EIA Short-Term Energy Outlook

EIA Short-Term Energy Outlook

- Source

- EIA

- Source Link

- https://www.eia.gov/

- Frequency

- Monthly

- Next Release(s)

- October 7th, 2025 10:00 AM

Latest Updates

-

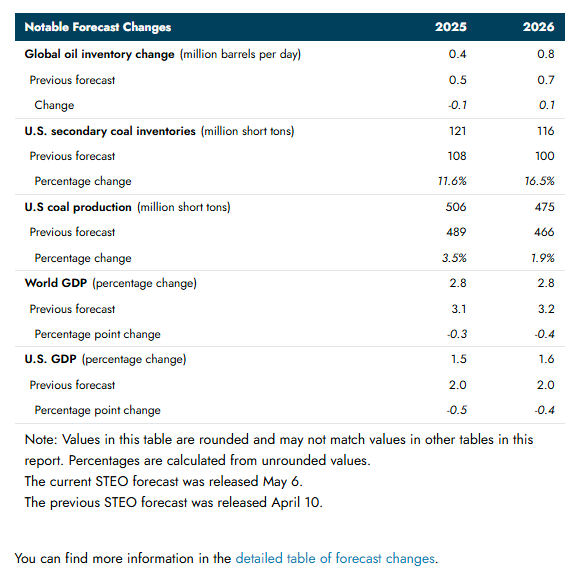

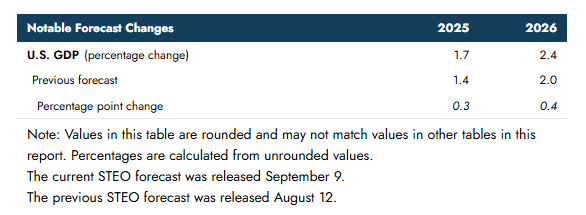

U.S. GDP growth was revised higher in the September 2025 STEO, with forecasts now at +1.7% for 2025 (+0.3 ppts vs prior) and +2.4% for 2026 (+0.4 ppts vs prior), supported by energy-related adjustments to prices, consumption, and electricity demand.

