Drewry World Container Index

Drewry World Container Index

- Source

- Drewry

- Source Link

- https://www.drewry.co.uk/

- Frequency

-

Weekly

Thursday

- Next Release(s)

- January 29th, 2026 9:45 AM

-

February 5th, 2026 9:45 AM

-

February 12th, 2026 9:45 AM

-

February 19th, 2026 9:45 AM

-

February 26th, 2026 9:45 AM

-

March 5th, 2026 9:45 AM

-

March 12th, 2026 9:45 AM

-

March 19th, 2026 9:45 AM

-

March 26th, 2026 9:45 AM

-

April 2nd, 2026 9:45 AM

-

April 9th, 2026 9:45 AM

-

April 16th, 2026 9:45 AM

Latest Updates

-

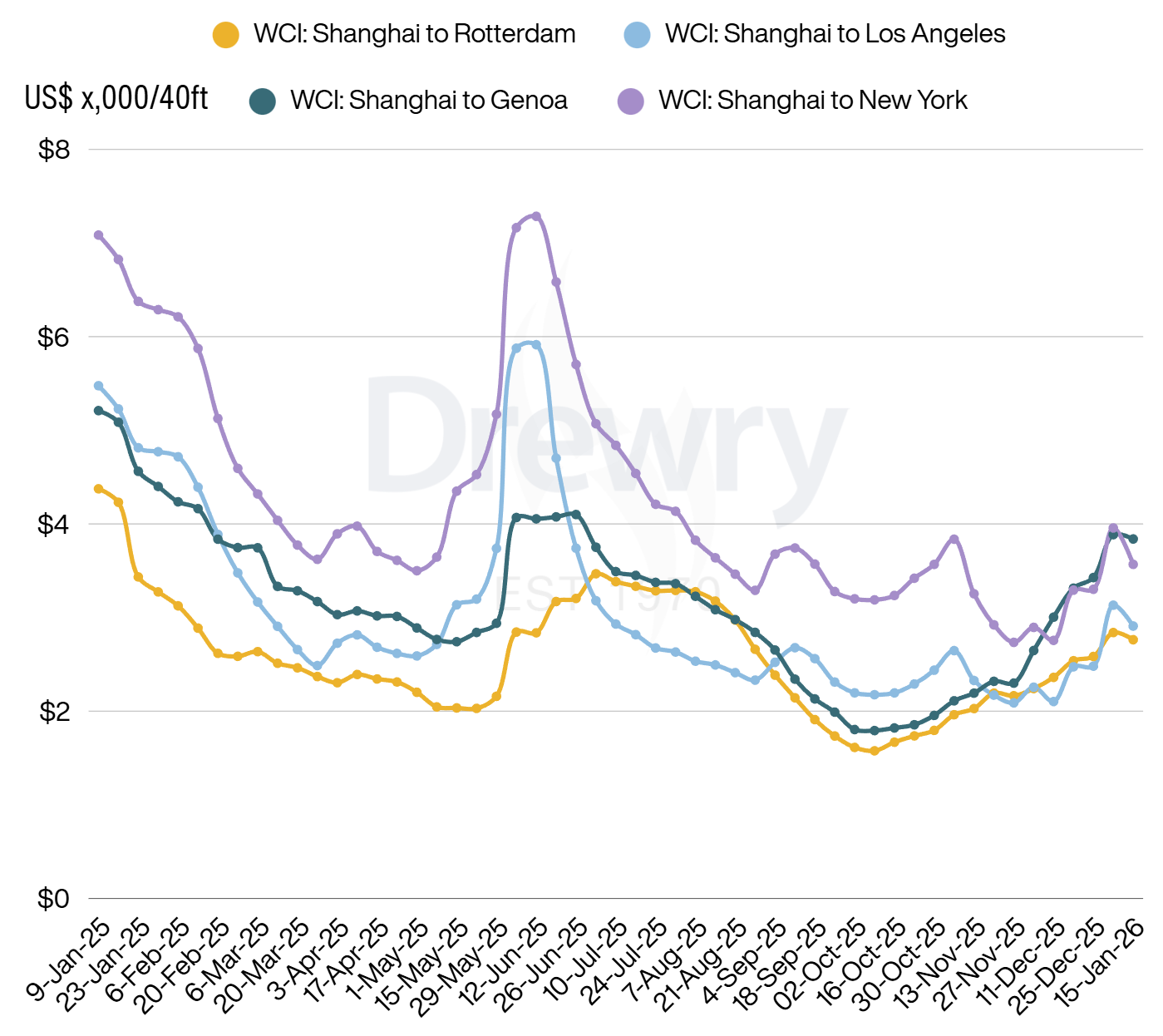

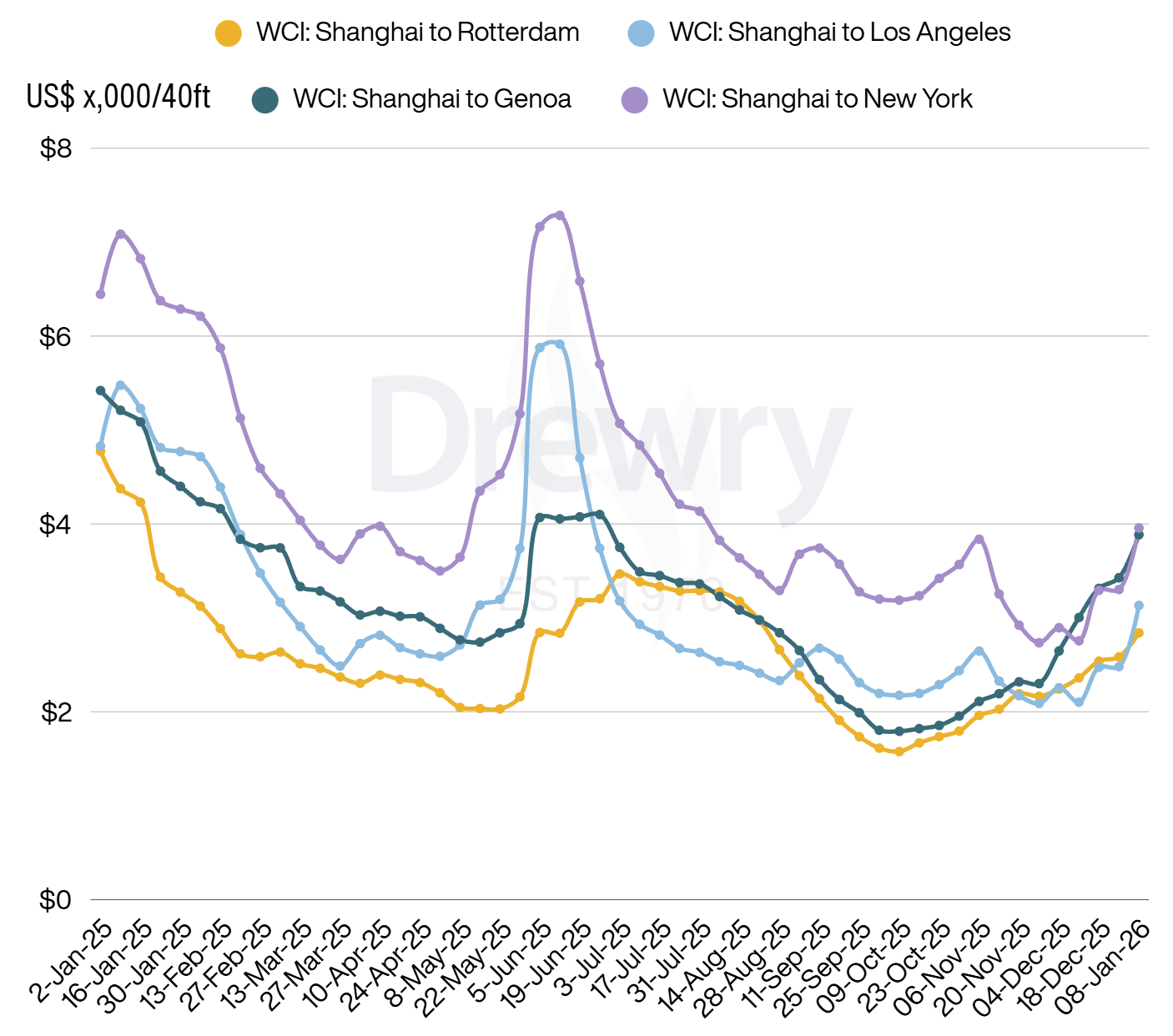

