Euro Area Monetary Developments

Euro Area Monetary Developments

- Source

- European Central Bank

- Source Link

- https://www.ecb.europa.eu/

- Frequency

- Monthly

- Next Release(s)

- January 29th, 2026 4:00 AM

Latest Updates

-

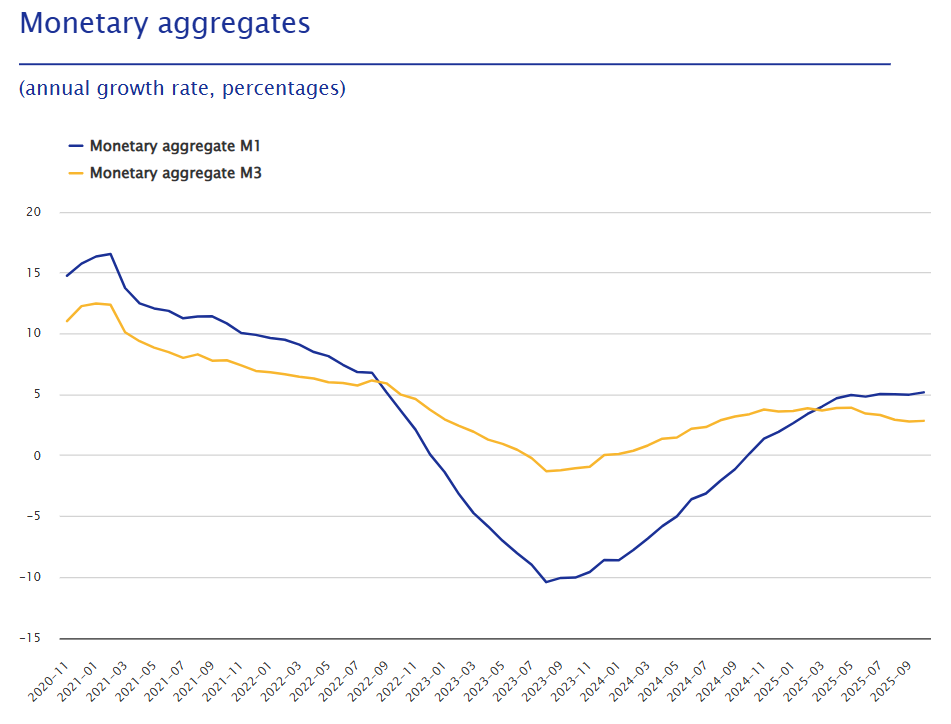

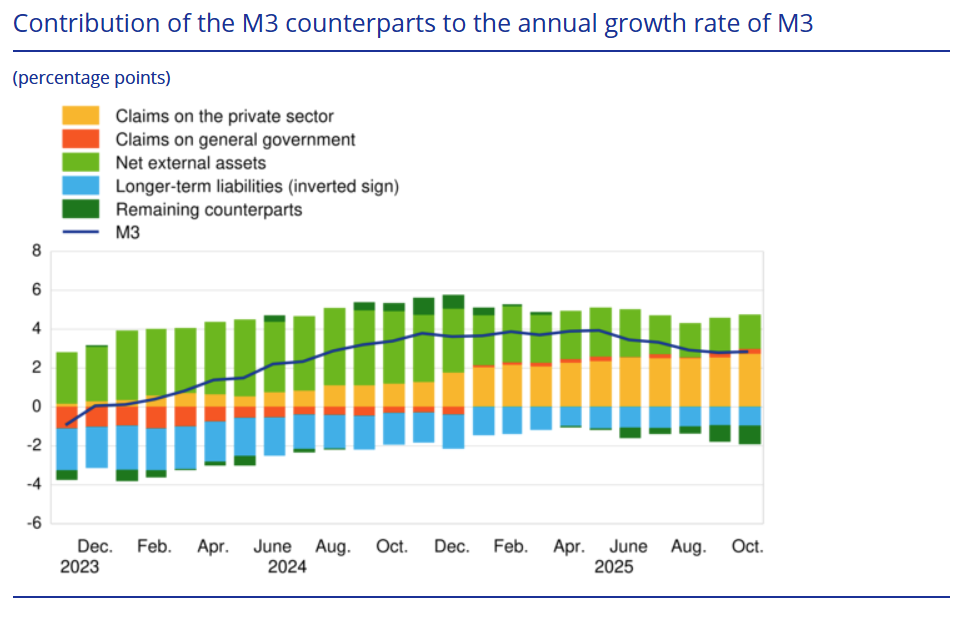

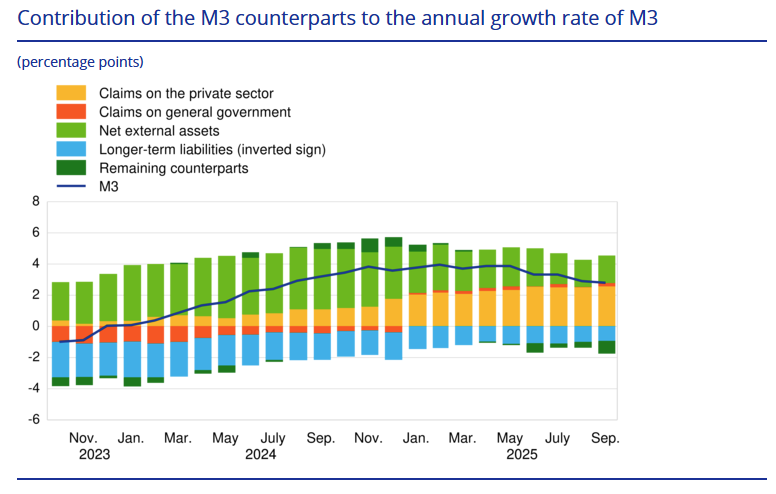

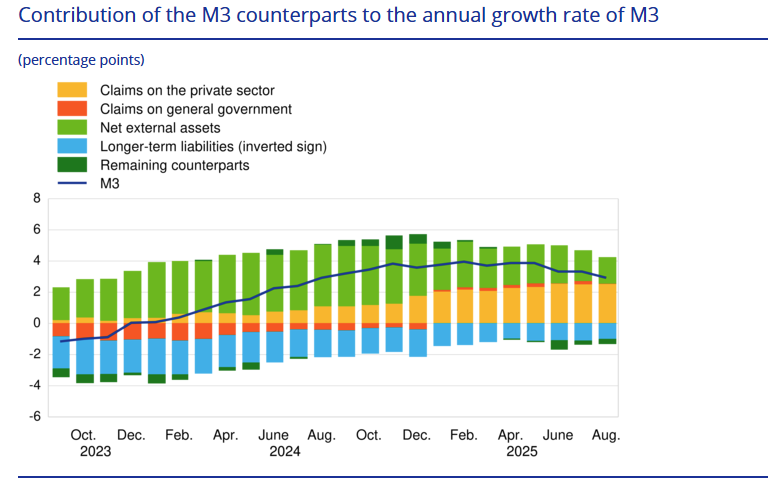

