Canada PPI

Canada PPI

- Source

- Statistics Canada

- Source Link

- https://www.statcan.gc.ca/

- Frequency

- Monthly

- Next Release(s)

- October 20th, 2025 8:30 AM

Latest Updates

-

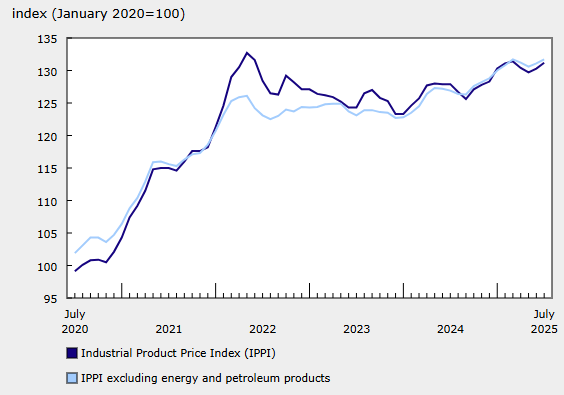

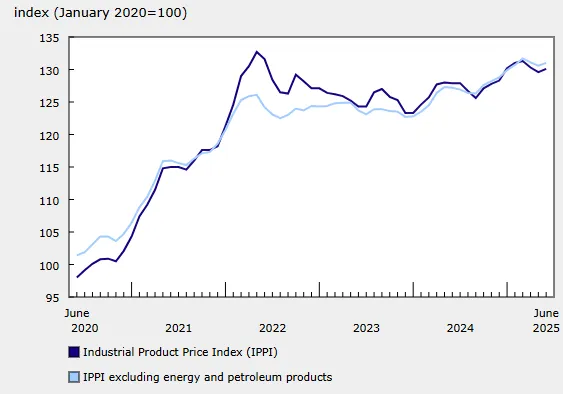

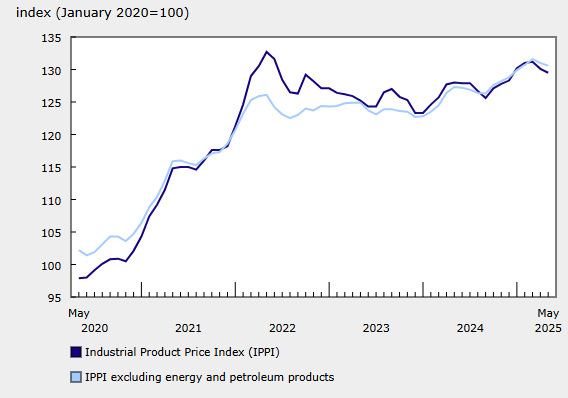

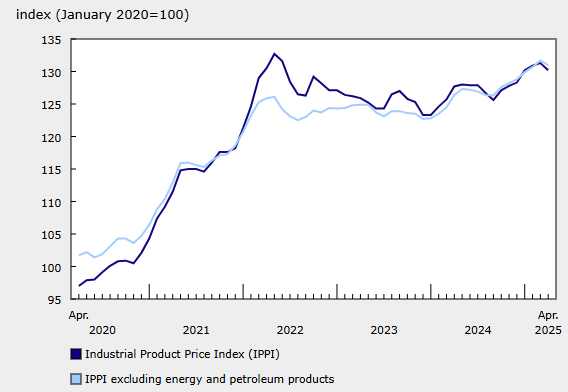

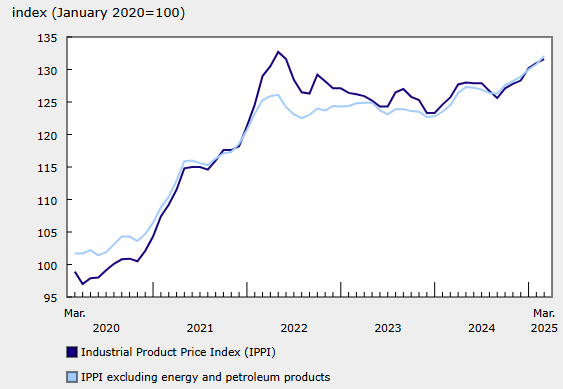

