CBI Distributive Trades Survey

CBI Distributive Trades Survey

- Source

- CBI Economics

- Source Link

- https://www.cbi.org.uk/

- Frequency

- Monthly

- Next Release(s)

- September 26th, 2025 6:00 AM

Latest Updates

-

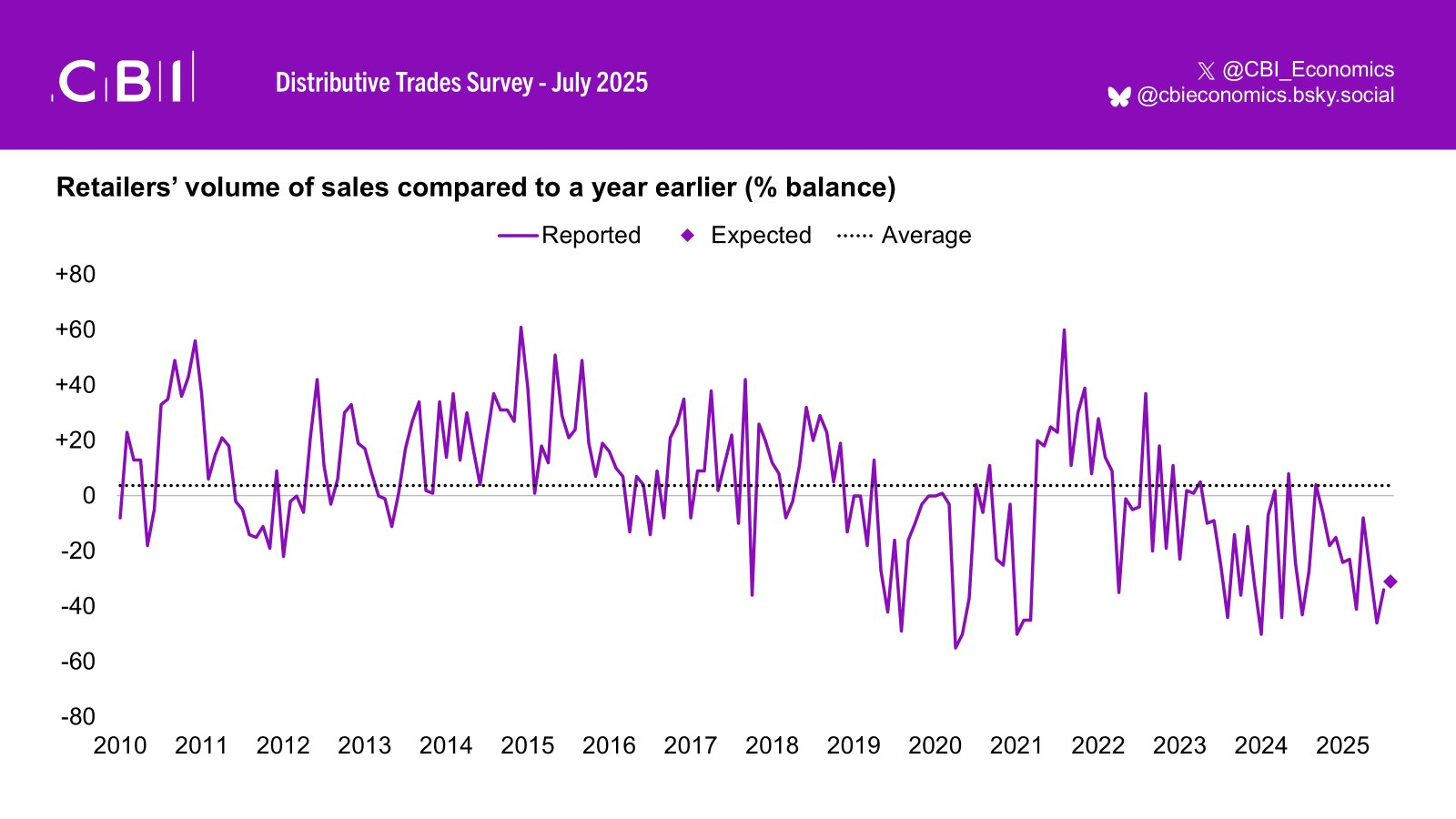

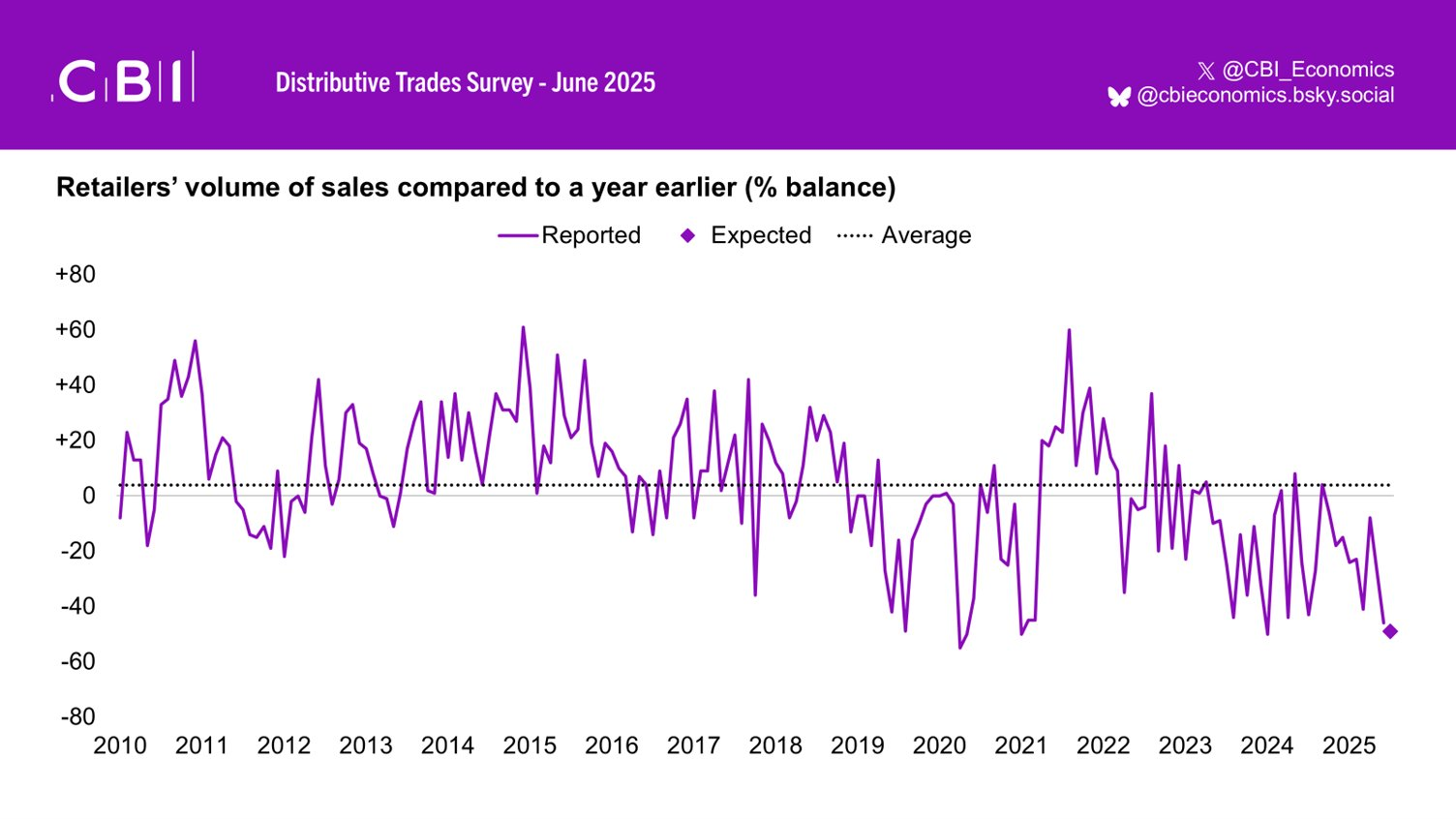

