Beige Book

Beige Book

Commentary

Macro

- Source

- Federal Reserve

- Source Link

- https://www.federalreserve.gov/

- Frequency

- 8 times a year

- Next Release(s)

- November 26th, 2025 2:00 PM

Latest Updates

-

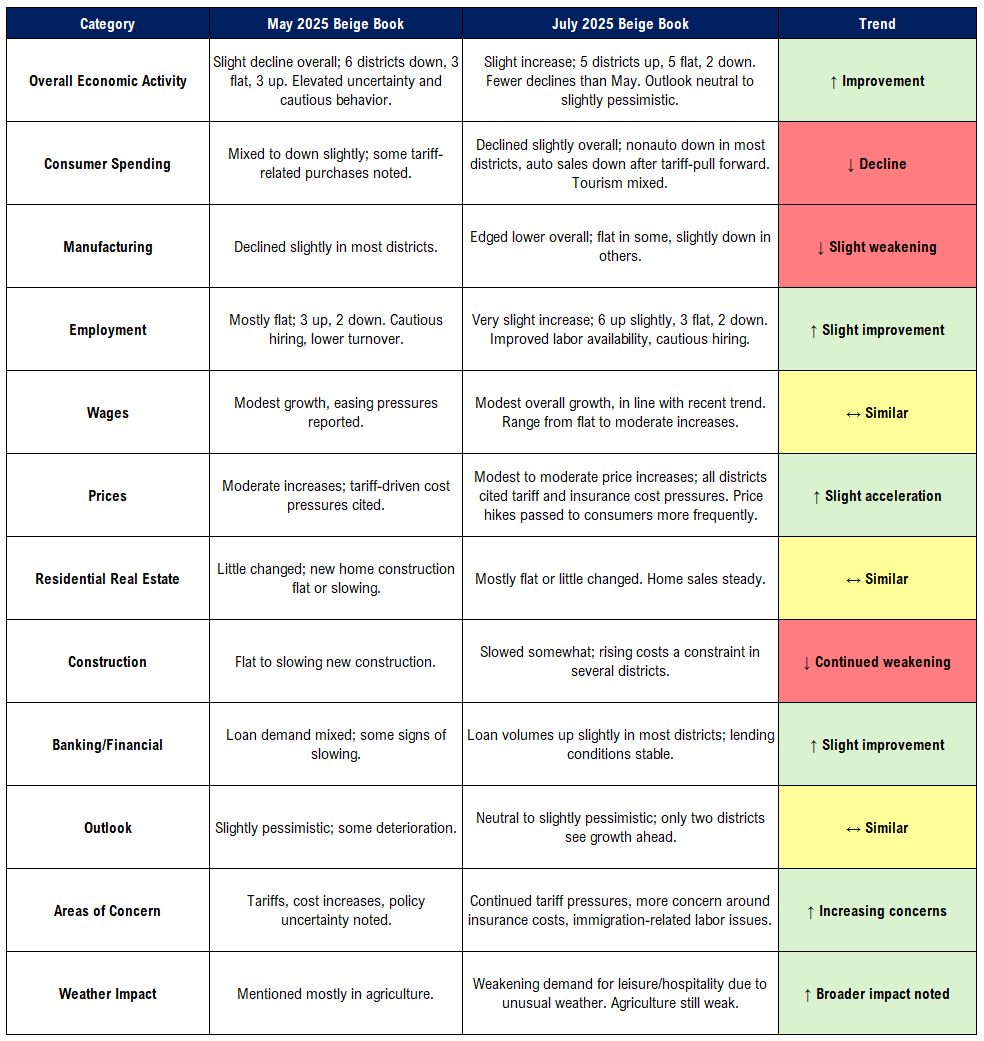

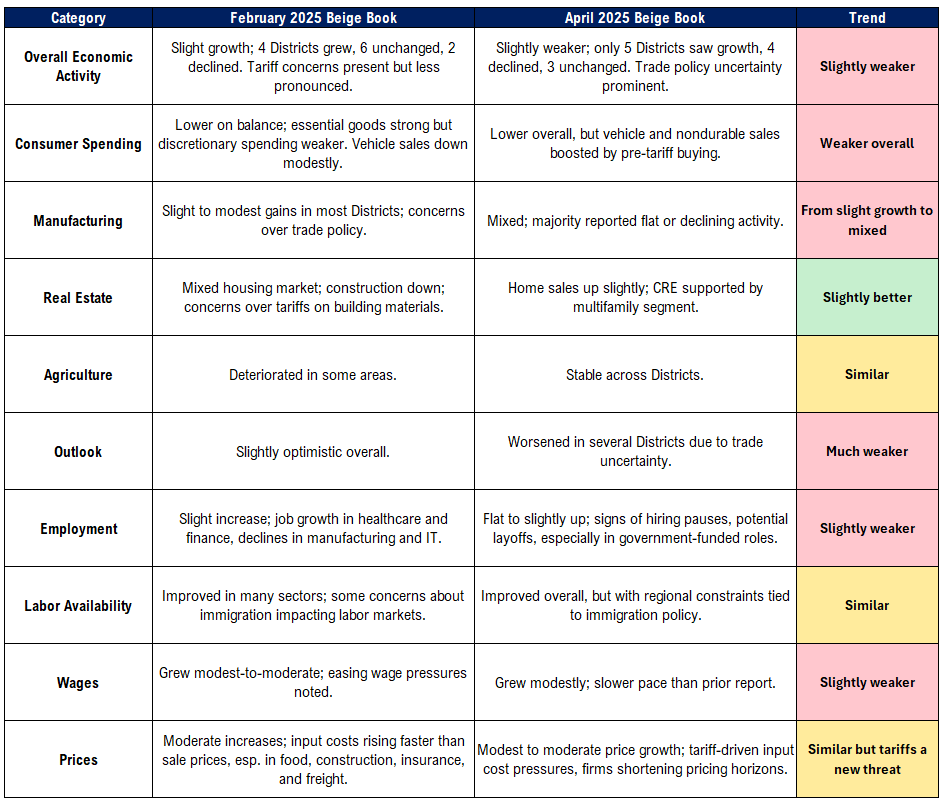

Category August 2025 Beige Book October 2025 Beige Book Trend Overall Economic Activity Most districts reported little or no change; four saw modest growth. Tariffs and uncertainty weighed on sentiment. Economic activity was largely unchanged overall; 3 districts grew slightly, 5 were flat, 4 softened. Tariffs, weak demand, and uncertainty persisted. ↓ Slight weakening Consumer Spending Flat to declining overall; households squeezed by rising insurance, utility, and living costs. Auto repairs demand up; international tourism fell. Retail spending edged lower, though EV sales rose ahead of tax credit expiry. Domestic travel steady but international tourism fell further. ↓ Decline Manufacturing Flat to modest declines; firms localizing supply chains and investing in automation. Varied by district, but most reported soft demand and tariff pressures. Several noted declines in agriculture, energy, and transport. ↓ Decline Employment Mostly unchanged; some layoffs and attrition. Firms hesitant to hire amid weak demand and automation. Largely stable but muted demand; layoffs and attrition up. Some hiring of temp/part-time workers. Labor shortages noted in key sectors due to immigration policy. ↓ Slight weakening Wages Modest to moderate growth in most districts; two flat. Wages grew modestly to moderately across all districts, but labor cost pressures rose sharply from higher