Cox Automotive Dealertrack Credit Availability Index

Cox Automotive Dealertrack Credit Availability Index

- Source

- Cox Automotive

- Source Link

- https://www.coxautoinc.com/

- Frequency

- Monthly

- Next Release(s)

- October 10th, 2025 10:00 AM

Latest Updates

-

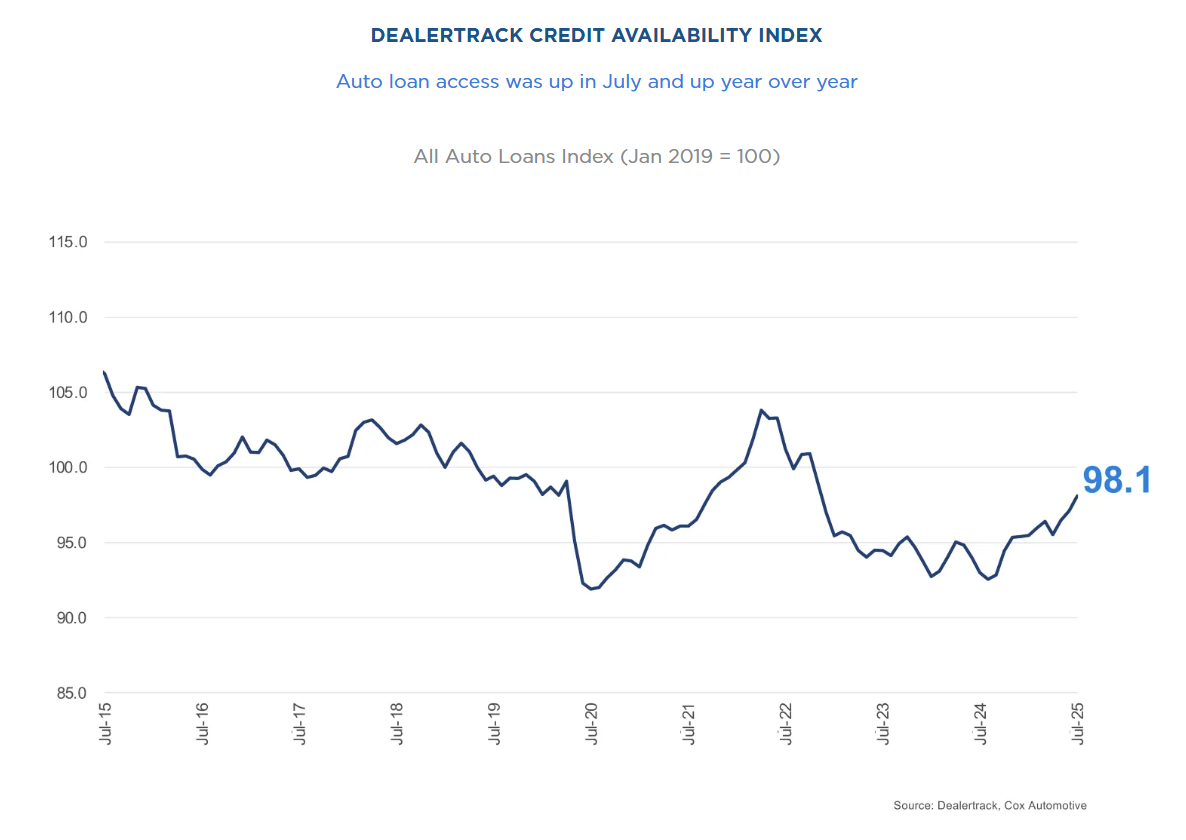

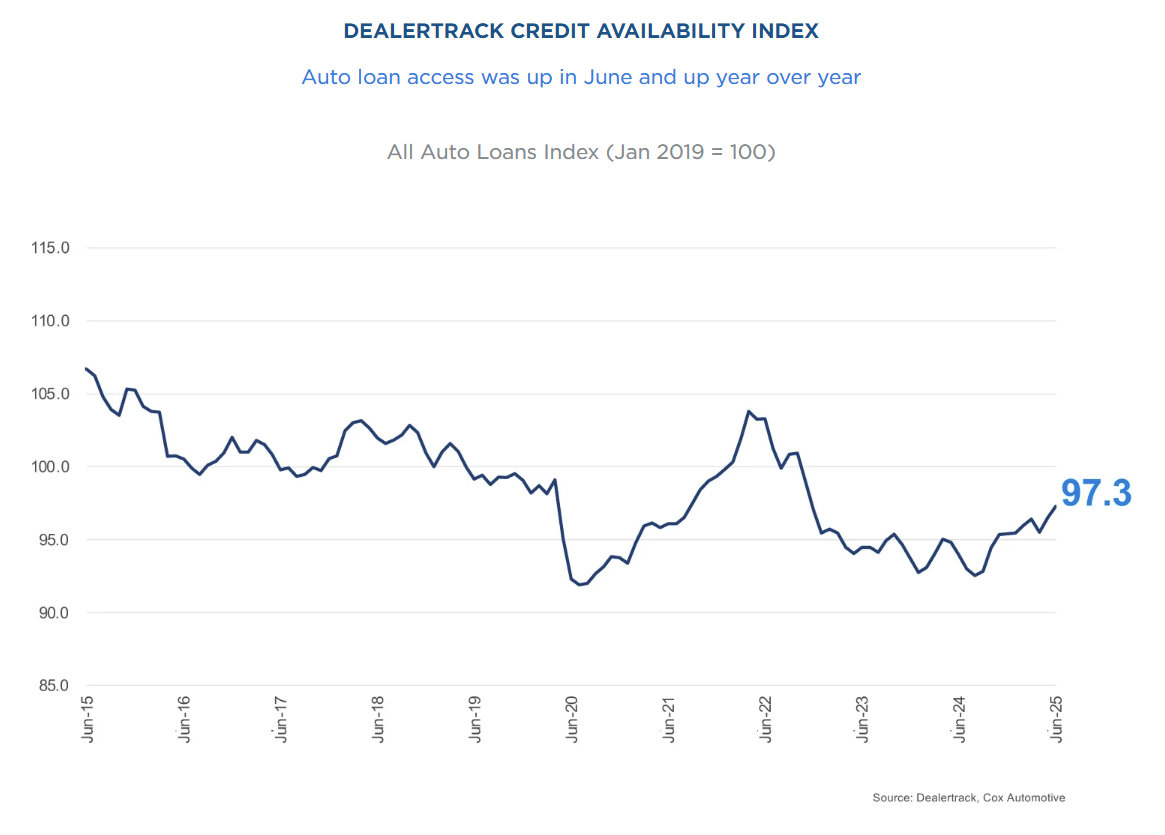

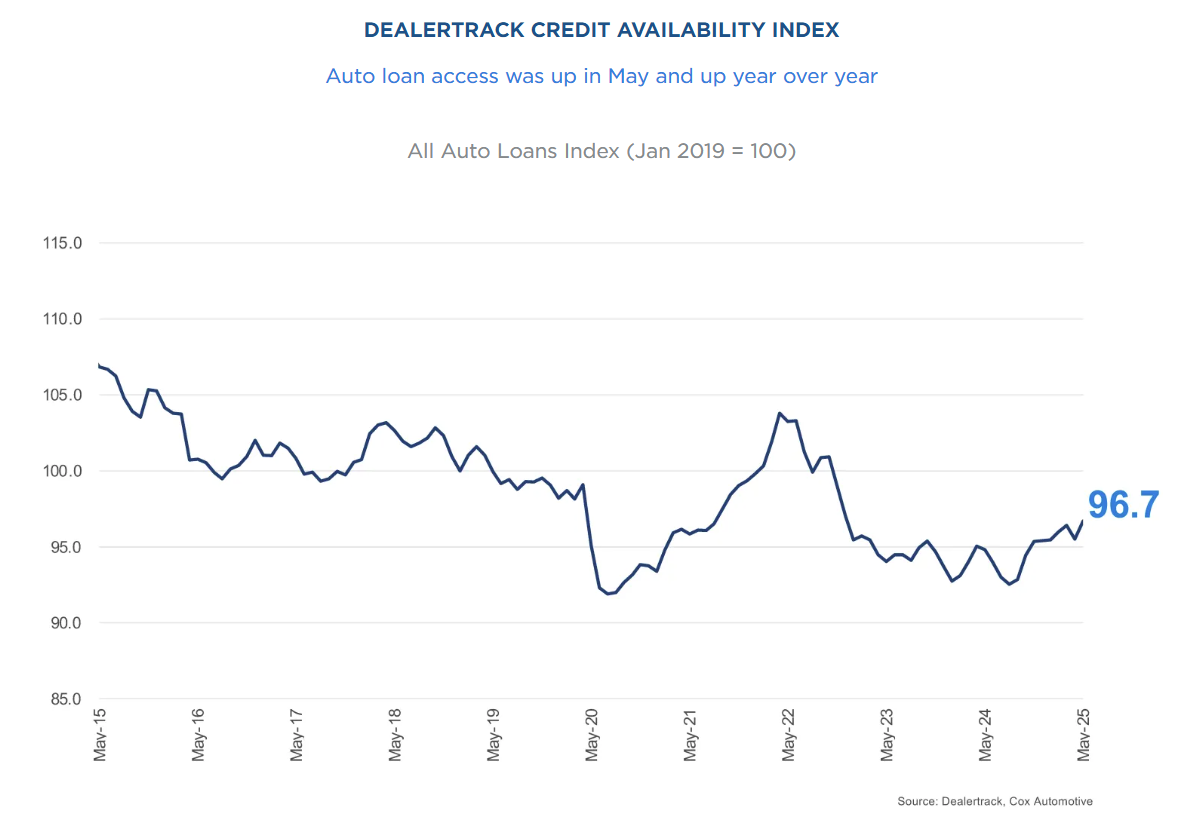

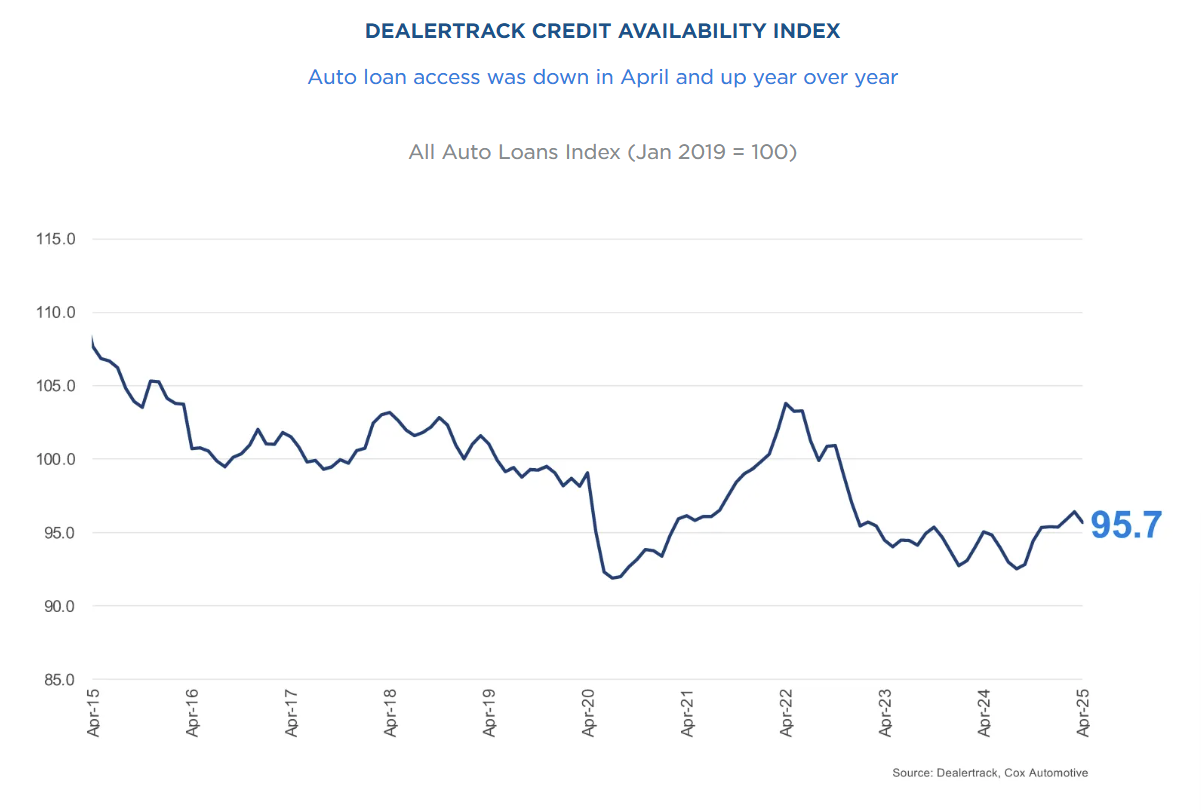

