China NBS PMIs

China NBS PMIs

- Source

- National Bureau of Statistics China

- Source Link

- https://www.stats.gov.cn/

- Frequency

- Monthly

- Next Release(s)

- January 30th, 2026 8:30 PM

-

March 3rd, 2026 8:30 PM

-

March 30th, 2026 9:30 PM

-

April 29th, 2026 9:30 PM

-

May 30th, 2026 9:30 PM

-

June 29th, 2026 9:30 PM

-

July 30th, 2026 9:30 PM

-

August 30th, 2026 9:30 PM

-

September 29th, 2026 9:30 PM

-

October 30th, 2026 9:30 PM

-

November 29th, 2026 8:30 PM

-

December 30th, 2026 8:30 PM

Latest Updates

-

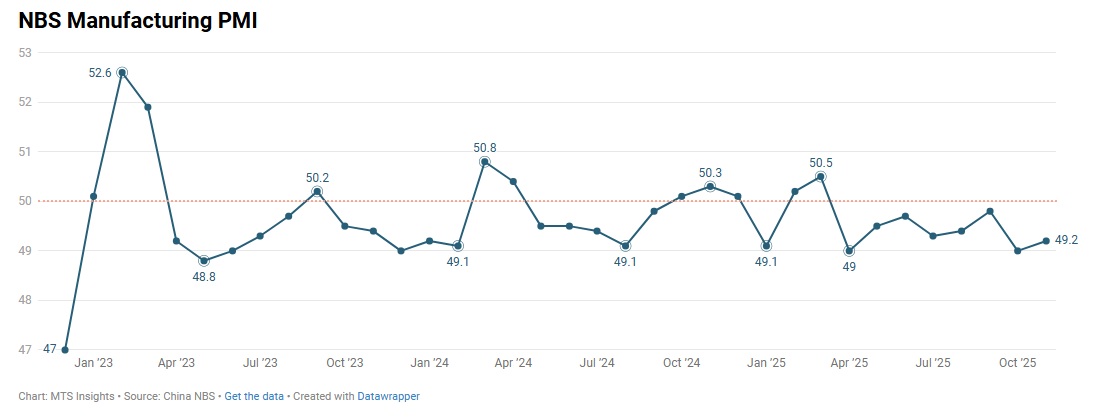

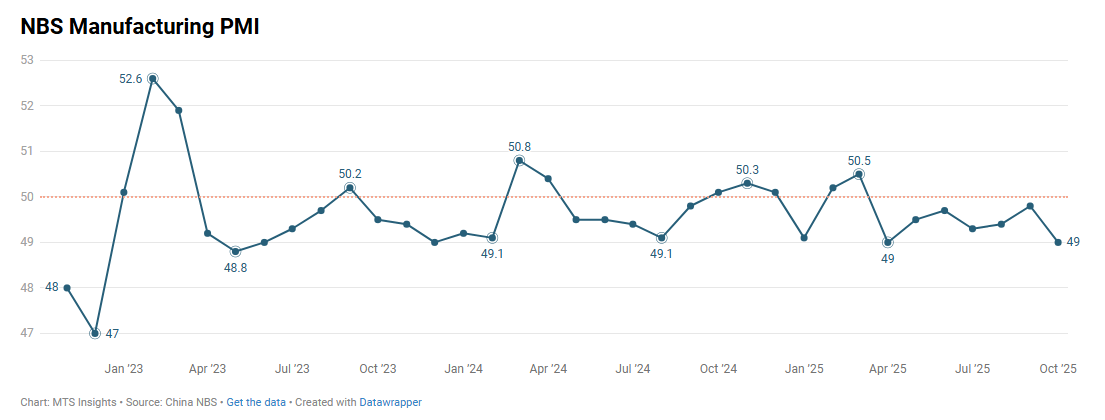

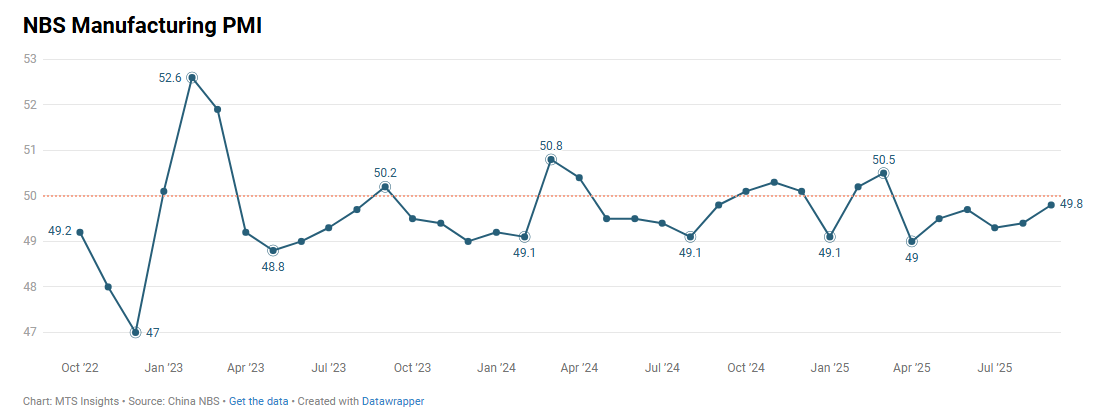

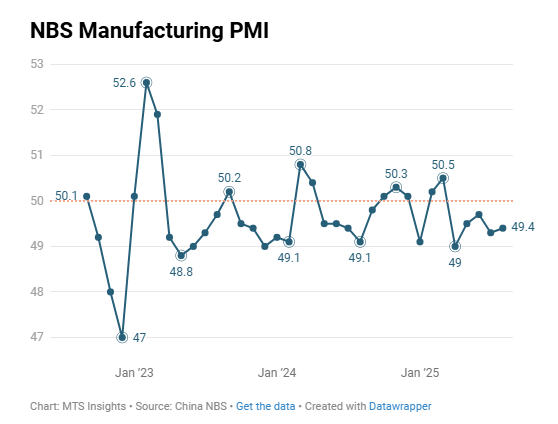

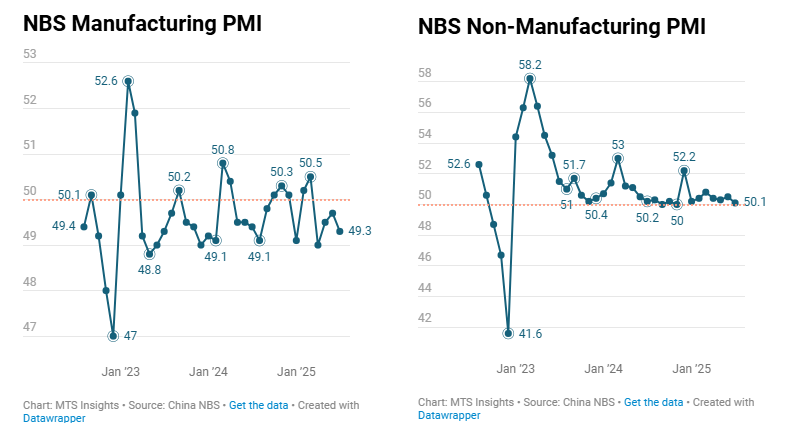

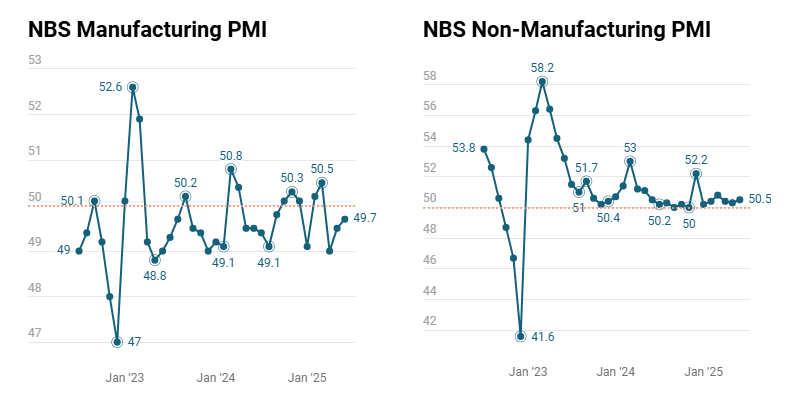

