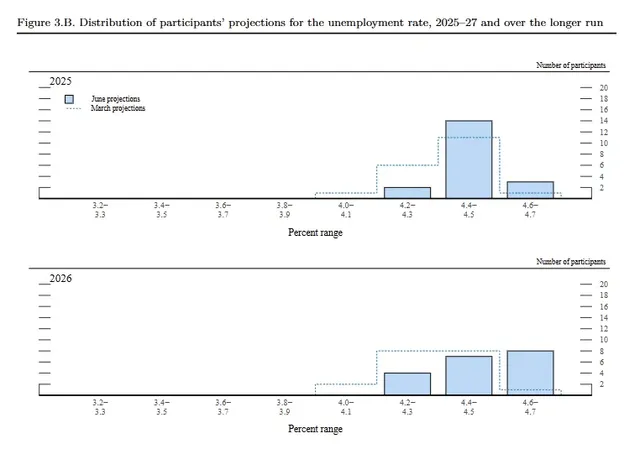

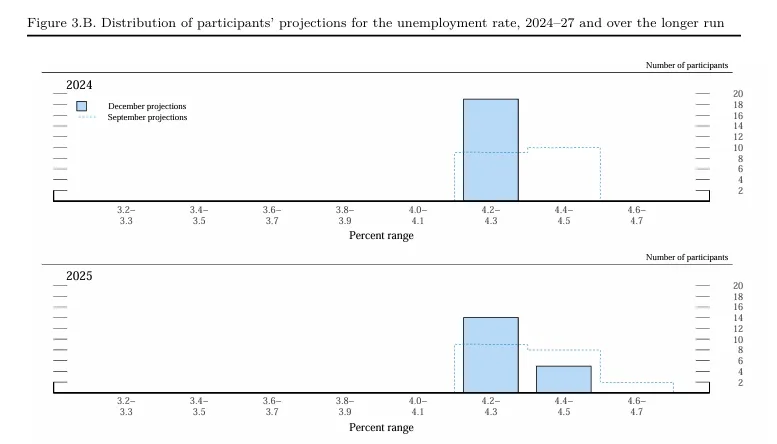

- Unemployment projections were mostly unchanged, though the distribution showed more participants expecting a higher jobless rate in 2025–2026. More than two thirds of members still saw risks to unemployment tilted to the upside, indicating lingering concern about labor market cooling.

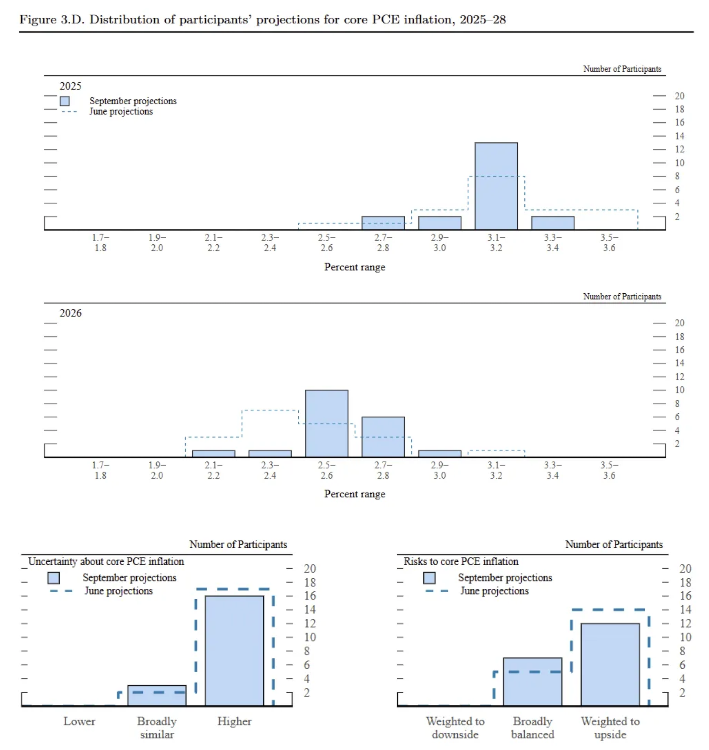

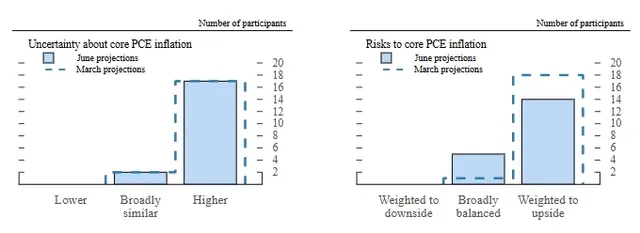

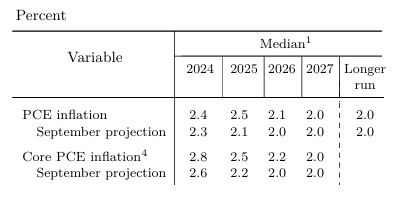

- Inflation projections for 2025–2026 were revised down -0.1 ppt for both headline and core PCE, consistent with moderation in earlier tariff effects, though officials still viewed risks as skewed to the upside. No participant who saw upside inflation risks in September changed that view in December.