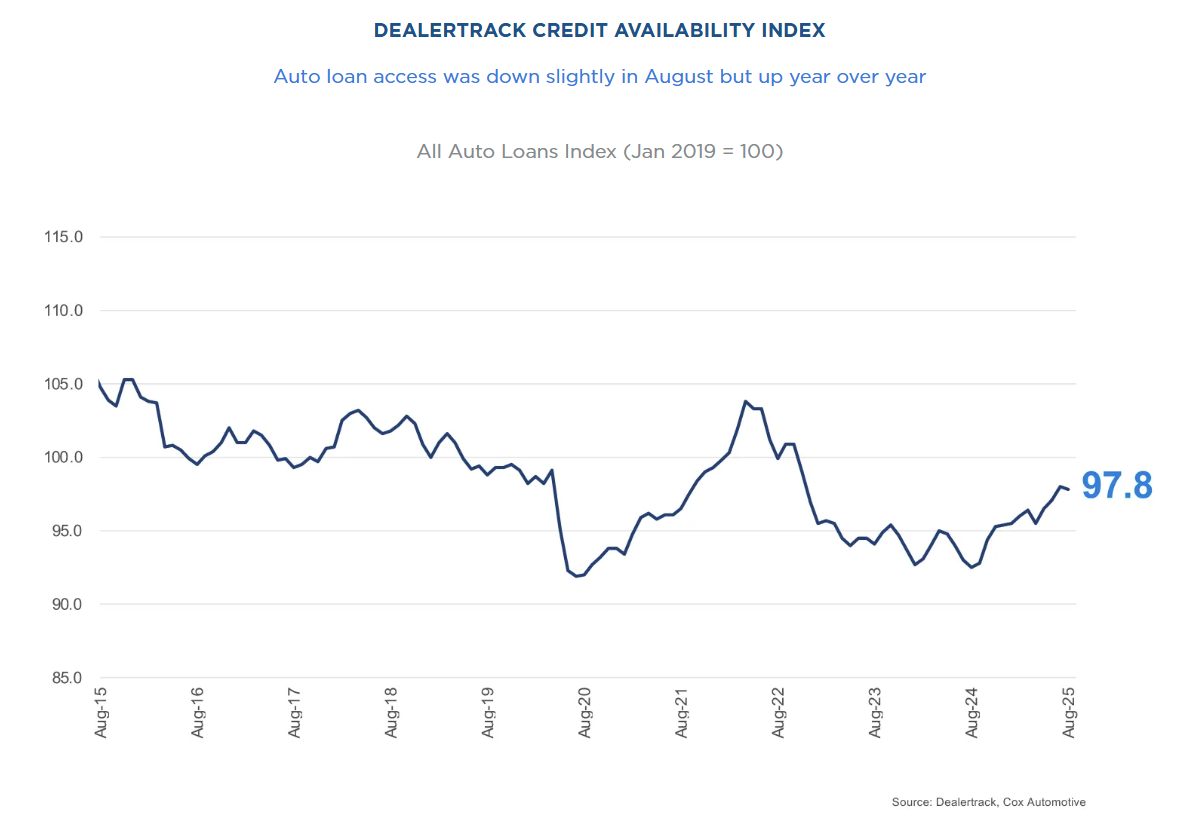

The Dealertrack Credit Availability Index edged down to 97.8 in August 2025 from 98.0 in July, marking a slight tightening in auto credit conditions even as access remains more than 5 points looser than a year ago.

-

Approval rates rose +100 bps to 105.4, the highest of 2025, indicating lenders are still approving more loans overall despite modest tightening elsewhere.

-

The subprime share held steady at 13.6%, suggesting no further expansion into higher-risk lending.

-

The yield spread narrowed -2 bps as the average contract rate fell -18 bps to 10.69% and the 5-year Treasury yield declined -16 bps to 3.79%, showing lenders offering competitive rates.

-

The share of loans >72 months dropped -80 bps to 25.4%, signaling a move toward shorter-term financing.

-

Negative equity share declined -60 bps to 53.5%, indicating improved borrower positions, while average down payments edged up +1 bp to 13.7%.

-

Credit access by channel was mixed: franchised used improved, while certified pre-owned saw the largest decline; by lender type, captives tightened most, while credit unions loosened.

-

Compared to August 2024, credit access was looser across all channels and lender types, with banks and finance companies showing the biggest improvements.

-