Bank Lending Survey: Q4 2024

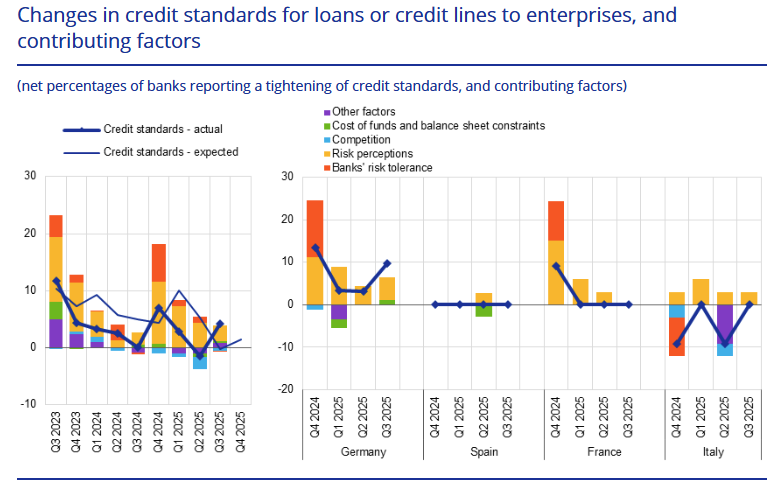

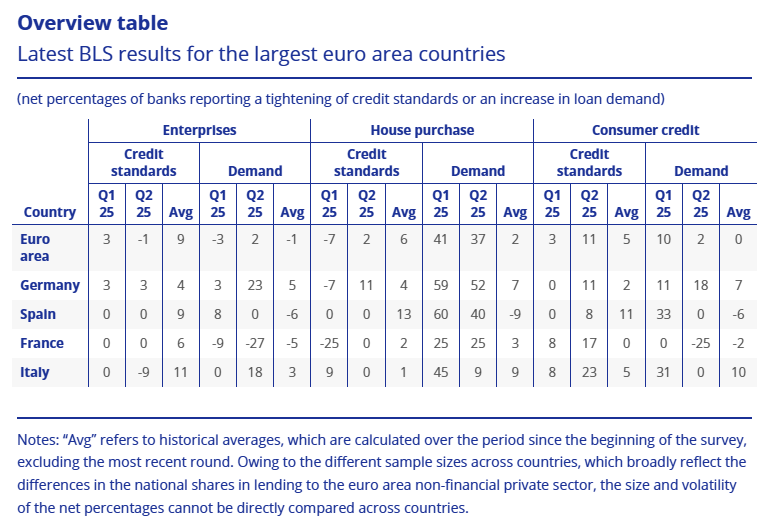

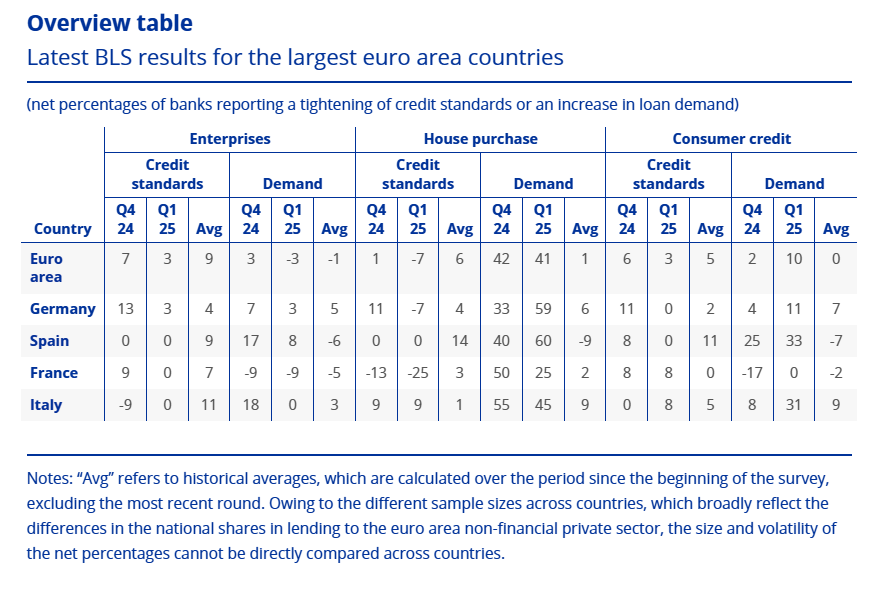

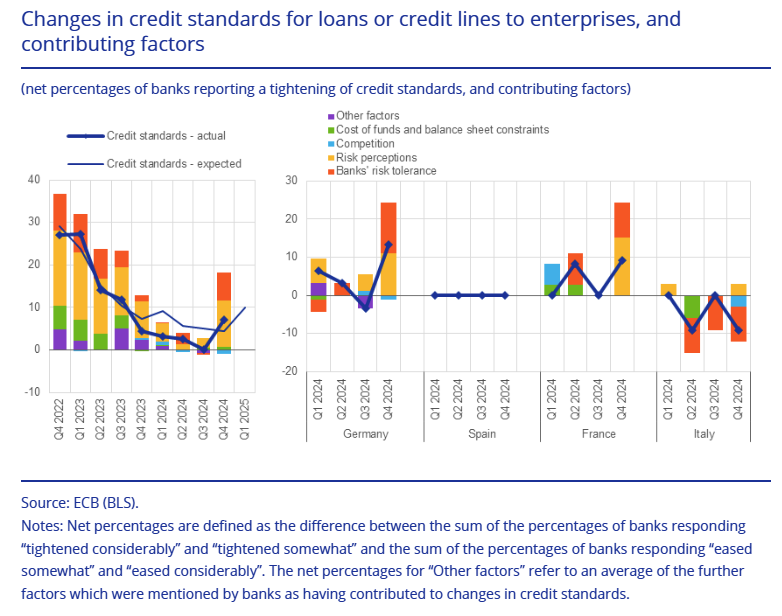

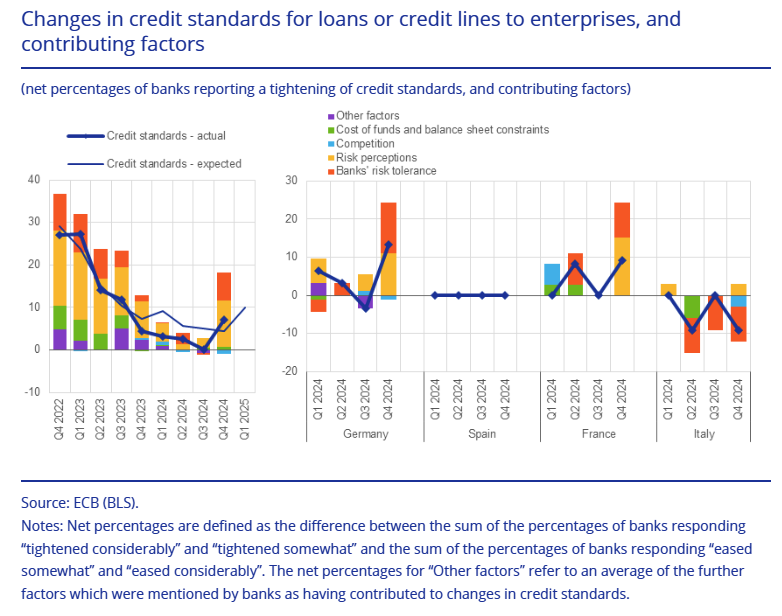

Euro area banks reported a renewed net tightening in credit standards for loans to enterprises with a net 7% of banks reporting tighter standards in Q4 2024, up from 0% in Q3 2024. Similarly, consumer credit standards were tightening slightly at a net 6% (unchanged from Q3). Standards for loans to households for home purchases were relatively unchanged on the other hand, at 1%, back to a slight tightening after a slight easing in the last three quarters.