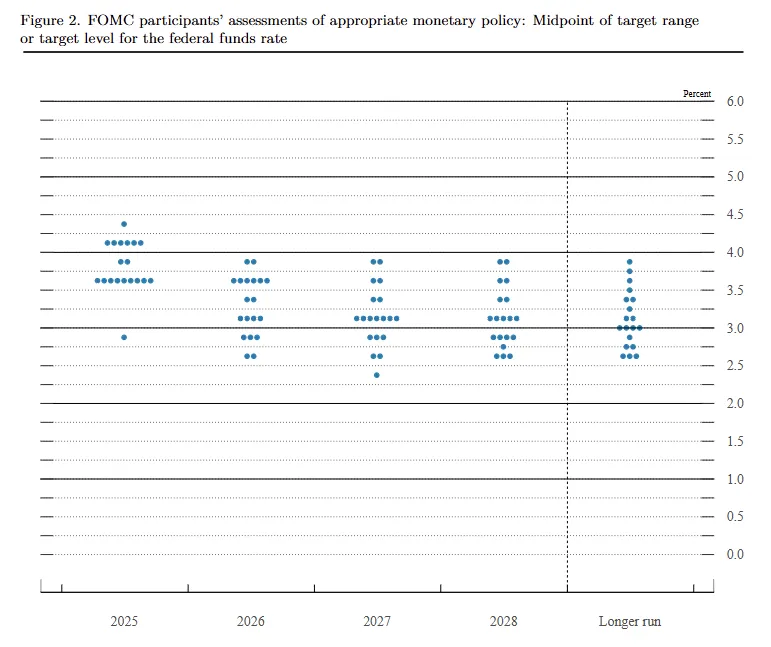

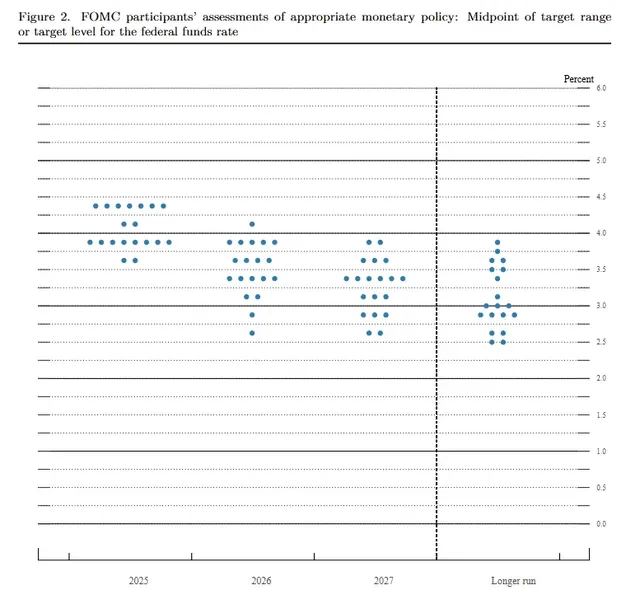

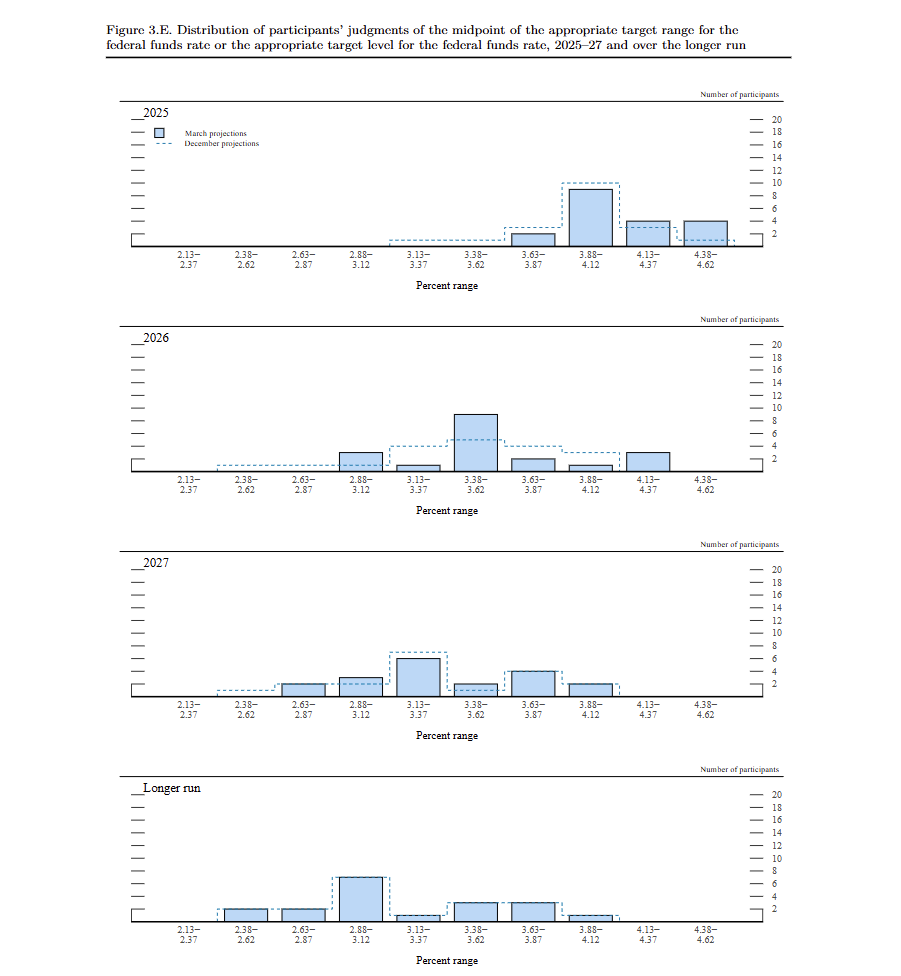

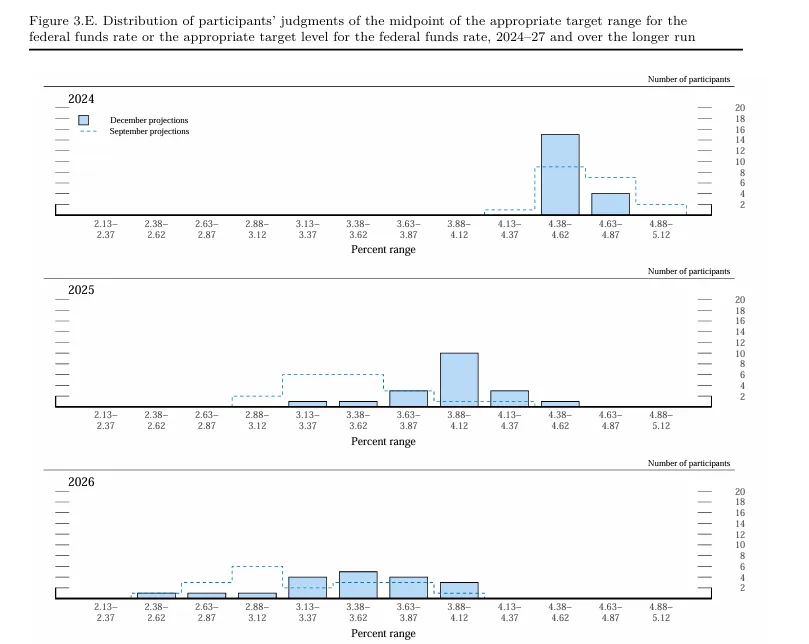

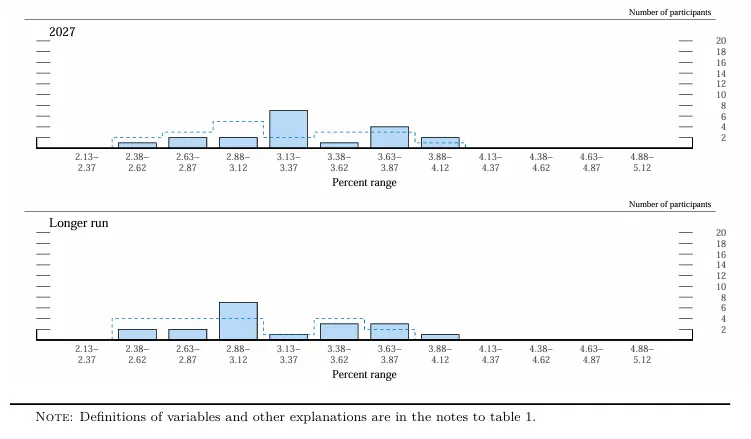

- The dot plot showed no change in the medians for 2025–2028, remaining at 3.6% in 2025, 3.4% in 2026, and 3.1% in 2027–2028, with dispersion reflecting uncertainty about future policy and potential changes in Fed leadership next year.

-

The October FOMC meeting offered little in the way of new information, yet managed to send a clear message: the Fed isn’t ready to promise more cuts. A 25 bp cut was widely expected, but Powell’s tone reminded markets that further easing is not necessarily a guarantee, especially when the Fed is dealing with a lack of data. With the labor market softening and inflation still sticky, the Committee is increasingly divided on how close policy is to neutral and how far it should go. The result was a “hawkish cut,” one that signaled flexibility rather than commitment, and left December’s decision very much in play.

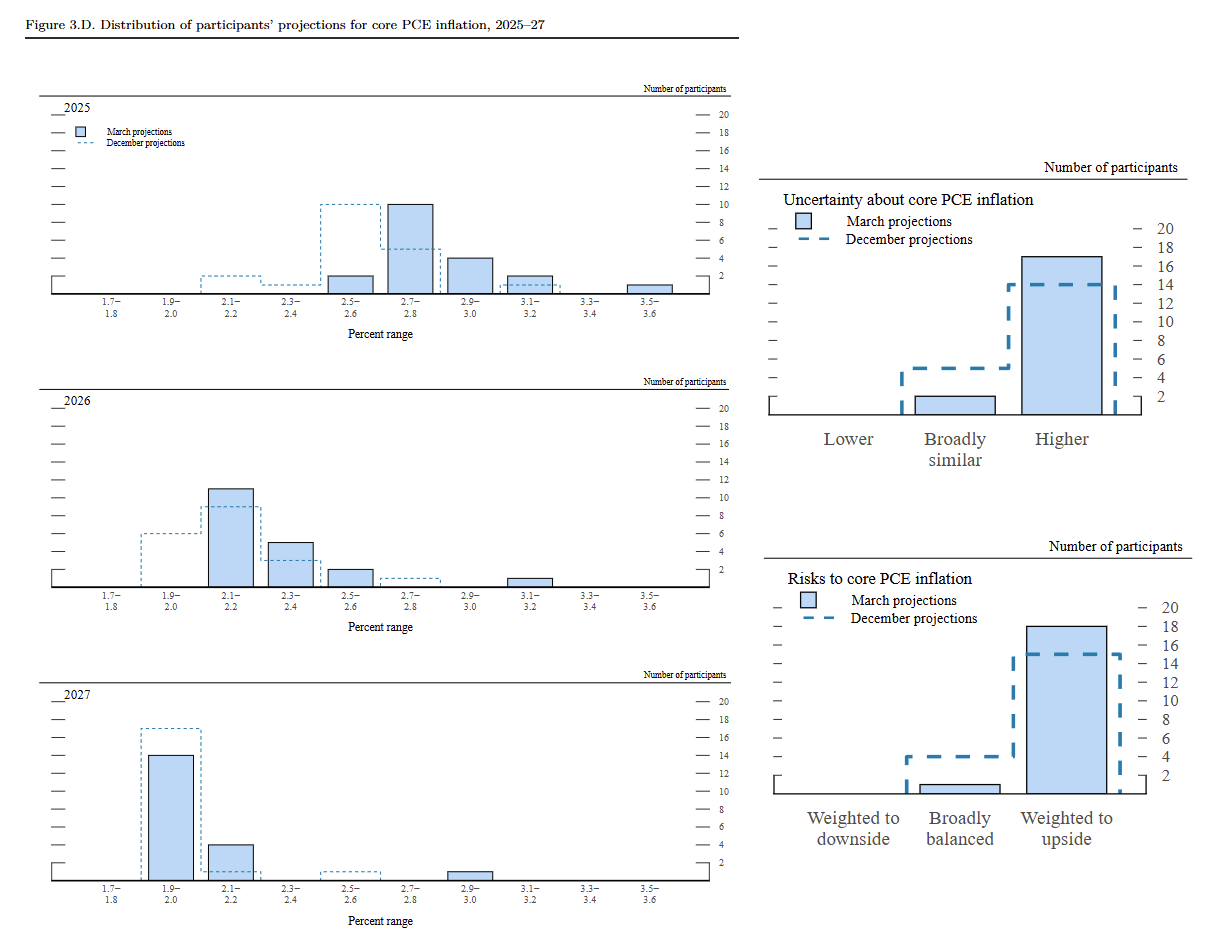

Fed Statement

The Federal Reserve decided to cut the federal funds rate by 25 bps at the conclusion of the October FOMC meeting, bringing the target range down to 3.75% to 4.00%. The last time the federal funds rate was set this low was almost three years ago, after the December 2022 meeting. While this is just the second cut so far this year, it is the fifth cut since the Fed started its cutting cycle in September 2024 that has led to a cumulative reduction in the federal funds rate of 150 bps. The decision was not unanimous and included two dissenters: the new FOMC member, Stephen Miran, preferred a 50 bps cut, and Kansas City Federal Reserve President Jeffrey Schmid voted for no change in the rate.

In addition to the decision to cut, the FOMC decided to conclude its quantitative tightening (QT) measures on December 1st. Beginning that date, the Fed will fully reinvest all principal payments from its Treasury and agency securities holdings rather than allowing them to roll off its balance sheet. Until then, the runoff caps of $5 billion for Treasuries and $35 billion for agency MBS will remain in place for October and November. The shift marks the end of the balance sheet reduction program that was first announced after the May 2022 FOMC meeting.

Here are the notable changes in the press release from September:

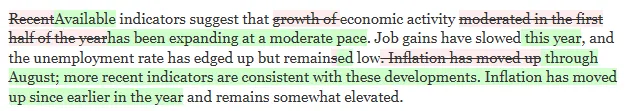

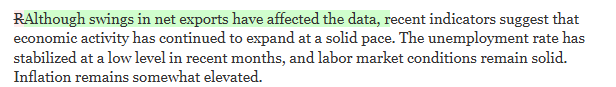

- The first paragraph saw substantial changes, but the underlying message has not really changed much. Most of the edits were to acknowledge that the Fed is dealing with a lack of data (”recent indicators” became “available indicators”, reference to “August” unemployment data since September has been delayed). In general, the Fed hasn’t changed its assessment on the economy and suggests that the available indicators are mostly consistent with the last meeting’s assessment.

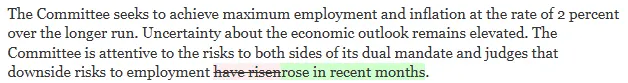

- The next paragraph only featured one change. This change does feel slightly relevant in that the Fed intends to keep current its view that there are downside risks to employment in saying that those risks remain visible “in recent months.”

- The changes in the rest of the statement just include edits to reflect the most recent decisions: a 25 bps cut to a target range of 3.75% to 4.00% and the end of QT measures.