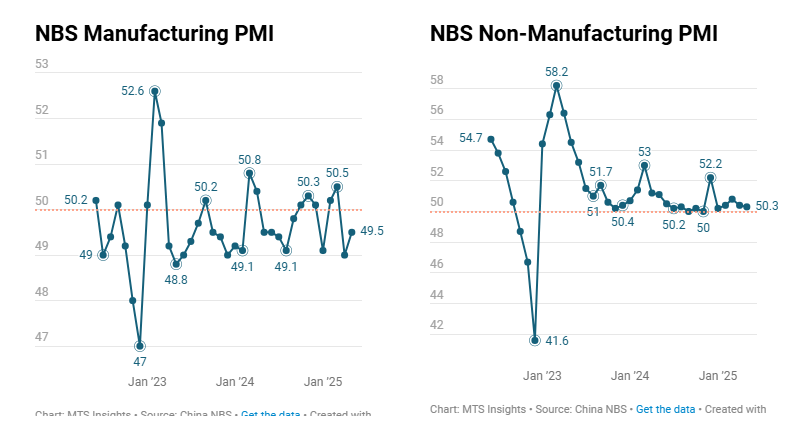

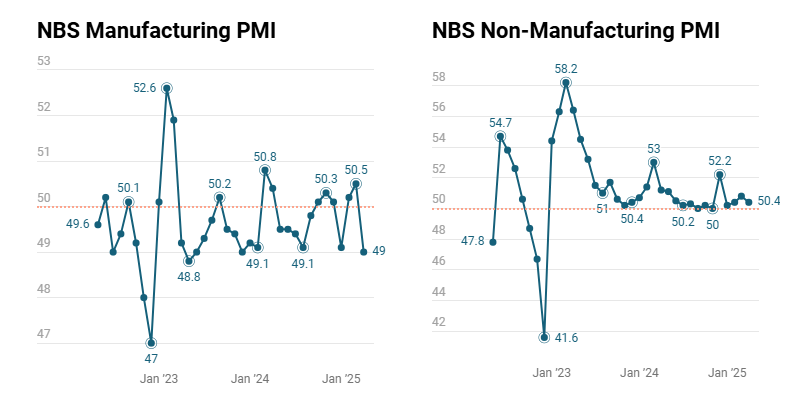

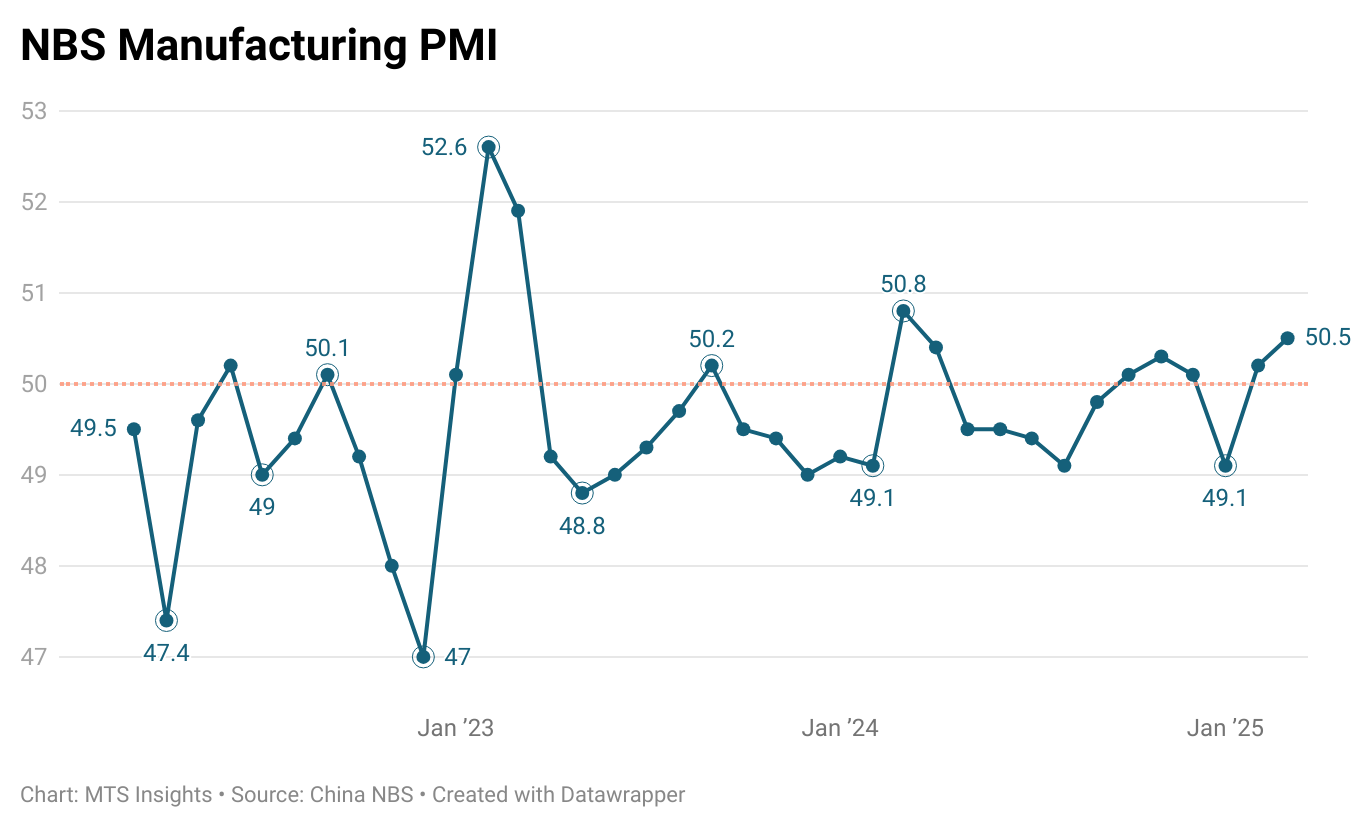

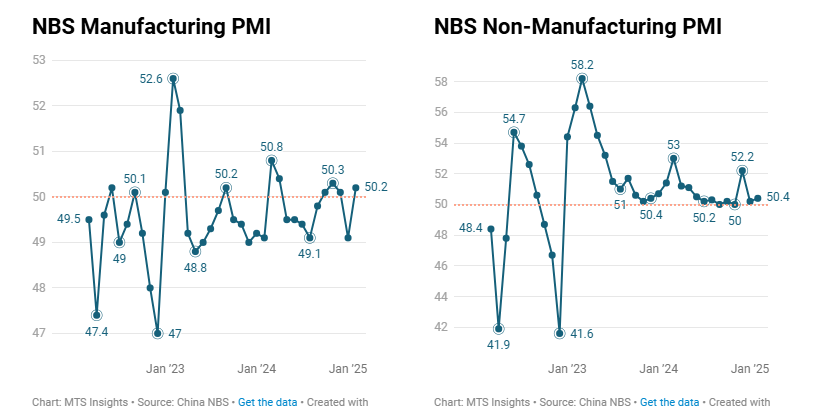

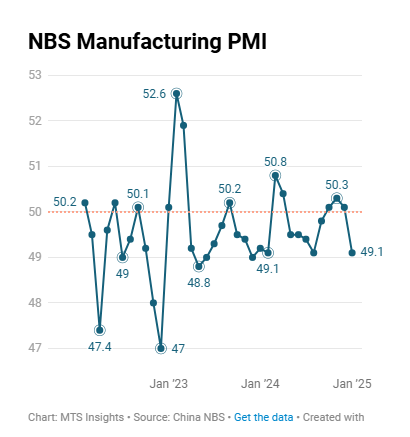

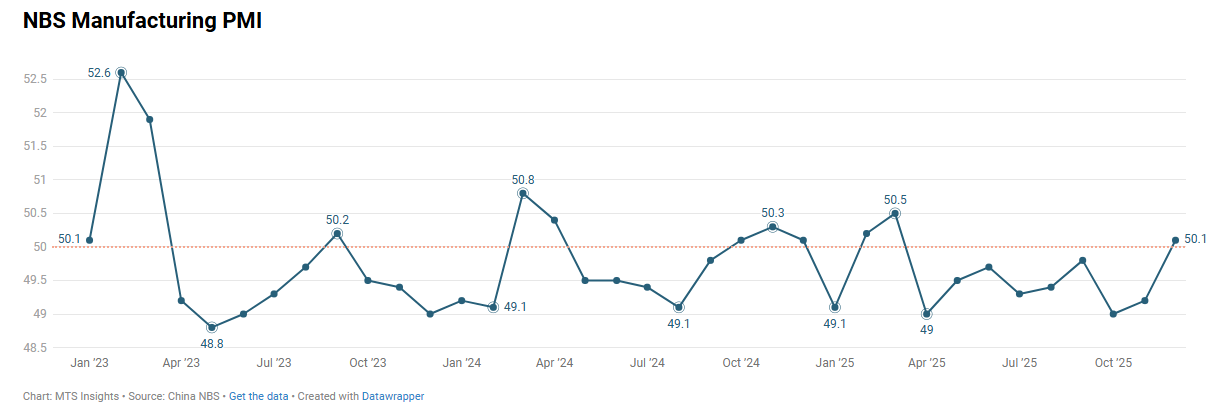

China’s NBS Manufacturing PMI rose to 50.1 in December 2025 (from 49.2 in November), moving back into expansion territory after several months below the threshold.

-

The headline PMI increased +0.9 pts MoM to 50.1, marking a return to expansion and the highest reading since March 2025.

-

The Production Index rose to 51.7 (+1.7 pts MoM), indicating faster manufacturing output growth.

-

The New Orders Index climbed to 50.8 (+1.6 pts MoM), signaling an improvement in domestic demand conditions.

-

Supplier Delivery Times edged up to 50.2 (+0.1 pts MoM), remaining above the 50 level and indicating continued acceleration in deliveries.

-

The Raw Material Inventory Index increased to 47.8 (+0.5 pts MoM) but stayed below 50, showing that inventory drawdowns continued, though at a slower pace.

-

The Employment Index slipped to 48.2 (-0.2 pts MoM), indicating a slight deterioration in manufacturing labor conditions.

-

By firm size, large enterprises expanded with a PMI of 50.8 (+1.5 pts), medium-sized firms improved to 49.8 (+0.9 pts) but remained in contraction, while small enterprises fell further to 48.6 (-0.5 pts).

-

Other indicators showed mixed conditions, with New Export Orders rising to 49.0 (from 47.6) and Purchase Prices increasing to 48.9 (from 48.2), both still below the expansion threshold.