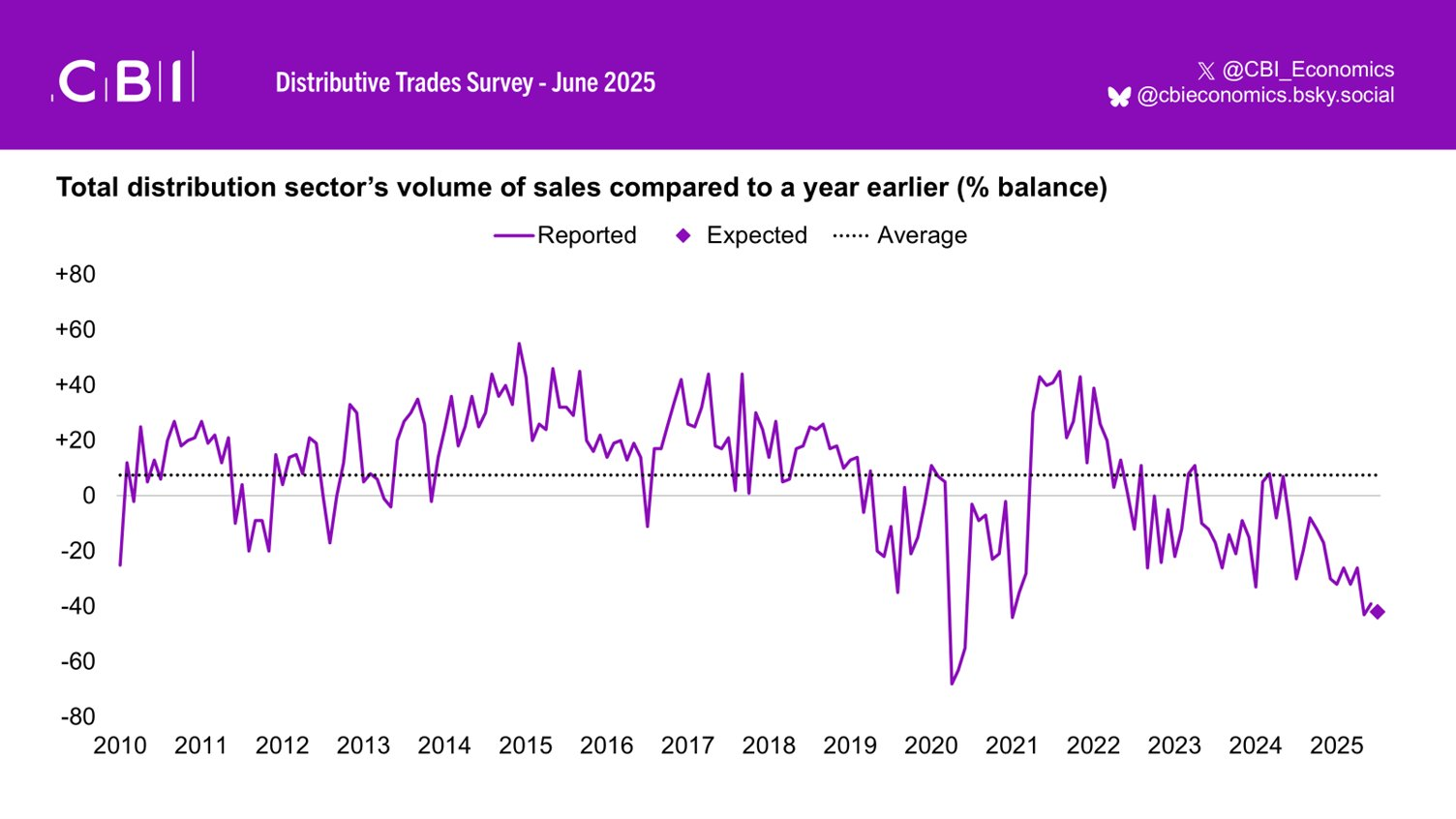

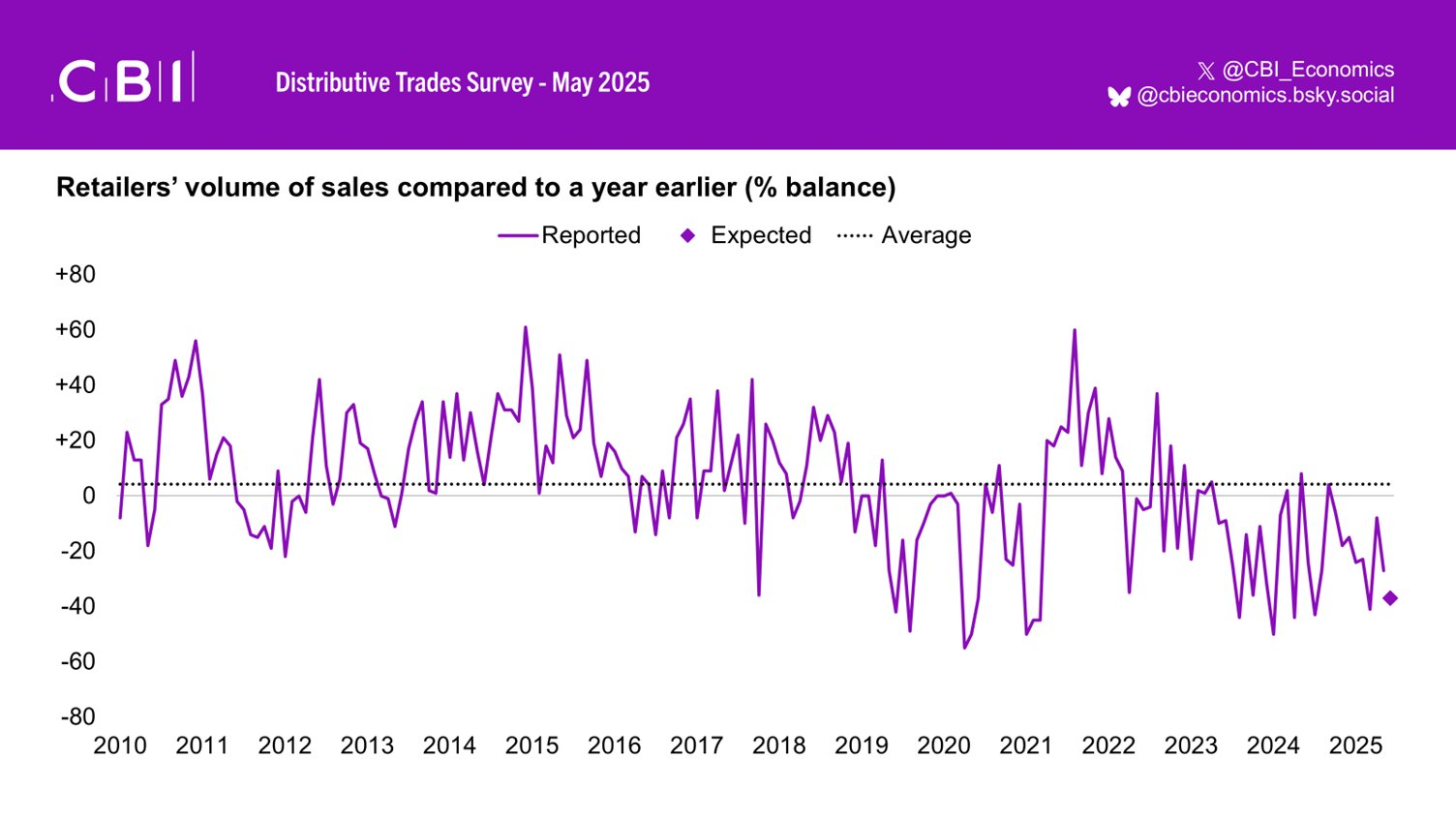

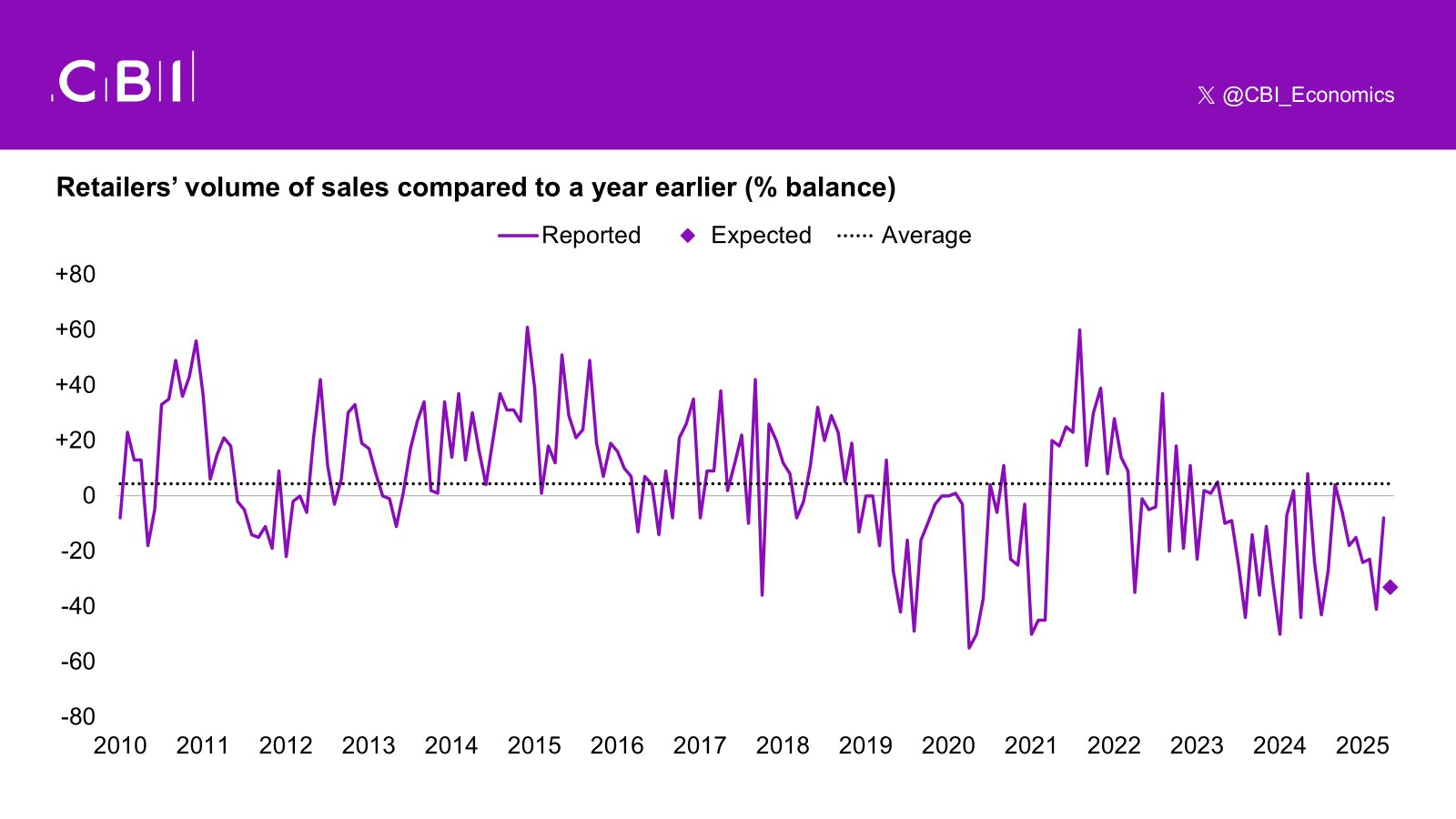

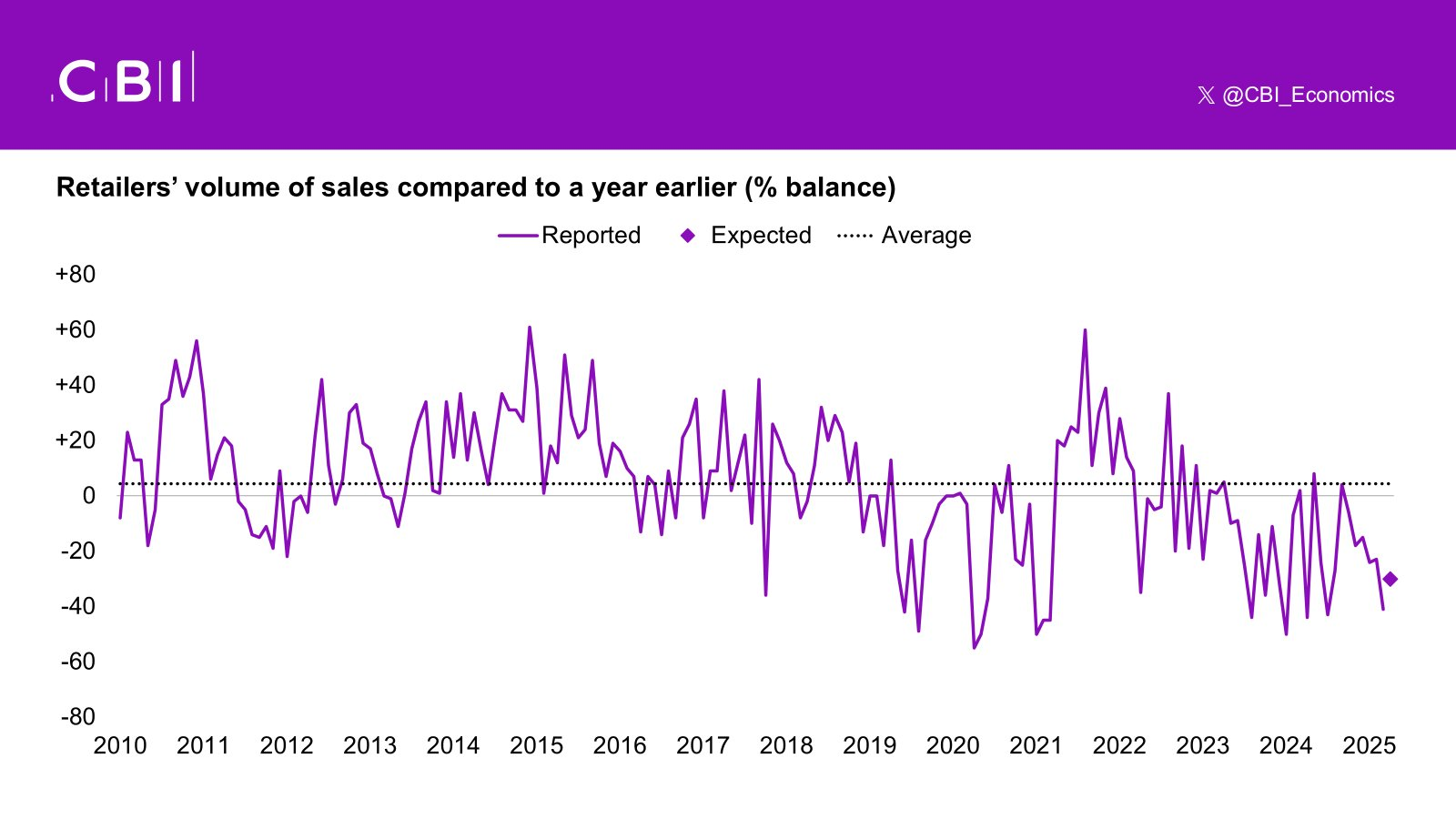