With really no new data to look at and no change in how the Fed is looking at the economy, one can assume two things about today’s decision. First, the decision for a 25 bps cut was likely already largely determined during the September meeting. Labor market data available at that time had already shown enough weakening to justify at least one cut, and possibly two, depending on how conditions evolved. Second, today’s move can be viewed as a “risk management” cut. The balance of risks had tilted toward the labor market, with downside risks to employment outweighing the potential for renewed inflation pressures. In that context, holding rates steady risked tightening policy too much, whereas delivering a small, precautionary cut carried less downside if the economy proved more resilient than expected.

Press Conference

Opening Remarks

The opening remarks of the post-meeting press conference reflected the tone of the September meeting, likely a result of the dearth of data that has plagued the Fed during the government shutdown:

- Powell noted that “economic activity has been expanding at a moderate pace” according to “available indicators,” even going so far as to admit that economic activity was “on a somewhat firmer trajectory than expected.” This suggests that tariffs were having a smaller impact on growth than the Fed initially thought. Powell also notes that the shutdown will weigh on economic growth, but also that these effects are temporary and will reverse when the government reopens.

- On the labor market, Powell noted that the unemployment rate remains low (as of August data), and job gains have slowed, an assessment similar to his September remarks. Once again, he points out that both labor supply and labor demand have eased, leading to a “less dynamic and somewhat softer labor market.” Again, this language is not new and is similar to Powell’s tone since the weak July jobs report.

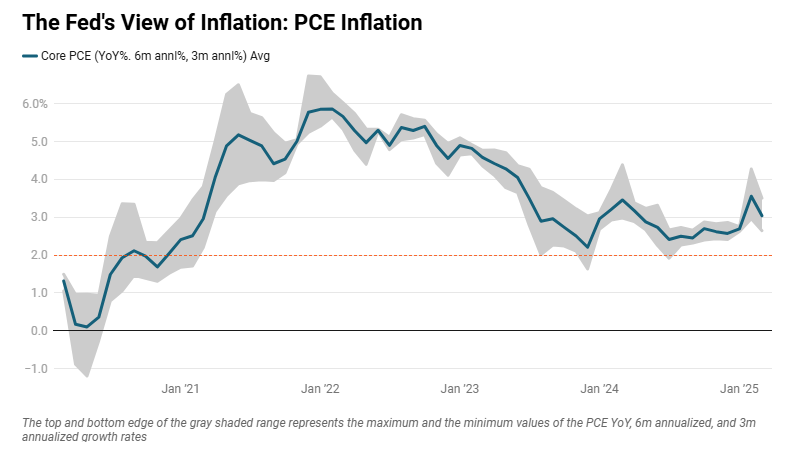

- On inflation, Powell notes that current inflation rates have fallen but remain “somewhat elevated” as goods inflation has “picked up” and services disinflation has continued. He points out that tariffs have increased prices, but it remains “a reasonable base case” that this rise will be “relatively short-lived.”

With the labor market softening and inflation still elevated, Powell highlights that the Fed continues to try and balance the risks to its dual mandate, calling it a “challenging situation.” But in recent months, since the labor market downside risks have become heavier, a reduction in the policy rate “toward a more neutral policy stance” has been warranted. But Powell was very clear to indicate that risks were coming more into balance, and he struck a much more hawkish tone, talking about the December meeting. The following statement was one that stuck out in his remarks and led to a significant response in markets:

In the Committee’s discussions at this meeting, there were strongly differing views about how to proceed in December. A further reduction in the policy rate at the December meeting is not a forgone conclusion—far from it. Policy is not on a preset course.

Powell ended his opening remarks explaining the decision to end the Fed’s quantitative tightening measures. Specifically, the condition to end balance sheet runoff where “reserves are somewhat above the level [the Fed] judge[s] consistent with ample reserve conditions” has been met.

Q&A

Here are some questions of note in the Q&A portion of the conference:

- Are you uncomfortable with how market pricing has assumed a rate cut is a foregone conclusion in the December meeting? - The first question was a heavy one, and it allowed Powell to continue to echo the hawkishness that came from the key quote that I highlighted from his opening remarks. He reasserted that a cut in December is “not a foregone conclusion,” given that there was a broad array of views being represented by all of the members of the FOMC in deliberations. Specifically, he said that “they hadn’t made a decision on December,” countering the market’s pricing in of a cut in the next meeting. A follow-up question from another reporter asks again about the December decision, to which he responds, “December is not a foregone conclusion. In fact, far from it.”

- When is “enough insurance,” and are you setting up a sequence of cuts like last year (risk management cuts)? - Powell reiterates that the balance of risks has shifted from inflation to the labor market since the post-July data revisions. Policy has been modestly to moderately restrictive and is moving toward neutral when risks are balanced. Today’s cut fits that risk-management logic, but crucially, the path ahead (”going forward”) is a separate decision.

- If the labor market stabilizes or strengthens, how would that change the rate path, especially with tariff risks? What if a shutdown limits data into December? - Powell notes that stronger labor data would matter for the path, but of course, without data, it is hard to get a full picture. But even without full federal data, the Fed will see initial claims, openings, surveys, and the Beige Book. With these data points, Powell says that “if there were a significant or material change in the economy one way or another, I think we would pick that up.” At the end of the answer, however, Powell highlights the “high level of uncertainty” the Fed is facing.

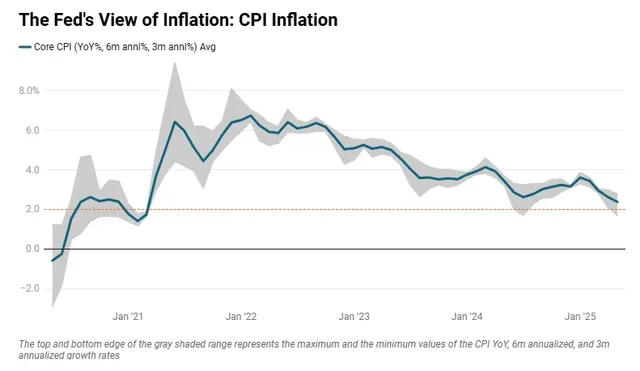

- How are officials reading the latest CPI, with core still near 3 percent, and where are the bigger policy risks? - Powell mostly repeats his notes from the opening remarks. Goods inflation is up mostly due to tariffs versus a long-run trend of mild goods deflation; housing services inflation is declining as expected; other services have moved sideways, with a sizable non-market component. He does point out that ex-tariffs, underlying inflation, “ is actually not so far from our 2% goal.”

- Is the government shutdown making it more difficult to move in December? Will it make you more cautious? - Powell: “…could it affect the December meeting, I am not saying it is going to, but yeah, you could imagine -- what do you do if you are driving in the fog? You slow down. So, that could or could not. I don't know how that will play into things.” We get more of that hawkish tone, suggesting that a December cut is not guaranteed.

- If December is not a foregone conclusion, what else besides missing data could hold you back? - Powell points out that after 150 bps of cuts, policy is near many of the FOMC members’ estimates of a neutral federal funds rate (between 3% to 4%). Some members may prefer to pause to assess labor market risks and whether growth strength is persistent, reflecting different estimates of neutral and risk tolerance.

- Are equities overvalued, and how do you balance labor support with asset prices and AI-linked job cuts? - An interesting question about the equity market leads to a typical non-answer from Powell. The Fed does not set or judge individual asset prices. It focuses on system stability, which currently looks mixed but not overly troubling. “We don't set asset prices. Markets do that.”

-

The long-awaited 2025 rate cut has finally come after six meetings. The Federal Reserve lowered its policy rate by a quarter point in September, marking the first reduction since December 2024. The decision reflects a significant shift in the Fed’s balancing act: labor market deterioration has become too evident to ignore, even as inflation remains elevated. September’s move also came alongside fresh projections and a carefully worded press conference, both of which carried a distinctly hawkish tone that underscored the Fed’s determination to guard against lingering price pressures while acknowledging softer labor conditions.

Statement

The Federal Reserve voted to reduce the target range for its federal funds rate by 25 bps to a range from 4.00% to 4.25% following the September FOMC meeting. This is the first time the rate has been cut since December 2024, and the new range is the lowest since December 2022 (right before the Fed hiked by 50 bps). The decision to cut by a quarter point was supported by all members except for one. The newly appointed Stephen Miran dissented in his first FOMC meeting, preferring to cut the federal funds rate by 50 bps to a range of 3.75% to 4.00%. The two dissenters from the July meeting, Michelle Bowman and Christopher Waller, both kept their votes for a quarter-point cut in this meeting.

The press release came with more changes than usual in September, briefly highlighting some of the shifts in the assessment of the US economy since the July meeting:

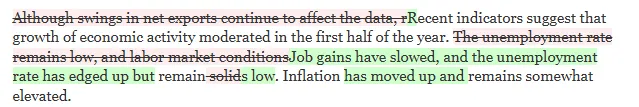

- The changes in the first paragraph are reflective of shifts in data that have occurred since the July meeting. The statement seeks to acknowledge the newfound weakness in the labor market that is evidenced by slower growth in job gains and a gradual, but significant rise in the unemployment rate. The Fed also removes its assertion that labor market conditions are “solid.” The shift away from this narrative underpins the FOMC’s decision to cut.

- In the same paragraph, it admits that inflation “has moved up” and confirms its assessment that inflation “remains somewhat elevated.” One might be surprised to find this change of wording in a Fed statement that later goes on to share the decision to cut rates, and they would usually be correct to be. There are only two ways to make sense of this: 1) the Fed is talking about inflation rising due to tariffs, which it sees as transitory, or 2) the labor market is deteriorating to such a degree that policymakers are ignoring a rise in inflation.

- The change in the second paragraph may provide an answer to that question on inflation. The statement contains a new line that communicates that the Fed now sees stronger “downside risks to employment” than they did in the last meeting. And since they did not mention a rise in the upside risks to inflation, the observed tick up in inflationary pressures is not leading to a more prolonged inflationary threat.

The changes in the statement lay out the reasoning for the rate cut today. Not only did the Fed see a significant deterioration in the labor market in the July and August jobs reports, but it sees a further rise in joblessness in the near future. More generally, the Fed is saying loud and clear that its focus has shifted away from the inflation mandate, even though inflation accelerated, towards the employment mandate.