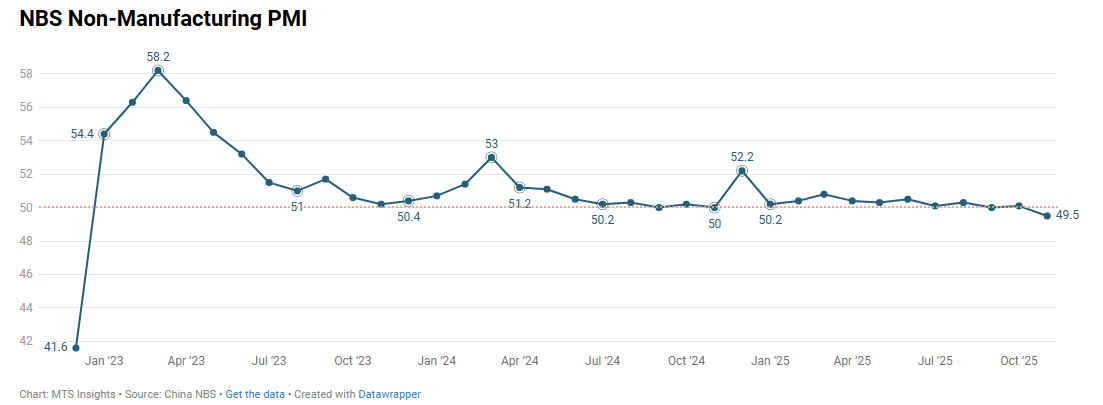

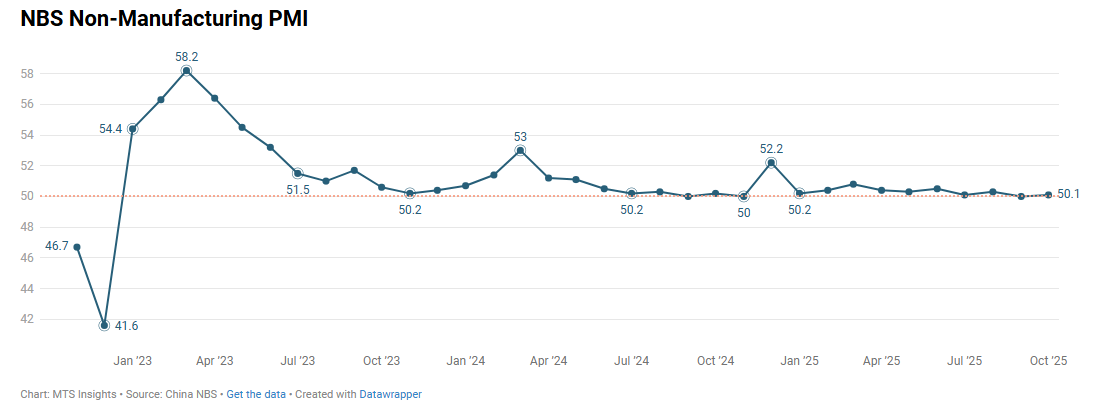

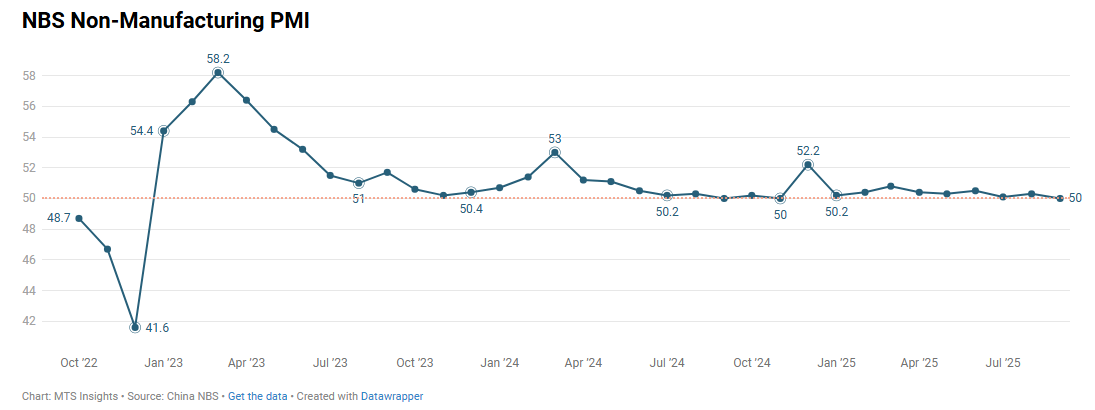

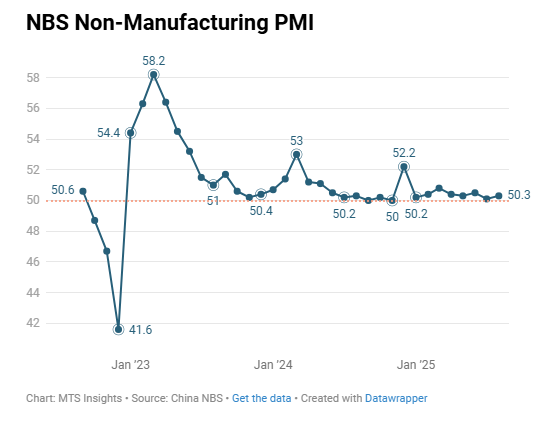

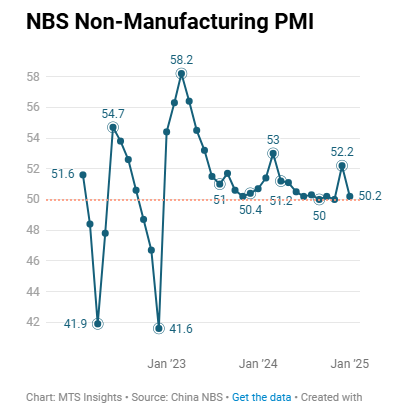

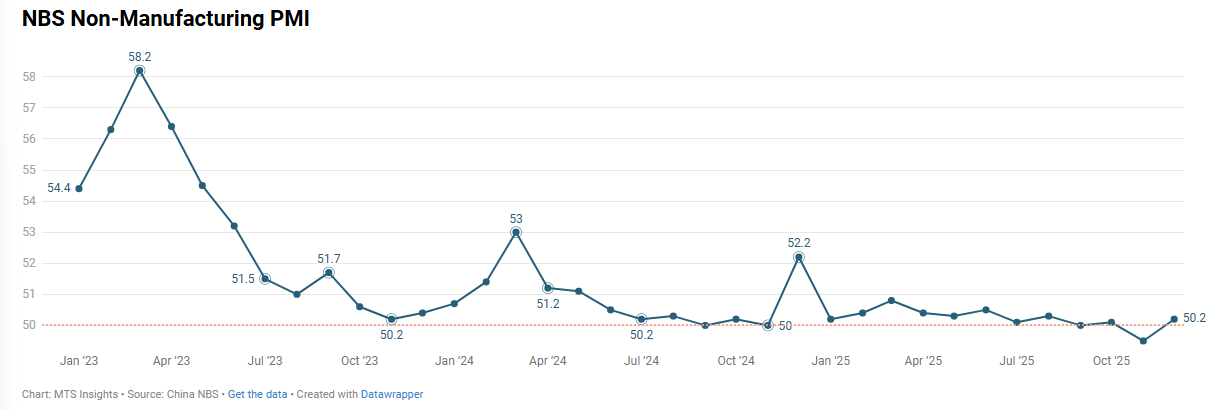

China’s NBS Non-Manufacturing PMI rose to 50.2 in December (from 49.5 in November), returning overall activity to expansion territory.

-

The headline non-manufacturing business activity index increased +0.7 pts MoM to 50.2, marking a rebound into expansion after dipping below 50 in November.

-

Construction activity strengthened sharply, with the construction business activity index rising to 52.8 (+3.2 pts MoM), while the services activity index edged up to 49.7 (+0.2 pts) but remained in contraction.

-

The New Orders Index improved to 47.3 (+1.6 pts MoM), indicating a rebound in demand that nonetheless stayed below the expansion threshold for both services (47.3, +1.7 pts) and construction (47.4, +1.3 pts).

-

Input prices eased slightly to 50.2 (-0.2 pts MoM) but remained above 50, showing continued cost increases, driven by construction inputs at 50.8 (+1.1 pts).

-

The Sales Price Index fell to 48.0 (-1.1 pts MoM), signaling a renewed decline in selling prices across both construction (47.4) and services (48.1).

-

Employment improved modestly, with the Employee Index rising to 46.1 (+0.8 pts), reflecting gains in services employment (47.0, +1.1 pts) that offset weaker construction employment (41.0, -0.8 pts).

-

Business activity expectations strengthened further, with the Expectations Index increasing to 56.5 (+0.3 pts MoM), indicating rising confidence for the period ahead in both services and construction.