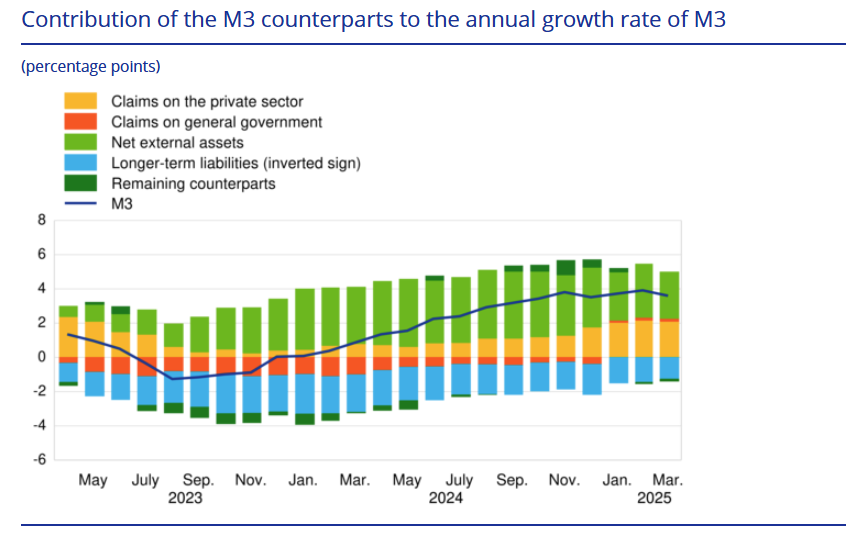

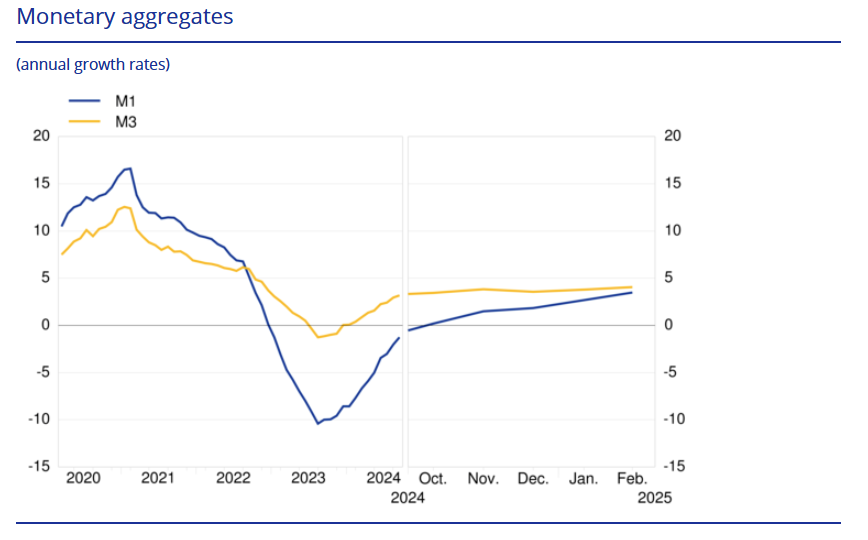

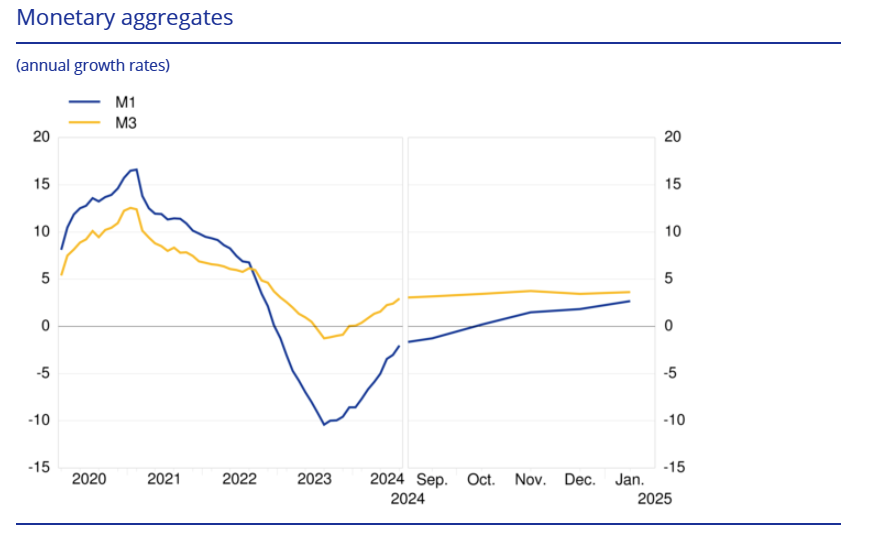

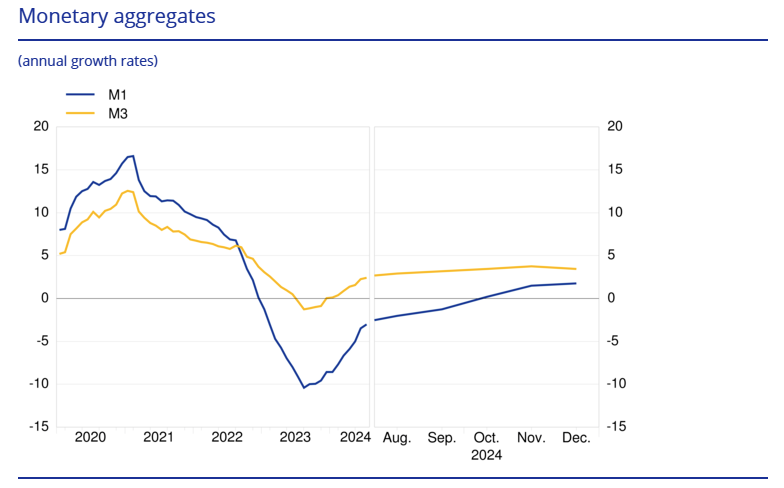

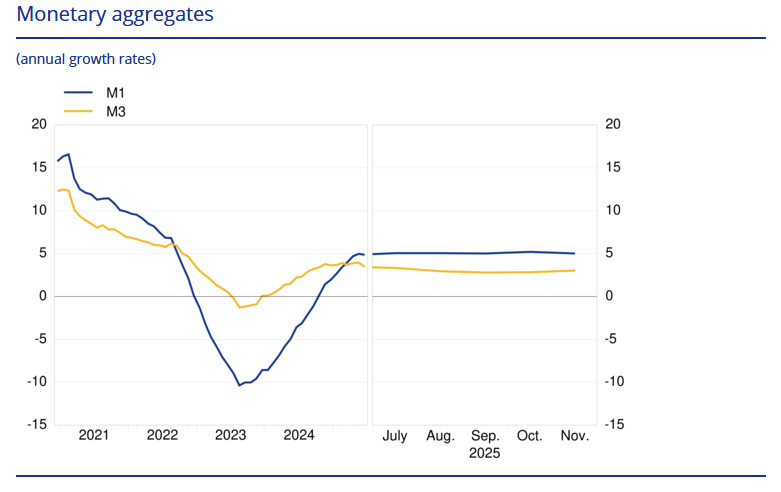

