CFIB Business Barometer

CFIB Business Barometer

- Source

- CFIB

- Source Link

- https://www.cfib-fcei.ca/

- Frequency

- Monthly

- Next Release(s)

- October 16th, 2025 7:00 AM

-

November 20th, 2025 7:00 AM

-

December 18th, 2025 7:00 AM

Latest Updates

-

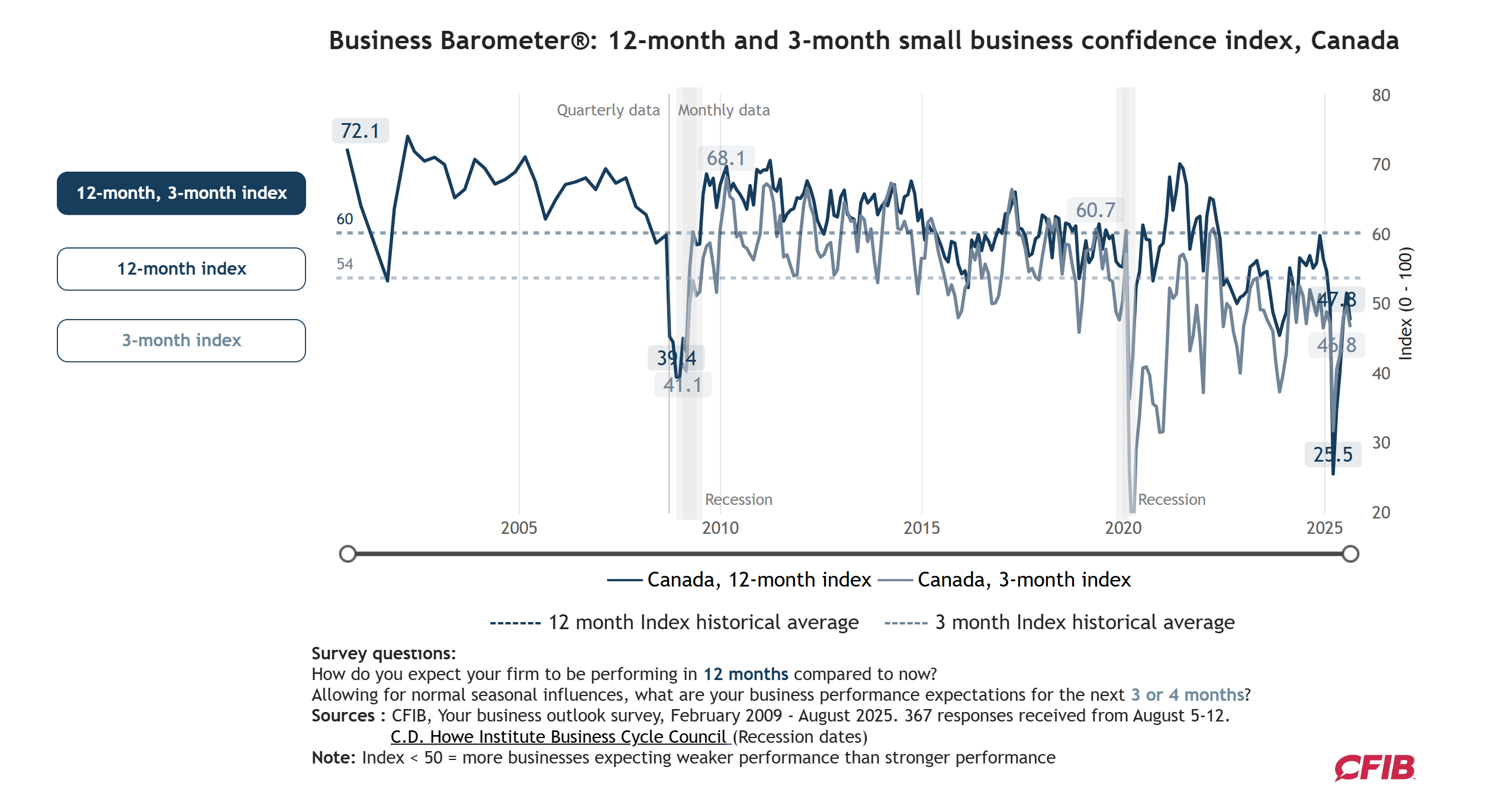

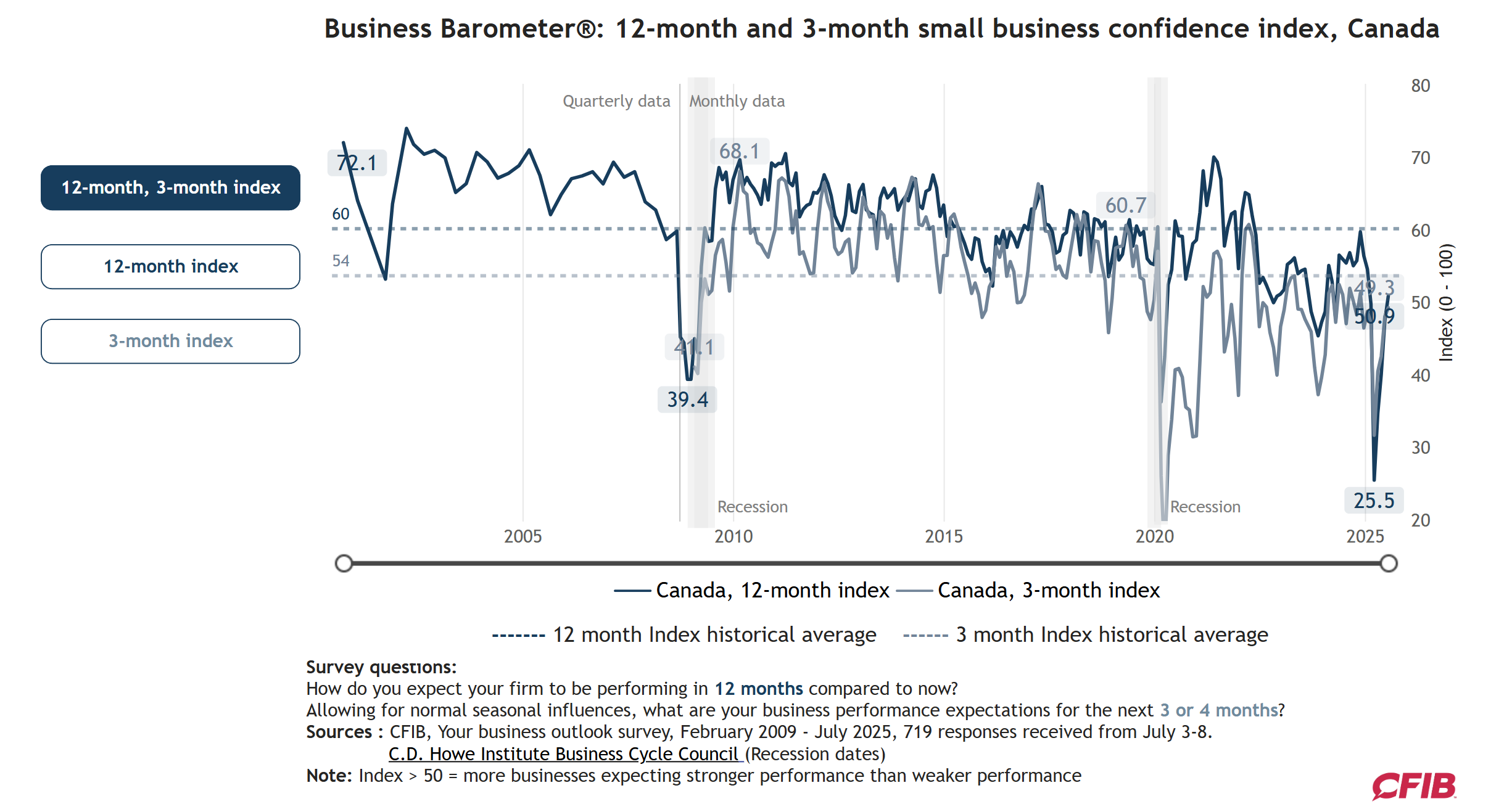

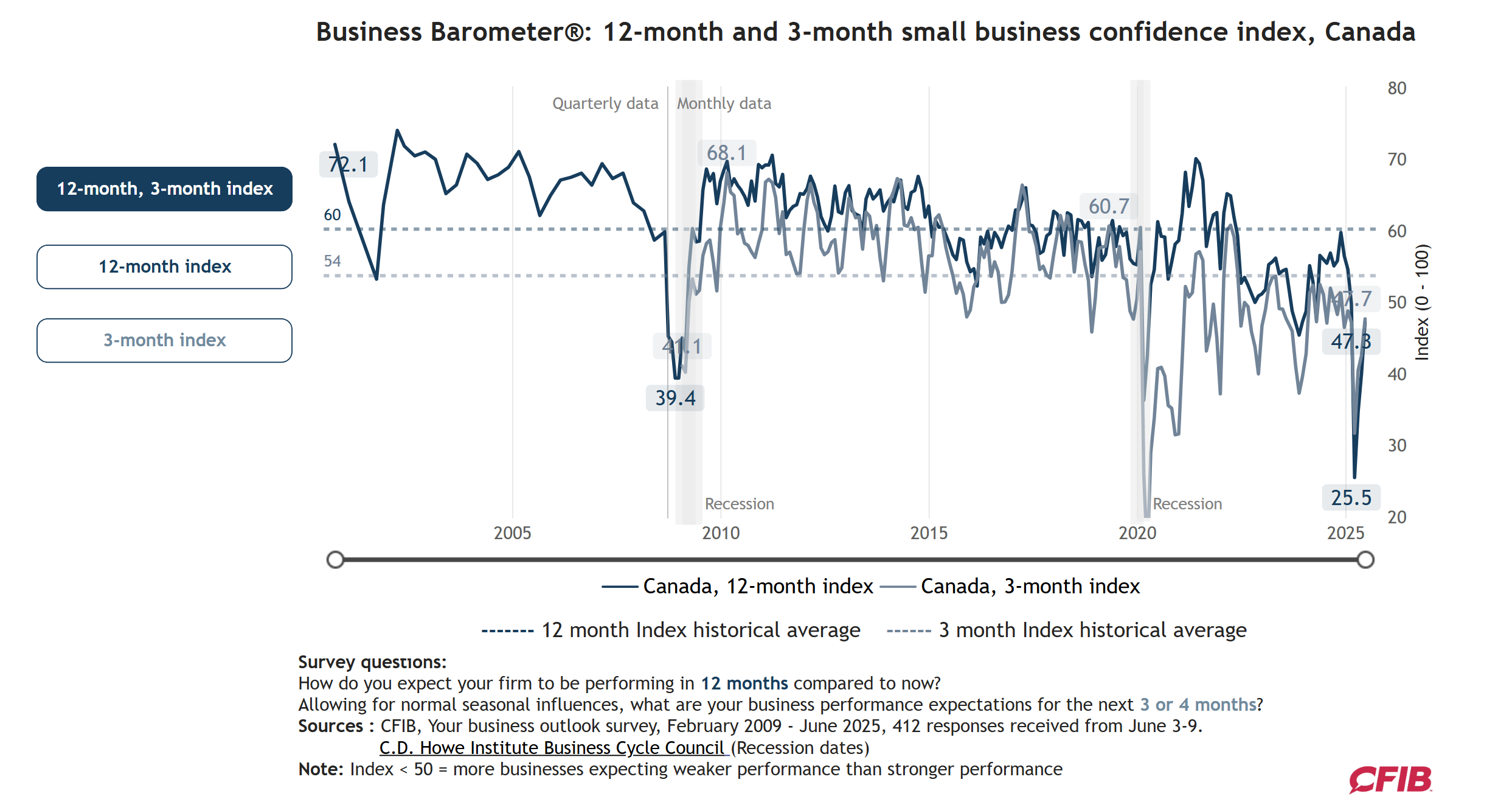

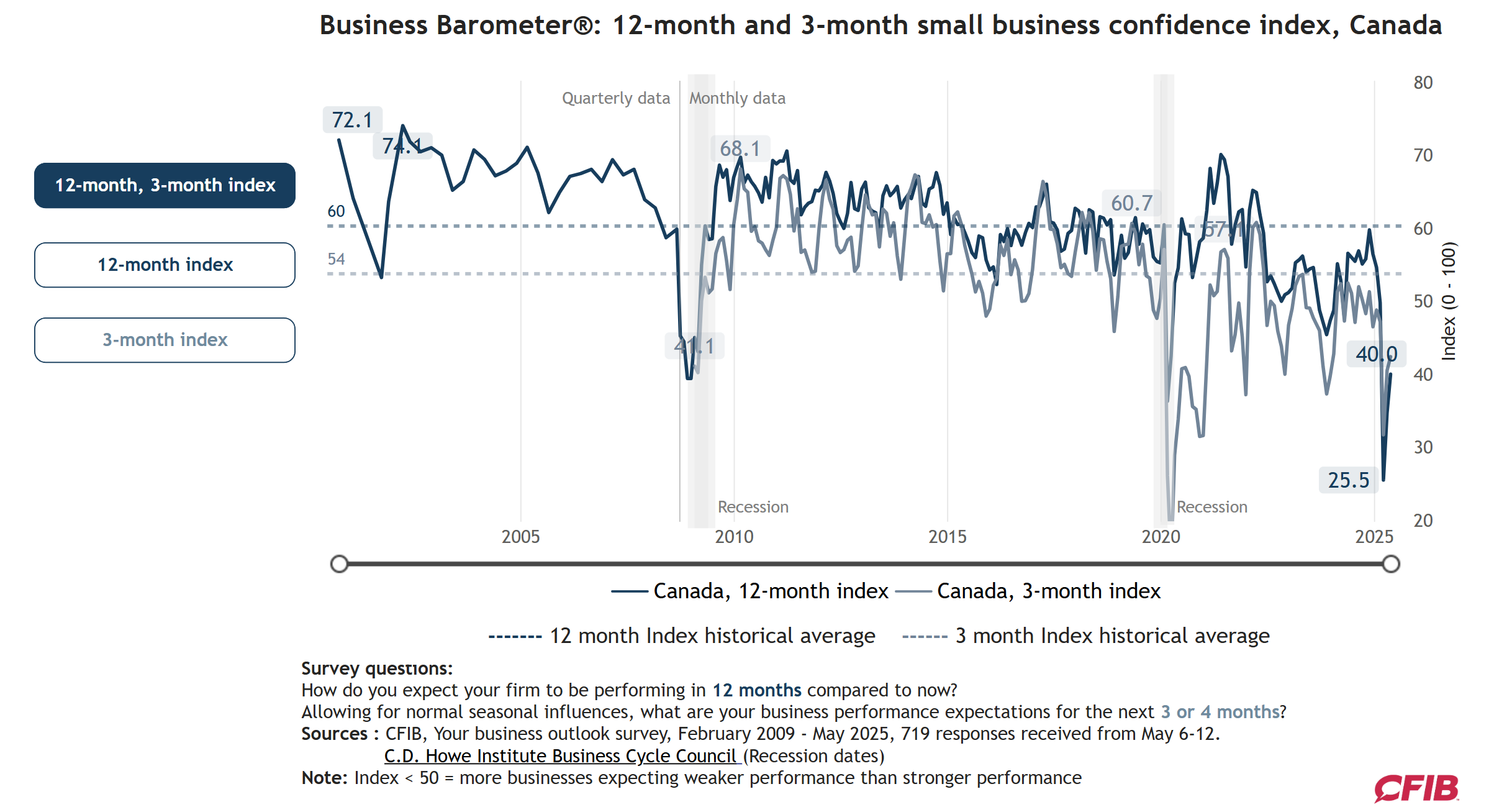

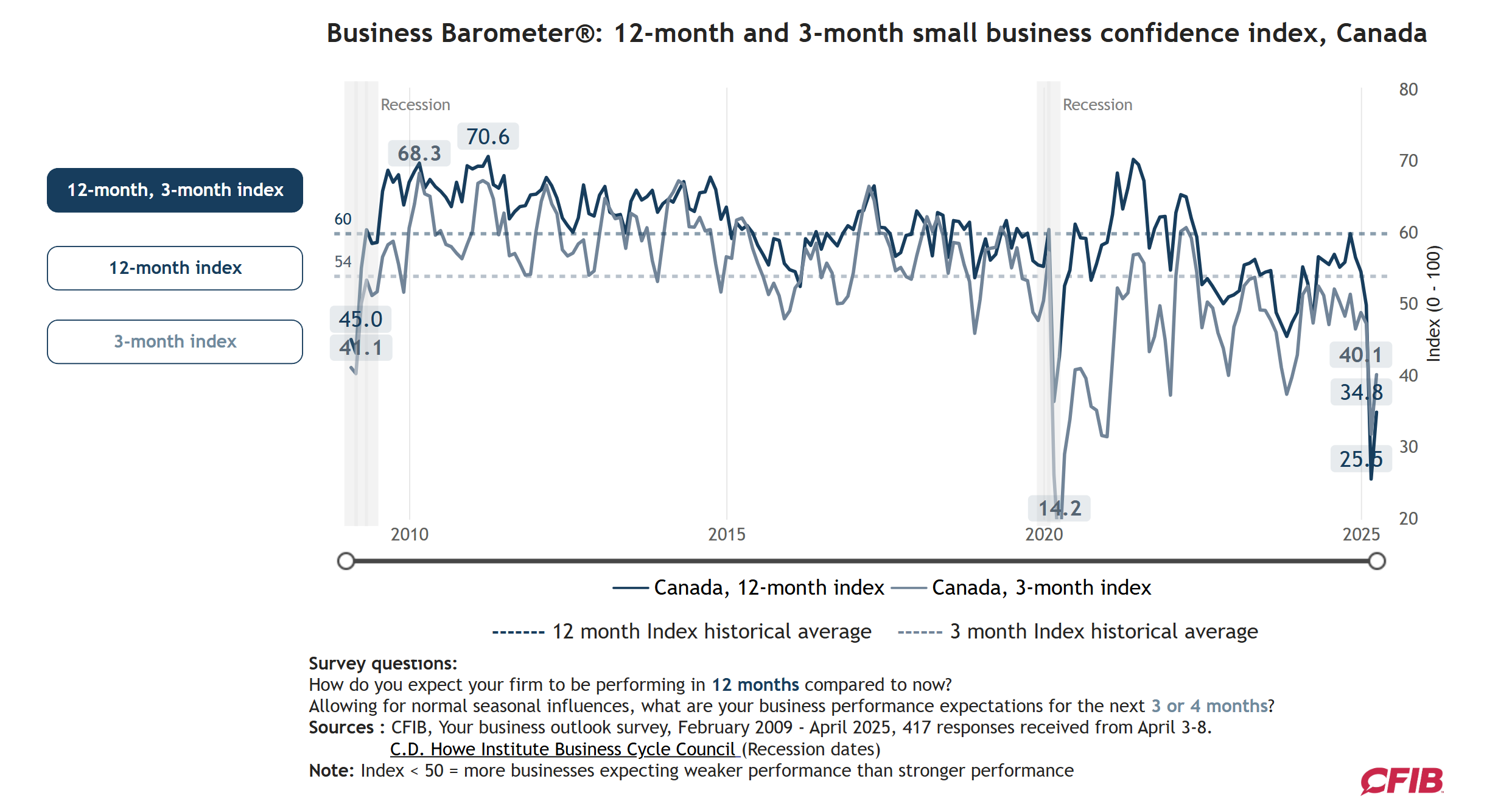

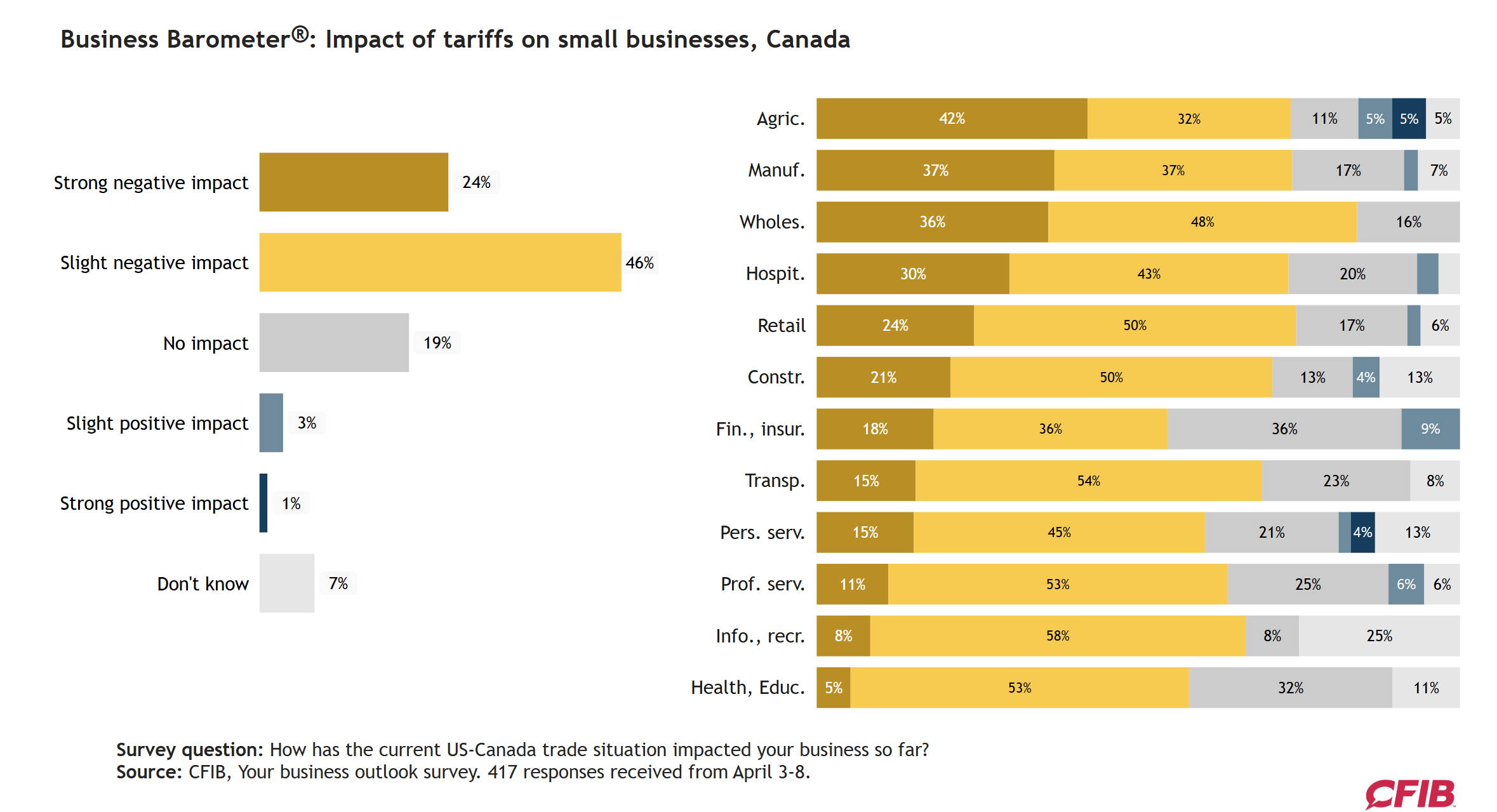

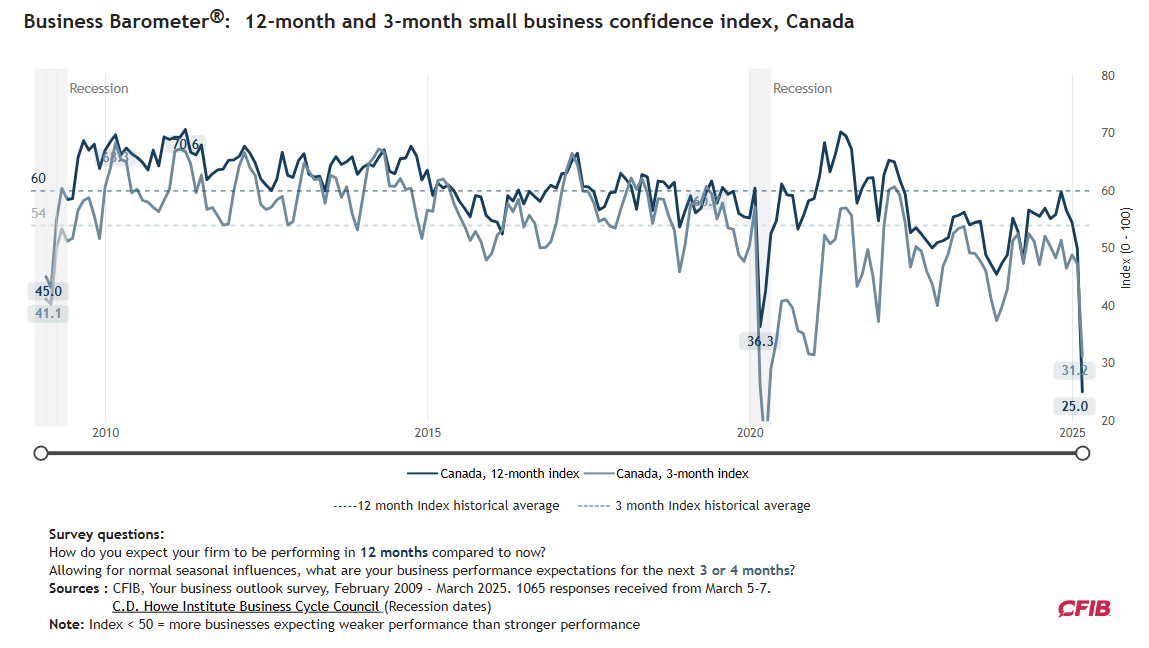

