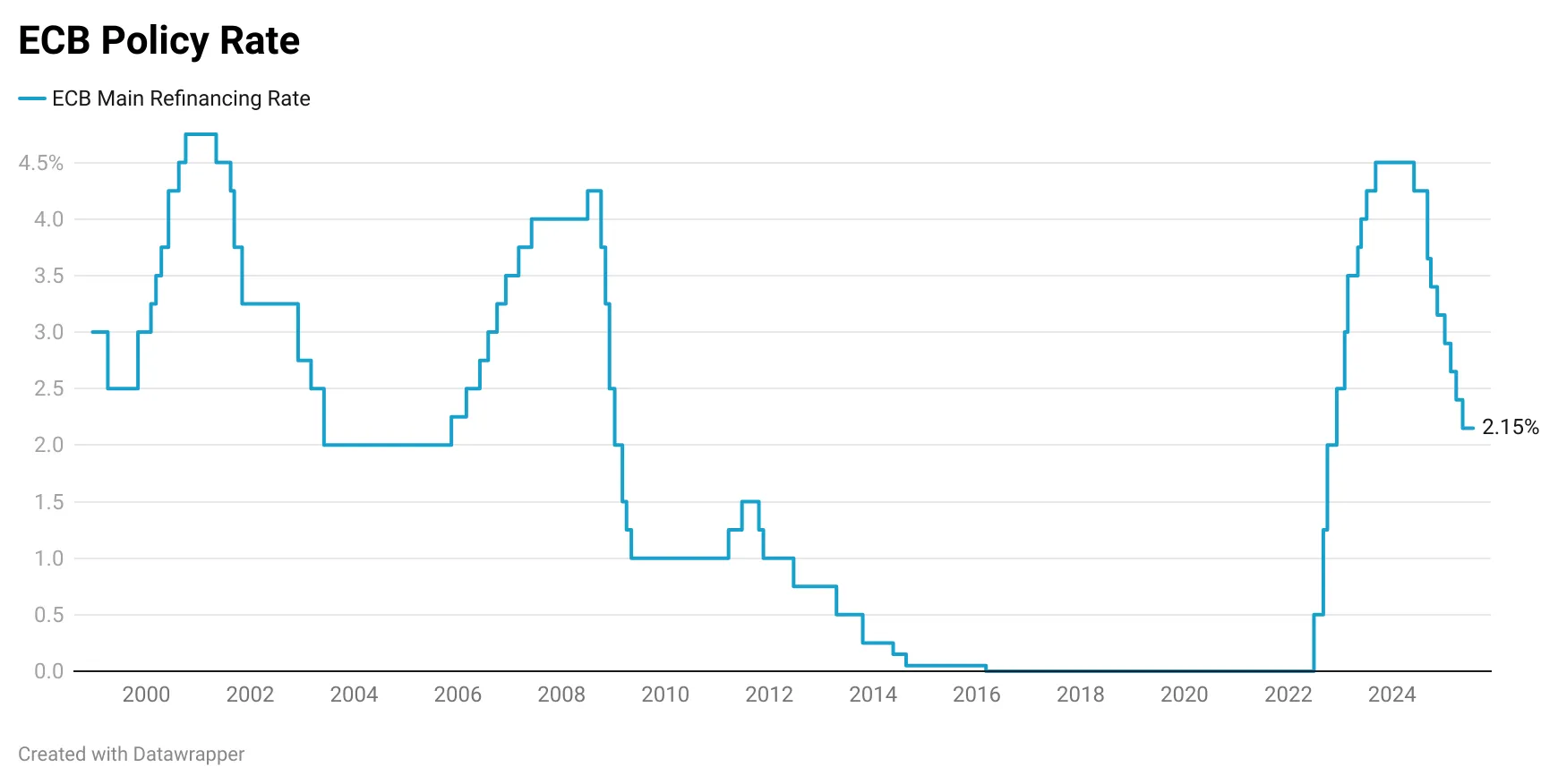

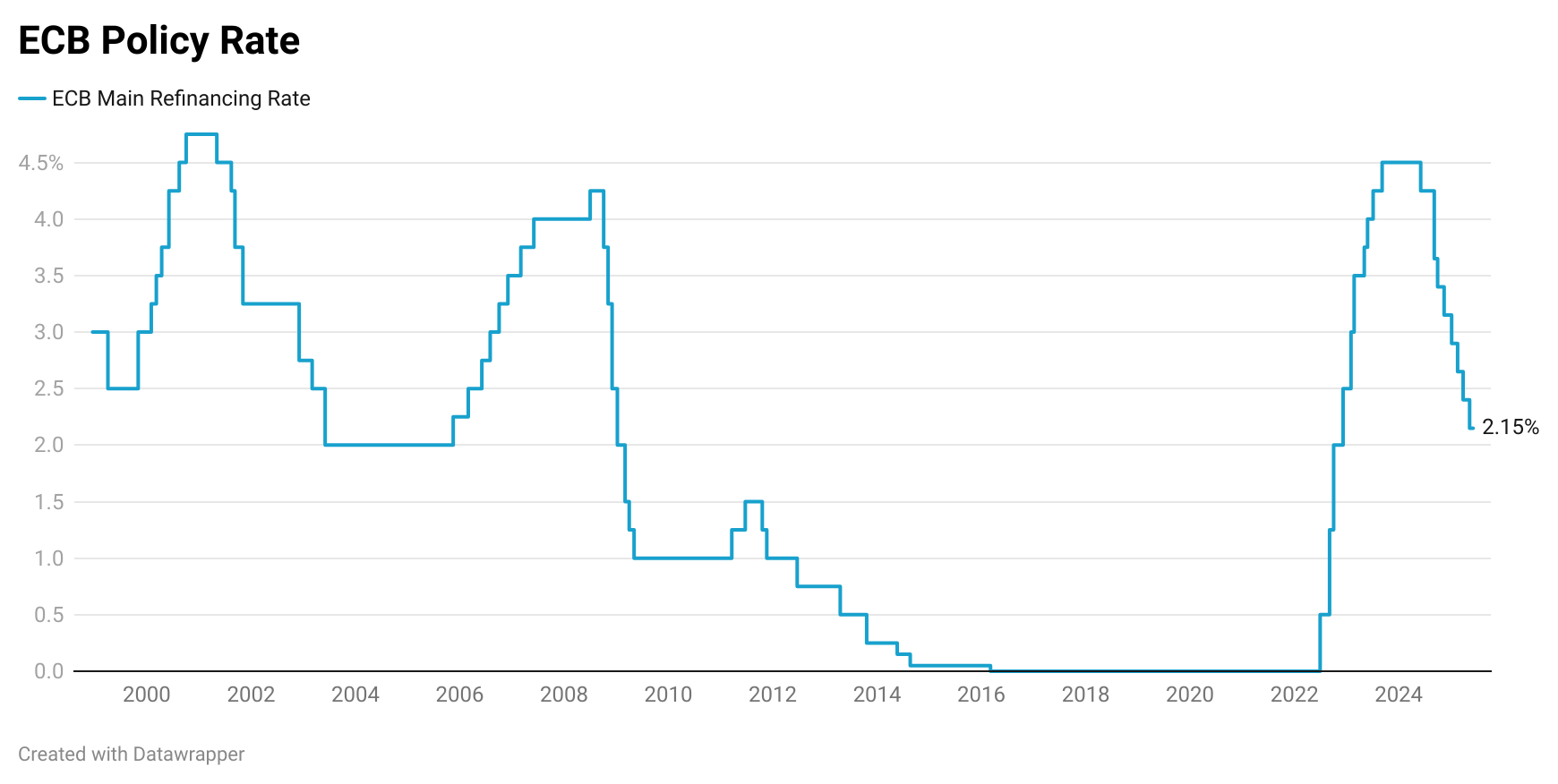

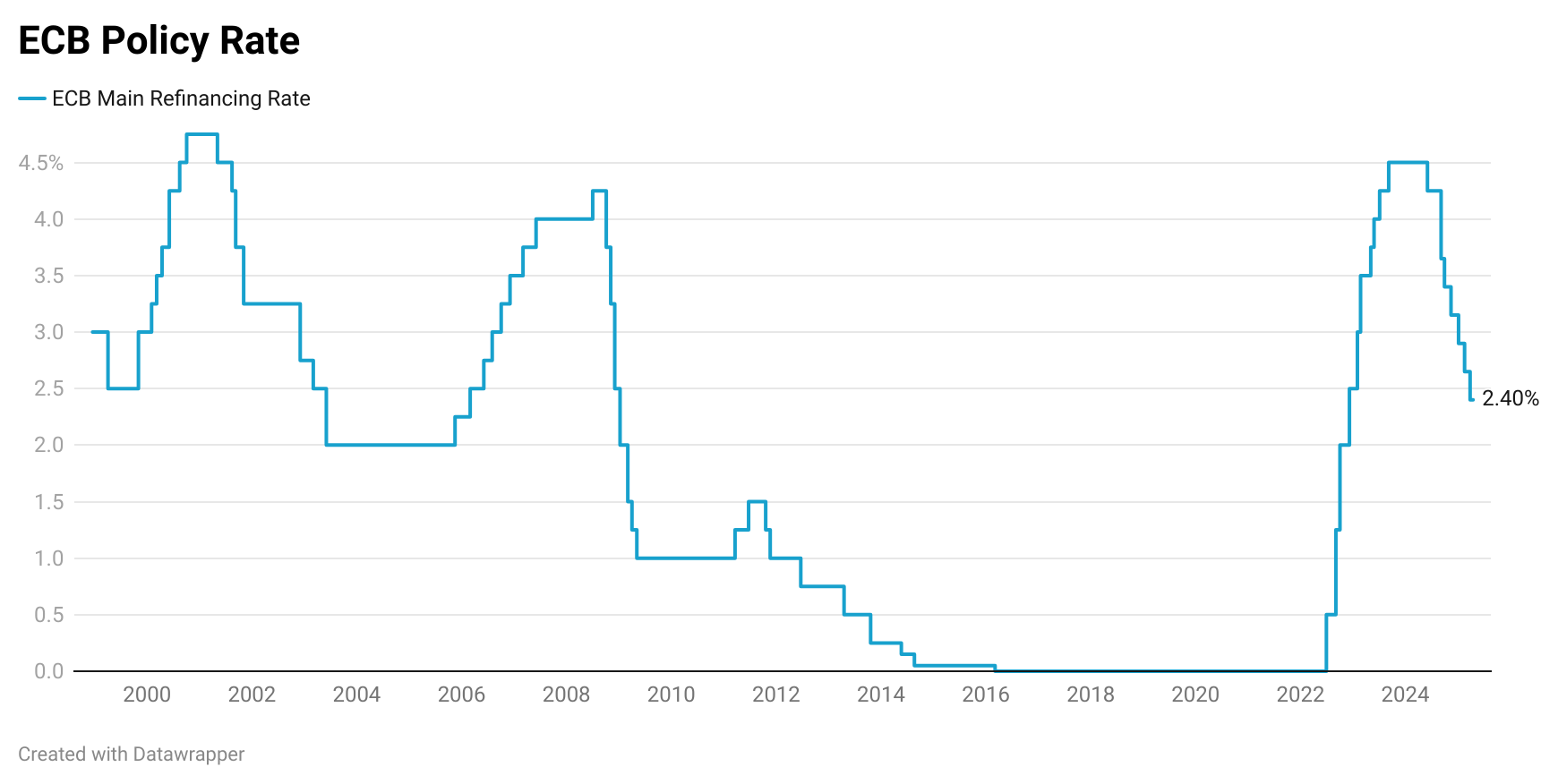

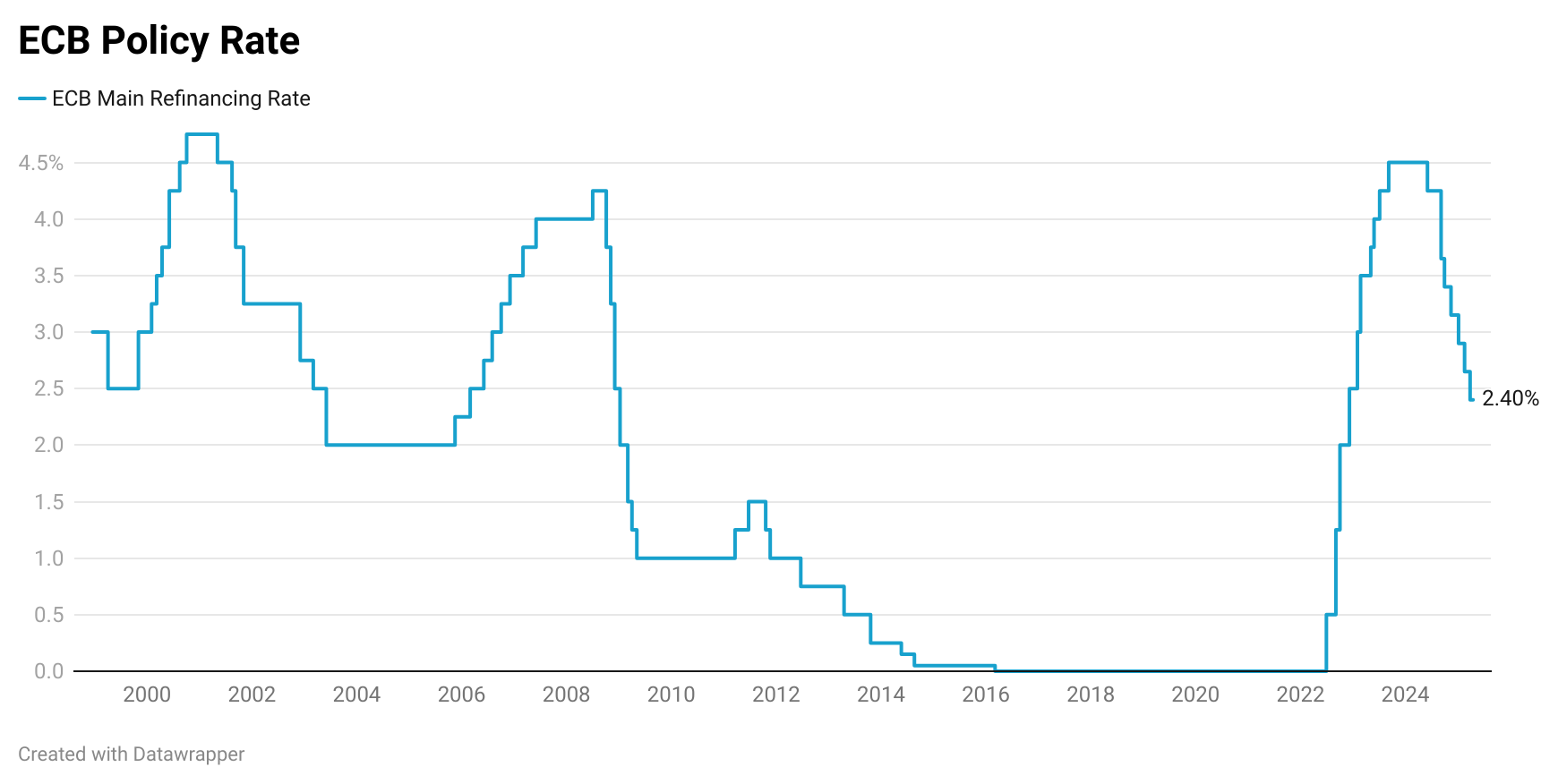

As most expected, the ECB cut its three policy interest rates following the conclusion of the April meeting. dropping the deposit rate to 2.25%, the main refinancing rate to 2.40%, and the marginal lending rate to 2.65%. This is the third straight quarter point cut in 2025, and the fifth straight cut of any size since September 2024. In total, the ECB’s policy rate is down -210 bps over the last two years which means that the central bank has undone almost half of the tightening done during the inflationary post-COVID period in 2022-2023.