Summary of Economic Projections

The significance of this meeting lies not only in being the first rate cut in nearly a year, but also in the release of a new set of projections in the September 2025 edition of the Summary of Economic Projections (SEP). This marked the first update since June, when policymakers presented a notably different view of the labor market. While the statement acknowledged a shift in labor market conditions, the September projections ultimately proved to be less convincing:

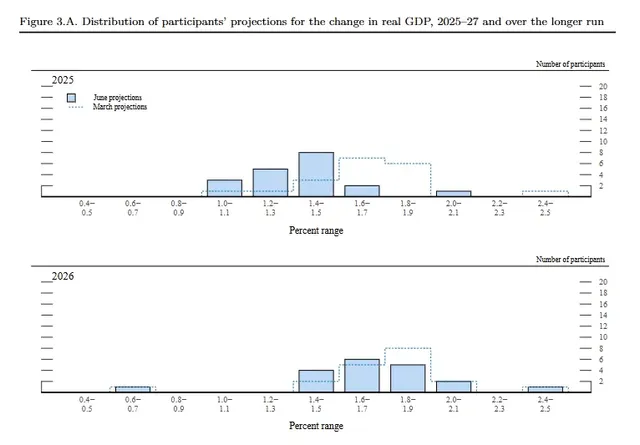

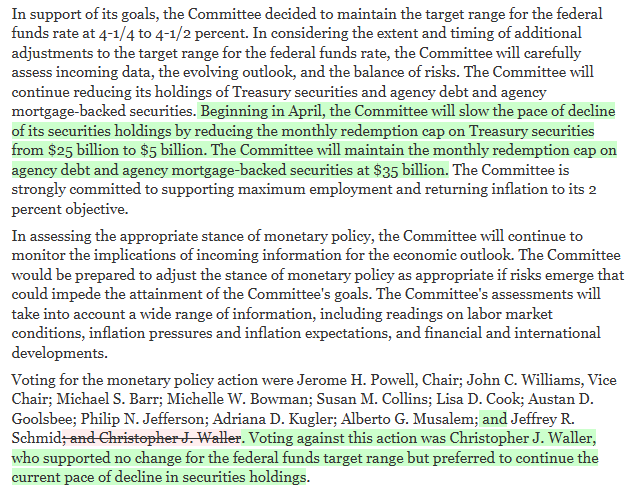

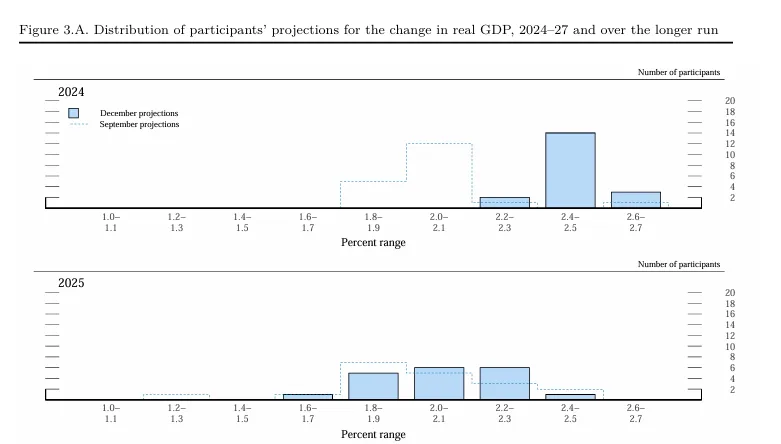

- FOMC members were broadly more optimistic about GDP growth in the September SEP compared to three months ago. The median projection of GDP growth was revised up across the next three years: up 0.2 ppts to 1.6% in 2025, up 0.2 ppts to 1.8% in 2026, and up 0.1 ppts to 1.9% in 2027. The bottom ends of the forecasts for all three years were also revised up, suggesting a broad-based assessment that the tariff worst-case scenario has been avoided. While these adjustments look optimistic, FOMC members did not shift their views on the risks to growth, as the same number of participants citing heavier downside risks in June said the same in September.

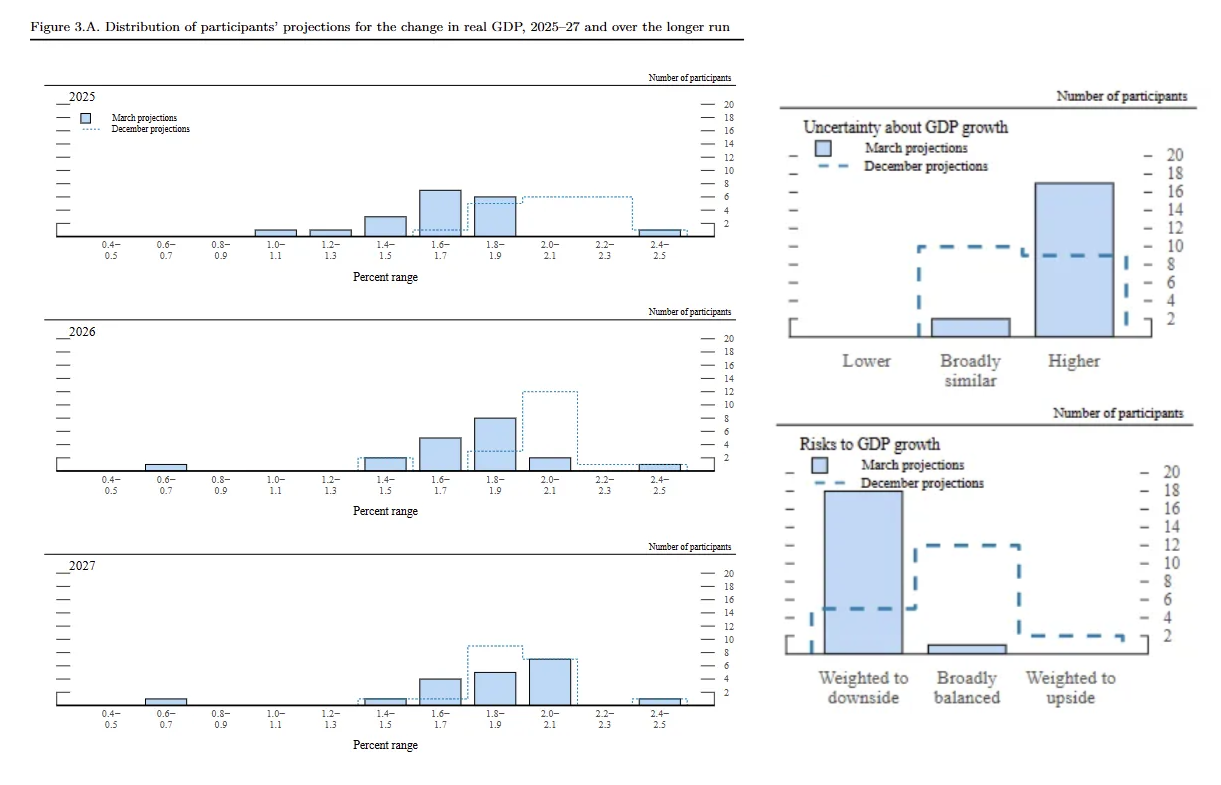

- The Fed just cut rates and pointed to weakness in the labor market as the main motivation for that cut, so one would assume that it would become more pessimistic in its unemployment rate forecast. Well, that is not the case. The September SEP revealed downward revisions to the projections of the unemployment rate in 2026 and 2027, each down -0.1 ppt to 4.4% and 4.3%, respectively, while the 2025 projection remained at 4.5%. The revisions in the next two years were caused by a tightening of the range of forecasts at both ends, driving a greater consensus in the middle. Despite projections moving lower and becoming tighter around the median, FOMC members still see risks entirely weighted to the upside, with only 4 members seeing risks “broadly balanced.”