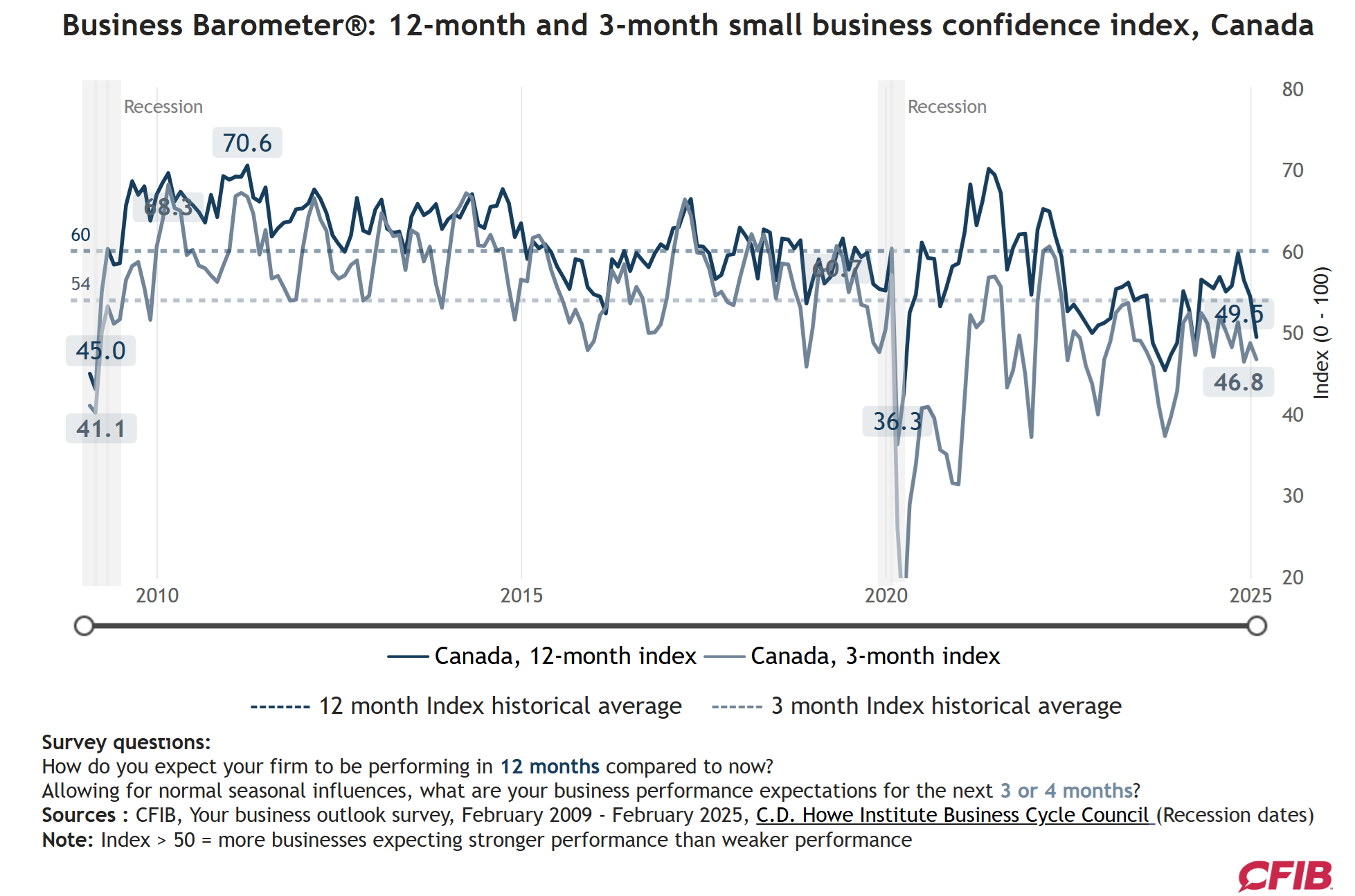

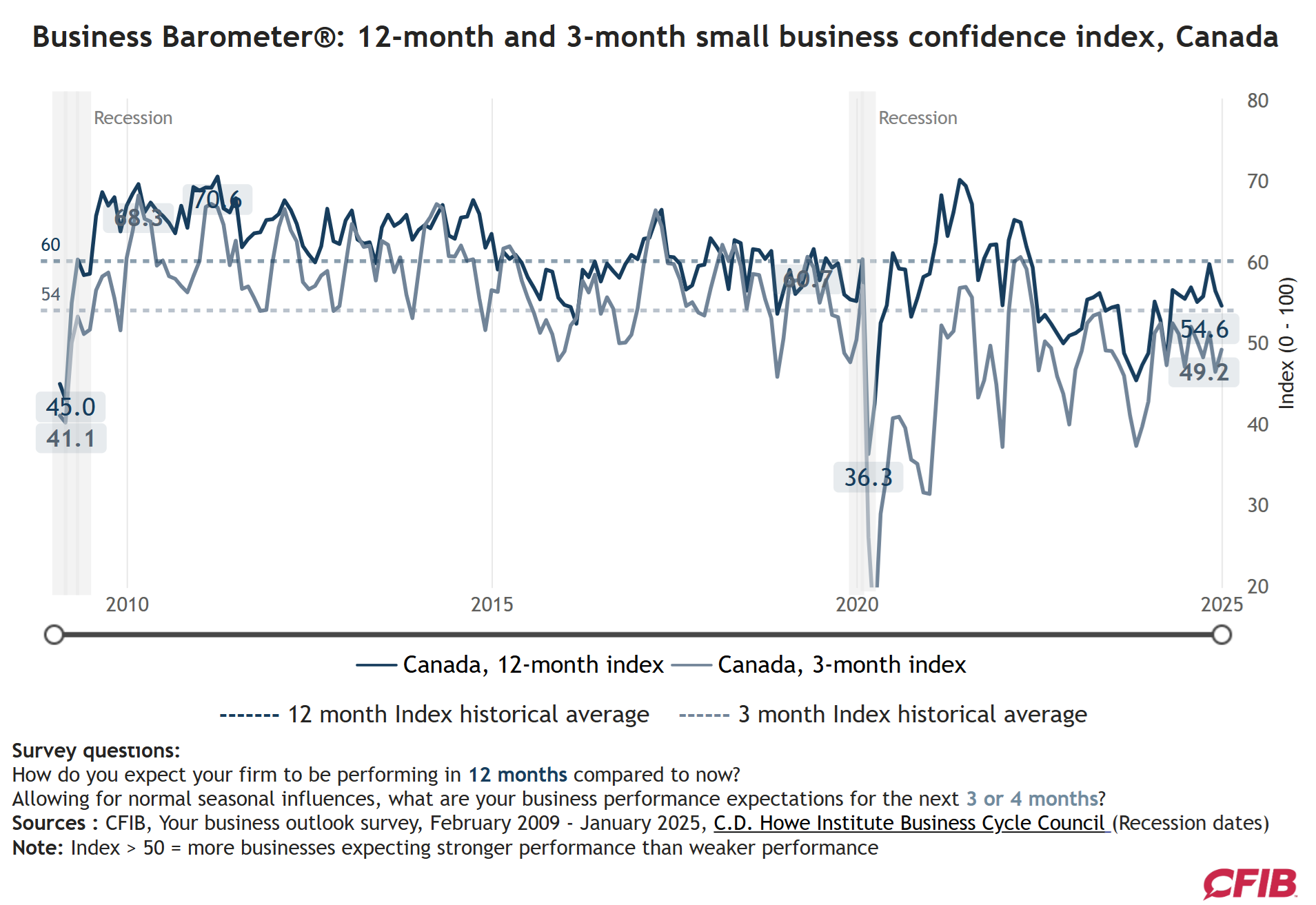

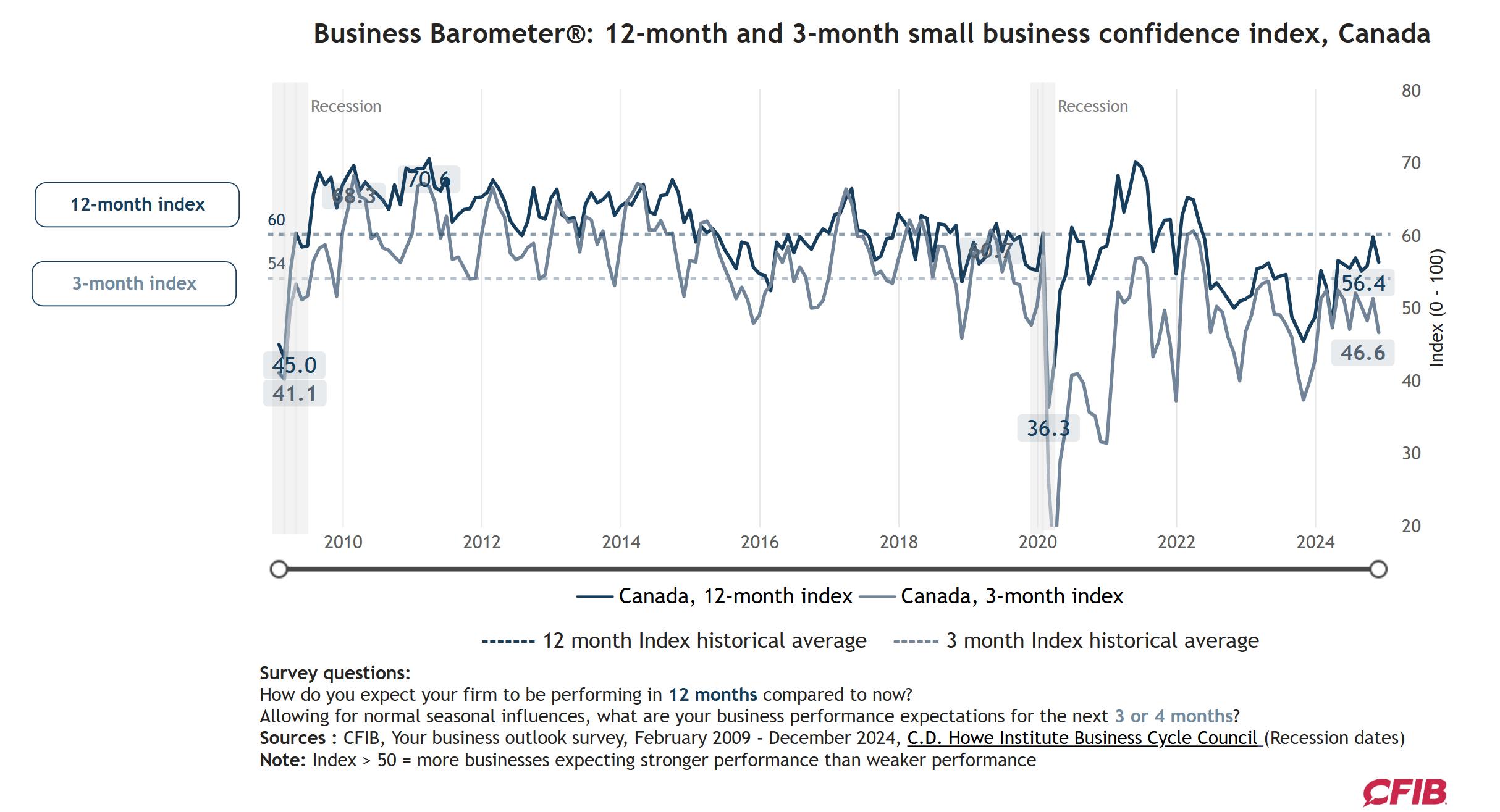

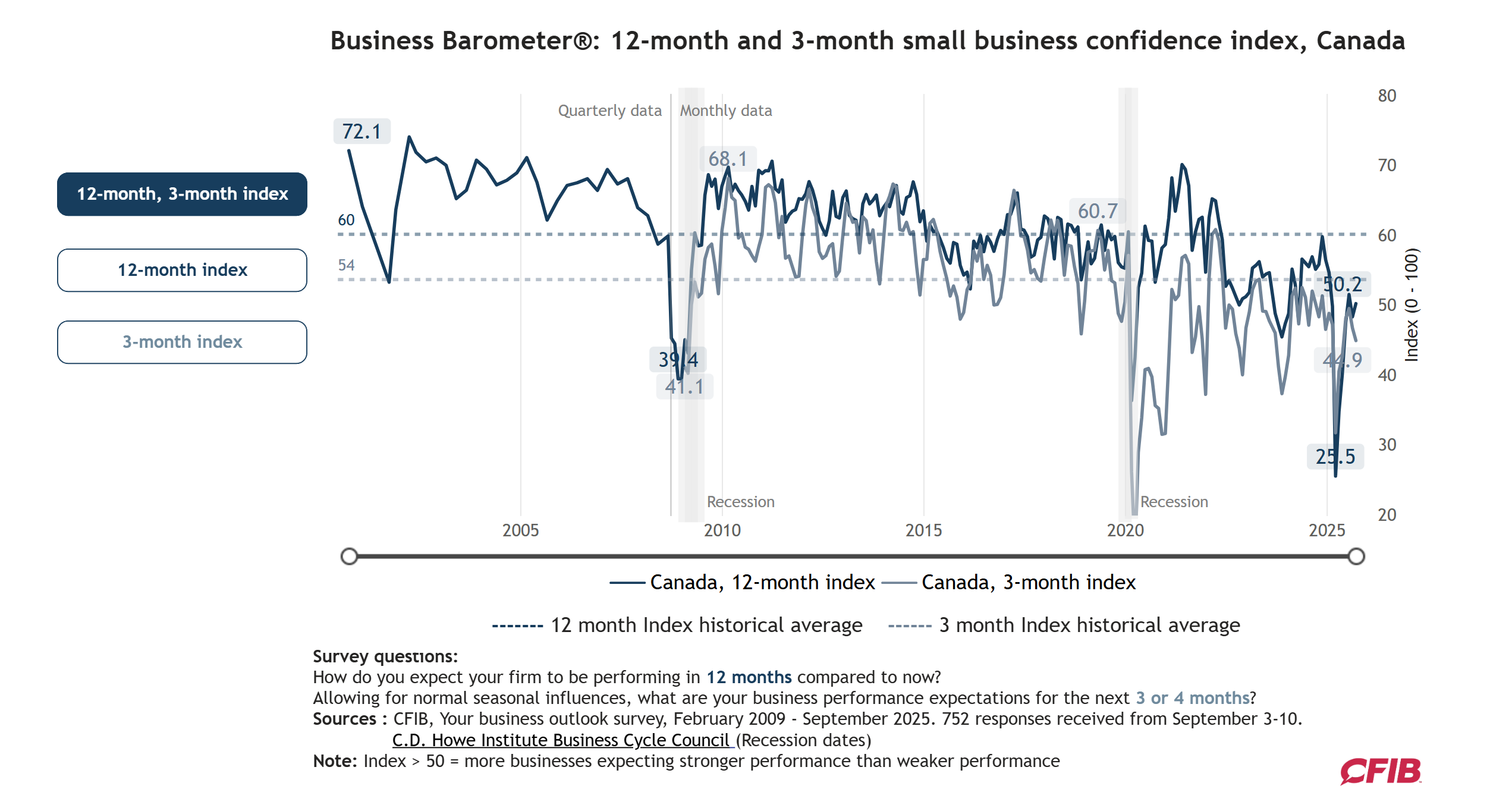

Canada’s CFIB small business optimism inched up in September 2025, with the 12-month index rising 2 pts to 50.2 (back to the breakeven