Inflation Outlook

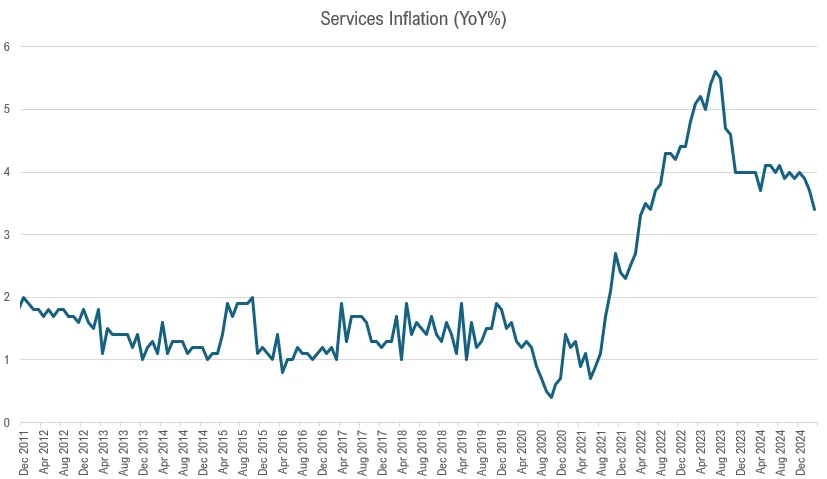

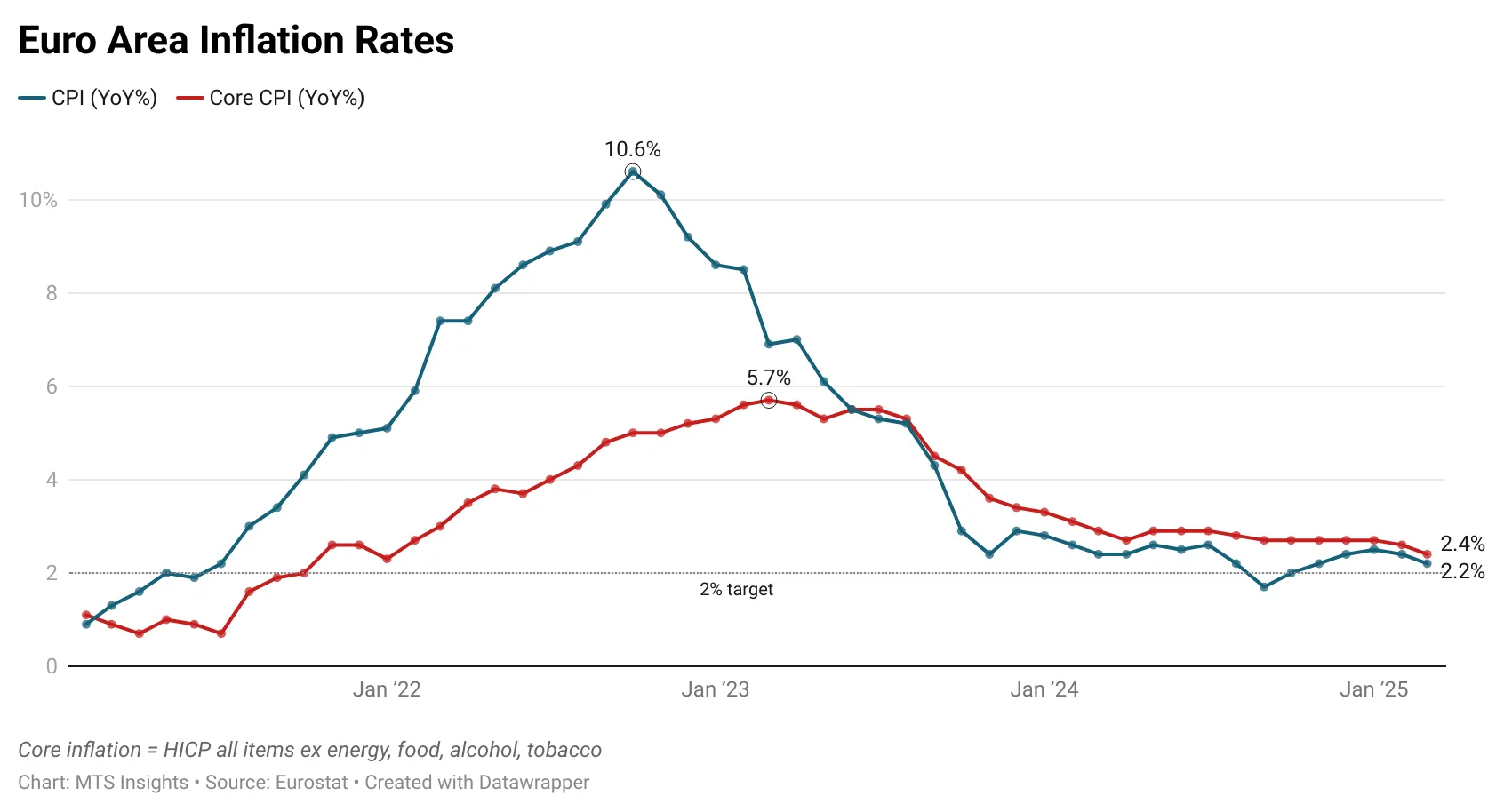

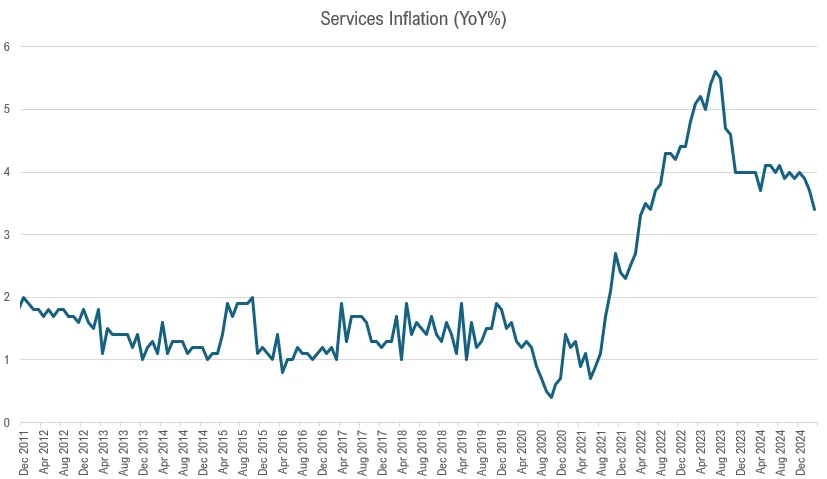

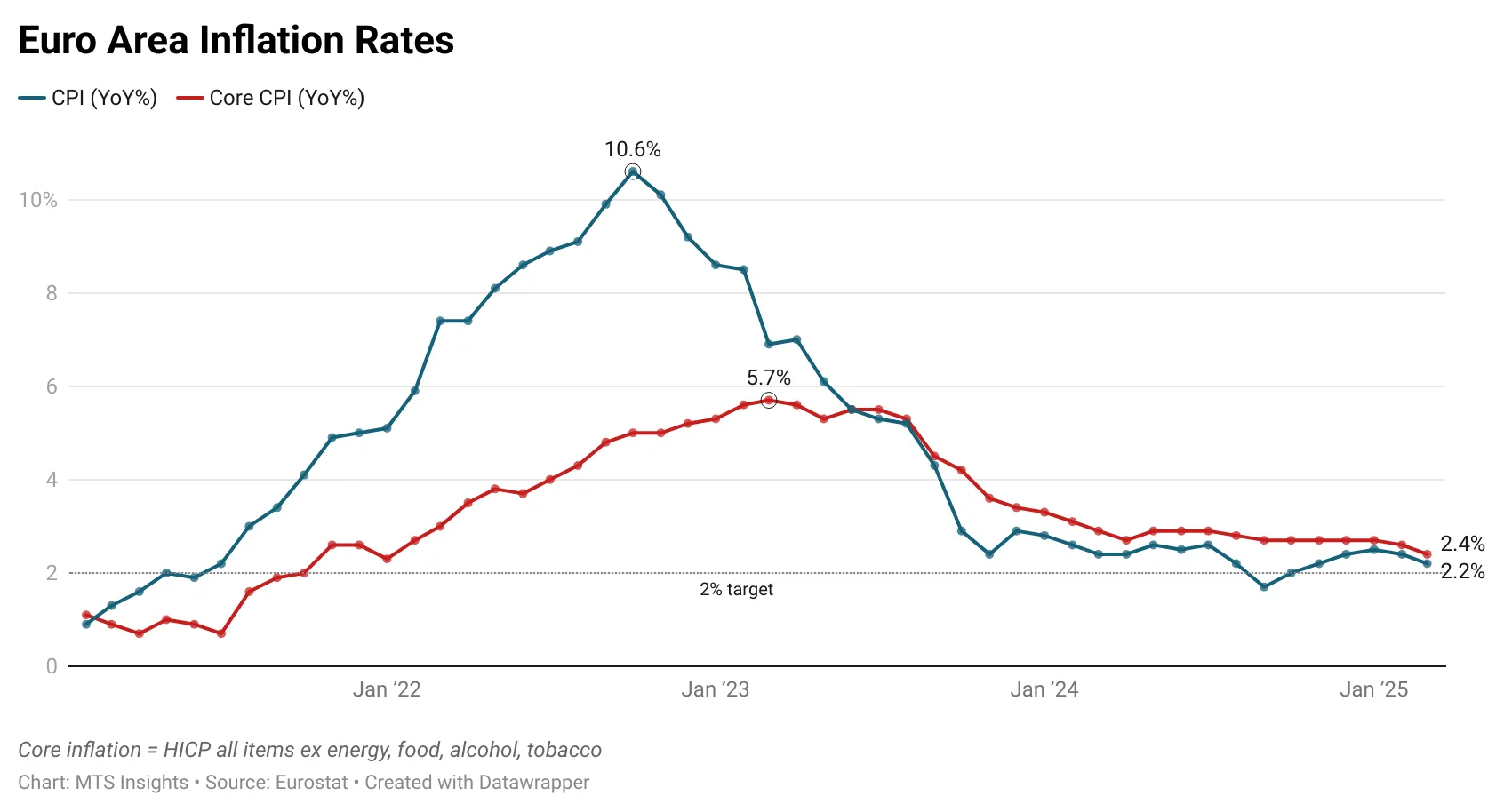

The ECB believed it could cut this month because it has seen progress on the inflation front. The statement is clear to point out that “the disinflation process is well on track,” indicating that the current trend in price growth is following the ECB’s expectations. Notably, services inflation has eased in the last few months and has become a driver of that disinflation. In the March euro area inflation report, the contribution from the services component to headline inflation was down to 1.56 ppts from 1.78 ppts in December 2024, a solid -22 bps drop. This trend gives the ECB confidence that underlying inflation is trending in the right direction toward the 2% medium-term target.

Growth Outlook

As the members become more optimistic about the inflation outlook, they can pivot to the rising risks to the growth outlook. The obvious rising risk to address is the uncertainty that stems from the volatility in US trade policy that now directly affects the euro area following the “Liberation Day” announcement of reciprocal tariffs. The ECB anticipates that uncertainty from trade tensions is “likely to reduce confidence among households and firms,” and the market reaction to the policies is tightening financial conditions. In general, these factors are impacting the economic outlook.

