EIA Weekly Petroleum Status Report

EIA Weekly Petroleum Status Report

- Source

- EIA

- Source Link

- https://www.eia.gov/

- Frequency

-

Weekly

Wednesday

- Next Release(s)

- February 4th, 2026 10:30 AM

-

February 11th, 2026 10:30 AM

-

February 18th, 2026 10:30 AM

-

February 25th, 2026 10:30 AM

-

March 4th, 2026 10:30 AM

-

March 11th, 2026 10:30 AM

-

March 18th, 2026 10:30 AM

-

March 25th, 2026 10:30 AM

-

April 1st, 2026 10:30 AM

-

April 8th, 2026 10:30 AM

-

April 15th, 2026 10:30 AM

-

April 22nd, 2026 10:30 AM

Latest Updates

-

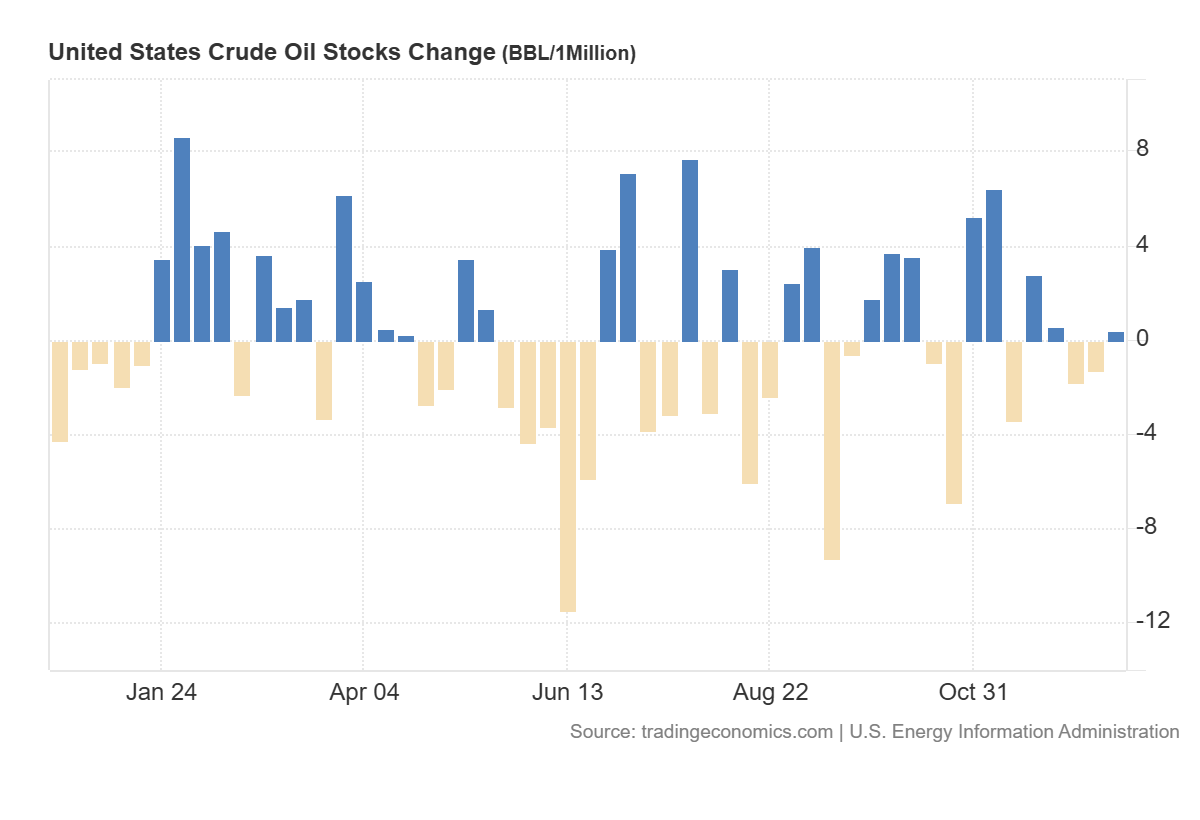

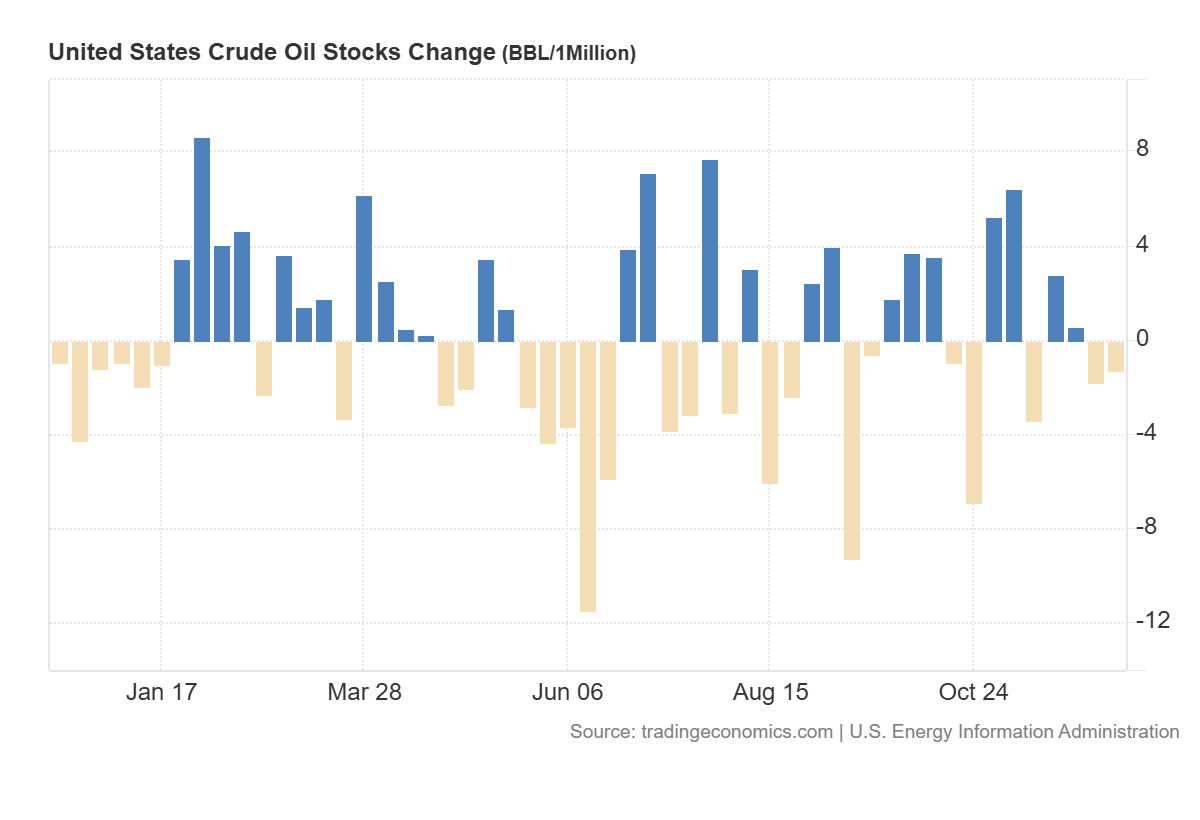

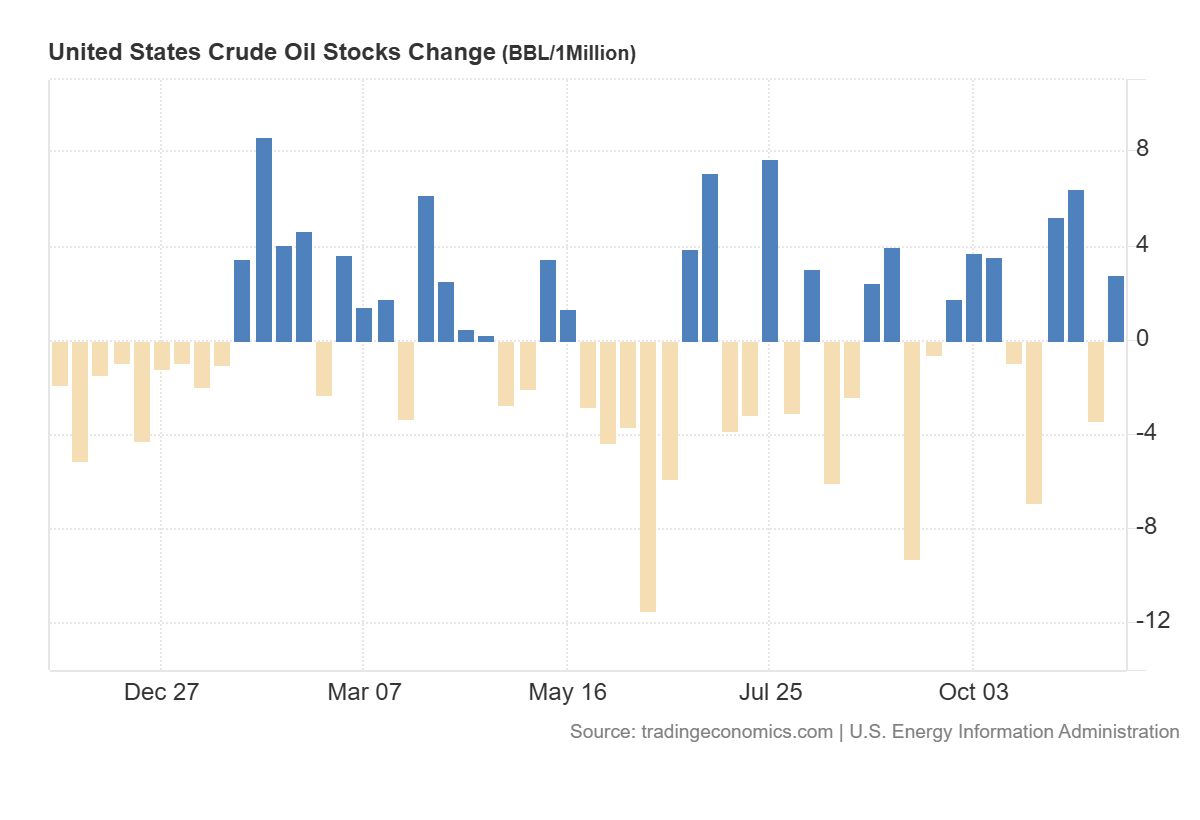

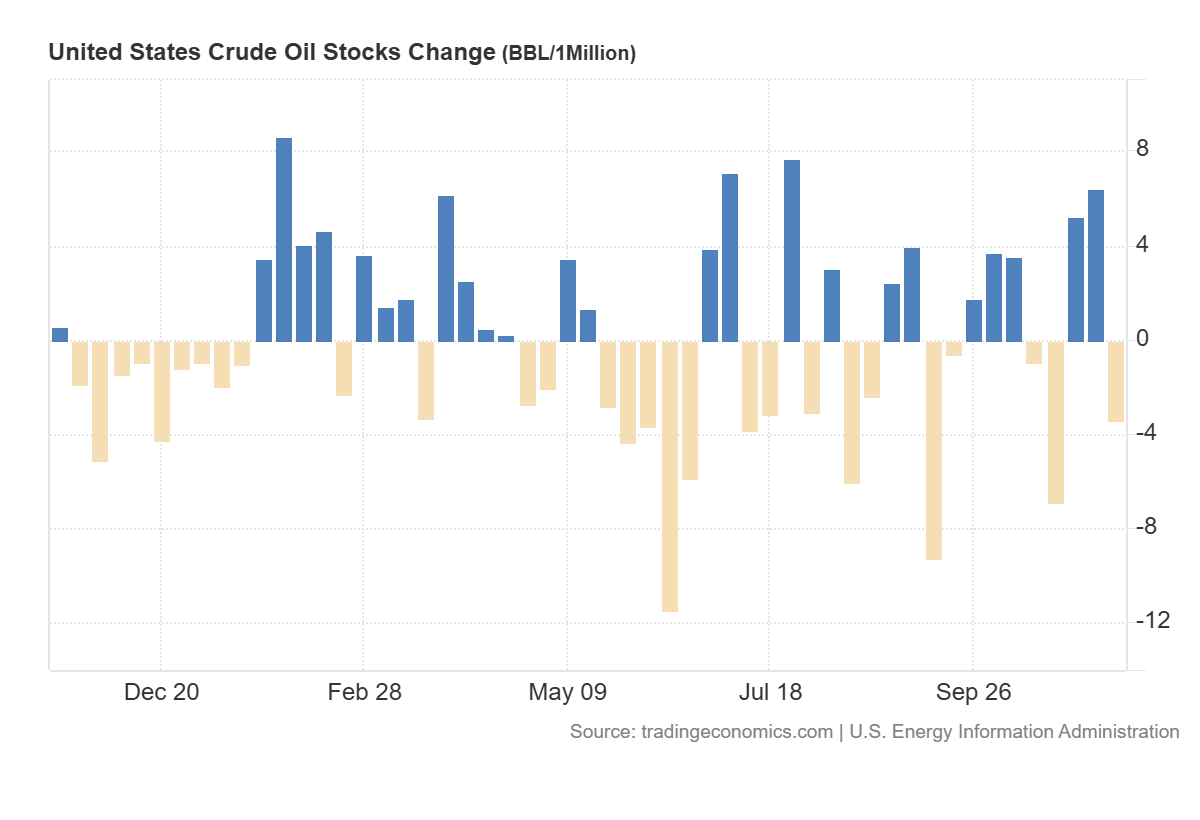

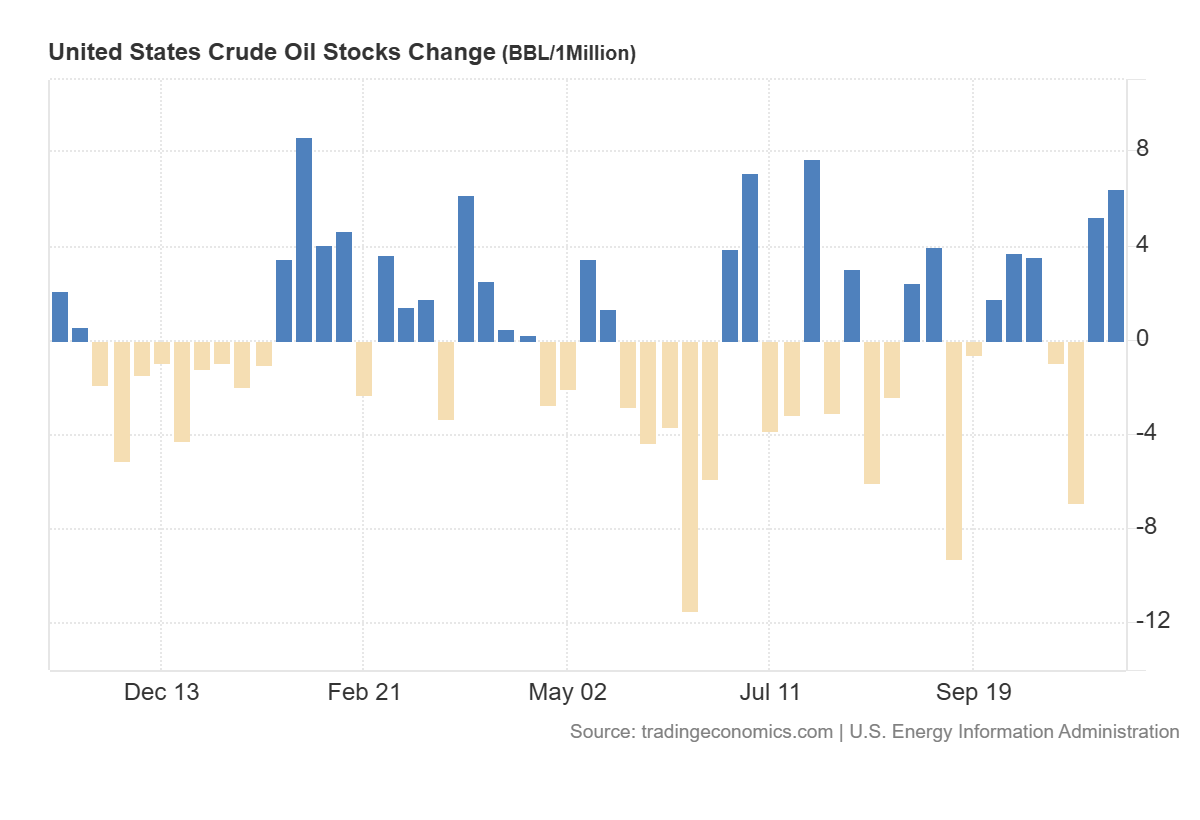

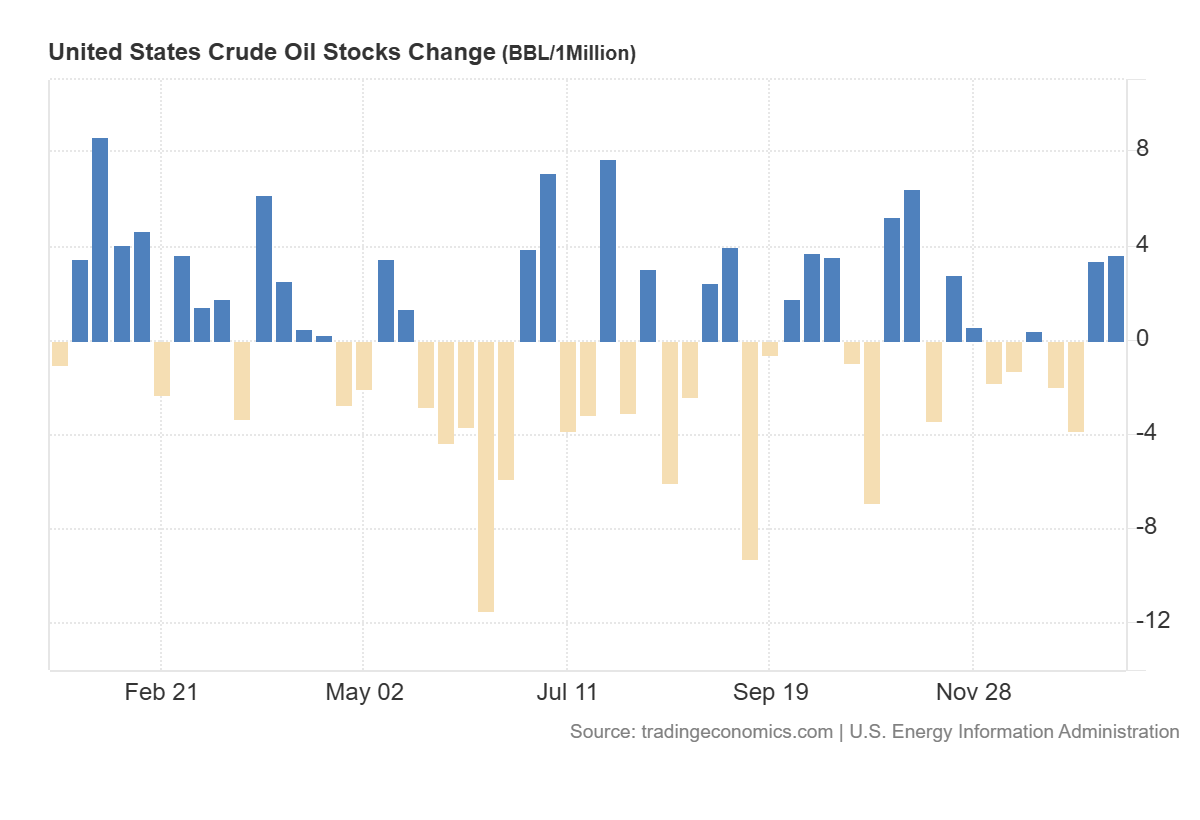

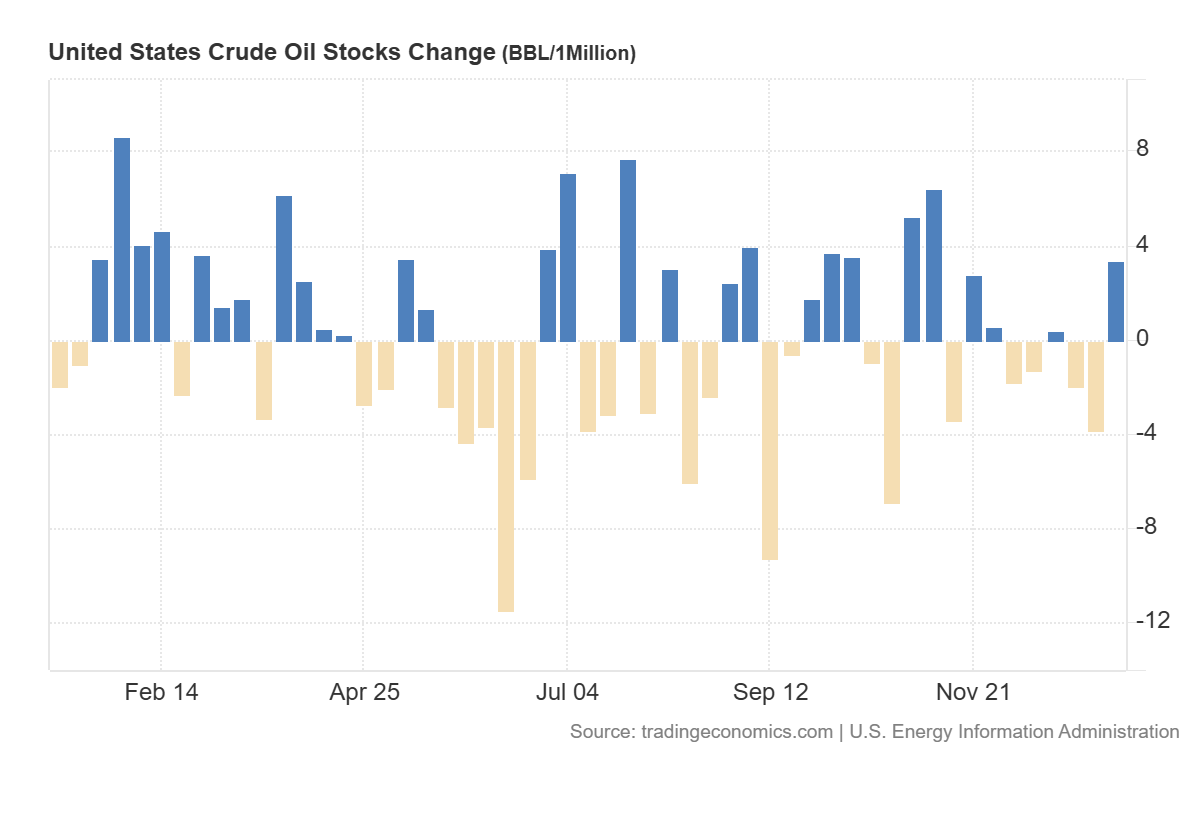

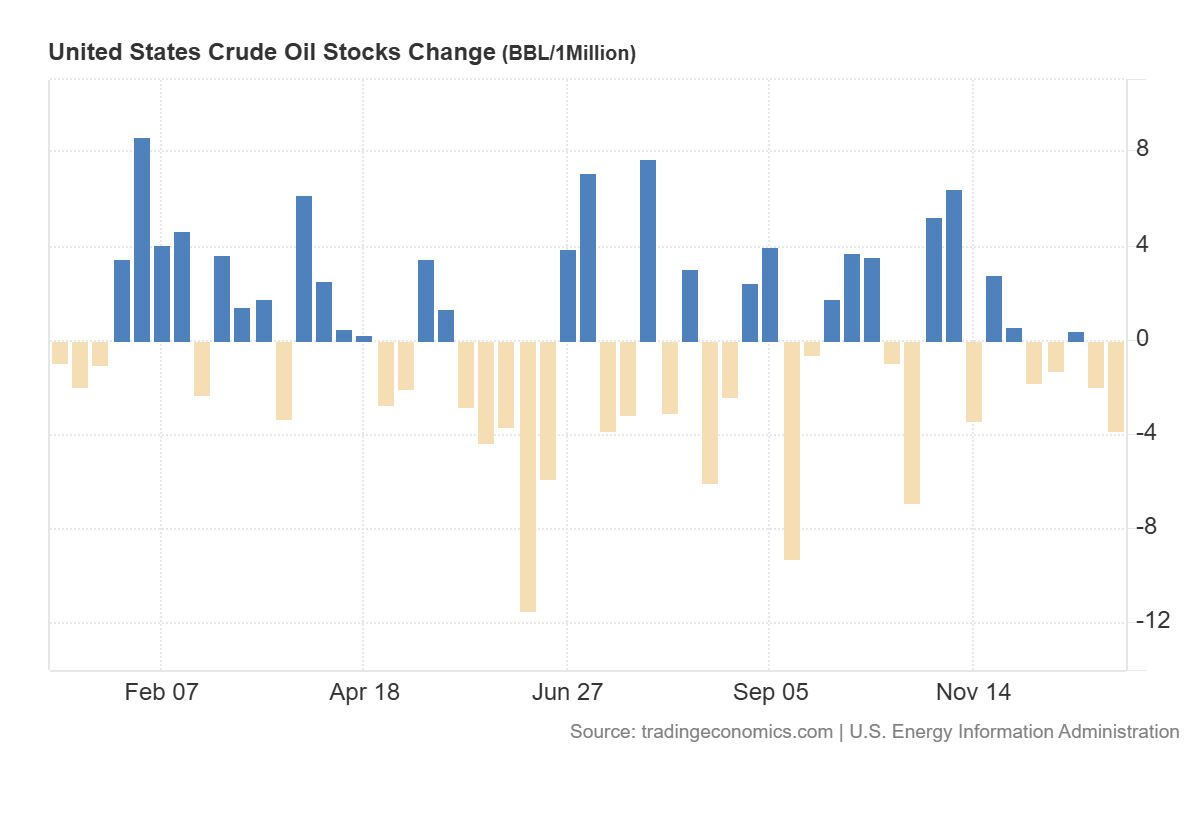

U.S. commercial crude oil inventories fell -2.3M bbl (vs +1.75M bbl expected) WoW to 423.8M bbl in the week