“Our latest survey reveals that the services sector is still under significant pressure. Business sentiment and activity have continued to fall, while rising costs are outstripping price growth, continuing to squeeze margins. As a result, profitability has dropped sharply once again. Looking ahead, businesses expect little near-term relief, with uncertainty about demand and persistent cost pressures set to constrain future hiring and investment plans.

“Last week’s Budget will add further costs to businesses, while also hampering business investment and profitability, notably with the addition of NICs to salary sacrifice pension contributions and failure to address punitive business energy costs. The government must now leverage enterprise expertise to unlock economic growth. This starts by applying the effective model of compromise and partnership achieved on the Employment Rights Bill, by collaborating directly with business to boost growth.”

The survey based on the responses of 398 services firms found that:

Business & professional services

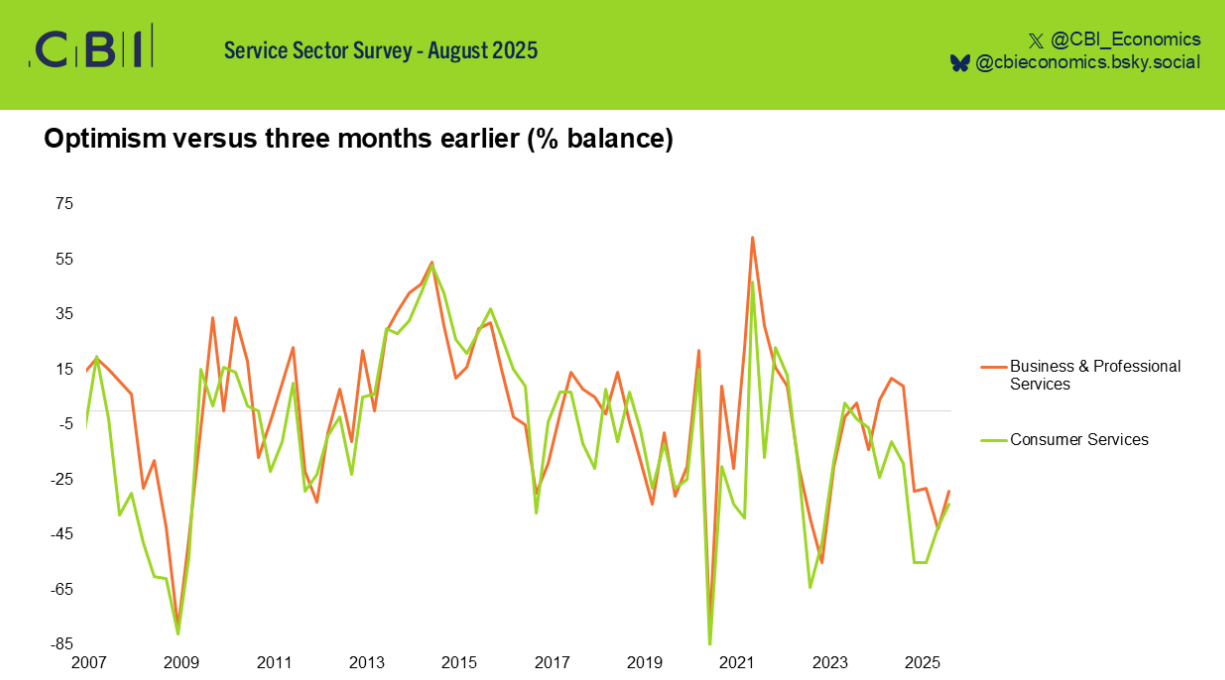

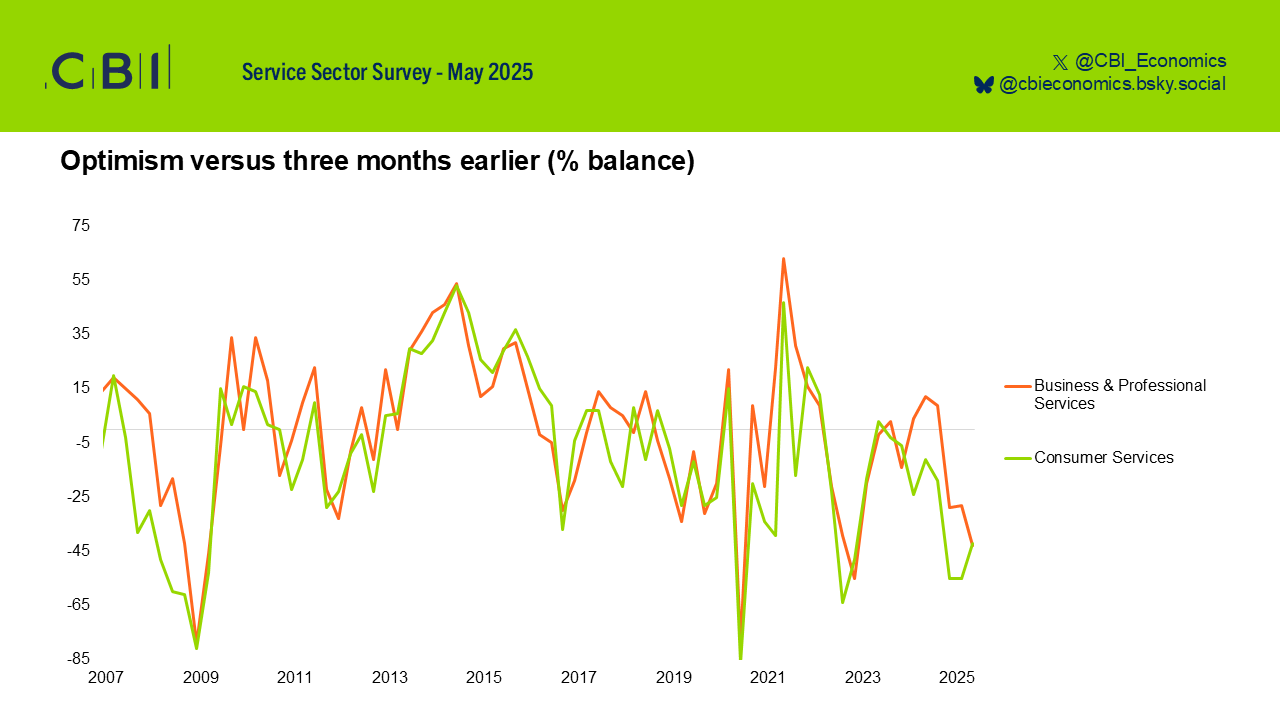

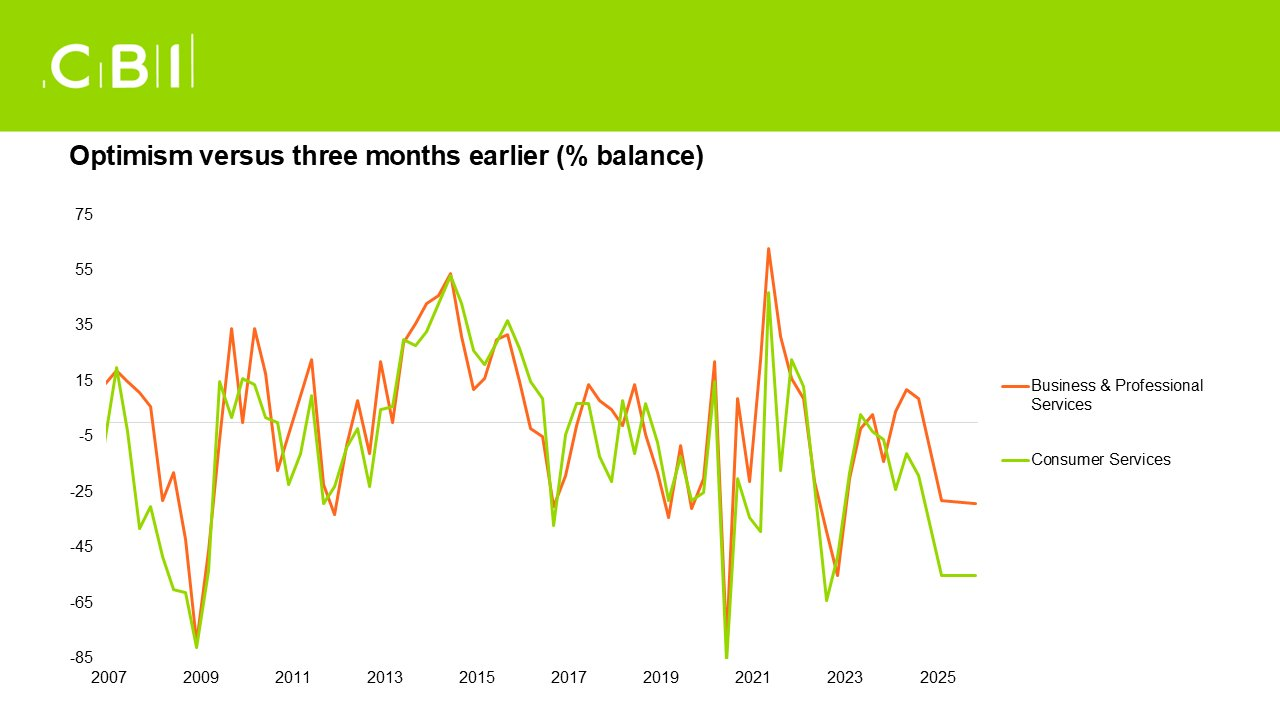

- Optimism about the general business situation deteriorated for the fifth consecutive quarter and at the fastest pace in three years (-50%, from -29% in August).