-

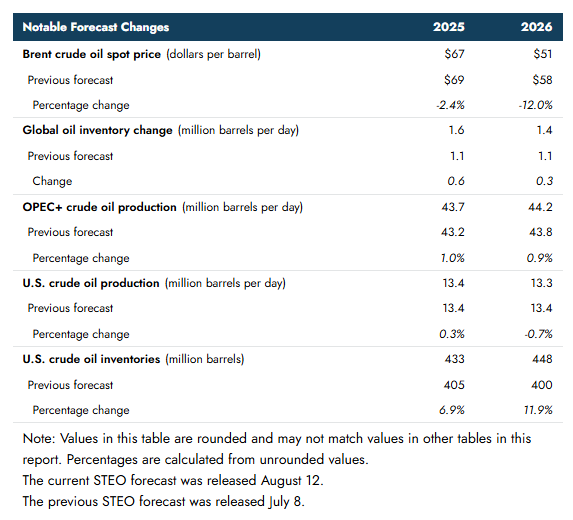

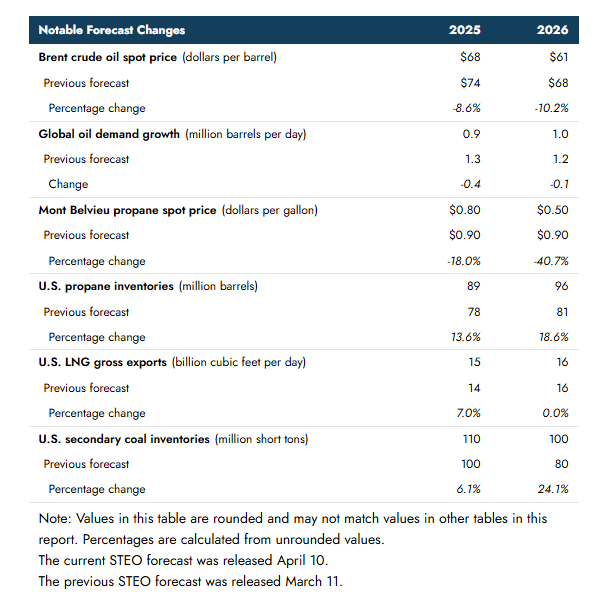

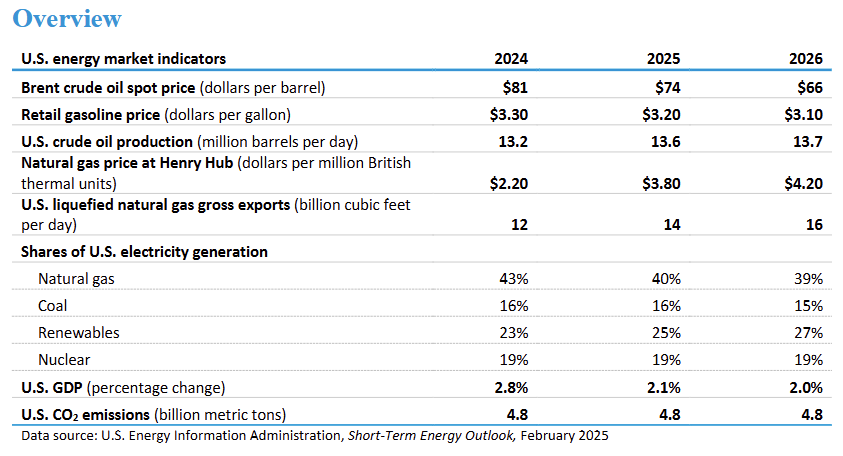

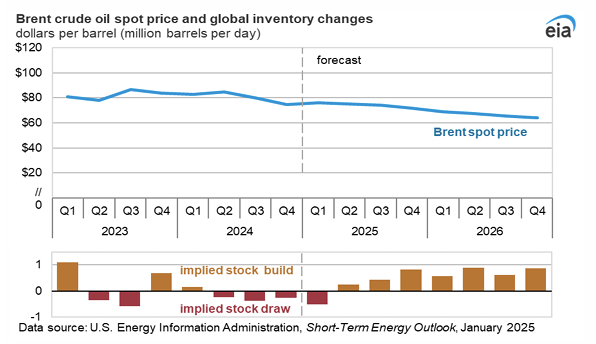

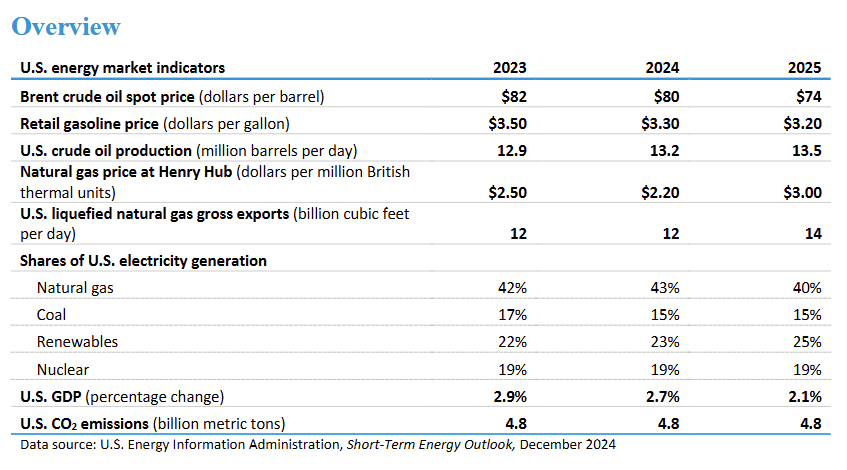

Oil prices: Brent crude is forecast to fall from $68/b in Aug 2025 to $59/b in Q4 2025, and to ~$50/b in early 2026, driven by inventory builds averaging >2 mb/d as OPEC+ increases output. Prices are expected to average $51/b in 2026.

-

Gasoline prices: The U.S. retail average for regular-grade is expected at $3.10/gal in 2025 (-20¢ YoY), dropping further to $2.90/gal in 2026, with all regions but the West Coast averaging below $3.00.

-

Gasoline expenditures: Outlays are projected to fall to <2% of disposable personal income in 2025, the lowest share since at least 2005 (ex-2020 pandemic year).

-

Gasoline consumption: First projected increase for 2026 in recent outlooks, supported by lower prices and higher working-age population.