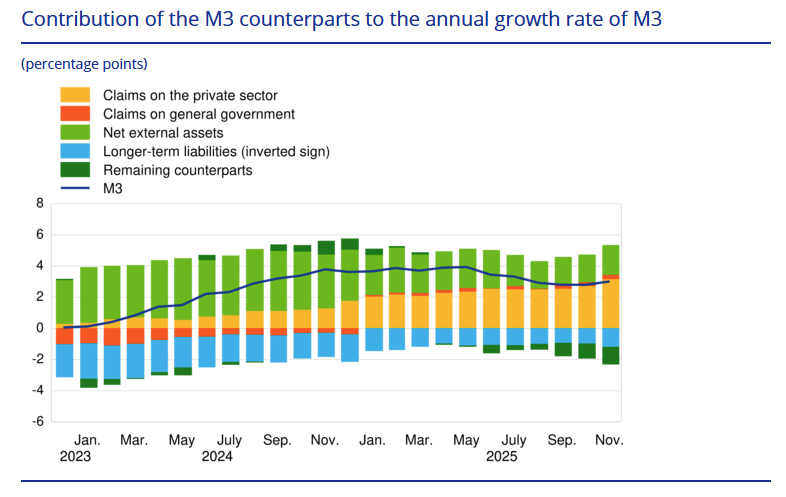

Euro area M3 growth rose to 3.0% YoY in November (from 2.8% in October), reflecting firmer broad money expansion driven by stronger credit contributions.