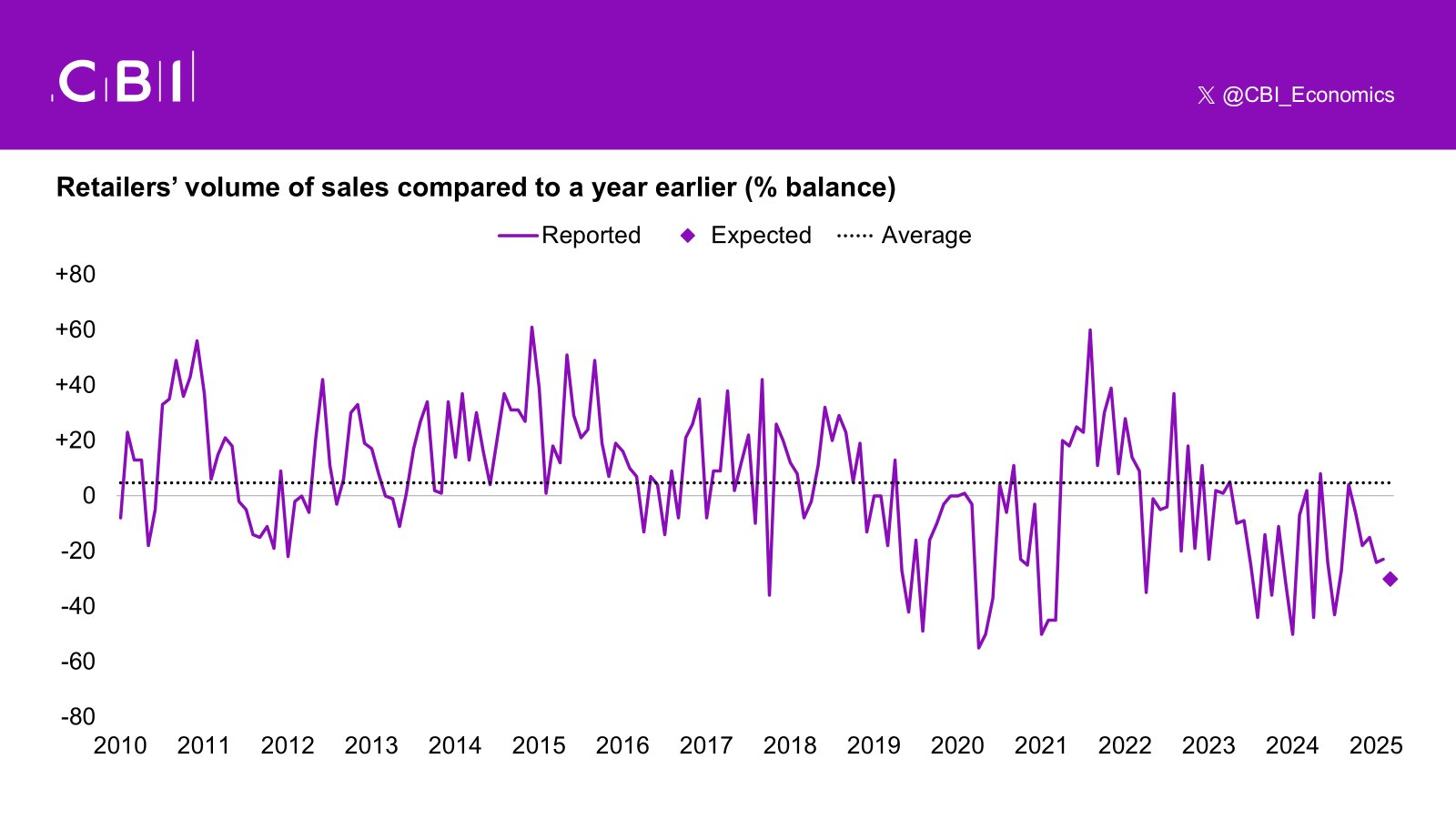

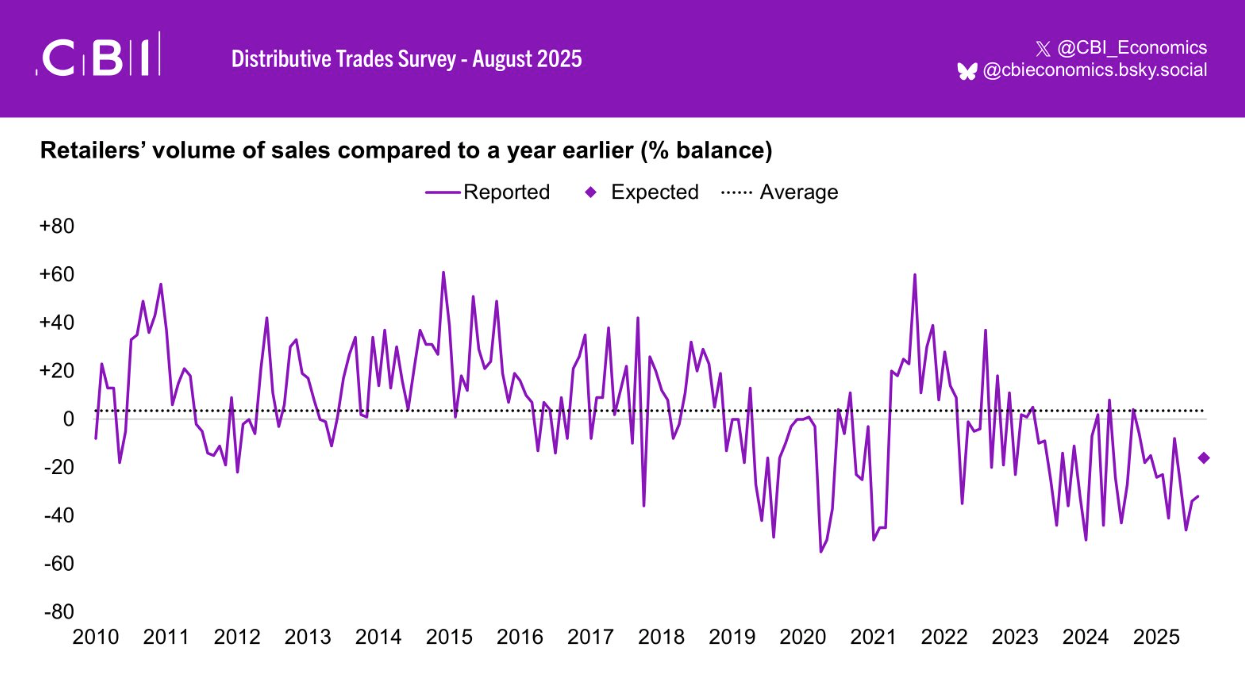

UK retail sales volumes declined for the eleventh straight month in August, with the CBI Distributive Trades Survey showing a net balance of -32% (vs -34% in July), though the pace of contraction is expected to ease in September.