- Business volumes declined at a quicker pace in the quarter to November (-38%, from -34% in the quarter to October). Volumes are expected to decline again over the quarter ahead, albeit at a slower rate (-23%).

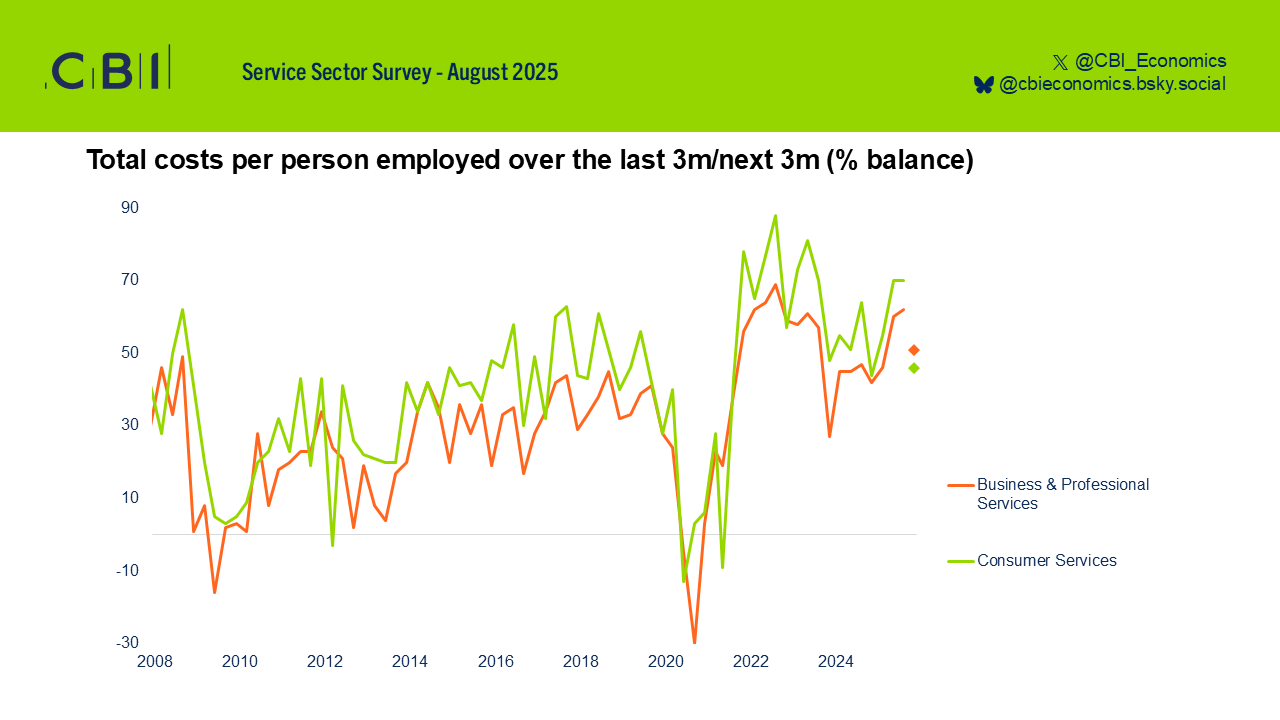

- Growth in total costs per person employed remained elevated in the quarter to November (+58%, from +62% in August; and ahead of the long run average of +31%). Cost growth is expected to remain elevated in the next quarter (+56%).