threshold), while the 3-month index slipped 2 pts to 44.9, highlighting continued short-term caution.

-

Long-term confidence reached or exceeded 50 in seven provinces, led by New Brunswick (58.8) and PEI (55.8), while Ontario, Nova Scotia, and British Columbia remained below 50 and well under historical averages.

-

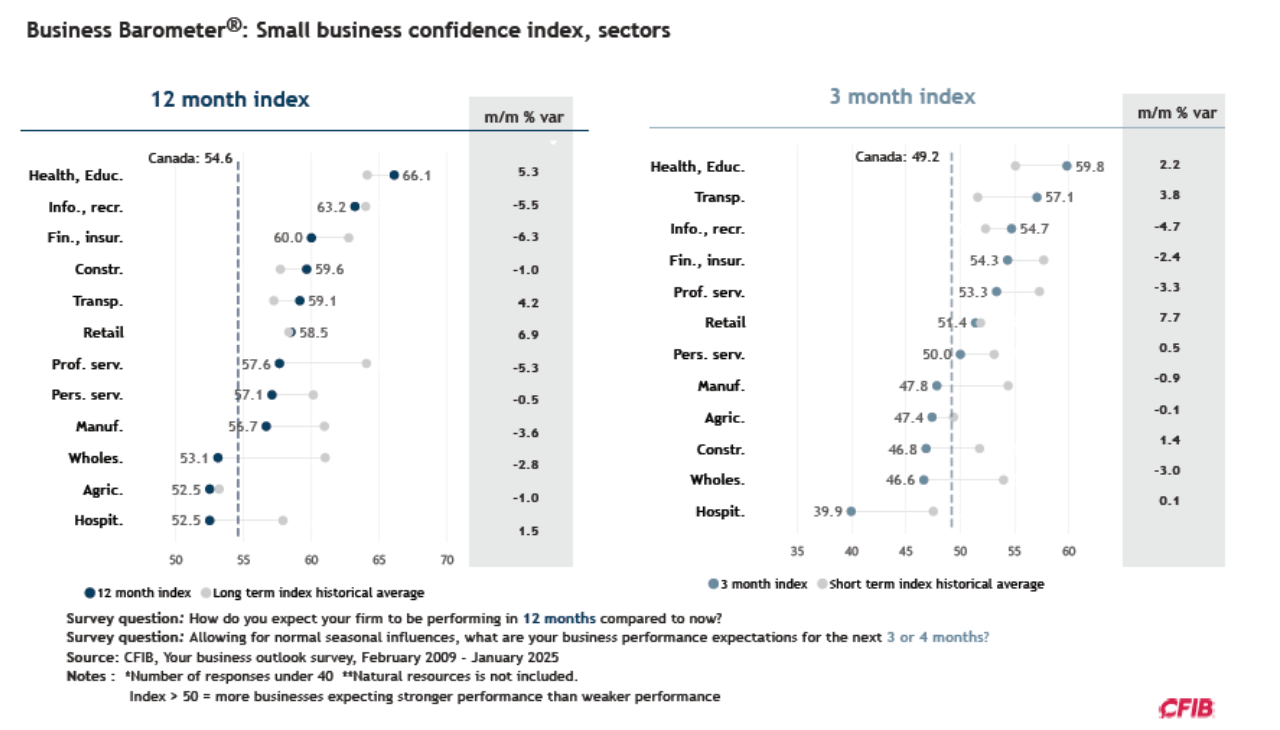

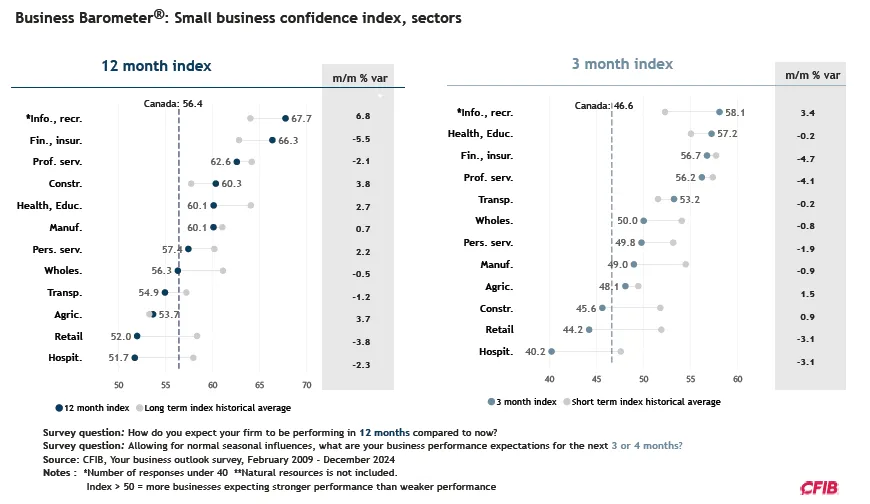

Sectoral optimism improved in transportation, agriculture, manufacturing, retail, and information, arts & recreation, while most other sectors saw slight deterioration.