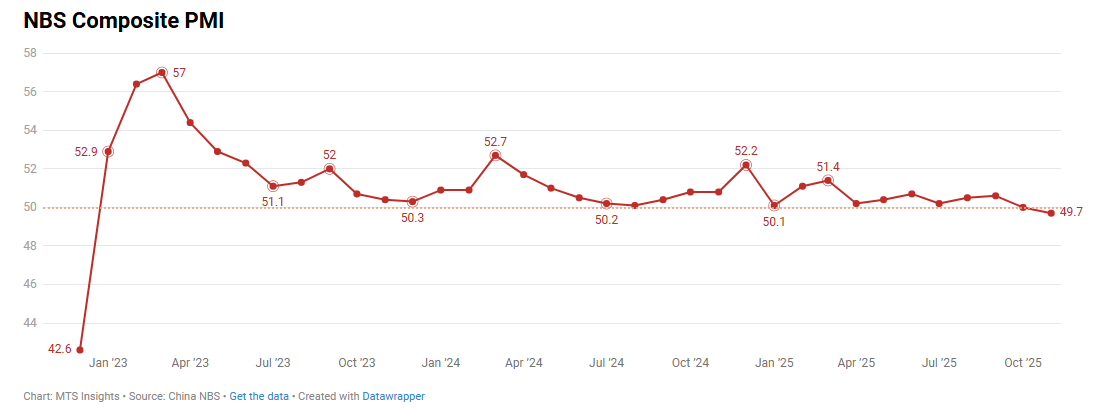

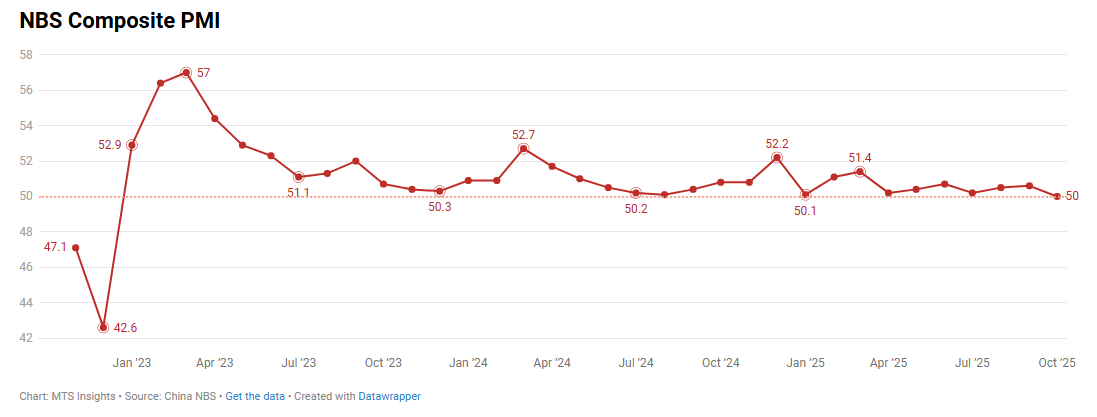

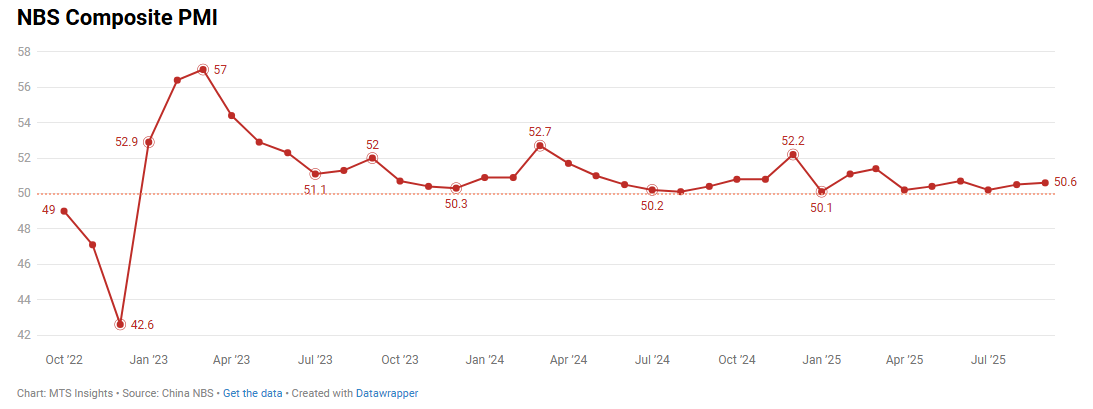

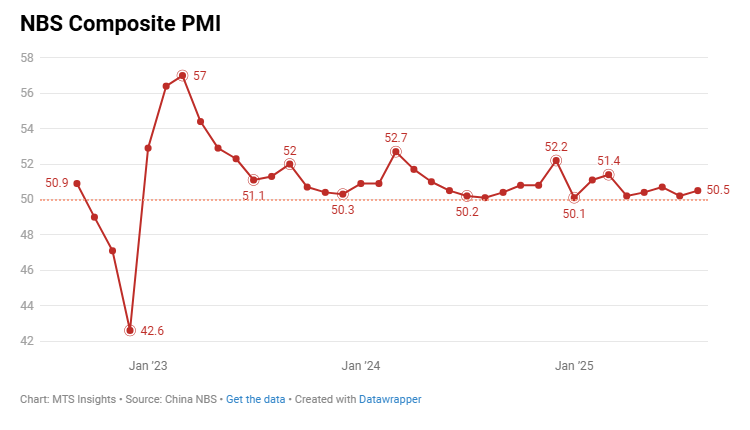

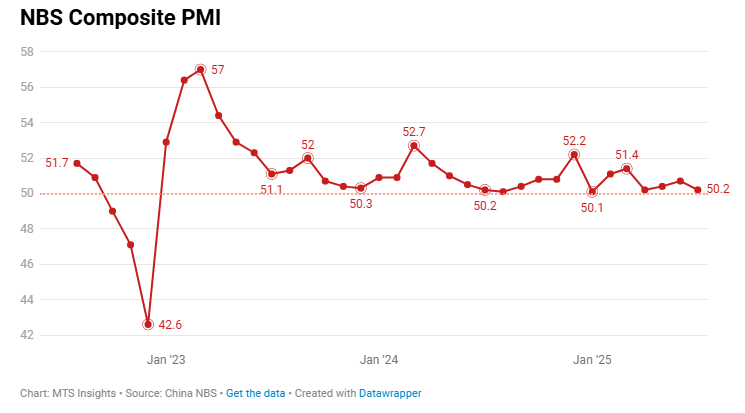

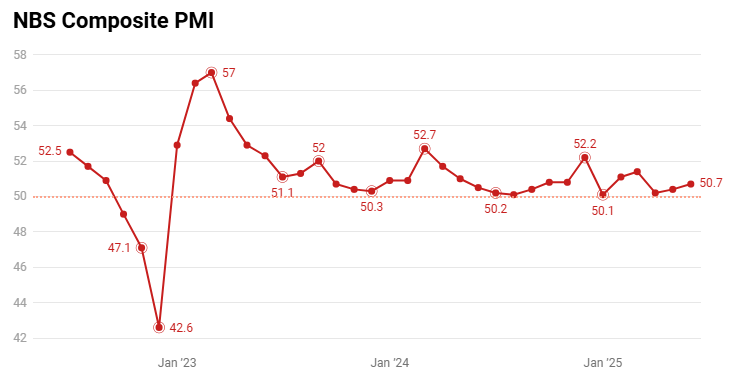