-

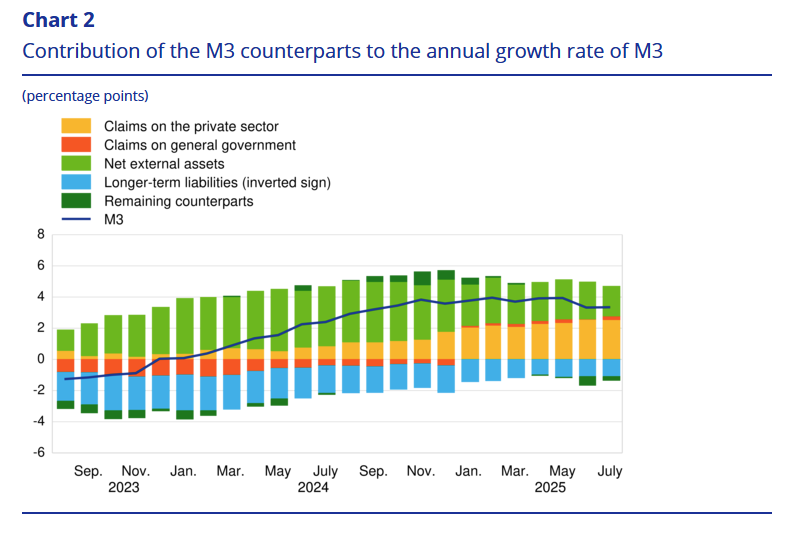

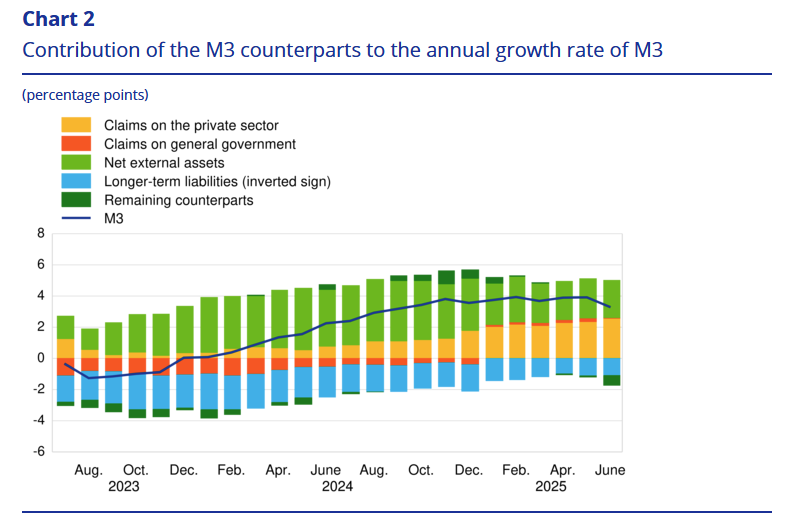

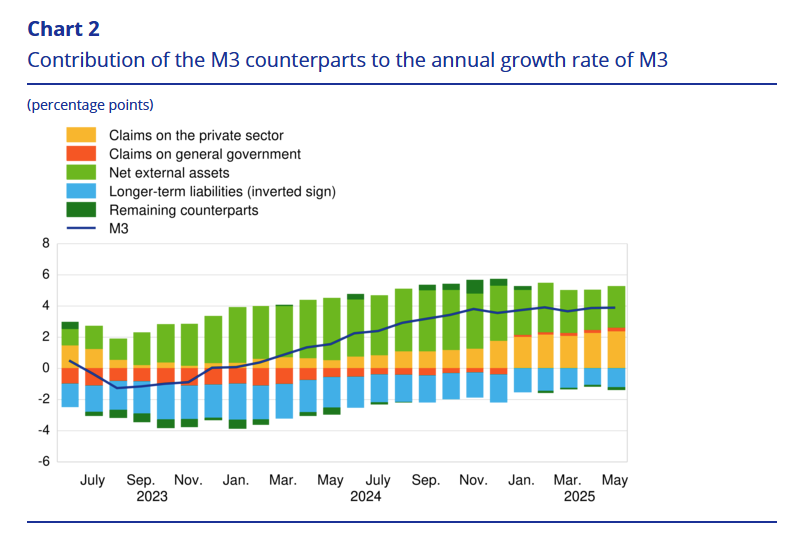

The annual growth rate of M3 increased to 3.0% YoY from 2.8% YoY, averaging 2.9% over the three months to November, indicating a modest acceleration in broad liquidity.

-

M1 growth slowed to 5.0% YoY (Oct: 5.2%), reducing its contribution to M3 growth to 3.2 ppts from 3.3 ppts, signaling softer momentum in currency and overnight deposits.

-

Short-term deposits excluding overnight deposits (M2-M1) contracted -0.8% YoY, an improvement from -1.8% YoY in October, contributing -0.3 ppts versus -0.5 ppts previously.