health insurance expenses. ↑ Slight acceleration Prices Moderate or modest price growth; tariff-related input cost pressures widespread. Some firms held prices steady due to sensitivity. Prices rose further, led by tariffs, insurance, health care, and tech costs. Some firms absorbed costs; others passed them fully to customers. ↑ Acceleration Residential Real Estate Mixed; modest gains in some areas, declines in others. Data center demand strong. Residential and commercial real estate mixed; some pickup in lending due to lower rates, but overall muted activity. → Similar Construction Flat to slightly up; data center demand a bright spot. Rising costs a constraint. Construction mixed; commercial and residential uneven. Activity supported by lower rates and select sector strength. → Similar Banking/Financial Lending mostly steady; data centers and energy demand supported some growth. Financial conditions mixed; some districts saw stronger business lending due to rate declines, others saw muted demand. → Similar / slight firming Outlook Mixed sentiment; many cautious due to tariffs, costs, and policy uncertainty. Outlook varied by district; some expecting modest demand gains, others remained pessimistic. Shutdown risk noted. → Similar / mixed Areas of Concern Tariffs, high insurance costs, labor shortages from immigration policy. Continued tariff impacts; immigration policy further constraining labor. Rising health and tech costs added pressure. ↑ Increasing concerns Weather & Agriculture Impact Leisure/hospitality hit by weather; agriculture steady to weak. Agriculture, energy, and transportation down. Broader weather and policy factors weighed on activity. ↓ Broader weakness