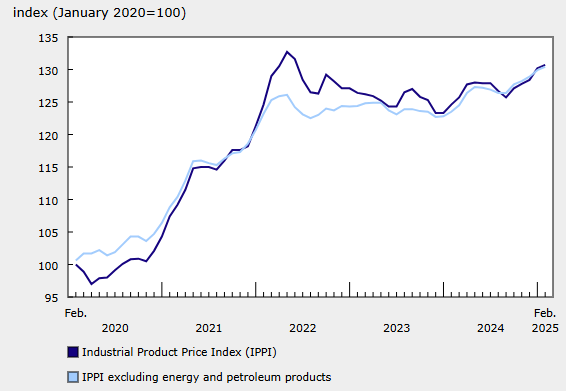

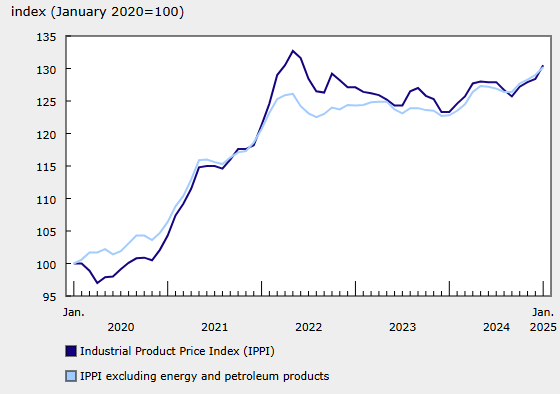

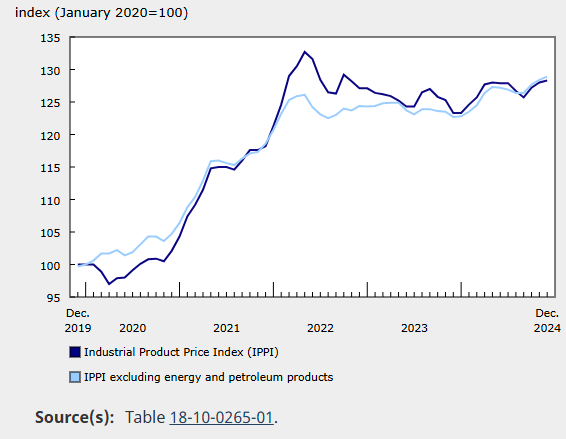

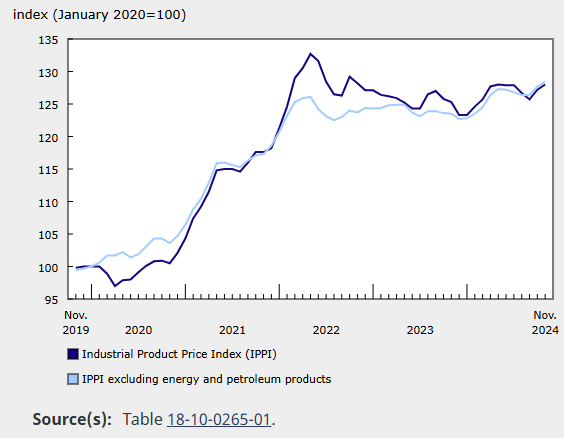

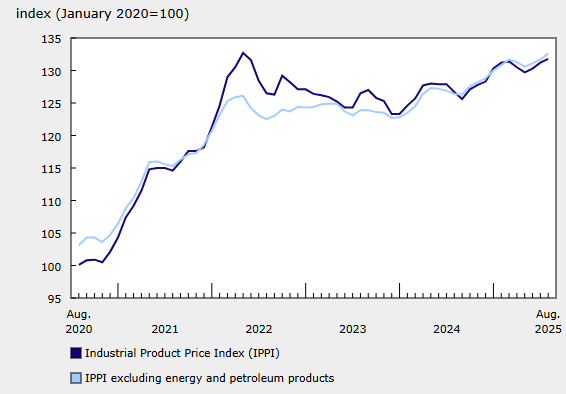

Canada's Industrial Product Price Index (IPPI) rose +0.5% MoM and +4.0% YoY in August 2025, marking the 11th consecutive annual increase despite energy prices weighing on the monthly gain.