ending Jan. 23, 2026, reflecting a modest draw alongside mixed refined product builds.

-

U.S. crude oil refinery inputs averaged 16.2M bpd (-395k bpd WoW), with utilization at 90.9%, indicating lower refinery runs compared with the prior week.

-

Gasoline production increased to 9.6M bpd, while distillate fuel production declined -268k bpd WoW to 4.8M bpd, showing divergent trends across refined products.

-

U.S. crude oil imports averaged 5.6M bpd (-804k bpd WoW); the 4-week average was 6.4M bpd (-0.9% YoY), indicating imports remain slightly below last year’s pace.

-

Commercial crude inventories (ex-SPR) decreased -2.3M bbl WoW to 423.8M bbl and remained about 3% below the five-year average, signaling relatively tight crude supply versus seasonal norms.

-

Total motor gasoline inventories rose +0.2M bbl WoW and stood about 5% above the five-year average, with finished gasoline increasing while blending components declined.

-

Distillate fuel inventories increased +0.3M bbl WoW and were about 1% above the five-year average, moving slightly above typical seasonal levels.

-

Propane/propylene inventories fell -4.7M bbl WoW but remained about 41% above the five-year average, continuing to sit well above normal seasonal stocks.

-

Total products supplied averaged 20.3M bpd over the past four weeks (-0.1% YoY), with gasoline demand 8.3M bpd (-0.4% YoY), distillate demand 3.7M bpd (-4.8% YoY), and jet fuel demand +5.5% YoY, highlighting stronger aviation usage relative to other fuels.