-

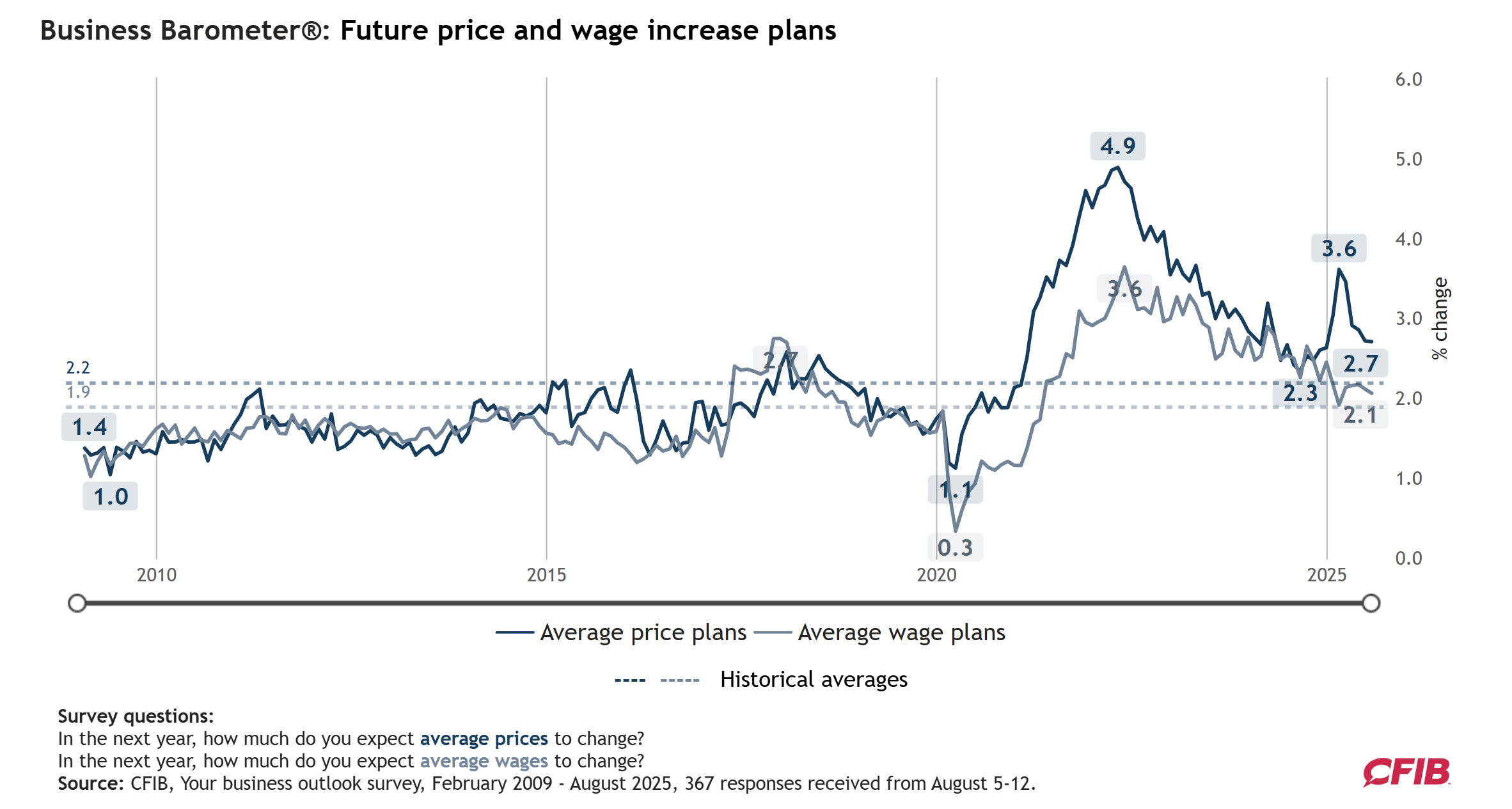

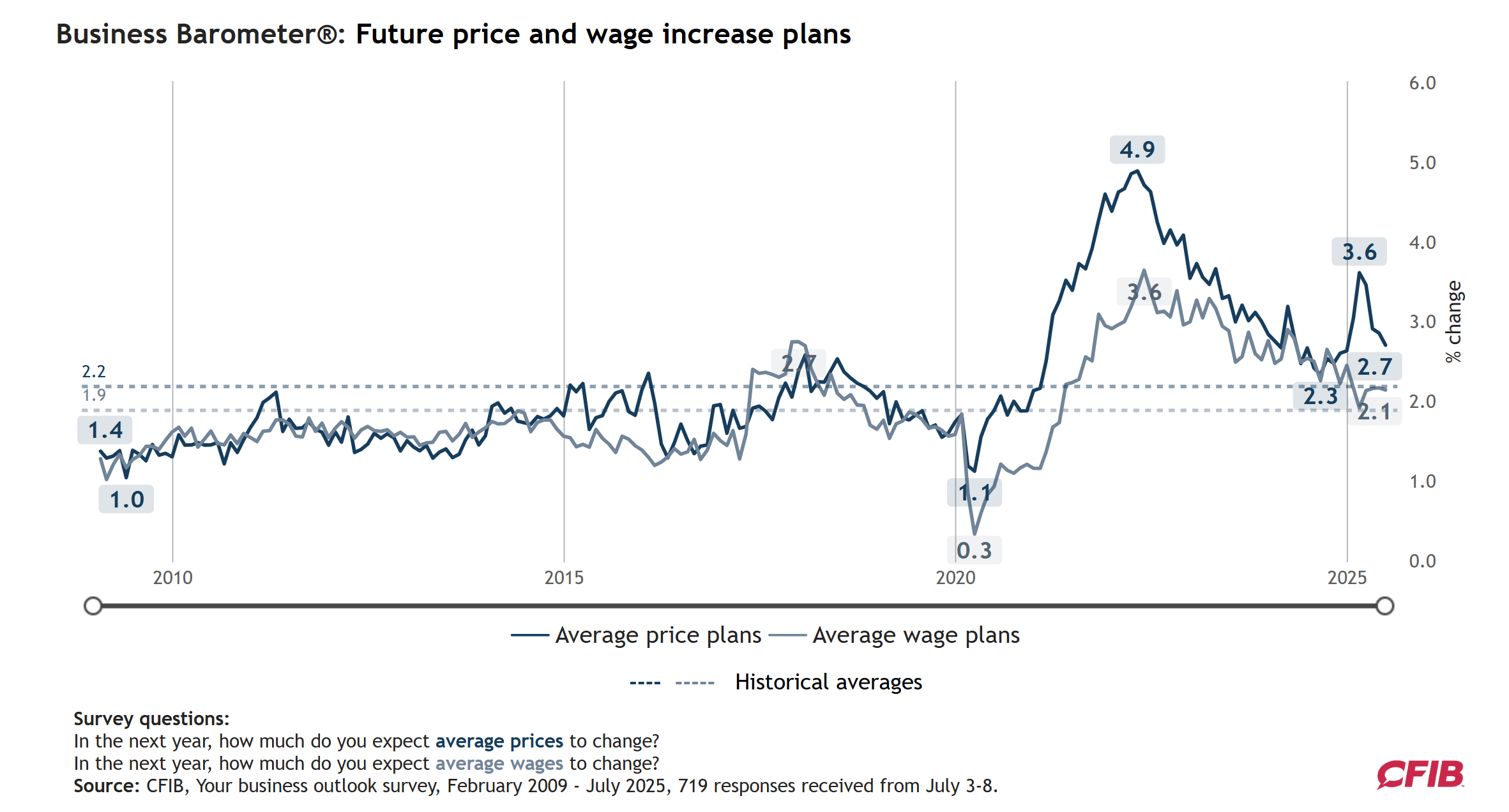

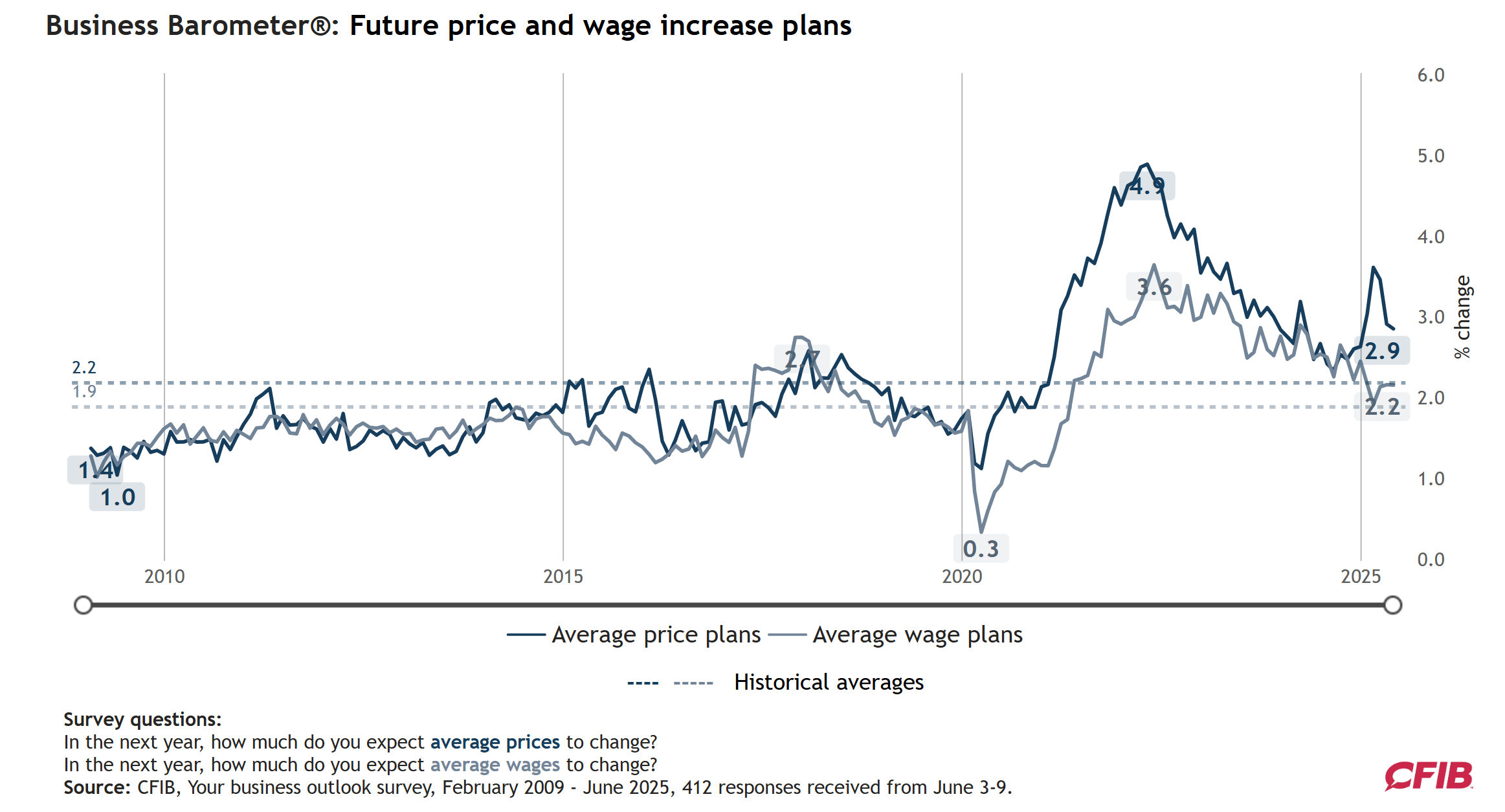

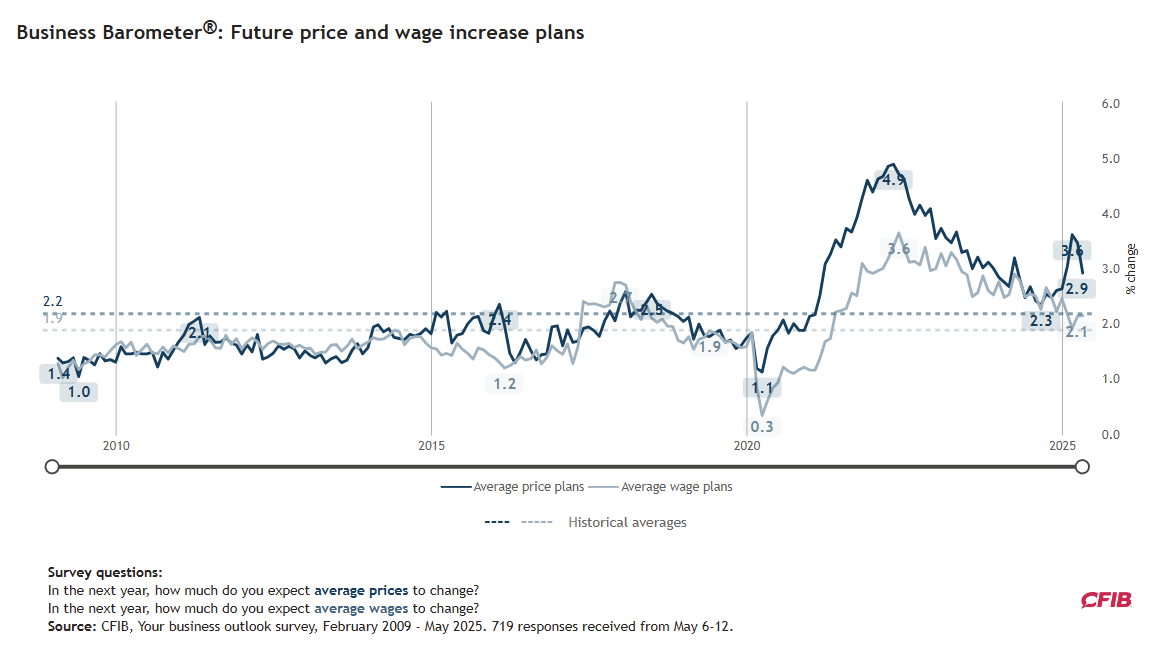

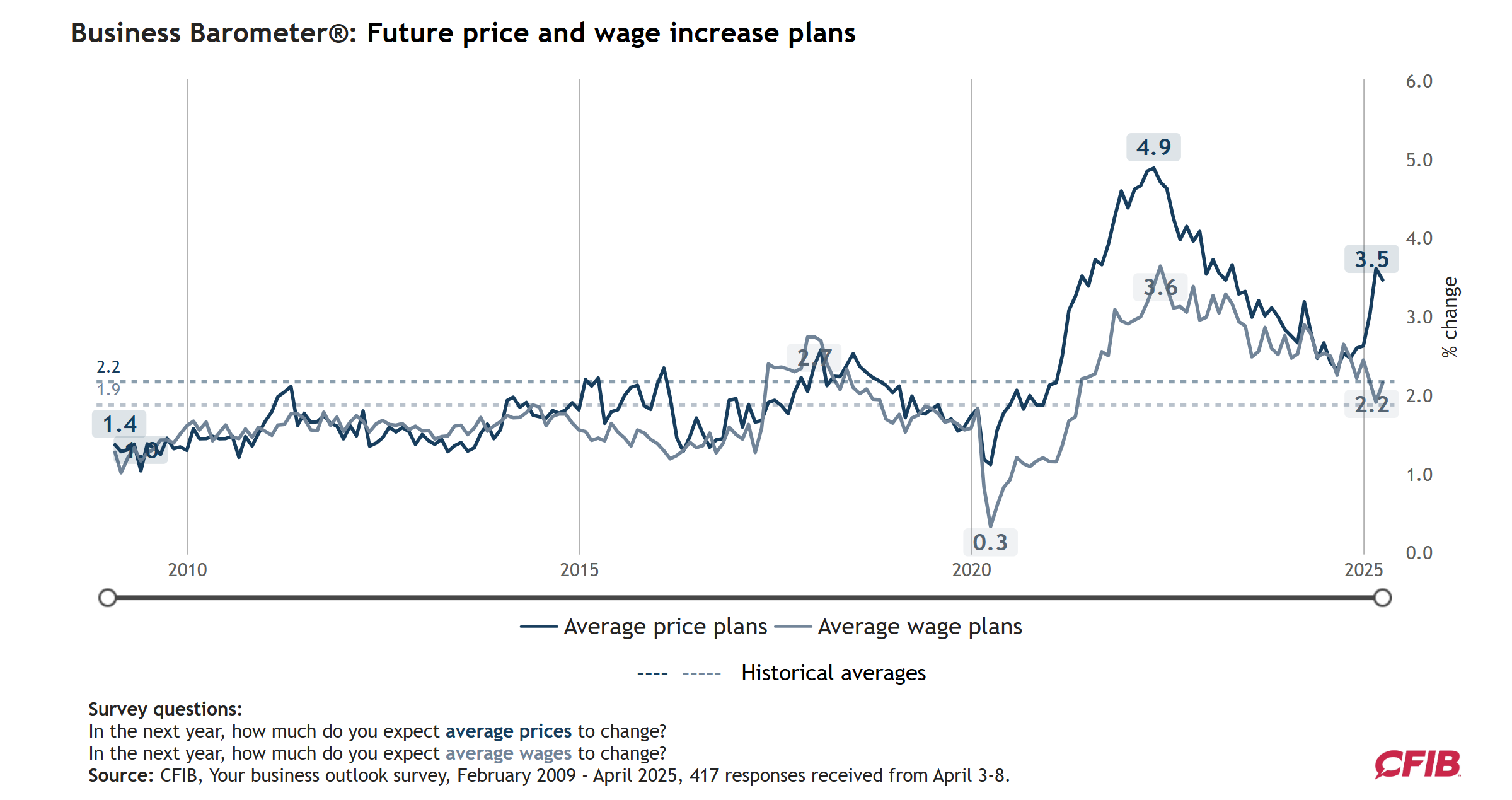

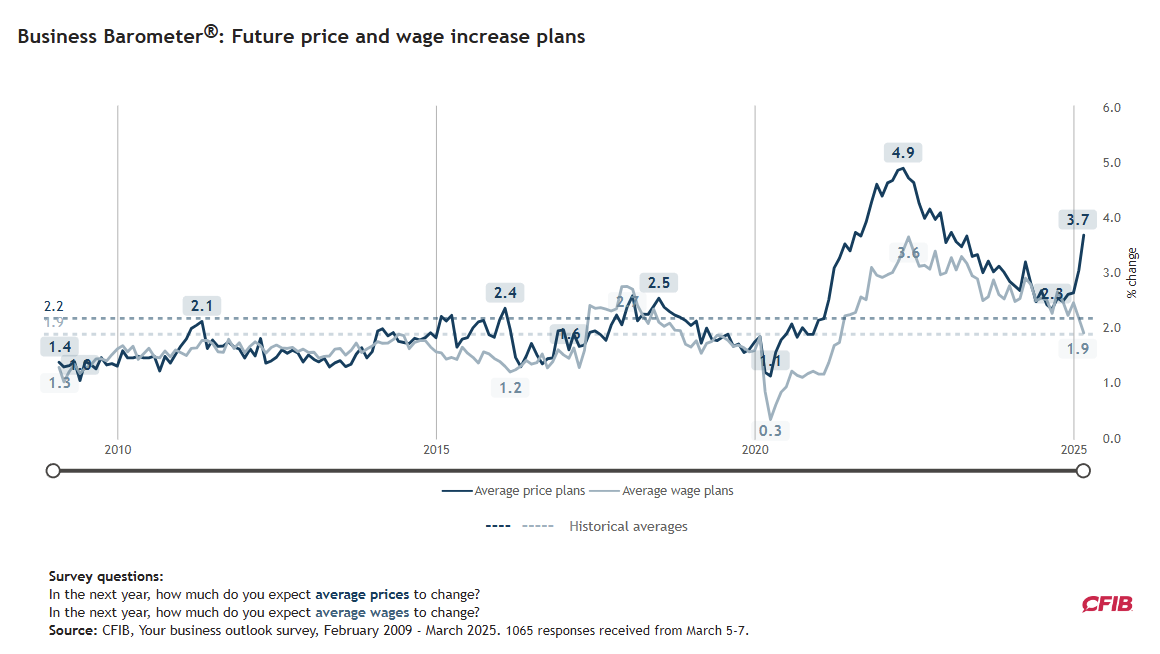

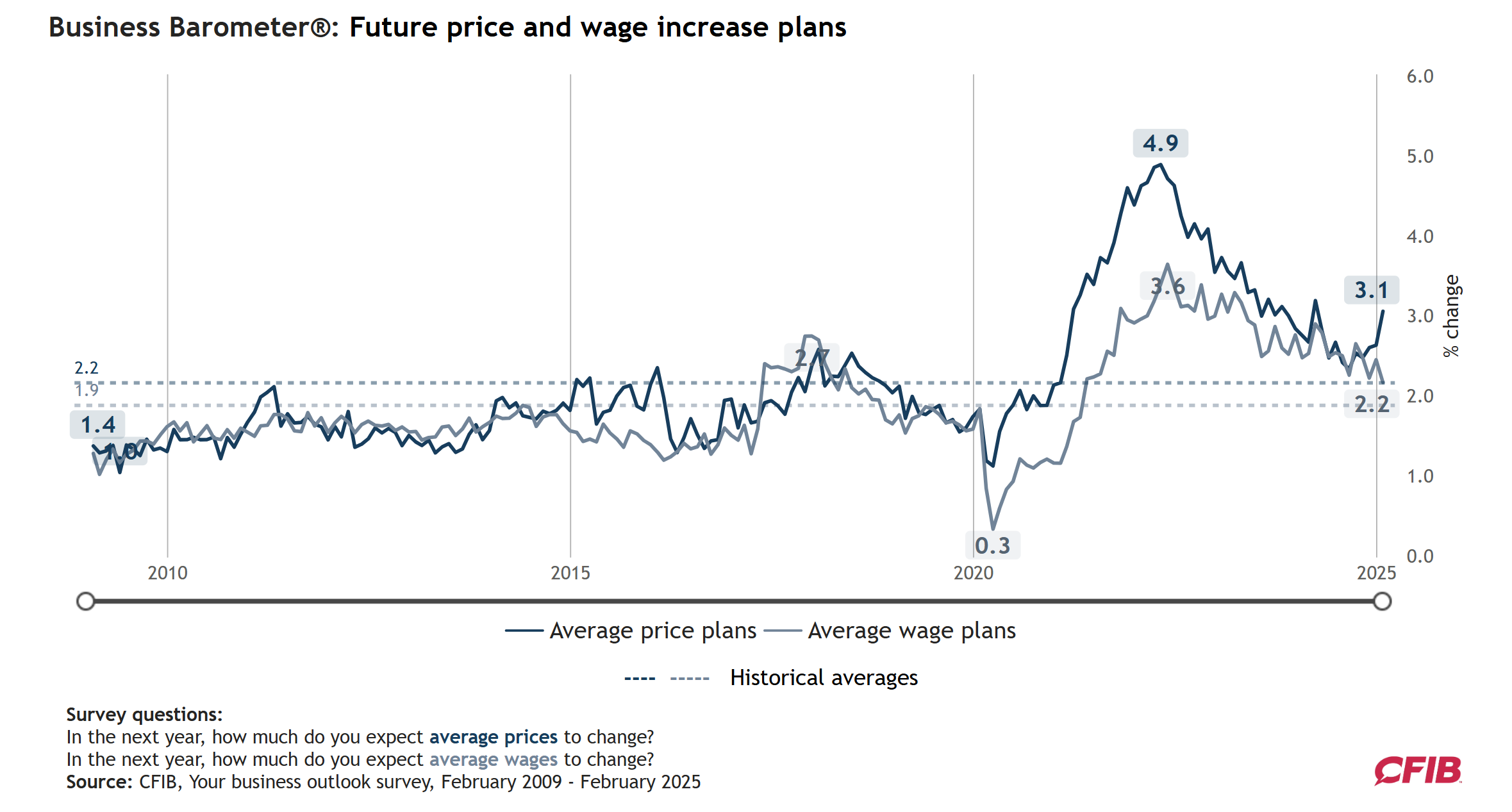

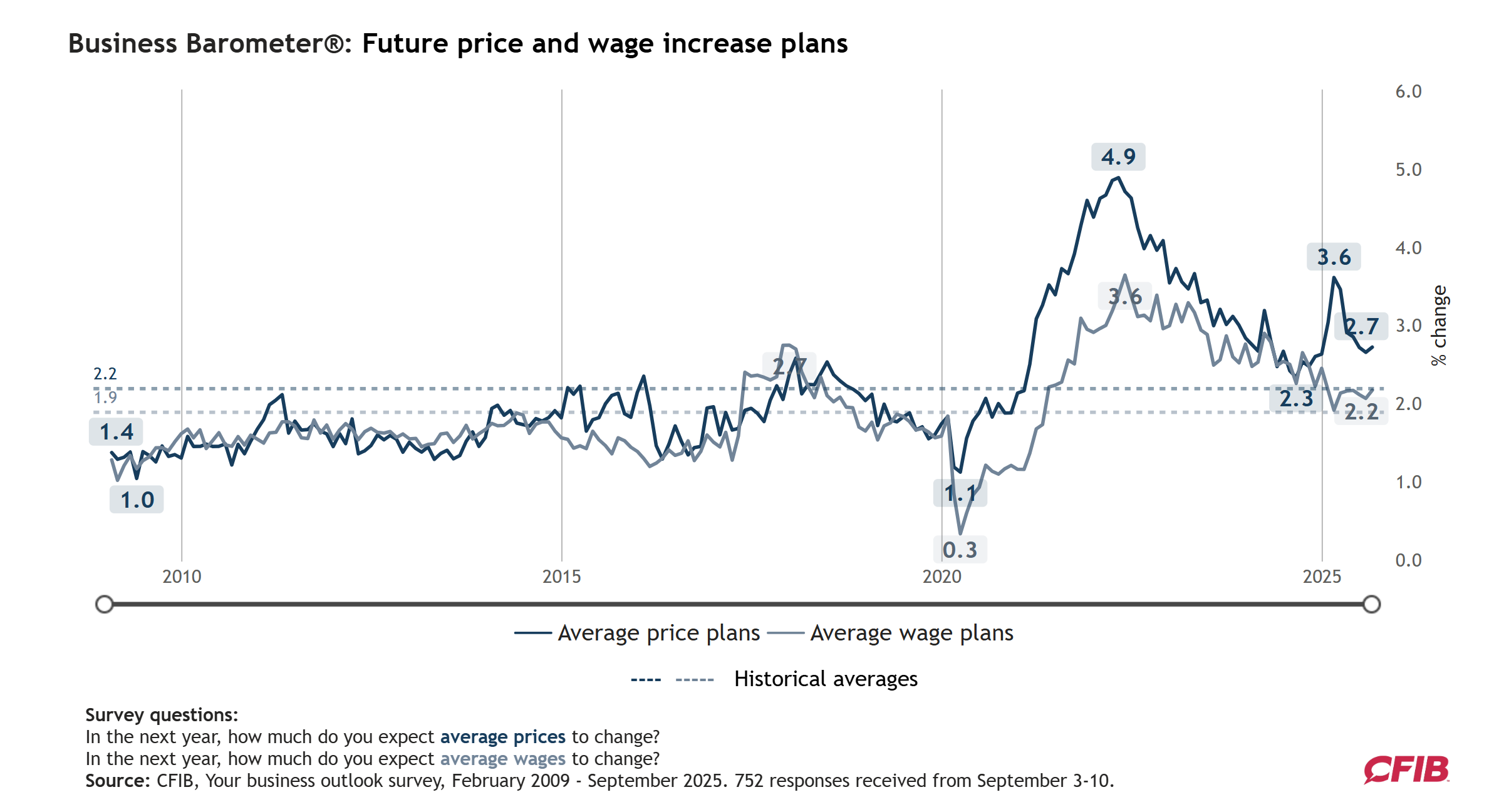

