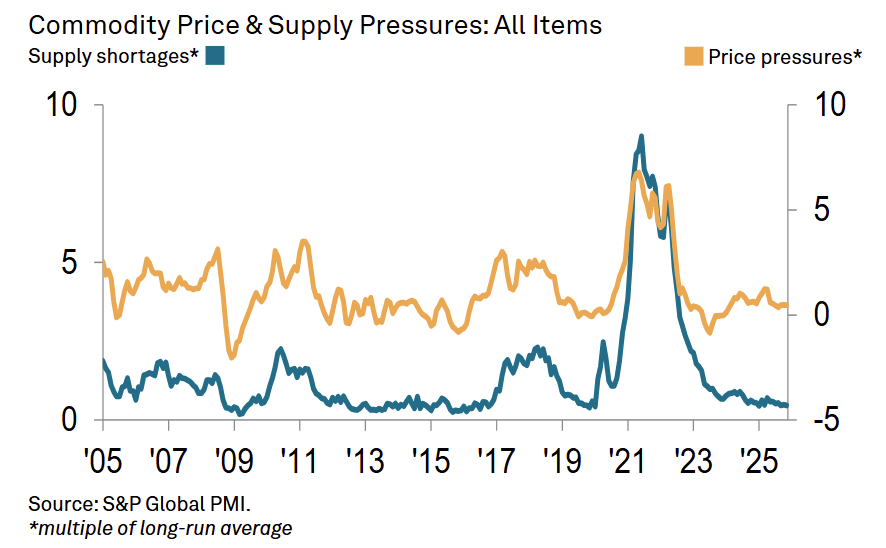

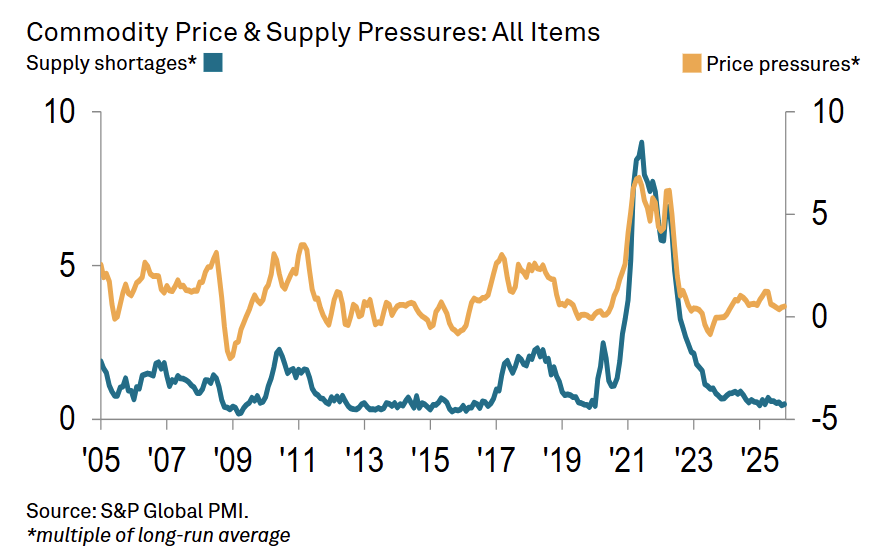

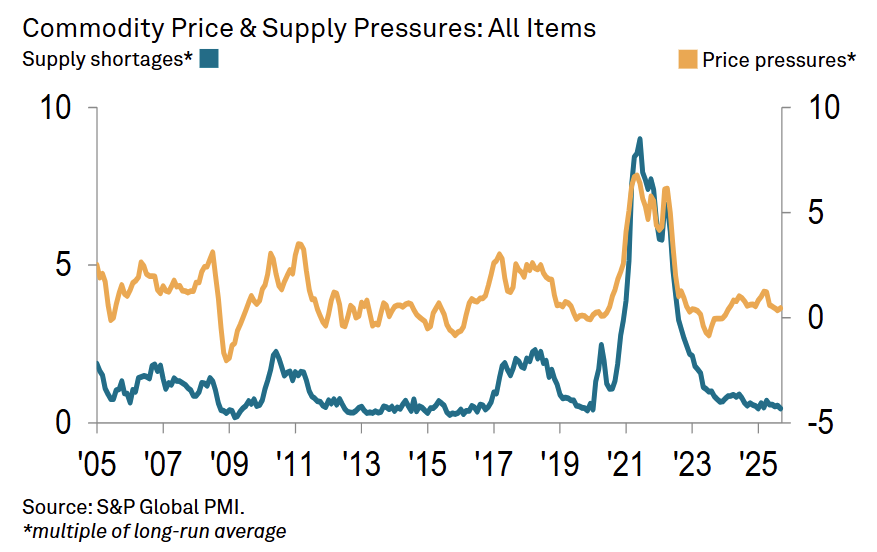

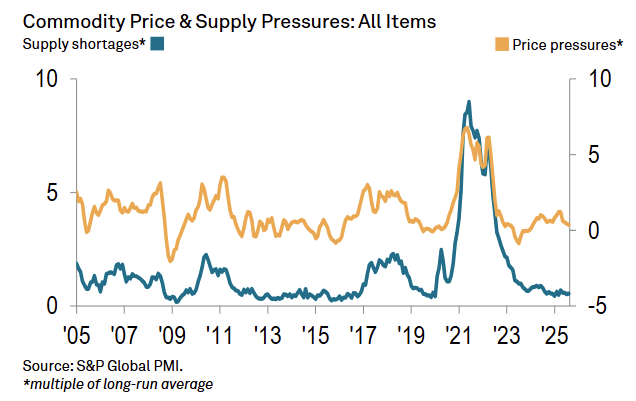

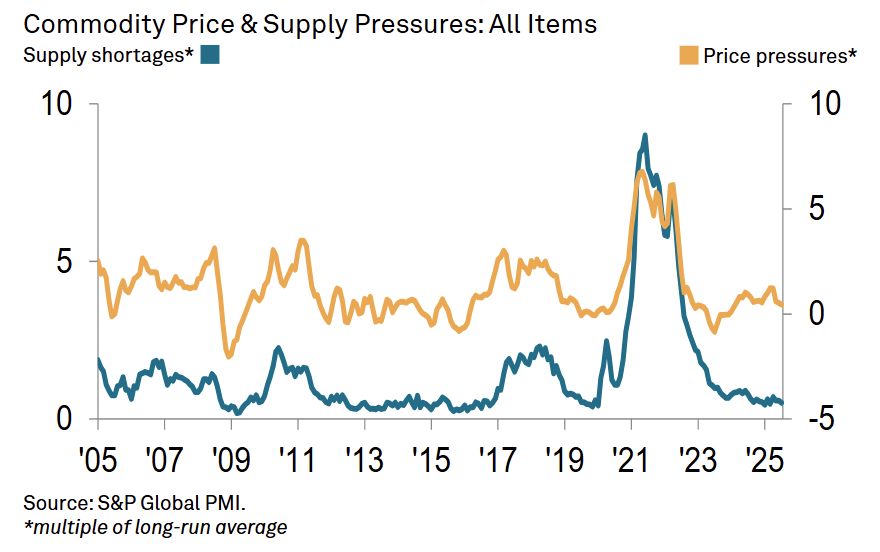

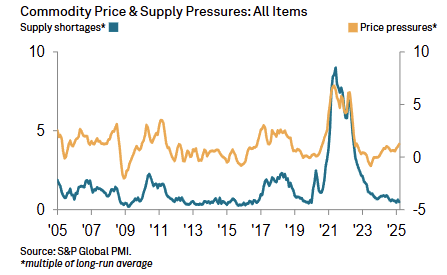

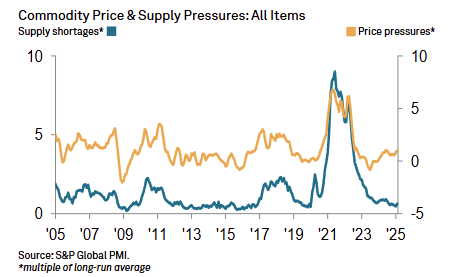

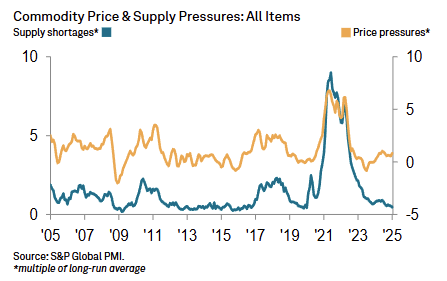

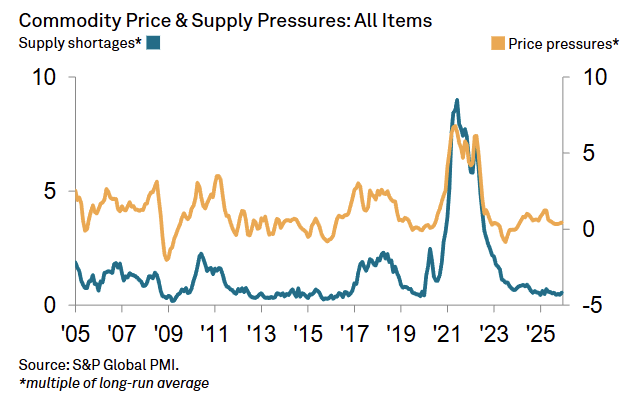

Commodity Price & Supply Indicators

Commodity Price & Supply Indicators

- Source

- S&P Global

- Source Link

- https://www.pmi.spglobal.com/

- Frequency

- Monthly

- Next Release(s)

- February 2nd, 2026 11:00 AM

-

March 2nd, 2026 11:00 AM

-

April 1st, 2026 11:00 AM

Latest Updates

-

The Global Price Pressures Index eased to 0.4 in December (from 0.5 in November), remaining well below its long-run average and reflecting broadly muted global commodity pricing conditions.

-

Semiconductor prices surged sharply, with reported price pressures nearly nine times above the historical norm and marking the strongest uplift outside the post-pandemic spike, highlighting concentrated cost pressure in this segment.

-

Aluminium and Copper recorded above-trend price increases for a third consecutive month, indicating persistent strength in select industrial metals despite softer conditions elsewhere.

-

Most other commodities saw subdued pricing, as muted manufacturing activity limited broader input cost pressures across global markets.

-

The Global Supply Shortages Index rose to 0.6 (from 0.5), signaling a modest uptick in supply constraints but still consistent with generally healthy material availability.

-

Above-average supply shortfalls were limited to Transport, Copper, and Stainless Steel, underscoring that supply stress remained narrow rather than widespread.

-

Oil prices declined in December amid expectations of a production surplus in 2026, helping offset cost pressures from metals and easing broader commodity price momentum.

-

Overall conditions pointed to a bifurcated commodity landscape, with intense pressures in semiconductors and select metals contrasted against broadly subdued pricing and supply dynamics elsewhere.

-