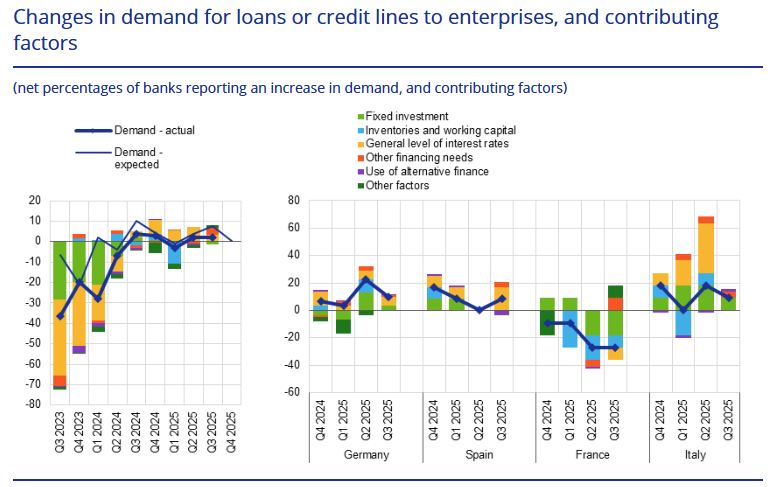

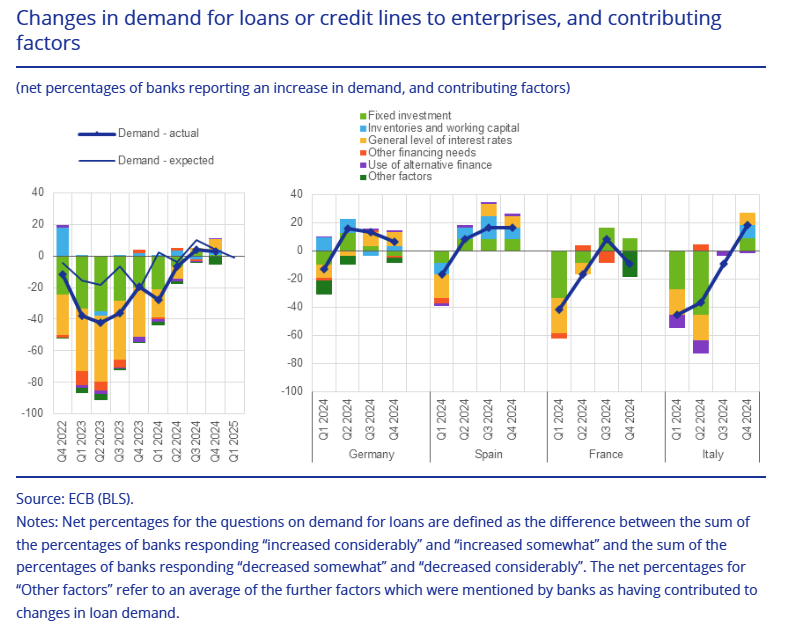

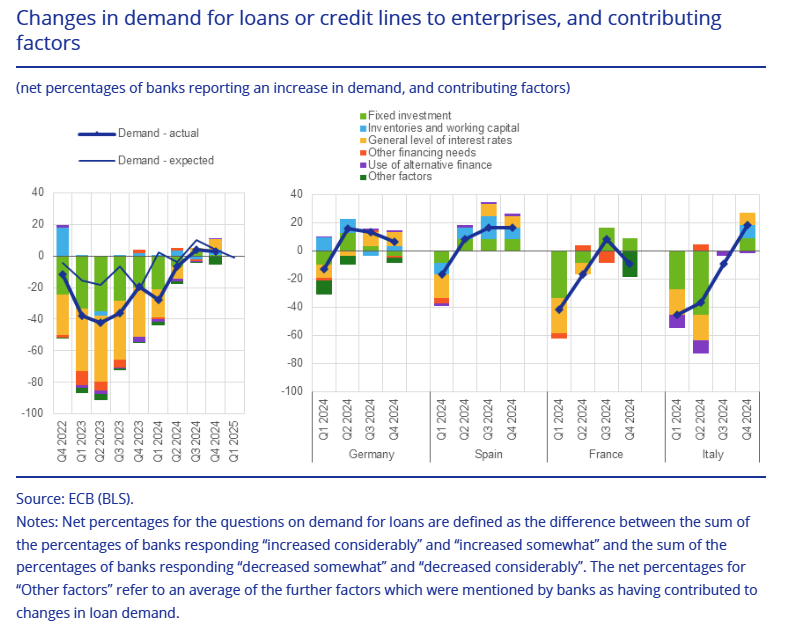

Loan demand from both firms and households improved but was still weak. Loan demand from firms was supported mainly by declining interest rates, with fixed investment having a still-muted impact after its small positive contribution in the previous quarter. With the same tailwinds, demand for home loans was bouncing as well.

Banks’ credit standards tightened further in all main economic sectors in the second half of 2024, especially in commercial real estate (CRE), wholesale and retail trade, construction and energy-intensive manufacturing. Banks also reported a net decrease in loan demand in CRE, construction and energy-intensive manufacturing. For the first half of 2025, banks expect a further net tightening of credit standards in most economic sectors, except for services. They expect muted loan demand in all sectors but residential real estate, for which they expect a moderate increase.

Euro Area Bank Lending Survey

Euro Area Bank Lending Survey