-

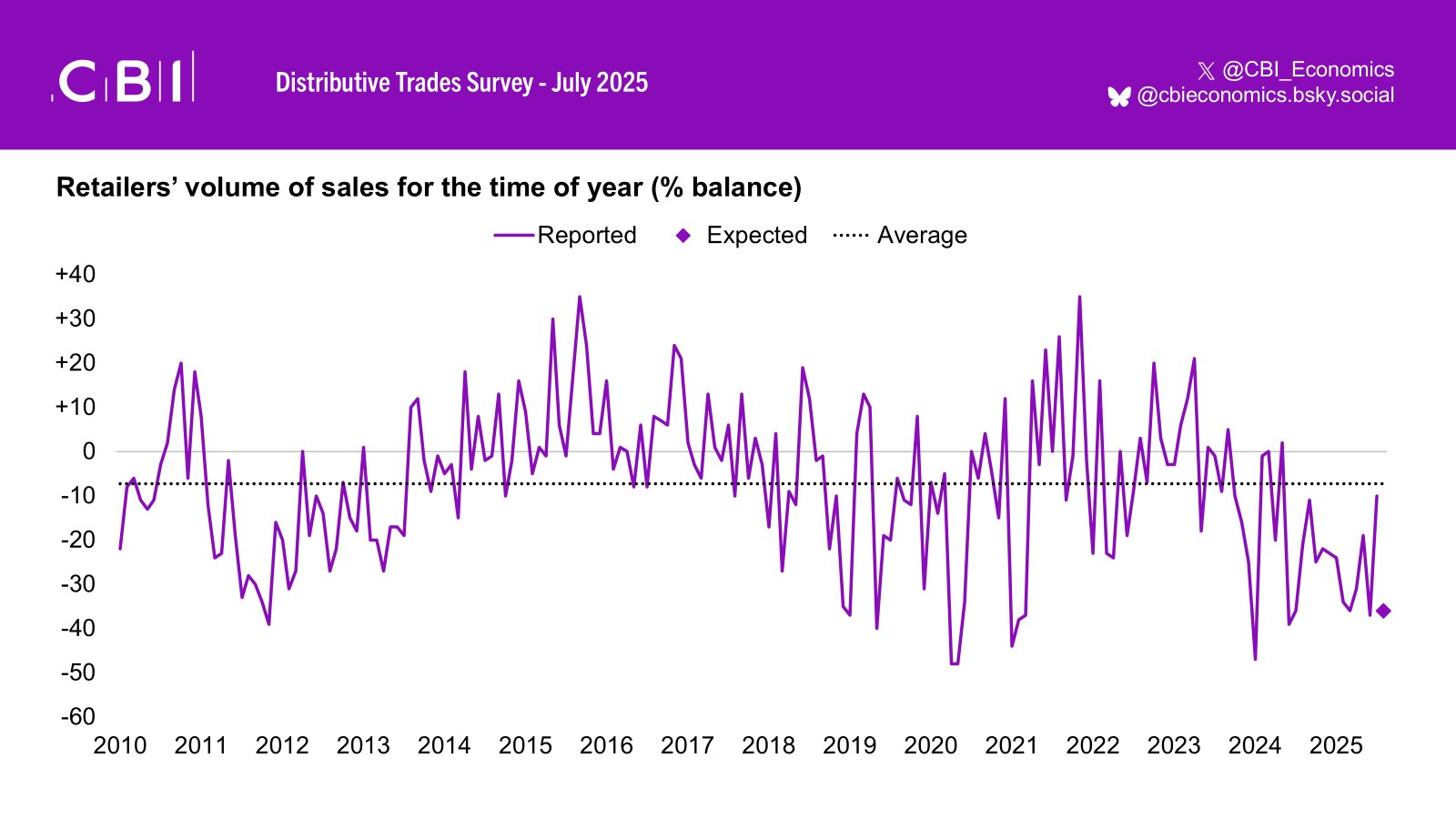

Sales for the time of year were judged “poor” at -19% (vs -10% in July), and are projected to remain weak in September (-20%).