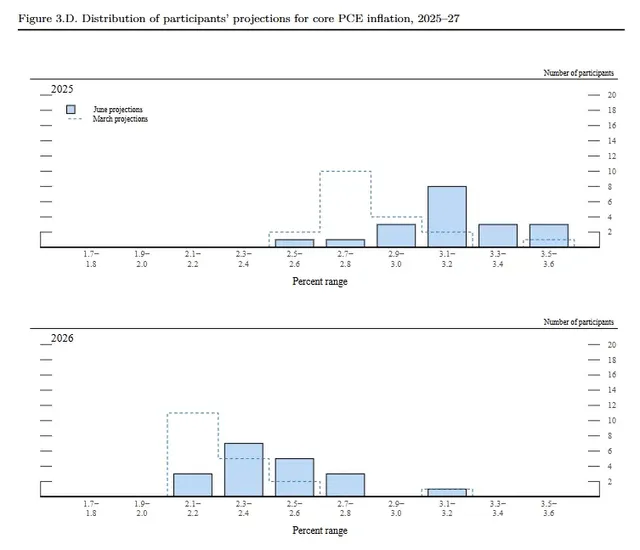

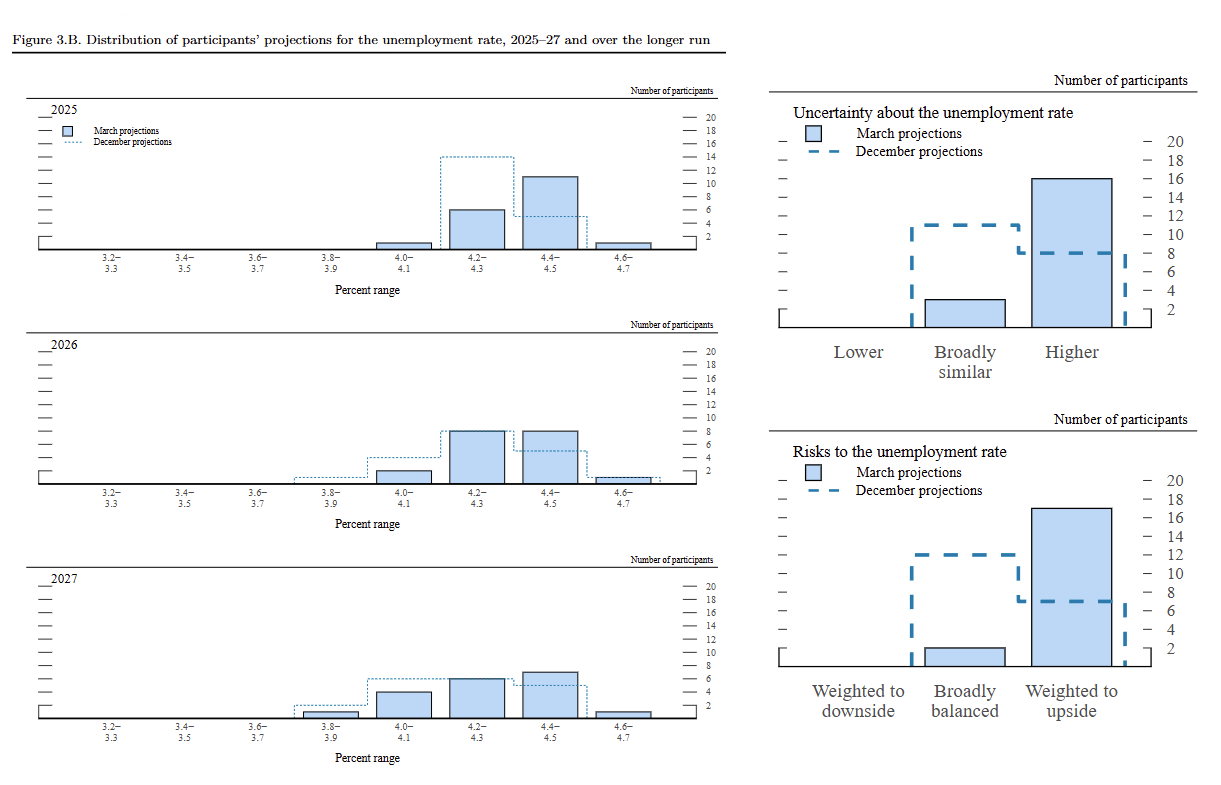

- The forecasts for PCE and core PCE inflation were the least unchanged out of all of the indicators in the SEP. Despite there being a shift in the intensity of tariff policy, the median projections of PCE and core PCE inflation in 2025 remained unchanged at 3.0% and 3.1%, respectively. The adjustments for each came in the 2026 forecast,s where both headline and core projections were revised up 0.2 ppts to 2.6%. This would suggest to me that the Fed sees the tariff inflation being less transitory than it may have thought before. In the assessment of risks, FOMC members were slightly less concerned about the upside risks to inflation than in June.

Overall, the September SEP does not seem to align neatly with the Fed’s decision to cut rates by a quarter point. The projections paint a more optimistic picture of the economy, with stronger GDP growth and a lower unemployment rate expected over the coming years, and inflation forecasts suggest policymakers now view tariff-related pressures as more persistent than previously assumed. These would be seen as hawkish shifts in the Fed’s views of the US economy. Despite the rosier projections, FOMC members placed greater weight on upside risks to unemployment and dialed back concerns about inflation, suggesting it was this shift in the balance of risks, rather than the projections themselves, that ultimately drove the rate cut.

The shift in the balance of risks clearly drove the Fed’s decision to cut rates at this meeting, but the policy rate projections tell a slightly different story. The median forecast for the federal funds rate was revised down by about 25 bps in each of the next three years, placing the midpoints at 3.625% in 2025, 3.375% in 2026, and 3.125% in 2027. These uniform adjustments appear less about a new economic outlook and more about correcting the policy stance to reflect the weaker labor market revealed earlier this year. In other words, while the immediate cut was guided by risk assessments, the longer-term policy path remains largely consistent with June’s projections, with some optimistic revisions pointing to stronger growth, lower unemployment, and slightly higher inflation.

Press Conference

Opening Statement

Powell’s opening statement for the press conference laid out the thinking behind the Federal Reserve’s decision to cut before taking questions. His assessment of the economy was actually very similar to his address at Jackson Hole in August:

- Powell noted that the “growth of economic activity has moderated” so far this year. This includes a slowdown in consumer spending and weakness in the housing sector.

- In the labor market, Powell highlights a slowdown in the demand for hiring and a decline in the labor supply, both contributing to stagnation in the labor market. He describes this “less dynamic” labor market as “unusual,” reflecting language used in his Jackson Hole speech. Powell suggests that this stagnation has caused the “downside risks to employment to have risen.”

- While inflation has come down from its 2022 peaks, Powell continues to describe inflation as “somewhat elevated” relative to the Fed’s target. He specifically points to a pick-up in goods inflation as the reason for higher inflation readings earlier this year. It seems that for now, the Fed’s base case is that the effects of tariffs on inflation “will be relatively short-lived, a one-time shift in the price level.” However, Powell notes that there is still uncertainty surrounding the effects of tariffs and asserts that it is the Fed’s “obligation” to ensure that tariff inflation does not become entrenched.

He ended his opening statement discussing the September SEP and policy outlook. Powell noted that the Fed’s median projection for the federal funds rate was lowered by 25 bps across the forecast horizon, to 3.6% in 2025, 3.4% in 2026, and 3.1% in 2027. He stressed that this path is “not a preset course,” but rather reflects individual participants’ views under their most likely scenarios. The decision to cut rates now, he explained, stemmed from a shift in the balance of risks, with “downside risks to employment” rising and concerns over inflation pressures easing. Powell framed the move as another step toward a more neutral stance, leaving the Fed “well positioned to respond in a timely way to potential economic developments.”

Despite the quarter-point cut, Powell’s opening struck a distinctly hawkish tone. His language echoed closely from Jackson Hole, suggesting the decision to ease was already taking shape after the weak July jobs revisions, with the soft August payrolls simply reinforcing it. That context matters because Powell framed the move less as the start of an easing cycle and more as risk management, aimed at recalibrating policy closer to neutral. At the same time, he underscored that inflation remains “somewhat elevated,” highlighted upside risks to prices from tariffs, and stressed the Fed’s “obligation” to prevent temporary shocks from becoming entrenched. By pairing the modest cut, sparked by a newfound softness in the labor market, with firm inflation vigilance and continued balance-sheet runoff, Powell is keeping doves who are calling for consecutive rate cuts at bay.

Q&A

Here are some questions of note in the Q&A portion of the conference:

- Are tariffs slowing the labor market more than showing up in inflation? - Powell: “It’s certainly possible.” Goods prices are contributing “most of the increase in inflation” this year, effects are “not very large” yet but may “continue to build.” On jobs, he pointed to lower immigration and participation and softer demand: a “curious balance” where both supply and demand fell, with demand falling more as unemployment rises. At the very least, it seems the impact of inflation has been less than what the Fed expected.

- Do economic conditions and the balance of risks no longer warrant a “restrict” policy setting? - Powell: “I don't think we can say this.” Earlier this year, policy was clearly restrictive with a strong labor market. He suggests revised payrolls mean “I can no longer say" that the labor market is strong. Risks were tilted towards inflation and have moved “meaningfully toward greater equality.” Despite that balance, Powell notes that the Fed should be “moving in the direction of neutral” but not necessarily that monetary policy should not be restrictive. This is the tone of a hawkish cut.

- Is AI dampening labor demand already? And what policy implications does this have? - Powell says that effects are possible but “not the main thing” driving labor market dynamics and its “hard to say how big it is.” He points out that this trend may be more visible for new grads. In general, multiple forces are slowing job creation.

- What evidence shows tariffs in inflation?- Powell points to how goods inflation moved from negative last year to ~1.2% YoY this year. He estimates that tariffs may be contributing “0.3–0.4 ppts” to 2.9% inflation. Notably, Powell admits that consumer pass-through is “slower and smaller than we thought,” but “there’s some pass-through.”

- Why a strong consensus for a cut, yet scattered dots about the path? - Powell says that there was broad recognition that labor-market risks have risen from “downside risks” to a “reality.” Nearly everyone supported this cut (except for Mian), but views differ on what’s next given unusually challenging trade-offs. This gives me confidence on my thought that the cut today was an admission that they should’ve cut once in Q2, but employment data was unclear.

- Is there tension between strong Q3 activity and downside labor risks? - This question seems to try to get Powell to address the divergence between the optimism, the outlook, and the cut today. Powell first claims that there’s not really tension in these things, citing AI and business investment as driving activity. He clarifies that today’s decision to cut was focused on labor-market risks rather than big changes in inflation or labor projections.

- The Q&A session featured several questions about Federal Reserve independence in various forms (referencing Miran’s addition to the FOMC, Bessent’s suggestion of “mission creep” and a review). Powell remained diplomatic in these instances and declined to explicitly comment as he always has, and he consistently reasserted that the Fed would be “strongly committed to maintaining its independence.”

-

The Federal Reserve opted to hold interest rates steady at the July FOMC meeting, extending the current pause streak to five meetings as policymakers continue to wrestle with an uncertain inflation outlook. While the decision itself was widely expected, the appearance of two dissents in favor of a cut, something not seen since 1993, added a dose of political intrigue and signaled growing pressure on the Fed to act. Still, Powell and the majority held firm, citing resilient labor market data, stickier inflation, and rising goods prices linked to tariffs as reasons to stay on hold. The message from the Fed remains one of cautious patience: data will guide the next move, not speculation.

Decision

At the conclusion of the July 2025 FOMC meeting, the members voted to keep the target rate of the Federal Funds rate at 4.25% to 4.50%. The move was largely expected as there has not been a major shifts in the attitudes of the voting FOMC members (even though there has been a lot of pressure from the White House). We continue to wait for the first rate cut of 2025 after the 100 bps of easing that ended the previous year. Since the Fed’s policy stance did not move much, its press release was more or less unchanged.

The biggest news in the mostly benign Fed decision is the fact that two FOMC voters dissented in today’s vote. This has not happened since 1993. Voting against a pause, in favor of a 25 bps cut, were FOMC members Christopher Waller and Michelle Bowman. Their dissents are not too surprising since both came out after the June meeting to voice their support for a rate cut as soon as July (this week’s) meeting. It has been suggested that these two members are increasingly trying to align with the Trump administration’s desires to cut interest rates to potentially become candidates for the position as Chair of the FOMC if it becomes vacant in the near future. Their dissents would certainly be looked favorably upon by the President.