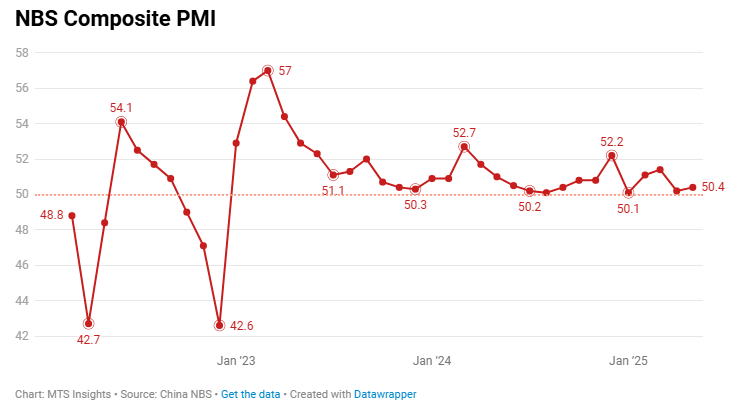

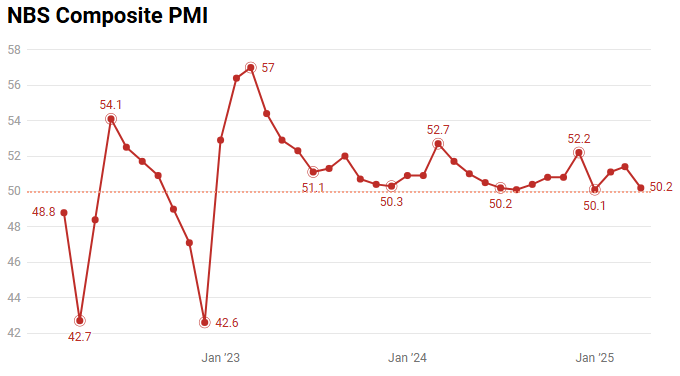

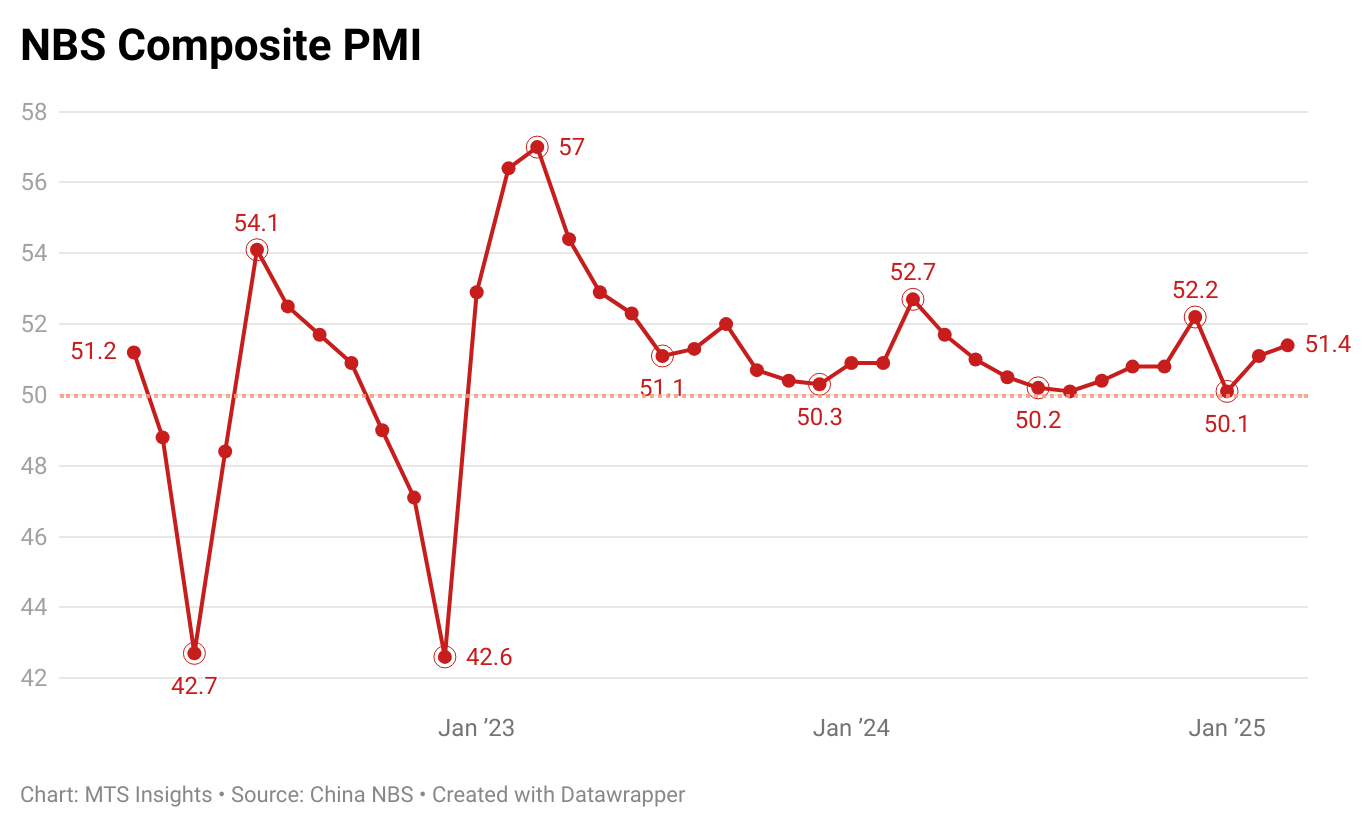

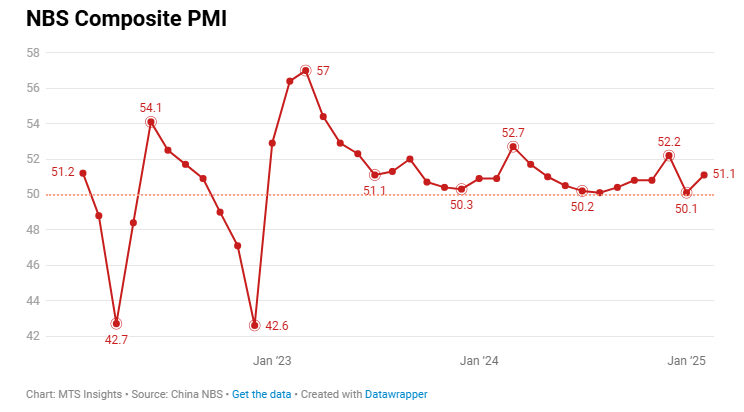

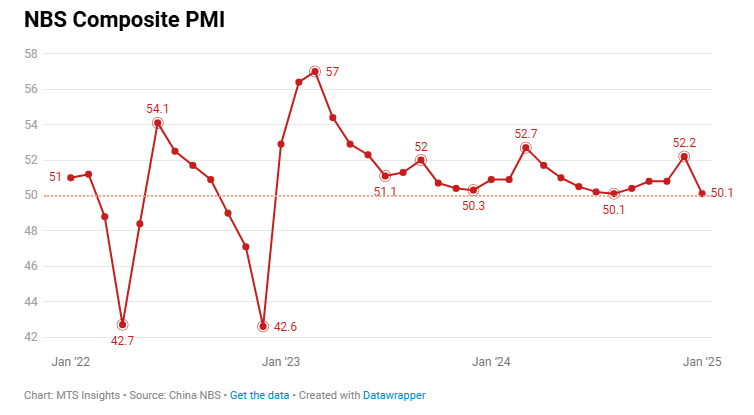