-

Marketable instruments (M3-M2) growth increased to 1.6% YoY (Oct: 1.4%), maintaining a small positive contribution of 0.1 ppts to M3 growth.

-

Household deposit growth strengthened to 3.3% YoY (Oct: 3.0%), while deposits by non-financial corporations held steady at 3.4% YoY.

-

Deposits placed by investment funds decelerated sharply to 0.5% YoY from 2.7% YoY, lowering their support for overall money growth.

-

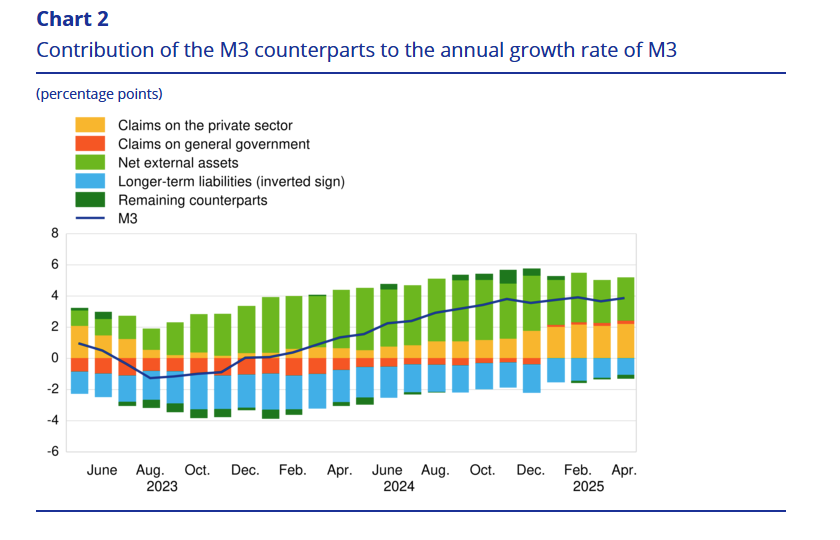

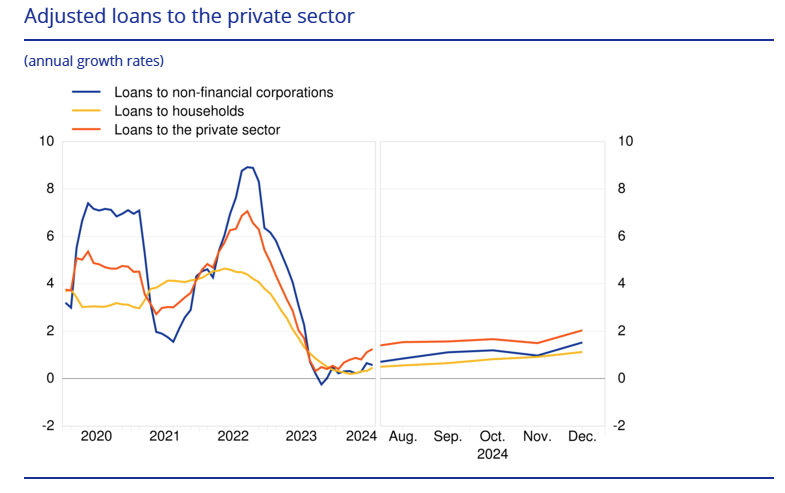

Claims on euro area residents rose to 2.6% YoY (Oct: 2.3%), led by faster growth in claims on the private sector at 3.4% YoY (Oct: 2.9%).