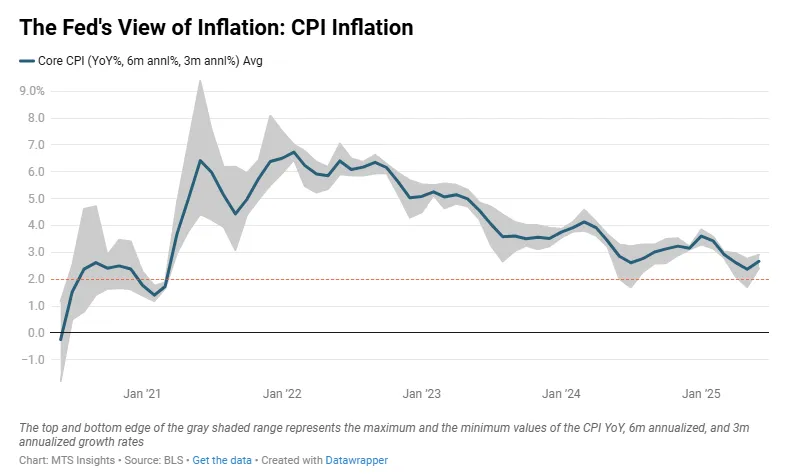

The bottom line is that the Fed still lacks clarity on inflation, which has kept it from cutting interest rates for the past three meetings. From January to May, core inflation had been easing in a clear short-term disinflationary trend, with the three-month annualized change in core CPI falling to 1.7% in May, the lowest since July 2024, just ahead of the Fed’s 50 bps cut in September. But the June data marked a reversal, reinforcing the Fed’s wait-and-see approach. Notably, goods inflation picked up, with some attributing it to the early effects of tariffs feeding through to consumer prices. That shift largely undercut any dovish interpretations of lagging price data and keeps the Fed squarely focused on the tariff-driven inflation outlook.

Since the June meeting, the trade outlook remains murky. The August 1st deadline for implementing additional tariffs has not been delayed, raising questions about whether the Fed can (or should) assume further postponements from the administration. While few new deals have been finalized, the ones that have suggest a baseline 15% tariff level under Trump’s current approach. That may give the Fed some footing for forecasting, but the broader uncertainty around timing, coverage, and enforcement still limits visibility and complicates the inflation outlook.

Press Conference

Opening Statement

Powell’s opening statement in the post-meeting press conference was also pretty similar to the thoughts given in the last three press conferences:

- “Economic activity has moderated” - Second quarter GDP growth was released earlier today, giving the FOMC a quick look at the most recent reading of economic growth. The headline growth rate of 3.0% was impacted by a sharp decline in imports and inventories, continuing the trend from Q1. Excluding these components, GDP was up just at an 1.1% SAAR in Q2, slowing from 1.5% in Q1. Powell specifically points out that, “GDP rose at a 1.2% pace in the first half of this year, down from 2.5% last year,” looking at the average of Q1 and Q2. Weakening GDP growth is worth noting, but it ultimately doesn’t directly factor into the Fed’s decision making.

- “In the labor market, conditions have remained solid” - Powell continues to highlight that the labor market is not flashing any warnings signs as he has in the last three meetings. He specifically notes that conditions are “consistent with maximum employment.” Notably, the unemployment rate hovers around 4.1%, and job creation is still averaging just above 100,000. A trend of rising jobless claims has, in recent weeks, given way to lower claims numbers recently. Overall, there is not much data out there that suggests the Fed should be worried about the employment mandate.

- “Inflation has eased… but remains somewhat elevated relative to our 2% longer run goal” - Powell notes that inflation is elevated compared to the Fed’s goal, keeping it as the main focus for policymakers. He points out that while services inflation has eased, “increased tariffs are pushing up prices in some categories of goods.” This likely refers to this month’s June CPI update. Powell also makes a quick note of a rise in short-term inflation expectations which is attributed to tariff news.

- “We see our current policy stance as appropriate to guard against inflation risks” - Powell roots the Fed’s patient approach to rates in its desire to dampen the upside risk in inflation. With tariffs beginning to feed into goods prices and near-term inflation expectations drifting higher, the Fed is focused on preventing what Powell called a one-time price increase from evolving into a more persistent inflation problem. He stressed the importance of keeping long-term expectations anchored and made clear that the Committee remains data-dependent as it gauges whether recent price pressures are transitory or something more entrenched.

Q&A

Here are some interesting questions and responses in the question and answer portion of the press conference:

- Is a September rate cut expectation unrealistic at this point? - Given current data, Powell says that the FOMC does not think that “restrictive policy is holding it back inappropriately and modestly restrictive policy seems appropriate.” In a follow up question, Powell does say that the data coming between now and September could cause that position to change.

- You removed that “uncertainty has diminished” in this months statement. Has uncertainty increased? - Overall, it seems that uncertainty has not changed much since the last meeting. Powell: **“**At the time of the last meeting, uncertainty had been moved down a little bit but it was more or less even this time so we took out had diminished because it didn't diminished further so not much in that.”

- When asked about the two dissenters, Powell did not speak on specifics. Instead, he highlighted that the two who disagreed had “clear explanations of their thinking” and that overall, “it was a good meeting around the table.” Not much to say about any potential fractures in the FOMC.

- On the policy being ‘modestly restrictive,’ does that mean there’s not much scope to reduce rates…? - Interestingly, in his answer to this question Powell noted that his own estimate is that rates are “modestly restrictive” and there are a range of views on rates from “neutral” to “more restrictive (than modestly restrictive).” This suggests no FOMC members see rates as “accommodative” at the current level.

- What have you learned about the tariffs passing though into prices and causing inflation? - Powell first says that the current data is “quite early days” but suggests that the evidence points to “companies or retailers… institutions that are upstream from the consumer are paying most of this for now.” However, the Fed expects to see more of what the June data showed, tariffs pushing through to consumer prices. Powell also said that survey data suggests firms plan on increasing prices. He finishes by saying the process “will probably be slower than expected at the beginning,” likely because firms built inventories ahead of tariffs.

- Do you have concerns about rates impacting interest rate charges? - This is related to Trump’s calls for rate cuts so that his administration can refinance the debt at lower rates. Powell: “We don't consider the fiscal needs of the federal government… It's just not something we take into consideration.”

- What kind of data does the Fed need to see before you’re ready to cut? - Powell, in my opinion, gives an interesting answer. He does not suggest that the Fed needs to see lower inflation data or weaker labor market data, explicitly. Instead, he says that if “the risks to the two goals were moving into balance” that this would imply policy should move to a more neutral stance. Because most FOMC members see rates as at least “modestly restrictive,” policymakers just need to be reassured that upside inflation risks have diminished before cutting. They don’t necessarily need to see inflation data move down.

-

The Federal Reserve left its target range for the federal funds rate unchanged at 4.25% to 4.50% for the fourth meeting in a row. The non-event was largely expected, as futures markets more or less had priced in the move for the last two to three weeks. However, the Fed’s “wait and see” position in the face of cooling inflation data made this pause look hawkish, and the market responded in kind.

Fed Statement

The Federal Reserve’s press release following the June meeting was left mostly the same as the last meeting in May. Only two minor changes were made:

- In the first paragraph, the description of the unemployment rate was simplified, and the underlying meaning remains the same. The Fed still assesses the labor market as strong, and the recent readings of the unemployment rate are low.

- In the second paragraph, the statement is adjusted to reflect an easing in the Fed’s uncertainty about the economic outlook. The FOMC is likely referring to some new clarity on trade policy, which has become less chaotic in the last two months with trade deals and pauses becoming the focus, and the worst of the China-US trade relationship likely behind us.

Overall, the official statement still communicates a “wait and see” position while policymakers attempt to look through uncertainty. This position is accompanied by the general assessment that the economy is in solid standing, even though Q1 GDP growth came in negative.

Summary of Economic Projections

The conclusion of the June FOMC meeting comes with an update of the central bank’s economic projections that were last updated in March. Since then, we have had the “Liberation Day” tariff announcement and the aftermath, including the attempts to make trade deals with China and the UK. The Fed should have been able to produce projections with more confidence than three months ago. Here are the details of the projections:

- FOMC members have become more bearish on growth in the next two years, with the median projection of GDP growth in 2025 moving down -0.3 ppts to 1.4% and in 2026 moving down -0.2 ppts to 1.6%. The range of forecasted 2025 values fell from 1.4 ppts in March to 1.0 ppts in June. The general message is that the Fed has become more confident that growth will slow down and expects a stronger slowdown over the next two years than three months ago.

- The projections for the unemployment rate look similar to the GDP projections. Across all three years, the median projections in June increased compared to the March projections, with the forecast holding at 4.5% in both 2025 and 2026. The range of values for those two years also shrank, sending the same message that FOMC members are more confident that the labor market will loosen and expect more loosening in labor markets over the next two years than three months ago.

- The most surprising shift in the projections came in the PCE and core PCE forecast. FOMC members upgraded their forecasted values significantly for the next two years, with the median core PCE projection rising to 3.1% in 2025 and 2.8% in 2026, both upward revisions of 0.3 ppts. Unlike the GDP and unemployment rate ranges, the range of values for expected inflation remains about as wide in June as it was in March. But when looking at the spread of values in the center (excluding the three largest and three smallest), the range actually got wider. These changes suggest to me that the inflation outlook is still being clouded by uncertainty, but the Fed does still want to insist that it sees tariffs as inflationary.

- One more interesting thing to note on the inflation outlook is a shift in the risk assessment that didn’t align with the revisions to the projections. The right bar chart shows that 4 FOMC members shifted their view of risks to the inflation outlook from “weighted to upside” to “broadly balanced.” This detail is further evidence that there is a growing split in the inflation assessment that should be watched closely.

Overall, the economic projections pointed to weaker growth, a weaker labor market, but higher prices, a dynamic situation that suggests the Fed will have to find a delicate balance between its employment and inflation mandates. The balance in the forecast shift has caused the median projection for the federal funds rate target level to be unchanged for 2025 and shifted up slightly for 2026, from 3.375% to 3.625%. However, that balance comes as a result of an even split among policymakers. For 2025, there are nine FOMC participants who see 0-1 quarter-point cuts, and there are ten FOMC participants who see 2-3 quarter-point cuts. These dynamics make it hard to decipher any kind of policy rate path, and, in the end, maintain a similar level of uncertainty than was seen in the March projections.