-

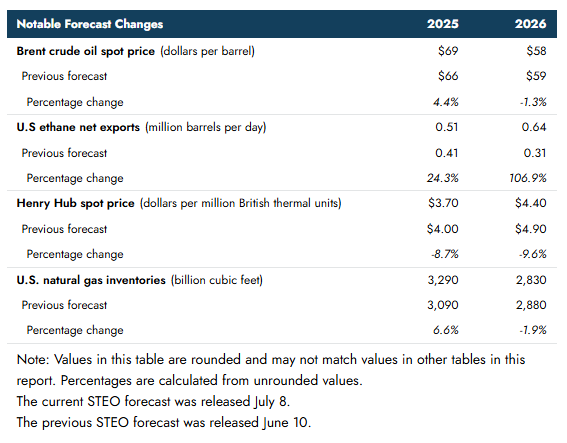

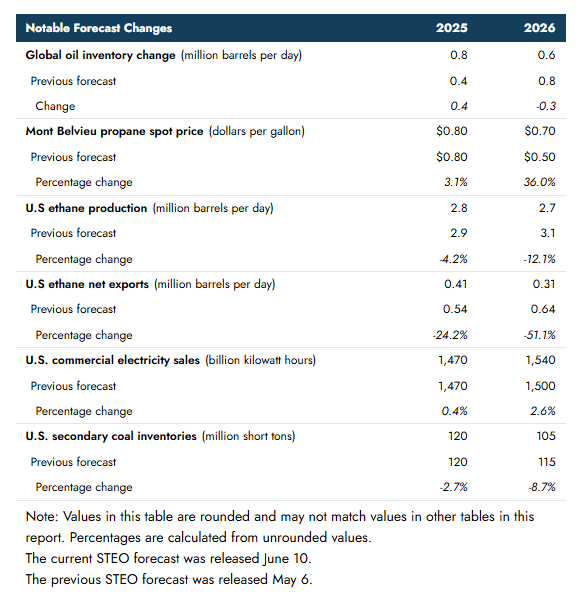

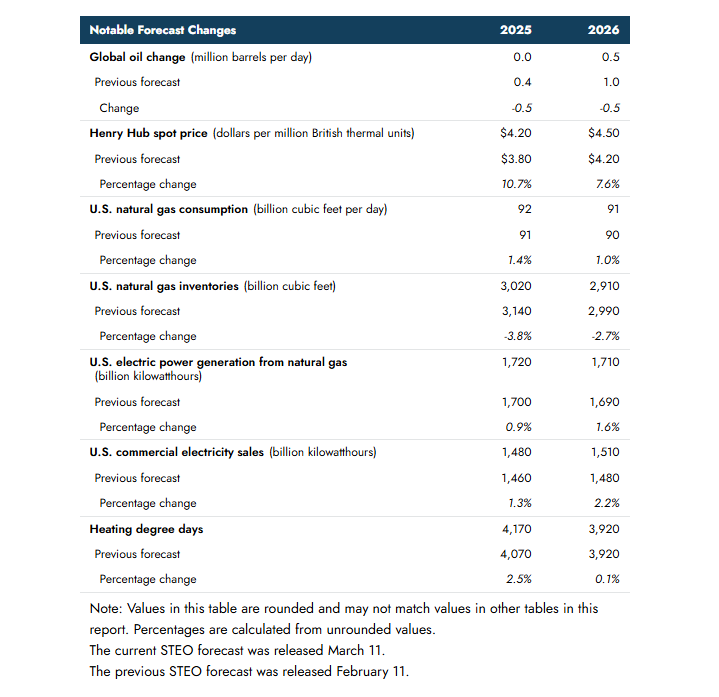

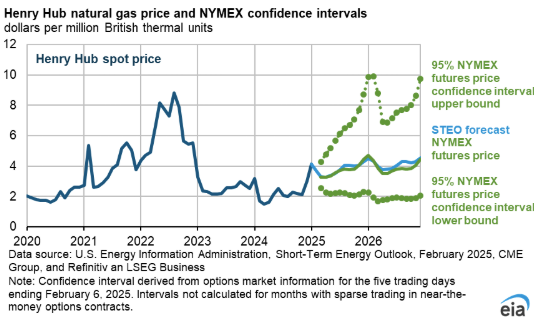

Natural gas prices: Henry Hub is forecast to rise from $2.91/MMBtu in Aug to $3.70 in Q4 2025 and $4.30 in 2026, reflecting stable production and growing LNG exports.

-

U.S. drilling: With oil prices declining and gas prices rising, 2026 drilling is expected to shift toward gas-focused regions; crude production is forecast to decline ~1% YoY.

-

Electricity generation: U.S. output is projected to rise +2.3% in 2025 and +3.0% in 2026, with solar supplying the largest share of growth amid surging demand from data centers and industrial users.

-