Cox Automotive Average New Vehicle Transaction Price

Cox Automotive Average New Vehicle Transaction Price

- Source

- Cox Automotive

- Source Link

- https://www.coxautoinc.com/

- Frequency

- Monthly

- Next Release(s)

- March 10th, 2026 10:00 AM

Latest Updates

-

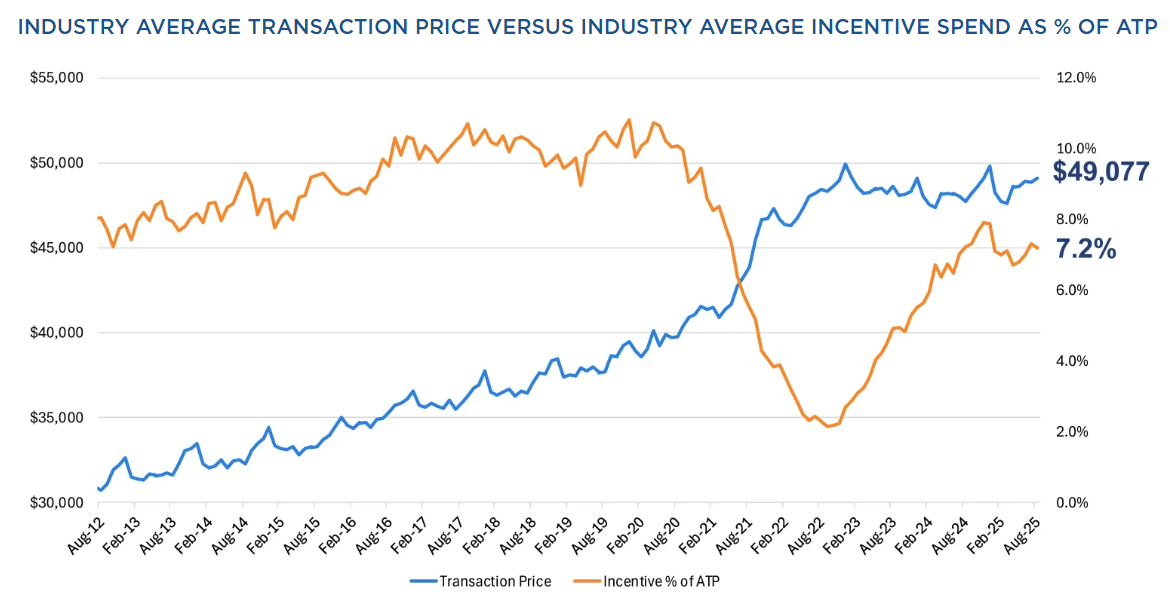

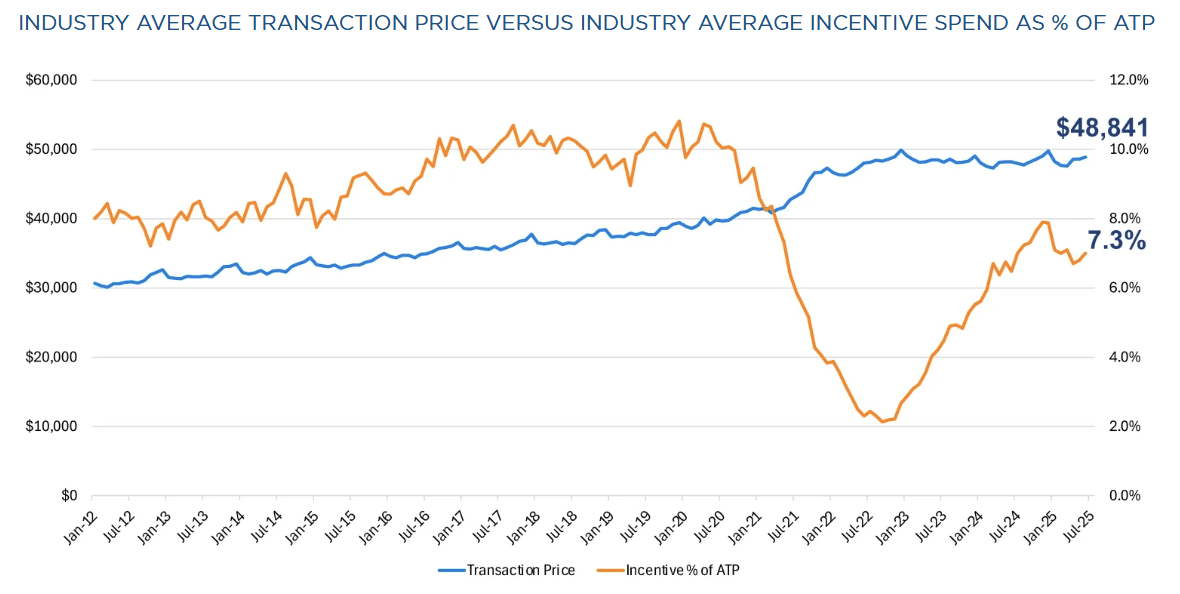

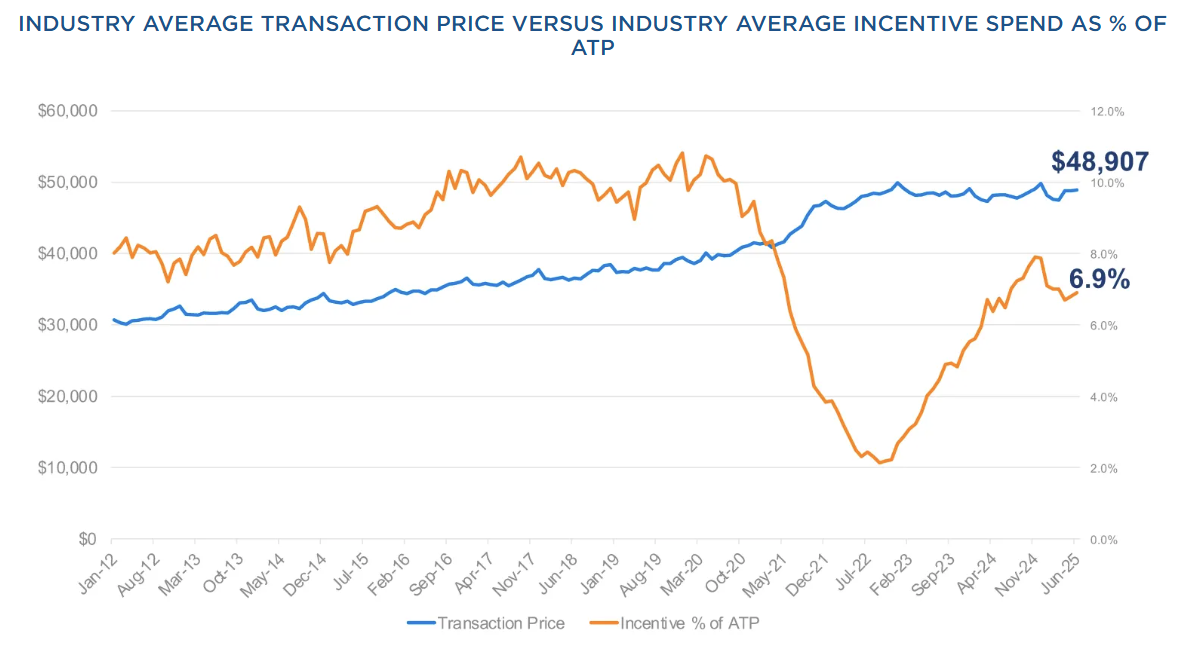

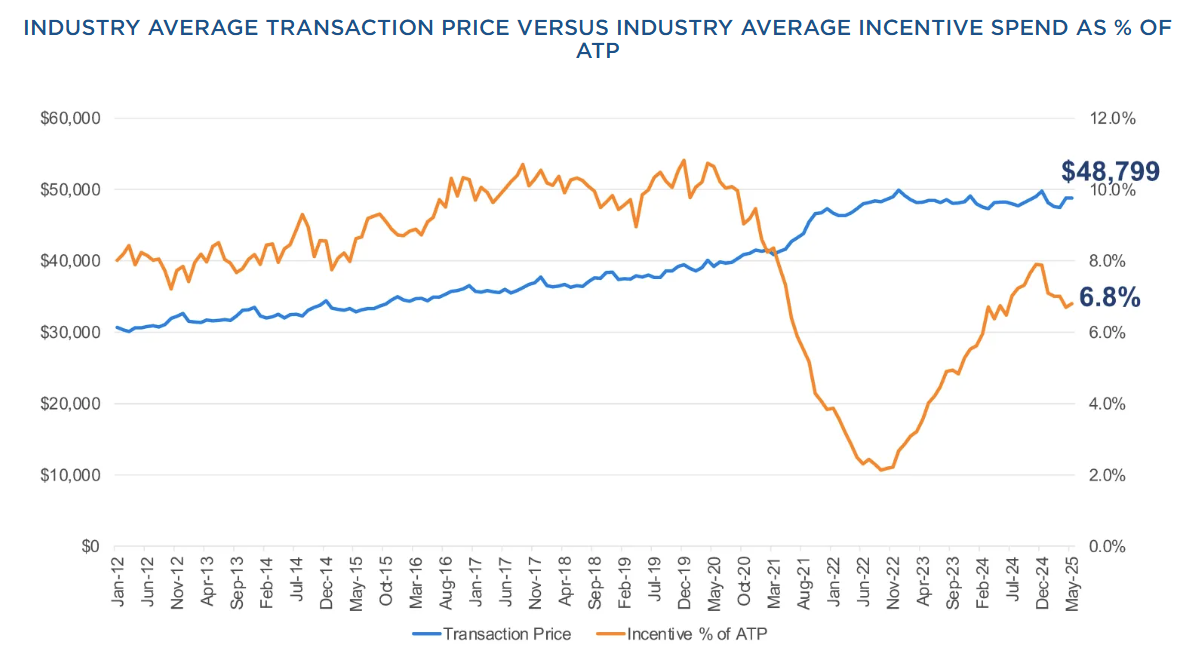

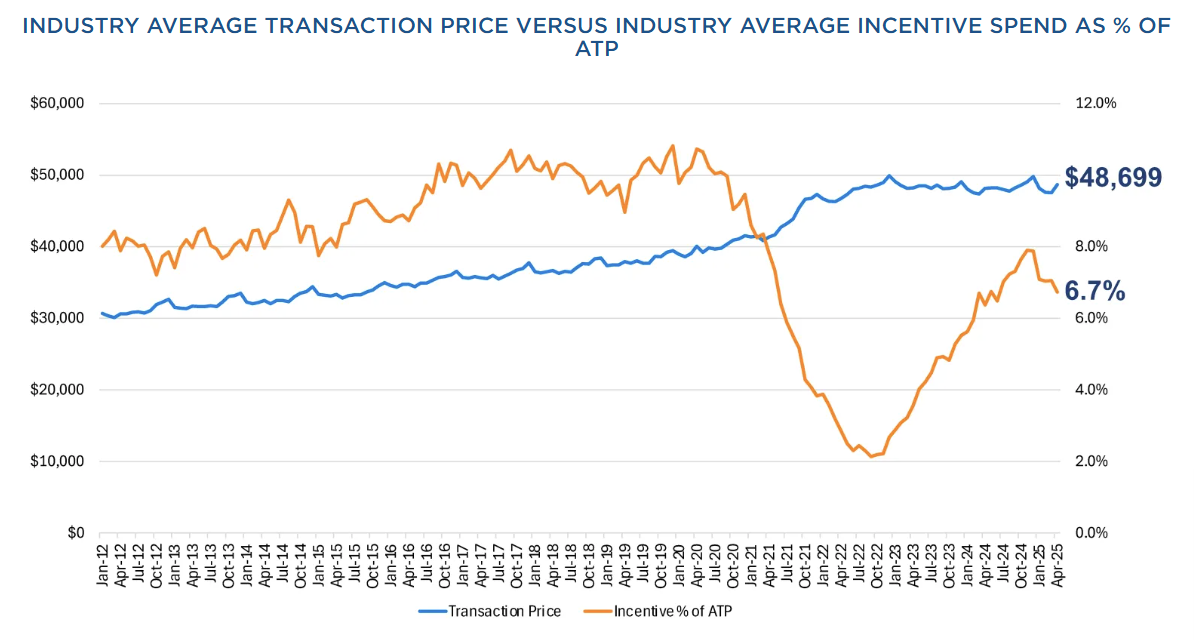

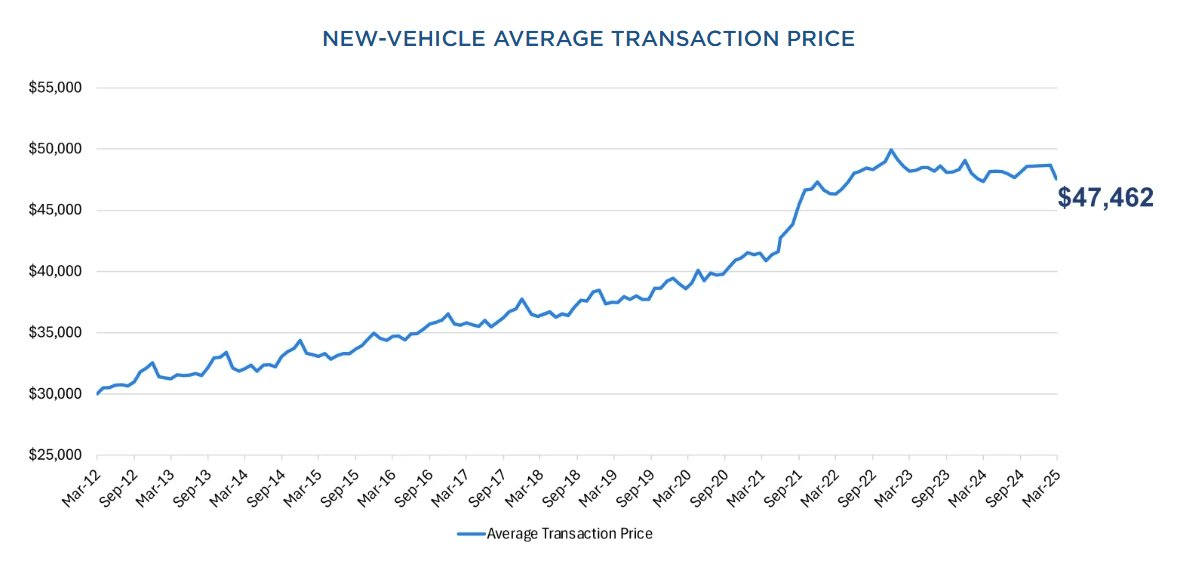

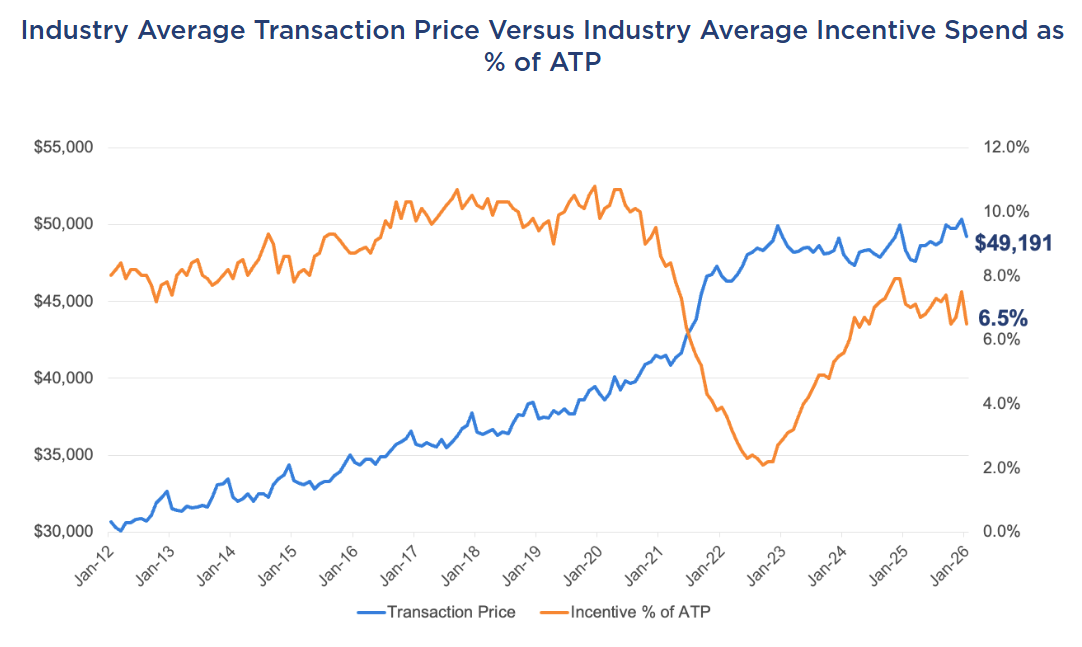

The average new-vehicle ATP rose +1.9% YoY to $49,191 in January (a record high for the month) but fell -2.2% MoM from December, reflecting normal seasonal cooling after year-end strength.

-

The January ATP of $49,191 marked an all-time high for the month and compared with a revised $50,318 in December, indicating prices remain elevated despite a typical post-holiday pullback.

-

The average MSRP increased +2.1% YoY to $51,288 and has stayed above $50,000 for 10 consecutive months, showing sustained elevation in asking prices even as the annual gain ran below the typical ~3% January increase.