In my opinion, these projections lean hawkish since they appear to disregard the progress in inflation that we have seen in the last few months despite tariffs. Near-term inflationary pressures have renewed the disinflationary trend that was lost in the first quarter (a main reason why the Fed turned more hawkish), and that doesn’t seem to have resonated with the Fed, or at least (roughly) half of the Fed that sees no rate cuts this year and core PCE inflation jumping back above 3%.

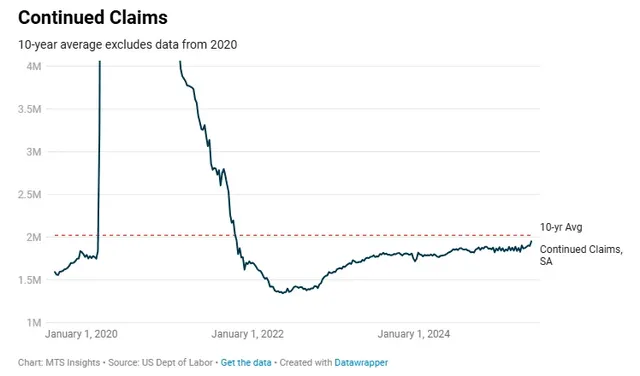

In terms of the outlook, I believe the Fed feels too secure about the labor market and economic activity as sources of strength in the demand side of pricing pressures. Just look at recent retail sales data (-0.9% MoM in May, below expectations) and rising continued claims data (highest since November 2021), and the cracks are showing. For these reasons, I see the June round of projections as more hawkish than expected, which should put upward pressure on short-term interest rates.

Fed Chair Powell Press Conference

In the post-meeting press conference, Chair Powell’s opening statement sought to reinforce the Fed’s “wait and see” position. The two main points underpinning the patience on policy changes were ones that we have heard before:

- Powell reasserts that the labor market remains solid and does not require any extra attention at this point, saying, “Overall, a wide set of indicators suggests that conditions in the labor market are broadly in balance and consistent with maximum employment.” This employment assessment has been the same in each 2025 meeting so far and is a key assumption in the “wait and see” position.

- Inflation has come down as seen in recent data, but Powell redirects from that to point out that tariffs complicate the future path of inflation. Because tariff effects are uncertain and perceived to be weighted to the upside (“Increases in tariffs this year are likely to push up prices… the effects could be short-lived or more persistent”), the motivation for a cut is dismissed.

At the end of the opening statement, we get a quote we’ve heard before, summing it all up.

“We are well-positioned to wait to learn more about the likely course of the economy before considering any adjustments.”

Powell was challenged on this position in the question-and-answer portion of the press conference. Multiple reporters pressed him on why the Fed chose not to cut rates in June despite cooling inflation, signs of economic softness, and consumer strain. Powell emphasized that while inflation has improved, the full impact of recently imposed tariffs remains unclear and is expected to show up over the coming months.

“Without tariffs, that confidence [in falling inflation] would be building… but we have to learn more.”

He reiterated that monetary policy must be forward-looking and cautioned against premature easing, noting that the Fed needs more data to understand whether the tariff-driven price increases will be temporary or more persistent. Despite acknowledging that inflation could remain contained, Powell reiterated that the Fed is “well-positioned to wait and learn,” underscoring the high degree of uncertainty and the need to avoid misreading a potentially transitory inflation bump as something more entrenched.

-

The Federal Reserve kept rates unchanged for the third consecutive meeting today as it continues to avoid rate cuts and assess the developing economic impacts of the newly implemented and threatened tariffs. The key difference between this month’s meeting and the March meeting is several new data points to contend with, including a negative Q1 GDP print.

Statement

The Federal Reserve kept the target rate of the Fed Funds rate unchanged at 4.25% to 4.50% in the announcement today. This is the third straight pause since the last rate cut in December. The FOMC also made no changes to its quantitative tightening (QT) measures, which were updated in the previous announcement in mid-March. The actions were agreed upon unanimously, which is a slight difference from the last meeting when FOMC Governor Christopher Waller voted against easing up on QT.

Aside from these differences, there were no major changes to the statement, just minor changes that provided some nuance to the typical assessments in the press release.

- The change at the beginning of the release is an attempt to address the negative Q1 2025 GDP growth print, which was heavily impacted by trade dynamics. The FOMC members want to make it clear that it is looking through the recent surge in imports to other indicators that showed the economy was still growing like the real final sales to private domestic purchasers aggregate (sum of consumer spending and gross private fixed investment) which grew at a SAAR of 3.0%, slightly above the Q4 2024 2.9% gain. Powell actually points to this data point in his opening remarks of the press conference.

- The minor adjustments made to the second paragraph highlight the increasingly uncertain outlook that consumers and businesses are facing due to Trump’s new trade policy. It seems that now the FOMC members are making it clear that they see upside risks to unemployment and inflation, which were first communicated in the March SEP materials.

Overall, the statement was largely in line with prior communications, but it carried a more cautious tone reflecting the FOMC's growing awareness of a softening outlook. While hard data, such as labor market conditions and economic activity, continue to appear "solid," the Fed acknowledged more uncertainty stemming from soft indicators like consumer sentiment and regional Fed surveys. These subtle shifts suggest the Committee is more attuned to downside risks, even as headline figures remain resilient. At the same time, the Fed’s outlook for inflation has also firmed up as it sees tariffs forcing companies to increase selling prices.

Press Conference

The FOMC press conference continued with the theme of a weaker economic outlook and unique upside inflation risks from tariffs. Powell acknowledged downside risks have risen, especially from trade policy, but emphasized they have not yet materialized in official data. He pointed out particularly that soft data continued to deteriorate while hard data had remained solid. Overall, the outlook is still uncertain, and the FOMC could not make assumptions about the timing and magnitude of the effects of tariffs on the outlook.

Regarding inflation, the Fed still sees inflation as above target, but Powell noted that it had eased significantly since mid-2022. While inflation has fallen, short-term inflation expectations have started to rise in response to tariff policy changes, but the FOMC still sees long-term inflation expectations as anchored. The Fed has not determined whether it sees tariffs as a temporary driver of pricing or if it will become a more persistent problem. Despite early inflation signals, FOMC members have opted to keep policy as it is until more is known about how trade policy plays out.

While Powell made sure to highlight the uncertainty in the inflation outlook, one quote during the Q&A session sticks out: “the underlying inflation picture is good.” In my view, the Fed’s focus is a bit more on the growth and unemployment side of the mandate as opposed to the inflation side. Yes, tariffs are likely to be a supply shock that drives prices higher, but the deflationary pressures from a much softer consumer are a bit overlooked. I believe that firms will struggle to successfully pass through most of the tariff costs and that the Fed is tuned into this downside risk.

On the policy outlook, Powell made clear that the Committee is not currently committing to rate cuts and is comfortable maintaining the current stance for now. While the March Summary of Economic Projections included two cuts penciled in for 2025, Powell acknowledged that recent developments, particularly around trade policy, have introduced enough uncertainty to potentially change that path. Indeed, the Fed continues to be caught out by Trump’s policy announcements:

He emphasized that the Fed's policy rate is “moderately restrictive” and well-positioned to respond flexibly as more data comes in. Any shift in policy, whether a cut or an extended hold, will be determined by how the balance of risks evolves, and not made in anticipation of future developments. Indeed, Powell stuck with his favorite phrasing of this dynamic throughout the Q&A session: “We don’t have to be in a hurry [to cut].” Funnily enough, this is one of Trump’s main criticisms, calling him “Mr. Too Late” in a Truth Social post a few weeks ago.

On the topic of President Trump and the new administration, Powell was asked about the escalation in political pressure and criticism in the last few months. Once again, the Fed Chairman reaffirmed that Fed decisions are not influenced by political pressure. In fact, his position seemed firmer than ever. In response to a question about whether Powell had “asked for a meeting” with President Trump, he responded bluntly:

If Chair Powell did anything in the press conference, he reassured the markets that as long as he is leading the Fed, there will be no political interjections into monetary policy.

-

In the second meeting of 2025, the Federal Reserve kept the target range of the Fed Funds rate at 4.25% to 4.50% meeting expectations that the US monetary authority would remain in a wait and see mode. While rate policy was unchanged, the Fed did decide to make some adjustments to its quantitative tightening (QT) policies in order to ease financial conditions in a particularly volatile period for financial markets.

Statement

In its main statement, the Federal Reserve indicated its intention keep rates the same as it tries to look through the new rise in uncertainty that has come in the Trump administration’s first two months in power. There were not many changes to the press release’s assessment of the economic situation. The Fed still sees economic activity expanding at a “solid pace” and “solid” labor market conditions while inflation is described as “somewhat elevated.”

The first change came in the second paragraph as the FOMC decided to communicate its sense that uncertainty was clouding the outlook. It removed the sentence “The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance,” and updated the next sentence to point out that “uncertainty around the economic outlook has increased.” Essentially, if the Fed had any kind of clarity on the inflation and employment situation in January, it no longer has that due to the seismic shifts in government policy.

This frames the March pause in a very different way than the January pause. The January pause was a break from cuts to let inflation data confirm a downtrend. The pause today is done out of a necessity to reassess the economic outlook in the face of the new reality of widespread tariffs and the potential for a large decline in government spending. Going into the new year, it felt like the Fed was only looking to move rates in one direction in 2025, but now it seems like all directions are in play.

The second and third changes in the statement are related to the shift in quantitative tightening that had been suggested by some analysts as a possible policy adjustment in the face of financial market turbulence. Indeed, the FOMC opted to reduce the pace of quantitative tightening by reducing the drawdown of Treasury securities on its balance sheet from $25 billion a month to just $5 billion a month. The final change relates to Governor Waller voting against this new pace of balance sheet run off but not voting against the pause on rates. A reduction in quantitative tightening should allow for some easing in financial conditions to improve liquidity during volatility.

