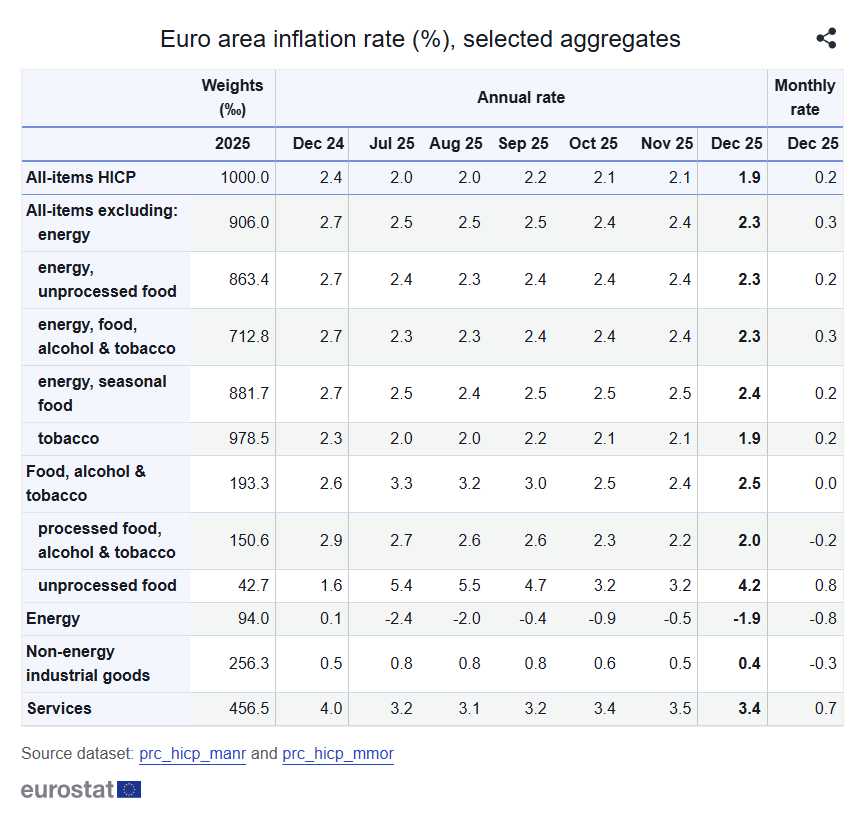

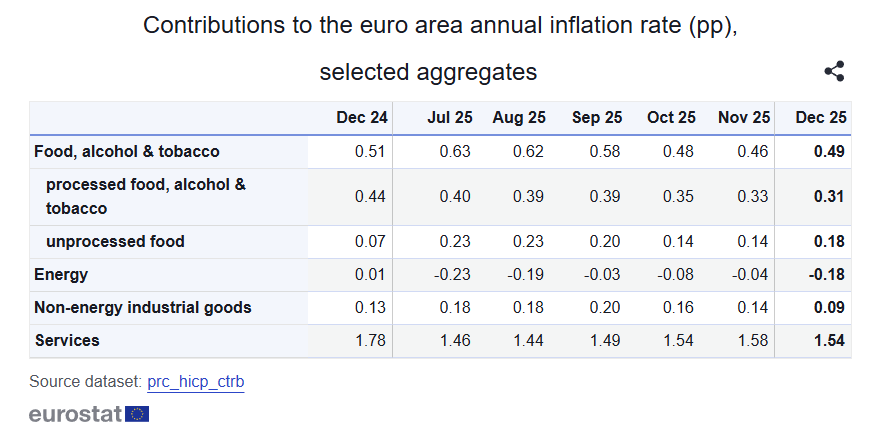

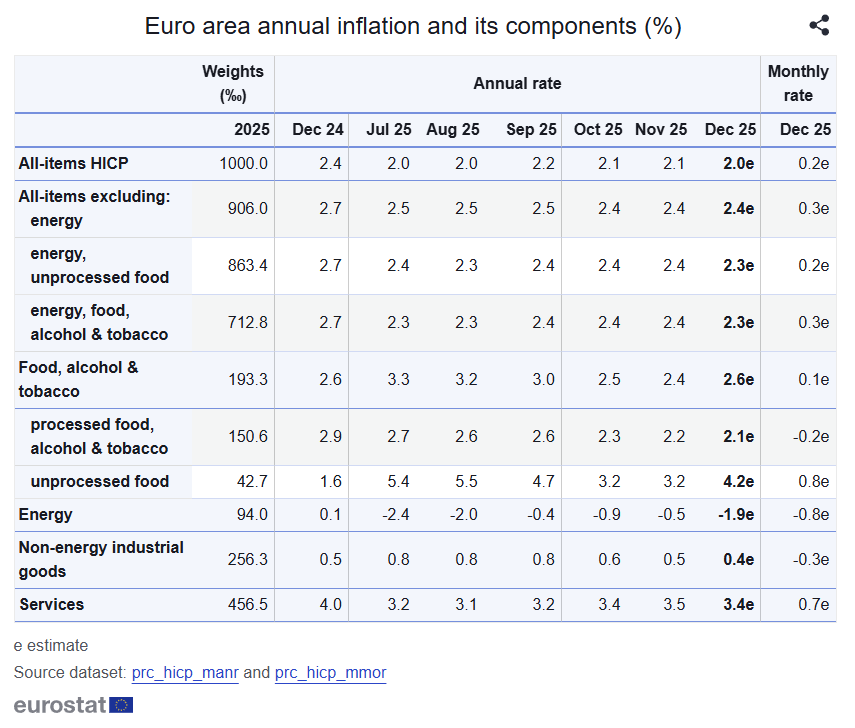

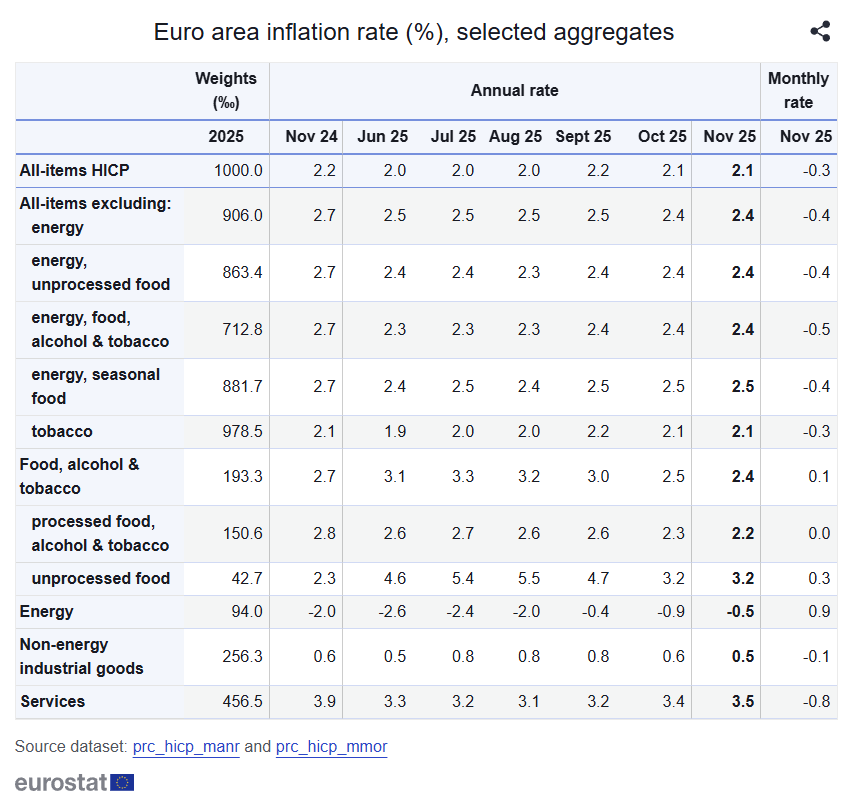

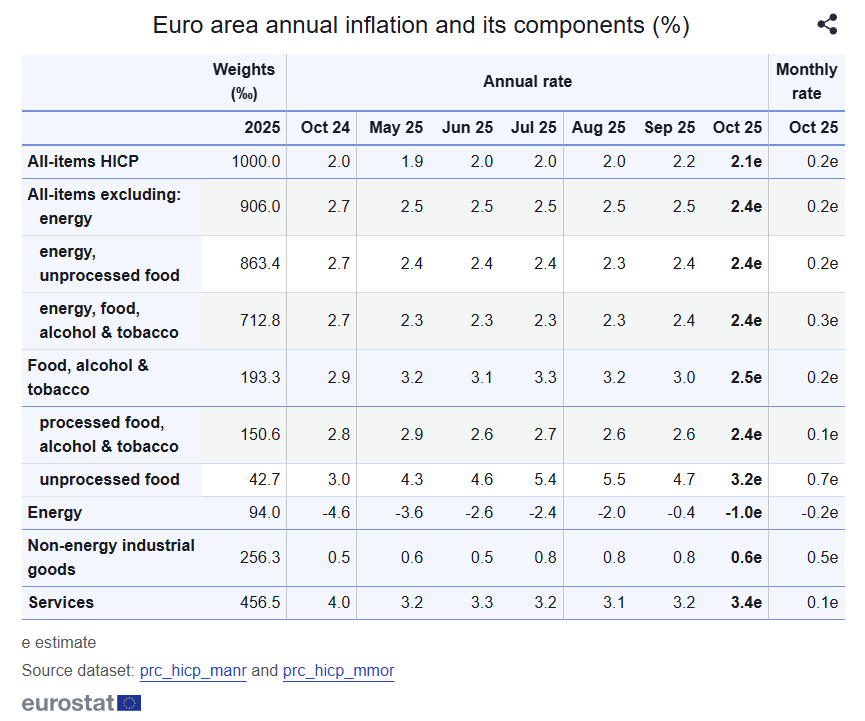

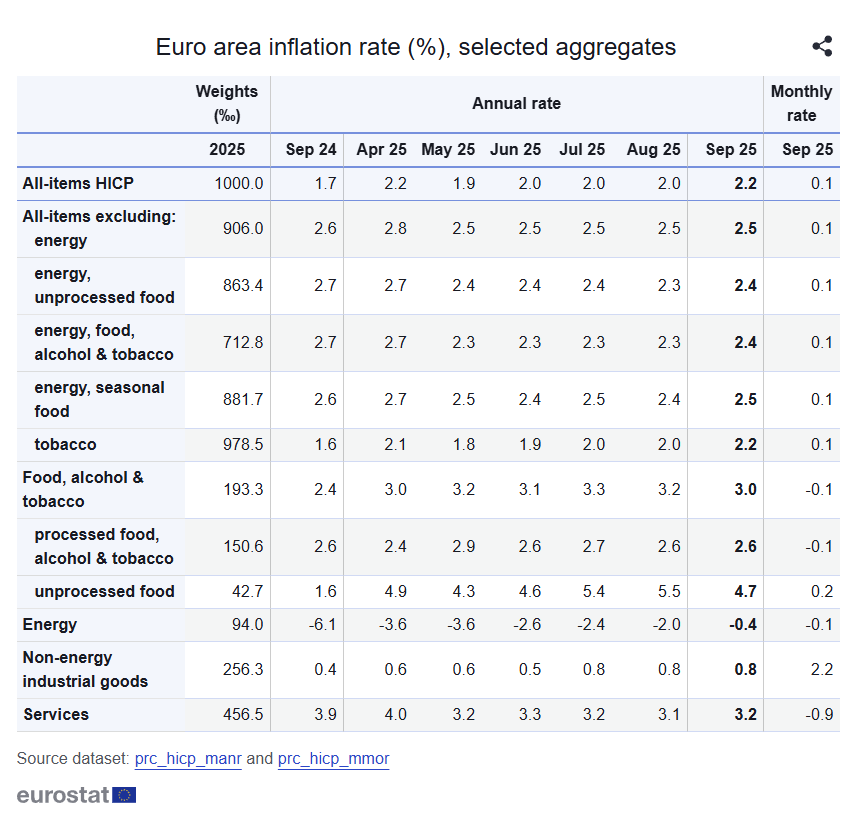