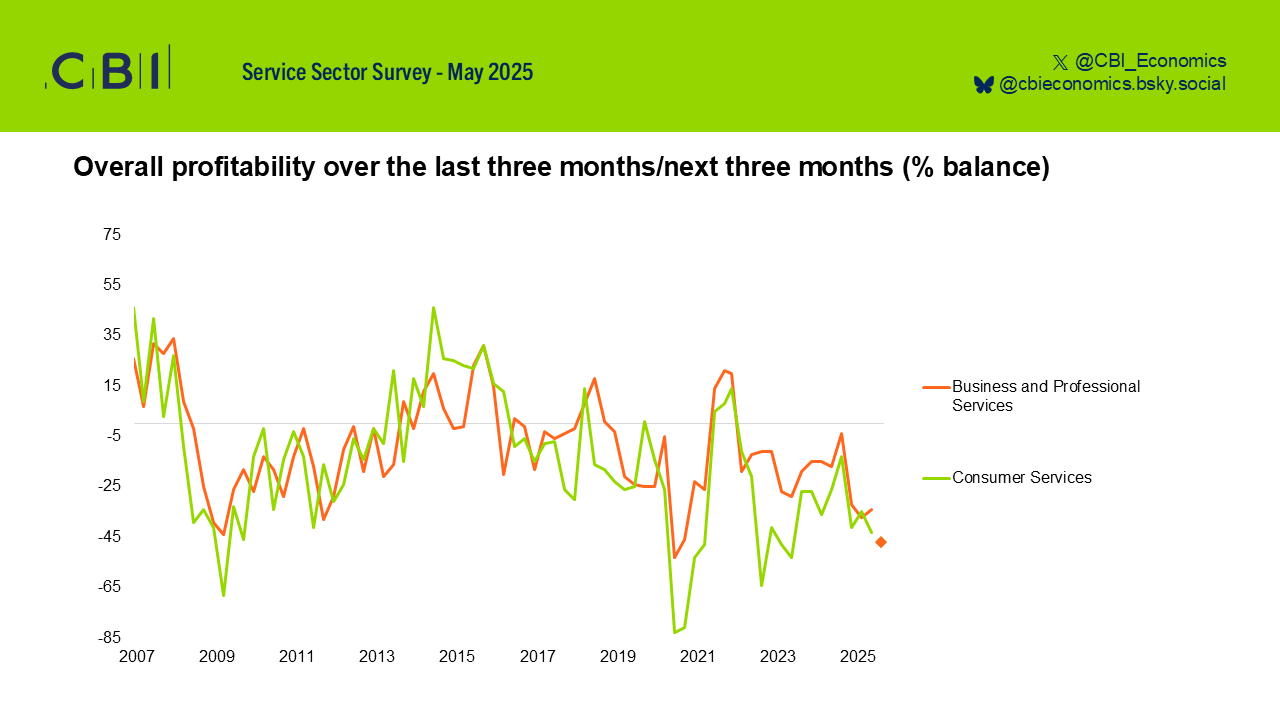

- Profitability dropped (-44%) for the sixteenth consecutive quarter and at the fastest pace since August 2020 (-46%). Overall profitability is expected to deteriorate again over the next quarter (-35%) but at a slower pace.

- Average selling prices were flat in the three months to November (0%, from +4% in August). Firms expect selling prices to return to growth next quarter (+4%).

- Headcount fell amongst business & professional services firms for the sixth month in a row (-21%, from -22% in October). It is set to fall at the same pace next quarter (-21%).

- Uncertainty about demand was the most cited factor limiting investment (cited by 68% of respondents). This was followed by those citing inadequate net returns (35%) and a shortage of internal finance (21%).

- Firms anticipate cutbacks in all investment categories: land & buildings (-24% from -20% in August), vehicles, plant & machinery (-23% from -22% in August) and IT (-5% from -2% in August).

Consumer Services

- Optimism amongst consumer services firms deteriorated in the quarter to November, for the ninth consecutive quarter (-47%, from -34% in August).

- Business volumes declined in the quarter to November (-40%), extending a period of flat or falling volumes that began in March 2022. Firms expect volumes to fall at the same pace in the three months to February 2026 (-40%).

- Growth in total costs per person employed eased slightly in the quarter to November, however growth still remained well above the long-run average (+66%, from +70% in August; long-run average of 40%). Costs are expected to grow at a similar pace next quarter (+68%).

- Overall profitability deteriorated for the sixteenth quarter running (-49%, from -36% in August) and at the fastest pace since May 2023. Profitability is expected to decline at a similar pace in the next three months (-52%).

- Average selling prices were broadly unchanged in the quarter to November (+1% from +20%). Selling prices are set to grow again in the three months to February 2026 (+17%).

- Headcount fell more sharply amongst consumer services firms in the three months to November (-39%, from -28% in October) for the eighteenth consecutive month. Numbers employed are expected to drop again, at a similar pace next quarter (-37%).

- Uncertainty about demand was the most cited factor limiting investment (cited by 61% of respondents). This was followed by those citing shortage of internal finance (43%), inadequate net return (33%) and cost of finance (30%).

- Firms anticipate cutbacks in investment in both land & buildings (-32% from -26% in August) and vehicles, plant & machinery (-29% from -17% in August). However, investment in IT is expected to be unchanged (-1% from +3% in August).

CBI Service Sector Survey

CBI Service Sector Survey