-

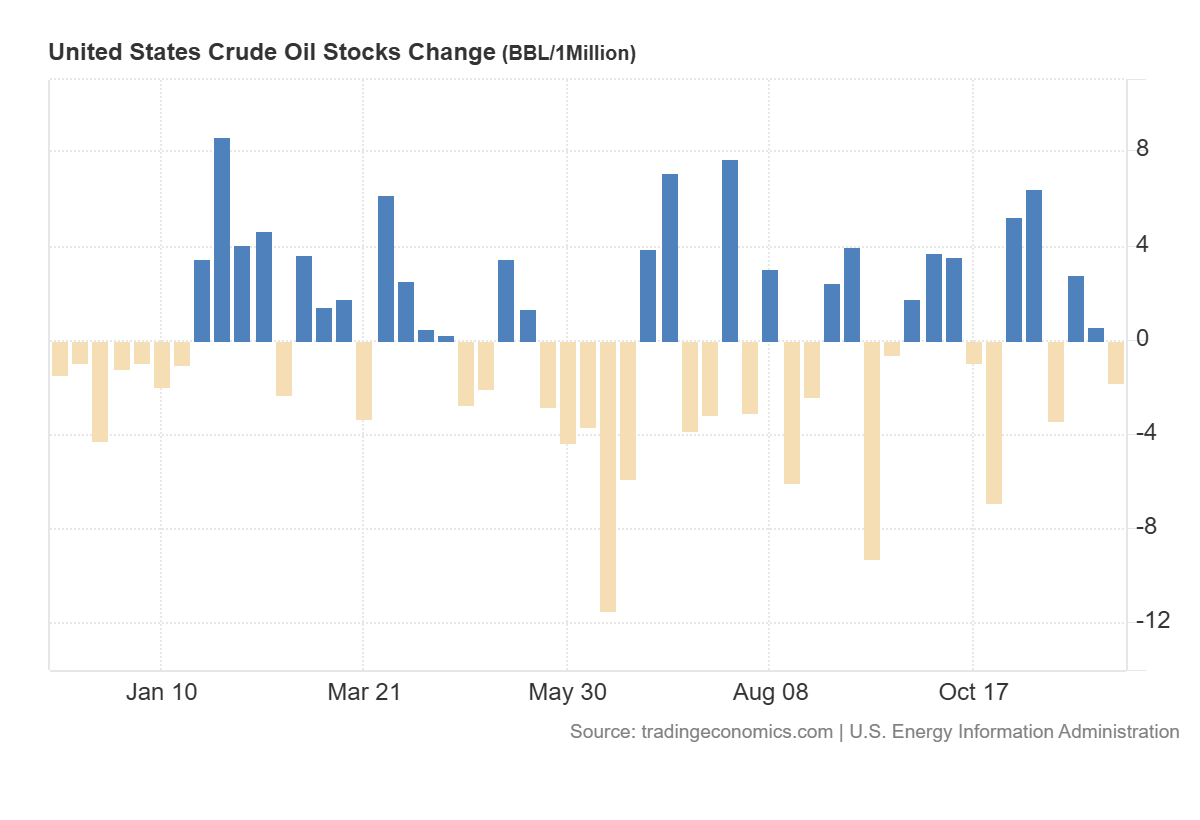

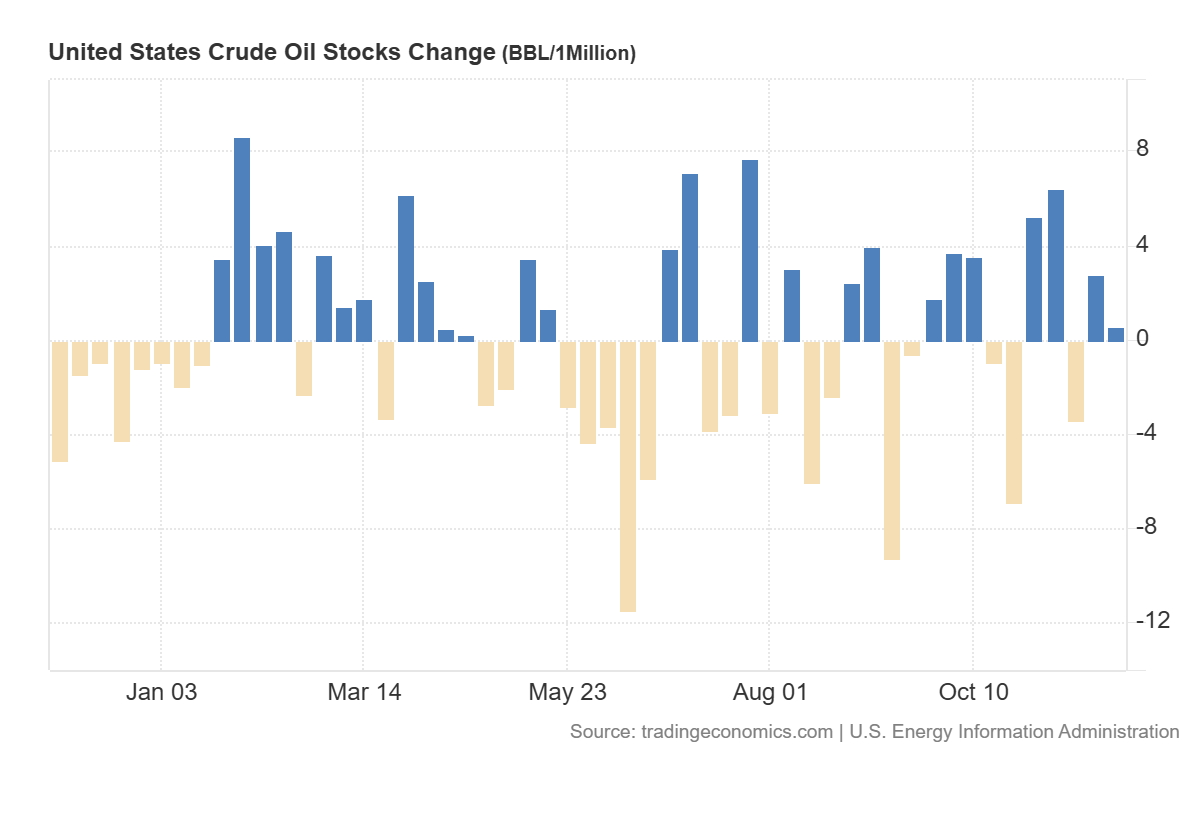

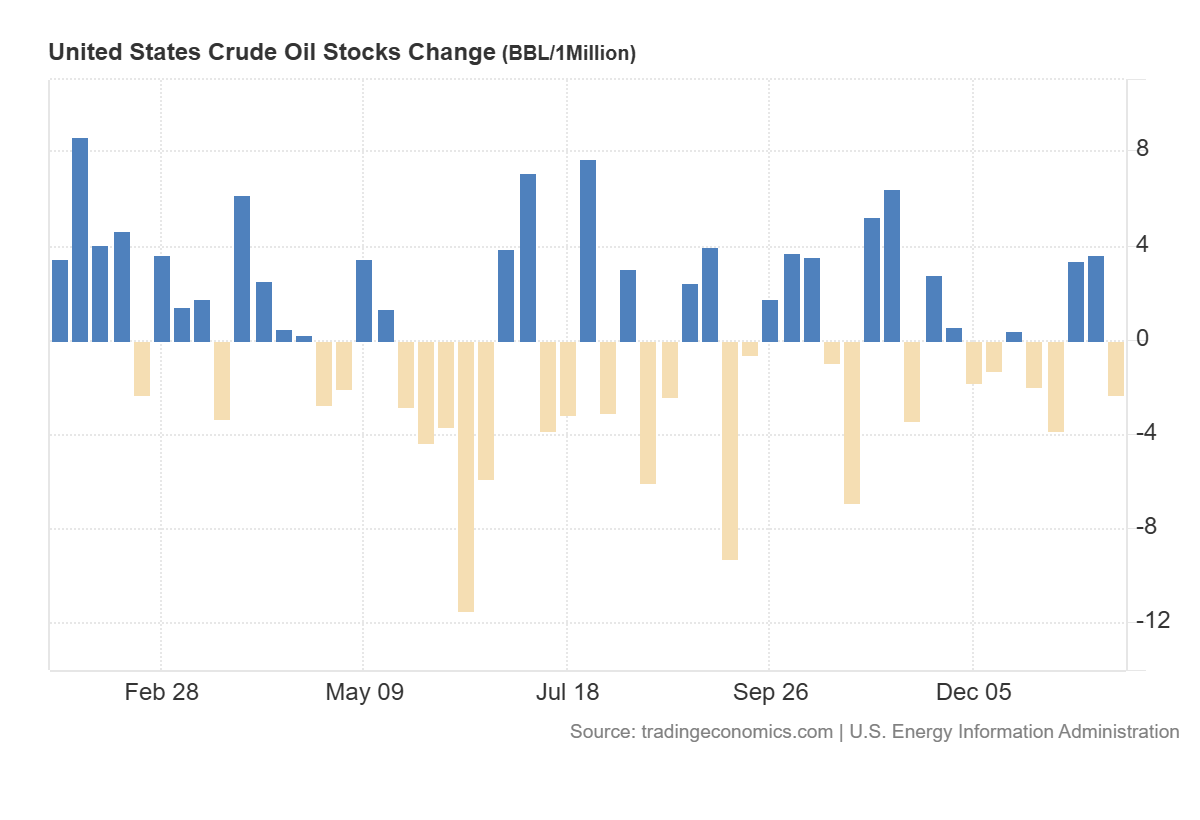

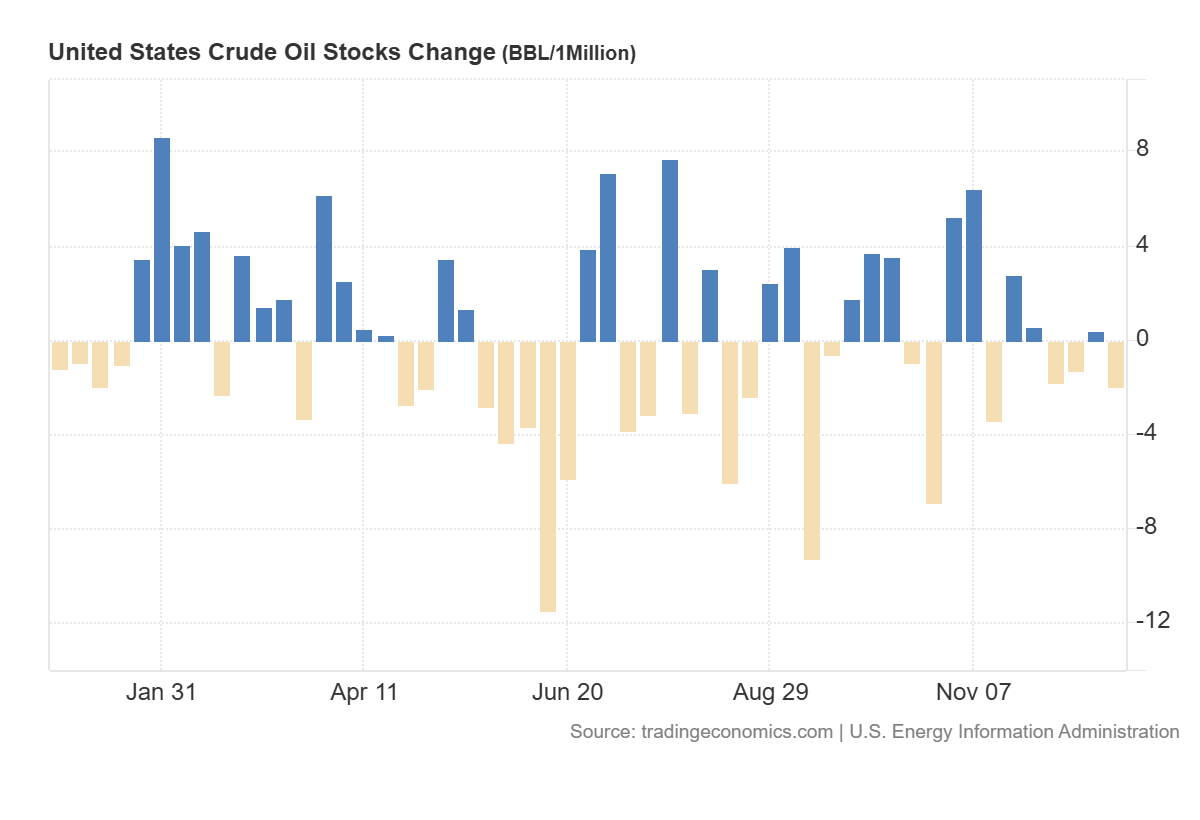

U.S. commercial crude oil inventories declined by -1.9M bbl to 422.9M bbl and stayed ~3% below the five-year average, indicating continued relative tightness in crude stocks.

U.S. commercial crude oil inventories declined by -1.9M bbl to 422.9M bbl and stayed ~3% below the five-year average, indicating continued relative tightness in crude stocks.