Bank of England Credit Conditions Survey

Bank of England Credit Conditions Survey

Data

Macro

- Source

- Bank of England

- Source Link

- https://www.bankofengland.co.uk/

- Frequency

- Quarterly

- Next Release(s)

- October 16th, 2025 4:30 AM

Latest Updates

-

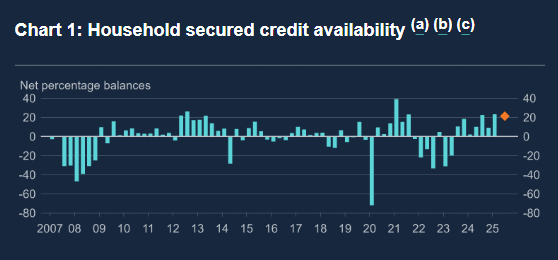

Financial conditions remained strong in the UK in Q2 2025 as the supply of credit increased while demand was more mixed.

- Availability of secured and unsecured household credit increased in Q2 and is expected to rise further in Q3.

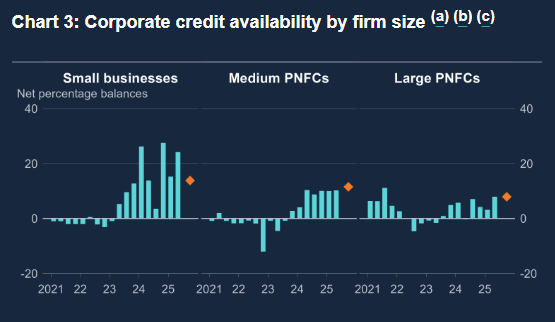

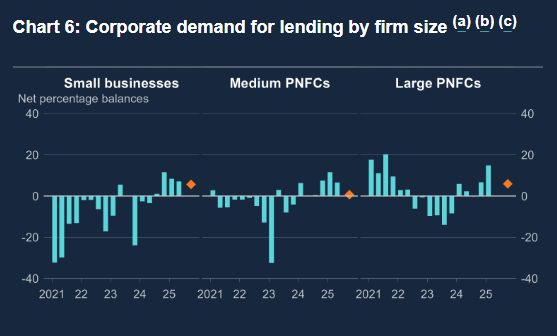

- Corporate credit availability also increased slightly, especially for small and medium-sized firms.

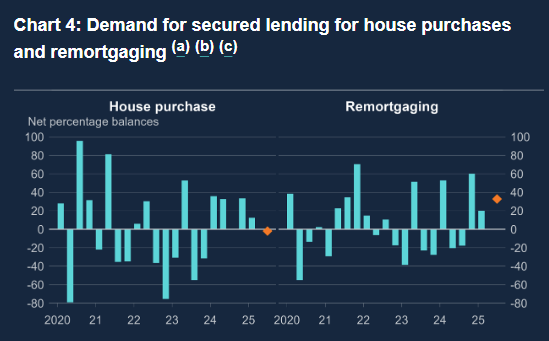

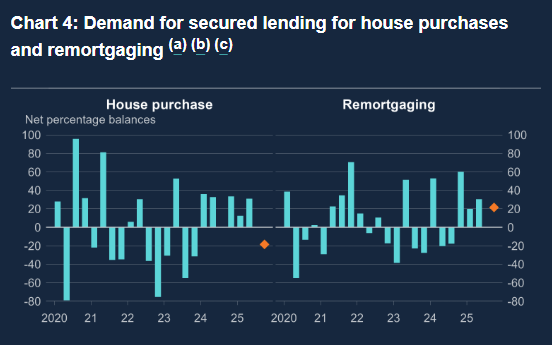

- Household demand for home purchase loans rose in Q2 but is expected to fall in Q3. However, remortgaging demand is expected to rise.

- Unsecured credit demand (credit cards and personal loans) increased, but some softening is expected next quarter.

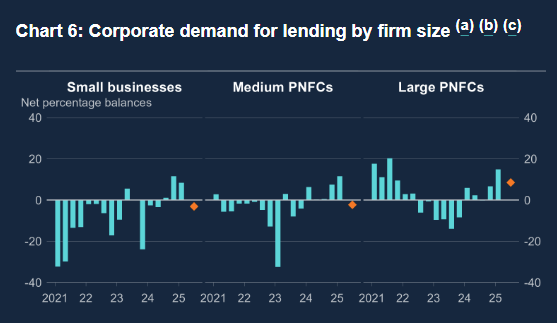

- Business loan demand rose modestly in Q2 and is expected to be flat to slightly stronger in Q3.

- Mortgage spreads widened slightly, consistent with upward pressure on rates.

- Corporate loan spreads widened for mid-sized firms and are expected to widen for large firms in Q3.

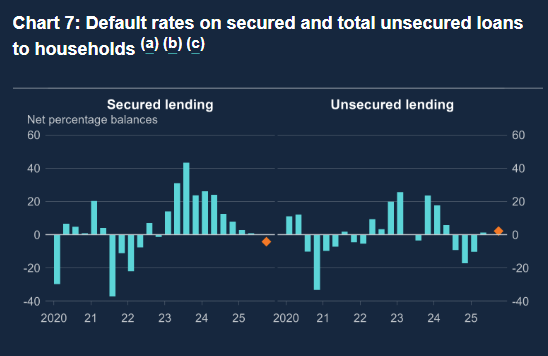

- Default rates were broadly unchanged across all borrower categories. Although, there was a slight uptick in losses given default on secured household loans and large corporate loans.