-

Excluding energy and petroleum products, the IPPI advanced +0.7% MoM, reflecting broader pricing strength across manufactured goods.

-

Meat, fish, and dairy products rose +1.9% MoM, led by fresh and frozen beef and veal (+5.2%) and chicken (+2.1%), with beef recording its largest monthly gain since June 2024.

-

Primary non-ferrous metals increased +1.0% MoM, driven by unwrought gold (+1.6%) and silver (+1.9%), though platinum group metals fell -3.7% after three months of strong gains.

-

Energy and petroleum products fell -1.3% MoM, as conventional crude oil (-3.9%) and diesel fuel (-6.0%) declined, partly offset by finished motor gasoline (+1.8%).

-

On a YoY basis, unwrought gold, silver, and platinum group metals surged +36.3%, while beef (+28.9%) and poultry (+18.4%) also saw strong increases.

-

Finished motor gasoline declined -5.4% YoY, the largest drag on the index, reflecting base effects from high prices in August 2024.

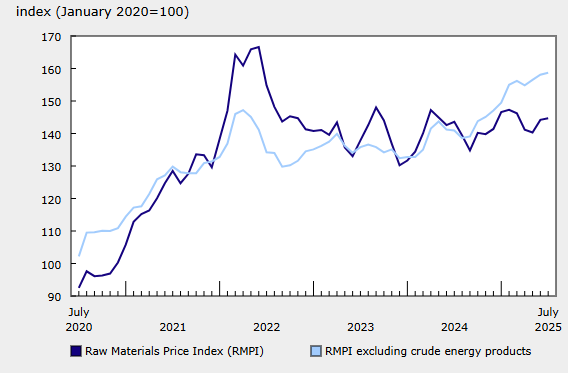

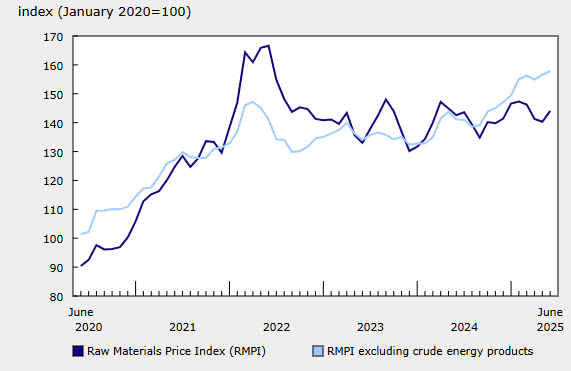

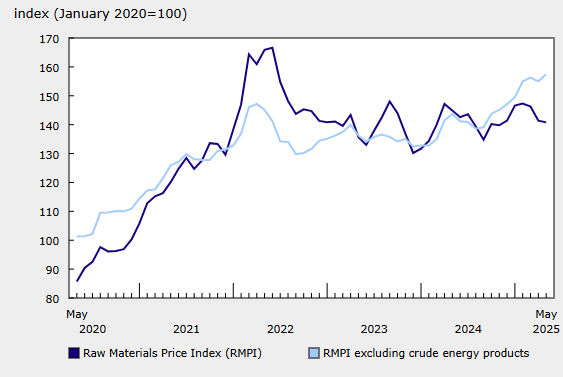