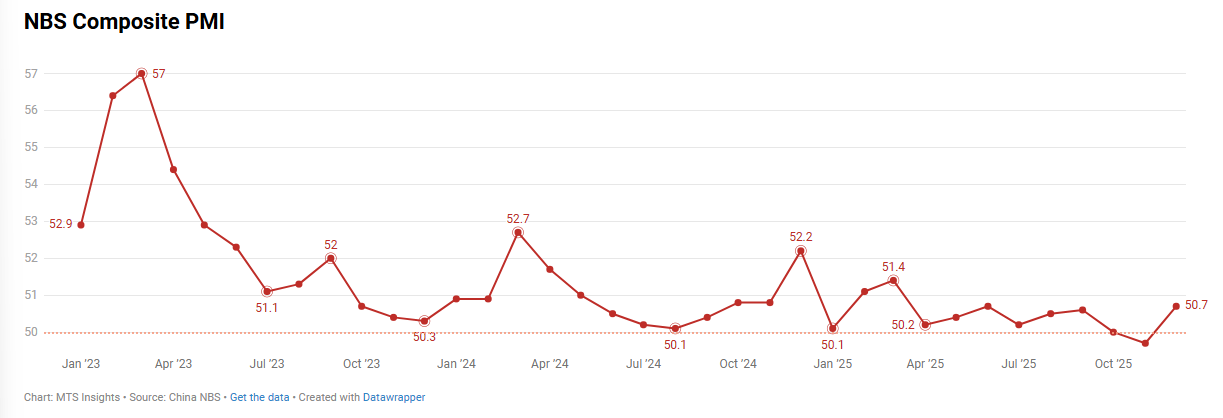

The NBS Composite PMI ended up a full point higher in December at 50.7, up from 49.7 in November. This suggests China's economy is expanding at the joint fastest pace since March (June 2025 was also at 50.7).

-