Inflation indicators held steady: firms’ average price increase expectations remained at 2.7% for the next 12 months, and wage growth expectations stayed at 2.2%.

-

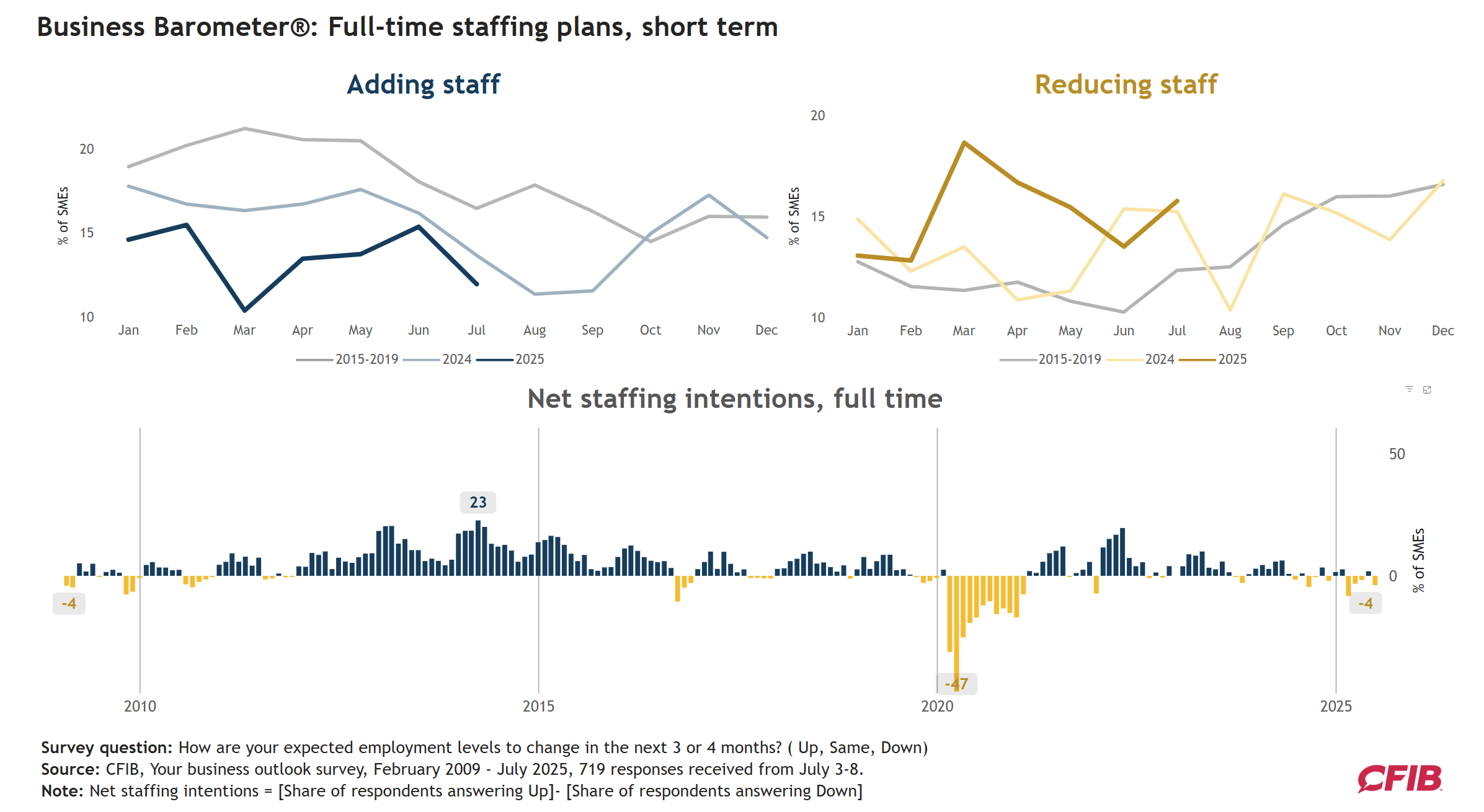

Full-time staffing plans remained negative, with 18% of employers planning layoffs versus 12% planning to hire, pointing to a weak labour market outlook.

-

Weak demand was cited by 55% of businesses as a key constraint, while distribution challenges were reported by 20%, nearly double the historical average.

-

Tax and regulatory costs (67%), insurance (66%), and wage costs (66%, up from 59% in August) were the top concerns, alongside a record 36% of firms reporting struggles with capital equipment and technology costs.

-