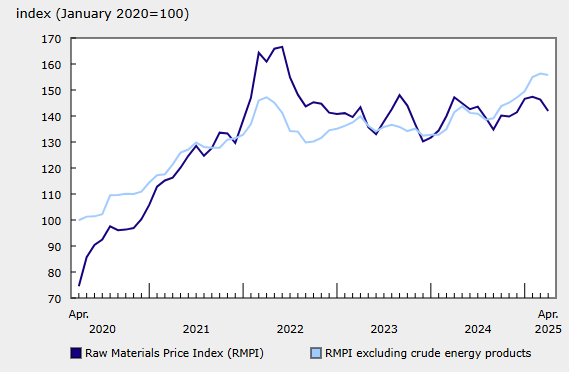

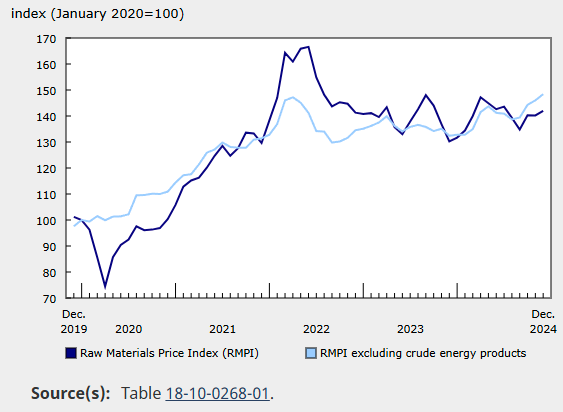

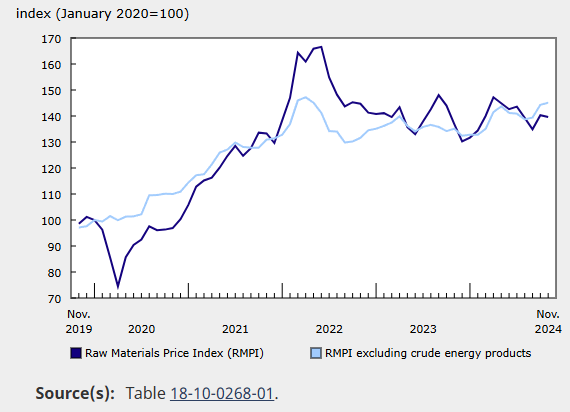

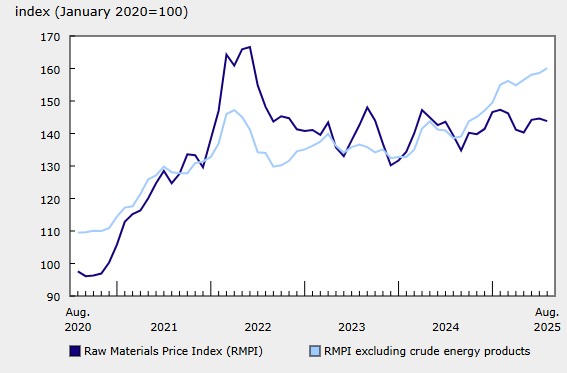

Canada's Raw Materials Price Index (RMPI) fell -0.6% MoM in August 2025 but rose +3.2% YoY, with crude energy declines offset by strength in metals and livestock.

-

Excluding crude energy, the RMPI rose +0.9% MoM and +15.5% YoY, showing broad-based gains outside the energy sector.

-

Crude energy products dropped -3.7% MoM, led by conventional crude oil (-3.5%) and synthetic crude (-5.1%), as OPEC+ supply increases pressured markets.

-

Metal ores, concentrates, and scrap rose +2.0% MoM, driven by gold (+2.0%) and silver (+2.3%), marking a 12th consecutive monthly increase.

-

Crop products fell -1.7% MoM, led by canola (-6.4%), after Chinese tariffs reduced export demand.

-

On a YoY basis, precious metal ores surged +37.0% and cattle and calves rose +19.9%, supported by supply shortages.

-

Conventional crude oil (-16.2% YoY) and synthetic crude (-16.6% YoY) posted sharp annual declines, limiting overall RMPI growth.

-