-

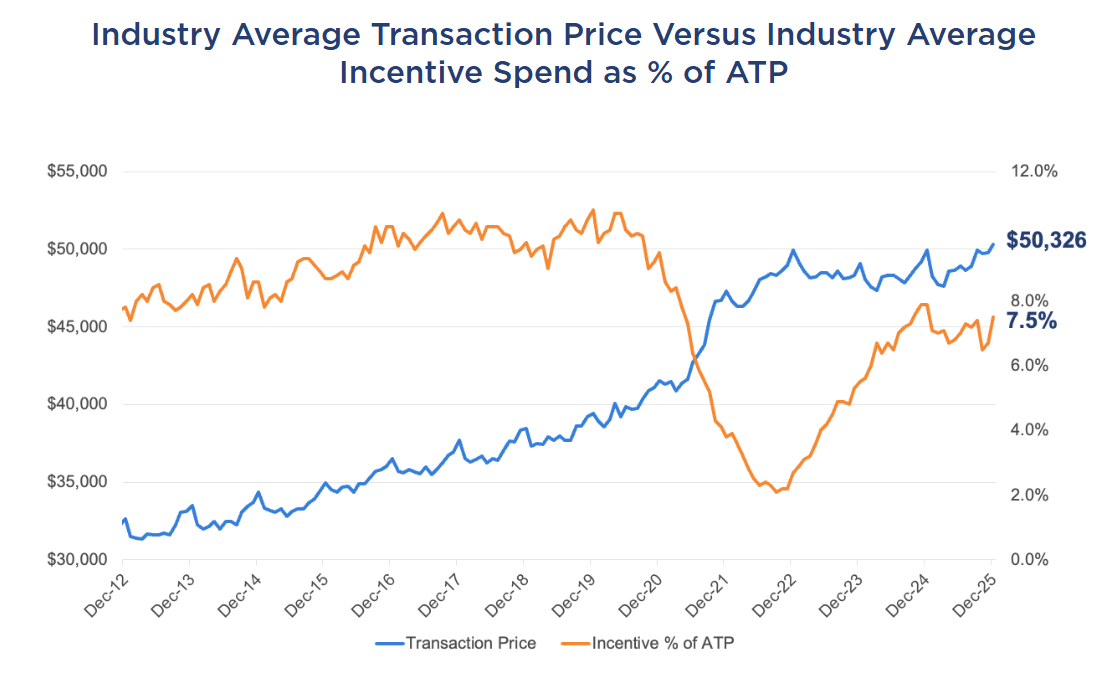

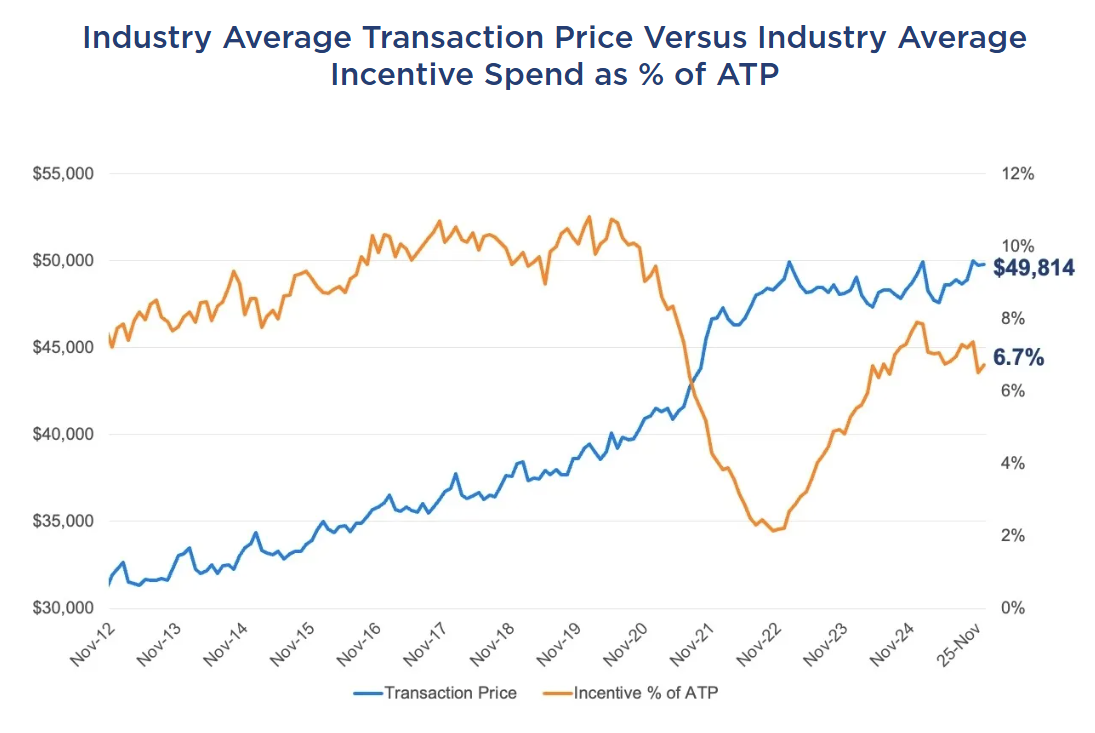

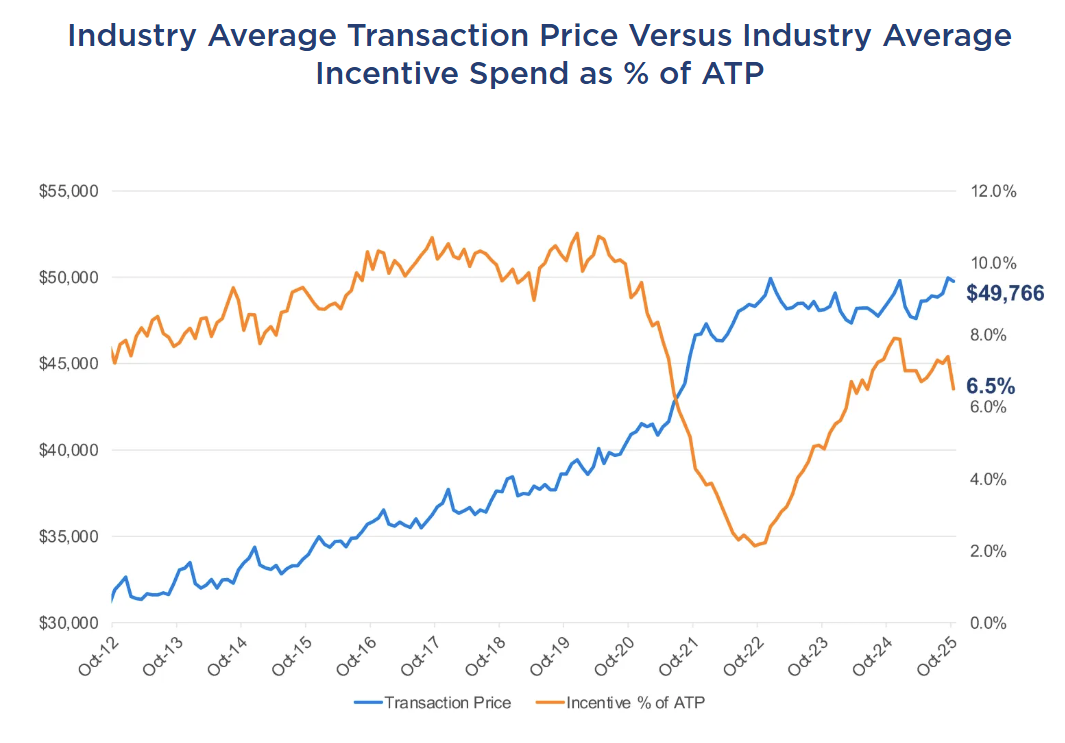

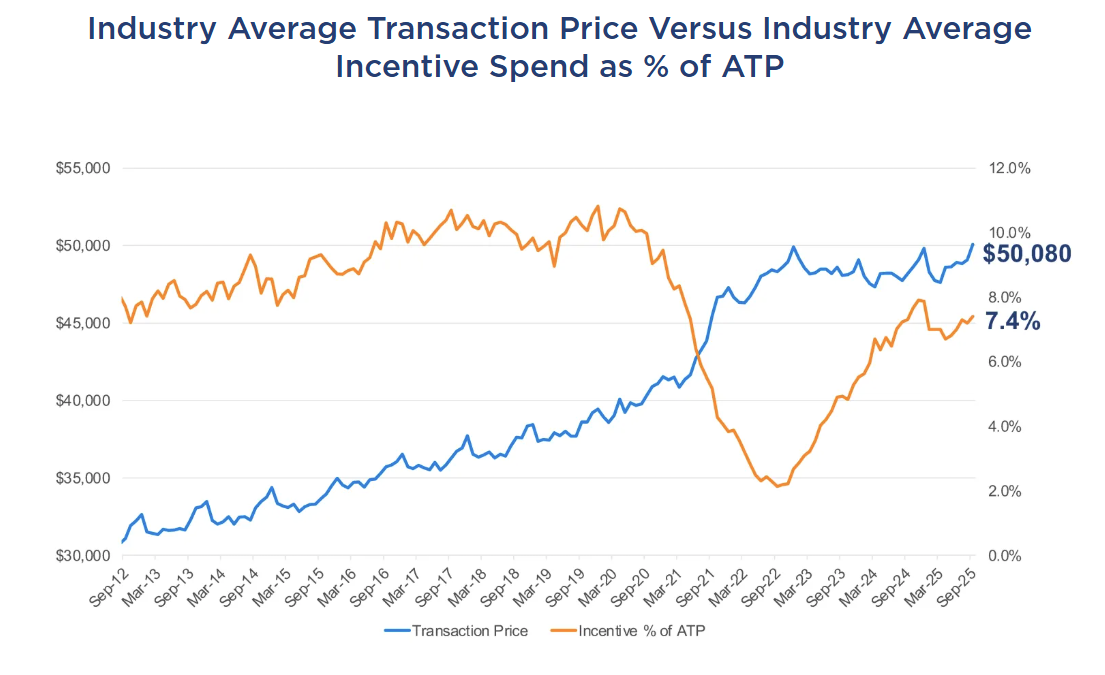

Sales incentives averaged 6.5% of ATP (~$3,200) in January, down from 7.5% in December and 7.1% a year ago, suggesting automakers reduced discounting to protect margins.

-

Compact SUVs, the best-selling segment, had ATPs of $36,414 (-0.4% YoY) versus the industry’s +1.9% YoY gain, highlighting that high volumes persist in lower-priced core segments.

-

Full-size pickups continued to lift averages, with average MSRPs above $70,000 for a fifth straight month and more than 150,000 units sold, underscoring resilience in high-priced segments.

-

Subcompact cars averaged MSRPs below $26,000 but recorded fewer than 4,000 sales, while no vehicle now carries an average MSRP below $20,000, reflecting the ongoing disappearance of true entry-level options.

-

EV ATPs declined -3.1% MoM and -0.6% YoY to $55,715, while EV incentives fell to 12.4% of ATP (from 18.3% in December), indicating both softer pricing and reduced discounting versus late 2025.

-

Tesla’s ATP fell -2.2% YoY to $52,628, and total EV sales were just over 66,000 units (-20% MoM; nearly -30% YoY), showing a sharper contraction in EV volumes relative to the broader market’s -25.4% MoM industry decline.

-