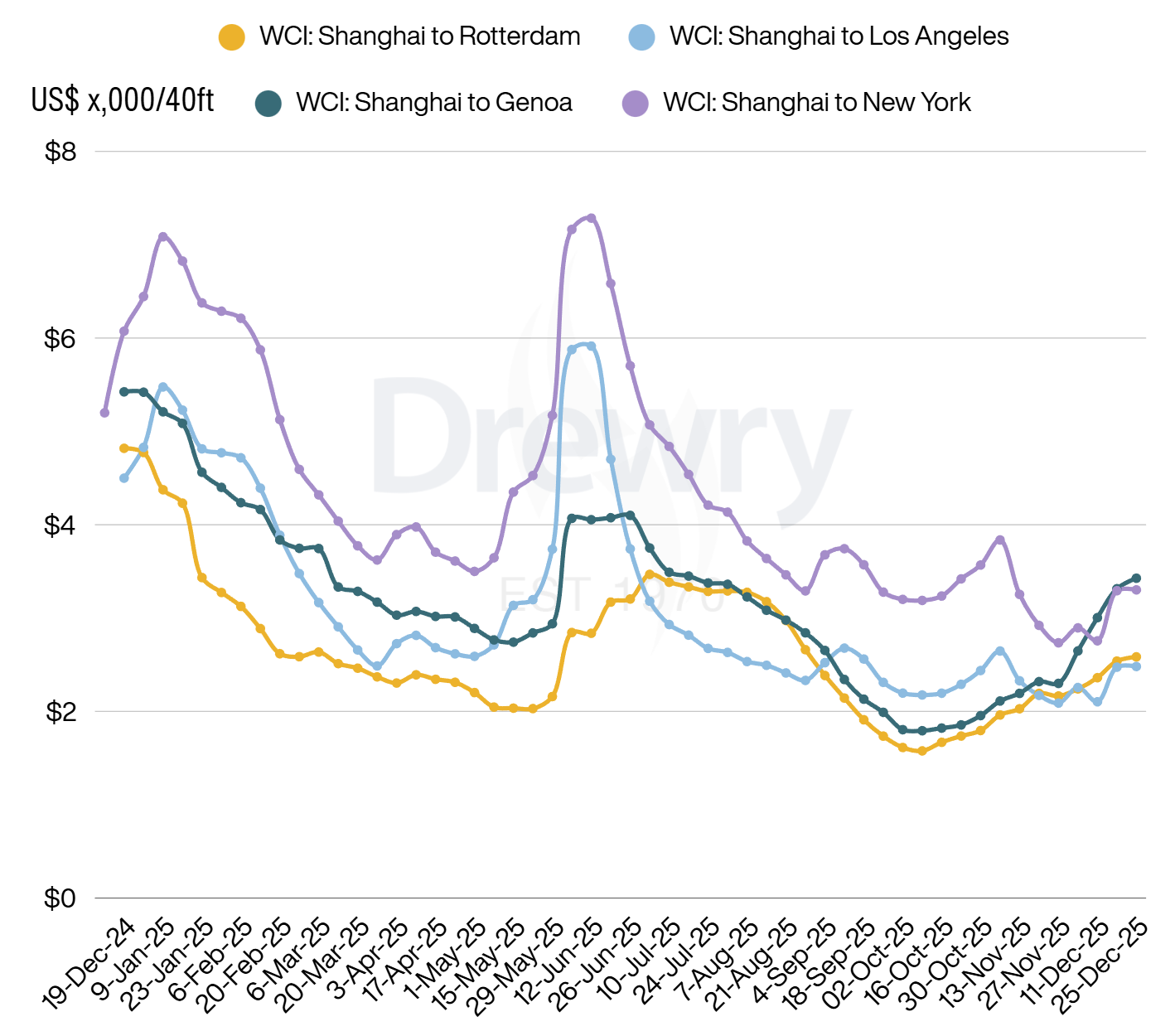

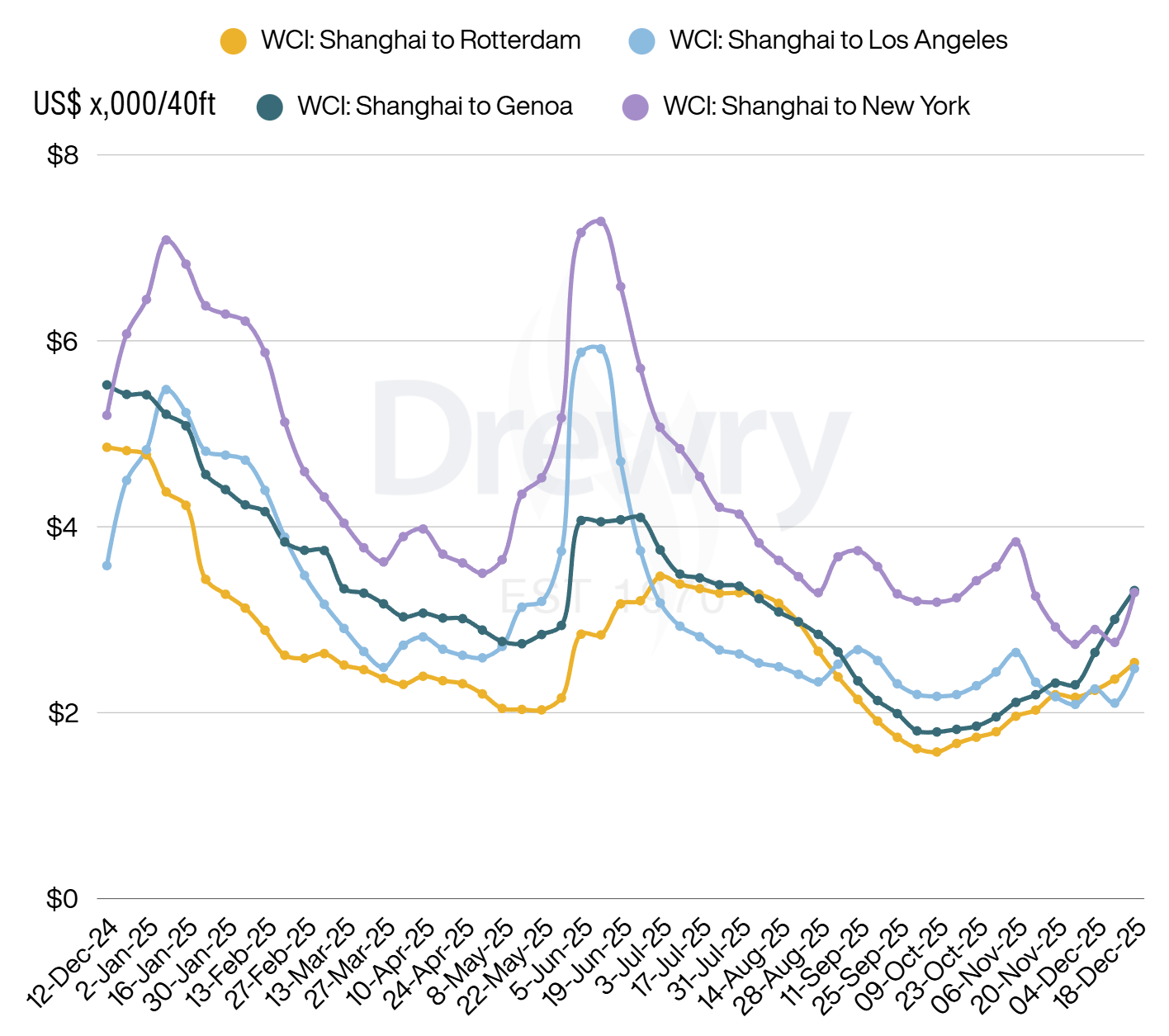

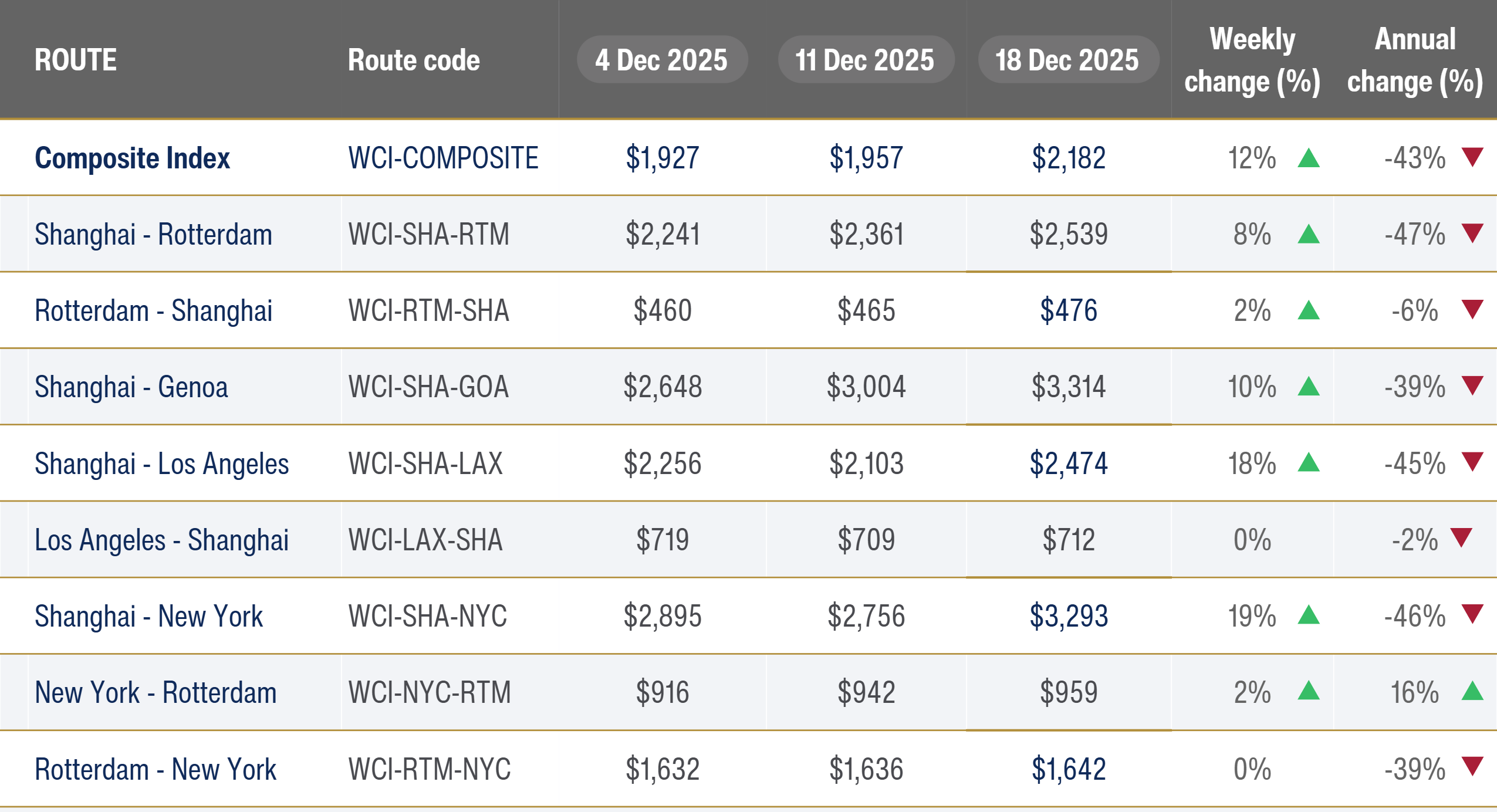

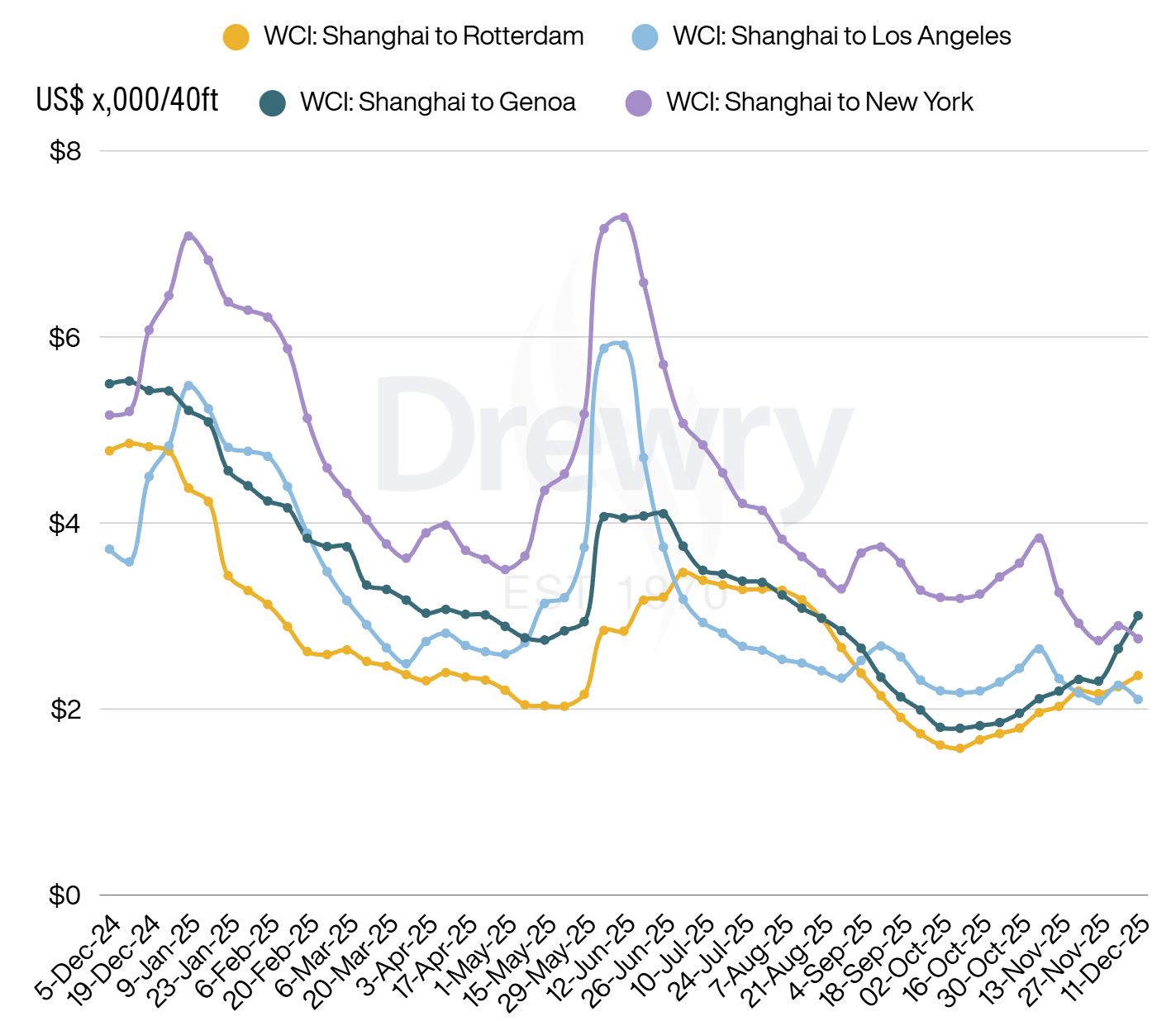

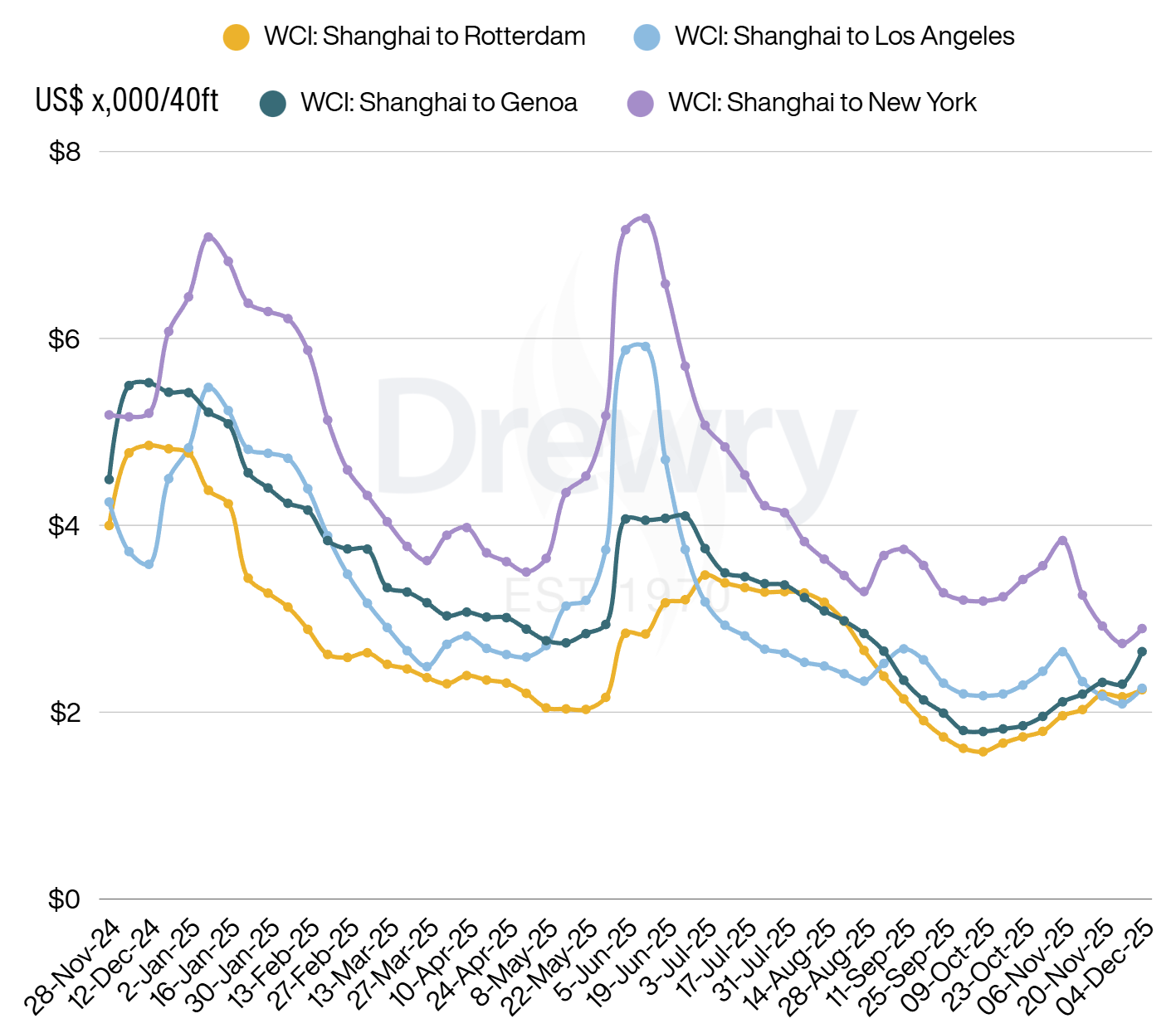

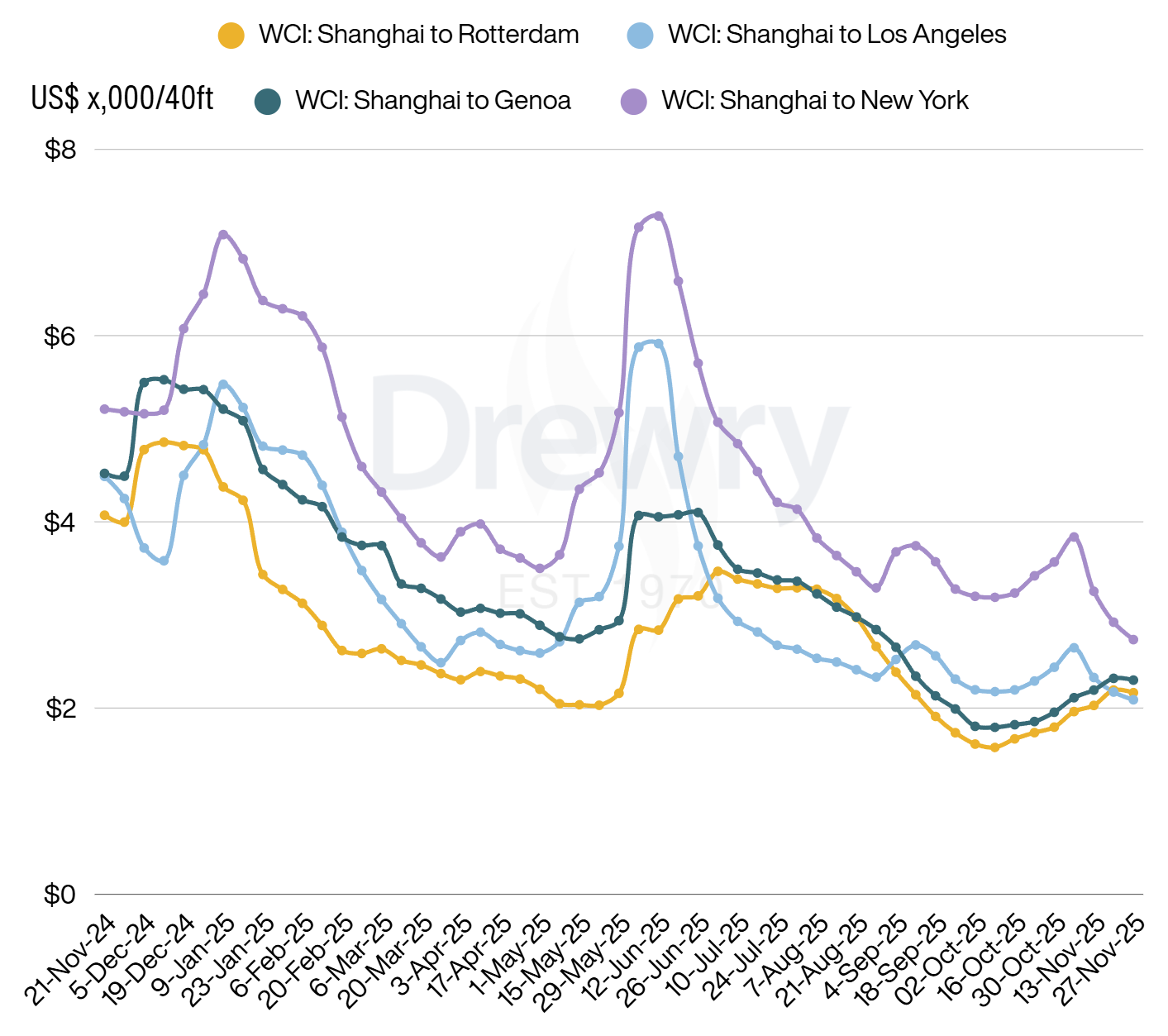

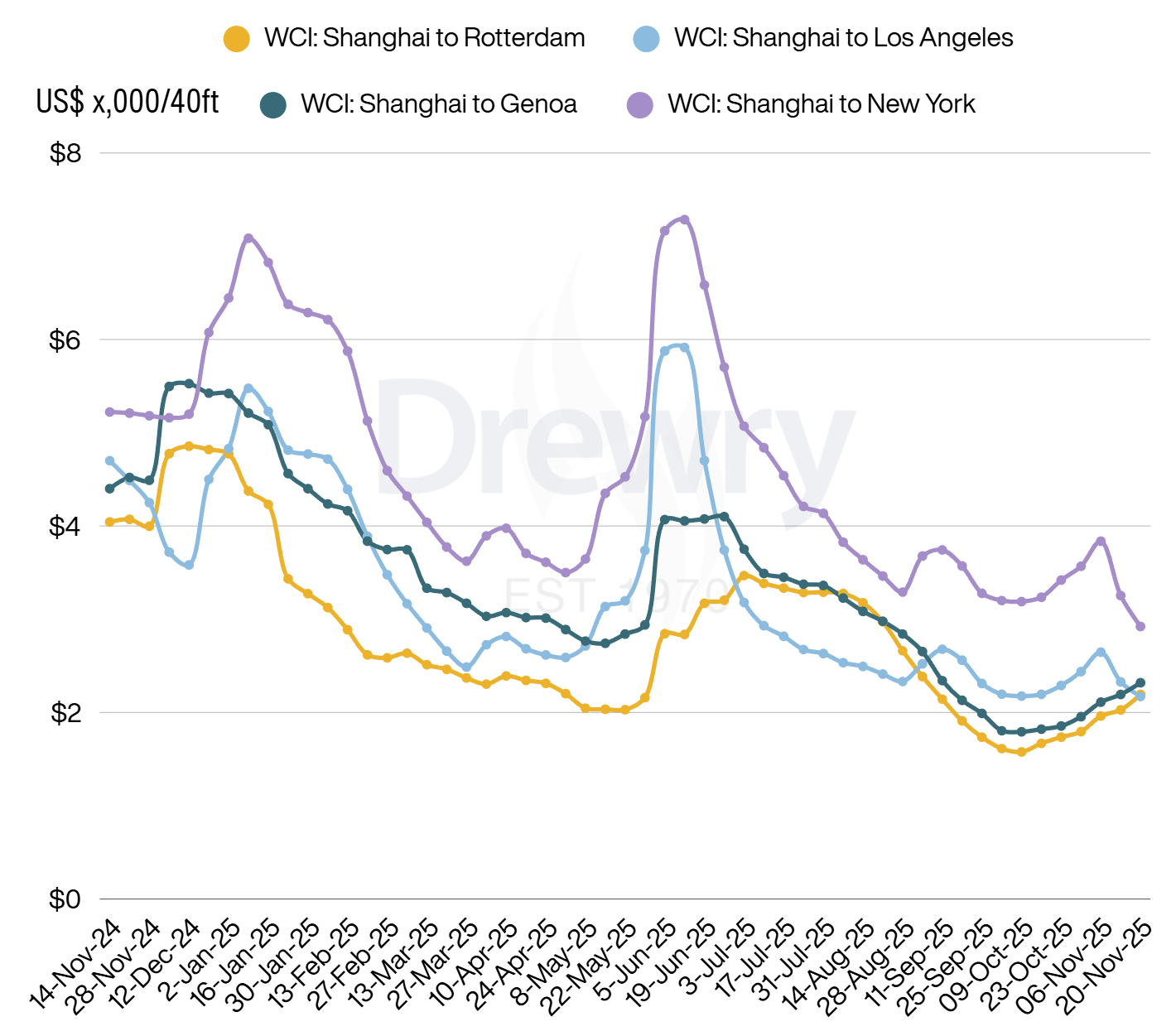