Summary of Economic Projections

This FOMC meeting was accompanied by an update in its Summary of Economic Projections (SEP) which was last adjusted in its December FOMC meeting that preceded the inauguration of President Trump. Thus, this first attempt by members to try and digest how the economy changes under new leadership.

- The projections with the most changes were in GDP growth over the next three years. The median projection was revised down in each of those three years with the largest downward revision being the -0.4 ppts downgrade to 2.1% for 2025. The change in the 2025 median came from 12 members abandoning their projections of 2% or higher growth this year with just one member at 2.4% to 2.5%. The downgrade was accompanied by a major shift upward in uncertainty and risk assessment that is now heavily weighted to the downside.

- FOMC members appear to be confident that the labor market will remain strong as it mostly confirms its forecasts for the unemployment rate. The only change was a minor upward revision of 0.1 ppts in the median projection of the 2025 unemployment rate. However, FOMC members agreed broadly that the risks to unemployment were weighted to the upside and shrouded in uncertainty.

- The updated inflation projections likely do include some thoughts on how tariffs will flow through to prices as that is one of the early Trump policies that has been put in place. FOMC members project a pick up in inflation this year with the median PCE inflation forecast up 0.2 ppts to 2.7% and the median core PCE inflation forecast up 0.3 ppts in 2025. This suggests that the initial assessment of the impact of tariffs on inflation is that the increase could be transitory or that weaker growth could offset the potential for higher inflation. Like other projections, there was an increase in uncertainty and a strong weight placed on upside risks.

- Through it all, the median projections for the Fed Funds rate were kept the same from December to March. The 2025 distribution was basically unchanged with most FOMC members looking for 1-2 cuts this year. The 2026 distribution shifted a lot with some members moving towards the extremes while most landed on the target range of 3.25% to 3.50% which would be about 100 bps of cuts in two years. With the inflation forecast revised up and the general consensus being that tariffs will be inflationary, an unchanged policy path projection looks dovish.

Press Conference

In the post-FOMC meeting press conference, Chair Powell remained set on communicating that the Fed is in a wait-and-see mode as it wants to gain clarity on the economic outlook. He was not shy in pointing out that trade policy had been a major source of uncertainty. Powell made several references to “separating the signal from the noise” in distilling the impacts of new policies.

Additionally, he wanted to make the case that the Fed did not have to be in a hurry to change policy and that the economy was in a good state and could handle the current level of interest rates. The quote that sticks out was near the end of Powell’s opening remarks: “We do not need to be to be in a hurry to adjust our policy rates and we are in great position to wait for clarity.”

In the question and answer session, Powell was pressed on his and other members’ assessment of how tariffs had been factored into the economic outlook, especially the inflation outlook. He was questioned on the shift in core PCE inflation projections (2025 up, no change in 2026 and 2027 forecasts) meant that the Fed sees tariffs as a “transitory” inflationary pressure. His answer was the following

“I think that's the base case. But as I said we really can't know that. We are going to have to see how things actually work out. And the fact that there wasn't much change, I think that's partly because you see weaker growth but higher inflation.”

So it does seem like the Fed wants to look through the tariff inflation impulse as a temporary force. or at the very least, it sees the drag on growth offsetting the upward pressure on prices. Again, uncertainty is high, so it is hard to distill meaning from this, as it’s possible that FOMC members still believe that Trump is bluffing with tariffs. This appeared to be a key message for markets that made equities and rates react dovishly.

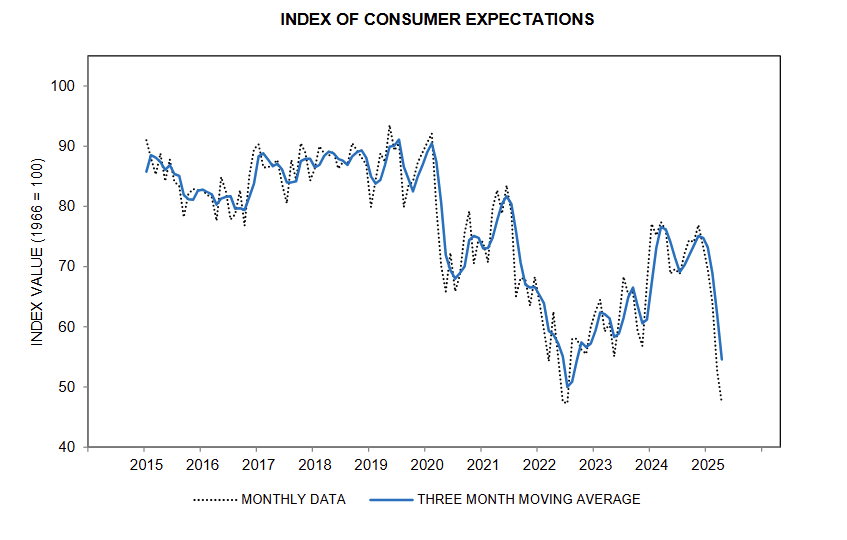

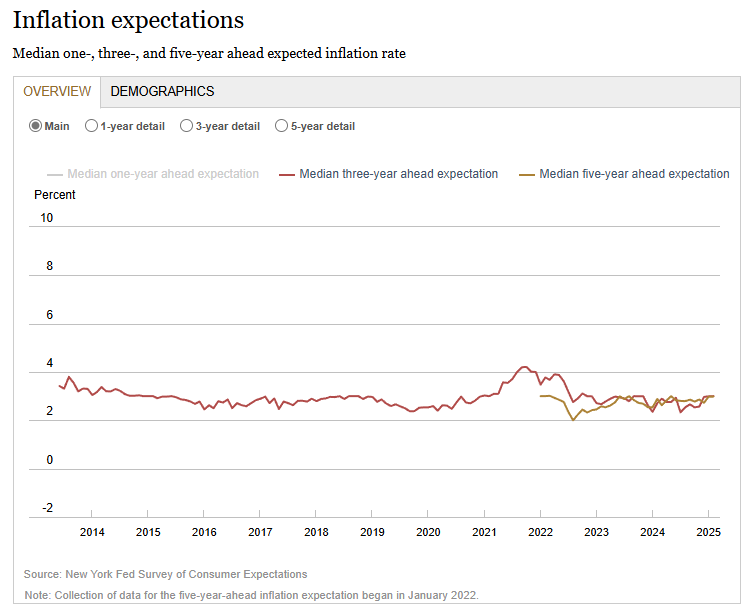

There were also several questions about inflation expectations, and whether or not the recent data in surveys (specifically the UMich consumer sentiment survey) was evidence of “de-anchoring” in inflation expectations. Powell was quick to blame tariffs for the rise in short-term expectations and pointed to long-term economic expectations remaining low and stable. He specifically points to the data in the NY Fed Survey of Consumer Expectations and market-based measures as evidence for his case.

Two of his statements stick out to me about the labor market and inflation:

- On the labor market: “What we have had is a low firing and low hiring situation. And it seems to be in balance now for - you know for the last six, seven, eight months.” This statement is a good overview of the current state of hiring. Unemployment remains low as there has been no major uptick in layoffs, but hiring has also slowed as demand for new workers gradually declines.

- On inflation: “We have had two very strong goods inflation readings in the last two months which is very unexpected.” The inflation outlook is extremely uncertain with tariffs and the Fed is looking at goods inflation as a signal. Powell mentioned these two monthly surprises in goods inflation twice in the Q&A session, and it sticks out to me as the upside risk that the Fed is watching out for on the price front.

-

The Federal Reserve kept rates unchanged at the target range of 4.25 to 4.50%. Describes inflation as “somewhat elevated and labor market conditions as “solid.” The Fed will consider data and the “implications of incoming information for the economic outlook” in its future monetary policy decisions.

-

The Fed cuts by 25 bps to a range of 4.25-4.50%. In the statement, the Fed moves into data dependence mode as it “will continue to monitor the implications of incoming information for the economic outlook.” The FOMC will adjust its monetary policy stance if “risks emerge that could impede the attainment of the Committee's goals.” There was one dissenter who opted to keep rates unchanged. The Fed also released its SEP.

The Fed has upgraded its projections of growth in 2024 and 2025 by 0.5 ppts to 2.5% and 0.1 ppts 2.1% respectively. Largely, this reflects stronger-than-expected growth in Q3 and another strong quarter likely in Q4. The 2025 shift looks more significant in the histogram. The mode has shifted from between 1.8% to 1.9% to 2.0% to 2.3%.

The Fed has adjusted its view of the labor market to account for stronger employment in the second half of 2024 and slightly stronger employment in 2025. Many more individuals have moved from expecting the unemployment rate at either 4.4% or 4.5% to either 4.2% or 4.3%. This appears to be an admission that the labor market is tighter than FOMC members initially thought and that the gradual weakening of the labor market might be very slight.

Inflation projections have moved quite considerably. The FOMC has admitted that core PCE inflation will overshoot its September projection at the end of 2024 with a reading around 2.8%. More concerning is a significant increase in the 2025 projection. Instead of core PCE inflation easing to 2.2% in 2025, the Fed now sees its favorite inflation indicator only falling to 2.5% by the end of next year. The upper bound of the range of FOMC projections increased 0.7% from September to December and sits at an ugly 3.2%. This could be the beginning of the Fed bringing the inflation mandate back into focus.

The Fed has completed a hawkish repositioning in response to stronger-than-expected growth and employment and renewed inflation concerns. The median forecast for the Fed funds rate at the end of 2025 was increased by 50 bps to 3.9% (Sep projection: 3.4%) in a significant upward shift in the distribution. There does seem to be a stronger consensus on where rates could land next year. 10/19 projections have a FFR midpoint of 3.9% with others split above or below that point roughly evenly.

In 2026, there was a similar increase in the projection for the FFR by 50 bps to 3.4%. The distribution for projections shifted to the right but was more spread out. The range of projections was actually unchanged from September at 2.4% to 3.9%. In 2027 and the long run, the Fed sees rates settling at a higher level than before. The median long run rate, often used to represent where FOMC members see the neutral Fed funds rate, ticked to 3.0% with a mode being a range of 2.9% to 3.1%. Several members see a long-term rate settling above 3.3%.

December falls to -2.5 ppts (or 250 bps of cuts). This is the second largest month in terms of cutting (behind only last month) since the pandemic.