-

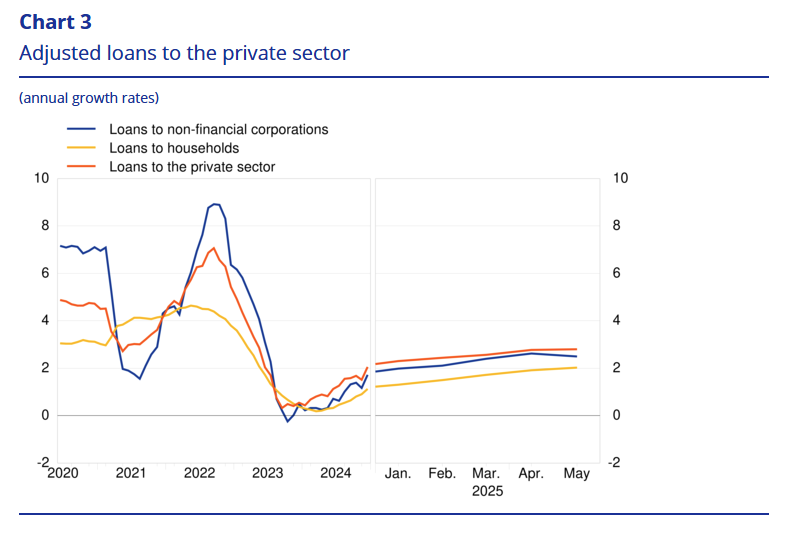

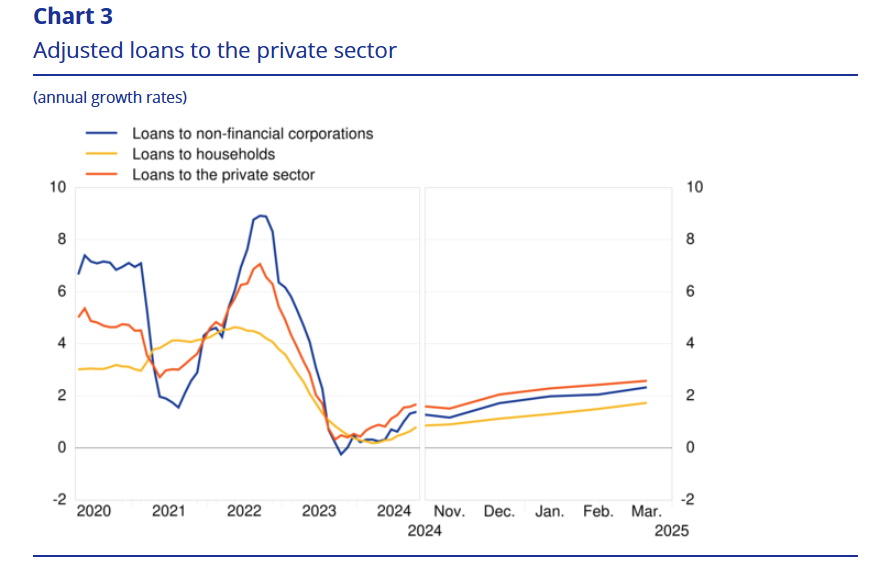

Adjusted loans to the private sector increased to 3.4% YoY (Oct: 3.0%), with household loan growth at 2.9% YoY and non-financial corporation loan growth accelerating to 3.1% YoY.

-