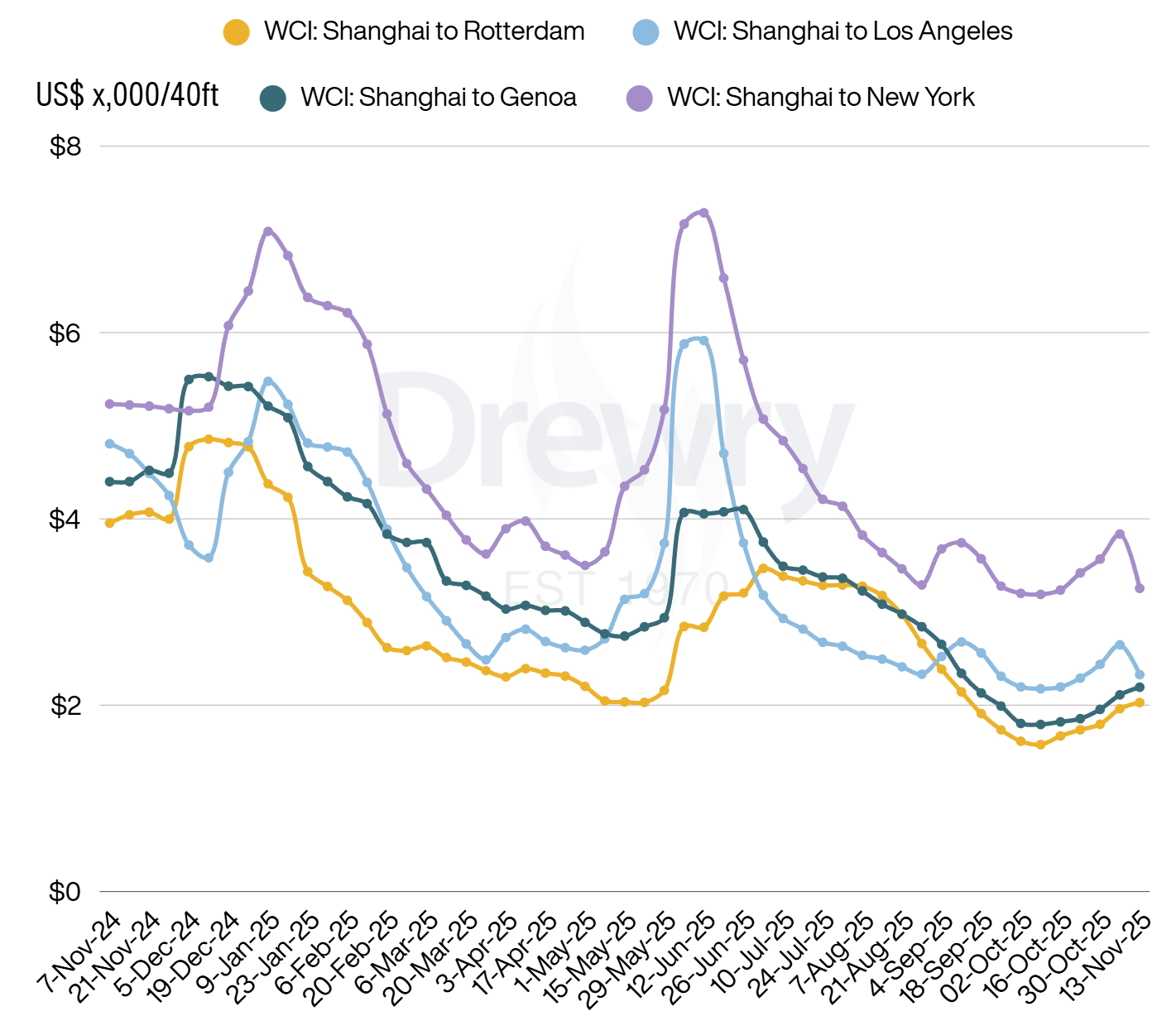

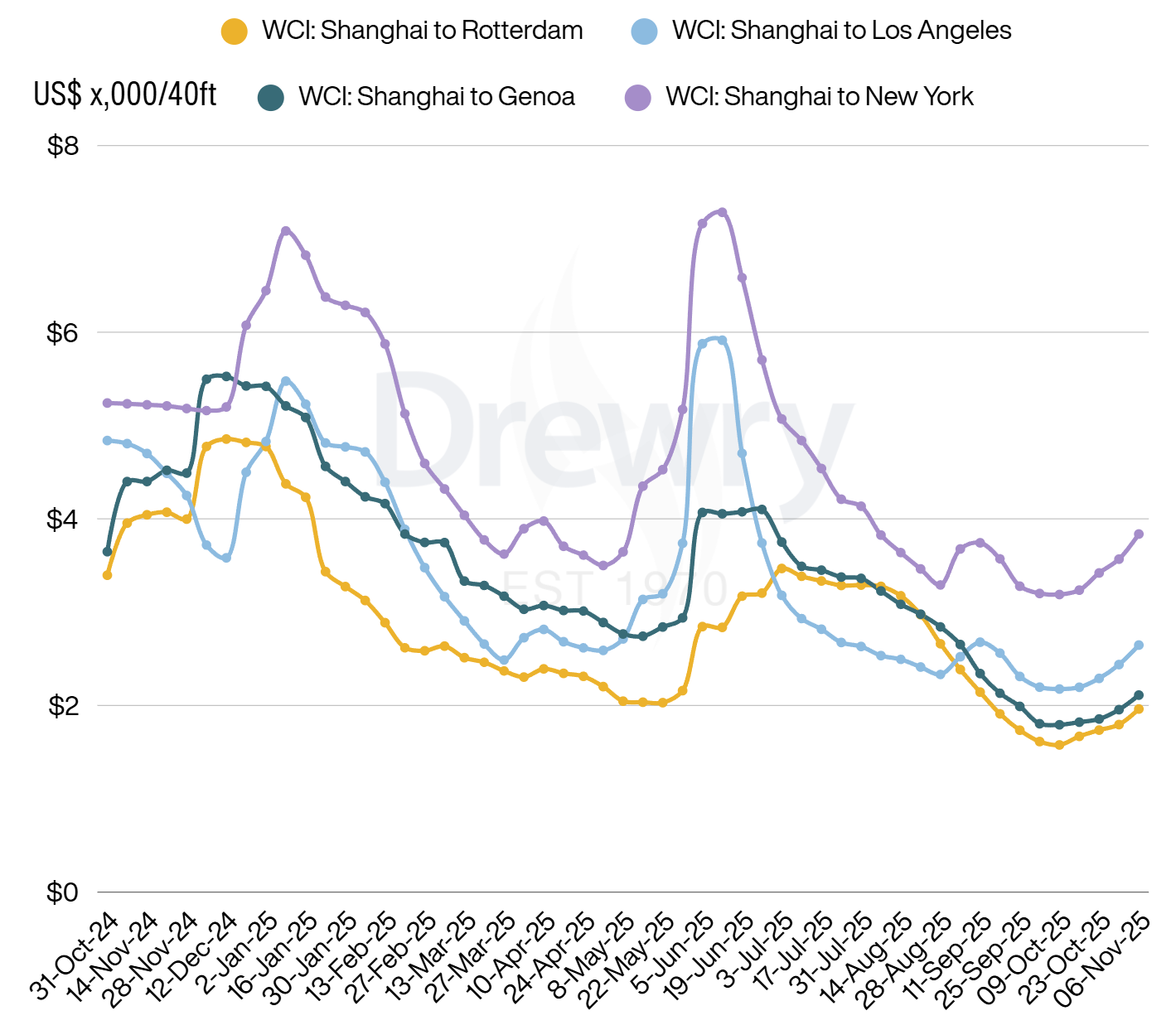

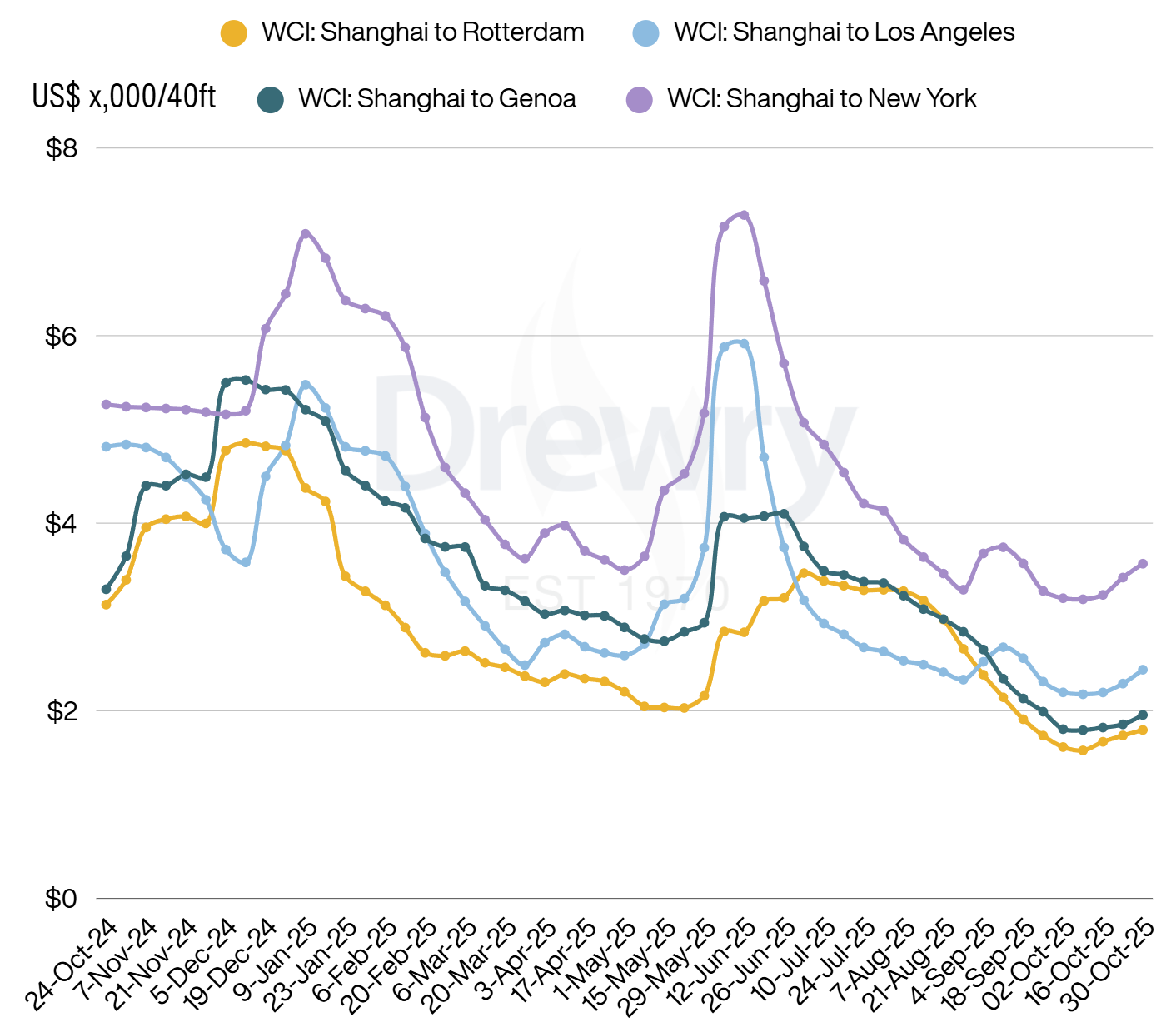

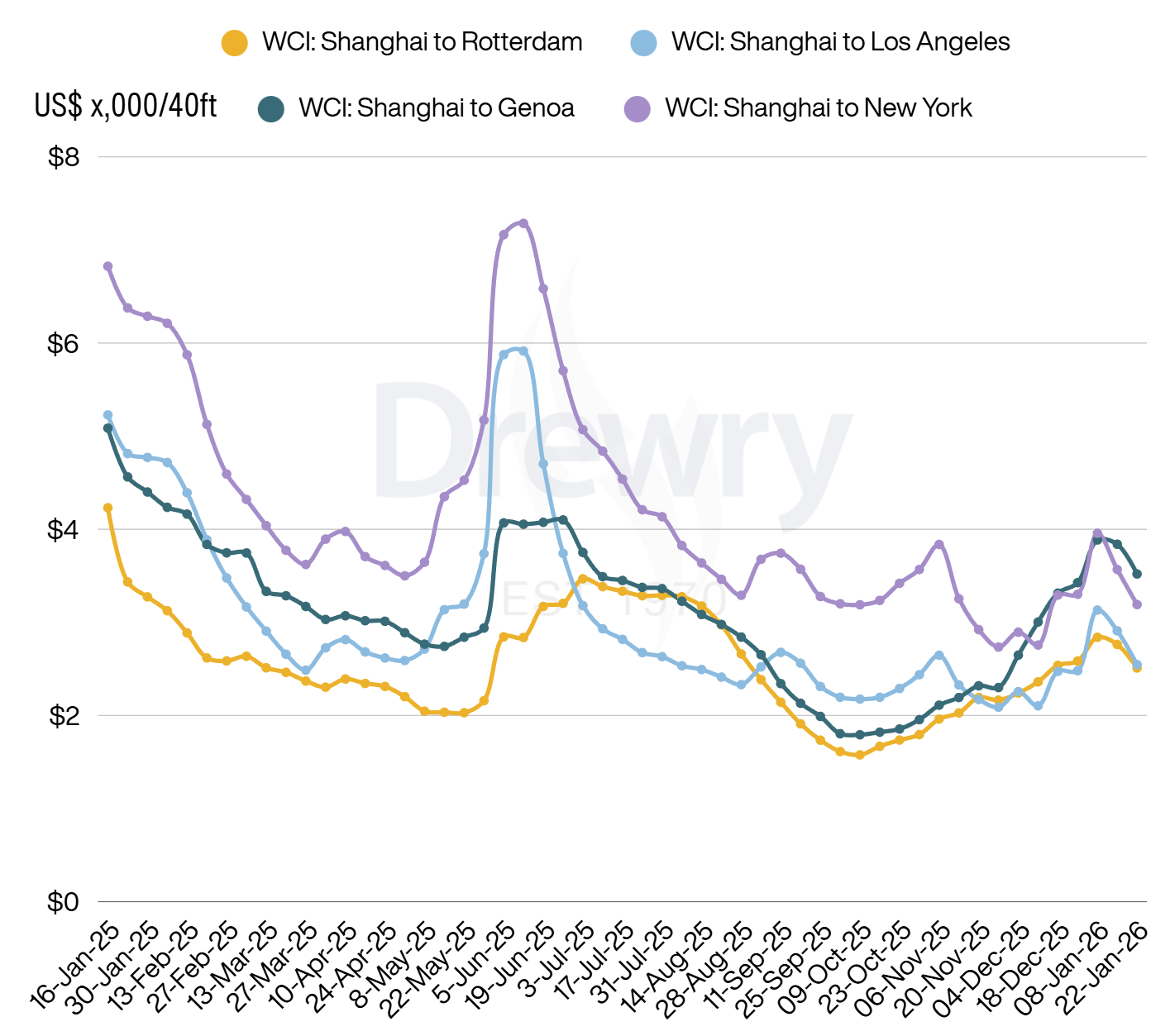

The Drewry World Container Index (WCI) fell -10% WoW to $2,212 per 40ft container, reflecting a broad pullback in Transpacific and Asia–Europe spot rates.

-

The composite WCI declined -10% WoW for a second straight week to $2,212, as falling rates across major routes outweighed any near-term support from capacity management.

-

Shanghai–New York spot rates dropped -11% WoW to $3,191 per 40ft container, pointing to renewed softness on the Transpacific.

-

Shanghai–Los Angeles rates fell -12% WoW to $2,546, another large weekly decline that contributed to the overall index drop.

-

Asia–Europe rates also weakened for a second week, with Shanghai–Rotterdam down -9% WoW to $2,510 and Shanghai–Genoa down -8% WoW to $3,520.

-

Carriers increased blank sailings to offset demand softening after the end of the Chinese New Year cargo rush, signaling active capacity responses to weaker spot conditions.

-

Drewry expects freight rates to decline further in coming weeks, implying continued downward pressure under the current demand backdrop.

-

Carrier routing strategies diverged: CMA CGM is shifting three Asia–Europe services from Suez to the Cape route, while Maersk plans to resume India to U.S. East Coast service via Suez starting Jan 26.

-

The uneven return of Suez-linked capacity is characterized as a gradual “drip-feed,” intended to avoid a sharp spot-rate reset from capacity reintroduction.

-