-

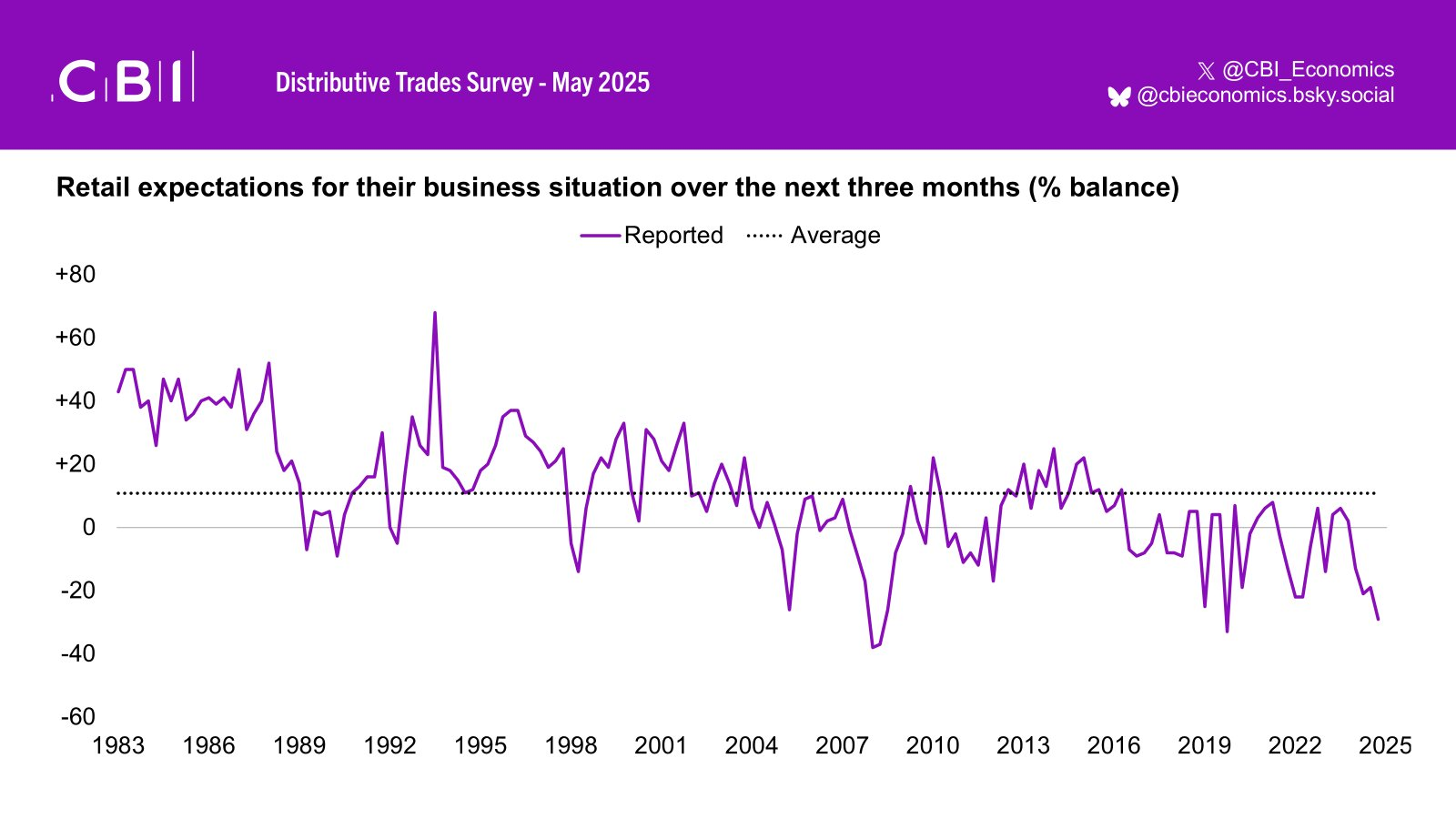

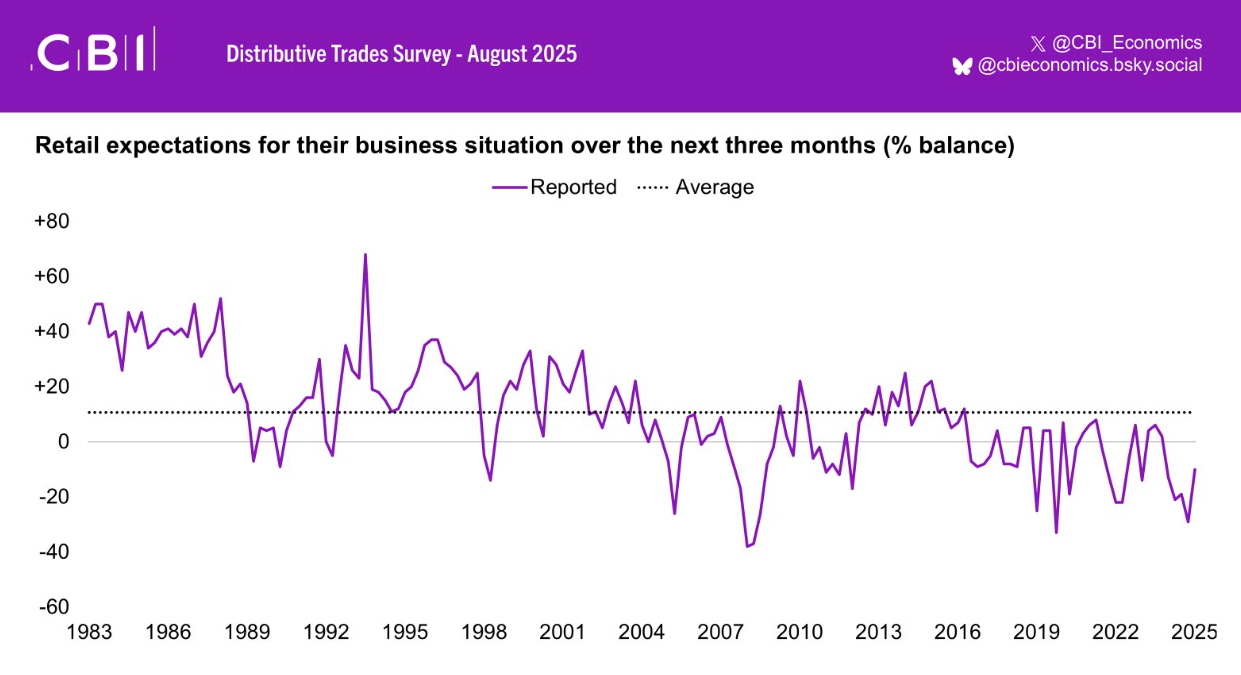

Retail sentiment stayed negative, though less severe, with business expectations at -10% for the next quarter (vs -29% in May).

-

Employment continued to fall at -14% (vs -15% in May), with headcount cuts expected to accelerate to -19% in September.

-

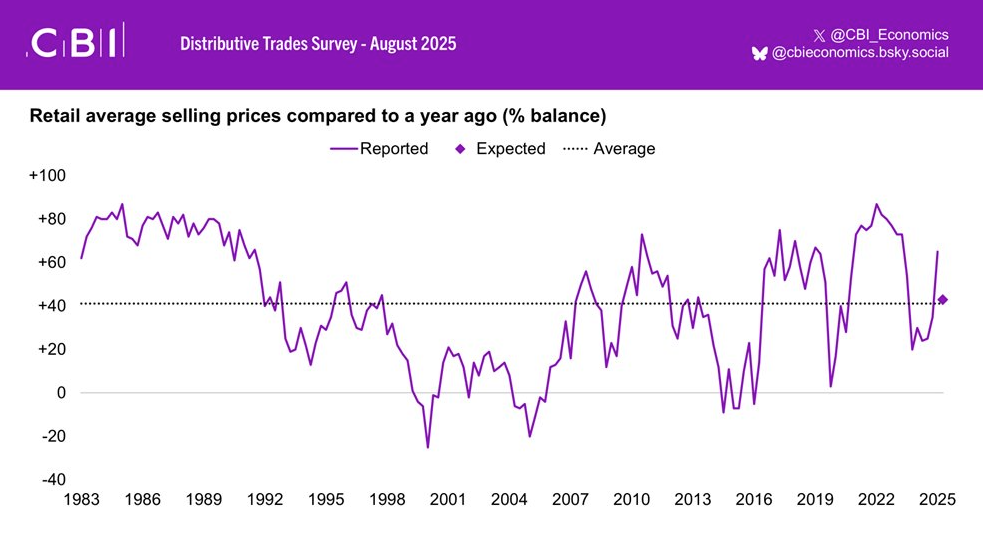

Selling prices rose sharply at +65% (vs +35% in May), the fastest pace since Nov 2023, but growth is expected to ease in September (+43%).

-

Orders to suppliers fell sharply at -40% (vs -21% in July), with another steep decline expected in September (-32%).

-

Online sales were flat at +3% (vs +4% in July) but are set to contract heavily next month (-35%).

-

Wholesale sales declined -25% (vs -32% in July) and are expected to fall steadily again in September (-26%).

-

Motor trades sales contracted at a slower -30% (vs -70% in July), with the same pace projected for September.

-

Stocks relative to expected demand strengthened to +23% (vs +12% in July; avg +17%), though are seen easing next month (+16%).

-