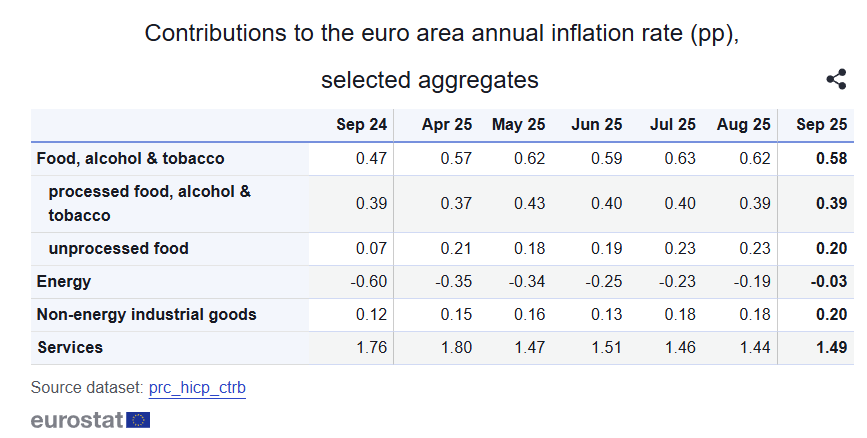

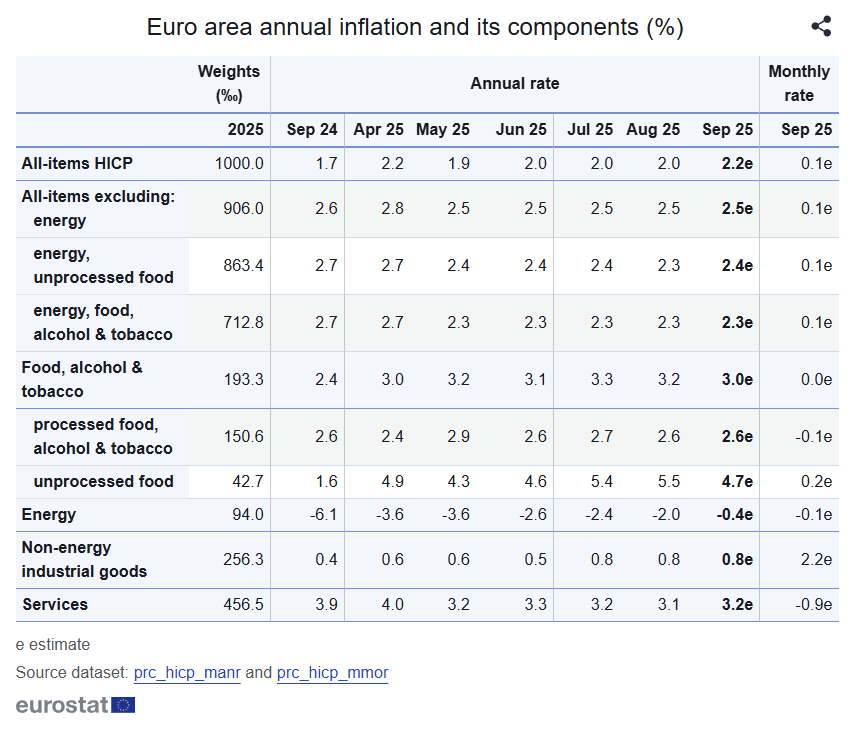

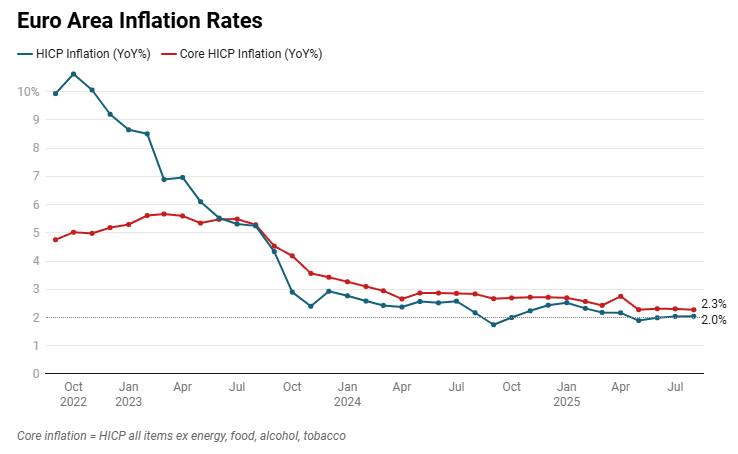

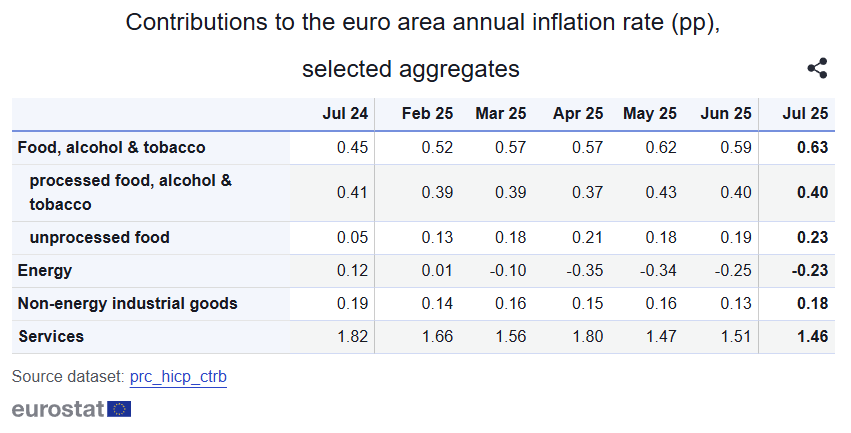

Euro Area HICP Inflation

Euro Area HICP Inflation

Data

Prices

- Source

- Eurostat

- Source Link

- https://ec.europa.eu/

- Frequency

- Monthly

- Next Release(s)

- February 4th, 2026 5:00 AM

-

February 25th, 2026 5:00 AM

-

March 3rd, 2026 5:00 AM

-

March 18th, 2026 5:00 AM

-

March 31st, 2026 5:00 AM

-

April 16th, 2026 5:00 AM

-

April 30th, 2026 5:00 AM

-

May 20th, 2026 5:00 AM

-

June 2nd, 2026 5:00 AM

-

June 17th, 2026 5:00 AM

-

July 1st, 2026 5:00 AM

-

July 17th, 2026 5:00 AM

-1.png)