We have seen this rhetoric about balancing inflation concerns and the new risks to the growth outlook from other central banks, including the Bank of England and the Bank of Canada. Both of those institutions have quickly shifted their economic outlooks, especially Canada, but at the same time, they both asserted their commitments to containing inflation. However, neither cut rates like the ECB has today. This is mostly because of differences in inflation trends, and it highlights how dovish the ECB inflation outlook is.

Policy Guidance

At the end of the statement, the ECB continued its data-dependence stance, and it specifically noted that it “is not pre-committing to a particular rate path.” The lack of guidance dampens some of the dovishness of the statement as it keeps a pause very much on the table for the next meeting in June. This will give time for ECB members to see two more inflation reports (April and May) and dozens more updates on US trade policies, which are consistently in flux.

This cut looks to be more driven by the positive inflation outlook than a response to weaker economic conditions. The latest March inflation report was a very positive development as core inflation fell to 2.4% YoY, the lowest rate since January 2022, and it probably had a major impact on ECB members going into the meeting. And with tariffs, both by the US and potential retaliatory measures, bringing the potential for upward inflationary pressures in the next few quarters, the ECB might not have had another chance to point to a solid disinflation trend to cut.

Tariff Outlook

There was no discussion in the statement about how the ECB sees trade developments impacting the economy, but ECB President Lagarde dropped some hints during the press conference. In general, Lagarde highlighted the uncertainty that tariffs bring to the outlook as ECB members do not fully agree on the potential impacts as of right now: “There are diverging views on short, and long-term impact, developments,” and, the ECB will need to time to get a “clearer” view of the “net impact of tariffs on inflation.” One quote was clearer: “Tariffs are a negative demand shock.” This one sticks out to me because it seems like a signal that Lagarde is focused on the downside risks to growth from the tariffs and that they could be a net deflationary event. This would paint today’s cut as more dovish than the statement makes it out to be.

Press conference

ECB Monetary Policy Decision

ECB Monetary Policy Decision